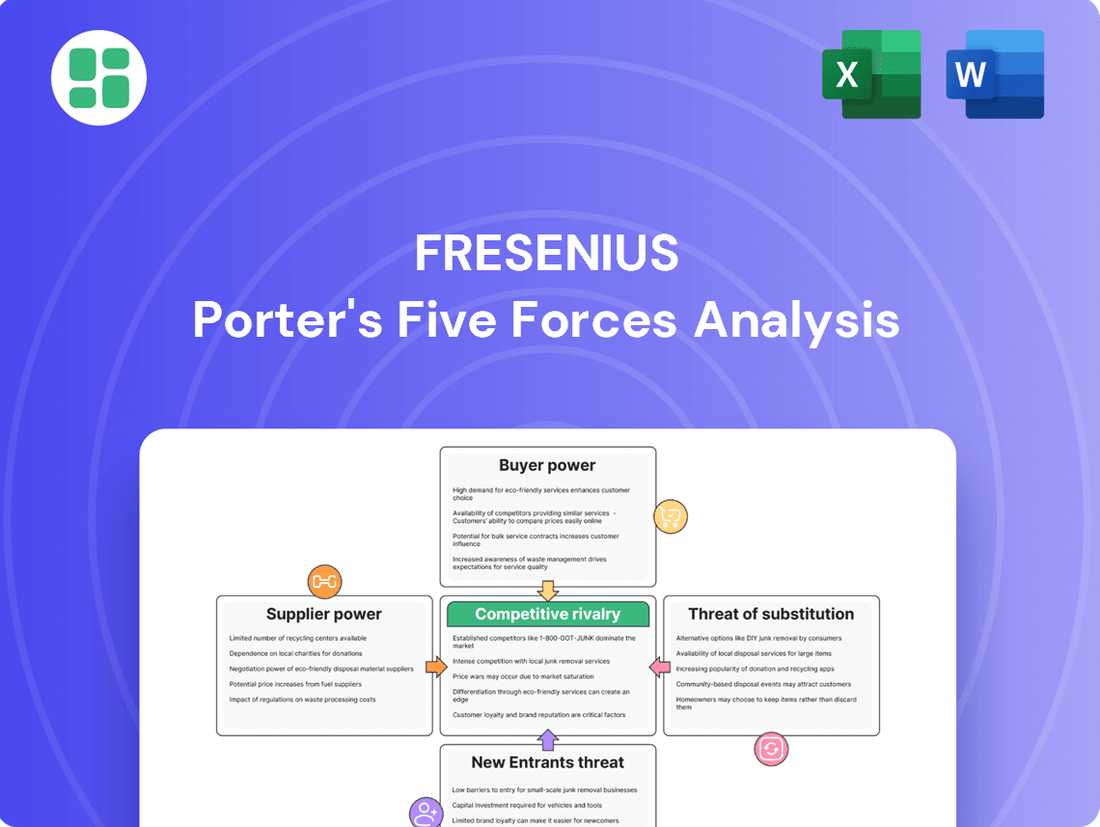

Fresenius Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fresenius Bundle

Fresenius operates in a dynamic healthcare landscape, facing intense competition and evolving regulatory pressures. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this complex market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fresenius’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for critical inputs significantly impacts Fresenius. For instance, if only a handful of companies provide specialized medical components or active pharmaceutical ingredients, those suppliers gain considerable leverage. This can translate into higher prices or even create vulnerabilities in Fresenius's supply chain if a key supplier faces disruptions.

Fresenius operates across diverse segments, including medical devices, pharmaceuticals, and healthcare services. This means the level of supplier concentration isn't uniform; it varies considerably depending on the specific product or service. For example, in 2023, the global market for certain advanced dialysis components was dominated by a few key manufacturers, giving them substantial bargaining power.

