Fresenius SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Bundle

Fresenius's robust global presence and strong brand recognition are key strengths, but navigating complex regulatory environments presents a significant challenge. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their opportunities.

Want the full story behind Fresenius's competitive advantages, potential threats, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning, pitches, and research.

Strengths

Fresenius boasts a robust, diversified healthcare portfolio, spanning dialysis services and products, intravenous generic drugs, clinical nutrition, medical devices, and hospital management. This integrated approach, evident across Fresenius Medical Care, Fresenius Kabi, and Fresenius Helios, significantly mitigates risk by lessening dependence on any single market segment. For instance, in 2023, Fresenius Medical Care, its largest segment, generated €21.7 billion in revenue, showcasing the scale of its dialysis operations, while Fresenius Kabi contributed €7.6 billion, highlighting its strength in hospital products and generics.

Fresenius Medical Care stands as the undisputed global leader in products and services for chronic kidney failure patients, a position that translates into substantial competitive advantages. This market dominance allows for significant economies of scale in its operations. For the fiscal year 2023, Fresenius Medical Care reported total revenue of €22.0 billion, underscoring its vast reach and operational capacity.

Furthermore, Fresenius Helios solidifies the group's strength by operating as Europe's largest private hospital network. This dual leadership across critical healthcare segments, dialysis and hospital services, provides a robust and diversified revenue base. In 2023, Fresenius Helios contributed €11.5 billion to the group's overall revenue, demonstrating its significant market share and operational scale within the European hospital sector.

Fresenius showcased impressive financial performance in 2024, exceeding projections and solidifying a positive outlook for 2025. The company reported growth in operating income, a testament to its operational efficiency.

A key highlight is Fresenius's successful deleveraging strategy. By the end of 2024, the company had significantly reduced its net financial debt, improving its net leverage ratio to a more robust level, which enhances its financial flexibility.

This stronger financial position is crucial, providing Fresenius with greater capacity to fund future growth initiatives and potentially increase returns for its shareholders.

Strategic Restructuring and Focus on Core Businesses

Fresenius's 'Future Fresenius' strategy has been a significant undertaking, marked by a decisive restructuring. A key move was the divestment of Fresenius Vamed's international project business, finalized in early 2025. This action has effectively streamlined the company's operations.

The strategic divestment allows Fresenius to concentrate more intently on its highly profitable core segments: Fresenius Kabi and Fresenius Helios. This sharpened focus is anticipated to yield greater margin stability and unlock enhanced growth potential for the group.

- Divestment of Fresenius Vamed's international project business completed early 2025.

- Increased focus on profitable core segments: Fresenius Kabi and Fresenius Helios.

- Expected improvement in margin stability and future growth prospects.

Commitment to Innovation and Digitalization

Fresenius is doubling down on innovation, pouring resources into digitalization, artificial intelligence (AI), and data analytics. This strategic push aims to pioneer new care models and refine treatment options, ultimately boosting efficiency across all its business areas.

The company is actively developing personalized medicine approaches, comprehensive home care solutions, and intelligent platforms designed to connect care teams, physicians, and patients seamlessly. For instance, in 2024, Fresenius Medical Care reported a significant increase in its digital health investments, aiming to connect over 500,000 patients to its digital platforms by the end of the year.

- Investing in AI for predictive diagnostics and treatment optimization.

- Expanding digital platforms for enhanced patient engagement and remote monitoring.

- Focusing on data-driven insights to improve operational workflows and patient outcomes.

Fresenius's market leadership in dialysis through Fresenius Medical Care, coupled with its extensive hospital network via Fresenius Helios, provides a formidable and diversified revenue stream. The company's strategic focus on its core, high-margin segments, Fresenius Kabi and Fresenius Helios, following the divestment of Fresenius Vamed's international project business in early 2025, is designed to enhance margin stability and unlock greater growth potential. This strategic realignment, supported by significant investments in innovation, particularly in digitalization and AI, positions Fresenius to capitalize on evolving healthcare trends and improve patient outcomes.

What is included in the product

Delivers a strategic overview of Fresenius’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing Fresenius's strategic challenges.

Weaknesses

Fresenius's strategic portfolio optimization, which involved divesting certain assets and clinic operations in various markets, led to a noticeable dip in revenue during 2024. This move, while aimed at long-term benefits, created a short-term financial drag.

The impact of these divestitures, particularly those in Latin America and Sub-Saharan Africa, is expected to persist, continuing to dampen Fresenius's Group revenue growth throughout 2025. This ongoing effect highlights the transitional challenges associated with the company's strategic realignment efforts.

