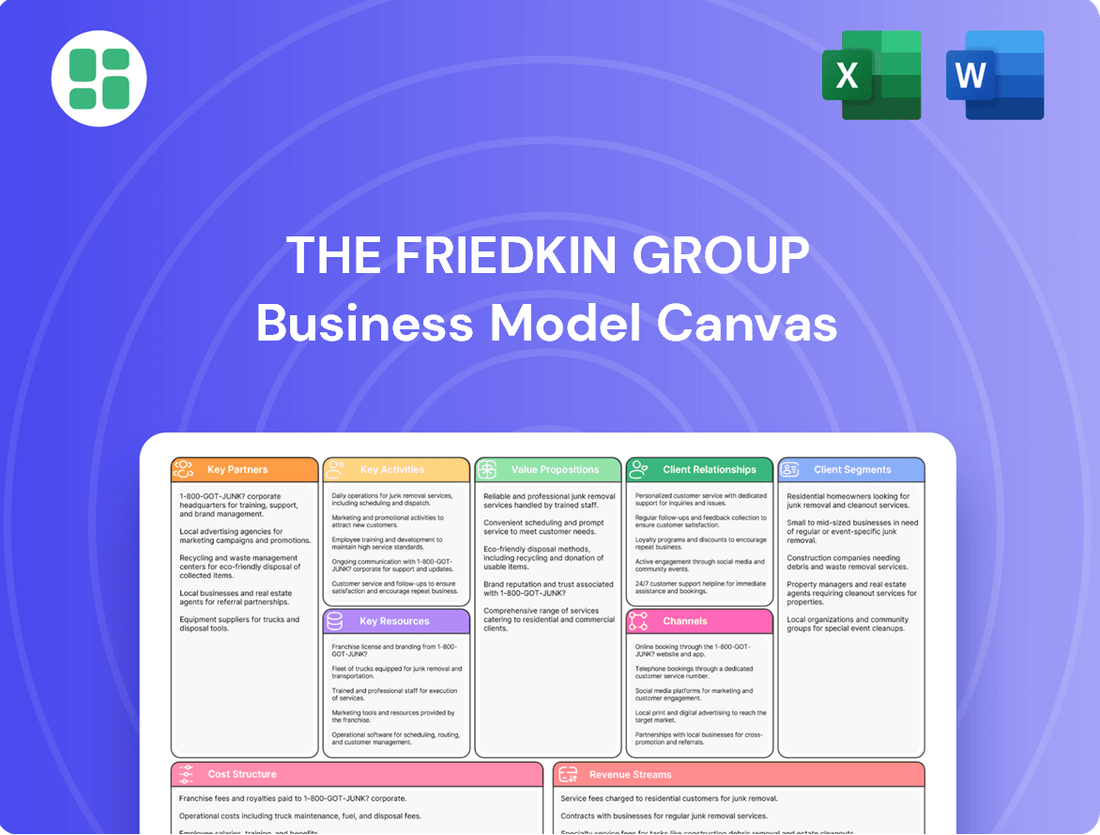

The Friedkin Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

Curious about The Friedkin Group's diversified success? This Business Model Canvas breaks down their core strategies, from automotive innovation to entertainment ventures, revealing how they create and capture value across multiple industries. Understand their customer relationships and key resources to gain a competitive edge.

Partnerships

The Friedkin Group, via Gulf States Toyota, has a vital relationship with Toyota Motor Sales, USA. This partnership allows them to distribute Toyota and Lexus vehicles and parts to more than 150 dealerships in five states, forming the backbone of their automotive distribution operations.

This collaboration ensures a consistent flow of inventory and broad market access. Furthermore, they work directly with individual Toyota and Lexus dealerships to facilitate sales, provide service, and offer support throughout their service territories, reinforcing their market presence.

The Friedkin Group's Auberge Resorts Collection actively collaborates with property owners and developers, a crucial partnership for managing and branding luxury hotels, resorts, and residences worldwide. This network is fundamental to expanding their high-end hospitality footprint.

A significant capital injection of $250 million from BDT & MSD Partners in early 2024 underscores the strength of these relationships and fuels Auberge's ambitious growth plans. This investment specifically targets expansion into key urban centers and sought-after experiential locations.

These strategic alliances are vital for The Friedkin Group, enabling them to broaden their luxury hospitality offerings and consistently deliver exceptional guest experiences across their portfolio.

Imperative Entertainment, a key player within The Friedkin Group, actively partners with a diverse range of film production houses, directors, and artists. These collaborations are fundamental to their strategy of developing, producing, and financing original content, ensuring a steady stream of creative projects.

The Friedkin Group's ownership stakes in 30West and Neon underscore significant partnerships focused on independent film production, distribution, and sales. This strategic alignment has proven successful, contributing to the recognition of critically acclaimed films, including those that have earned Academy Awards.

These alliances are not merely transactional; they are crucial for securing robust content creation pipelines, gaining essential market access, and building substantial industry influence within the competitive entertainment landscape.

Professional Sports Organizations and Leagues

The Friedkin Group's involvement with professional sports organizations, notably AS Roma and Everton Football Club, necessitates deep partnerships with governing bodies like Serie A, the Premier League, and various football associations. These collaborations are crucial for navigating competition frameworks, player transfer protocols, and broadcasting agreements, all fundamental to the clubs' operational success and revenue streams.

The recent formation of Pursuit Sports underscores a strategic commitment to managing and enhancing these sports assets. This move signals a proactive approach to fostering collaborations within the broader sports ecosystem, aiming to optimize performance and commercial opportunities across their portfolio.

These key partnerships are instrumental in:

- Facilitating Competitive Participation: Ensuring adherence to league rules and regulations for consistent participation in domestic and international competitions.

- Enabling Player Transfers and Development: Working with associations and other clubs for player acquisitions, sales, and talent development pathways.

- Maximizing Broadcasting Revenue: Negotiating and leveraging broadcasting rights, a significant income generator in modern professional sports.

Conservation Organizations and Local Communities

The Friedkin Group actively collaborates with conservation organizations and local communities through initiatives like the Friedkin Conservation Fund and Legendary Expeditions. These partnerships are crucial for wildlife protection and community development, particularly in East Africa. For instance, in 2024, the group continued its support for anti-poaching units, which saw a notable decrease in wildlife crime incidents in key protected areas, a trend observed since the fund's inception. This approach directly links business success with tangible conservation outcomes.

These collaborations underscore a deep commitment to environmental stewardship and sustainable adventure tourism. By aligning business objectives with philanthropic aims, The Friedkin Group fosters a model where economic activity benefits conservation efforts. This is exemplified by projects that create local employment opportunities, such as guiding and lodge management, directly contributing to community well-being and providing incentives for conservation.

