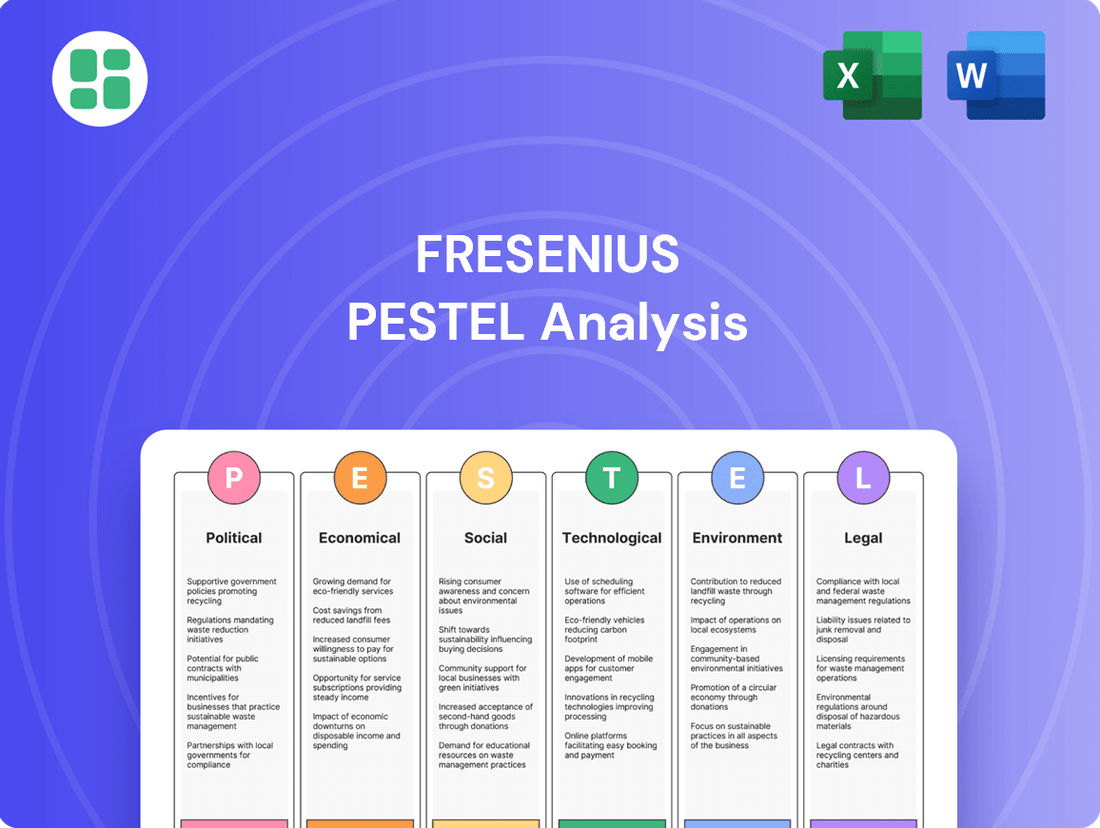

Fresenius PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Bundle

Navigate the complex global landscape affecting Fresenius with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its operations and future growth. Gain a critical advantage by anticipating market shifts and identifying opportunities.

Unlock actionable intelligence to inform your strategy. Our PESTLE analysis provides deep insights into the external factors impacting Fresenius, empowering you to make informed decisions. Download the full report now and gain the clarity needed to stay ahead.

Political factors

Government healthcare spending and reimbursement policies are huge drivers for companies like Fresenius. These policies directly shape how much revenue Fresenius can expect, especially in areas like dialysis and hospital services. For instance, in 2024, many countries are grappling with rising healthcare costs, which could lead to tighter budgets or shifts in how services are paid for.

Changes in reimbursement rates for dialysis treatments or hospital stays can have a significant impact on Fresenius's bottom line. If governments decide to pay less for these services, it directly affects profitability. Conversely, policy shifts favoring value-based care, where providers are reimbursed for patient outcomes rather than just services rendered, could create new opportunities or require strategic adjustments for Fresenius Medical Care and Fresenius Helios.

Political decisions about public health funding and insurance coverage are absolutely critical for Fresenius's financial future. For example, a government expanding insurance coverage could boost demand for Fresenius's services, while a reduction in coverage could have the opposite effect. Keeping a close eye on these political trends is essential for forecasting the company's performance.

The healthcare industry, Fresenius's core market, is characterized by a dynamic and often stringent regulatory environment. Constant updates to medical device approvals, pharmaceutical regulations, and healthcare operational standards create a significant compliance burden. For instance, the EU Medical Device Regulation (MDR) has mandated extensive data collection and conformity assessments, impacting product development timelines and costs for companies like Fresenius.

