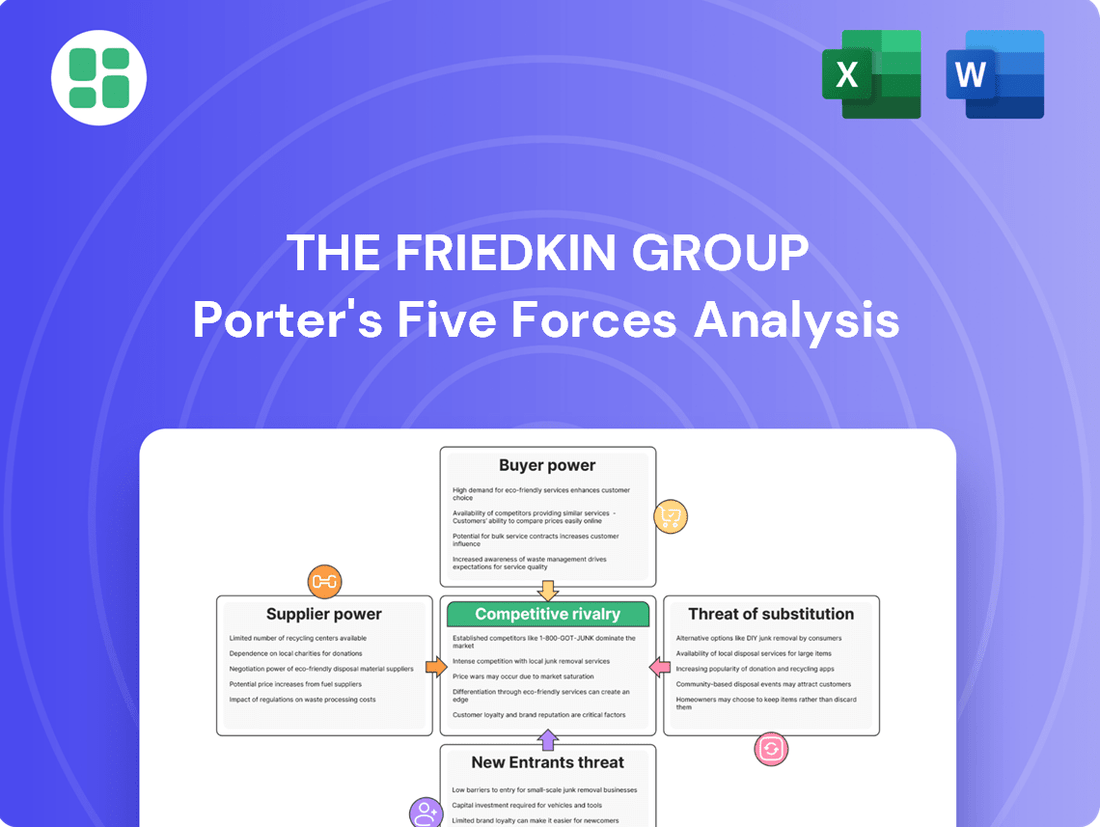

The Friedkin Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

The Friedkin Group navigates a complex landscape shaped by intense rivalry and evolving buyer power. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping The Friedkin Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Friedkin Group's diverse portfolio, spanning automotive, entertainment, and hospitality, exposes it to a wide array of suppliers. In its automotive sector, particularly with Gulf States Toyota, major vehicle manufacturers and component suppliers hold significant sway. These suppliers often possess strong brand recognition, patented technologies, and intricate global supply networks, giving them considerable leverage.

For instance, in 2024, the automotive industry continued to grapple with supply chain disruptions, particularly for semiconductors and certain raw materials. Major automotive manufacturers like Toyota, a key partner for Gulf States Toyota, demonstrated robust pricing power due to consistent global demand and their ability to control production volumes. This situation translates to higher input costs and less favorable terms for distributors like those within The Friedkin Group.

For The Friedkin Group's entertainment division, Imperative Entertainment, the bargaining power of suppliers is a key consideration. This includes talent like actors, directors, and writers, as well as providers of specialized equipment and post-production services. In 2024, the demand for top-tier talent remained exceptionally high, allowing these individuals to negotiate favorable terms, particularly for projects with significant box office potential. Similarly, specialized equipment and niche post-production houses often face limited competition, granting them considerable leverage in pricing and contract negotiations.

