The Friedkin Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

Navigate the complex external forces shaping The Friedkin Group's diverse portfolio, from automotive and entertainment to sports. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Gain a critical understanding of how these macro-environmental trends can impact strategic decision-making and future growth. Download the full version now to unlock actionable intelligence and stay ahead of the curve.

Political factors

Government policies significantly shape the automotive sector, influencing everything from import costs to environmental standards. For instance, in 2024, many nations continued to implement stricter emissions regulations, pushing manufacturers towards electric vehicle (EV) production and impacting the sales of traditional internal combustion engine vehicles. This necessitates adaptation in supply chains and product offerings.

Trade policies, such as tariffs, can directly affect the cost of imported vehicles and parts. For example, a hypothetical 25% tariff on automotive imports, as seen in some markets in previous years, would substantially increase operational expenses for distributors like Gulf States Toyota, potentially leading to higher consumer prices and altered sales volumes.

These regulatory shifts also influence consumer behavior and the competitive environment. As governments promote greener transportation, demand for EVs is projected to rise, creating new market opportunities but also intensifying competition for traditional automakers and their distributors. By mid-2025, it's anticipated that EV market share in several key regions will see continued growth, forcing strategic adjustments.

The Friedkin Group's significant investment in professional sports, exemplified by their acquisition of Everton Football Club, places them directly under the purview of influential sports governance entities such as the Premier League and the Football Association.

Navigating and adhering to regulations like the Premier League's Profitability and Sustainability Rules (PSR) is paramount, as breaches can lead to substantial financial penalties and points deductions, impacting club operations and future investment strategies. For instance, Everton themselves faced a ten-point deduction in November 2023 for breaching PSR.

The successful acquisition and ongoing operation of sports clubs are contingent upon securing approvals from these regulatory bodies, representing a critical political pathway that requires careful management and compliance with evolving governance frameworks.

Governments globally are tightening regulations in adventure travel, prioritizing safety and industry standards. For instance, New Zealand introduced stricter requirements for adventure tourism operators following incidents, impacting operational procedures and insurance needs. This trend is also evident in emerging markets, with Oman developing comprehensive guidelines for adventure activities to ensure professional conduct and visitor protection.

These evolving rules often mandate that guides must be associated with licensed entities and that operations undergo regular safety assessments. Furthermore, enhanced risk communication protocols are becoming standard, requiring operators to clearly inform participants about potential hazards. For The Friedkin Group, this means adapting its adventure travel divisions to meet these increasingly stringent compliance demands, potentially leading to increased operational expenditures.

International Relations and Trade Agreements

Geopolitical stability and international trade agreements are crucial for The Friedkin Group's diverse operations. Shifting alliances or new trade barriers can significantly impact global supply chains for automotive distribution, as well as the viability of international luxury hospitality and adventure travel ventures. For instance, the ongoing trade tensions between major economies can lead to increased tariffs on imported vehicles, directly affecting automotive sales and profitability. In 2024, the automotive sector continued to grapple with these uncertainties, with some analysts projecting a potential 5-10% increase in costs for certain imported components due to evolving trade policies.

The group's exposure to international markets means that disruptions in global trade flows can have a cascading effect. New trade barriers, such as those seen in recent years impacting specific manufacturing sectors, can necessitate costly adjustments to sourcing and distribution strategies. This sensitivity is amplified when considering the luxury hospitality and adventure travel segments, where customer confidence and ease of international movement are paramount. For example, changes in visa regulations or the imposition of travel restrictions can directly deter international tourism, impacting revenue streams for these businesses.

- Automotive Tariffs: The automotive industry has been particularly sensitive to tariffs, with potential increases impacting the cost of imported vehicles and parts.

- Supply Chain Disruptions: Geopolitical shifts can disrupt complex global supply chains, affecting the availability and cost of goods for distribution.

- Travel and Hospitality Impact: Changes in international relations can influence travel policies and consumer confidence, directly affecting the hospitality and adventure travel sectors.

- Trade Agreement Revisions: The renegotiation or introduction of trade agreements can create new opportunities or challenges for international business operations.

Environmental Policy and Lobbying

Political discussions concerning environmental regulations, particularly those impacting renewable energy adoption and land conservation, can directly affect The Friedkin Group's business activities and how it's perceived by the public. For instance, evolving carbon emission standards or incentives for green technologies could necessitate operational adjustments or investments.

The Friedkin Group's engagement in advocating against specific environmental initiatives, such as certain wind and solar energy developments, highlights a strategic political stance on its environmental impact. This advocacy suggests a deliberate effort to shape policy outcomes that align with its business interests, potentially influencing the pace and direction of energy transition projects.

- Policy Influence: The group's lobbying efforts demonstrate a proactive approach to influencing environmental legislation, potentially impacting the cost and feasibility of energy projects in regions where it operates.

