Fresenius Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Bundle

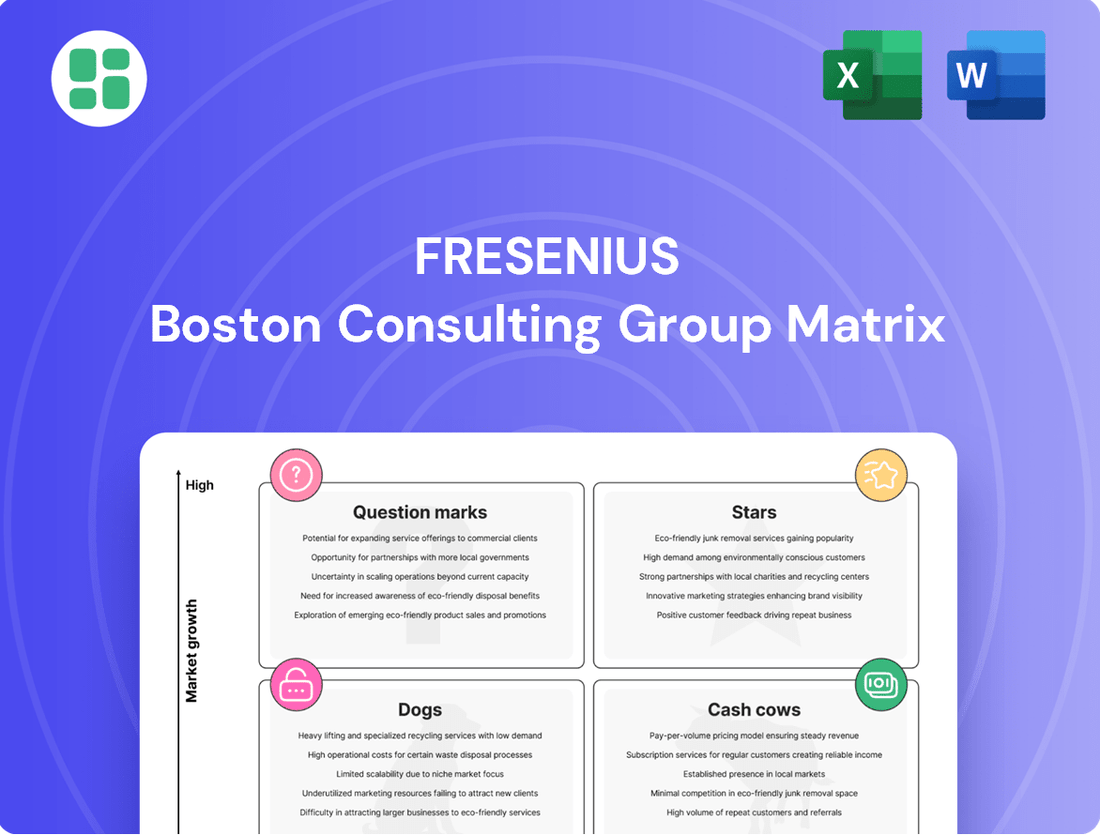

Curious about Fresenius's strategic product portfolio? Our BCG Matrix analysis reveals their Stars, Cash Cows, Dogs, and Question Marks, offering a snapshot of their market dominance and potential.

Don't stop at a glimpse; unlock the full potential of this insight by purchasing the complete BCG Matrix. Gain a detailed breakdown of each product's quadrant placement and actionable strategies to optimize Fresenius's market position and drive future growth.

Stars

Fresenius Kabi's biopharma segment is a key growth driver, with a strong focus on biosimilars in immunology and oncology. This area taps into a rapidly expanding market, driven by the demand for more affordable and accessible biologic therapies.

The company's strategic investments are paying off, evidenced by the successful 2024 European launch of its tocilizumab biosimilar, Tyenne®, with a U.S. launch planned for 2025. Furthermore, a recent agreement for an adalimumab-aacf biosimilar further strengthens its pipeline, positioning Fresenius Kabi for substantial growth in these critical therapeutic areas.

Clinical Nutrition Solutions is a star in Fresenius Kabi's portfolio, benefiting from a robust global market. This sector is expanding due to an aging demographic and a rise in chronic illnesses. In 2024, the global clinical nutrition market was valued at approximately $50 billion and is projected to grow at a CAGR of over 7% through 2030.

Fresenius Kabi's strength lies in its specialized offerings, including infant nutrition, enteral feeding, and parenteral nutrition. The company's focus on innovation, particularly in personalized nutrition and advanced delivery systems, positions it well to capitalize on market trends. The company reported strong sales growth in its nutrition segment in early 2024, indicating continued market penetration.

