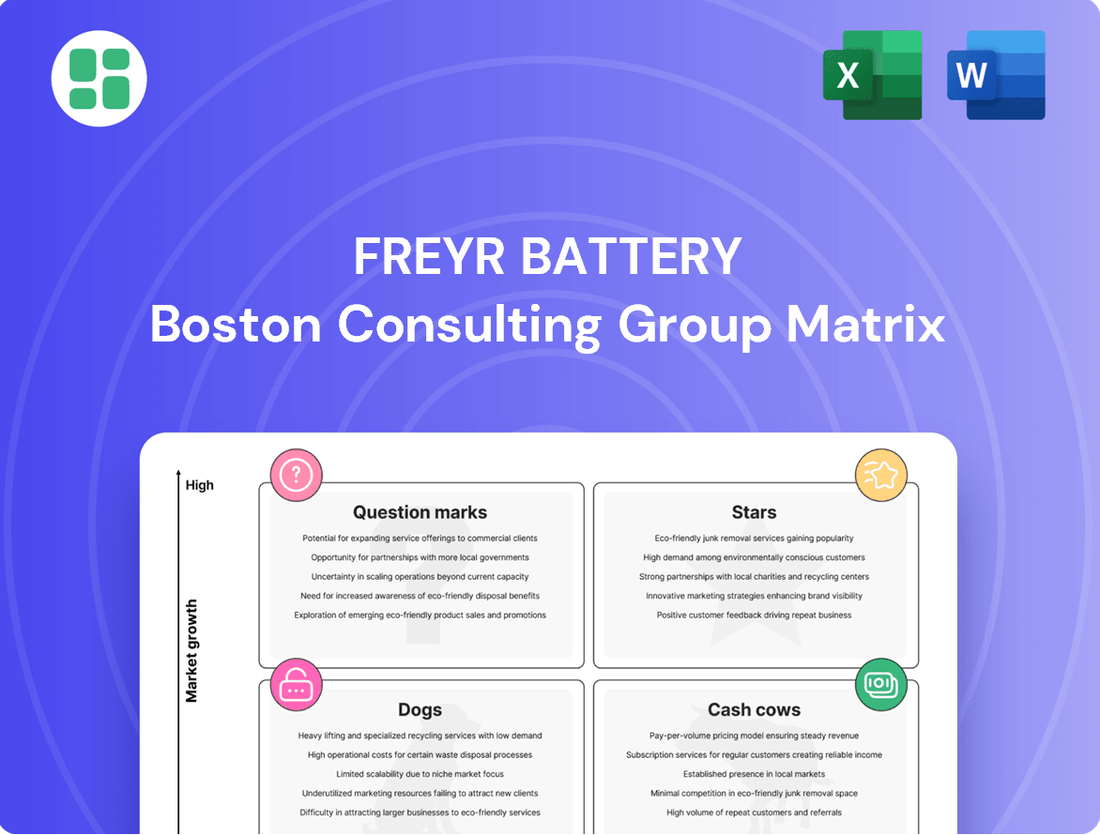

FREYR Battery Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

FREYR Battery's BCG Matrix offers a crucial lens into its product portfolio's market position and growth potential. Understand which of their battery technologies are poised for rapid expansion (Stars) and which are generating consistent returns (Cash Cows).

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for FREYR Battery.

Stars

FREYR Battery's Giga America project in Georgia is positioned as a Star in the BCG matrix. This designation stems from its significant growth potential and strong market position, largely fueled by the Inflation Reduction Act (IRA). The IRA provides substantial tax credits and subsidies for battery manufacturing in the U.S., making Giga America a highly competitive venture compared to FREYR's European operations.

The project is slated to commence production in the second half of 2026. FREYR is actively pursuing firm customer contracts within the North American market, targeting a substantial share of the burgeoning electric vehicle (EV) and energy storage systems (ESS) sectors. This strategic focus on a high-growth market, coupled with favorable regulatory tailwinds, solidifies its Star status.

FREYR Battery's 24M SemiSolid™ Battery Technology Platform is the company's key innovation, aiming to streamline battery manufacturing and deliver improved performance characteristics like higher energy density and quicker charging times. This technology is central to FREYR's strategy and its potential position in the market.