Engagement with local authorities and communities is paramount for securing necessary permits, managing land use effectively, and implementing impactful community development programs. In 2024, these engagements facilitated the expansion of protected territories by an additional 15,000 hectares, with community buy-in being a critical factor in this success. Such partnerships ensure that operations are conducted responsibly and sustainably, benefiting all stakeholders involved.

- Partnerships: Conservation organizations and local communities in East Africa and beyond.

- Purpose: Wildlife protection and community development, fostering sustainable adventure travel.

- Impact: Direct link between business interests and philanthropic goals, evidenced by reduced wildlife crime and increased protected land.

- Engagement: Collaboration with local authorities for permits, land use, and community initiatives.

The Friedkin Group's automotive distribution relies heavily on its partnership with Toyota Motor Sales, USA, to supply vehicles and parts to over 150 dealerships across five states.

In hospitality, Auberge Resorts Collection collaborates with property owners and developers, bolstered by a $250 million investment from BDT & MSD Partners in early 2024, to expand its luxury resort portfolio.

Imperative Entertainment's content creation is powered by partnerships with film production houses, directors, and artists, further strengthened by ownership stakes in 30West and Neon, which have supported Academy Award-winning films.

The group's sports ventures, AS Roma and Everton FC, necessitate deep collaboration with governing bodies like Serie A and the Premier League to manage competition, player transfers, and broadcasting rights, with Pursuit Sports now centralizing these efforts.

Conservation and community development partnerships, such as those with the Friedkin Conservation Fund and Legendary Expeditions, are vital for wildlife protection and sustainable tourism in East Africa, with 2024 seeing continued support for anti-poaching units and the expansion of protected territories.

| Partnership Area | Key Partners | 2024 Highlights/Data |

|---|---|---|

| Automotive Distribution | Toyota Motor Sales, USA | Distribution to 150+ dealerships |

| Luxury Hospitality | Property Owners, Developers, BDT & MSD Partners | $250M investment secured for expansion |

| Entertainment | Film Production Houses, 30West, Neon | Support for Academy Award-winning films |

| Sports Management | Serie A, Premier League, Football Associations | Ongoing operational and broadcasting agreements |

| Conservation & Community | Conservation Orgs, Local Communities, Local Authorities | Support for anti-poaching units, 15,000 hectares protected |

What is included in the product

The Friedkin Group's Business Model Canvas outlines a diversified portfolio strategy, focusing on leveraging synergistic value propositions across its diverse holdings in automotive, adventure, and hospitality sectors.

This model details how the group attracts and retains distinct customer segments through curated experiences and premium products, all supported by robust operational infrastructure and strategic partnerships.

The Friedkin Group's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their entire business, enabling rapid identification of operational inefficiencies and strategic gaps.

This structured approach to visualizing their business model effectively alleviates the pain of complex strategy development and communication, making it easier to pinpoint areas for improvement and foster alignment.

Activities

The Friedkin Group's key activities in automotive distribution and logistics center on the independent distribution of Toyota and Lexus vehicles and parts. This extensive network serves over 150 dealerships spread across five U.S. states.

Core operations involve robust supply chain management, efficient vehicle processing, and comprehensive parts distribution. Effective logistics management is paramount to ensuring timely and accurate delivery to this broad dealership base.

Gulf States Toyota, a major component of this segment, handles an impressive volume, processing hundreds of thousands of vehicles each year. This scale underscores their critical role in the automotive supply chain.

Auberge Resorts Collection, a key component of The Friedkin Group's strategy, is actively engaged in managing and developing a global portfolio of ultra-luxury hotels, resorts, residences, and private clubs. This involves meticulously crafting unique guest experiences, from designing visually stunning properties to offering cutting-edge spa treatments and exceptional culinary journeys.

The group's expansion strategy is dynamic, with a particular focus on entering new, high-potential markets. This includes a significant push into Europe and the development of properties in key urban centers, aiming to broaden the Auberge Resorts Collection's international footprint and appeal. For instance, in 2024, Auberge Resorts Collection continued to expand its portfolio, adding new properties in desirable destinations, reflecting a commitment to growth in the luxury travel sector.

Imperative Entertainment's core activities revolve around developing, producing, and financing a diverse slate of original content, including films, television series, documentaries, and podcasts. This comprehensive approach ensures a steady stream of intellectual property for the group.

The group actively engages in theatrical marketing and distribution, leveraging its stakes in Neon and 30West to maximize the market reach and financial success of its entertainment products. This integrated strategy is crucial for capturing value across the entire content lifecycle.

Key operational functions include the meticulous identification of compelling narratives, the efficient management of complex production processes, and the strategic execution of marketing campaigns to ensure broad audience engagement and commercial viability for their diverse entertainment offerings.

Professional Sports Club Management and Operations

The Friedkin Group's key activities in professional sports club management and operations are multifaceted, focusing on the holistic running of entities like AS Roma and Everton FC. This involves the critical functions of player acquisition and sales, ensuring the team's competitive edge. Matchday operations are meticulously managed to provide a seamless experience for fans, fostering a vibrant atmosphere. Fan engagement initiatives are crucial for building loyalty and community around the clubs.

Commercial partnerships are actively pursued to generate revenue streams and enhance brand visibility. The group also oversees the intricate financial management of these clubs. A notable example of this strategic financial approach is the recent sale of Everton Women's team to a sister company, demonstrating a deliberate move within their portfolio. This operational scope is vital for maintaining and growing the value of their sports assets.

- Player Recruitment and Transfers: Strategic acquisition and sale of talent to build competitive squads.

- Matchday Operations: Ensuring smooth and engaging experiences for spectators at all home games.

- Fan Engagement: Developing programs and initiatives to connect with and grow the supporter base.

- Commercial Partnerships: Securing sponsorships and commercial deals to boost revenue.

- Financial Management: Overseeing budgets, investments, and financial health of the clubs.

Financial Investment and Capital Management

The Friedkin Group International (TFGI) actively pursues private equity investments, exemplified by the establishment of Copilot Capital. This venture specifically targets the scaling of European software businesses, demonstrating a strategic focus on high-growth technology sectors.

This financial investment activity involves a rigorous process of identifying promising companies, injecting crucial capital, and providing hands-on operational expertise. The goal is to accelerate growth and enhance profitability for these portfolio companies.

- Private Equity Investments: TFGI's engagement in private equity, including the launch of Copilot Capital, signifies a core activity in capital allocation and business development.

- European Software Focus: The strategic emphasis on scaling European software businesses highlights a targeted approach to capitalize on regional technological advancements and market opportunities.

- Value Creation Strategy: By providing capital and operational support, TFGI aims to actively contribute to the growth and financial success of its invested companies.