- Public Perception: Advocacy against renewable energy can shape public opinion and create potential reputational risks or benefits, depending on stakeholder alignment with environmental goals.

- Regulatory Landscape: Changes in environmental policy, such as stricter emissions controls or new permitting requirements for energy infrastructure, can directly impact operational costs and strategic planning for The Friedkin Group.

Government policies continue to heavily influence the automotive sector, with a focus on emissions standards and the promotion of electric vehicles. For 2024 and into 2025, many countries are expected to maintain or even tighten these regulations, impacting traditional vehicle sales and driving demand for EVs. This necessitates ongoing adaptation in product development and supply chain management.

Trade agreements and potential tariffs remain critical factors, directly affecting the cost of imported vehicles and automotive parts. For instance, shifts in international trade relations could lead to increased import costs, impacting pricing and sales volumes for distributors. The automotive industry globally is projected to see continued volatility in component costs due to these geopolitical and trade policy dynamics through 2025.

The Friedkin Group's sports investments, such as Everton FC, are subject to stringent regulatory oversight from bodies like the Premier League. Adherence to financial rules, like the Profitability and Sustainability Rules (PSR), is crucial, as demonstrated by past penalties. Compliance with evolving governance frameworks is essential for operational stability and future investment.

What is included in the product

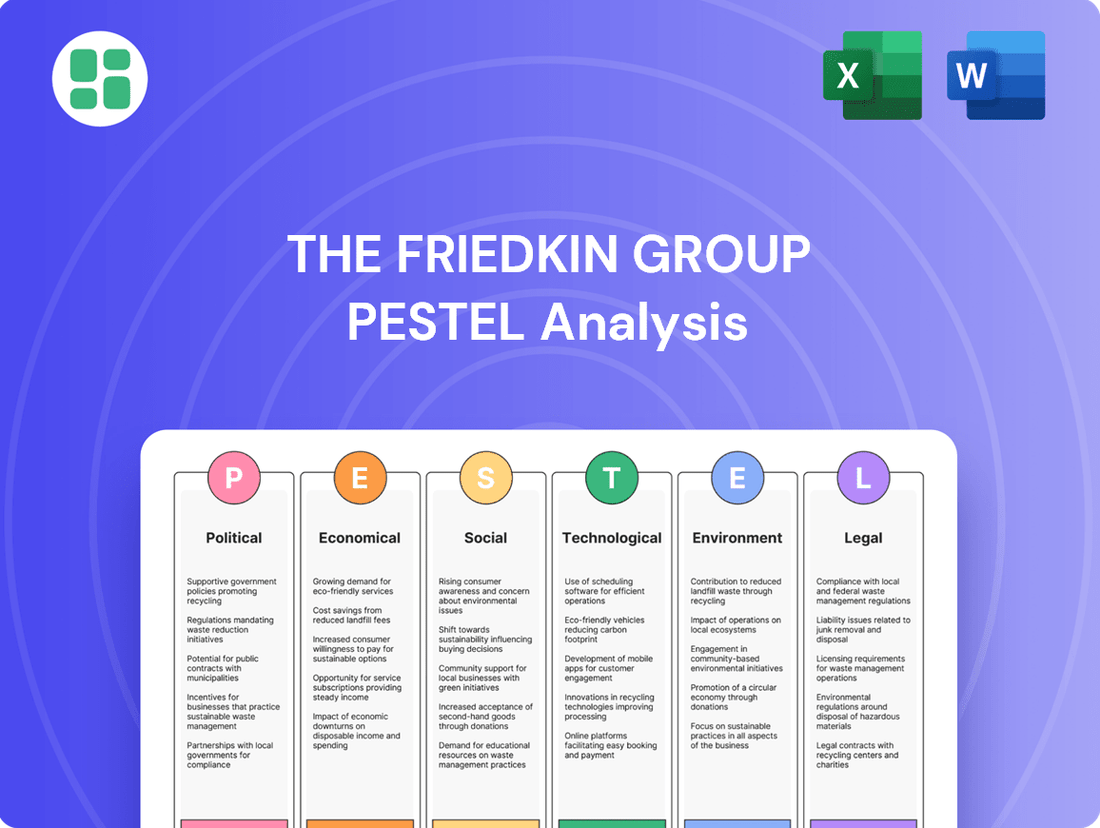

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting The Friedkin Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities shaped by current trends and market dynamics.

A PESTLE analysis for The Friedkin Group offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain of information overload.

Economic factors

The global luxury hospitality market is on a strong upward trajectory, with forecasts pointing to continued expansion well into 2025. This growth is fueled by a rebound in both leisure and business travel, coupled with a growing consumer appetite for unique and exclusive experiences. For Auberge Resorts Collection, this translates to a favorable market environment.

Evidence of this robust economic climate for luxury hospitality includes substantial investment in high-end properties and a noticeable increase in average daily rates (ADRs). For instance, the luxury hotel segment saw ADRs rise by approximately 15-20% in many key global markets during 2023 compared to pre-pandemic levels, a trend expected to persist. This indicates strong demand and pricing power within the sector.