Significant strides were made in the first half of 2024 with successful automated production trials of the SemiSolid™ technology at FREYR's Customer Qualification Plant (CQP) located in Mo i Rana, Norway. These trials are a crucial step in validating the technology's readiness for commercial-scale deployment.

Should the 24M SemiSolid™ technology prove viable at GWh-scale production and achieve broad market acceptance, it would firmly establish FREYR Battery as a frontrunner in the development and supply of advanced battery solutions for the future.

FREYR Battery's strategic offtake agreements, such as the one with Nidec Corporation, position it strongly in the market. This agreement alone is for 38 GWh of cells between 2025 and 2030, with an option for an additional 12 GWh, highlighting significant customer commitment.

These agreements are crucial for FREYR's growth, with total conditional offtake agreements and a long-term sales agreement reaching approximately 130 GWh. This translates to a potential revenue stream of $9 to $10 billion, underscoring the substantial market demand for FREYR's products.

Sustainable, Low-Carbon Battery Production

FREYR Battery's focus on sustainable, low-carbon battery production, leveraging Norway's hydropower, positions it strongly in a market increasingly prioritizing environmental impact. This clean energy approach is a key differentiator, attracting environmentally conscious customers and partners. For instance, in 2024, the demand for batteries with a lower carbon footprint is projected to significantly influence purchasing decisions across various sectors, including electric vehicles and grid storage.

- Sustainable Production Advantage: FREYR's reliance on Norway's hydropower offers a distinct competitive edge, contributing to a lower carbon footprint for its battery cells.

- Market Demand for Green Solutions: The growing global emphasis on decarbonization means customers are actively seeking suppliers with verifiable green credentials.

- Alignment with Global Goals: This production strategy directly supports international efforts to reduce greenhouse gas emissions, making FREYR a relevant player in the clean energy transition.

Focus on Energy Storage Systems (ESS) and Commercial Mobility

FREYR Battery is strategically positioning itself within the burgeoning Energy Storage Systems (ESS) and commercial mobility sectors. This focus is driven by the increasing global demand for energy storage solutions, a critical component in achieving renewable energy targets. For instance, the global ESS market was valued at approximately USD 150 billion in 2023 and is projected to grow significantly in the coming years, with commercial mobility representing a substantial and expanding segment within this overall market.

By concentrating on these high-growth areas, FREYR aims to leverage its technological advancements and production capabilities to capture a meaningful market share. The commercial mobility segment, particularly electric buses and trucks, presents a clear opportunity for FREYR's battery solutions. In 2024, many regions are accelerating their adoption of electric commercial fleets, with government mandates and incentives playing a crucial role in this transition.

- Targeting High-Growth Markets: FREYR's emphasis on ESS and commercial mobility aligns with substantial market expansion forecasts.

- Strategic Resource Allocation: This focus allows for concentrated investment in areas with high potential for technological impact and market leadership.

- Commercial Mobility Potential: The electrification of commercial fleets, including buses and trucks, represents a key avenue for FREYR's growth.

- Alignment with Global Trends: FREYR's strategy supports the worldwide push for increased energy storage capacity and sustainable transportation solutions.

FREYR Battery's Giga America project in Georgia is a prime example of a Star in the BCG matrix. Its strong market position is bolstered by significant growth potential, largely driven by the Inflation Reduction Act (IRA) which offers substantial tax credits for U.S. battery manufacturing. This makes the Georgia facility highly competitive.

The project is expected to begin production in the latter half of 2026, with FREYR actively securing customer contracts in the expanding North American electric vehicle (EV) and energy storage systems (ESS) markets. This strategic focus on high-growth sectors, combined with favorable regulatory support, cements its Star status.

FREYR's 24M SemiSolid™ Battery Technology Platform is central to its strategy, aiming for streamlined manufacturing and enhanced performance. Successful automated production trials of this technology at the Customer Qualification Plant (CQP) in Mo i Rana, Norway, during the first half of 2024 validated its readiness for commercial scale.