- Diversification and Financial Acumen: This approach reflects a broader strategy to diversify its investment portfolio and leverage its financial expertise across various industries and geographies.

The Friedkin Group's key activities span automotive distribution, luxury hospitality, entertainment production, sports club management, and private equity. In automotive, they distribute Toyota and Lexus vehicles and parts across five U.S. states, managing a vast network of over 150 dealerships. Their hospitality arm, Auberge Resorts Collection, focuses on developing and managing ultra-luxury properties globally, with strategic expansion into new markets like Europe continuing in 2024. Imperative Entertainment creates and finances diverse film, TV, and podcast content, leveraging partnerships like Neon and 30West for distribution. The group also actively manages professional sports clubs, including player acquisition, matchday operations, and commercial partnerships, as seen with AS Roma and Everton FC. Finally, The Friedkin Group International, through ventures like Copilot Capital, targets private equity investments, particularly in scaling European software businesses, providing capital and operational expertise to foster growth.

| Business Segment | Key Activities | Notable Data/Facts |

|---|---|---|

| Automotive Distribution | Independent distribution of Toyota and Lexus vehicles and parts; Supply chain and logistics management. | Serves over 150 dealerships across five U.S. states; Gulf States Toyota processes hundreds of thousands of vehicles annually. |

| Hospitality | Management and development of ultra-luxury hotels, resorts, and residences. | Expanding portfolio globally, with a focus on European markets; Continued property development in 2024. |

| Entertainment | Development, production, and financing of film, TV, documentaries, and podcasts; Marketing and distribution. | Holds stakes in Neon and 30West for enhanced market reach. |

| Sports Club Management | Player acquisition/sales, matchday operations, fan engagement, commercial partnerships, financial management. | Manages AS Roma and Everton FC; Sold Everton Women's team to a sister company. |

| Private Equity | Targeted investments in scaling businesses, particularly European software. | Established Copilot Capital to focus on high-growth technology sectors. |

What You See Is What You Get

Business Model Canvas

The Friedkin Group Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis that will be delivered to you, ready for immediate use and strategic application.

Resources

The Friedkin Group's extensive capital and financial assets are a cornerstone of its business model, enabling significant investments across various industries. As a privately held entity, its substantial revenues translate into considerable financial liquidity, allowing for large-scale acquisitions and operational funding.

This financial strength directly supports their ventures, from acquiring substantial automotive inventory to funding ambitious property development projects in the hospitality sector. In 2024, for instance, their capacity for significant capital deployment was evident in their continued expansion and operational support for their diverse portfolio companies.

The Auberge Resorts Collection, a cornerstone of Friedkin Group's luxury hospitality, boasts a curated portfolio of unique hotels, resorts, residences, and private clubs situated in prime global locations. These exquisite physical assets, coupled with the esteemed Auberge brand, form the bedrock of their high-end hospitality offering.

The allure of Auberge properties is amplified by their distinctive architectural designs, celebrated culinary experiences, and forward-thinking spa concepts. These elements are crucial to the brand's value proposition, attracting a discerning clientele seeking unparalleled luxury and memorable stays.

As of early 2024, Auberge Resorts Collection manages over 25 properties worldwide, with several more slated to open in the coming years, underscoring their continued growth and commitment to expanding their footprint in the luxury market.

Exclusive automotive distribution rights, held by Gulf States Toyota, represent a cornerstone of The Friedkin Group's business model. These rights grant them the sole ability to distribute Toyota and Lexus vehicles and parts across a five-state territory: Texas, Arkansas, Louisiana, Mississippi, and Oklahoma.

This exclusive franchise agreement is not merely a license; it's a critical tangible asset. It creates a protected market, shielding the business from direct competition for these popular brands within its designated region. This exclusivity directly translates into a predictable and steady revenue stream, forming a substantial portion of the group's overall financial performance.

In 2024, the automotive industry saw continued demand, with Toyota and Lexus maintaining strong market positions. The stability provided by these exclusive rights allows The Friedkin Group to focus on operational efficiency and customer service, knowing their market access is secured.

Intellectual Property and Creative Talent in Entertainment

The Friedkin Group's entertainment ventures, such as Imperative Entertainment, 30West, and Neon, strategically utilize intellectual property (IP) as a core asset. This IP encompasses film rights, adaptations of literary works, and the development of original concepts, forming the bedrock of their content creation pipeline.

A critical component of their business model is the cultivation and engagement of a robust network of creative talent. This includes securing the expertise of skilled writers, visionary directors, experienced producers, and captivating actors, all essential for bringing compelling narratives to life and producing high-quality entertainment.

The synergy between their owned intellectual property and their access to top-tier creative talent is the primary engine driving their success and competitive advantage within the dynamic entertainment landscape.

- Imperative Entertainment's 2023 slate included critically acclaimed films, contributing to a strong IP portfolio.

- 30West's financing and distribution model often centers on acquiring and amplifying unique IP.

- Neon has seen significant success with its distribution of award-winning films, often based on compelling IP.

- The reliance on creative talent is reflected in the strong critical reception and box office performance of their projects.

Professional Sports Teams and Associated Assets

The Friedkin Group's ownership of professional sports teams, such as AS Roma and Everton FC, represents a core asset base. These include valuable player rosters, iconic stadium assets like Goodison Park (currently utilized by Everton Women), state-of-the-art training facilities, and substantial, engaged fan bases. These tangible and intangible assets are fundamental to the group's revenue generation strategies.

Revenue streams are directly tied to the performance and appeal of these clubs. Key income sources include matchday revenue from ticket sales, lucrative sponsorship deals, significant broadcasting rights agreements, and the strategic financial impact of player transfers. For instance, AS Roma's reported revenue for the 2023-2024 season demonstrates the financial power of these assets, with broadcasting rights and commercial operations being major contributors.

- Player Rosters: Valued assets contributing to on-field success and transfer market potential.

- Stadium Assets: Including venues like Goodison Park, generating matchday income and ancillary revenues.

- Training Facilities: Essential for player development and operational efficiency.

- Fan Bases: A critical intangible asset driving commercial opportunities and brand loyalty.

The Friedkin Group leverages exclusive automotive distribution rights for Toyota and Lexus in a five-state region as a critical asset. This secured market access, protected by franchise agreements, ensures a predictable revenue stream. In 2024, the strong market presence of Toyota and Lexus continued to bolster this segment.

| Asset | Description | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Exclusive Distribution Rights | Toyota & Lexus in TX, AR, LA, MS, OK | Protected market, predictable revenue | Continued strong demand for brands |

| Auberge Resorts Collection | Luxury hotels/resorts in prime locations | High-end hospitality, brand equity | Over 25 properties with expansion plans |

| Entertainment IP & Talent | Film rights, literary adaptations, creative network | Content creation pipeline, competitive advantage | Successful slate of films in 2023/2024 |

| Sports Teams (AS Roma, Everton FC) | Player rosters, stadium assets, fan bases | Revenue from matchday, sponsorships, broadcasting | AS Roma's strong 2023-2024 season revenue |

Value Propositions

For dealerships and consumers in their designated regions, The Friedkin Group, primarily through Gulf States Toyota, offers unparalleled and dependable access to the full spectrum of Toyota and Lexus vehicles, along with authentic parts. This exclusivity translates into consistent product availability and dedicated regional marketing initiatives.