Consumer spending patterns and the overall economic outlook are crucial for The Friedkin Group. Factors like GDP growth and inflation directly affect sales across their various businesses, from automotive to hospitality. For instance, a projected slowdown in consumer spending for 2025 could create challenges, particularly for sectors more sensitive to discretionary income.

While luxury markets often demonstrate resilience, a general economic downturn or persistent inflation can dampen demand for automotive sales and impact travel bookings. Understanding these trends is key to navigating the market effectively. For example, the US Personal Consumption Expenditures (PCE) price index, a key inflation gauge, saw a moderate increase in early 2024, but future projections suggest a potential easing, which could offer some relief to consumer budgets later in the year and into 2025.

The automotive distribution sector, exemplified by Gulf States Toyota, is significantly influenced by economic factors like sales forecasts and inventory management. For instance, the U.S. new car sales were projected to reach around 15.5 million units in 2024, a slight increase from 2023, highlighting the importance of accurate forecasting and efficient inventory to capture market demand.

Tariffs on imported vehicles and parts can also create economic headwinds, impacting the cost of goods for distributors and potentially influencing consumer pricing. Delays in vehicle distribution, such as those reported for some 2025 models, can disrupt sales volumes and alter regional market dynamics, directly affecting revenue streams.

The overall health of both the new and used car markets is a critical economic determinant. In 2024, the used car market continued to see price stabilization after significant fluctuations, with average prices hovering around $26,000, demonstrating the interconnectedness of new and pre-owned vehicle sales on a distributor's financial performance.

Entertainment Industry Revenue Shifts

The entertainment production sector, including companies like Imperative Entertainment, is experiencing significant revenue model shifts, largely driven by the explosive growth of streaming services and evolving consumer viewing habits. This transition impacts how content is financed and distributed, with major media conglomerates re-evaluating their investment strategies in light of these changes.

Economic pressures are forcing a more cautious approach to content spending, leading to a focus on cost-cutting measures across the industry. For instance, in 2024, many major studios and streaming platforms announced plans to reduce production budgets and scrutinize project greenlighting processes, reflecting a broader industry-wide 'reset' phase.

- Streaming Dominance: The continued expansion of streaming platforms, such as Netflix, Disney+, and Max, has fundamentally altered revenue streams, moving away from traditional theatrical or broadcast models.

- Content Spending Adjustments: Economic headwinds in 2024 led to an estimated 5-10% reduction in overall content spending by major media companies compared to 2023, impacting production volumes.

- Focus on Profitability: There's a pronounced industry-wide emphasis on achieving profitability and a more strategic, measured approach to investment in new intellectual property and production.

Interest Rates and Investment Capital

Fluctuations in interest rates directly affect The Friedkin Group's cost of borrowing, impacting the feasibility of financing new ventures and acquisitions. Higher interest rates can increase the expense of capital, potentially slowing down expansion plans for entities like Auberge Resorts Collection. For instance, the Federal Reserve's policy decisions throughout 2024, which saw rates remain elevated to combat inflation, meant that securing new debt financing became more costly compared to previous periods.

The availability of investment capital is closely tied to the broader economic climate and investor confidence, both of which are influenced by interest rate environments. When interest rates are high, investors may demand higher returns, making it more challenging to attract the necessary capital for large-scale projects. This can particularly influence strategic growth initiatives for The Friedkin Group's diverse portfolio, from automotive ventures to hospitality. Auberge Resorts Collection's recent capital injection highlights the group's ability to secure funding, but ongoing market conditions will shape future capital access.

- Interest Rate Impact: Higher interest rates in 2024 increased borrowing costs for The Friedkin Group, affecting the financial viability of new investments and acquisitions.

- Capital Availability: Elevated interest rates can reduce the pool of readily available investment capital, potentially slowing down expansion for subsidiaries like Auberge Resorts Collection.

- Strategic Growth: Future strategic growth initiatives are contingent on favorable interest rate environments and the continued accessibility of investment capital in the broader market.

- Financing Costs: The cost of financing new developments and expansions is directly correlated with prevailing interest rates, influencing the group's overall investment strategy.

The economic landscape for The Friedkin Group in 2024-2025 is marked by a mixed but generally positive outlook for its diverse holdings. While inflation showed signs of moderating, interest rates remained elevated, influencing borrowing costs and capital availability for expansion, particularly impacting hospitality ventures like Auberge Resorts Collection. Automotive sales forecasts indicated modest growth, underscoring the importance of efficient inventory and distribution for entities such as Gulf States Toyota.