Fresenius Medical Care's introduction of the 5008X dialysis machine in the U.S. for High-Volume Hemodiafiltration (HVHDF) marks a significant push into a high-growth segment of renal care. This advanced technology aims to enhance patient well-being and decrease hospital readmissions, fitting neatly into value-based healthcare strategies.

By investing in innovative treatments like HVHDF, Fresenius is positioning itself to gain market share in a segment characterized by technological advancement and improved patient outcomes. The company's commitment to these cutting-edge modalities underscores its strategy to lead in the evolving dialysis market.

Digital Health and AI in Healthcare

Fresenius is actively investing in digital health and artificial intelligence (AI) to enhance its healthcare offerings. This strategic push aims to leverage these transformative technologies across diagnostics, patient care, and operational management.

AI and digital solutions are poised to redefine healthcare delivery. For instance, AI is showing promise in improving diagnostic accuracy, with some AI algorithms achieving performance comparable to or exceeding human experts in specific medical imaging tasks. In 2024, the global digital health market was valued at over $200 billion, with AI in healthcare projected to grow significantly, reaching an estimated $100 billion by 2028.

- AI-driven diagnostics: Enhancing accuracy and speed in identifying diseases.

- Personalized treatment planning: Tailoring therapies based on individual patient data.

- Operational efficiency: Streamlining hospital workflows and resource allocation.

- Remote patient monitoring: Expanding access to care through digital platforms.

Expansion of Helios in Spain (Quirónsalud)

Fresenius Helios's Spanish network, Quirónsalud, is a significant growth driver. In 2024, the company continued its expansion by opening new, advanced hospitals. This strategic move enhances its service offerings in a robust healthcare market.

Quirónsalud's commitment to modern infrastructure is evident in its numerous highly-ranked facilities. For instance, several Quirónsalud hospitals consistently appear in national quality rankings, underscoring the network's dedication to excellence.

- Market Presence: Quirónsalud operates a vast network across Spain, making it a leading private healthcare provider.

- Investment in Infrastructure: Fresenius Helios is channeling significant capital into building and upgrading state-of-the-art facilities.

- Quality Recognition: Multiple Quirónsalud hospitals have received high accolades in Spanish healthcare quality assessments.

- Growth Trajectory: The ongoing expansion and focus on quality position Quirónsalud for continued market leadership and revenue growth.

Clinical Nutrition Solutions stands out as a star performer for Fresenius Kabi, capitalizing on a growing global demand driven by an aging population and increasing chronic diseases.

In 2024, the clinical nutrition market was valued at approximately $50 billion, with projections indicating a compound annual growth rate exceeding 7% through 2030, highlighting the significant potential for this segment.

Fresenius Kabi's specialized offerings in infant, enteral, and parenteral nutrition, coupled with innovation in personalized nutrition and advanced delivery systems, are key factors in its strong market penetration and sales growth observed in early 2024.

The company's strategic focus on these high-demand areas solidifies Clinical Nutrition Solutions' position as a star within Fresenius Kabi's portfolio.

| Business Unit | Market Growth | Fresenius's Position | Key Strengths | 2024 Data Point |

| Clinical Nutrition Solutions | High (CAGR >7% projected) | Star | Specialized offerings, innovation, strong sales growth | Global market valued at ~$50 billion |

What is included in the product

The Fresenius BCG Matrix analyzes business units by market share and growth rate.

It guides strategic decisions on investment, divestment, or harvesting.

A clear, visual Fresenius BCG Matrix instantly clarifies portfolio performance, easing the pain of strategic indecision.

Cash Cows

Fresenius Medical Care's in-center dialysis services are a classic cash cow. As the largest global provider, these clinics operate in a mature market where they hold a dominant position. This segment consistently delivers strong, reliable cash flow, driven by the essential and continuous demand for renal replacement therapy.

In 2023, Fresenius Medical Care operated over 4,000 dialysis clinics in North America alone, serving more than 200,000 patients. While this segment experiences lower growth compared to newer ventures, its substantial and predictable earnings are crucial, forming the financial bedrock that supports the company's investments in other areas.

Fresenius Kabi's core business revolves around its extensive production and distribution of intravenous generic drugs and standard fluids. This segment is a cornerstone of the company, dominating a mature but critical segment of the healthcare market.

This high-volume business generates a consistent and substantial stream of revenue and cash flow. For instance, in 2023, Fresenius Kabi reported sales of €7.65 billion for its infusion therapy and clinical nutrition segment, a significant portion of which is attributed to these essential products, highlighting their role as a reliable cash generator.