For The Friedkin Group's Auberge Resorts Collection, suppliers of unique, high-quality goods and services, like artisanal food producers or bespoke furniture makers, hold significant bargaining power. This power stems from the luxury hospitality sector's intense focus on exclusivity and exceptional guest experiences, making specialized suppliers difficult to replace.

In 2024, the luxury travel market continued its robust recovery, with global spending projected to reach over $1.5 trillion. This strong demand means that suppliers catering to this niche, such as those providing premium linens or advanced smart room technology, are in a favorable position to negotiate terms, knowing that resorts like Auberge are highly motivated to secure their offerings to maintain their brand's prestige.

Supplier Power 4

The Friedkin Group's diverse operations, spanning automotive, entertainment, and hospitality, mean it can encounter significant supplier power from specialized technology providers. For instance, in its automotive sector, reliance on unique software for advanced driver-assistance systems (ADAS) or proprietary manufacturing components can grant these tech suppliers considerable leverage. This is amplified if few alternatives exist for critical, cutting-edge technology.

The group's ventures in digital production and advanced manufacturing also expose it to suppliers of specialized equipment or software. A prime example could be a provider of high-end motion capture technology or advanced AI platforms essential for content creation or efficient production workflows. If these suppliers control patents or possess unique expertise, their bargaining power increases substantially, potentially impacting costs and project timelines.

In the hospitality sector, specialized providers of integrated property management systems (PMS) or unique guest experience technologies can also exert considerable influence. For example, a system offering seamless integration of booking, in-room controls, and personalized guest services might be difficult to replace, giving the supplier a stronger negotiating position. The Friedkin Group's ability to mitigate this power often depends on its diversification of suppliers and its own technological capabilities.

- Specialized Tech Providers: Companies offering unique software, AI, or advanced manufacturing components for automotive systems, digital production, or hospitality management can hold significant leverage.

- Reliance on Unique Solutions: Dependence on proprietary technology, such as advanced ADAS software or specialized production equipment, strengthens supplier bargaining power.

- Limited Alternatives: The availability of few substitutes for critical, cutting-edge technologies empowers suppliers, potentially leading to higher costs or constrained project execution for The Friedkin Group.

Supplier Power 5

The Friedkin Group faces significant supplier power, exacerbated by ongoing global supply chain disruptions and rising raw material costs. For instance, in 2024, the automotive industry, a key sector for Friedkin through its Gulf States Toyota dealerships, experienced continued volatility. Average prices for key metals like aluminum and steel saw fluctuations, impacting vehicle manufacturing costs.

Labor shortages also contribute to this pressure. In 2024, many manufacturing sectors, including those supplying components to the automotive and entertainment industries (also part of Friedkin's portfolio), reported difficulties in finding skilled workers, driving up labor costs for suppliers and subsequently for Friedkin.

This dynamic necessitates a strategic focus on agile and resilient supply chain management for The Friedkin Group to effectively mitigate these escalating pressures and maintain operational efficiency.

- Increased Raw Material Costs: Global commodity prices, particularly for metals and energy, remained elevated in early 2024, directly impacting input costs for suppliers.

- Labor Market Tightness: Persistent labor shortages across multiple industries in 2024 meant suppliers had to offer higher wages and benefits, translating to increased component prices.

- Supply Chain Bottlenecks: Lingering effects of past disruptions and geopolitical events continued to cause delays and increased shipping costs for critical components throughout 2024.

- Supplier Consolidation: In certain sectors, a trend towards supplier consolidation in 2024 has further concentrated power in the hands of fewer, larger entities.

The Friedkin Group faces considerable supplier power across its diverse holdings, particularly in sectors reliant on specialized components or unique talent. In 2024, the automotive sector, through Gulf States Toyota, saw manufacturers like Toyota maintain strong pricing power due to consistent global demand and controlled production. This translates to higher input costs for distributors.

The entertainment division, Imperative Entertainment, experiences similar leverage from highly sought-after talent and specialized service providers. In 2024, demand for top-tier actors and directors remained exceptionally high, allowing them to negotiate favorable terms, impacting production budgets.