FREYR's offtake agreements, such as the 38 GWh deal with Nidec Corporation (with an option for an additional 12 GWh), highlight significant customer commitment. Total conditional offtake agreements and long-term sales agreements reach approximately 130 GWh, indicating a potential revenue stream of $9 to $10 billion, reflecting substantial market demand.

| Project/Technology | BCG Category | Key Growth Drivers | Market Position Indicator | Production Start (Target) |

| Giga America (Georgia) | Star | IRA Tax Credits, US Market Demand (EV/ESS) | Secured offtake agreements (~130 GWh) | H2 2026 |

| 24M SemiSolid™ Technology | Star | Technological Innovation (Energy Density, Charging), Market Acceptance | Successful CQP trials (H1 2024) | Commercial Scale Deployment |

What is included in the product

FREYR Battery's BCG Matrix offers a strategic overview of its battery production units, categorizing them by market share and growth potential.

Visualizes FREYR's battery portfolio, easing strategic decisions by highlighting Stars and Cash Cows.

Cash Cows

FREYR Battery's Customer Qualification Plant (CQP) in Mo i Rana, Norway, achieved a significant milestone in H1 2024 by successfully completing automated unit cell production trials. This demonstration of giga-scale production line equipment functionality is a crucial step, even though the CQP is primarily a development facility and not yet a revenue-generating powerhouse.

While the CQP's operational success in H1 2024 doesn't translate to immediate large-scale revenue, it serves as a powerful validation of FREYR's technology and production processes. This validation could pave the way for high-value sample sales or the generation of early-stage, stable revenue through specialized testing services for potential customers.

As FREYR Battery's 24M SemiSolid™ technology matures, its intellectual property (IP) holds significant potential as a future cash cow. Licensing this proven platform to other battery manufacturers could establish a consistent, high-margin revenue stream with minimal incremental operational expenses, effectively monetizing their substantial R&D investments.

FREYR Battery's potential for Cathode Active Material (CAM) production in Vaasa, Finland, positions it as a possible Cash Cow. The company secured a significant €122 million grant from the EU Innovation Fund for a joint venture focused on LFP CAM.

Should this facility reach industrial scale and serve a stable, mature supply chain, it's projected to deliver steady cash flow. This steady income stream, while likely having a lower growth trajectory than cell manufacturing, is characteristic of a Cash Cow business unit within the BCG framework.

Optimized Capital Structure and Liquidity Management

FREYR Battery's strategic approach to capital structure and liquidity management is a cornerstone of its operational stability, even as it navigates the demanding battery manufacturing landscape. The company's financial discipline is evident in its Q1 2024 performance, where it reported a robust cash position of $252.8 million, notably with no outstanding debt.

This focus on maintaining ample liquidity is critical for FREYR's growth trajectory. By extending its liquidity runway, the company ensures it has the necessary financial resources to support ongoing operations and future expansion plans without the immediate burden of debt servicing. This prudent financial stewardship is particularly important for a company in the growth phase, aiming to achieve profitability.

- Strong Cash Position: FREYR ended Q1 2024 with $252.8 million in cash.

- Zero Debt: The company maintained a debt-free status in Q1 2024, enhancing financial flexibility.

- Liquidity Runway Extension: FREYR actively works to prolong its financial runway, ensuring sustained operations.

- Capital Preservation: A focus on less capital-intensive opportunities helps preserve capital, crucial for growth and eventual profitability.

Early Revenue from Downstream Module and Pack Solutions (Future)

FREYR Battery is strategically looking at downstream modules and pack solutions as a way to generate early revenue. This approach is less demanding on capital compared to their primary battery cell manufacturing, offering a quicker route to initial cash flows.

These downstream offerings, if they gain traction, are expected to become reliable revenue generators. While they might not exhibit high growth rates, they will capitalize on FREYR's established battery cell technology, presenting more accessible financing opportunities.

For instance, FREYR's focus on customized battery solutions for specific applications, such as stationary energy storage or niche electric mobility, could be seen as these downstream opportunities. The company has indicated a target for initial production of battery cells by late 2024, with downstream product revenues potentially following.

- Focus on Downstream: FREYR is exploring less capital-intensive downstream module and pack solutions.

- Faster Revenue Path: These solutions offer a quicker route to first revenues and cash flows.

- Stable Revenue Streams: Established downstream products are anticipated to provide stable, though potentially lower-growth, revenue.

- Leveraging Core Tech: The strategy utilizes FREYR's core battery cell technology in more financeable end-products.

