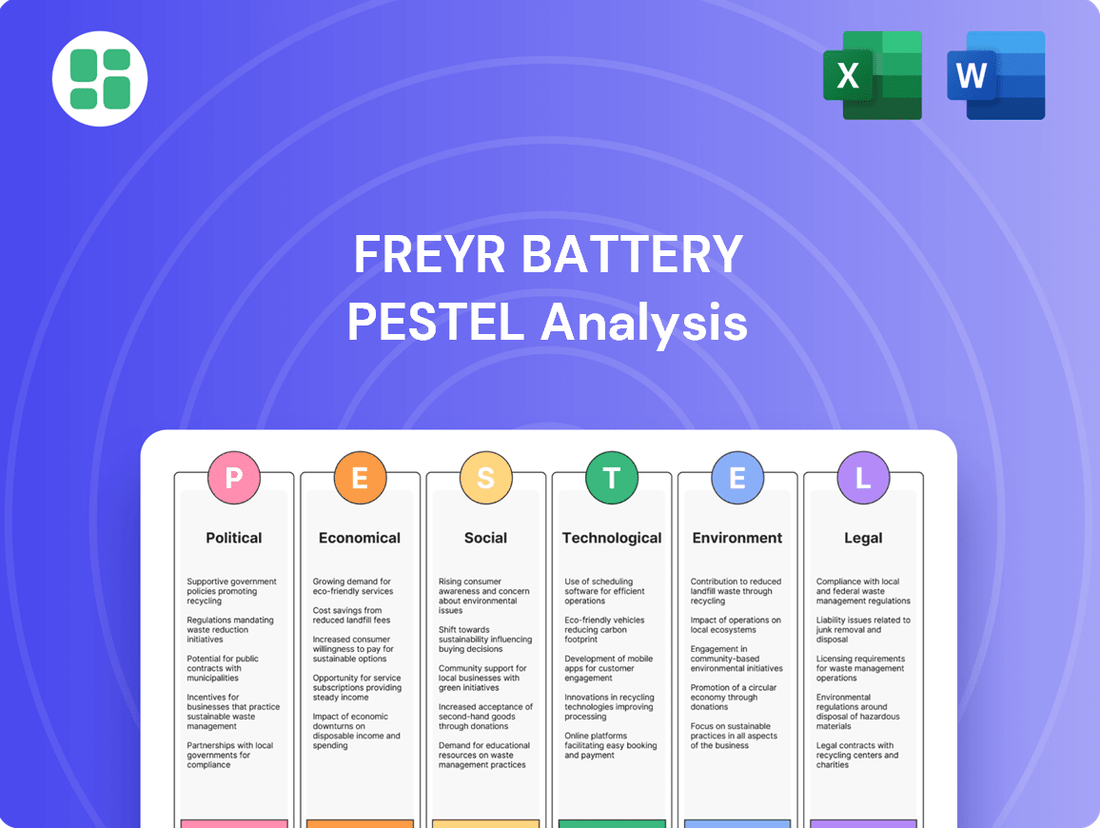

FREYR Battery PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

FREYR Battery operates within a dynamic landscape shaped by evolving political support for green energy, economic fluctuations impacting investment, and rapid technological advancements in battery production. Understanding these external forces is crucial for navigating the company's growth trajectory.

Gain a competitive edge by delving into the complete PESTLE analysis of FREYR Battery. Discover how political incentives, economic viability, social acceptance of EVs, technological breakthroughs, environmental regulations, and legal frameworks are all influencing its future. Download the full version now to arm yourself with actionable intelligence and make informed strategic decisions.

Political factors

Government incentives and subsidies are a major driver for companies like FREYR Battery. Policies that encourage clean energy adoption and electric vehicle production directly benefit FREYR's business model. For instance, the US Inflation Reduction Act (IRA) offers substantial support through grants, tax credits, and loans, which can significantly speed up factory construction and lower operating expenses.

These financial aids are crucial for FREYR's expansion plans. The IRA alone is expected to inject billions into the clean energy sector, making projects more economically viable. Such government backing is essential for FREYR to compete and scale its operations effectively in the burgeoning battery manufacturing market.

However, political stability and consistent policy implementation are vital. Any shifts in government or unexpected policy changes can create uncertainty and risk. For example, a slowdown in federal climate and energy spending disbursements can negatively impact the entire sector, including FREYR's access to crucial funding and its overall investment climate.