The costs Fresenius incurs when switching suppliers are significant. These include the expense and time involved in re-qualifying new suppliers, obtaining necessary regulatory approvals for altered components or processes, and the complex task of integrating new materials or systems with Fresenius's existing infrastructure. For instance, changes in manufacturing processes for critical dialysis components might require extensive validation and testing to meet stringent healthcare standards.

These substantial switching costs effectively lock Fresenius into its current supplier relationships. This dependency grants suppliers considerable leverage, enabling them to negotiate more favorable terms, potentially increasing prices or dictating supply conditions. This situation is especially pronounced when Fresenius relies on highly specialized medical device components or proprietary pharmaceutical ingredients that are not readily available from multiple sources.

Suppliers offering unique or patented inputs hold considerable sway over Fresenius. If a supplier provides a critical, proprietary component, like a specialized membrane for dialysis machines or a key ingredient for a life-saving drug, Fresenius has fewer alternatives, increasing the supplier's leverage. For instance, in 2024, the medical device industry continued to see innovation in patented materials for advanced dialysis technologies, potentially giving those suppliers more pricing power.

Threat of Forward Integration by Suppliers

If suppliers can credibly threaten to integrate forward into Fresenius's market, their bargaining power significantly increases. This means a supplier could potentially start manufacturing the end products that Fresenius currently produces or offer services that Fresenius provides. While this threat might be less common in the highly regulated healthcare sector, it remains a consideration for certain components or services with lower barriers to entry.

For instance, consider a supplier of specialized medical components used in Fresenius's dialysis machines. If this supplier possesses the necessary manufacturing expertise and capital, they could decide to produce their own dialysis machines, directly competing with Fresenius. This would shift the power dynamic, as Fresenius would then be reliant on a competitor for crucial parts, or forced to find alternative, potentially more expensive, suppliers.

- Forward Integration Threat: Suppliers can gain leverage by threatening to enter Fresenius's market, potentially producing finished goods or offering competing services.

- Healthcare Sector Nuances: While less prevalent in highly regulated healthcare, this threat exists for components or services with accessible market entry.

- Supplier Leverage: A credible forward integration threat forces Fresenius to consider supplier terms more carefully, as they could lose a key partner to a direct competitor.

Importance of Fresenius to Suppliers

The significance of Fresenius as a customer for its suppliers directly impacts the suppliers' bargaining power. If Fresenius accounts for a substantial percentage of a supplier's overall revenue, that supplier's leverage is considerably weakened due to their reliance on Fresenius's business. For instance, if Fresenius were to represent over 20% of a key component supplier's annual sales, that supplier would likely be more accommodating on pricing and contract terms to retain such a significant client.

Conversely, when Fresenius is a minor customer for a supplier, the supplier's bargaining position strengthens. In such scenarios, the supplier may have less incentive to offer favorable terms or pricing, as their overall financial health is not heavily dependent on the Fresenius account. This dynamic allows suppliers to potentially dictate more favorable conditions, particularly if their products or services are critical and have limited substitutes for Fresenius.

- Supplier Dependence: If Fresenius is a major client, representing a significant portion of a supplier's revenue, the supplier's bargaining power is reduced.

- Customer Size: Conversely, if Fresenius is a small customer for a supplier, the supplier's bargaining power increases, allowing for less flexibility on pricing and terms.

- Market Concentration: The fewer suppliers available for critical inputs, the greater their collective bargaining power against Fresenius.

- Switching Costs: High costs for Fresenius to switch suppliers for essential components or services bolster supplier bargaining power.

The bargaining power of suppliers for Fresenius is influenced by several factors, including supplier concentration, switching costs, and the threat of forward integration. When few suppliers provide critical inputs, like specialized dialysis components, their leverage increases, potentially leading to higher prices for Fresenius. For instance, in 2024, the market for advanced dialysis membranes saw a few key manufacturers dominating, granting them significant pricing power.