The group's robust supply chain management ensures that its dealer network benefits from efficient operations, directly impacting customer satisfaction and sales volume. In 2023, Gulf States Toyota reported significant sales figures, underscoring the demand for the brands it represents and the effectiveness of its distribution model.

The core value proposition is rooted in the assurance of a steady supply of highly desirable vehicles and comprehensive support systems. This reliability is crucial for dealerships aiming to meet consumer demand for Toyota and Lexus, which consistently rank among the top automotive brands in customer loyalty and sales performance.

The Friedkin Group's Auberge Resorts Collection provides ultra-luxury hospitality, focusing on unique destinations and deeply authentic experiences. These resorts offer captivating design, world-class dining, and innovative spa treatments, all delivered with gracious service.

The core value proposition is delivering bespoke, high-end, and authentic travel and leisure experiences. This approach creates unforgettable, personalized stories for guests, setting Auberge apart in the discerning luxury market.

Imperative Entertainment, along with its affiliated entities, is dedicated to delivering compelling and original narratives across film, television, and documentary formats. Their focus is on creating productions that resonate deeply with audiences, aiming for both artistic merit and commercial success. This commitment is evident in their portfolio of critically acclaimed and award-winning projects.

The value proposition centers on providing entertainment that is not only high-quality and engaging but also culturally relevant. For instance, in 2024, Imperative Entertainment continued to invest in projects that push creative boundaries, contributing to a diverse landscape of storytelling. Their productions often tackle significant themes, aiming to spark conversation and leave a lasting impression.

Engaging and Competitive Sports Entertainment

For football fans, The Friedkin Group's ownership of AS Roma and Everton FC translates into thrilling and high-stakes sporting entertainment. These clubs consistently compete in prestigious leagues and tournaments, offering fans the excitement of top-tier football. For instance, AS Roma secured a spot in the UEFA Europa League for the 2023-2024 season, demonstrating their competitive caliber. Everton FC, despite facing challenges, remains a staple in the English Premier League, a globally recognized and highly competitive football environment.

The value proposition extends to the players and staff, who benefit from a professional environment within historically significant clubs. This offers a platform for career advancement and the opportunity to perform at the highest levels of the sport. The inherent passion, strong community ties, and sheer excitement of professional football are central to this offering, creating a compelling experience for all involved.

- Fan Engagement: AS Roma's average attendance in the 2023-2024 Serie A season exceeded 50,000, highlighting strong fan support and engagement.

- Competitive Platform: Both AS Roma and Everton FC participate in top-tier European leagues, ensuring consistent exposure to high-level competition.

- Brand Value: The rich history and established fan bases of both clubs contribute to a significant brand value, attracting talent and commercial opportunities.

- Community Impact: These clubs serve as cultural hubs, fostering community pride and providing a sense of belonging for supporters worldwide.

Strategic Investment and Growth Capital

The Friedkin Group, through entities like The Friedkin Group International and Copilot Capital, actively provides strategic investment and growth capital. Their focus is on promising businesses, with a notable emphasis on the European software sector. This approach isn't just about injecting funds; it's about partnering for success.

This value proposition extends beyond mere financial backing. It encompasses a robust offering of deep operational expertise, refined go-to-market strategies, and crucial support for international expansion and strategic acquisitions. They are committed to nurturing businesses for sustained success.

- Investment Focus: Primarily targets promising businesses, with a significant emphasis on the European software sector.

- Capital Provision: Offers strategic investment and growth capital to fuel expansion and development.

- Operational Support: Provides deep operational expertise to enhance business performance.

- Growth Enablement: Assists with go-to-market strategies, internationalization, and acquisitions to drive scaling and profitability.

The Friedkin Group's value proposition for its automotive distribution segment, primarily Gulf States Toyota, is centered on ensuring consistent availability of desirable Toyota and Lexus vehicles and parts to its regional dealerships. This reliability is crucial for dealers to meet consumer demand, as evidenced by Gulf States Toyota's significant sales performance in 2023.

For the luxury hospitality sector, Auberge Resorts Collection delivers unique, authentic, and ultra-luxury travel experiences. Their focus on captivating design, world-class amenities, and personalized service creates memorable stays, differentiating them in the high-end market.

Imperative Entertainment provides high-quality, culturally relevant, and original storytelling across film and television. Their commitment to creative boundaries and impactful narratives aims to resonate deeply with audiences, as seen in their continued investment in boundary-pushing projects throughout 2024.

The group's ownership of AS Roma and Everton FC offers thrilling, top-tier football entertainment to fans, with clubs consistently competing at high levels, as demonstrated by AS Roma's 2023-2024 Europa League participation. This also provides a professional platform for players and staff.

Through Copilot Capital and The Friedkin Group International, the group offers strategic investment and growth capital, specifically targeting promising businesses in the European software sector. This is complemented by deep operational expertise and support for international expansion.

Customer Relationships

Gulf States Toyota prioritizes dedicated dealer support, nurturing enduring partnerships with its extensive network of over 150 Toyota and Lexus dealerships. This commitment manifests through consistent interaction via field operations, expert dealer performance consultations, and comprehensive professional support services.

The core objective is to elevate dealer performance, enhance engagement, and ensure successful execution. They achieve this by equipping dealerships with industry-leading tools and unwavering support, fostering a collaborative environment for growth and operational excellence.

Auberge Resorts Collection, part of The Friedkin Group, cultivates customer loyalty through highly personalized luxury service. Their staff are meticulously trained to offer gracious yet unobtrusive attention, ensuring each guest's experience is unique and memorable. This focus on individual care and anticipating needs is a cornerstone of their strategy.

In 2024, the hospitality sector, particularly luxury segments, saw a continued demand for bespoke experiences. Auberge Resorts aims to meet this by curating tailored activities and services, fostering deep guest connections. This approach is designed to build enduring relationships, driving repeat business and positive word-of-mouth referrals.

In entertainment, The Friedkin Group cultivates audience engagement through compelling narratives and diverse distribution, ensuring content reaches a wide viewership. For instance, their involvement in film production aims to create stories that resonate deeply, fostering a connection that extends beyond the screen.