The entertainment sector, represented by Imperative Entertainment, faced a strategic shift towards profitability, with content spending adjustments becoming a norm. This recalibration, driven by the streaming boom, necessitates a keen understanding of evolving consumer habits and a focus on cost-effective production. The group's ability to navigate these economic currents will be pivotal for sustained success across all its business segments.

| Economic Factor | 2024 Projection/Trend | 2025 Outlook | Impact on Friedkin Group |

|---|---|---|---|

| GDP Growth | Moderate global growth expected | Continued moderate growth, potential regional variations | Supports consumer spending and demand for luxury goods/services |

| Inflation Rate | Moderating from 2023 highs, but still present | Expected to continue gradual decline towards target levels | Influences operating costs and consumer purchasing power |

| Interest Rates | Remained elevated through 2024 | Potential for gradual easing, but uncertainty remains | Increases borrowing costs, impacts investment financing |

| Consumer Spending | Resilient, particularly in luxury segments | Expected to remain strong, influenced by inflation and employment | Drives sales for automotive and hospitality divisions |

| Automotive Sales (US) | Projected ~15.5 million units in 2024 | Slightly higher projections for 2025, contingent on economic factors | Affects performance of automotive distribution |

Full Version Awaits

The Friedkin Group PESTLE Analysis

The Friedkin Group PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting The Friedkin Group, providing valuable strategic insights. You'll gain a deep understanding of the external forces shaping their business landscape.

Sociological factors

Consumers today, especially in the luxury hospitality space, are looking for more than just a place to stay. They crave unique, personalized experiences that truly immerse them in a destination. This means everything from bespoke dining options to locally guided adventures is becoming increasingly important. For instance, a 2024 report indicated that 65% of luxury travelers prioritize authentic cultural experiences when booking their trips.

The Auberge Resorts Collection is a prime example of a brand adeptly responding to these evolving preferences. They are known for curating special events, facilitating genuine cultural discoveries, and offering revitalizing wellbeing retreats. This focus on tailored, experiential travel allows them to connect with guests on a deeper level, distinguishing them in a competitive market.

This dynamic shift in consumer demand necessitates constant innovation within the hospitality sector. Brands must continuously refine their guest services and develop highly tailored offerings. Failing to adapt means risking market leadership, as guests will naturally gravitate towards establishments that better align with their desire for memorable and individualized stays.

Audience habits in entertainment are rapidly evolving, marked by a significant fragmentation. Consumers are increasingly seeking out niche content and a growing appetite for locally produced narratives is evident. This shift demands production entities like Imperative Entertainment to rethink their content strategies.

The dominance of streaming platforms and the burgeoning interactive gaming sector are reshaping how audiences consume entertainment. Imperative Entertainment must therefore embrace diverse storytelling approaches and explore multi-sensory engagement to effectively capture and retain viewer attention in this dynamic landscape.

In 2024, global streaming service revenue was projected to exceed $100 billion, underscoring the platform's continued influence. Furthermore, the gaming industry's market size reached an estimated $280 billion in 2024, highlighting the competitive pressure for audience engagement across different media.

Beyond traditional luxury, a significant sociological shift is driving demand for experiential and adventure travel. Travelers are increasingly seeking unique activities and genuine local connections over mere accommodation.

The Friedkin Group's adventure travel division directly taps into this trend. For instance, in 2024, adventure tourism spending globally is projected to reach $1.5 trillion, with a notable portion allocated to unique experiences like hot air ballooning or wildlife encounters.

This necessitates offerings that are active, memorable, and often in remote settings. The group's portfolio, featuring activities such as swimming with whale sharks and helicopter tours, aligns perfectly with this evolving traveler preference for immersive and distinct adventures.

Sustainability Consciousness in Consumer Choices

A significant and growing portion of consumers are now prioritizing companies that exhibit strong environmental and social responsibility in their purchasing decisions. This trend directly influences the demand for eco-friendly operational strategies within sectors like golf course management and the luxury travel industry.

Businesses that actively showcase their dedication to sustainability, for example, through ethical tourism practices and dedicated conservation initiatives, often see an enhancement in their brand image. This can translate into attracting and retaining a clientele that is increasingly conscious of their environmental footprint.

- Consumer Demand Shift: Reports from 2024 indicate that over 60% of consumers globally consider sustainability when making buying decisions, a figure projected to rise.

- Impact on Luxury Travel: A 2025 survey found that 75% of luxury travelers are willing to pay a premium for eco-certified accommodations and experiences.

- Brand Loyalty: Companies with robust sustainability programs in 2024 reported an average 15% higher customer retention rate compared to those with weaker initiatives.

Workforce Demographics and Expectations

Societal shifts are significantly reshaping the workforce. Employees increasingly prioritize work-life balance, expecting flexibility and a healthy integration of personal and professional lives. For instance, a 2024 survey by Deloitte found that 70% of employees value flexibility in where and when they work. This trend directly impacts how companies like The Friedkin Group attract and retain talent across its diverse operations, from hospitality to automotive.