High switching costs for Fresenius, encompassing re-qualification, regulatory approvals, and integration, further solidify supplier relationships and enhance their bargaining position. This is particularly true for proprietary pharmaceutical ingredients or patented medical device components, where alternatives are scarce. For example, the development of new, patented materials for dialysis machines in 2023 meant Fresenius faced substantial costs to switch suppliers for these innovations.

Suppliers gain additional leverage if they can credibly threaten to integrate forward into Fresenius's business, such as by manufacturing finished dialysis machines. While less common in the highly regulated healthcare sector, this threat can influence contract negotiations. The extent to which Fresenius represents a significant portion of a supplier's revenue also plays a crucial role; if Fresenius is a minor customer, suppliers have greater power to dictate terms.

| Factor | Impact on Fresenius | Example (2023-2024) |

|---|---|---|

| Supplier Concentration | High leverage for few dominant suppliers | Few manufacturers of advanced dialysis membranes |

| Switching Costs | Increased dependency on existing suppliers | Costs to re-qualify specialized medical components |

| Forward Integration Threat | Potential for suppliers to become competitors | Supplier manufacturing own dialysis machines |

| Customer Significance | Reduced supplier power if Fresenius is a major client | Fresenius accounting for >20% of a supplier's sales |

What is included in the product

Analyzes the competitive intensity within the healthcare sector for Fresenius, examining supplier and buyer power, new entrant threats, and the impact of substitute products and services.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Customer concentration is a key factor influencing Fresenius's bargaining power of customers. For Fresenius Medical Care, large government healthcare systems and major hospital chains act as significant customers. These entities can wield considerable leverage when negotiating prices for essential dialysis services and products, impacting Fresenius's revenue streams.

In the Fresenius Kabi segment, large hospital groups that purchase medical devices and generic drugs also represent concentrated customer bases. Their substantial purchasing volume allows them to exert significant price pressure on Fresenius, a common dynamic in the healthcare supply chain.

Customers in the healthcare sector, especially governments and insurance companies, are very sensitive to price. This is because they operate with strict budgets and are constantly trying to control costs. For instance, in 2024, many national health systems reported significant pressure to reduce spending on medical equipment and pharmaceuticals.

Fresenius tries to lessen this price sensitivity by making its products stand out. They focus on quality, new ideas, and offering complete service packages. This approach helps them justify their pricing, especially for more complex or specialized medical solutions.

However, when it comes to basic items like generic drugs or standard medical supplies, price often becomes the most important factor for buyers. In these segments, competition can be fierce, and customers will likely choose the lowest-cost option available.

The availability of substitutes for Fresenius's products and services significantly bolsters customer bargaining power. If patients or healthcare providers can readily access comparable dialysis treatments, hospital management solutions, or medical devices from other companies, they have more leverage to demand better pricing or terms.

For instance, in the dialysis market, the presence of numerous regional and national providers offering similar treatment modalities means Fresenius cannot solely dictate terms. In 2023, the global dialysis market was valued at approximately $100 billion, with a considerable portion being competitive. This competitive landscape forces Fresenius to focus on value and innovation to retain its customer base.

Similarly, in hospital management, if healthcare facilities can find alternative consulting firms or software providers that meet their needs, Fresenius's ability to command premium prices diminishes. The increasing digitization of healthcare in 2024 means more tech companies are entering the hospital management space, offering new alternatives.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large hospital networks and healthcare systems, poses a significant challenge to Fresenius. These entities might explore producing certain medical supplies or managing services internally to decrease their dependence on external suppliers. This strategic move, though requiring substantial capital investment, becomes more viable for standardized products or services where Fresenius's pricing is perceived as elevated.

For example, in 2024, major hospital groups in North America, facing rising costs for disposable medical devices, began exploring pilot programs for in-house sterilization and repackaging of certain high-volume items. This initiative aims to capture cost savings and gain greater control over their supply chain.

- Backward Integration Potential: Large healthcare systems can leverage their scale to produce or manage certain medical supplies and services, reducing reliance on Fresenius.

- Cost Sensitivity: If Fresenius's pricing is perceived as high, customers are more likely to consider in-house production as a cost-saving measure.