In hospitality, Auberge Resorts Collection deals with suppliers of artisanal goods and bespoke services, whose exclusivity grants them significant bargaining power. The luxury travel market's robust recovery in 2024, with global spending exceeding $1.5 trillion, further strengthens these suppliers' positions.

| Sector | Key Supplier Type | 2024 Impact | Supplier Bargaining Power Factor |

|---|---|---|---|

| Automotive (Gulf States Toyota) | Vehicle Manufacturers, Component Suppliers | Increased raw material costs (e.g., metals), semiconductor shortages | High brand recognition, patented technology, global supply networks |

| Entertainment (Imperative Entertainment) | Talent (Actors, Directors), Post-Production Services | High demand for top-tier talent, limited competition for niche services | Unique skills, strong negotiation leverage for in-demand individuals |

| Hospitality (Auberge Resorts Collection) | Artisanal Food Producers, Bespoke Furniture Makers, Tech Providers | Strong luxury market recovery, focus on exclusivity and guest experience | Difficulty in finding substitutes, reliance on unique offerings |

What is included in the product

This analysis delves into the competitive forces impacting The Friedkin Group, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within its diverse business sectors.

Instantly visualize competitive intensity across all five forces, enabling rapid identification of key pressure points for The Friedkin Group.

Streamline strategic planning by quickly assessing the impact of each force, allowing for more targeted and effective pain point relief.

Customers Bargaining Power

The bargaining power of customers for The Friedkin Group is a mixed bag, highly dependent on the specific industry they operate in. For instance, in their automotive distribution segment, individual car buyers, while many, don't wield much power over the sticker price of new vehicles. Factors like strong brand loyalty, the established dealership system, and financing options tend to limit their ability to negotiate heavily, although the sheer number of competing dealerships does offer some leverage.

For Imperative Entertainment, its primary customers—large streaming platforms, traditional distributors, and studios—hold considerable sway. These entities, with their substantial content appetites and deep financial pockets, can significantly influence licensing fees and distribution agreements for independent production companies.

This buyer power is amplified as the media landscape continues to evolve. For instance, in 2024, major streaming services, while still investing heavily in content, are also becoming more selective, leading to tighter negotiations for independent producers seeking distribution deals.

Customers of Auberge Resorts Collection, typically affluent individuals, possess significant bargaining power due to their discerning tastes and access to numerous luxury travel options. These travelers expect highly personalized and exclusive experiences, and their willingness to pay a premium is tempered by the availability of alternatives like private villas and competing high-end hotel brands.

Buyer Power 4

The Friedkin Group's customers, particularly in the hospitality and travel sectors, wield significant bargaining power, amplified by the digital age. The proliferation of online platforms and review sites, like TripAdvisor and Google Reviews, offers unprecedented transparency. In 2024, the average traveler consults at least six online sources before booking a hotel, a clear indicator of empowered decision-making.

This ease of access to information allows customers to readily compare pricing, amenities, and service quality across numerous providers. For instance, in the competitive hotel market, a significant portion of bookings are influenced by online reviews, putting pressure on businesses like those within The Friedkin Group's portfolio to offer compelling value propositions and maintain exceptional service standards to remain competitive.

- Increased Transparency: Digital platforms provide customers with easy access to competitor pricing and service reviews.

- Information Accessibility: Travelers in 2024 utilize an average of six online sources to inform booking decisions.

- Price Sensitivity: Customers can quickly identify and leverage the best available deals, driving price competition.

- Reputation Management: Online reviews directly impact customer choice, forcing businesses to prioritize customer satisfaction.

Buyer Power 5

Customers in the golf course management and adventure travel sectors often prioritize unique, experiential offerings. This growing demand, however, is met with a wide array of choices. For instance, the global adventure tourism market was valued at approximately $624.3 billion in 2023 and is projected to reach $1,929.5 billion by 2030, indicating significant competition and customer options.

The sheer volume of available options, ranging from local golf clubs to international adventure tour operators, grants customers considerable bargaining power. They can readily compare prices, service quality, and the uniqueness of experiences, pushing providers to offer competitive value. This competitive landscape means customers can often negotiate better terms or switch to alternatives if their expectations aren't met.