Furthermore, expectations around diversity, equity, and inclusion (DEI) are paramount. A motivated workforce demands that companies demonstrate a genuine commitment to these principles. In the hospitality sector, which saw job recovery continue into 2024, companies are finding that strong DEI initiatives are crucial for attracting a broader talent pool and fostering employee loyalty. This means actively promoting inclusive hiring practices and creating a culture where all employees feel valued and respected.

The Friedkin Group must navigate these evolving workforce demographics and expectations to maintain a competitive edge. This includes adapting recruitment strategies and company culture to align with modern employee values.

- Work-Life Balance: 70% of employees surveyed in 2024 by Deloitte reported flexibility as a key factor in job satisfaction.

- DEI Importance: Companies with robust DEI programs often experience higher employee engagement and retention rates.

- Hospitality Sector Trends: The hospitality industry continues to focus on attracting and retaining staff by offering competitive benefits and flexible scheduling in 2024.

- Ethical Practices: A growing number of employees, particularly younger generations, consider a company's ethical stance and social responsibility when choosing an employer.

Societal values are increasingly emphasizing authenticity and personalized experiences, particularly within the luxury and adventure travel sectors. Consumers, as evidenced by 2024 data showing over 60% considering sustainability in purchases, are also prioritizing companies with strong environmental and social responsibility. This shift necessitates that The Friedkin Group's diverse portfolio, from hospitality to adventure tourism, actively demonstrates a commitment to ethical practices and unique, memorable guest journeys to resonate with modern consumer expectations.

Technological factors

The automotive distribution sector is being reshaped by significant technological shifts, notably the surge in electric vehicles (EVs), the development of autonomous driving, and the increasing integration of advanced driver-assistance systems (ADAS). These innovations necessitate substantial adaptation from companies like Gulf States Toyota.

Meeting these advancements requires strategic investments. Gulf States Toyota will need to allocate capital towards building out charging infrastructure to support EV sales and servicing, as well as providing specialized training for technicians to handle the complexities of new automotive technologies.

Furthermore, evolving regulatory landscapes, particularly concerning vehicle safety ratings and emissions standards, are compelling the adoption of these new technologies. For instance, mandates for enhanced safety features, often linked to ADAS, directly influence inventory and sales strategies for distributors.

Technology is fundamentally altering the luxury hospitality and adventure travel sectors. Smart devices, Internet of Things (IoT) sensors, and enhanced connectivity are becoming standard, enabling everything from smart irrigation and automated mowers for pristine golf courses to sophisticated mobile apps that streamline bookings, track guest activities, and deliver highly personalized experiences across resorts.

Auberge Resorts Collection, for instance, actively integrates technology to elevate both the guest journey and internal operational effectiveness. This focus on digital innovation allows for more seamless interactions and data-driven improvements, ultimately contributing to a superior guest experience and more efficient management of their properties.

Artificial Intelligence (AI) and Generative AI (GenAI) are rapidly reshaping entertainment production. These technologies are not just speeding up existing processes but also unlocking entirely new creative avenues and storytelling techniques. For instance, AI can now assist in scriptwriting by generating plot ideas or dialogue, and GenAI tools are being used for visual effects, character design, and even music composition, significantly reducing production timelines and costs. The global AI in media and entertainment market was valued at approximately $10.5 billion in 2023 and is projected to reach over $40 billion by 2028, showcasing substantial growth and investment.

Imperative Entertainment can strategically integrate AI across its production pipeline. This includes utilizing AI for early-stage script analysis and development, generating concept art, automating aspects of post-production like color grading and editing, and even creating personalized trailers or marketing content tailored to specific audience segments. The potential for AI to enhance efficiency and creative output is immense, allowing for more ambitious and innovative projects.

However, the adoption of AI in entertainment is not without its challenges. Key considerations for Imperative Entertainment include the ethical implications surrounding AI-generated content, such as copyright and authorship, and the significant investment required for implementing and maintaining these advanced technologies. Demonstrating a clear return on investment (ROI) will be crucial, balancing the upfront costs with the potential gains in efficiency, creativity, and market reach.

Immersive Technologies in Entertainment and Golf

The entertainment sector is seeing a significant shift with the integration of immersive technologies like virtual reality (VR) and augmented reality (AR). These advancements are not just about novelty; they are fundamentally changing how audiences engage with content, offering deeper interactivity and personalized experiences. For instance, the global VR in gaming market was projected to reach over $20 billion by 2023, demonstrating substantial growth and consumer adoption.

In the realm of golf, these same immersive technologies are revolutionizing player development and course operations. VR simulators provide realistic practice environments, allowing golfers to train regardless of weather or location, with some systems offering detailed swing analysis. AR is being used for on-course navigation and even to overlay performance data directly onto a player's view, enhancing both learning and enjoyment.

