FREYR Battery Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FREYR Battery Bundle

FREYR Battery faces a dynamic competitive landscape, with significant forces shaping its market. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FREYR Battery’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for crucial battery materials like lithium and nickel has experienced fluctuations, but the refining of these materials is largely concentrated in China. This concentration in refining capacity, even when raw material supply is plentiful, can give significant leverage to a small number of refiners. This creates potential weak spots in the supply chain for companies like FREYR Battery.

For instance, while global lithium production has been increasing, the dominance of Chinese companies in the lithium refining sector means that disruptions or policy changes in China could significantly impact the availability and price of refined lithium for battery manufacturers worldwide. This concentration of power among a few refiners can increase the bargaining power of suppliers, as they control a critical bottleneck in the production process.

FREYR Battery is actively working to address this by building out its own localized refining capabilities in the U.S. and Europe. This strategy aims to reduce reliance on any single geographic region and diversify its supply chain, thereby mitigating the risks associated with supplier concentration and strengthening its position against powerful raw material suppliers.

Lithium prices saw a substantial drop in 2024, largely due to an oversupply situation. However, forecasts suggest a tightening market and a potential rebound in prices by 2025, highlighting ongoing volatility. This price fluctuation directly affects FREYR's manufacturing expenses and overall profitability, indirectly strengthening the bargaining power of raw material suppliers.

FREYR's ability to navigate these price swings is critical. The company's efforts to forge strategic alliances and explore vertical integration in cathode material production are key strategies to mitigate the impact of raw material cost volatility and maintain a competitive edge.

FREYR Battery faces substantial switching costs when it comes to its raw material suppliers or the adoption of new battery chemistries. These processes demand rigorous qualification, extensive testing, and potentially significant retooling of manufacturing lines. This complexity inherently creates a degree of lock-in with its current or chosen suppliers, thereby strengthening their bargaining power.

The company's strategic reliance on the 24M SemiSolid™ platform further solidifies this dynamic. This specific technology dictates particular material requirements, making it challenging and costly for FREYR to deviate from established supply chains without substantial investment and validation.

Uniqueness of Supplier Inputs

While many battery raw materials are considered commodities, the uniqueness of certain inputs significantly impacts supplier bargaining power. Specialized components or highly refined materials with stringent purity requirements for battery-grade production can originate from a limited number of suppliers, granting them considerable leverage. For instance, FREYR Battery's strategic focus on next-generation semi-solid technology may necessitate materials with very specific characteristics, further empowering the suppliers of these niche inputs.

FREYR's proactive approach to securing essential materials is evident in its joint venture with Aleees. This collaboration aims to establish a local supply of LFP cathode materials in the Nordic region, highlighting the company's strategy to ensure access to specific, high-quality inputs crucial for its production processes.

- Specialized Material Requirements: FREYR's advanced battery technologies may demand inputs with unique properties not readily available from multiple sources.

- Limited Supplier Base: The concentration of suppliers for critical, high-purity battery materials can create significant bargaining power for those suppliers.

- Strategic Sourcing: Partnerships like the one with Aleees for LFP cathode materials demonstrate FREYR's efforts to mitigate supplier power by securing dedicated supply chains for specific inputs.

Threat of Forward Integration by Suppliers

Suppliers of critical battery raw materials, particularly those with advanced refining capabilities, may explore forward integration into battery cell manufacturing. This strategic move would transform them into direct competitors, thereby amplifying their bargaining power over battery producers like FREYR. While less probable for pure mining operations, integrated producers or refiners could indeed present this threat, compelling FREYR to prioritize securing robust long-term supply agreements or investigate opportunities for backward integration.

For instance, in 2024, the global demand for lithium, a key battery component, continued to surge, driven by electric vehicle (EV) adoption. Companies controlling significant lithium reserves and possessing sophisticated refining processes might leverage this market position. The potential for these suppliers to enter the battery manufacturing space themselves represents a tangible risk, as it could disrupt established supply chains and alter competitive dynamics within the industry.