Norway's government has identified battery production as a cornerstone of its industrial future, actively championing companies like FREYR Battery. This national strategy translates into tangible benefits, such as a more predictable regulatory landscape and potential access to government-backed financing. For instance, Norway's commitment to green industries, including battery manufacturing, was reinforced with significant investments announced in the 2024 budget, aiming to bolster domestic production capabilities.

Geopolitical stability and evolving global trade policies significantly impact FREYR Battery's operational landscape. Tensions and shifting trade agreements can disrupt the supply chain for essential battery materials, such as lithium and cobalt, and influence market access for FREYR's finished battery products. For instance, the US Inflation Reduction Act (IRA) of 2022, with its domestic content requirements, directly shapes manufacturing location decisions and supply chain strategies for companies like FREYR, aiming to bolster North American battery production.

FREYR's strategic pivot, moving away from a primarily European focus to emphasize its US operations, underscores the sensitivity to regional policy. The decision to sell its European business in late 2023, for approximately $600 million, reflects a calculated response to differing regulatory environments and market opportunities. This move highlights how distinct national and regional industrial policies, including incentives for green technology and manufacturing, can drive significant corporate restructuring and investment decisions.

Regulatory Environment for Manufacturing and Permitting

The regulatory landscape significantly impacts manufacturing operations, particularly concerning the ease and speed of obtaining permits for large-scale facilities. A supportive and streamlined permitting process is essential for companies like FREYR Battery to execute projects efficiently in key markets such as Norway and the United States.

For instance, the Inflation Reduction Act (IRA) in the US, enacted in 2022 and continuing its influence through 2024-2025, offers significant tax credits for battery manufacturing, aiming to accelerate domestic production. However, navigating the permitting processes for new gigafactories can still involve lengthy environmental reviews and approvals, potentially delaying project timelines and increasing capital expenditures.

- Permitting Speed: Delays in environmental impact assessments and construction permits can add months, or even years, to project schedules, impacting market entry and revenue generation.

- Regulatory Support: Government incentives, like those in the IRA, can offset some costs, but the underlying regulatory framework for siting and operating large industrial facilities remains a critical factor.

- Cost Implications: Extended permitting processes can lead to increased consulting fees, legal expenses, and the cost of capital due to prolonged construction periods.

International Climate Agreements and Decarbonization Goals

International climate agreements, such as the Paris Agreement, are a significant political driver for FREYR Battery. These accords establish global targets for reducing greenhouse gas emissions, which directly spurs demand for clean energy technologies. The push for decarbonization creates a burgeoning market for battery solutions like those FREYR produces, positioning the company to capitalize on this transition.

FREYR's business model is inherently aligned with these global decarbonization goals. The company focuses on producing battery cells with a significantly lower carbon footprint, utilizing renewable energy in its manufacturing processes. This strategic focus is expected to resonate well as nations strive to meet their climate commitments, potentially leading to favorable regulatory environments and incentives for low-carbon battery production.

The increasing commitment from countries worldwide to achieve net-zero emissions by mid-century provides a robust long-term outlook for FREYR's products. For instance, the European Union aims to cut net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, with a long-term goal of climate neutrality by 2050. Such ambitious targets necessitate a massive scale-up in renewable energy storage, a core market for FREYR.

- Global Decarbonization Drive: International agreements are accelerating the shift away from fossil fuels, increasing the need for energy storage solutions.

- Market Growth for Sustainable Batteries: FREYR's focus on low-carbon battery production aligns with the growing demand for environmentally friendly energy technologies.

- Favorable Regulatory Landscape: Adherence to climate targets by various nations is likely to create supportive policies and incentives for companies like FREYR.

Government incentives and regulatory support are critical for FREYR Battery's growth. The US Inflation Reduction Act (IRA), enacted in 2022 and continuing through 2024-2025, provides significant tax credits and grants, bolstering domestic battery manufacturing. Norway's government also champions battery production as a key industrial sector, offering a more predictable regulatory environment and potential access to financing, as seen in its 2024 budget allocations for green industries.

Geopolitical shifts and trade policies directly influence FREYR's supply chain and market access. For instance, the IRA's domestic content requirements shape manufacturing location and supply chain strategies, pushing companies like FREYR towards North American production. This sensitivity to regional policies was evident in FREYR's late 2023 decision to sell its European business for approximately $600 million, highlighting strategic responses to differing regulatory climates.

International climate agreements, such as the Paris Agreement and the EU's goal of at least a 55% emissions reduction by 2030, fuel demand for FREYR's clean energy solutions. FREYR's commitment to low-carbon battery production aligns with these global decarbonization targets, positioning the company to benefit from favorable policies and growing markets for sustainable energy storage.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting FREYR Battery, covering political stability, economic trends, social acceptance, technological advancements, environmental regulations, and legal frameworks.