Stricter regulations, such as those concerning drug pricing controls in various nations or the increasing focus on data privacy for patient information, necessitate substantial investments. Fresenius must allocate resources to research and development, robust quality control systems, and dedicated legal and compliance teams to ensure adherence. This ongoing need for adaptation and investment is a critical political factor.

Navigating the diverse and often conflicting regulatory landscapes across the numerous countries where Fresenius operates presents a complex, ongoing challenge. For example, differing reimbursement policies and approval processes for dialysis equipment or biosimil drugs in markets like the United States versus Germany require tailored strategies and significant resources to manage effectively.

Political stability is a cornerstone for Fresenius's global operations, directly influencing its capacity to maintain consistent business activities, safeguard its supply chains, and guarantee uninterrupted patient access to vital healthcare services. Regions experiencing political upheaval can pose significant challenges to Fresenius's established infrastructure and service delivery models.

Geopolitical tensions and escalating trade disputes present tangible risks to Fresenius. For instance, disruptions in the flow of critical medical supplies and equipment, such as those experienced during recent global supply chain reconfigurations, can directly impact Fresenius Kabi's production schedules and the service continuity offered by Fresenius Medical Care and Helios hospitals.

Given Fresenius's extensive international footprint, a proactive approach to assessing and mitigating risks stemming from evolving global political landscapes is imperative. This involves continuous monitoring of international relations and potential trade policy shifts that could affect market access or operational costs.

Public Health Initiatives and Prevention Strategies

Government-led public health initiatives focusing on disease prevention and early detection significantly shape the market for healthcare providers like Fresenius. For instance, increased government investment in preventative screenings, such as those for kidney disease or cardiovascular issues, directly boosts demand for Fresenius's diagnostic services and dialysis treatments. In 2024, many nations continued to prioritize chronic disease management, with public health budgets reflecting this trend. This focus can lead to higher patient volumes for Fresenius's core services.

While a healthier population might seem to reduce the need for certain treatments, it also opens doors for Fresenius in emerging areas. The push towards preventative care creates opportunities for the company to develop and market new technologies in diagnostics, home-based care solutions, and personalized health management. For example, the global market for preventative healthcare technologies was projected to reach over $100 billion by 2025, a segment Fresenius is well-positioned to tap into.

- Increased Screening Programs: Government campaigns promoting early detection of conditions like diabetes and hypertension, which are risk factors for kidney disease, can lead to a rise in diagnosed patients requiring Fresenius's dialysis services.

- Focus on Chronic Disease Management: Public health strategies emphasizing the management of chronic conditions directly benefit Fresenius by ensuring a steady patient base for its ongoing treatment offerings.

- Investment in Preventative Technologies: As governments allocate funds to public health, Fresenius can explore partnerships or internal development of diagnostic tools and digital health platforms that support preventative care.

- Evolving Healthcare Priorities: Fresenius must remain agile, aligning its service portfolio and strategic investments with shifting public health priorities to maintain its competitive edge and relevance in the evolving healthcare landscape.

Healthcare System Reforms and Privatization Trends

Governments globally continue to grapple with healthcare system efficiency and access, leading to ongoing reforms. In 2024 and looking into 2025, many nations are exploring or implementing models that involve greater private sector participation, including public-private partnerships (PPPs) and outright privatization of certain services. This trend presents significant opportunities for companies like Fresenius, which operates in both hospital management (Helios) and healthcare services (Vamed), by potentially expanding their service offerings and market reach.

However, these reforms are not uniform and can also pose challenges. A shift towards increased state control or nationalization of healthcare assets in certain regions could restrict private operators. For instance, while some European countries are fostering PPPs, others might reinforce public healthcare structures. Fresenius must remain agile, closely monitoring these evolving healthcare delivery models to capitalize on growth avenues and mitigate potential operational hurdles stemming from diverse governmental approaches.

- Healthcare spending as a percentage of GDP is projected to rise in many developed economies through 2025, driven by aging populations and technological advancements, potentially increasing demand for private healthcare services.

- The global healthcare PPP market is expected to see steady growth, with an estimated value of over $100 billion by 2026, offering a fertile ground for companies like Fresenius Vamed.

- Regulatory changes in key markets, such as Germany and the United States, continue to shape the landscape for hospital operators and service providers, impacting revenue streams and operational flexibility.

Government policies on healthcare spending and reimbursement are pivotal for Fresenius. In 2024, many nations are re-evaluating healthcare budgets, which could impact Fresenius's revenue streams, particularly for dialysis and hospital services. Shifts towards value-based care models are also influencing how companies like Fresenius Medical Care are compensated, requiring strategic adaptation.

Regulatory frameworks for medical devices and pharmaceuticals are constantly evolving, creating compliance challenges for Fresenius. For example, the EU's Medical Device Regulation (MDR) has increased data requirements and conformity assessments. This necessitates ongoing investment in R&D, quality control, and legal teams to ensure adherence across diverse global markets.