- Supplier Integration Risk: The possibility of raw material suppliers moving into battery cell production directly increases their leverage.

- Competitive Landscape Shift: Such integration would turn suppliers into direct rivals, intensifying competition for battery manufacturers.

- Strategic Responses: FREYR must consider long-term supply contracts and potential backward integration to mitigate this threat.

The bargaining power of suppliers for FREYR Battery is significantly influenced by the concentration of refining capacity, particularly for materials like lithium, which remains largely dominated by China. This geographic concentration, even with ample raw material extraction, grants substantial leverage to a few refiners, creating potential supply chain vulnerabilities for FREYR.

For example, while lithium production increased globally, China's control over refining means policy shifts there can heavily impact lithium availability and pricing for battery manufacturers worldwide. This bottleneck empowers suppliers, as they control a critical stage in the production process.

FREYR's strategy to build its own localized refining in the U.S. and Europe aims to reduce this dependency, diversify its supply chain, and mitigate risks associated with supplier concentration.

The company's reliance on specific technologies, like the 24M SemiSolid™ platform, dictates unique material needs. This specialization, coupled with the high costs and extensive testing required for new material qualification and potential retooling, creates supplier lock-in, thereby strengthening supplier bargaining power.

FREYR's joint venture with Aleees for LFP cathode materials in the Nordic region exemplifies its proactive approach to securing specific, high-quality inputs and mitigating the power of specialized material suppliers.

The potential for suppliers to integrate forward into battery cell manufacturing, transforming them into direct competitors, poses a significant threat, amplifying their leverage over battery producers like FREYR. This risk necessitates robust long-term supply agreements or exploring backward integration.

| Factor | Impact on FREYR | Mitigation Strategy |

|---|---|---|

| Refining Concentration (e.g., Lithium in China) | High supplier leverage due to control over critical processing stage. | Building localized refining capabilities in U.S./Europe. |

| Specialized Material Requirements (e.g., for SemiSolid™ tech) | Creates supplier lock-in due to high switching costs and validation needs. | Strategic sourcing, partnerships (e.g., Aleees for LFP). |

| Potential Supplier Forward Integration | Suppliers becoming direct competitors, increasing their bargaining power. | Long-term supply agreements, exploring backward integration. |