It provides a comprehensive overview of how these forces create both challenges and opportunities for FREYR Battery's strategic planning and market positioning.

This FREYR Battery PESTLE analysis serves as a pain point reliever by offering a clean, summarized version of external factors for easy referencing during meetings, ensuring stakeholders can quickly grasp market dynamics and potential challenges.

Economic factors

The global electric vehicle (EV) market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond. This surge directly fuels demand for battery cells, the core product for companies like FREYR Battery. For instance, the International Energy Agency (IEA) reported that global EV sales reached approximately 10 million in 2022, a significant jump from previous years, and this trend is expected to accelerate.

Similarly, the energy storage solutions (ESS) market is a critical growth engine. As grids increasingly integrate renewable energy sources, the need for reliable energy storage becomes paramount. BloombergNEF forecasts that the global energy storage market will reach hundreds of gigawatt-hours annually by 2025, creating substantial opportunities for battery manufacturers to supply these vital systems.

This escalating demand from both EV and ESS sectors provides a powerful market pull for FREYR Battery's production plans. The company's strategy to scale up manufacturing capacity is directly supported by these expanding end markets, encouraging further investment and innovation in battery technology and production efficiency to meet future needs.

The cost and availability of essential battery components like lithium, nickel, and cobalt are major economic drivers for FREYR Battery. For instance, lithium carbonate prices saw significant swings in 2023, reaching highs of over $70,000 per ton before falling to around $15,000 per ton by year-end, illustrating the inherent volatility.

FREYR's strategy to build localized battery production facilities in Norway and the US aims to reduce reliance on distant suppliers and buffer against global supply chain disruptions. However, the company remains exposed to the broader economic forces influencing the global mining and refining industries for these critical minerals.

Building gigafactories demands massive upfront investment, making access to capital absolutely critical for companies like FREYR Battery. Securing this funding is heavily influenced by the broader economic climate.

For instance, the economic factor of rising interest rates, a trend observed throughout 2023 and continuing into early 2024, directly impacts the cost and availability of financing. This was a key consideration for FREYR Battery, contributing to their decision in late 2023 to cancel their Giga America project. The higher cost of borrowing makes large-scale capital projects significantly more challenging to finance profitably.

Competition and Battery Price Trends

The battery manufacturing landscape is intensely competitive, with a significant influx of lower-cost batteries, predominantly from Asian manufacturers. This oversupply is driving down battery prices globally, directly affecting companies like FREYR Battery. For instance, the average price of lithium-ion battery packs for electric vehicles saw a notable decline in 2023, reaching approximately $150 per kilowatt-hour (kWh), a decrease from earlier years. This trend puts pressure on FREYR's pricing power and necessitates a strong emphasis on operational efficiency and technological innovation to maintain profitability.

FREYR must navigate this competitive environment by focusing on cost optimization throughout its production processes and by developing battery technologies that offer distinct advantages, such as higher energy density or faster charging capabilities. The company's strategy to leverage Gigafactories and its proprietary production methods aims to achieve economies of scale and reduce manufacturing costs. For example, by 2024, FREYR is targeting a production cost of under $70 per kWh for its 24M LFP batteries, a figure that would position it competitively.

- Global battery prices are declining due to increased supply, particularly from Asian producers.

- The average price for EV battery packs fell to around $150/kWh in 2023.

- FREYR aims for a production cost below $70/kWh for its 24M LFP batteries by 2024.

- Cost efficiency and technological differentiation are crucial for FREYR's market position.

Energy Costs and Renewable Energy Availability

FREYR Battery's strategic advantage is deeply rooted in Norway's abundant and cost-effective renewable energy, particularly hydropower. This access to clean energy is a significant factor in keeping operational expenses down and producing battery cells with a lower carbon footprint.

The stability and affordability of Norway's energy grid directly translate into a competitive edge for FREYR. In 2024, Norway's electricity prices remained among the lowest in Europe, with average industrial prices hovering around €50-€70 per megawatt-hour, significantly lower than many other manufacturing hubs. This low-cost energy is crucial for the energy-intensive battery manufacturing process.

Renewable energy availability not only impacts production costs but also aligns with the growing global demand for sustainable products. FREYR's commitment to using clean energy sources supports its positioning in a market increasingly focused on environmental, social, and governance (ESG) criteria.