The profitability derived from these established products provides the financial stability needed for Fresenius to invest in and develop other business units with higher growth potential. This steady cash generation is vital for maintaining Fresenius's overall financial health and strategic flexibility.

Fresenius Helios' German hospital operations represent a significant cash cow within the Fresenius portfolio. As the operator of Germany's largest private hospital network, Helios holds a dominant market share in a mature, well-established healthcare system.

Despite potentially moderate growth in the overall German hospital market, Helios's leadership ensures consistent patient volumes and robust financial performance, making it a reliable source of cash generation for the broader Fresenius group.

Fresenius Medical Care's Dialysis Consumables and Equipment

Fresenius Medical Care's dialysis consumables and equipment are a prime example of a cash cow within the company's BCG matrix. Beyond providing dialysis services, FMC is a significant global manufacturer and supplier of essential dialysis products. These include dialysate, hemodialysis machines, and various other consumables crucial for patient treatment.

This segment thrives on the consistent, recurring demand inherent in the mature dialysis market. Fresenius Medical Care commands a leading position in this space, ensuring high-volume sales that translate into substantial and stable cash flow generation for the company. For instance, in 2023, Fresenius Medical Care reported revenue from its Medical Care segment (which includes products) of €10.98 billion, highlighting the sheer scale of its operations.

The reliability of this revenue stream makes it a cornerstone of Fresenius's financial stability. Key aspects contributing to its cash cow status include:

- Dominant Market Share: FMC's established presence and brand reputation in the global dialysis market allow for consistent sales of its products.

- Recurring Revenue Model: The ongoing need for dialysis consumables ensures a predictable and steady income stream, independent of major new product cycles.

- High Volume, Low Margin (relative to innovation): While individual product margins might not be as high as cutting-edge medical devices, the sheer volume of sales for essential items like dialysate and filters generates significant overall profit and cash.

- Operational Efficiency: Mature product lines often benefit from optimized manufacturing processes and supply chains, contributing to strong profitability.

Established Parenteral Nutrition Product Lines

Established parenteral nutrition product lines within Fresenius Kabi's portfolio, like their amino acid and lipid solutions, are considered cash cows. These products cater to a stable patient population, including those who are critically or chronically ill, and have a strong market presence.

Their consistent demand and low growth environment mean they reliably generate significant cash flow without requiring substantial new investment. For instance, Fresenius Kabi reported net sales of €7.3 billion in 2023, with their nutrition business contributing a substantial portion, reflecting the ongoing strength of these established product lines.

- High Market Share: These established parenteral nutrition products hold a dominant position in their respective market segments.

- Low Market Growth: The market for these standard formulations is mature, with modest growth prospects.

- Consistent Cash Generation: They are reliable sources of substantial, predictable cash flow for Fresenius Kabi.

- Minimal Investment Required: Their established nature means they need little in the way of new capital expenditure for continued success.

Fresenius Medical Care's dialysis consumables and equipment are a prime example of a cash cow. This segment thrives on the consistent, recurring demand inherent in the mature dialysis market, with FMC commanding a leading position. The reliability of this revenue stream makes it a cornerstone of Fresenius's financial stability, generating substantial and stable cash flow.

In 2023, Fresenius Medical Care reported revenue from its Medical Care segment, which includes products, of €10.98 billion. This highlights the sheer scale of operations for essential items like dialysate and filters, contributing significantly to overall profit and cash generation due to high sales volumes and optimized manufacturing processes.

Established parenteral nutrition product lines within Fresenius Kabi, such as amino acid and lipid solutions, are considered cash cows. These products cater to a stable patient population and have a strong market presence, reliably generating significant cash flow without requiring substantial new investment. Fresenius Kabi reported net sales of €7.3 billion in 2023, with its nutrition business contributing a substantial portion.

These established parenteral nutrition products hold a dominant position in their respective market segments, benefiting from a mature market with modest growth prospects. Their consistent cash generation and minimal investment requirements make them reliable sources of substantial, predictable cash flow for Fresenius Kabi.

| Segment | Product Category | 2023 Revenue (approx.) | Key Characteristic |

| Fresenius Medical Care | Dialysis Consumables & Equipment | €10.98 billion (Medical Care Segment) | Dominant market share, recurring revenue, high volume |

| Fresenius Kabi | Parenteral Nutrition Products | Significant portion of €7.3 billion (Kabi Net Sales) | Established, stable demand, low growth, consistent cash flow |

Full Transparency, Always

Fresenius BCG Matrix

The Fresenius BCG Matrix you are currently viewing is the identical, fully completed document you will receive immediately after completing your purchase. This means you get the exact same comprehensive analysis, meticulously crafted for strategic decision-making, without any alterations or watermarks. The preview accurately represents the professional, ready-to-deploy report that will be yours to utilize for your business planning and competitive strategy.