What is included in the product

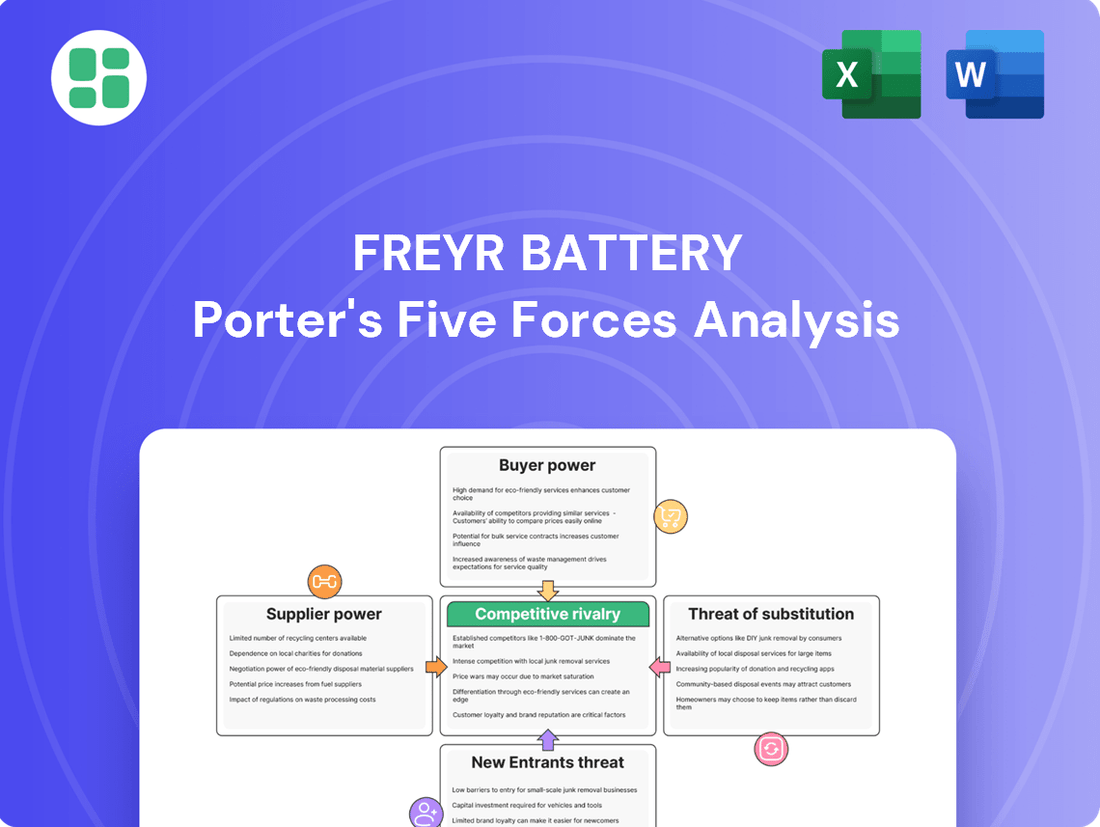

This analysis evaluates the competitive intensity and attractiveness of the battery manufacturing market for FREYR Battery, examining threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Instantly visualize FREYR Battery's competitive landscape with a comprehensive Porter's Five Forces analysis, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Customer concentration presents a key challenge for FREYR Battery. The company has secured significant conditional offtake agreements, notably a long-term sales agreement with Nidec Corporation for 38-50 GWh of cells between 2025 and 2030. This represents a substantial portion of FREYR's anticipated production capacity.

While these agreements are crucial for revenue generation, the reliance on a few large customers grants them considerable bargaining power due to their sheer purchasing volume. Any adverse development, such as the loss or renegotiation of these major contracts, could materially affect FREYR's financial health and stability.

The battery industry has seen substantial price declines, largely driven by major Chinese manufacturers. This intense competition has created a low-margin environment, significantly boosting the bargaining power of customers who can now negotiate for more favorable pricing and terms. For instance, the average price of lithium-ion battery packs for electric vehicles dropped by approximately 89% between 2010 and 2023, according to BloombergNEF, highlighting the scale of these price reductions.

FREYR Battery must therefore focus on relentless cost optimization in its production processes. Leveraging its unique selling proposition of low-carbon battery production is crucial for maintaining a competitive edge against these aggressive pricing strategies. This includes ensuring efficient manufacturing and supply chain management to offset the downward pressure on prices.

For major clients such as electric vehicle manufacturers and energy storage system integrators, changing battery providers isn't a simple swap. It necessitates significant product redesign, rigorous testing, and lengthy qualification procedures, all of which contribute to substantial switching costs. These high barriers can effectively diminish a customer's bargaining leverage once a supplier relationship is solidified and the battery technology becomes embedded in their product lines.

FREYR Battery's innovative semi-solid battery technology, which offers advantages like enhanced safety and faster charging, could further elevate these switching costs for any customer who chooses to integrate it. For instance, if a major automotive OEM were to adopt FREYR's semi-solid cells, retooling production lines and revalidating vehicle performance with the new battery chemistry would represent a considerable investment, making a subsequent switch to another supplier economically challenging.

Demand for Localized and Sustainable Solutions

Customers in North America and Europe are increasingly prioritizing battery solutions that are produced locally and have a reduced environmental impact. This shift is fueled by a growing awareness of geopolitical risks and stricter environmental regulations. For example, a 2024 survey indicated that over 60% of European automotive manufacturers consider supply chain resilience and sustainability as key purchasing criteria.