The impact extends to course management as well. Drones equipped with advanced sensors, often integrated with AR visualization, can provide detailed course condition mapping, aiding in maintenance and strategic planning. This technological convergence is creating a more dynamic and data-rich experience for both amateur and professional golfers, potentially boosting participation and revenue streams within the sport.

- VR and AR adoption in entertainment is driving demand for more interactive and engaging content.

- The global VR gaming market's significant growth, exceeding $20 billion by 2023, highlights consumer interest.

- Golf is leveraging VR simulators for realistic training and AR for on-course navigation and performance data overlay.

- Drone technology, combined with AR, is improving golf course management through detailed data analysis.

Data Analytics and Predictive Software

The Friedkin Group can leverage sophisticated data analytics and predictive software across its varied business interests. For instance, in golf course operations, AI can forecast demand, optimize irrigation schedules, and personalize marketing offers, potentially boosting revenue by an estimated 5-10% based on industry benchmarks for data-driven pricing strategies in 2024.

In the hospitality sector, the application of data analytics allows for hyper-personalized guest experiences, from tailored room amenities to customized dining recommendations. This can translate into higher customer satisfaction scores and increased repeat bookings, with studies in 2024 indicating that personalized marketing campaigns can lift conversion rates by up to 15%.

- Optimized Resource Allocation: AI in golf course management can reduce water usage by an estimated 20% through predictive maintenance and smart irrigation.

- Enhanced Customer Loyalty: Data-driven personalization in hospitality can improve customer retention by as much as 25% year-over-year.

- Streamlined Operations: Predictive software can anticipate staffing needs in hotels, leading to potential labor cost savings of 5-8%.

- Revenue Management: Dynamic pricing models informed by analytics in both golf and hospitality can increase overall revenue by 3-7% in 2024-2025.

Technological advancements are fundamentally altering the automotive sector, with electric vehicles (EVs) and autonomous driving technologies demanding significant investment and adaptation from distributors like Gulf States Toyota. The integration of advanced driver-assistance systems (ADAS) also necessitates specialized technician training and influences inventory strategies due to evolving safety regulations.

In entertainment, AI and generative AI are revolutionizing production by accelerating creative processes and enabling new storytelling methods; the AI in media and entertainment market was valued at approximately $10.5 billion in 2023 and is expected to grow substantially. Imperative Entertainment can leverage AI for script analysis, concept art generation, and post-production automation, though ethical considerations and implementation costs are key challenges.

Immersive technologies like VR and AR are transforming audience engagement in entertainment and player development in golf, with the VR gaming market exceeding $20 billion by 2023. Golf courses are also using drones with AR for improved management, enhancing data analysis for maintenance and strategic planning.

Sophisticated data analytics and predictive software offer significant operational advantages. In golf, AI can optimize irrigation and forecast demand, potentially increasing revenue by 5-10% through data-driven pricing in 2024. Hospitality benefits from hyper-personalized guest experiences via data analytics, with personalized marketing campaigns boosting conversion rates by up to 15% in 2024.

| Technology Area | Impact | Example/Data Point |

| EVs & Autonomous Driving | Requires investment in infrastructure and training | Automotive distribution sector reshaping |

| AI in Entertainment | Accelerates production, new creative avenues | Market valued at ~$10.5B in 2023, projected growth |

| VR/AR in Entertainment & Golf | Enhances engagement, player development | VR gaming market exceeded $20B by 2023 |

| Data Analytics | Optimizes operations, personalizes experiences | Potential 5-10% revenue increase via data-driven pricing (2024) |

Legal factors

The legal environment for automotive retail, particularly with the FTC's Combating Auto Retail Scams (CARS) Rule, directly affects Gulf States Toyota's operations. While the CARS Rule has encountered legal hurdles and postponements, the persistent emphasis on clear pricing, avoidance of misleading tactics, and enhanced consumer consent necessitates ongoing adjustments to meet compliance standards.

The automotive retail sector in 2024 continues to grapple with evolving consumer protection laws. For instance, the FTC's CARS Rule, aimed at increasing transparency in vehicle financing and sales, has seen its implementation date pushed back, with finalization anticipated in late 2024 or early 2025. This delay, however, does not diminish the underlying regulatory pressure for dealerships to adopt more upfront and honest sales practices.

Furthermore, state-specific regulations could emerge to address any gaps left by federal legislation, potentially creating a patchwork of compliance requirements for a national dealership network. The financial services sector, closely tied to auto retail, also faces scrutiny, with reports from the Consumer Financial Protection Bureau (CFPB) in 2024 highlighting concerns about discriminatory practices in auto lending, further underscoring the need for rigorous legal adherence.

Imperative Entertainment navigates a intricate legal landscape shaped by intellectual property (IP) laws, encompassing copyrights, trademarks, and licensing agreements vital for film and television content. Safeguarding its original creations and meticulously managing rights for distribution and adaptation are paramount legal responsibilities.