FREYR Battery's 24M SemiSolid™ technology intellectual property (IP) is a prime candidate for a Cash Cow. Licensing this proven technology to other manufacturers could generate consistent, high-margin revenue with minimal additional investment, effectively monetizing their substantial research and development efforts.

The potential for industrial-scale Cathode Active Material (CAM) production in Vaasa, Finland, particularly with the secured €122 million EU Innovation Fund grant for LFP CAM, positions this as another possible Cash Cow. If this facility achieves stable, mature supply chain integration, it's expected to deliver steady cash flow, characteristic of a mature, lower-growth business unit.

FREYR's exploration of downstream modules and pack solutions represents a strategic move towards generating early, stable revenue. These less capital-intensive offerings leverage their core battery cell technology and are anticipated to become reliable, albeit potentially lower-growth, revenue generators.

| Potential Cash Cow Area | Rationale | Key Data/Facts |

|---|---|---|

| 24M SemiSolid™ Technology IP Licensing | Monetizing R&D through licensing agreements. | Validated giga-scale production line equipment functionality at CQP in H1 2024. |

| LFP Cathode Active Material (CAM) Production (Vaasa, Finland) | Potential for stable, industrial-scale production. | Secured €122 million grant from EU Innovation Fund for LFP CAM joint venture. |

| Downstream Modules and Pack Solutions | Generating early revenue with lower capital intensity. | Targeting initial battery cell production by late 2024, with downstream revenues potentially following. |

Preview = Final Product

FREYR Battery BCG Matrix

The FREYR Battery BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a comprehensive, analysis-ready report designed for strategic decision-making.

What you see here is the actual FREYR Battery BCG Matrix file you’ll get upon purchase, reflecting its complete structure and professional design. Once acquired, this document will be instantly available for editing, printing, or direct integration into your business strategy presentations.

This preview showcases the exact FREYR Battery BCG Matrix report that will be delivered to you after your purchase is complete. It’s a professionally crafted document, ready for immediate application in your strategic planning or competitive analysis efforts.

Dogs

FREYR Battery's Giga Arctic project in Mo i Rana, Norway, has been significantly de-prioritized. This strategic shift is largely driven by the more attractive incentives offered by the U.S. Inflation Reduction Act, which favors their Giga America project.

While the Norwegian site is being maintained, the minimal investment in this large-scale factory means it currently consumes resources without generating immediate market share or progress. This positions Giga Arctic as a 'Dog' within FREYR's portfolio, representing a low-growth, low-market-share asset that requires careful management of its ongoing costs.

FREYR Battery's legacy technologies, such as early-stage research into chemistries or manufacturing processes that have since been surpassed by their semi-solid advancements, would likely fall into the Dogs quadrant. Continuing to invest in these areas, which are now less competitive, would drain resources and yield minimal market share in the fast-paced battery industry.

FREYR Battery's strategic pivot away from certain European expansion attempts, beyond the planned CAM facility in Finland, highlights the inherent risks in capital-intensive manufacturing. These explorations, though not explicitly detailed in public filings as distinct "failed" projects, represent significant sunk costs in terms of research, site selection, and initial planning. The competitive landscape and funding hurdles in Europe for battery cell production, particularly in 2023 and early 2024, made some ventures less attractive than initially anticipated.

The company's increased focus on its U.S. operations, including the Giga Arctic project in Norway and the planned Giga America facility in Georgia, signals a strategic reallocation of resources. This shift underscores a pragmatic assessment of where FREYR sees the most viable path to market share and profitability, likely influenced by factors such as government incentives and market demand dynamics observed in the U.S. during 2024.

Inefficient Early Production Processes

FREYR Battery's initial production processes at their CQP (Customer Qualification Plant) have presented significant hurdles. If these early stages prove too costly, inefficient, or incapable of scaling up to commercial production volumes, they would be classified as Question Marks within the BCG matrix. This situation directly impacts FREYR's ability to gain substantial market share and achieve profitability.

The challenges in industrializing new battery technologies are substantial, and FREYR is not immune. For instance, by the end of 2023, FREYR had not yet achieved mass production at its CQP, a critical step for demonstrating commercial viability and securing customer orders.

- Production Inefficiencies: Early CQP processes may require more manual labor or slower cycle times than anticipated, driving up per-unit costs.