This growing demand for localized and sustainable batteries effectively diminishes the bargaining power of customers who might otherwise push for lower prices by solely considering less sustainable or geographically distant options. FREYR Battery's strategic focus on utilizing Norway's abundant renewable energy sources and building regional production facilities directly addresses this customer preference.

- Growing Customer Demand: Over 60% of European automotive manufacturers in 2024 cited supply chain resilience and sustainability as critical factors in their purchasing decisions.

- Reduced Customer Bargaining Power: The emphasis on localized and sustainable solutions limits the leverage of customers who previously relied on cost-driven, less sustainable alternatives.

- FREYR's Value Proposition: Leveraging Norway's renewable energy and establishing regional supply chains aligns with and strengthens FREYR's offering to these discerning customers.

Customer Threat of Backward Integration

Large customers, especially significant automotive manufacturers, often have the financial muscle and technical know-how to explore producing battery cells themselves. This capability forces battery suppliers like FREYR to remain competitive on price and technological advancement to keep their business.

The threat of major EV makers backward integrating is a real concern. For instance, in 2024, many automotive giants continued to invest heavily in battery research and development, signaling a growing interest in controlling their own supply chains. This pressure incentivizes battery producers to offer superior value propositions.

- Customer Bargaining Power: Threat of Backward Integration

- Major EV manufacturers possess substantial financial resources and technical expertise, enabling them to consider in-house battery cell production.

- This potential for backward integration compels battery suppliers to offer competitive pricing, cutting-edge technology, and dependable supply to secure and retain customer contracts.

- FREYR Battery's strategy, including its focus on advanced semi-solid battery technology and strategic alliances, aims to present a strong value proposition that discourages customers from pursuing self-manufacturing.

FREYR Battery faces significant customer bargaining power, primarily due to the concentration of its major offtake agreements with a few large entities like Nidec Corporation. The intense price competition within the battery industry, driven by global manufacturers, further empowers customers to negotiate favorable terms. However, FREYR can mitigate this by emphasizing its unique low-carbon production and innovative semi-solid technology, which create substantial switching costs for clients.

| Factor | Impact on FREYR | Mitigation Strategy |

|---|---|---|

| Customer Concentration | High bargaining power for large clients (e.g., Nidec) | Diversify customer base, secure long-term contracts |

| Price Competition | Downward pressure on margins | Cost optimization, focus on value-added technology |

| Switching Costs | High for customers integrating FREYR's technology | Emphasize technological innovation and integration support |

| Demand for Sustainability | Growing preference for eco-friendly solutions | Leverage renewable energy sources and regional production |

| Threat of Backward Integration | Potential for major customers to self-manufacture | Offer superior value proposition in price, technology, and reliability |

What You See Is What You Get

FREYR Battery Porter's Five Forces Analysis

This preview showcases the comprehensive FREYR Battery Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the battery manufacturing industry. You're viewing the exact document you'll receive instantly after purchase, offering a thorough examination of industry rivalry, buyer and supplier power, the threat of new entrants, and the menace of substitutes. This professionally formatted analysis is ready for immediate use, providing actionable insights into FREYR Battery's market dynamics without any placeholders or surprises.

Rivalry Among Competitors

The global battery manufacturing landscape is intensely competitive, with a significant number of companies vying for market share. This crowded field, particularly with the substantial production capacity originating from China, has led to widespread overcapacity.

This structural overcapacity directly translates into downward pressure on battery prices, consequently narrowing profit margins for all industry participants. For instance, the average selling price for lithium-ion batteries saw a notable decline in 2024, impacting profitability across the sector.

FREYR Battery's strategic decision to cancel its Giga America project in early 2025 serves as a stark example of these market dynamics. The company cited falling battery prices and intense competition as key factors influencing this decision, underscoring the challenging operating environment.