Fresenius operates within a heavily regulated healthcare sector, making it susceptible to shifts in government policies. For instance, changes in reimbursement rates for dialysis services or medical devices can directly affect revenue. The company's 2023 financial reports indicated that approximately 40% of its revenue comes from government payers in the US, highlighting this vulnerability.

Evolving legislative frameworks, such as the ongoing implementation of the EU's Medical Devices Regulation (MDR) and the proposed EU Pharma Package, present significant adaptation challenges. These regulations often necessitate substantial investment in compliance, product re-certification, and updated documentation, potentially increasing operational costs and impacting the timeline for new product launches. For example, the MDR has already led to delays and increased costs for many medical device manufacturers.

The continuous need to adapt to these changing regulatory environments requires significant financial and human resources. Failure to comply or delays in adapting can lead to restricted market access, product recalls, or penalties, all of which can negatively impact Fresenius's revenue streams and overall profitability. The company must remain agile to navigate these complexities effectively.

Fresenius's reliance on its dialysis segment, primarily through Fresenius Medical Care, presents a notable weakness. While this segment is a market leader, its performance is sensitive to factors like patient mortality rates, which saw an increase impacting Fresenius Medical Care's results in recent periods, and evolving reimbursement policies. Any significant downturn in this core area could disproportionately affect the company's overall financial health.

Geographic and Segment-Specific Headwinds

Fresenius has encountered specific headwinds in certain geographic regions and business segments, impacting its financial performance. For example, the cessation of energy relief payments for Fresenius Helios Germany and the loss of a significant volume-based procurement tender for a nutrition product in China by Fresenius Kabi have directly pressured earnings before interest and taxes (EBIT). These instances underscore the company's susceptibility to localized market dynamics and shifts in public policy.

These challenges highlight vulnerabilities to specific market conditions and policy changes. For instance, the phasing out of energy relief payments at Fresenius Helios Germany, a key market, has directly affected profitability. Similarly, the loss of a volume-based procurement tender for a nutrition product in China at Fresenius Kabi demonstrates the impact of competitive tender processes and evolving market access strategies in crucial emerging markets.

- Geographic Vulnerability: Fresenius Helios Germany's EBIT was negatively impacted by the discontinuation of energy relief measures, illustrating exposure to national economic support policies.

- Segment-Specific Tender Loss: Fresenius Kabi experienced EBIT pressure due to losing a volume-based tender for a nutrition product in China, highlighting the competitive nature of procurement in key growth markets.

- Impact on Profitability: These localized headwinds collectively exerted pressure on the company's earnings before interest and taxes (EBIT), underscoring the need for diversified revenue streams and robust market penetration strategies.

Operational Costs and Margin Volatility

Despite ongoing initiatives like FME25+ aimed at operational efficiency, Fresenius continues to grapple with persistent high operational costs. These costs, particularly elevated medical benefit expenses for its U.S. workforce and other labor-related expenditures, exert downward pressure on the company's profit margins. This ongoing challenge in expense management can hinder Fresenius's capacity to significantly boost its profitability.

For instance, in the first quarter of 2024, Fresenius Medical Care's (FMC) operating expenses increased, impacting its profitability. The company reported that higher personnel costs and other operating expenses contributed to this trend.

- Increased U.S. employee medical benefit expenses

- Rising labor costs across various segments

- Pressure on overall profit margins due to cost management challenges

- Impact on the company's ability to drive margin expansion

Fresenius's significant reliance on its dialysis segment, primarily through Fresenius Medical Care, presents a key vulnerability. The performance of this segment is closely tied to patient mortality rates and evolving reimbursement policies, as seen with increased patient mortality impacting Fresenius Medical Care's recent results. Any substantial decline in this core business area could disproportionately affect the company's overall financial stability.