- Customer Choice: A vast number of golf courses and adventure travel providers exist globally, offering diverse price points and experiences.

- Price Sensitivity: Customers can easily compare pricing across similar offerings, leading to a focus on value for money.

- Information Availability: Online reviews and booking platforms provide customers with extensive information, enabling informed decision-making and comparison shopping.

- Switching Costs: For many customers, the cost or effort to switch between different golf courses or adventure travel providers is relatively low.

The bargaining power of customers for The Friedkin Group varies significantly across its diverse business units. In sectors like automotive distribution, individual buyers have limited power due to brand loyalty and dealership structures, though competition offers some leverage. Conversely, in entertainment, major distributors and streaming platforms hold substantial sway, influencing licensing terms for content producers.

Affluent customers in hospitality, such as those booking with Auberge Resorts, possess considerable power, driven by high expectations and abundant luxury travel alternatives. This power is amplified by digital transparency, with travelers in 2024 consulting an average of six online sources before booking, making price and service comparisons effortless and pressuring providers to deliver exceptional value.

In golf and adventure travel, customers benefit from a wide array of choices and readily available information, enabling them to compare offerings and negotiate terms. The global adventure tourism market, valued at approximately $624.3 billion in 2023, highlights this competitive environment, where customer choice directly influences provider strategies and pricing.

What You See Is What You Get

The Friedkin Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the Friedkin Group's Porter's Five Forces Analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is professionally written and ready for your immediate use.

Rivalry Among Competitors

Competitive rivalry is a significant force for The Friedkin Group, particularly within its automotive distribution segment, Gulf States Toyota. This sector sees intense competition from other major automotive manufacturers and their extensive dealership networks. Key differentiators in this space often boil down to competitive pricing strategies, the availability and breadth of vehicle inventory, and the quality of customer service provided.

The entertainment production sector, where Imperative Entertainment competes, is intensely competitive. Major studios, streaming services like Netflix and Disney+, and numerous independent producers are locked in a continuous battle for audience attention and market share, often referred to as content wars.

This dynamic environment requires constant innovation and significant content spending. For instance, in 2024, global spending on content by major streamers was projected to exceed $200 billion, highlighting the immense investment needed to stay relevant and attract viewers.

Fluctuating consumer preferences and the rapid evolution of distribution platforms further intensify this rivalry. Producers must not only create compelling content but also adapt quickly to changing market demands and technological advancements to succeed.

The luxury hospitality sector, where Auberge Resorts Collection operates, is intensely competitive. Established global giants like Marriott and Hyatt, alongside specialized boutique brands and exclusive private accommodations, vie for discerning clientele. Differentiation is paramount, with unique guest experiences, unparalleled service, and a strong brand reputation being key battlegrounds.

In 2024, the luxury travel market continues to show resilience, with brands focusing on hyper-personalized offerings and unique destination experiences to stand out. For instance, Auberge Resorts Collection emphasizes its curated experiences, such as private culinary tours or adventure excursions, to attract and retain high-net-worth individuals seeking more than just a place to stay.

Competitive Rivalry 4

The golf course management sector is characterized by intense rivalry, with public, private, and resort courses all competing for golfer engagement and memberships. This competition is fueled by a focus on course condition, available amenities, and the overall value proposition offered to players.

Key competitive factors include pricing strategies, such as daily green fees versus membership tiers, and the capacity to provide varied golfing experiences, from casual play to premium resort packages. In 2024, the average green fee for a public golf course in the United States hovered around $35-$50, while private club memberships can range from several thousand dollars annually to substantial initiation fees.

- Diverse Offerings: Public, private, and resort courses compete on a broad spectrum of services and accessibility.

- Key Differentiators: Course quality, amenities, and pricing structures are primary drivers of golfer choice.

- Market Dynamics (2024): Public courses often compete on price, while private and resort clubs emphasize exclusive experiences and amenities.

- Golfer Acquisition: Success hinges on attracting and retaining golfers through compelling value and unique offerings.

Competitive Rivalry 5

The adventure travel sector, where The Friedkin Group operates, is characterized by a high degree of competitive rivalry. This is fueled by a growing number of specialized tour operators, major travel conglomerates venturing into experiential offerings, and highly focused niche providers.