- Norway's hydropower capacity provides a consistent and low-cost energy supply for battery production.

- In 2024, industrial electricity prices in Norway were significantly lower than the European average, benefiting FREYR's operational costs.

- The use of renewable energy enhances FREYR's product sustainability and market appeal.

- This energy advantage contributes to FREYR's competitive pricing and lower carbon emissions per battery cell.

The robust growth in the electric vehicle (EV) and energy storage solutions (ESS) markets, with global EV sales hitting around 10 million in 2022 and the ESS market projected for significant expansion by 2025, creates substantial demand for FREYR Battery's products. However, the company must contend with volatile raw material prices, such as lithium, which saw price swings from over $70,000 to $15,000 per ton in 2023. Furthermore, rising interest rates, exemplified by the cancellation of the Giga America project in late 2023 due to higher financing costs, present a significant economic hurdle for capital-intensive projects.

The competitive landscape is intensified by lower-cost batteries from Asian manufacturers, driving down average EV battery pack prices to approximately $150/kWh in 2023, compelling FREYR to focus on efficiency and target production costs below $70/kWh for its 24M LFP batteries by 2024. Norway's abundant and low-cost hydropower, with industrial electricity prices around €50-€70/MWh in 2024, offers FREYR a critical cost advantage and supports its sustainability claims, enhancing its market appeal in an ESG-conscious environment.

| Economic Factor | Impact on FREYR Battery | Key Data/Trend (2023-2024) |

| EV & ESS Market Growth | Drives demand for battery cells | Global EV sales ~10M (2022); ESS market expanding rapidly |

| Raw Material Price Volatility | Affects production costs | Lithium prices: $70k+/ton to ~$15k/ton (2023) |

| Interest Rates & Financing Costs | Impacts capital project feasibility | Rising rates led to Giga America cancellation (late 2023) |

| Battery Price Competition | Pressures pricing and profitability | Avg. EV battery pack price ~$150/kWh (2023); FREYR target <$70/kWh (2024) |

| Renewable Energy Costs (Norway) | Provides operational cost advantage | Industrial electricity ~€50-€70/MWh (2024) |

Preview Before You Purchase

FREYR Battery PESTLE Analysis

The preview shown here is the exact FREYR Battery PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive overview of the external forces shaping FREYR Battery's future.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into the opportunities and threats FREYR Battery faces within its operating landscape.

Sociological factors

Public acceptance of electric vehicles (EVs) is a key driver for FREYR Battery. By the end of 2023, global EV sales surpassed 13 million units, a significant increase from previous years, indicating growing consumer interest in sustainable transportation. This trend directly translates to a larger potential market for FREYR's battery cell production.

Environmental awareness continues to shape consumer choices, pushing demand for green technologies. Surveys in 2024 show a majority of consumers are concerned about climate change and actively seek products with a lower carbon footprint. This heightened consciousness benefits companies like FREYR that offer sustainable energy solutions.

FREYR Battery's focus on creating clean, next-generation battery cells, powered by renewable energy sources, directly taps into a growing global demand for sustainable manufacturing practices. This commitment resonates strongly with consumers and investors alike, who are increasingly prioritizing environmental responsibility.

A strong public perception of FREYR's sustainability efforts is a significant asset, bolstering its brand reputation. This positive image is crucial for attracting top talent in a competitive industry and cultivating lasting consumer loyalty, especially as environmental consciousness continues to rise among purchasing demographics.

The availability of a skilled workforce is paramount for the success of advanced manufacturing, especially for Gigafactories. FREYR Battery's strategic location in Norway provides access to a highly educated and capable workforce, a significant advantage in this competitive sector. However, the burgeoning global battery industry demands constant adaptation and investment in training to meet evolving skill requirements.

Corporate Social Responsibility and Local Community Engagement

FREYR Battery's commitment to corporate social responsibility (CSR) and local community engagement is crucial for its operational success, particularly given its plans for large-scale battery manufacturing facilities. Building trust and fostering positive relationships with the communities where it operates, such as in Norway and potentially the United States, is essential for securing its social license to operate. This proactive approach helps mitigate potential opposition to new projects and ensures smoother development processes.

Effective CSR initiatives can translate into tangible economic benefits for local areas. For instance, FREYR's planned Gigafactory in Mo i Rana, Norway, is projected to create significant employment opportunities, contributing to the regional economy. Similarly, their potential expansion into the U.S. market, as indicated by discussions around facilities in states like Georgia, will necessitate similar community integration strategies. These efforts not only enhance FREYR's reputation but also build a supportive environment for its growth.