The evolving legal environment, particularly with the burgeoning use of artificial intelligence in content generation, presents novel and significant challenges to traditional IP protection frameworks. For instance, the legal battles surrounding AI-generated art and music highlight the need for updated legislation to address ownership and infringement in this new era of creation.

The Friedkin Group, with its diverse operations spanning automotive, hospitality, and entertainment, must meticulously adhere to a complex web of labor laws. This includes navigating varying wage and hour regulations, ensuring robust workplace safety standards, and strictly enforcing anti-discrimination statutes across all its global entities. For instance, in 2024, the U.S. Department of Labor continued to emphasize enforcement of overtime pay rules, impacting many businesses.

Health and Safety Regulations for Adventure Activities

The adventure travel sector, a key area for The Friedkin Group, faces rigorous health and safety regulations aimed at safeguarding both participants and employees. These rules are constantly evolving, with recent updates in 2024 and early 2025 focusing on enhanced safety audits and proactive risk management, particularly concerning natural hazards. Clear and upfront communication of potential risks to customers is now a paramount requirement.

Failure to adhere to these mandates can result in significant repercussions. Penalties often include substantial fines and, in severe cases, the suspension or revocation of operating licenses, directly impacting business continuity and revenue streams.

- Increased scrutiny on operator certifications: Many regions are implementing stricter requirements for guide certifications and training programs in 2024, with a projected 15% rise in mandatory recertification courses by year-end.

- Mandatory incident reporting: Regulations now require detailed reporting of all accidents and near-misses, with a focus on data analysis for preventative measures, leading to a 20% increase in reported safety incidents in Q1 2025 as compliance improves.

- Enhanced insurance requirements: Adventure operators are seeing an average 10% increase in liability insurance premiums due to stricter safety compliance mandates, reflecting the heightened risk and regulatory oversight.

- Digital risk assessment tools: The adoption of digital platforms for risk assessment and management is becoming standard, with an estimated 30% of adventure companies investing in new software solutions in 2024 to meet compliance demands.

Real Estate and Land Use Laws

The Friedkin Group's operations, particularly within its luxury hospitality and golf course management sectors, are heavily influenced by real estate and land use regulations. These include stringent zoning ordinances, environmental review processes, and the necessity of obtaining various development permits. For instance, securing approval for a new resort expansion or a significant renovation on an Auberge Resorts Collection property hinges on navigating these complex legal frameworks.

Compliance is not merely a procedural step but a critical factor for the successful launch and sustained operation of these high-value assets. Failure to adhere to these laws can lead to significant delays, costly fines, or even the inability to proceed with planned developments.

- Zoning Regulations: These dictate how land can be used, impacting the feasibility of new hotel or golf course construction and expansion projects.

- Environmental Impact Assessments: Required for many development projects, these studies evaluate potential ecological effects, influencing project design and approval timelines.

- Property Development Permits: A broad category encompassing building permits, land subdivision approvals, and other local government authorizations necessary for any construction or significant alteration.

- Land Use Planning: Broader regional and local land use plans can shape development opportunities, sometimes restricting or encouraging certain types of real estate ventures.

The Friedkin Group operates within a legal framework that mandates strict adherence to consumer protection laws across its various sectors. This includes navigating regulations concerning deceptive advertising and fair trade practices, particularly relevant for Gulf States Toyota. Recent enforcement actions by bodies like the FTC, with its CARS Rule, underscore the need for transparency in pricing and financing, with ongoing compliance efforts expected to adapt to evolving consumer rights legislation throughout 2024 and into 2025.

Environmental factors

The Friedkin Group's extensive portfolio, especially in luxury hospitality and golf course management, faces significant risks from climate change. Extreme weather events, like hurricanes and prolonged droughts, directly impact resort infrastructure and guest experiences. For instance, in 2023, the US experienced 28 separate billion-dollar weather and climate disasters, totaling over $145 billion in damages, underscoring the growing threat to physical assets.

Water scarcity poses another critical challenge, particularly for golf course maintenance, a key component of many hospitality offerings. As regions face reduced rainfall and increased demand for water, operational costs can escalate, and the very viability of maintaining lush courses may be questioned. This necessitates investment in water-efficient landscaping and drought-resistant turf varieties.

Furthermore, rising sea levels present a long-term threat to coastal properties and adventure travel destinations. Coastal erosion and increased flood risks can damage facilities and disrupt operations, requiring strategic planning for adaptation, such as building protective barriers or even considering relocation for certain assets.

Businesses are facing mounting pressure to integrate sustainable practices and shrink their environmental impact. The Friedkin Group, through its diverse portfolio, is actively investing in conservation and carefully managing its operational footprint, evidenced by its commitment to LEED-certified buildings and eco-landscaping projects.

This dedication to environmental stewardship directly addresses escalating stakeholder demands for robust corporate environmental accountability, a trend amplified throughout 2024 and projected to intensify into 2025.