- Standardized Products: The threat is amplified for standardized, high-volume products where the technical barriers to in-house production are lower.

- Impact on Fresenius: Successful backward integration by key customers could lead to reduced sales volume and pressure on Fresenius's profit margins.

Information Asymmetry

Information asymmetry significantly impacts the bargaining power of customers, particularly large buyers like healthcare systems or government tenders. When customers have access to comprehensive data on pricing benchmarks, competitor offerings, and even Fresenius's own cost structures, their ability to negotiate favorable terms increases dramatically. For instance, in 2024, the increasing availability of real-time market intelligence platforms allows major purchasers to benchmark prices across the medical device and healthcare services industry with unprecedented ease.

Fresenius, like many in the healthcare sector, faces this challenge. Customers, armed with detailed insights into the total cost of ownership and potential alternatives, can effectively reduce the information gap. This often translates into demands for lower prices or more customized service agreements. In 2024, the trend towards value-based purchasing further empowers these customers, as they scrutinize not just the product cost but the overall health outcome and efficiency gains.

To mitigate this, Fresenius must focus on transparency and clearly articulating its unique value proposition. This includes demonstrating superior product quality, innovative solutions, and reliable customer support that justifies its pricing. For example, highlighting clinical trial data that proves better patient outcomes or showcasing operational efficiencies gained through their products can help counter well-informed customer demands.

- Reduced Information Gap: Large customers possess extensive market data, diminishing information asymmetry.

- Negotiating Leverage: Access to pricing, cost, and alternative solution information strengthens customer negotiation power.

- Value Demonstration: Fresenius must clearly communicate its value to justify pricing against informed customer demands.

- 2024 Trend: Real-time market intelligence and value-based purchasing models enhance customer bargaining power.

The bargaining power of Fresenius's customers is significant due to factors like customer concentration, price sensitivity, availability of substitutes, and the potential for backward integration. Large healthcare systems and government entities often have substantial purchasing volumes, making them price-sensitive and capable of negotiating favorable terms.

The healthcare sector's inherent cost-consciousness, especially evident in 2024 with numerous national health systems facing budget pressures, amplifies this power. Customers can readily switch to competitors or even consider in-house production for standardized items, particularly if Fresenius's pricing is perceived as high.

Information asymmetry is also decreasing, as market intelligence platforms in 2024 provide customers with detailed pricing and competitor data, further strengthening their negotiation leverage.

| Factor | Impact on Fresenius | Supporting Data/Trend (2024) |

|---|---|---|

| Customer Concentration | High leverage for large buyers | Major hospital chains, government healthcare systems |

| Price Sensitivity | Pressure on pricing, especially for standard items | National health systems' focus on cost reduction |

| Availability of Substitutes | Limits pricing power, encourages value focus | Competitive global dialysis market (~$100B in 2023), new tech entrants in hospital management |

| Backward Integration Potential | Risk of reduced sales for standardized products | Pilot programs for in-house sterilization by North American hospital groups |

| Information Asymmetry | Strengthens negotiation position of informed customers | Increased use of real-time market intelligence platforms |

Preview Before You Purchase

Fresenius Porter's Five Forces Analysis

This preview showcases the complete Fresenius Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the healthcare industry. What you see here is precisely the document you will receive immediately after purchase, ensuring full transparency and immediate usability. This professionally formatted analysis is ready for your strategic planning needs, providing actionable insights into Fresenius's competitive landscape.

Rivalry Among Competitors

Fresenius operates in several distinct healthcare sectors, and each of these areas is populated by a significant number of competitors, both on a global scale and within specific regions. This broad competitive landscape means Fresenius must contend with a wide array of rivals, each employing different strategies to gain market share.

In the critical area of dialysis, for instance, Fresenius faces formidable competition from established giants such as DaVita and Baxter. These companies are not only significant in size but also possess deep expertise and extensive market reach, directly challenging Fresenius's position.