Demand for unique, authentic, and sustainable travel experiences is the primary driver of this intense competition. Companies are constantly striving to differentiate their offerings and capture market share by providing distinct and memorable adventures.

- Market Growth: The global adventure tourism market was valued at approximately $620.7 billion in 2023 and is projected to grow significantly, reaching an estimated $1,571.3 billion by 2030, indicating substantial opportunities but also increased competition.

- Key Competitors: Major players include companies like G Adventures, Intrepid Travel, and National Geographic Expeditions, alongside a proliferation of smaller, specialized operators focusing on specific activities or regions.

- Differentiation Strategy: Success hinges on offering truly unique itineraries, exceptional customer service, and a strong commitment to sustainability, which are becoming table stakes for attracting discerning travelers.

- Pricing Pressure: While differentiation is key, the competitive landscape can also lead to pricing pressure, especially for more commoditized adventure experiences.

Competitive rivalry is a defining characteristic across The Friedkin Group's diverse portfolio. Within automotive distribution, Gulf States Toyota faces rivals offering similar pricing, inventory, and service levels, necessitating constant adaptation to consumer demands.

In entertainment, Imperative Entertainment competes fiercely with established studios and streaming giants for audience attention, a battle underscored by projected global content spending exceeding $200 billion in 2024.

The luxury hospitality sector, represented by Auberge Resorts Collection, sees intense competition from global brands and boutique operators, where differentiation through unique experiences and exceptional service is paramount, with brands increasingly focusing on hyper-personalization in 2024.

The golf course management sector experiences significant rivalry among public, private, and resort facilities, with key differentiators being course condition, amenities, and value propositions, as evidenced by varying green fees and membership costs in 2024.

| Segment | Key Competitors | Competitive Factors | 2024 Market Insight |

|---|---|---|---|

| Automotive Distribution | Major Manufacturers & Dealerships | Pricing, Inventory, Customer Service | Intense price and service competition. |

| Entertainment Production | Major Studios, Streaming Services | Content Quality, Spending, Distribution | Global content spending projected >$200 billion. |

| Luxury Hospitality | Global Hotel Chains, Boutique Brands | Guest Experience, Service, Brand Reputation | Focus on hyper-personalization and unique experiences. |

| Golf Course Management | Public, Private, Resort Courses | Course Condition, Amenities, Pricing | Public courses average $35-$50 green fees; private memberships vary widely. |

SSubstitutes Threaten

The threat of substitutes for The Friedkin Group differs across its diverse business segments. In the automotive sector, the rise of ride-sharing platforms like Uber and Lyft, coupled with advancements in public transportation and emerging micro-mobility options, presents a growing substitution threat, particularly in densely populated urban environments. For instance, by the end of 2023, global ride-sharing revenue was projected to reach approximately $150 billion, indicating a significant shift in consumer transportation preferences.

For entertainment production, the threat of substitutes is significant. Platforms like YouTube and TikTok offer user-generated content that directly competes for audience attention and time, often at a lower production cost than traditional film and TV. In 2024, it's estimated that over 2 billion users actively engage with YouTube monthly, showcasing the immense reach of these substitute platforms.

Video games and other digital leisure activities also present a strong substitute threat. These interactive experiences can capture significant consumer engagement, diverting potential viewers from traditional media. The global video game market is projected to reach over $250 billion by 2024, highlighting the substantial resources consumers allocate to these alternatives.

In the luxury hospitality sector, The Friedkin Group faces a significant threat from substitutes. These include high-end vacation rentals, private villa bookings, and exclusive boutique cruises. Glamping experiences, offering a blend of luxury and nature, also present an alternative. These substitutes often provide comparable exclusivity and personalized service, albeit in different settings, potentially drawing customers away from traditional luxury hotel stays.

4

The threat of substitutes for golf course management is moderate. While traditional golf remains popular, alternative leisure activities compete for consumers' time and discretionary spending. For instance, the burgeoning market for indoor golf simulators and virtual reality golf experiences offers a convenient and weather-independent way to enjoy the sport, potentially drawing some players away from physical courses. In 2023, the global golf simulator market was valued at approximately $1.5 billion and is projected to grow, indicating a tangible substitute.