Dogs

Fresenius Vamed's project business is positioned as a Dog in the Fresenius BCG Matrix. The company has clearly communicated its intention to divest this segment, labeling it a loss-making service unit. This strategic move indicates that Fresenius Vamed likely holds a low market share and faces limited growth opportunities, making it a prime candidate for divestment to streamline the overall portfolio.

Non-core dialysis operations in divested regions represent Fresenius Medical Care's strategic move to streamline its global presence. These divested segments, including operations in Latin America, Sub-Saharan Africa, Turkey, and Australia, were identified as non-core assets.

The decision to divest these regions was driven by factors such as lower profitability, limited growth potential, or a desire to focus resources on more strategic markets. For instance, in 2023, Fresenius Medical Care reported a net income attributable to shareholders of €1.16 billion, and such divestitures are aimed at improving overall financial performance and operational efficiency.

Within Fresenius Kabi's diverse medical device offerings, certain legacy technologies could be categorized as Dogs in the BCG matrix. These are products that have been surpassed by more advanced innovations or are struggling against aggressive market competition. For example, older generations of infusion pumps or certain diagnostic equipment that have been replaced by more sophisticated, feature-rich alternatives might fall into this segment.

Products identified as Dogs typically exhibit a declining market share and possess minimal growth prospects. Fresenius Kabi likely dedicates significant resources to maintain these offerings, which could include ongoing support, regulatory compliance, and inventory management. In 2024, Fresenius Kabi's focus has been on streamlining its portfolio and investing in high-growth areas, suggesting a strategic review of such legacy products to optimize resource allocation.

Highly Commoditized Generic Drugs with Severe Price Erosion

Certain intravenous generic drugs within Fresenius Kabi's portfolio, particularly those that are very old or highly commoditized, are experiencing significant price declines. This severe price erosion is a direct result of aggressive competition in the market.

These products typically offer very low profit margins and have limited growth potential. Consequently, they are often considered for discontinuation or require only minimal strategic investment to maintain their presence.

- Low Growth: The market for these older generics is largely saturated, leading to minimal expansion opportunities.

- Intense Competition: Numerous manufacturers compete, driving down prices and squeezing margins.

- Minimal Profitability: The low selling prices result in slim profit margins, often barely covering costs.

- Potential for Divestment: Fresenius Kabi may consider divesting these non-core, low-margin assets to focus resources elsewhere.

Underperforming or Geographically Isolated Dialysis Clinics

Underperforming or geographically isolated dialysis clinics within Fresenius Medical Care's vast network can be categorized as Dogs in the BCG Matrix. These facilities often face challenges such as declining local patient bases or unfavorable reimbursement environments, impacting their profitability and growth prospects. For instance, while Fresenius reported a global network of over 4,000 dialysis centers as of 2023, specific locations might struggle due to these localized issues.

- Low Market Share: These clinics typically operate in niche or shrinking markets, limiting their ability to capture a significant patient population.

- Limited Growth Potential: Factors like demographic shifts or increased competition in specific geographic areas hinder their expansion opportunities.

- Profitability Concerns: Unfavorable reimbursement rates or high operational costs can lead to consistently low or negative profit margins.

- Strategic Review: Fresenius may consider divestment, closure, or significant operational restructuring for such underperforming assets to reallocate resources effectively.

Certain older, commoditized intravenous generic drugs within Fresenius Kabi's portfolio, facing severe price erosion due to intense competition, are classified as Dogs. These products offer minimal profit margins and limited growth prospects, often requiring minimal investment to maintain. Fresenius Kabi's 2024 strategy focuses on streamlining its portfolio and investing in high-growth areas, suggesting a review of these legacy products.

Question Marks

Fresenius could strategically target emerging markets for its specialized therapies, like advanced renal care solutions or innovative drug delivery systems. These new ventures would likely start with a relatively small market share, perhaps below 5%, given the initial hurdles of establishing brand recognition and distribution channels in unfamiliar territories. However, the projected annual growth rate in these markets for advanced healthcare services could exceed 10% over the next five years, presenting a significant upside.