Political stability is crucial for Fresenius's global operations, affecting supply chains and patient access to essential services. Geopolitical tensions and trade disputes can disrupt the flow of medical supplies, impacting Fresenius Kabi's production and Fresenius Medical Care's service continuity. Continuous monitoring of international relations is therefore vital.

Public health initiatives, such as increased screening for chronic diseases like kidney disease, directly benefit Fresenius by expanding its patient base. Many governments in 2024 continued to prioritize chronic disease management, with healthcare spending reflecting this trend. This focus can boost demand for Fresenius's diagnostic and treatment services.

What is included in the product

This Fresenius PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategy.

A concise, actionable summary of Fresenius's PESTLE factors, designed to quickly identify and address potential market disruptions and strategic opportunities during critical planning phases.

Economic factors

Global economic growth is a significant driver for healthcare spending. In 2024, the International Monetary Fund projects global growth at 3.2%, a rate that, while steady, can influence how much governments and individuals allocate to healthcare. Stronger growth typically encourages greater investment in healthcare infrastructure and services, which directly benefits companies like Fresenius across its dialysis, hospital, and medical technology divisions.

Conversely, economic slowdowns pose challenges. If major economies experience recessions, public healthcare budgets may shrink, and private insurance coverage could be reduced. This directly impacts Fresenius's revenue potential, as fewer patients might be able to afford or access the company's services and products during such periods.

Rising inflation, especially in energy, raw materials, and labor, is a significant challenge for Fresenius, impacting operational expenses across its global operations. For instance, in 2023, the company noted that higher procurement costs for raw materials and energy, alongside increased personnel expenses, were key drivers of cost pressures.

To counter these inflationary headwinds, Fresenius is actively employing efficiency programs, strategic sourcing for materials, and careful pricing adjustments to protect its profit margins. The company has stated its commitment to ongoing savings initiatives aimed at boosting productivity and mitigating the impact of escalating costs.

As a global healthcare giant, Fresenius faces significant exposure to currency fluctuations. For instance, in 2024, the Euro's performance against major currencies like the US Dollar and the British Pound directly impacts how Fresenius's international sales and costs are reported in its financial statements. This volatility can sway reported profits and alter the price competitiveness of its medical devices and services across different regions.

The exchange rate volatility experienced in late 2024 and early 2025, with the Euro seeing notable movements against the Yen and Swiss Franc, presents a clear challenge. Such shifts can create unpredictable swings in Fresenius's reported earnings, making it harder for investors to gauge the company's underlying operational performance and potentially affecting its market share in countries with strengthening local currencies.

To navigate these risks, Fresenius actively employs currency hedging strategies. These financial instruments, such as forward contracts and currency options, are crucial tools to lock in exchange rates for future transactions, thereby stabilizing its financial results and protecting its profitability from adverse currency movements throughout 2024 and into 2025.

Interest Rate Environment and Financing Costs

The prevailing interest rate environment significantly shapes Fresenius's financial strategy, directly affecting its cost of capital. As of mid-2024, major central banks like the Federal Reserve and the European Central Bank have maintained relatively elevated interest rates to combat inflation, a trend expected to persist into 2025, albeit with potential for gradual easing. This means Fresenius likely faces higher borrowing costs for new investments and refinancing existing debt. For instance, a 1% increase in interest rates on a substantial debt portfolio could add tens of millions to annual interest expenses.

Higher financing costs can dampen the attractiveness of capital-intensive projects, such as building new manufacturing facilities or acquiring smaller biotech firms, which are crucial for Fresenius's growth strategy. This environment necessitates a sharper focus on financial discipline and efficient capital allocation. The company's leverage ratio, a key indicator of its financial health, becomes even more critical; a higher debt-to-equity ratio in a rising rate environment amplifies financial risk.

- Increased Borrowing Costs: Fresenius's financing expenses are directly impacted by global interest rate fluctuations. For example, if Fresenius needs to raise €1 billion in debt, a 0.5% increase in interest rates would translate to an additional €5 million in annual interest payments.

- Impact on Investment Feasibility: Higher interest rates can reduce the net present value of future cash flows from expansion projects, potentially making them less viable. This requires more rigorous hurdle rates for new investments.

- Leverage Management: Maintaining a healthy leverage ratio is paramount. Fresenius's ability to service its debt obligations becomes more challenging as interest expenses rise, emphasizing the need for strong cash flow generation and prudent debt management.

- 2024-2025 Outlook: While interest rates are expected to remain elevated through much of 2024 and into 2025, a gradual decline is anticipated. However, the exact pace and magnitude of these changes will depend on inflation trends and central bank policy decisions, creating ongoing uncertainty for Fresenius's long-term financing plans.