Furthermore, other recreational sports and leisure pursuits, such as tennis, pickleball, or even fitness classes, provide social engagement and physical activity. These activities often have lower perceived barriers to entry and may appeal to a broader demographic. The increasing popularity of activities like pickleball, which saw millions of new participants in 2023, highlights the competitive landscape for leisure time.

- Indoor Golf Simulators: Offer convenience and accessibility, bypassing weather and time constraints.

- Virtual Reality Golf: Provides an immersive, technology-driven alternative to on-course play.

- Other Recreational Sports: Activities like pickleball, tennis, and fitness classes compete for leisure time and social engagement.

- Lower Barrier to Entry: Many substitutes require less equipment, time commitment, or specialized skill than traditional golf.

5

The threat of substitutes in the adventure travel sector, where The Friedkin Group operates, is a significant consideration. While adventure travel itself is experiencing growth, other leisure activities can serve as alternatives for consumers. These substitutes offer different experiences that might attract a similar customer base, potentially diverting spending away from adventure-focused trips.

Conventional tourism, wellness retreats, and cultural tours represent key substitutes. These options often appeal to a broader demographic seeking relaxation, cultural immersion, or personal enrichment rather than the high-adrenaline activities characteristic of adventure travel. For instance, a family looking for a vacation might choose a beach resort or a historical city tour over a strenuous hiking expedition.

The market for leisure travel is vast, and consumer preferences can shift. In 2024, the global tourism market is projected to reach trillions of dollars, with a significant portion allocated to non-adventure segments. This indicates a substantial pool of spending that could potentially be redirected towards substitute activities if they are perceived as more appealing or accessible.

- Substitute Leisure Activities: Conventional tourism, wellness retreats, and cultural tours offer alternative vacation experiences.

- Consumer Appeal: These substitutes cater to desires for relaxation and cultural immersion, potentially drawing customers away from adventure travel.

- Market Size: The broader leisure travel market, valued in the trillions in 2024, includes substantial segments that are not adventure-focused.

- Shifting Preferences: Changes in consumer tastes and economic conditions can influence the attractiveness of adventure travel versus its substitutes.

The threat of substitutes for The Friedkin Group's diverse portfolio is a dynamic factor influencing each segment. In automotive, ride-sharing and public transit offer alternatives to car ownership, with global ride-sharing revenue nearing $150 billion by late 2023. Entertainment faces competition from platforms like YouTube, boasting over 2 billion monthly users in 2024, and the $250 billion video game market, which captures significant leisure spending.

| Segment | Key Substitutes | Market Data (2023/2024 Estimates) |

| Automotive | Ride-sharing, Public Transit | Global Ride-sharing Revenue: ~$150 billion (late 2023) |

| Entertainment | User-generated content platforms (YouTube), Video Games | YouTube Monthly Users: ~2 billion+ (2024); Global Video Game Market: ~$250 billion+ (2024) |

| Adventure Travel | Conventional Tourism, Wellness Retreats | Global Tourism Market: Trillions of dollars (2024) |

Entrants Threaten

The threat of new entrants in the automotive distribution sector, especially for established brands like Toyota, is generally considered low. This is largely due to the significant capital investment required to establish a widespread dealership network and the complex regulatory landscape that governs automotive sales and service.

For instance, setting up a single new car dealership can easily cost millions of dollars, encompassing real estate, inventory, and specialized equipment. Furthermore, navigating franchise laws and consumer protection regulations adds another layer of difficulty for potential newcomers. In 2024, the average cost to open a new car dealership in the US is estimated to be between $1 million and $5 million, depending on location and brand.

Existing players benefit from strong brand loyalty, which is difficult for new entrants to overcome. Toyota, for example, has cultivated a reputation for reliability and customer satisfaction over decades, creating a significant barrier to entry for any upstart aiming to capture market share. The need for a robust after-sales service infrastructure, including parts availability and trained technicians, further solidifies the position of established distributors.

The threat of new entrants in entertainment production for a company like The Friedkin Group is generally moderate. While the digital revolution has democratized some aspects of content creation, making it easier for smaller players to produce content, significant hurdles persist.