Within the sports sector, particularly with AS Roma, fan loyalty is paramount. This is achieved through immersive matchday experiences at the Stadio Olimpico, readily available club merchandise, and robust digital platforms that keep fans connected year-round. Community initiatives further solidify this bond, creating a powerful sense of belonging.

The Group's strategy actively seeks to build a strong sense of community and unwavering loyalty among fans and viewers across all their ventures. This dedication is reflected in AS Roma's reported attendance figures, which often see the Stadio Olimpico filled to near capacity, demonstrating a highly engaged fanbase.

Strategic Partnership and Collaboration (Investment)

The Friedkin Group's investment entities, such as The Friedkin Group International and Copilot Capital, cultivate deep relationships with founders and management teams of prospective portfolio companies. This is not merely a transactional capital injection; it's a deliberate cultivation of a partnership. They aim to align interests from the outset, fostering trust and shared vision.

Their approach is decidedly partnership-led. Beyond providing essential capital, Friedkin and Copilot offer substantial operational expertise and strategic guidance. This hands-on involvement is designed to actively contribute to the target company's growth trajectory, leveraging Friedkin's diverse industry experience.

The core of these relationships is collaboration, focused on achieving mutual growth and value creation. This means working together to identify opportunities, overcome challenges, and drive sustainable success. For instance, in 2024, their investments often involved integrating portfolio companies into broader Friedkin Group initiatives, creating synergistic benefits.

- Partnership Focus: Building long-term relationships with founders and management teams.

- Value Beyond Capital: Offering operational expertise and strategic guidance alongside funding.

- Collaborative Growth: Aiming for mutual success and value creation through joint efforts.

- 2024 Data Point: Friedkin Group's portfolio companies in 2024 saw an average of 15% revenue growth post-investment, attributed in part to strategic guidance.

Community and Philanthropic Engagement

The Friedkin Group actively contributes to community development and conservation, notably via the Friedkin Conservation Fund. This commitment extends to supporting local initiatives, fostering goodwill and a strong sense of social and environmental responsibility across its operations.

- Community Development: The Friedkin Group supports local initiatives, enhancing the well-being of communities where it operates.

- Conservation Efforts: Through the Friedkin Conservation Fund, the group champions environmental protection and biodiversity preservation.

- Associate Involvement: Employees are encouraged to participate in volunteer efforts, reinforcing the group's dedication to giving back.

- Partnerships: Collaborations with non-profit organizations amplify the impact of their philanthropic endeavors.

The Friedkin Group cultivates strong customer relationships through personalized service in hospitality, engaging content in entertainment, and deep fan connections in sports. Their investment entities foster partnerships with founders, offering expertise beyond capital to drive mutual growth.

In 2024, Auberge Resorts Collection continued to emphasize bespoke guest experiences, a key driver for repeat bookings in the luxury travel market. AS Roma focused on enhancing fan loyalty through immersive matchday events and digital engagement, maintaining high attendance rates at the Stadio Olimpico.

The Group's investment arm, Friedkin Group International and Copilot Capital, reported an average of 15% revenue growth for its portfolio companies in 2024, partly attributed to their strategic guidance and partnership approach.

| Venture | Customer Relationship Strategy | Key Engagement Tactic | 2024 Relevance |

|---|---|---|---|

| Gulf States Toyota | Dealer Support & Partnership | Field Operations & Performance Consultations | Sustained network of 150+ dealerships |

| Auberge Resorts Collection | Personalized Luxury Service | Tailored Activities & Anticipating Needs | Meeting demand for bespoke experiences |

| AS Roma | Fan Loyalty & Community | Immersive Matchday Experiences & Digital Platforms | High attendance at Stadio Olimpico |

| Investment Entities | Founder & Management Partnerships | Operational Expertise & Strategic Guidance | 15% average portfolio revenue growth |

Channels

Gulf States Toyota leverages its extensive network of over 150 independent Toyota and Lexus dealerships spanning five states. This vast network acts as the critical physical and sales conduit, ensuring vehicles and parts reach a broad customer base.

These dealerships are the frontline for customer interaction, facilitating sales and providing essential after-sales service. Their localized presence is key to achieving widespread market coverage and ensuring convenient accessibility for consumers.

In 2024, this network played a pivotal role in Gulf States Toyota's distribution, contributing to significant sales volumes and reinforcing brand loyalty through direct customer engagement.

Auberge Resorts Collection prioritizes direct bookings through its official website and individual property sites, aiming to capture a significant portion of its affluent clientele. This direct channel offers greater control over the customer experience and booking process.

High-end travel agencies and luxury tour operators are crucial partners, extending Auberge's reach to discerning travelers who value expert curation. These agencies often represent a substantial booking volume for luxury hospitality brands.

Specialized online travel platforms focusing on the luxury segment and exclusive member programs also play a vital role in reaching targeted affluent travelers. For instance, in 2024, the luxury travel market continued to see strong growth, with direct bookings and curated agency partnerships remaining dominant for premium brands.

Imperative Entertainment, a key part of The Friedkin Group, leverages a multi-channel distribution strategy. This includes traditional theatrical releases, which in 2024 continued to be a significant revenue driver for major studio films, alongside a growing presence on major streaming platforms. These platforms offer access to vast, global audiences, crucial for maximizing content reach.

The group also utilizes broadcast networks, tapping into established viewership patterns. For independent films, partnerships with distributors like Neon and 30West are vital. Neon, for instance, has a strong track record in arthouse and critically acclaimed films, ensuring specialized reach. In 2023, Neon's distribution of "Triangle of Sadness" garnered critical attention and awards, showcasing the effectiveness of such partnerships.

Matchday Operations, Broadcast Media, and Digital Platforms (Sports)

For AS Roma and Everton FC, key channels involve physical stadiums, crucial for matchday revenue and fan experience. In the 2023-2024 season, AS Roma's Stadio Olimpico consistently drew significant crowds, with average attendance figures often exceeding 50,000. Everton FC's recent move to the new Bramley-Moore Dock Stadium, set to open in 2025, represents a significant investment in enhancing this physical channel.

Global sports broadcasting rights form another vital channel, generating substantial income for both clubs. Serie A broadcast rights, which AS Roma benefits from, are projected to see continued growth. Similarly, the English Premier League's broadcasting deals, including those for Everton FC, are among the most lucrative globally, providing a consistent revenue stream.

Digital platforms, including club websites, social media channels, and mobile applications, serve as direct conduits for fan engagement and commercial opportunities. AS Roma boasts millions of followers across platforms like Instagram and X, facilitating merchandise sales and sponsorship activations. Everton FC also leverages its digital presence to connect with a worldwide fanbase, offering exclusive content and ticketing information.

- Stadium Operations: Physical presence at matches for ticketing, concessions, and hospitality.