Insurance and Reimbursement Model Evolution

The healthcare landscape is rapidly shifting, with insurance and reimbursement models evolving significantly. Fresenius, a major player in healthcare services and products, must navigate this transformation. A key trend is the move from fee-for-service to value-based care, where providers are compensated based on patient outcomes and quality rather than the sheer volume of services rendered. This necessitates a strategic adaptation of Fresenius's offerings to align with these new payment structures.

For Fresenius Medical Care and Fresenius Helios, this evolution means a heightened focus on demonstrating superior clinical results and cost-efficiency. The shift towards bundled payments, for example, consolidates payment for a course of treatment into a single fee. This encourages integrated care and penalizes inefficiencies. For instance, in the US, Medicare's shift towards bundled payments for kidney transplants aims to improve outcomes and reduce costs, directly impacting dialysis providers like Fresenius.

- Value-Based Care Growth: The global value-based healthcare market was projected to reach over $30 billion by 2023, indicating a strong trend away from traditional fee-for-service models.

- Bundled Payment Initiatives: Many countries are implementing or expanding bundled payment programs for chronic conditions, including renal disease, directly affecting reimbursement for dialysis services.

- Quality Metrics Emphasis: Reimbursement is increasingly tied to specific quality metrics, such as patient satisfaction scores, readmission rates, and clinical outcome improvements, requiring Fresenius to invest in data analytics and care coordination.

- Cost Containment Pressures: Payers are exerting greater pressure to control healthcare spending, pushing companies like Fresenius to innovate in service delivery and product development to offer more cost-effective solutions without compromising quality.

Economic growth directly influences healthcare expenditure, with the IMF projecting global growth at 3.2% for 2024, a steady rate that supports healthcare investment. However, economic downturns and rising inflation, particularly in energy and raw materials, present significant cost pressures for Fresenius, impacting its operational expenses and profit margins. The company is actively pursuing efficiency programs and strategic sourcing to mitigate these challenges.

Currency fluctuations and interest rate environments are critical economic factors for Fresenius. As of mid-2024, elevated interest rates persist, increasing borrowing costs for capital-intensive projects. The company employs currency hedging strategies to stabilize financial results amidst exchange rate volatility. For example, a 0.5% increase in interest rates on €1 billion in debt would add €5 million annually to interest payments, highlighting the need for prudent debt management and strong cash flow.

The shift towards value-based care and bundled payments significantly impacts reimbursement models in healthcare. Fresenius must adapt its services to demonstrate superior clinical outcomes and cost-efficiency, as payers increasingly tie compensation to quality metrics. The global value-based healthcare market's growth, projected to exceed $30 billion by 2023, underscores this trend, requiring Fresenius to invest in data analytics and care coordination.

Preview Before You Purchase

Fresenius PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fresenius PESTLE analysis delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic decision-making.

Sociological factors

The world's population is getting older, with projections indicating that by 2050, nearly 1.6 billion people will be over 65. This demographic shift directly fuels demand for healthcare services, particularly for chronic conditions. For Fresenius Medical Care, this means a growing patient base for its dialysis and chronic care management services.

Chronic diseases are on the rise globally, with conditions like diabetes and cardiovascular disease, which often lead to kidney failure, becoming more prevalent. The World Health Organization (WHO) reported in 2023 that noncommunicable diseases, primarily chronic ones, are responsible for 74% of all deaths worldwide. This sustained increase in chronic illness ensures a consistent and expanding need for Fresenius's core offerings, including dialysis treatments and related healthcare solutions.

Growing public health awareness is a significant sociological shift. For instance, in 2024, surveys indicated that over 70% of adults in developed nations actively sought health information online before consulting a doctor, reflecting increased patient engagement.

This trend towards patient empowerment means individuals are more proactive in managing their health. They demand not just treatment, but also transparency regarding care quality and accessibility, pushing providers like Fresenius to offer more personalized and convenient options, such as telehealth and home dialysis services.

Meeting these evolving expectations requires Fresenius to prioritize patient satisfaction and experience. By 2025, patient-reported outcome measures (PROMs) are expected to become a key benchmark for healthcare providers, influencing reimbursement and reputation, making a strong patient focus crucial for Fresenius's market position.

The global healthcare sector, including Fresenius's operations, faces a critical shortage of skilled professionals like doctors, nurses, and technicians. This scarcity directly impacts the quality and availability of care, posing a significant operational hurdle. For instance, the World Health Organization projected a global shortfall of 10 million healthcare workers by 2030, a trend that will undoubtedly affect Fresenius's ability to staff its facilities and expand services effectively.

Workforce burnout is another pervasive sociological factor. High patient loads and demanding work environments contribute to stress and exhaustion among healthcare staff, leading to retention challenges. This burnout not only degrades the quality of patient care but also increases recruitment costs as Fresenius must constantly seek new talent to replace those who leave. Addressing these staffing gaps requires substantial investment in recruitment strategies, comprehensive training programs, and robust employee well-being initiatives to foster a sustainable workforce.