Securing substantial financing is a major barrier; for instance, major studio films in 2024 often require budgets in the hundreds of millions of dollars, a sum difficult for newcomers to raise. Attracting and retaining top-tier talent, both in front of and behind the camera, also demands considerable resources and established relationships, which new entrants lack.

Furthermore, building the necessary distribution networks to reach a global audience is complex and capital-intensive. The industry remains consolidated, with established studios and distributors holding significant power, making it challenging for new entities to gain traction and build a recognizable brand in a crowded market.

The threat of new entrants in the luxury hospitality sector, relevant to The Friedkin Group, is generally considered low. This is primarily due to the immense capital required for acquiring prime real estate, developing high-end properties, and establishing the sophisticated infrastructure synonymous with luxury. For instance, a new luxury hotel in a major global city can easily cost hundreds of millions of dollars to build or acquire and renovate.

Furthermore, building a reputable brand in luxury hospitality takes years, if not decades, of consistent delivery of exceptional service and curated experiences. Newcomers face significant hurdles in cultivating the brand loyalty and perceived exclusivity that established players like those The Friedkin Group might compete with command. The operational complexity, including sourcing and training highly specialized staff capable of delivering personalized, world-class service, also acts as a substantial deterrent.

4

The threat of new entrants in golf course management is generally moderate to high, influenced by substantial capital requirements. Acquiring suitable land alone can cost millions, with development and ongoing maintenance adding significantly to this. For instance, building a championship-level golf course in 2024 often requires an investment exceeding $10 million, sometimes reaching $50 million or more depending on location and features. This high initial outlay acts as a considerable barrier.

However, the landscape isn't entirely prohibitive. Smaller, niche golf facilities or driving ranges with fewer amenities might present lower entry barriers, attracting less capital-intensive ventures. The need for specialized knowledge in course design, agronomy, and customer experience also creates a knowledge-based barrier, though this can be overcome through hiring experienced professionals or strategic partnerships. The overall market in 2024 shows a mix of established, high-end resorts and more accessible, community-focused courses, indicating room for varied entry strategies.

Key barriers to entry include:

- Significant land acquisition costs, often running into millions of dollars per property.

- High initial development and ongoing maintenance expenses, encompassing construction, landscaping, and operational upkeep.

- The necessity for specialized expertise in areas like golf course architecture, agronomy, and hospitality management.

- Brand reputation and established customer loyalty, which can be difficult for new players to penetrate.

5

The adventure travel market, a sector experiencing robust growth, presents moderate barriers to entry for new players. While smaller, niche operators can launch with comparatively lower initial overheads, significant investment becomes necessary for scaling operations. This includes meeting stringent safety standards, crucial for high-risk activities, and establishing a global network of partners and suppliers.

Building a strong reputation and earning customer trust is paramount in adventure travel, especially for activities demanding specialized expertise and rigorous safety protocols. For instance, companies offering activities like mountaineering or deep-sea diving must demonstrate a proven track record and invest heavily in certified training for guides and staff. The global adventure tourism market was valued at over $140 billion in 2023 and is projected to continue its upward trajectory, indicating a competitive landscape where established trust and safety credentials are key differentiators.

- Moderate Barriers: While niche players can start lean, scaling requires significant capital for safety, infrastructure, and global reach.

- Safety & Trust: High-risk activities demand substantial investment in certified training and a strong, verifiable safety record to build customer confidence.

- Reputation is Key: In adventure travel, a well-earned reputation for reliability and safety is a critical asset, often built over years of consistent performance.

- Market Growth: The adventure tourism sector's continued expansion, reaching over $140 billion in 2023, signals opportunity but also intensifies competition for established players.

The threat of new entrants in the automotive distribution sector for The Friedkin Group is low. The substantial capital outlay for dealerships, estimated at $1 million to $5 million in 2024, and stringent regulatory frameworks create significant barriers. Established brand loyalty and the necessity for extensive after-sales service networks further solidify the position of existing players, making it difficult for new companies to gain a foothold.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for The Friedkin Group is built on a foundation of publicly available financial statements, industry-specific market research reports, and news releases from the companies themselves to provide a comprehensive view of the competitive landscape.