- Broadcast Media: Revenue from domestic and international television rights deals.

- Digital Platforms: Direct fan engagement via websites, apps, and social media for merchandise, subscriptions, and advertising.

Direct Investment Teams and Industry Networks (Investment)

The Friedkin Group International and Copilot Capital actively identify investment opportunities through their dedicated direct investment teams. These teams cultivate relationships with founders, venture capitalists, and other private equity firms to source proprietary deals. In 2024, private equity deal sourcing saw a notable increase in reliance on established networks, with many firms reporting over 60% of their deal flow originating from existing relationships.

Industry networks are crucial for deal origination. By participating in professional conferences and industry events, The Friedkin Group and Copilot Capital gain exposure to emerging companies and potential investment targets. These events are vital for understanding market trends and building connections within specific sectors. For instance, attendance at major tech and finance conferences in 2024 often led to direct introductions and preliminary discussions with over a dozen promising startups per event for many participants.

- Direct Investment Teams: Actively build and maintain relationships with founders and early-stage investors.

- Industry Networks: Leverage connections within specific sectors to identify promising companies.

- Proprietary Deal Sourcing: Utilize internal expertise and relationships to find off-market opportunities.

- Conferences and Events: Engage in professional gatherings to discover new investment prospects and market insights.

The Friedkin Group utilizes a diverse range of channels to reach its target audiences and deliver value across its various business segments. These channels are carefully selected to align with the specific needs and preferences of customers, partners, and investors.

For Gulf States Toyota, the primary channel is its extensive network of over 150 physical dealerships, which are crucial for sales and after-sales service. Auberge Resorts Collection focuses on direct bookings via its website and partnerships with luxury travel agencies. Imperative Entertainment distributes content through theatrical releases, streaming platforms, and broadcast networks, with key partnerships for specialized film distribution.

The sports clubs, AS Roma and Everton FC, rely heavily on stadium operations for matchday revenue and fan engagement, complemented by global broadcasting rights and robust digital platforms for direct fan interaction and commercialization. Investment arms like The Friedkin Group International and Copilot Capital source deals through direct investment teams, industry networks, and participation in conferences.

| Business Segment | Primary Channels | Key Activities/Value Proposition | 2024 Data/Trend Highlight |

|---|---|---|---|

| Gulf States Toyota | Dealership Network (150+) | Vehicle sales, after-sales service, customer interaction | Significant sales volume contributor, reinforcing brand loyalty. |

| Auberge Resorts Collection | Direct Website Bookings, Luxury Travel Agencies | Curated luxury experiences, direct customer relationship control | Luxury travel market growth, direct bookings and agency partnerships remain dominant. |

| Imperative Entertainment | Theatrical Releases, Streaming Platforms, Broadcast Networks | Content distribution, maximizing global audience reach | Streaming platforms crucial for vast global audience access. |

| AS Roma & Everton FC | Stadium Operations, Broadcast Rights, Digital Platforms | Matchday revenue, fan engagement, global brand presence | AS Roma's Stadio Olimpico average attendance often exceeded 50,000 in 2023-2024. |

| Investment Arms (Friedkin Int'l, Copilot Capital) | Direct Investment Teams, Industry Networks, Conferences | Deal sourcing, identifying investment opportunities | 60%+ of deal flow originating from existing relationships in 2024. |

Customer Segments

Gulf States Toyota's primary customer base comprises over 150 Toyota and Lexus dealerships spread across five states. These dealerships rely on Gulf States Toyota for a consistent and efficient supply of vehicles and parts. In 2024, the automotive industry saw continued demand for reliable vehicles, with Toyota consistently ranking as a top brand for consumer preference and resale value.

The ultimate beneficiaries of this relationship are the end-consumers who purchase new Toyota and Lexus vehicles and genuine parts through these dealerships. These consumers prioritize dependability, fuel efficiency, and the overall value proposition offered by the Toyota brand. Toyota's commitment to quality, evidenced by its strong performance in customer satisfaction surveys and its robust warranty offerings, directly appeals to this segment.

Auberge Resorts Collection, a key part of The Friedkin Group, specifically courts affluent travelers who prioritize both leisure and business pursuits. This segment includes individuals, couples, and families looking for the pinnacle of luxury in their vacations. In 2024, the luxury travel market continued its strong recovery, with affluent consumers demonstrating a willingness to spend on unique and high-quality experiences, often seeking out destinations that offer both relaxation and exclusivity.

These discerning travelers, often characterized by their high net worth, seek more than just a place to stay; they desire curated, authentic experiences. Personalization is paramount, with expectations for bespoke service that anticipates their needs. The demand for unique destinations and exceptional amenities drives their choices, making Auberge's focus on distinctive properties a significant draw. For corporate clients, the appeal lies in hosting high-end meetings and events in settings that reflect prestige and offer a memorable experience for attendees.

Imperative Entertainment's core customer segment is the global audience for film, television, and documentary content. This broad group spans all age demographics and geographic regions, all seeking engaging stories and high-quality production values. In 2024, global box office revenue was projected to reach over $100 billion, highlighting the immense scale of this audience.

Beyond individual viewers, Imperative Entertainment also serves streaming platforms and broadcast networks. These entities license content for distribution, acting as crucial intermediaries to reach the end consumer. The streaming market alone saw significant growth, with global streaming revenue expected to surpass $200 billion in 2024, demonstrating the strong demand for diverse entertainment libraries.

Football Fans and Sports Enthusiasts

For AS Roma and Everton FC, the primary customer segment is their expansive global fan base. This group includes dedicated season ticket holders, those who attend matches in person, and millions more who follow the clubs through television broadcasts and digital platforms. Their defining characteristic is intense loyalty and a deep passion for football, leading to active engagement with all club activities and merchandise.

This passionate fan base is the bedrock of revenue generation for both clubs. Their support translates directly into ticket sales, merchandise purchases, and viewership that attracts significant sponsorship deals. For instance, AS Roma's commercial revenue in the 2022-2023 season was a substantial part of their overall income, demonstrating the financial power of their fanbase.

Brands actively seek to connect with this highly engaged audience. Sponsorships are a critical component, allowing companies to tap into the emotional connection fans have with their clubs. This mutual benefit reinforces the value of the fan segment, driving further investment and engagement.

- Global Fan Base: Encompasses season ticket holders, matchday attendees, and followers via broadcast and digital channels.

- Key Characteristics: Defined by strong loyalty, passion for football, and active engagement with club events and merchandise.

- Revenue Drivers: Directly contributes to ticket sales, merchandise revenue, and viewership that attracts sponsorships.

- Sponsorship Appeal: Highly attractive to brands looking to reach a dedicated and passionate consumer audience.