Lifestyle Changes and Disease Patterns

Societal shifts towards less active lifestyles and changing dietary habits are directly impacting global health, leading to a rise in non-communicable diseases (NCDs). For instance, the World Health Organization (WHO) reported in 2023 that NCDs, such as cardiovascular diseases and diabetes, account for an estimated 74% of all deaths worldwide. This trend creates a growing demand for specialized medical products and services that manage and treat these conditions.

Fresenius, through its divisions like Fresenius Kabi, is positioned to capitalize on these evolving health needs. The company's focus on areas like clinical nutrition, infusion therapy, and transfusion technologies directly addresses the management of chronic illnesses and critical care situations. As NCDs become more prevalent, the need for advanced nutritional support, like parenteral and enteral nutrition, is expected to increase significantly, aligning with Fresenius's core competencies.

- Rising NCD Prevalence: Globally, NCDs are responsible for a substantial portion of mortality, with figures indicating around 41 million deaths annually, as per WHO data from 2023.

- Impact on Healthcare Demand: This demographic shift necessitates greater investment in long-term care, specialized treatments, and preventative health measures, including advanced nutritional support.

- Fresenius's Strategic Alignment: Fresenius’s portfolio, particularly in areas like specialized nutrition and critical care, is well-suited to meet the escalating demand driven by these lifestyle-driven disease patterns.

Demand for Accessible and Personalized Healthcare

Societies increasingly expect healthcare that is not only accessible and convenient but also tailored to individual needs. This shift is pushing healthcare delivery away from traditional hospitals and towards outpatient clinics, home-based treatments like dialysis, and virtual consultations via telemedicine. Fresenius is well-positioned to capitalize on this trend, actively expanding its services in these very areas.

The demand for personalized healthcare is a significant sociological driver. For instance, by 2025, the global telemedicine market is projected to reach over $150 billion, showcasing a clear consumer preference for remote and convenient care options. Fresenius's investment in home dialysis solutions, such as their VIVASYS platform, directly addresses this by allowing patients to manage their treatment in the comfort of their own homes. This not only enhances patient convenience but also reduces the burden on hospital infrastructure.

- Growing demand for convenience: Patients are seeking healthcare solutions that fit into their daily lives, favoring at-home or easily accessible outpatient services.

- Personalization in care: There's a clear societal push for treatments and health management plans that are customized to individual patient needs and preferences.

- Telemedicine adoption: The increasing acceptance and use of telehealth services, projected to grow substantially in the coming years, highlight a shift towards digital healthcare delivery.

- Fresenius's strategic alignment: The company's expansion into home dialysis and telehealth directly addresses these evolving patient expectations.

Societal expectations for healthcare are shifting towards greater personalization and convenience. This is evident in the growing demand for at-home treatments and telehealth services, with the global telemedicine market projected to exceed $150 billion by 2025. Fresenius is actively adapting by expanding its home dialysis offerings and digital health solutions to meet these evolving patient preferences for more accessible and customized care.

Technological factors

Continuous innovation in medical devices and diagnostic technologies is crucial for Fresenius Medical Care and Fresenius Kabi. This includes developing more efficient dialysis machines, advanced infusion systems, and sophisticated diagnostic tools that enhance patient care and operational effectiveness.

Fresenius, for instance, has been a leader in developing next-generation hemodialysis machines, with ongoing research into more portable and user-friendly devices. The company's commitment to R&D, which saw significant investment in 2023, aims to integrate cutting-edge technologies like AI-powered diagnostics and remote patient monitoring into their product lines.

The digital health and telemedicine sector is experiencing explosive growth, fundamentally reshaping healthcare delivery. By mid-2024, the global telemedicine market was projected to reach over $200 billion, a testament to its rapid adoption. Fresenius is actively integrating these advanced digital solutions, such as remote patient monitoring and AI diagnostics, to elevate patient outcomes and streamline its operations, especially in its outpatient and home care divisions.

This digital transformation is not merely an operational upgrade for Fresenius; it's a core strategic imperative. The company’s investment in these technologies aims to broaden access to its specialized services, making care more convenient and efficient for a wider patient base. For instance, Fresenius Medical Care reported a significant increase in digital service utilization in its 2023 annual report, highlighting the growing reliance on these platforms.

Artificial intelligence and data analytics are revolutionizing healthcare, offering Fresenius substantial avenues for growth. By leveraging AI, Fresenius can enhance patient care through personalized treatment plans and predictive analytics, aiming to improve outcomes and reduce readmissions. For instance, AI-powered diagnostic tools are showing remarkable accuracy, with some systems achieving over 90% accuracy in identifying certain conditions, directly impacting efficiency and patient well-being.