The battery industry is characterized by intense competition, especially in the race to develop advanced technologies like semi-solid, solid-state, lithium-sulfur, and sodium-ion batteries. FREYR Battery is positioning itself with its 24M SemiSolid™ platform, focusing on streamlining production and achieving cost advantages.

This rapid innovation cycle means that competitors can swiftly bring new or enhanced technologies to market, demanding substantial and ongoing investment in research and development for FREYR to maintain its competitive edge. For instance, in 2024, significant venture capital funding continues to flow into battery tech startups, with some focusing on solid-state advancements, highlighting the aggressive R&D landscape.

The battery industry is experiencing a fierce race to build Gigafactories, driving massive capacity expansions worldwide. This surge in production capability has led to increased competition, with some newer manufacturers facing project cancellations due to the intense market pressure. FREYR Battery, for instance, is actively participating with its Giga Arctic project in Norway and its previously planned Giga America facility, underscoring the aggressive build-out across the sector.

Geographical Focus and Regional Support

Competition in the battery manufacturing sector is becoming increasingly regionalized, driven by governments offering incentives to bolster domestic production. Companies are strategically aligning their operations to capitalize on these localized support mechanisms, such as the U.S. Inflation Reduction Act (IRA) or various European grant programs. This geographical focus allows firms to secure critical supply chain advantages and government backing, shaping the competitive landscape.

FREYR Battery's strategic repositioning highlights this trend. The company's pivot towards focusing on its U.S. operations, alongside its ongoing evaluation of European assets like the planned LFP cathode facility in Finland, demonstrates a clear response to these regional dynamics. This approach aims to leverage specific market opportunities and governmental support available in these key geographies.

- Regional Incentives Drive Competition: The U.S. Inflation Reduction Act (IRA) offers significant tax credits for battery manufacturing and component production, encouraging companies to establish or expand operations within the United States. Similarly, the European Union provides grants and funding through initiatives like the European Battery Alliance, fostering regional battery ecosystems.

- FREYR's Geographical Strategy: FREYR's decision to prioritize its U.S. Gigafactory in Georgia and its continued exploration of European projects, such as the potential LFP cathode plant in Vaasa, Finland, directly reflects the competitive advantage gained by aligning with regional support. This dual focus allows FREYR to tap into different governmental and market-specific opportunities.

- Supply Chain Localization: Companies are actively seeking to build robust domestic supply chains for critical battery materials and manufacturing processes. This localization effort is a key factor in securing government support and achieving cost efficiencies, intensifying competition among those vying for these advantages.

Cost Reduction as a Dominant Theme

The global battery market, particularly for electric vehicles (EVs), is currently defined by an intense focus on cost reduction. This pressure is amplified by the current economic climate and the evolving EV market landscape, leading to fierce price competition that squeezes margins for all participants. For instance, by the end of 2023, the average transaction price for new EVs in the US saw a noticeable decline compared to previous periods, reflecting this cost-down imperative.

FREYR Battery's strategic emphasis on its semi-solid battery technology is directly aimed at addressing this critical cost-reduction theme. This innovative approach is designed to significantly lower production expenses, a vital factor for FREYR to remain competitive. The company's ability to achieve lower manufacturing costs will be paramount when competing against established players who benefit from substantial economies of scale built over years of high-volume production.

- Cost Pressure: Intense competition in the battery sector, driven by economic conditions and EV market dynamics, makes cost reduction a primary objective for all manufacturers.

- Pricing Wars: Companies are actively competing on price, which directly impacts profitability and necessitates efficient, low-cost production methods.

- FREYR's Solution: FREYR's semi-solid battery technology is positioned as a key enabler for achieving lower production costs.

- Competitive Advantage: Lower production costs are crucial for FREYR to effectively challenge rivals, especially those with established scale advantages.