- Job Creation: FREYR's Gigafactory in Mo i Rana, Norway, is expected to generate approximately 1,000 direct jobs and many more indirect jobs in the surrounding region.

- Local Sourcing: The company aims to prioritize local suppliers and service providers where feasible, injecting capital directly into the community's economy.

- Community Investment: FREYR plans to invest in local infrastructure and community development programs as part of its CSR strategy, fostering goodwill and long-term partnerships.

Health and Safety Standards in Manufacturing

FREYR Battery's commitment to robust health and safety standards is critical, especially given the inherent risks in battery manufacturing. In 2024, the Occupational Safety and Health Administration (OSHA) reported a 4% decrease in workplace injuries within the manufacturing sector, highlighting the ongoing focus on safety improvements.

Maintaining a strong safety culture is not just about compliance; it directly impacts operational efficiency and employee morale. Companies like FREYR, utilizing advanced battery chemistries, must implement rigorous training and protective measures. For instance, the global battery manufacturing market is projected to reach over $200 billion by 2027, underscoring the scale and potential hazards involved.

- Employee Well-being: Prioritizing worker safety minimizes accidents and fosters a more productive environment.

- Operational Continuity: Strict safety protocols prevent disruptions caused by incidents, ensuring consistent production.

- Technological Advancement: Adherence to safety is paramount when working with new and potentially hazardous materials in battery production.

- Regulatory Compliance: Meeting evolving safety regulations is essential for legal operation and corporate reputation.

Societal shifts towards sustainability and electric mobility are fundamental to FREYR Battery's growth. Global EV sales exceeded 13 million units by the end of 2023, demonstrating robust consumer adoption and a clear market signal for battery manufacturers. This increasing environmental consciousness, with a majority of consumers in 2024 expressing concern over climate change, directly benefits companies like FREYR that champion green technologies.

FREYR's emphasis on sustainable manufacturing, utilizing renewable energy for its battery cell production, aligns perfectly with evolving consumer preferences. This commitment not only enhances brand perception but also attracts both environmentally conscious consumers and investors seeking sustainable investments. The company's proactive approach to corporate social responsibility, including significant job creation in regions like Mo i Rana, Norway, where its Gigafactory is projected to create around 1,000 direct jobs, further solidifies its positive societal standing.

The company's dedication to health and safety standards is crucial, especially as the global battery manufacturing market is projected to exceed $200 billion by 2027. By prioritizing worker well-being and adhering to stringent safety protocols, FREYR ensures operational continuity and regulatory compliance, which are vital for long-term success in this rapidly expanding industry.

Technological factors

FREYR Battery's strategic advantage hinges on its adoption of 24M Technologies' semi-solid battery platform, a move designed to boost energy density and lower manufacturing expenses. This technological pivot is central to FREYR's ambition to compete effectively in the rapidly evolving battery market.

The successful maturation and widespread adoption of this advanced battery technology are paramount for FREYR to achieve its production goals and maintain a competitive advantage. As of early 2024, 24M Technologies has been actively demonstrating its platform's capabilities, with pilot production lines showing promise for scalability.

FREYR Battery is heavily invested in automating its production trials at the Customer Qualification Plant (CQP), signaling a strong commitment to advanced manufacturing. This focus on automation is critical for achieving the high levels of efficiency and cost-effectiveness needed to scale up operations for their planned Gigafactories.

The company's strategic adoption of automation is designed to ensure consistent product quality and reduce manufacturing costs, a key differentiator in the competitive battery market. By the end of 2024, FREYR aims to have its CQP fully operational and producing qualification batteries, paving the way for the Giga Arctic facility.

The battery market is a hotbed of innovation, with ongoing research into chemistries beyond FREYR's initial focus. While FREYR is strategically positioned with LFP production, the rapid advancements in technologies like solid-state batteries present a significant competitive challenge. Companies are pouring billions into R&D; for instance, in 2024, global battery R&D spending is projected to exceed $20 billion, with a substantial portion dedicated to exploring next-generation chemistries that could offer higher energy density or faster charging.

FREYR's commitment to LFP is a solid foundation, but staying ahead requires constant adaptation. The emergence of improved NMC variants and the long-term potential of solid-state batteries, which promise enhanced safety and performance, mean FREYR must remain agile. For example, by the end of 2025, several automakers are expected to announce or expand their use of LFP in mainstream vehicles, increasing supply and potentially driving down costs, but also highlighting the need for FREYR to differentiate through manufacturing efficiency and other technological advantages.