Beyond patient care, AI and data analytics are key to optimizing Fresenius's operational backbone. This includes streamlining research and development processes, accelerating drug discovery, and improving the efficiency of its extensive supply chain. In 2024, the global AI in healthcare market was valued at approximately $20 billion and is projected to grow significantly, presenting Fresenius with a dynamic landscape to capitalize on technological advancements.

Cybersecurity and Data Privacy Challenges

The increasing digitization of healthcare presents significant cybersecurity and data privacy challenges for Fresenius. Protecting sensitive patient information and intellectual property is crucial for maintaining trust and adhering to regulations like GDPR. In 2024, the global healthcare cybersecurity market was valued at approximately $25.6 billion, highlighting the substantial investment required.

Fresenius must continually invest in advanced cybersecurity infrastructure to mitigate risks associated with data breaches. Failure to do so could lead to severe financial penalties and reputational damage. For instance, a significant data breach in the healthcare sector can cost millions in recovery and fines, impacting profitability.

- Growing threat landscape: Cyberattacks on healthcare organizations are becoming more sophisticated, targeting patient records and operational systems.

- Regulatory compliance: Strict data privacy laws, such as GDPR and HIPAA, mandate robust security measures, with non-compliance resulting in substantial fines.

- Intellectual property protection: Safeguarding proprietary research and development data is vital for maintaining a competitive edge in the medical technology sector.

- Patient trust: Demonstrating a strong commitment to data security is essential for maintaining patient confidence and loyalty.

Biopharmaceutical Innovations and Biosimilar Development

Breakthroughs in biopharmaceutical research, especially the development of biosimilars, present significant opportunities for Fresenius Kabi. The company's capacity to innovate and bring cost-effective biosimilar treatments to market directly addresses the increasing global demand for accessible, high-quality medications.

This strategic focus allows Fresenius to broaden its therapeutic offerings. For instance, the recent market entry and approvals for denosumab biosimilars exemplify Fresenius's commitment to expanding its portfolio in key therapeutic areas, thereby enhancing its competitive position.

- Biosimilar Market Growth: The global biosimilar market was valued at approximately USD 20.5 billion in 2023 and is projected to reach over USD 75 billion by 2030, indicating substantial growth potential for companies like Fresenius Kabi.

- Denosumab Biosimilar Approvals: Multiple denosumab biosimilars have received regulatory approvals in major markets throughout 2023 and early 2024, creating a direct avenue for Fresenius to capture market share.

- Cost-Effectiveness Drive: The increasing pressure on healthcare systems worldwide to manage costs makes biosimilars a critical component of drug access, aligning with Fresenius's strategy to provide affordable alternatives.

Technological advancements are reshaping healthcare delivery, with Fresenius actively integrating innovations like AI-powered diagnostics and remote patient monitoring. The global telemedicine market, projected to exceed $200 billion by mid-2024, underscores the rapid adoption of digital health solutions. Fresenius’s investment in these areas, including AI for personalized treatment plans, aims to boost patient outcomes and operational efficiency.

The company's commitment to R&D, evidenced by significant investment in 2023, focuses on next-generation dialysis machines and user-friendly devices. Fresenius Kabi is also capitalizing on the biosimilar market, with the global market valued at approximately USD 20.5 billion in 2023 and projected significant growth. This strategic expansion into biosimilars, like denosumab, enhances its competitive edge by offering cost-effective treatments.

| Key Technology Area | 2023/2024 Market Data | Fresenius Relevance |

| Telemedicine | Projected >$200 billion by mid-2024 | Enhancing patient access and operational efficiency through remote monitoring. |

| AI in Healthcare | Valued ~$20 billion in 2024 | Improving diagnostics, personalized treatment, and operational optimization. |

| Biosimilars | Valued ~$20.5 billion in 2023 | Expanding therapeutic offerings with cost-effective alternatives, capturing market share. |

Legal factors

Fresenius navigates a dense landscape of healthcare regulations globally, impacting everything from product safety and manufacturing to how services are delivered. For instance, compliance with the EU Medical Device Regulation (MDR) is critical, and in 2024, companies faced ongoing adaptation challenges and significant investment in ensuring their products meet these stringent requirements.

Failure to adhere to these complex legal frameworks, such as national drug approval processes or international quality standards, carries substantial risks. In 2025, the potential for hefty fines, product recalls, and severe reputational damage remains a constant concern for companies like Fresenius, necessitating robust legal and compliance departments.

Stringent data protection laws like GDPR and HIPAA significantly influence Fresenius's handling of sensitive patient and operational data. Compliance requires robust data governance and cybersecurity, essential for preserving patient trust and preventing financially damaging breaches.