The battery industry is experiencing a significant oversupply, particularly from Chinese manufacturers, which is driving down prices and squeezing profit margins for all players. This intense price competition is a defining characteristic of the market.

FREYR Battery's decision to cancel its Giga America project in early 2025 highlights the impact of this fierce rivalry and declining battery prices on strategic decisions. Companies must navigate this challenging environment to survive and thrive.

The ongoing race for technological innovation, especially in areas like solid-state batteries, demands substantial R&D investment. Startups in 2024 continue to attract significant venture capital, signaling the aggressive pace of development that FREYR must match.

Governments worldwide are offering incentives to boost domestic battery production, leading to a more regionalized competitive landscape. FREYR's strategy to focus on its U.S. operations and evaluate European assets reflects this trend.

| Metric | 2023 (Estimated) | 2024 (Projected) | Impact on Rivalry |

|---|---|---|---|

| Global Battery Production Capacity (GWh) | ~1,500 | ~2,000+ | Increased overcapacity, driving price competition. |

| Average Lithium-ion Battery Price (USD/kWh) | ~$130-$150 | ~$110-$130 | Downward pressure on prices and margins. |

| EV Sales Growth Rate (%) | ~30% | ~25-30% | Slowing growth can exacerbate overcapacity issues. |

SSubstitutes Threaten

The emergence of next-generation battery chemistries poses a significant threat of substitutes for FREYR Battery. Innovations like solid-state batteries, promising higher energy density and enhanced safety, could disrupt the market if they achieve commercial viability. For instance, companies like QuantumScape reported significant progress in their solid-state battery development in 2024, aiming for a 2025 pilot line.

Furthermore, lithium-sulfur batteries are gaining traction due to their potential for lower costs and improved environmental profiles. This alternative technology could offer a compelling value proposition, potentially displacing current lithium-ion or semi-solid state technologies in various applications. Research continues to advance, with ongoing investments in these promising areas, underscoring the dynamic nature of the battery industry and the constant pressure from evolving substitute technologies.

The battery industry is seeing significant shifts that could impact FREYR Battery. Sodium-ion batteries are becoming more attractive, especially for applications where cost is a primary concern or for storing energy over extended periods. This development presents a challenge to the current dominance of lithium-ion technology in specific market niches.

Furthermore, silicon anode batteries are emerging as a potentially transformative technology for electric vehicles. By replacing traditional graphite anodes, silicon anodes promise higher energy density and extended battery lifespan. For instance, companies like Sila Nanotechnologies are already supplying silicon anode materials, aiming to boost EV range and performance significantly.

While FREYR is focused on its next-generation semi-solid battery approach, it's crucial for the company to closely track these broader industry advancements. The increasing viability of sodium-ion and the performance gains offered by silicon anodes could alter the competitive landscape and customer demand in the coming years.

Beyond lithium-ion, alternative energy storage technologies like flow batteries are gaining traction, especially for long-duration needs in the utility sector. These systems, while not directly competing for electric vehicle battery markets, vie for significant share within the broader energy storage systems (ESS) market, a crucial area for FREYR's growth. For instance, in 2023, the global ESS market saw substantial investment, with projects utilizing technologies beyond traditional batteries becoming increasingly common.

Price-Performance Trade-offs of Substitutes

The viability of substitute technologies for battery solutions hinges on their price-performance ratio. If alternatives offer comparable or superior performance at a lower cost, they pose a significant threat to established players like FREYR Battery.

While emerging technologies might boast technical advancements, their market penetration can be significantly hampered by elevated manufacturing expenses or nascent production capabilities. For instance, early-stage solid-state battery development, while promising, often faces higher production costs than current lithium-ion technologies.

FREYR's strategic emphasis on developing cost-competitive semi-solid battery technology is a direct response to this threat. By aiming for a favorable price-performance trade-off, FREYR seeks to ensure its offerings remain attractive and competitive against a landscape of evolving and potentially disruptive substitute solutions.