Research and Development Investment

FREYR Battery's commitment to technological advancement is evident in its sustained investment in research and development. This focus is crucial for enhancing battery performance, driving down production costs, and exploring novel applications for their battery technology. The company understands that innovation is key to staying competitive in the rapidly evolving energy storage sector.

Collaborations and strategic partnerships play a significant role in FREYR's R&D strategy. For instance, their participation in initiatives like the Norwegian Green Platform underscores a dedication to pushing technological boundaries. These collaborations allow FREYR to leverage external expertise and resources, accelerating the development and commercialization of next-generation battery solutions.

FREYR's R&D efforts are geared towards tangible improvements and market readiness. Key areas of focus include:

- Improving energy density and cycle life of their battery cells to offer longer-lasting and more efficient energy storage.

- Reducing manufacturing costs through process optimization and material innovation, making their batteries more accessible.

- Developing advanced battery management systems (BMS) for enhanced safety, performance, and longevity.

- Exploring new chemistries and cell designs to meet diverse market demands and environmental regulations.

Intellectual Property Protection and Licensing

FREYR Battery's technological advantage hinges on robust intellectual property (IP) protection for its innovative battery cell designs and manufacturing processes. This is vital for maintaining a competitive edge in the rapidly evolving battery market. The company actively manages its IP portfolio to safeguard its proprietary technologies.

Strategic licensing agreements are central to FREYR's technology acquisition and IP risk management. For instance, their collaboration with 24M Technologies grants access to their advanced Semi-Solid platform technology, a key differentiator. Similarly, licensing agreements with Aleees provide access to essential materials and manufacturing expertise.

- IP Protection: FREYR prioritizes securing patents for its unique battery cell architectures and production methodologies to prevent unauthorized use and maintain market exclusivity.

- Licensing Strategy: Agreements with partners like 24M and Aleees enable FREYR to leverage cutting-edge technologies while mitigating the complexities and costs associated with in-house development and IP ownership.

- Competitive Advantage: Effective IP management and strategic licensing allow FREYR to differentiate its offerings and command a stronger position in the global battery manufacturing landscape.

FREYR Battery's technological strategy centers on the 24M Technologies semi-solid battery platform, aiming for higher energy density and reduced manufacturing costs. This platform is key to their competitive positioning, with 24M actively demonstrating scalability in pilot lines as of early 2024.

Automation is a core focus at FREYR's Customer Qualification Plant (CQP), critical for achieving efficiency and cost-effectiveness needed for Gigafactory scaling. The company anticipates the CQP to be fully operational by the end of 2024, producing qualification batteries for the Giga Arctic project.

The battery industry is highly innovative, with significant R&D investment, projected to exceed $20 billion globally in 2024, focusing on next-generation technologies. While FREYR leverages LFP, advancements in chemistries like solid-state batteries present ongoing competitive challenges, necessitating agility and continuous improvement.

FREYR's commitment to LFP is strengthened by strategic licensing, such as with 24M Technologies for its semi-solid platform and Aleees for materials and manufacturing expertise. This approach allows them to access cutting-edge technology while managing IP complexities, aiming to secure patents for unique cell designs and production methods.

Legal factors

Environmental regulations significantly impact battery manufacturing, focusing on emissions, waste, and resource use. FREYR Battery's strategy emphasizes low-carbon production, which is crucial for meeting these stringent requirements. For instance, the EU's Battery Regulation, effective from 2024, mandates carbon footprint declarations and sets limits on hazardous substances, directly influencing manufacturing processes and material sourcing.

Ongoing compliance and adaptation to evolving environmental standards are paramount for FREYR. The company's commitment to sustainability, including its planned Giga factories aiming for energy efficiency, positions it favorably, but continuous investment in cleaner technologies and robust waste management systems will be necessary to maintain compliance and competitive advantage in the 2024-2025 period.

FREYR Battery must navigate a complex web of labor laws, encompassing everything from minimum wage requirements and working hour regulations to health and safety standards across its global operations. For instance, in Norway, where its initial operations are based, adherence to strict employee protection laws and collective bargaining agreements is paramount. Failure to comply with these regulations, such as those governing overtime pay or workplace safety protocols, could lead to significant fines and operational disruptions.

The company's workforce, projected to grow substantially in the coming years, necessitates careful management of union relations and employee representation. In the United States, where FREYR is establishing significant manufacturing capacity, understanding the National Labor Relations Act (NLRA) and its implications for union organizing is crucial. Potential disputes arising from non-compliance with wage laws or unfair labor practices could impact production schedules and brand reputation.