- Scaling Challenges: The transition from pilot to full-scale manufacturing often reveals unforeseen bottlenecks in machinery, material handling, or quality control.

- Cost Overruns: Unexpected expenses related to equipment calibration, material sourcing, or process refinement can significantly impact the cost-effectiveness of early production.

Overhead from Redomiciliation and Restructuring

FREYR Battery's strategic move to redomicile from Luxembourg to the United States, coupled with internal restructuring, has unfortunately led to a temporary financial setback. This process, while crucial for long-term growth and market positioning, has directly impacted the company's bottom line, placing it in the 'Dog' quadrant of the BCG Matrix for the immediate future. These are essentially one-time costs associated with setting up operations in a new jurisdiction and reorganizing the business structure.

The financial impact of these actions is evident in FREYR's reported figures. For instance, in the first quarter of 2024, the company reported a net loss of $70.5 million. A significant portion of this loss is attributable to the costs associated with these redomiciliation and restructuring initiatives. These expenses, while substantial, are viewed as necessary investments to align the company with its strategic objectives in the North American market.

- Redomiciliation Costs: Expenses incurred in transferring the company's legal domicile to the U.S.

- Restructuring Expenses: Costs related to reorganizing operations, including potential severance packages for affected employees.

- Impact on Net Loss: These one-time expenses directly contribute to increased net losses in the short term.

- Strategic Investment: Despite the immediate financial drag, these costs are essential for FREYR's future market access and operational efficiency.

FREYR Battery's Giga Arctic project in Norway, while maintained, represents a low-growth, low-market-share asset due to the U.S.'s more attractive incentives under the Inflation Reduction Act. This strategic shift means minimal investment in the Norwegian site, which consumes resources without immediate market progress, thus classifying it as a 'Dog'. Similarly, any legacy battery technologies or research areas that have been surpassed by newer advancements would also fall into this category, draining resources with little to no market share potential.

The company's redomiciliation to the United States and internal restructuring, while strategically important for long-term North American market positioning, have resulted in immediate financial setbacks. These one-time costs, such as those reported in Q1 2024 contributing to a $70.5 million net loss, place these initiatives in the 'Dog' quadrant for the short term. While these expenses are viewed as necessary investments, their immediate impact is a drag on profitability and market share growth.

Question Marks

FREYR Battery's Giga America project in Georgia represents a significant investment in the burgeoning US battery market, aiming for substantial growth. However, as a project currently under development, it demands considerable capital, with funding likely reliant on successful applications for programs like the Department of Energy's Title 17 loan.

The project's current market share is negligible, reflecting its developmental stage. It's a cash-intensive venture where profitability hinges on the successful completion of construction, securing necessary financing, and achieving efficient production ramp-up.

FREYR Battery's 24M SemiSolid™ technology, while demonstrating promise at the pilot stage, faces a significant hurdle in scaling up from its Current Qualification Plant (CQP) to full Gigafactory production. This transition is a classic 'Question Mark' scenario in the BCG matrix, indicating high potential but also substantial risk.

The core challenge lies in translating the CQP's achievements into the high-volume, efficient output required for commercial viability. This involves not just replicating the process but optimizing it for speed and consistency across larger manufacturing footprints. For instance, achieving production speeds that can compete with established battery technologies is critical for market penetration.

Successful customer qualification is another key determinant for this technology's success. Without securing significant orders from major players in the electric vehicle or energy storage sectors, the investment in Gigafactory scale-up remains speculative. The ability to meet stringent performance and quality demands from these customers will be paramount.

The market for advanced battery technologies is experiencing rapid growth, with the global battery market projected to reach over $400 billion by 2030. However, FREYR's SemiSolid™ technology must overcome technical and operational challenges to capture a meaningful share of this expanding market and achieve profitability.

FREYR Battery's reliance on conditional off-take agreements for its future Gigafactories places securing firm commitments for full capacity as a significant 'Question Mark' in its BCG Matrix. While the company has announced several potential agreements, the transition from conditional to binding, financeable contracts is critical for operationalizing its ambitious production plans.