- Price-Performance is Key: The adoption rate of substitute battery technologies is directly tied to how their price compares to the performance they deliver, relative to existing solutions.

- Cost Hurdles for Innovation: High manufacturing costs and unproven production processes can significantly slow down the widespread adoption of technically superior substitute technologies.

- FREYR's Competitive Stance: FREYR Battery's focus on cost-competitive semi-solid technology is designed to maintain its market appeal against these emerging alternatives.

Customer Willingness to Adopt New Technologies

Customer willingness to adopt new battery technologies, such as FREYR Battery's offerings, hinges on demonstrating reliability, safety, and seamless integration into existing systems. Industries like electric vehicles (EVs) and energy storage systems (ESS) are actively seeking innovation but demand proven, scalable solutions.

The true threat of substitution is directly tied to how quickly new battery chemistries can gain market acceptance. For instance, in 2023, the global EV market saw significant growth, with sales reaching over 13.6 million units, indicating a strong appetite for advanced battery technology, but also a high bar for new entrants to displace established players.

- Reliability and Safety: Customers in demanding sectors like automotive and grid storage prioritize long-term performance and safety records, which can take years to establish.

- Integration Ease: The ability for new battery technologies to easily fit into current manufacturing processes and infrastructure is crucial for rapid adoption.

- Market Acceptance Pace: The speed at which alternative battery chemistries prove their value and gain traction will dictate the intensity of the substitution threat against FREYR's products.

The threat of substitutes for FREYR Battery is multifaceted, encompassing alternative battery chemistries and energy storage solutions. While FREYR focuses on semi-solid state technology, advancements in sodium-ion batteries, for example, offer a lower-cost alternative for specific applications. Similarly, silicon anode batteries are poised to enhance energy density in electric vehicles, potentially impacting demand for FREYR's current offerings. Beyond batteries, flow batteries are emerging as viable substitutes in the broader energy storage systems market, especially for long-duration needs. The ultimate impact of these substitutes depends on their price-performance ratio and the speed of their market adoption.

| Substitute Technology | Potential Impact on FREYR | Key Differentiator | 2024/2025 Outlook |

|---|---|---|---|

| Sodium-ion Batteries | Cost-sensitive market segments | Lower cost, environmental profile | Increasing pilot production, potential for niche adoption. |

| Silicon Anode Batteries | EV market share | Higher energy density, longer lifespan | Supplier partnerships expanding, integration into premium EVs. |

| Solid-State Batteries | Overall market disruption | Enhanced safety, higher energy density | Continued R&D, pilot lines targeting 2025; high initial cost remains a barrier. |

| Flow Batteries | Energy Storage Systems (ESS) market | Scalability for long-duration storage | Growing investment in grid-scale projects, competition for ESS market share. |

Entrants Threaten

Establishing gigafactories for battery cell manufacturing demands multi-billion dollar investments, presenting a formidable financial barrier. This immense capital requirement effectively deters many potential new entrants from entering the market.

FREYR Battery's own strategic initiatives, such as the previously planned Giga America facility, involved substantial capital commitments exceeding $1 billion, illustrating the sheer scale of investment needed and reinforcing this entry barrier.

The development and scaling of advanced battery technologies, like FREYR's semi-solid platform, demand substantial R&D investment and specialized knowledge, acting as a significant barrier to entry. Companies like FREYR must navigate complex manufacturing processes and secure crucial intellectual property, which can be costly and time-consuming for newcomers. For instance, the global battery market, projected to reach over $400 billion by 2030, highlights the immense capital required to establish a competitive presence.

Securing essential raw materials like lithium, nickel, and cobalt presents a significant hurdle for new battery manufacturers. Geopolitical tensions and price swings can disrupt supply, and a large portion of refining capacity is concentrated in a few regions, making it tough for newcomers to get consistent access to battery-grade materials. For instance, in 2024, the price of lithium carbonate saw considerable volatility, impacting the cost structures for any company looking to enter the market.