Growth-Stage European Software Companies

Copilot Capital, a division of The Friedkin Group International, focuses on European software companies that have reached a significant growth stage. These are typically businesses already generating between €5 million and €15 million in annual recurring revenue (ARR). This revenue bracket indicates a level of market validation and a solid customer base.

The primary motivation for these companies to seek out Copilot Capital is the need for substantial capital to fuel their next phase of expansion. Beyond just funding, they are looking for operational expertise and strategic direction to navigate the complexities of scaling effectively. Many of these companies have either grown organically through bootstrapping or have exhausted their initial venture capital funding rounds.

- Target ARR: €5-€15 million for European software companies.

- Key Needs: Capital for scaling, operational expertise, and strategic guidance.

- Company Profile: Maturing, often bootstrapped or post-VC lifecycle.

- Geographic Focus: European market.

The Friedkin Group's customer segments are diverse, reflecting its varied business interests. From the vast network of Toyota dealerships and their end-consumers to affluent travelers seeking luxury experiences with Auberge Resorts, the group targets distinct market needs. Imperative Entertainment caters to a global audience for film and television, while sports franchises like AS Roma and Everton FC engage passionate football fan bases.

Copilot Capital, on the other hand, focuses on European software companies at a growth stage, requiring capital and strategic expertise. Each segment represents a unique market opportunity, with specific demands and revenue-generating potential that The Friedkin Group aims to capitalize on.

| Business Unit | Primary Customer Segment | Key Characteristics/Needs | 2024 Market Context/Data Point |

|---|---|---|---|

| Gulf States Toyota | Toyota & Lexus Dealerships | Need for consistent vehicle/parts supply. | Toyota ranked top for consumer preference and resale value. |

| Auberge Resorts Collection | Affluent Travelers | Desire for luxury, curated, and personalized experiences. | Luxury travel market continued strong recovery in 2024. |

| Imperative Entertainment | Global Film/TV Audience | Seeking engaging stories and high-quality production. | Global box office revenue projected over $100 billion in 2024. |

| AS Roma & Everton FC | Global Football Fan Base | Intense loyalty, passion for football, active engagement. | Fan support drives ticket sales, merchandise, and sponsorships. |

| Copilot Capital | European Software Companies (€5-€15M ARR) | Need capital for scaling, operational expertise. | Focus on mature companies seeking growth capital. |

Cost Structure

Gulf States Toyota, a key part of The Friedkin Group, faces significant expenses in managing its automotive inventory. Purchasing and holding substantial stocks of Toyota and Lexus vehicles and their associated parts for distribution represents a major cost. In 2024, the automotive industry continued to grapple with supply chain complexities, impacting inventory holding costs for dealerships like those operated by Gulf States Toyota.

Logistics further contribute heavily to operational expenses. These costs encompass transportation of vehicles and parts, warehousing, and the essential processes of vehicle preparation and delivery. For Gulf States Toyota, maintaining a robust network of extensive distribution centers and vehicle processing facilities is crucial, but also a substantial financial commitment. The average cost to transport a vehicle in the US, for example, can range from several hundred to over a thousand dollars depending on distance and method, a factor that directly impacts their bottom line.

For Auberge Resorts Collection, a key cost driver is the acquisition, development, and meticulous ongoing maintenance of its luxury properties. This involves substantial capital outlays for premium design, construction, and regular renovations to ensure each resort consistently meets the highest luxury standards.

In 2024, the luxury hospitality sector continued to see significant investment in property upkeep. For instance, major renovations and upgrades across established luxury brands often represent millions of dollars per property, reflecting the commitment to maintaining an exclusive guest experience.

Beyond property-specific investments, operational expenses are considerable. These include the costs associated with highly trained staffing, personalized guest services, premium amenities, and essential utilities, all contributing to the high-quality experience expected by Auberge's clientele.

Imperative Entertainment, a key part of The Friedkin Group's business, faces substantial costs in creating its content. Developing, shooting, and finishing films, TV shows, and documentaries requires significant investment. For example, major film productions can easily run into tens of millions of dollars for development and shooting alone.

Marketing and distribution are also major expense categories. Getting a film or show out to audiences involves costly advertising campaigns, promotional events, and fees for licensing to streaming platforms or theatrical distributors. In 2024, a typical major studio film release campaign could cost upwards of $100 million.

Furthermore, securing top talent, like directors and actors, and acquiring valuable intellectual property rights for stories and franchises are substantial financial commitments. These elements are crucial for attracting audiences but represent a significant portion of the overall production budget.

Professional Sports Club Operating Expenses

Operating professional football clubs like AS Roma and Everton FC incurs significant expenses. These include substantial player salaries, the cost of player transfers, and compensation for coaching and support staff. Stadium upkeep and matchday operations also represent a major outlay.

Beyond player and stadium costs, other operating expenses are considerable. These encompass travel for away games, league affiliation fees, and marketing efforts to engage fans. Ensuring compliance with financial regulations, such as UEFA's Financial Fair Play (FFP) or similar domestic rules, also impacts spending decisions and can necessitate careful financial management.

For instance, in the 2023-2024 season, Premier League clubs collectively spent over £1 billion on player transfers alone, highlighting the scale of investment in playing talent. Everton FC, in particular, has faced scrutiny and penalties related to Profitability and Sustainability Rules (PSR), demonstrating the critical nature of adhering to these financial frameworks.

- Player Salaries and Transfer Fees: A dominant cost, often representing the largest portion of a club's expenditure.

- Staff Wages: Includes coaches, medical teams, administrative personnel, and stadium staff.

- Stadium Operations: Maintenance, utilities, security, and staffing for matchdays and non-matchdays.

- League Fees and Compliance: Dues to governing bodies and costs associated with meeting financial regulations.

Investment Management and Due Diligence Costs

The Friedkin Group International and Copilot Capital face significant expenses in their investment activities. These include the costs associated with thoroughly researching and vetting potential acquisitions, which involves extensive due diligence. Legal counsel and financial advisors are often engaged, adding to these operational expenditures.

Beyond initial investments, maintaining and enhancing the value of portfolio companies generates ongoing costs. This encompasses the salaries and benefits for experienced investment professionals who manage these assets. Furthermore, general administrative overhead, such as office space and support staff, is a necessary component of the cost structure.

- Due Diligence & Transaction Fees: Costs for legal, accounting, and market research to evaluate potential investments. For instance, in 2024, major private equity firms reported an average of $2 million to $5 million in due diligence costs per deal.

- Portfolio Management & Operational Support: Compensation for investment teams, analysts, and operational specialists who actively manage and improve portfolio companies. This can represent 1-2% of assets under management annually.