Product liability and patient safety legislation are paramount for Fresenius, especially concerning its extensive range of medical devices and pharmaceutical offerings. The company navigates a complex web of regulations that mandate strict adherence to safety standards throughout a product's entire journey, from initial conception and manufacturing to ongoing post-market monitoring. These legal frameworks are designed to establish clear lines of accountability in instances of product defects or unforeseen adverse patient events.

Antitrust and Competition Laws

Fresenius's market position and ambitious growth strategies, particularly its reliance on mergers and acquisitions, are under the watchful eye of national and international antitrust and competition laws. These regulations are designed to prevent market monopolies and ensure a level playing field for all participants in the healthcare sector.

Regulatory bodies globally, such as the European Commission and the U.S. Federal Trade Commission, actively scrutinize large healthcare transactions. For instance, any significant acquisition by Fresenius would likely undergo a detailed review to assess its potential impact on market competition and consumer choice. This scrutiny is a critical factor in the timing and feasibility of their strategic expansion plans.

- Regulatory Scrutiny: Large healthcare mergers, like those Fresenius might pursue, face rigorous antitrust reviews.

- Market Impact Assessment: Regulators evaluate potential impacts on competition and pricing.

- Compliance is Key: Adherence to antitrust laws is vital for Fresenius's strategic growth and ongoing operations.

- Global Enforcement: Enforcement actions by bodies like the FTC and European Commission influence Fresenius's M&A activity.

Labor Laws and Workforce Regulations

Fresenius, as a significant global employer, navigates a complex web of labor laws and workforce regulations. These legal frameworks govern everything from working conditions and fair wages to fundamental employee rights across its diverse operating regions. Staying compliant is paramount to its operational integrity.

Recent shifts in labor legislation present direct challenges and opportunities. For instance, the ongoing trend of increasing minimum wages in various countries, coupled with evolving collective bargaining mandates, can directly influence Fresenius's operational expenditures and necessitate adaptive human resource planning. This is particularly relevant given the persistent shortages experienced within the healthcare workforce globally.

- Minimum Wage Impact: In 2024, several key markets where Fresenius operates saw minimum wage hikes, potentially increasing labor costs by an estimated 3-5% in affected regions.

- Collective Bargaining Trends: The 2024-2025 period has shown a slight uptick in unionization efforts within the healthcare sector, requiring proactive engagement from Fresenius to maintain positive employee relations.

- Workforce Shortages: The global healthcare sector continued to face critical staffing gaps in 2024, with estimates suggesting a deficit of over 10 million healthcare workers by 2030, impacting Fresenius's recruitment and retention strategies.

Fresenius operates within a highly regulated healthcare sector, meaning compliance with evolving legal frameworks is paramount. In 2024, the company continued to adapt to stringent medical device regulations, like the EU MDR, demanding significant investment in product conformity and documentation. Navigating global data privacy laws, such as GDPR, also requires robust cybersecurity measures to protect sensitive patient information, with potential fines for non-compliance remaining substantial.

Antitrust and competition laws are critical considerations for Fresenius, particularly given its strategy of pursuing mergers and acquisitions. Regulatory bodies worldwide, including the FTC in the US and the European Commission, scrutinize such deals to prevent market consolidation and ensure fair competition, impacting the feasibility and timeline of strategic growth initiatives.

Labor laws and workforce regulations significantly influence Fresenius's operations, covering aspects from wages to employee rights across its international presence. For instance, minimum wage increases in key markets during 2024 could impact labor costs. Furthermore, the ongoing global healthcare worker shortage, estimated to reach millions by 2030, necessitates proactive recruitment and retention strategies.

| Legal Factor | Impact on Fresenius | 2024/2025 Relevance |

|---|---|---|

| Healthcare Regulations (e.g., EU MDR) | Product safety, manufacturing standards, service delivery | Ongoing adaptation, significant compliance investment |

| Data Privacy Laws (e.g., GDPR, HIPAA) | Patient data handling, cybersecurity, trust | Essential for preventing breaches and maintaining reputation |

| Antitrust & Competition Laws | Mergers & acquisitions, market position | Scrutiny of deals by global regulators impacts strategic growth |

| Labor Laws & Workforce Regulations | Wages, working conditions, employee rights | Impacted by minimum wage trends and healthcare worker shortages |

Environmental factors

The healthcare industry, including Fresenius, is under growing pressure to address its environmental impact, especially its carbon footprint. As a global healthcare company with numerous facilities, Fresenius is actively working to reduce its Scope 1, 2, and 3 emissions.

Fresenius has committed to significant CO2 reduction targets, aiming to mitigate its environmental impact. This includes substantial investments in improving energy efficiency across its operations and transitioning towards renewable energy sources to power its hospitals, clinics, and manufacturing sites.

Fresenius faces significant environmental considerations regarding the proper management and disposal of medical waste, especially hazardous materials generated from dialysis treatments and hospital operations. Strict regulations, such as those outlined by the EPA and state-level environmental agencies, dictate how this waste must be handled to prevent ecological harm.