Economies of Scale and Cost Competitiveness

Established battery manufacturers, like CATL and LG Energy Solution, leverage substantial economies of scale, enabling them to produce battery cells at significantly lower unit costs. For instance, in 2023, the average price for lithium-ion battery packs dropped to around $150 per kWh, a trend that continues to put pressure on new entrants.

New companies entering the battery manufacturing space face a steep uphill battle in matching these cost efficiencies. Without the same production volume, they often incur higher per-unit costs, making it difficult to compete on price in a market where cost competitiveness is a primary driver of demand.

- Economies of Scale Advantage: Major players benefit from massive production volumes, driving down costs per unit.

- Cost Disadvantage for Newcomers: Start-ups struggle to achieve comparable cost efficiencies due to lower initial output.

- Price Sensitivity: The battery market is highly price-sensitive, with average lithium-ion battery pack prices falling below $150/kWh in 2023, intensifying the challenge for new entrants.

Regulatory Landscape and Government Incentives

The regulatory environment, encompassing stringent environmental standards and evolving trade policies, presents a dual-edged sword for new entrants in the battery sector. While government incentives can be a powerful enabler, the complexity of navigating these rules and securing funding poses significant hurdles. Established players often possess a distinct advantage in their ability to understand and effectively leverage these policy frameworks.

For instance, the U.S. Inflation Reduction Act (IRA), enacted in 2022, offers substantial tax credits and incentives for clean energy manufacturing, including battery production. Similarly, the European Union provides various grants and funding mechanisms to bolster its domestic battery industry. However, the sheer volume and intricacy of these regulations, coupled with the competitive race for limited government support, can deter smaller or less experienced companies. In 2024, the global battery market continues to see significant investment driven by these policies, but the administrative burden remains a key consideration for potential new entrants.

- Regulatory Complexity: Navigating environmental regulations and trade policies requires specialized expertise, acting as a barrier to entry for those lacking resources.

- Government Incentives: Programs like the IRA and EU grants can lower capital costs for new battery manufacturers, but access is competitive and requires compliance.

- Established Player Advantage: Incumbents often have existing relationships with regulators and a proven track record, facilitating easier access to incentives and permits.

- Policy Uncertainty: Changes in government policies or trade disputes can create an unpredictable operating environment, increasing risk for new entrants.

The threat of new entrants in the battery manufacturing sector, including for companies like FREYR Battery, is significantly mitigated by the immense capital requirements, estimated to be in the billions for gigafactory construction. Furthermore, the need for substantial investment in research and development for advanced battery technologies, coupled with securing a consistent supply of raw materials amidst price volatility, creates formidable barriers.

| Barrier Type | Description | Example Data/Impact |

|---|---|---|

| Capital Investment | Establishing gigafactories requires multi-billion dollar outlays. | FREYR's Giga America plan exceeded $1 billion. |

| R&D and Technology | Developing advanced battery tech demands significant R&D spending and expertise. | Global battery market projected >$400B by 2030, indicating scale of investment needed. |

| Raw Material Access | Securing lithium, nickel, cobalt is challenging due to geopolitical factors and concentrated refining. | Lithium carbonate price volatility in 2024 impacts cost structures. |

| Economies of Scale | Established players benefit from lower unit costs due to high production volumes. | Average lithium-ion battery pack prices fell below $150/kWh in 2023. |

| Regulatory Landscape | Navigating complex environmental and trade policies, while accessing incentives, is difficult for newcomers. | IRA and EU grants offer support but are competitive and require compliance. |

Porter's Five Forces Analysis Data Sources

Our FREYR Battery Porter's Five Forces analysis is built upon a foundation of verified data, including FREYR's official SEC filings, investor presentations, and annual reports. We supplement this with insights from reputable industry research firms and market intelligence platforms to capture a comprehensive view of the competitive landscape.