Beyond dialysis, Fresenius also competes in the pharmaceuticals and medical devices markets. Here, the competitive environment is characterized by the presence of large, multinational corporations. These players often have vast research and development budgets, established distribution networks, and strong brand recognition, all of which contribute to a highly competitive dynamic.

The sheer volume of competitors, coupled with the diverse strategic orientations they adopt, significantly heightens the intensity of rivalry across Fresenius's entire business portfolio. This multifaceted competition demands constant innovation and strategic agility from Fresenius to maintain its market standing and profitability.

The healthcare industry, like many others, sees its growth rate significantly shape competitive rivalry. In segments that are mature or experiencing slower growth, companies often find themselves battling more fiercely for existing market share. This can translate into aggressive pricing strategies and intensified marketing efforts as businesses vie for every customer. Fresenius operates within this dynamic, managing exposure to both established, slower-growing areas like traditional dialysis services and faster-expanding segments such as home dialysis solutions and certain specialty pharmaceuticals.

The healthcare industry, especially hospital operations and medical device production, is characterized by substantial fixed costs. These include investments in state-of-the-art facilities, ongoing research and development for new treatments and devices, and the rigorous costs associated with meeting stringent regulatory standards. For instance, in 2024, the average cost to build a new hospital in the US could range from $300 million to over $1 billion, reflecting these high initial outlays.

Furthermore, companies within this sector often face considerable exit barriers. These can manifest as highly specialized, non-transferable assets, long-term contractual agreements with suppliers or insurers, and a significant social responsibility to continue providing essential services to communities. These factors make it exceedingly difficult and costly for businesses to withdraw from the market, thereby intensifying competition as firms are compelled to remain operational even when facing economic headwinds.

Product Differentiation and Brand Loyalty

Fresenius's ability to differentiate its offerings, like its advanced dialysis machines and specialized hospital services, directly influences how intensely competitors battle each other. Strong brand recognition and proven patient results can build loyalty, which in turn lessens the pressure to compete solely on price.

For instance, Fresenius Medical Care's commitment to innovation in dialysis technology, such as its next-generation dialysis machines, helps create a distinct market position. This differentiation can lead to higher customer retention and a reduced susceptibility to price wars, especially in segments where its technological edge is clear.

- Product Differentiation: Fresenius Medical Care’s advanced dialysis technologies, like the 5008 CorDiax system, offer distinct clinical advantages, potentially commanding premium pricing and fostering loyalty.

- Brand Loyalty: A strong reputation built on clinical efficacy and patient outcomes can significantly reduce the impact of price-based competition, as seen in the consistent demand for their established product lines.

- Generic Product Challenges: In areas with more commoditized products, where differentiation is minimal, Fresenius faces heightened rivalry and greater pressure on margins.

Strategic Stakes

The strategic importance of specific markets to competitors can significantly escalate rivalry within the healthcare sector. When a market is deemed critical for a competitor's long-term growth trajectory or their overarching global strategy, they are more likely to employ aggressive tactics. These can include engaging in price wars to gain market share or making substantial investments in research and development to secure a competitive edge.

Fresenius's extensive global presence means it frequently encounters competitors who hold high strategic stakes in various sub-markets. For instance, in the dialysis market, companies like DaVita and Baxter are deeply invested in expanding their patient base and technological innovation, leading to intense competition for market leadership. Fresenius's broad operational footprint across dialysis care, hospital services, and medical technology means it must contend with rivals who view these segments as vital for their future success, often resulting in heightened competitive pressures.

- Market Criticality: Competitors with high strategic stakes in specific healthcare segments, such as dialysis or hospital management, may aggressively defend or expand their positions.

- Aggressive Tactics: This criticality can manifest as price wars, increased marketing spend, or accelerated R&D to outpace rivals.

- Fresenius's Exposure: Fresenius's diverse operations across multiple healthcare sub-markets mean it faces these high-stakes rivalries in various regions and service lines.