The burgeoning battery market, projected to reach hundreds of billions of dollars by 2030, offers substantial growth opportunities. However, FREYR must convert its existing conditional agreements, such as the memorandum of understanding with Koch Industries for up to 4.5 GWh, into firm orders to guarantee revenue streams and justify the massive capital expenditure required for its Gigafactories. This is essential for financial stability and capturing a substantial market share amidst increasing competition from established players and emerging technologies.

Expansion into Passenger Electric Vehicle (EV) Market

FREYR's strategic push into the passenger electric vehicle (EV) market is currently positioned as a Question Mark within the BCG Matrix. This segment represents a rapidly expanding opportunity, with global passenger EV sales projected to reach approximately 20 million units in 2024, a significant increase from previous years.

However, this high-growth arena is also intensely competitive, demanding advanced battery performance, cost-effectiveness, and stringent quality standards. FREYR's success hinges on its ability to navigate these challenges, requiring considerable investment in research and development tailored to specific automotive requirements and the establishment of resilient, large-scale supply chains.

- High Growth Potential: The passenger EV market is experiencing exponential growth, driven by government incentives and increasing consumer adoption.

- Intense Competition: Established automotive manufacturers and battery giants already dominate this space, creating significant barriers to entry.

- Investment Requirements: Significant capital is needed for R&D, specialized product development, and building reliable, high-volume battery production capacity to meet automotive demands.

- Market Share Capture: Achieving a meaningful presence will necessitate differentiation in technology, cost, and supply chain reliability.

Development of Cathode Active Materials (CAM) Project in Finland

FREYR Battery's proposed Cathode Active Material (CAM) manufacturing project in Finland is categorized as a Question Mark within the BCG matrix. This initiative, while having secured a significant €122 million grant from the European Union, still faces considerable uncertainty regarding its ultimate success and market position.

The project represents a potential joint venture aimed at tapping into the high-growth market for battery components. However, its progression hinges on securing final funding approvals and demonstrating commercial viability within a highly competitive global supply chain.

- Market Potential: The CAM market is experiencing robust growth, driven by the accelerating adoption of electric vehicles and renewable energy storage solutions.

- Investment and Grants: The €122 million EU grant signifies strong governmental support and confidence in the project's strategic importance for European battery production.

- Risks and Uncertainties: Key challenges include finalizing investment, achieving efficient production scale, and navigating the competitive landscape dominated by established players.

- Strategic Importance: Successful development could position FREYR as a key European supplier of critical battery materials, reducing reliance on external sources.

FREYR's 24M SemiSolid™ technology, while promising, faces the classic 'Question Mark' dilemma. It requires significant capital to scale from pilot to mass production, with profitability uncertain until efficient, high-volume output is achieved. Key hurdles include translating pilot success to Gigafactory scale and securing firm customer orders to validate the investment.

The passenger EV market, a target for FREYR, is a high-growth area with approximately 20 million units projected for 2024. However, it's fiercely competitive, demanding substantial investment in R&D and supply chains to meet automotive standards. FREYR must demonstrate technological differentiation and cost-competitiveness to gain traction.

FREYR's CAM manufacturing project in Finland, backed by a €122 million EU grant, is also a Question Mark. While it taps into the growing battery component market, final funding and commercial viability in a competitive landscape remain uncertain. Success hinges on efficient scaling and securing market position as a key European supplier.

| Project/Technology | BCG Category | Key Characteristics | Market Data/Projections | Key Uncertainties |

| 24M SemiSolid™ Technology | Question Mark | Promising technology, requires scaling from pilot to mass production. High capital intensity. | Global battery market projected to exceed $400 billion by 2030. | Technical scaling challenges, customer qualification, achieving cost-competitiveness. |

| Passenger EV Market Entry | Question Mark | High-growth segment, requires specialized product development and large-scale production. | Global passenger EV sales ~20 million units in 2024. | Intense competition, R&D investment needs, supply chain reliability. |

| Finnish CAM Manufacturing | Question Mark | Potential joint venture for battery components, EU grant secured. | Robust growth in CAM market due to EV and storage adoption. | Final funding approval, commercial viability, competitive landscape navigation. |

BCG Matrix Data Sources

Our FREYR Battery BCG Matrix is built upon a foundation of robust market data, encompassing financial disclosures, industry growth forecasts, and competitive landscape analysis to provide strategic clarity.