Same Document Delivered

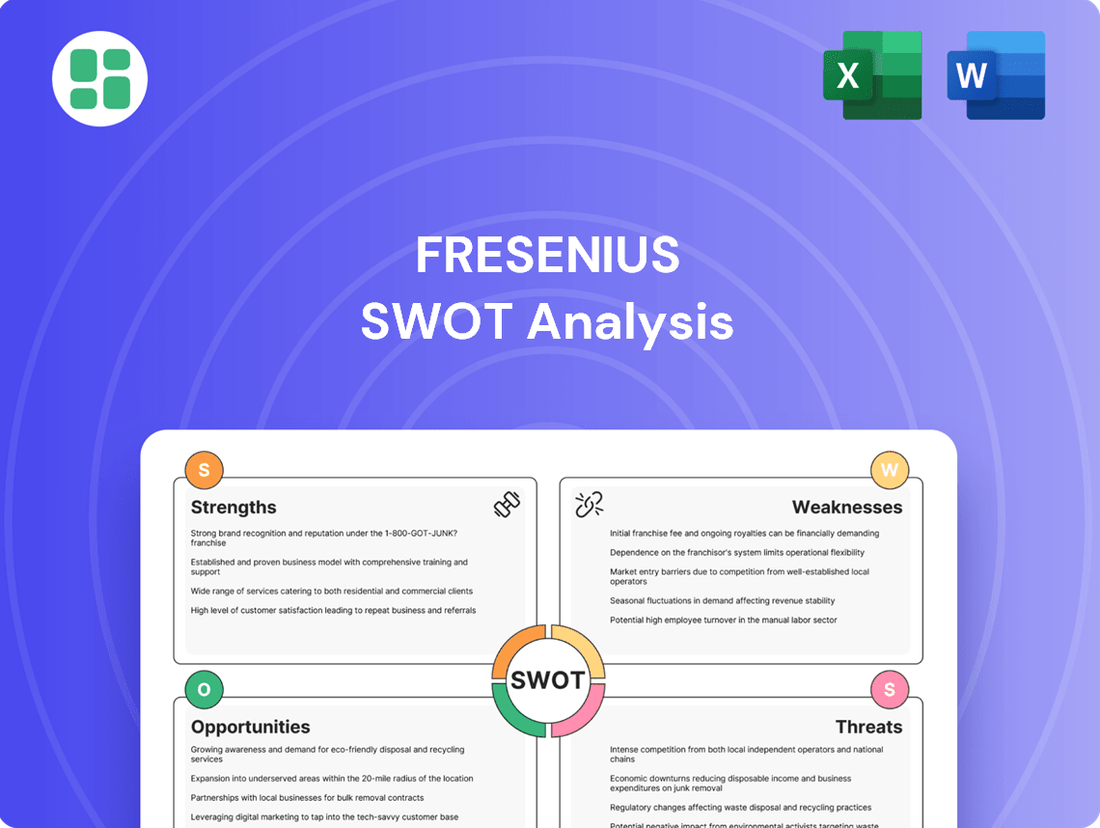

Fresenius SWOT Analysis

This is the actual Fresenius SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the key strengths, weaknesses, opportunities, and threats that define Fresenius's market position. Purchase unlocks the entire in-depth version for your strategic planning.

Opportunities

The world's population is aging, and with it comes a rise in chronic conditions like kidney disease. This demographic shift is a major opportunity for Fresenius, as more people will require their specialized healthcare services. For example, the global dialysis market is expected to see substantial growth, reaching an estimated $170.4 billion by 2031, up from $108.2 billion in 2023, according to recent market analyses.

The increasing prevalence of diabetes and hypertension, key drivers of chronic kidney disease (CKD) and end-stage renal disease (ESRD), further fuels this demand. As these conditions become more common globally, the need for dialysis treatments and related healthcare solutions will continue to expand, creating a stable and growing customer base for Fresenius's core business.

Fresenius is well-positioned to capitalize on the growing healthcare needs in emerging markets, despite recent divestitures. The company's established global presence and deep expertise in dialysis and hospital operations provide a strong foundation for strategic expansion. For instance, regions like Southeast Asia and parts of Africa are experiencing significant growth in healthcare spending, driven by rising incomes and an increasing burden of chronic diseases like kidney failure, a core area for Fresenius.

Fresenius has a significant opportunity to expand its digital health, AI, and telemedicine offerings. These technologies can revolutionize renal care by enabling personalized treatment plans and remote patient monitoring, as seen in the growing adoption of virtual care platforms. For instance, the global digital health market was valued at approximately $208 billion in 2023 and is projected to reach over $700 billion by 2030, indicating substantial growth potential for Fresenius to tap into.

Integrating AI can streamline hospital operations, improve diagnostic accuracy, and optimize resource allocation, leading to greater efficiency. Telemedicine further extends Fresenius's reach, allowing for more accessible and convenient patient care, particularly for those in remote areas or with mobility challenges. This strategic focus can drive innovation and create new revenue streams.

Strategic Acquisitions and Partnerships

Fresenius actively pursues strategic acquisitions and partnerships to bolster its market presence and service portfolio. This strategy is crucial for integrating cutting-edge technologies and expanding into new, high-growth therapeutic areas, such as cell and gene therapy. For instance, in late 2023 and early 2024, Fresenius Medical Care continued to refine its business model, focusing on core dialysis services which often involves acquiring smaller, regional providers to consolidate market share and improve operational efficiencies.