International trade laws and tariffs significantly shape FREYR Battery's global operations. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in 2023 and fully operational by 2026, could impact the cost of imported battery components if their embedded carbon emissions exceed EU standards. Similarly, ongoing trade negotiations and potential adjustments to tariffs on critical minerals like lithium and cobalt, essential for battery production, could alter supply chain economics and FREYR's sourcing strategies for 2024 and 2025.

Product Safety and Certification Standards

FREYR Battery's products, particularly battery cells for electric vehicles (EVs), energy storage systems (ESS), and marine applications, must adhere to stringent safety and performance standards. This is crucial for market acceptance and to prevent legal repercussions. For instance, the UN ECE R100 regulation is a key standard for EV battery safety.

Compliance with certification bodies like UL (Underwriters Laboratories) in North America and CE marking in Europe is non-negotiable. These certifications validate that FREYR's batteries meet established safety, quality, and environmental requirements, thereby building trust with customers and regulators. Failure to obtain or maintain these certifications can lead to market exclusion and significant financial penalties.

- Product Safety: Battery cells must meet rigorous safety and performance standards for various applications (EV, ESS, marine).

- Certification Necessity: Compliance with national and international certification bodies is necessary for product quality, market acceptance, and avoiding legal liabilities.

- Regulatory Landscape: For example, UN ECE R100 is a critical safety standard for EV batteries, and UL certification is vital for market entry in North America.

Corporate Governance and Reporting Requirements

As a company traded on the New York Stock Exchange (NYSE), FREYR Battery is subject to rigorous corporate governance standards and financial reporting obligations. These legal mandates are essential for fostering investor trust and ensuring the integrity of the capital markets. For instance, the Sarbanes-Oxley Act of 2002 (SOX) imposes strict rules on financial reporting and internal controls, which FREYR must diligently follow.

Adherence to these legal frameworks is not merely a compliance exercise but a fundamental aspect of FREYR's operational strategy. The company's commitment to transparency and its ability to meet these requirements directly impact its valuation and access to capital. In 2024, for example, companies are increasingly scrutinized for their Environmental, Social, and Governance (ESG) reporting, a legal and market expectation that FREYR must address.

Key reporting requirements and governance aspects include:

- SEC Filings: FREYR must submit regular reports like 10-K (annual) and 10-Q (quarterly) to the Securities and Exchange Commission (SEC), detailing financial performance and material business developments.

- NYSE Listing Standards: Compliance with NYSE rules regarding board composition, shareholder rights, and corporate governance practices is mandatory.

- SOX Compliance: Implementing and maintaining effective internal controls over financial reporting to prevent fraud and ensure accuracy is a critical legal requirement.

- Shareholder Communication: Transparent and timely communication with shareholders through proxy statements and other disclosures is legally mandated.

FREYR Battery operates within a dynamic legal landscape, necessitating constant vigilance regarding product safety and certification. Key regulations like UN ECE R100 for EV battery safety and the need for certifications such as UL in North America and CE marking in Europe are critical for market access and avoiding penalties. These standards ensure that FREYR's battery cells meet established safety and quality benchmarks, vital for building customer and regulatory trust.

Environmental factors

FREYR Battery's core strategy hinges on utilizing Norway's abundant hydropower resources, aiming to produce batteries with an exceptionally low carbon footprint. This deliberate choice to power manufacturing with clean energy directly minimizes the environmental impact of their operations, bolstering their sustainability profile.

This strategic reliance on renewable energy sources is particularly advantageous given the global push towards decarbonization. For instance, Norway's electricity mix in 2023 was over 98% renewable, primarily hydropower, providing FREYR with a stable and environmentally sound energy supply for its Gigafactories, such as the one in Mo i Rana.

FREYR Battery is actively working to reduce the carbon footprint associated with its battery cell production, a critical environmental consideration. This involves a dual approach: powering its manufacturing facilities with renewable energy sources and meticulously optimizing its supply chain, from raw material acquisition to final logistics, to minimize emissions across the entire value chain.

For instance, FREYR has secured agreements to utilize renewable energy for its Gigafactory in Mo i Rana, Norway, aiming for a manufacturing process powered by 100% clean energy. This commitment is crucial, as the production phase of batteries, particularly the energy-intensive processes, significantly contributes to their overall lifecycle carbon impact. By focusing on renewable energy, FREYR aims to set a benchmark for sustainable battery manufacturing.