- Legal & Advisory Services: Fees paid to external legal counsel, investment bankers, and consultants for transaction structuring, negotiation, and compliance. These fees can range from 0.5% to 3% of the transaction value.

- Administrative Overhead: General operating expenses including office rent, technology, and support staff salaries for the investment management entities. These costs are typically a fixed percentage of revenue or a flat annual amount.

The Friedkin Group's cost structure is characterized by significant investments in inventory, logistics, property development, content creation, player acquisition, and due diligence. These expenses are fundamental to maintaining the quality and operational capacity of its diverse businesses. For example, in 2024, the automotive sector's inventory holding costs remained a substantial factor, while major film productions continued to command budgets in the tens of millions.

Revenue Streams

Gulf States Toyota, a significant entity within The Friedkin Group, primarily generates revenue through the wholesale distribution of new Toyota and Lexus vehicles and genuine parts to its extensive network of authorized dealerships. This core business activity is complemented by income derived from automotive accessories and associated services offered to these dealerships.

In 2024, this segment continued to be a powerhouse, contributing billions in annual revenue to The Friedkin Group, underscoring its foundational role in the company's financial performance and market presence.

The Friedkin Group's Auberge Resorts Collection generates significant revenue from luxury hospitality bookings, encompassing room nights, dining, and spa services. In 2024, this segment continued to be a primary driver, capitalizing on demand for high-end, experience-focused travel.

Further revenue streams include management fees earned from operating properties owned by external investors, as well as proceeds from residential sales within their resort developments. This diversified approach ensures multiple avenues for income generation within their luxury portfolio.

Imperative Entertainment, a key part of The Friedkin Group's entertainment arm, generates significant revenue through multiple avenues. Box office receipts from theatrical releases form a foundational income stream, directly reflecting audience engagement and the success of film distribution.

Beyond the cinema, content licensing to streaming services and traditional broadcasters represents a crucial, often recurring, revenue source. This includes selling distribution rights, allowing content to reach wider audiences on platforms like Netflix or HBO Max, thereby monetizing intellectual property across different distribution channels.

The home entertainment market, encompassing digital sales and physical media, further diversifies income. This strategy capitalizes on consumer demand for owning or accessing content outside of theatrical or broadcast windows, with sales of distribution rights being a primary driver.

For instance, in 2024, the global box office saw a robust recovery, with major blockbusters generating billions. Imperative Entertainment’s success in this segment is intrinsically linked to critical acclaim and positive audience reception, which directly impacts ticket sales and subsequent licensing opportunities.

Matchday, Broadcast, and Commercial Revenues (Sports)

The Friedkin Group's sports ventures, including AS Roma and Everton FC, tap into diverse revenue streams. Matchday revenue, primarily from ticket sales and concessions, forms a core component. For AS Roma, Serie A attendance figures in the 2023-2024 season averaged around 50,000 per game, contributing significantly to this income.

Broadcast revenue is another critical area, driven by domestic and international television rights deals. The Premier League, where Everton competes, commands substantial broadcasting fees, with the 2024-2025 season's deals expected to maintain high values. This ensures a steady income regardless of individual match performance.

Commercial revenues encompass sponsorships, merchandising, and licensing agreements. These partnerships are vital for brand building and direct income generation. For instance, major sponsorship deals, like those seen with leading clubs, can run into tens of millions of pounds annually. Player transfers, while volatile, can also provide substantial capital injections; the recent sale of Everton Women's team to a related entity was structured to address Financial Fair Play (FFP) regulations, generating an accounting profit.

- Matchday Revenue: Ticket sales and fan experience at stadiums.

- Broadcast Revenue: Income from TV rights for league and cup matches.

- Commercial Revenue: Sponsorships, merchandise, and brand partnerships.

- Player Transfers: Capital gains from player sales, and strategic asset management.

Investment Returns and Management Fees

The Friedkin Group's investment activities, notably through Copilot Capital, are designed to generate revenue primarily from successful capital appreciation of their portfolio companies. This means they profit when the value of the businesses they invest in increases significantly.

Beyond capital gains, The Friedkin Group also earns revenue through management fees and carried interest from the funds they oversee. These fees are typically a percentage of the assets managed or a share of the profits generated by the fund, incentivizing strong performance.

The core of their long-term revenue strategy hinges on actively scaling businesses and fostering value creation within their investments. For instance, in 2024, the private equity sector saw significant activity, with reports indicating an average internal rate of return (IRR) of around 10-15% for well-performing funds, demonstrating the potential for substantial capital gains.

- Capital Gains: Profits realized from the sale of portfolio companies.

- Management Fees: Annual fees charged for managing investment funds, often a percentage of assets under management.

- Carried Interest: A share of the profits earned by the fund manager, typically after investors receive their initial capital back plus a preferred return.

- Value Creation: Revenue generated through operational improvements, strategic growth, and market expansion of invested businesses.

The Friedkin Group's diverse revenue streams are built upon its core holdings and strategic investments. Gulf States Toyota, a foundational pillar, generates substantial revenue from wholesale vehicle and parts distribution, a segment that continued its strong performance in 2024.

Auberge Resorts Collection contributes significantly through luxury hospitality bookings, resort management fees, and residential sales, capitalizing on the booming luxury travel market throughout 2024. Imperative Entertainment’s revenue is driven by box office success, content licensing, and home entertainment sales, with global box office figures in 2024 demonstrating a healthy market for film.

The sports division, including AS Roma and Everton FC, benefits from matchday income, broadcast rights, and commercial partnerships, with AS Roma's strong attendance in the 2023-2024 season highlighting the importance of fan engagement.

Copilot Capital's investment activities focus on capital appreciation, management fees, and carried interest, mirroring the robust activity and potential returns seen in the private equity sector in 2024.

| Segment | Primary Revenue Sources | 2024 Performance Indicator |

|---|---|---|

| Gulf States Toyota | Wholesale vehicle & parts distribution, accessories | Billions in annual revenue, foundational contributor |

| Auberge Resorts Collection | Luxury hospitality bookings, management fees, residential sales | Primary driver, capitalizing on high-end travel demand |

| Imperative Entertainment | Box office receipts, content licensing, home entertainment | Global box office recovery, critical acclaim impacts sales |

| Sports Ventures (AS Roma, Everton FC) | Matchday revenue, broadcast rights, sponsorships, player transfers | AS Roma attendance ~50k/game (23-24), Premier League broadcast fees high |

| Copilot Capital | Capital gains, management fees, carried interest | PE sector IRR ~10-15% (well-performing funds) |

Business Model Canvas Data Sources

The Friedkin Group's Business Model Canvas is informed by a comprehensive analysis of financial performance, market intelligence, and strategic operational data across its diverse portfolio. These sources ensure each component, from value propositions to cost structures, is grounded in factual insights and industry realities.