These strategic moves are designed to enhance Fresenius's ability to offer integrated healthcare solutions. By acquiring complementary businesses or forging alliances, the company can broaden its service offerings, gain access to innovative treatments, and solidify its position in key markets. Fresenius's commitment to this strategy is evident in its ongoing evaluation of potential targets and collaborations that align with its long-term vision for healthcare delivery.

Key opportunities stemming from this strategy include:

- Acquiring innovative technologies: Gaining access to novel medical devices, diagnostic tools, or treatment modalities that can be integrated into existing service lines.

- Expanding service capabilities: Broadening the scope of care offered, potentially moving into adjacent healthcare segments like home healthcare or specialized chronic disease management.

- Entering new therapeutic areas: Diversifying the company's focus by acquiring or partnering with entities in emerging fields like precision medicine or advanced regenerative therapies.

- Strengthening geographic reach: Acquiring businesses in underpenetrated markets to expand the company's global footprint and customer base.

Shift Towards Value-Based Care Models

The healthcare sector's pivot towards value-based care, prioritizing patient outcomes and cost efficiency, presents a significant opportunity. Fresenius Medical Care is strategically aligning with this shift, aiming to lead in this evolving landscape. This focus can bolster the company's standing, draw in more patients, and secure advantageous reimbursement, fostering long-term expansion.

By excelling in value-based care, Fresenius can differentiate itself. For example, in 2024, healthcare providers increasingly focused on bundled payment models for chronic disease management, a core area for Fresenius. Successfully navigating these models can lead to improved patient satisfaction and potentially higher profit margins as the company demonstrates its ability to deliver quality care efficiently.

- Enhanced Reputation: Leading in value-based care can significantly improve Fresenius's brand image as a quality-focused provider.

- Patient Attraction: A demonstrated commitment to better outcomes will likely attract more patients seeking effective treatment.

- Favorable Reimbursement: Success in value-based models can unlock more lucrative and stable reimbursement rates.

- Sustainable Growth: This strategic alignment positions Fresenius for sustained growth in a changing healthcare environment.

The aging global population and the rising incidence of chronic diseases like kidney disease present a substantial growth avenue for Fresenius, particularly in its core dialysis services. This demographic trend is expected to drive increased demand for renal care solutions worldwide. For instance, the global dialysis market is projected to grow significantly, with estimates suggesting it will reach approximately $170.4 billion by 2031, up from $108.2 billion in 2023.

Fresenius is also poised to benefit from the expansion of digital health technologies, including AI and telemedicine, within the healthcare sector. These advancements offer opportunities to enhance patient care, streamline operations, and create new service models. The digital health market itself is experiencing rapid growth, valued at around $208 billion in 2023 and anticipated to exceed $700 billion by 2030, indicating a strong potential for Fresenius to leverage these innovations.

Strategic acquisitions and partnerships remain a key opportunity for Fresenius to enhance its market position and service offerings. By integrating new technologies and expanding into adjacent therapeutic areas, the company can strengthen its competitive advantage. This approach allows Fresenius to gain access to innovative treatments and broaden its reach into high-growth segments of the healthcare industry.

The ongoing shift in healthcare towards value-based care models, which prioritize patient outcomes and cost-effectiveness, offers Fresenius a chance to differentiate itself and secure favorable reimbursement. By demonstrating its ability to deliver high-quality, efficient care, Fresenius can attract more patients and solidify its leadership in this evolving landscape. Success in these models can lead to improved patient satisfaction and more sustainable financial performance.

Threats

Fresenius operates in fiercely competitive arenas, especially within the dialysis services and generic drug sectors. Major global players are constantly battling for market dominance, which naturally squeezes profit margins and necessitates ongoing, substantial investments in research and development to stay ahead. For instance, the dialysis market alone is projected to reach over $120 billion by 2027, highlighting the sheer scale and intensity of the competition Fresenius faces.

Changes in healthcare policies, particularly concerning reimbursement rates and drug pricing, present a significant challenge for Fresenius. For instance, the U.S. Medicare Part B reimbursement rate for dialysis services, a core business for Fresenius Medical Care, has seen adjustments that can impact revenue. These shifts, alongside evolving healthcare reform initiatives in key markets like the U.S. and Europe, necessitate continuous adaptation and strategic advocacy to mitigate potential impacts on profitability.