The environmental and social impacts associated with mining critical battery materials like lithium, nickel, and cobalt are substantial, raising concerns about water usage, land disruption, and labor practices. For instance, lithium extraction in arid regions can strain local water resources, while cobalt mining in some areas has been linked to human rights issues.

FREYR Battery is actively addressing these challenges by focusing on developing more sustainable and localized supply chains. This strategy aims to reduce the environmental footprint associated with long-distance transportation and to ensure more responsible sourcing of these essential minerals.

Waste Management and Battery Recycling Initiatives

Addressing the end-of-life management of batteries through robust recycling and waste reduction programs is paramount for environmental sustainability. FREYR's commitment to establishing a circular economy for batteries is a cornerstone of its long-term environmental strategy, aiming to minimize its ecological footprint.

FREYR is actively participating in initiatives to develop efficient battery recycling processes. For instance, the company has been involved in discussions and collaborations aimed at improving the recovery rates of critical materials like lithium and cobalt from spent batteries, contributing to resource conservation.

Key aspects of FREYR's waste management and battery recycling initiatives include:

- Partnerships for advanced recycling technologies: Collaborating with specialized recycling firms to ensure responsible and efficient processing of end-of-life batteries.

- Design for recyclability: Incorporating design principles in battery development that facilitate easier disassembly and material recovery.

- Circular economy models: Exploring business models that promote the reuse and repurposing of battery components, extending their lifespan and reducing waste.

- Regulatory compliance and leadership: Staying ahead of evolving environmental regulations concerning battery disposal and recycling, and actively contributing to industry best practices.

Land Use and Ecosystem Impact of Gigafactories

The construction of FREYR Battery's Gigafactories, such as the one planned in Vaaler, Norway, necessitates substantial land acquisition. This can lead to significant alterations in local land use patterns and potentially impact sensitive ecosystems. For instance, the Vaaler facility, initially envisioned to occupy a large footprint, required careful consideration of its environmental surroundings.

To mitigate these effects, comprehensive Environmental Impact Assessments (EIAs) are crucial. These studies help identify potential ecological disruptions and inform strategies for minimizing harm. FREYR's approach involves site selection processes that aim for responsible development, balancing industrial needs with environmental preservation.

- Land Footprint: Gigafactory projects, by nature, require extensive land, impacting local topography and habitats.

- Ecosystem Sensitivity: Careful site selection is paramount to avoid ecologically sensitive areas like wetlands or critical wildlife corridors.

- Mitigation Strategies: EIAs guide the implementation of measures such as habitat restoration or buffer zones to lessen environmental impact.

FREYR Battery's environmental strategy heavily leverages Norway's renewable energy advantage, aiming for a significantly lower carbon footprint in battery production. This focus on clean energy, with Norway's electricity mix being over 98% renewable in 2023, provides a strong foundation for sustainable manufacturing.

The company is committed to reducing the environmental impact across its entire value chain, from sourcing raw materials to managing battery end-of-life. This includes developing localized and sustainable supply chains to minimize transportation emissions and investing in advanced battery recycling technologies.

Addressing the environmental and social impacts of critical mineral extraction, such as water usage and land disruption, is a key challenge. FREYR is actively pursuing more responsible sourcing and circular economy models to mitigate these concerns.

The land footprint required for Gigafactory construction necessitates careful environmental impact assessments to minimize disruptions to local ecosystems. Mitigation strategies, including habitat restoration and responsible site selection, are integral to FREYR's development approach.

| Environmental Factor | Impact on FREYR Battery | Mitigation/Strategy | Relevant Data/Example |

|---|---|---|---|

| Renewable Energy Availability | Enables low-carbon manufacturing | Utilizing Norway's hydropower | Norway's 2023 electricity mix: >98% renewable |

| Raw Material Sourcing | Environmental & social risks (mining) | Sustainable supply chains, responsible sourcing | Concerns over water usage in lithium extraction |

| Battery End-of-Life | Waste generation, resource depletion | Circular economy, advanced recycling | Partnerships for efficient material recovery |

| Land Use & Construction | Habitat disruption, land footprint | Environmental Impact Assessments (EIAs) | Careful site selection for Gigafactories |

PESTLE Analysis Data Sources

Our PESTLE Analysis for FREYR Battery is built on a robust foundation of data from official government agencies, leading financial institutions, and reputable industry research firms. We meticulously gather information on regulatory landscapes, economic indicators, technological advancements, and socio-environmental trends to provide a comprehensive overview.