Early-stage biosimilar candidates in Fresenius Kabi's pipeline, those in preclinical or early clinical trials, are considered Question Marks within the BCG matrix. These ventures demand substantial research and development funding, with their future market success being highly uncertain. For instance, Fresenius Kabi's ongoing investment in developing biosimilars for complex biologics like adalimumab and ustekinumab, which are still in relatively early development stages, exemplifies this category.

Fresenius Medical Care is actively looking into and investing in advanced renal care technologies that move beyond conventional dialysis. These include promising fields like implantable artificial kidneys and regenerative therapies, representing significant growth opportunities.

While these innovative areas currently hold a small market share for Fresenius, they possess immense future potential to revolutionize kidney disease treatment. For instance, the global regenerative medicine market, which encompasses these advanced therapies, was valued at approximately $13.4 billion in 2023 and is projected to grow substantially, indicating the scale of the opportunity Fresenius is targeting.

Personalized and Digitalized Clinical Nutrition Programs

Personalized and digitalized clinical nutrition programs represent a potential 'Question Mark' for Fresenius Kabi within the BCG Matrix. This market is experiencing rapid growth, driven by advancements in nutrigenomics and the increasing adoption of digital health platforms. The global personalized nutrition market was valued at approximately USD 11.4 billion in 2023 and is projected to reach USD 33.0 billion by 2028, growing at a CAGR of 23.6% during this period.

Fresenius Kabi's involvement in this nascent segment would likely see them with a low market share initially, reflecting the early stage of development and market penetration. However, the high growth potential means that successful innovation and strategic marketing of tailored nutritional solutions could lead to significant future expansion and a dominant position.

- Market Growth: The personalized nutrition sector is a high-growth area, with projections indicating substantial expansion in the coming years.

- Nutrigenomics and Digital Health: Key drivers include the application of genetic information to dietary recommendations and the integration of digital tools for program delivery and monitoring.

- Fresenius Kabi's Position: As an emerging player, Fresenius Kabi would start with a small market share but has the opportunity to capture a larger portion through focused development.

- Strategic Importance: Investing in this area aligns with the trend towards precision medicine and could offer a significant competitive advantage if executed effectively.

Strategic Partnerships in Novel Healthcare Delivery Models

Fresenius's exploration into novel healthcare delivery models, like integrated care networks and advanced home-based critical care, positions them within a high-growth market segment. These ventures, while promising, represent nascent areas where Fresenius's current market share is likely minimal. For instance, the global home healthcare market was valued at approximately $331.4 billion in 2023 and is projected to grow significantly, offering substantial upside potential.

- Strategic partnerships are crucial for Fresenius to gain traction in these emerging healthcare delivery models.

- These new models, while high-growth, require significant upfront investment to scale and establish market presence.

- Fresenius's initial market share in these novel areas would be low, characteristic of a 'question mark' in a BCG matrix analysis.

- Success hinges on effectively managing the investment required to build scale and capture market share in these innovative healthcare solutions.

Question Marks for Fresenius represent ventures with high growth potential but low current market share, requiring significant investment to determine their future success. These are often new technologies or market entries where Fresenius is still building its presence.

For example, Fresenius Kabi's development of biosimilars for complex biologics, such as adalimumab, fits this category, demanding substantial R&D funding with uncertain market outcomes.

Similarly, Fresenius Medical Care's investments in implantable artificial kidneys and regenerative therapies are positioned as Question Marks, targeting a rapidly expanding regenerative medicine market valued at approximately $13.4 billion in 2023.

Fresenius Kabi's foray into personalized nutrition, a market projected to reach $33.0 billion by 2028 with a 23.6% CAGR, also exemplifies a Question Mark due to its nascent stage and Fresenius's initial low market share.

| Fresenius Business Area | Potential Question Mark Venture | Market Growth Projection | Current Market Share (Estimated) | Key Investment Focus |

|---|---|---|---|---|

| Fresenius Kabi | Biosimilars (e.g., Adalimumab) | High (driven by patent expiries) | Low | R&D, Clinical Trials |

| Fresenius Medical Care | Regenerative Therapies for Kidney Disease | Very High (Global Regenerative Medicine Market ~ $13.4B in 2023) | Low | Research, Development, Partnerships |

| Fresenius Kabi | Personalized Nutrition | High (Projected to reach $33.0B by 2028, 23.6% CAGR) | Low | Digital Platform Development, Nutrigenomics Research |

| Fresenius Medical Care / Kabi | Advanced Home-Based Critical Care | High (Global Home Healthcare Market ~ $331.4B in 2023) | Low | Technology Integration, Service Network Expansion |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.