Global supply chain vulnerabilities, exacerbated by geopolitical instability, pose a significant threat. For instance, the ongoing conflicts and trade tensions experienced throughout 2023 and into early 2024 have continued to strain logistics networks.

Persistent inflationary pressures are also a major concern, driving up the cost of essential raw materials and manufacturing for medical products. This trend, evident in rising producer price indices for healthcare goods in major economies during 2024, directly impacts Fresenius's operational expenses.

These combined factors can compress profit margins and potentially create shortages of critical medical supplies, hindering Fresenius's capacity to deliver its services efficiently and meet patient demand.

Cybersecurity Risks and Data Breaches

Fresenius's increasing reliance on digital systems for managing sensitive patient data and its global operations exposes it to significant cybersecurity threats. A data breach could result in substantial financial penalties, alongside severe reputational damage and erosion of patient confidence. For instance, the healthcare sector experienced a 2023 increase in cyberattacks, with ransomware incidents costing an average of $4.1 million per breach, according to IBM's 2023 Cost of a Data Breach Report.

The potential for data breaches necessitates continuous investment in advanced security protocols and employee training. Key areas of concern include:

- Protection of patient health information (PHI)

- Safeguarding operational technology (OT) systems

- Mitigation of ransomware and phishing attacks

- Compliance with evolving data privacy regulations like GDPR and HIPAA

Economic Volatility and Healthcare Spending Constraints

Economic downturns and government austerity measures pose a significant threat by potentially constraining healthcare spending. This reduction in expenditure, whether from public or private payers, can directly impact demand for Fresenius's products and services, particularly those deemed non-essential. For instance, a prolonged recession in key markets could lead to increased pressure on pricing and tighter budget controls within healthcare systems.

These financial pressures can translate into slower sales growth and reduced opportunities for capital investment, hindering Fresenius's ability to expand its operations or invest in new technologies. In 2024, several European countries are implementing fiscal consolidation measures, which could indirectly affect healthcare budgets and, consequently, Fresenius's revenue streams.

- Reduced Demand: Austerity measures may lead to decreased utilization of certain medical treatments and devices.

- Pricing Pressure: Healthcare providers facing budget constraints are likely to negotiate harder on prices, impacting Fresenius's margins.

- Investment Constraints: Limited public and private sector investment in healthcare infrastructure could slow down Fresenius's market penetration and growth.

- Economic Sensitivity: Fresenius's reliance on healthcare spending makes it vulnerable to macroeconomic fluctuations and recessionary periods.

The escalating threat of cybersecurity breaches looms large, with the healthcare sector experiencing a notable rise in attacks. In 2023, ransomware incidents alone cost an average of $4.1 million per breach, according to IBM. Fresenius's extensive digital infrastructure, managing sensitive patient data, makes it a prime target, risking substantial financial penalties and severe reputational damage.

Intense competition within the dialysis and generic drug markets, projected to reach over $120 billion by 2027 for dialysis alone, forces continuous R&D investment and squeezes profit margins. Furthermore, fluctuating healthcare policies, such as adjustments to U.S. Medicare Part B reimbursement rates for dialysis services, necessitate constant strategic adaptation to mitigate revenue impacts.

Geopolitical instability and ongoing conflicts in 2023-2024 have strained global supply chains, potentially leading to shortages of critical medical supplies. Coupled with persistent inflationary pressures driving up raw material costs, as seen in rising producer price indices for healthcare goods in 2024, these factors compress profit margins and hinder efficient service delivery.

Economic downturns and government austerity measures in Europe during 2024 threaten to constrain healthcare spending, directly impacting demand and creating pricing pressure. This vulnerability to macroeconomic fluctuations can slow sales growth and limit capital investment opportunities.

| Threat Category | Specific Risk | Impact | 2024/2025 Data Point |

| Cybersecurity | Data Breaches | Financial penalties, reputational damage | Healthcare ransomware costs averaged $4.1M per breach in 2023 (IBM) |

| Competition | Market Dominance | Margin compression, R&D costs | Dialysis market projected >$120B by 2027 |

| Regulatory/Policy | Reimbursement Rate Changes | Revenue impact | U.S. Medicare Part B reimbursement rate adjustments |

| Supply Chain & Inflation | Disruptions & Cost Increases | Shortages, reduced margins | Rising producer price indices for healthcare goods in 2024 |

| Economic Conditions | Reduced Healthcare Spending | Lower demand, pricing pressure | European fiscal consolidation measures in 2024 |

SWOT Analysis Data Sources

This Fresenius SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful strategic overview.