The company must invest in sustainable waste management practices, including advanced recycling and reprocessing initiatives, to ensure compliance with these evolving regulations. For instance, in 2024, the global medical waste management market was valued at approximately $30 billion, highlighting the substantial operational costs and opportunities for innovation in this sector for companies like Fresenius.

The healthcare sector, including Fresenius, faces increasing pressure to build sustainable supply chains, impacting everything from raw material sourcing to final product delivery. This focus extends to improving how resources are used, minimizing waste, and collaborating with suppliers who share environmental commitments.

Fresenius is actively working on enhancing resource efficiency and reducing its environmental footprint. For instance, in 2023, the company reported progress in its sustainability initiatives, including efforts to electrify its vehicle fleets and optimize logistics routes, aiming to significantly cut down on emissions. This commitment is crucial for meeting evolving regulatory demands and stakeholder expectations.

Water Usage and Wastewater Treatment

Fresenius Medical Care's extensive network of dialysis clinics, a core part of its operations, demands substantial water volumes for patient treatment and facility sanitation. This high water usage necessitates robust water management strategies to ensure sustainability and cost-effectiveness.

Proper wastewater treatment is paramount, as dialysis processes generate effluent containing various substances that require careful handling to prevent environmental contamination. Adherence to stringent local and national water quality regulations is non-negotiable, impacting operational permits and public perception.

Fresenius is actively pursuing innovative solutions to reduce its water footprint. For instance, advancements in water recycling and purification technologies for dialysis machines are being explored to minimize freshwater dependency. In 2023, the company reported ongoing investments in sustainability initiatives, including water conservation projects across its global facilities, though specific water usage figures for dialysis services are not publicly detailed annually.

Key considerations for Fresenius regarding water usage and wastewater treatment include:

- Water Consumption: Dialysis requires significant water for purification and treatment, impacting operational costs and local resource availability.

- Wastewater Management: Ensuring compliance with environmental regulations for treated wastewater is critical to avoid pollution and penalties.

- Resource Efficiency: Implementing technologies to reduce water usage and improve wastewater treatment efficiency can lead to substantial cost savings and environmental benefits.

- Regulatory Compliance: Navigating diverse and evolving water quality standards across different operating regions presents an ongoing challenge.

Environmental, Social, and Governance (ESG) Reporting and Investor Scrutiny

Investors and stakeholders are increasingly prioritizing Environmental, Social, and Governance (ESG) performance, pushing Fresenius to provide detailed and transparent reporting. This heightened scrutiny means that strong ESG credentials, particularly in environmental stewardship, are vital for securing sustainable investments and bolstering the company's public image. For instance, Fresenius's 2023 sustainability report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating a commitment to environmental goals.

Fresenius actively addresses these demands by publishing comprehensive sustainability statements that clearly outline its ESG priorities and performance metrics. The company highlights its efforts in areas such as reducing water consumption and waste generation across its global operations. In 2024, Fresenius announced a new target to achieve 100% renewable electricity sourcing for its European facilities by 2027.

- Investor Demand: A significant majority of institutional investors now integrate ESG factors into their investment decisions, with over 80% of surveyed investors in a 2024 industry report indicating ESG integration is standard practice.

- Reputational Impact: Companies with robust ESG reporting often experience higher market valuations and improved brand loyalty, as seen in the positive correlation between strong ESG scores and stock performance in recent market analyses.

- Regulatory Landscape: Evolving regulations, such as the EU's Corporate Sustainability Reporting Directive (CSRD), mandate more rigorous ESG disclosures, requiring companies like Fresenius to adapt their reporting frameworks.

Fresenius is actively working to reduce its environmental footprint, focusing on emissions reduction and resource efficiency. The company has set ambitious targets, including a 15% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022, and aims for 100% renewable electricity for its European facilities by 2027.

Managing medical waste, particularly hazardous materials from dialysis, is a critical environmental challenge for Fresenius. The global medical waste management market was valued at approximately $30 billion in 2024, underscoring the significant operational costs and innovation opportunities in this sector.

Water consumption and wastewater treatment are also key environmental considerations, especially for Fresenius Medical Care's extensive network of dialysis clinics. The company is investing in water conservation projects and exploring water recycling technologies to enhance sustainability and manage operational costs effectively.

Increasing investor and regulatory focus on ESG performance is driving Fresenius to enhance its transparency in environmental stewardship. Over 80% of investors in a 2024 report integrate ESG factors, making robust environmental reporting crucial for investment and reputation.

PESTLE Analysis Data Sources

Our Fresenius PESTLE Analysis is meticulously constructed using data from reputable global health organizations, governmental regulatory bodies, and leading market research firms. We incorporate insights from economic reports, technological advancements, and socio-cultural trends impacting the healthcare sector.