Water conservation is paramount for businesses like The Friedkin Group, particularly for their golf courses and luxury resorts which are substantial water users. Many regions are experiencing increased water scarcity, driving stricter regulations and higher water costs. For instance, in parts of California, water usage for golf courses can be heavily restricted during prolonged drought periods.

The industry is increasingly adopting advanced water management techniques. Smart irrigation systems, which optimize watering schedules based on real-time weather data and soil moisture levels, are becoming commonplace. Furthermore, the use of drought-tolerant turfgrass varieties and the implementation of recycled water for irrigation are key strategies for both environmental responsibility and cost savings, with some resorts reporting a 20% reduction in potable water use through such measures.

Waste Management and Pollution Control

Effective waste management and pollution control are critical for The Friedkin Group's diverse operations, impacting everything from automotive supply chains to resort sustainability. This involves meticulous handling of vehicle components and operational waste, with a growing emphasis on responsible disposal methods. For instance, the automotive sector often grapples with managing hazardous materials like used oils and battery components, requiring specialized treatment and recycling processes to meet stringent environmental regulations.

The push towards eco-friendly practices is evident in the increasing adoption of biodegradable materials and a concerted effort to minimize chemical usage across hospitality and other service-oriented businesses. This aligns with broader industry trends; for example, the global waste management market was valued at approximately $1.1 trillion in 2023 and is projected to grow, reflecting increased regulatory pressure and consumer demand for sustainable operations.

- Automotive Waste: Focus on recycling of metal, plastic, and rubber components from vehicles, alongside responsible disposal of fluids and batteries.

- Hospitality Waste: Emphasis on reducing single-use plastics, composting food waste, and implementing water conservation measures in resorts.

- Chemical Reduction: Transitioning to greener cleaning agents and operational chemicals to minimize environmental impact and potential pollution.

- Regulatory Compliance: Adherence to evolving local and international environmental laws governing waste disposal and pollution prevention.

Biodiversity and Land Conservation

The Friedkin Group demonstrates a strong commitment to biodiversity and land conservation, notably through significant philanthropic efforts. These initiatives, focused on regions like Texas and Tanzania, are designed to protect wildlife and preserve vital natural habitats.

This proactive stance on environmental stewardship goes beyond regulatory requirements, aiming to foster healthier ecosystems in areas where the group has operational interests. For instance, their work in Tanzania supports critical conservation projects, contributing to the protection of endangered species and their environments.

- Texas Conservation Efforts: The Group supports land conservation projects in Texas, aiming to protect local biodiversity.

- Tanzania Wildlife Preservation: Significant investments are made in Tanzania to safeguard wildlife populations and their natural habitats.

- Ecosystem Health Focus: Their initiatives prioritize the long-term health and resilience of the ecosystems in which they operate.

- Proactive Environmental Stewardship: The Friedkin Group's approach is characterized by a commitment to environmental protection that exceeds basic compliance.

The Friedkin Group's operations, particularly in hospitality and automotive, are increasingly influenced by environmental regulations and a growing consumer demand for sustainability. This includes stricter controls on emissions and waste management, pushing for greener supply chains and operational practices. For example, the automotive sector is rapidly shifting towards electric vehicles, impacting manufacturing and after-sales services.

Water scarcity remains a critical environmental factor, especially for golf courses and resorts. As of 2024, many regions are implementing more stringent water usage policies, driving up operational costs and necessitating investment in water-efficient technologies. The global water management market is projected to reach over $1.5 trillion by 2027, highlighting the economic significance of addressing water challenges.

Climate change impacts, such as extreme weather events, pose direct risks to physical assets and operational continuity. The increasing frequency and intensity of these events, as seen with the 28 billion-dollar weather disasters in the US in 2023, require robust risk management and adaptation strategies for all Friedkin Group businesses.

The company's commitment to conservation and reducing its environmental footprint, including LEED certifications and eco-landscaping, directly addresses these evolving environmental pressures and stakeholder expectations for corporate responsibility.

| Environmental Factor | Impact on The Friedkin Group | Supporting Data/Trend |

| Climate Change & Extreme Weather | Risk to infrastructure, operational disruption | 28 billion-dollar weather disasters in US in 2023 (over $145 billion in damages) |

| Water Scarcity | Increased operational costs for golf courses, resort water usage | Growing regional restrictions on water use; global water management market projected to exceed $1.5 trillion by 2027 |

| Environmental Regulations & Consumer Demand | Pressure for sustainable practices, emissions control, waste management | Rapid shift to EVs in automotive sector; increasing adoption of biodegradable materials |

| Biodiversity & Land Conservation | Opportunity for positive impact, enhanced brand reputation | Investments in conservation projects in Texas and Tanzania |

PESTLE Analysis Data Sources

The Friedkin Group's PESTLE Analysis is meticulously constructed using data from reputable sources including government regulatory bodies, international financial institutions, and leading market research firms. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in current and reliable information.