- Example: In 2024, the global dialysis market, valued at over $100 billion, saw continued strategic investments from major players aiming for market dominance, impacting Fresenius's competitive landscape.

Competitive rivalry is a significant force for Fresenius, stemming from a crowded marketplace with numerous global and regional players across its diverse healthcare segments. This intense competition necessitates continuous innovation and strategic agility.

In 2024, the global dialysis market, a key area for Fresenius, was valued at over $100 billion, featuring fierce competition from giants like DaVita and Baxter. These rivals possess substantial market reach and expertise, directly challenging Fresenius's dominance.

The pharmaceutical and medical device sectors, where Fresenius also operates, are characterized by large multinational corporations with significant R&D budgets and established brand recognition, further intensifying the competitive landscape.

High fixed costs, such as those associated with building new hospitals (estimated at $300 million to over $1 billion in the US in 2024), and substantial exit barriers, like specialized assets and contractual obligations, compel companies to remain competitive even during downturns, thus heightening rivalry.

| Competitor | Key Segment | Estimated 2024 Market Share (Dialysis) | Key Differentiator |

|---|---|---|---|

| DaVita | Dialysis Services | ~20-25% (US) | Extensive clinic network, patient care focus |

| Baxter International | Dialysis Products & Services | ~10-15% (Global) | Broad portfolio of medical devices, innovation |

| Fresenius Medical Care | Dialysis Products & Services | ~30-35% (Global) | Technological leadership, integrated care model |

SSubstitutes Threaten

Kidney transplantation represents a significant substitute for Fresenius Medical Care's core dialysis services, offering a potentially permanent solution. In 2023, the United Network for Organ Sharing (UNOS) reported over 25,000 kidney transplants performed in the US, indicating a substantial, albeit limited, alternative.

Advancements in medical science that accelerate organ donation or improve transplant success rates could directly impact the demand for dialysis. Furthermore, emerging pharmacological treatments aimed at slowing the progression of chronic kidney disease (CKD) present another layer of substitution, potentially delaying or reducing the need for dialysis for a portion of the patient population.

The growing emphasis on preventative healthcare presents a significant threat of substitutes for Fresenius Medical Care. As individuals and healthcare systems prioritize wellness and early intervention, the demand for treatments addressing advanced chronic conditions, a core area for Fresenius, could diminish. For instance, advancements in personalized medicine and genetic screening, which identify predispositions to certain diseases, may lead to lifestyle changes or early treatments that avert the need for long-term dialysis or critical care services. This societal shift represents a systemic substitute, potentially impacting the volume of services and products Fresenius offers over the long term.

Technological advancements are a significant threat of substitutes for Fresenius Medical Care. Innovations enabling more complex medical procedures and monitoring at home can replace in-clinic or hospital-based services. This trend is already evident with home dialysis machines, a growing segment for Fresenius, and further advancements could diminish reliance on traditional clinics.

Remote patient monitoring, another technological leap, has the potential to reduce hospitalizations, impacting Fresenius Helios. For instance, by mid-2024, the adoption of AI-powered remote diagnostics is expected to accelerate, allowing for earlier intervention and potentially fewer acute care episodes requiring hospital stays, thereby creating a substitute for traditional inpatient services.

Generic Alternatives for Pharmaceuticals and Devices

The rise of biosimilars presents a considerable threat to Fresenius Kabi's branded pharmaceutical portfolio. These biologically identical versions of existing biologic medicines offer comparable efficacy and safety at a lower price point, directly impacting Fresenius's market share and pricing power. For instance, the global biosimilar market was valued at approximately $20.4 billion in 2023 and is projected to grow substantially in the coming years, indicating a widening competitive landscape.

Similarly, the medical device sector within Fresenius faces substitution threats from lower-cost, functionally equivalent alternatives. As technology advances, new entrants can develop devices that perform similar functions to Fresenius's products, especially in less complex or highly specialized areas. This competition can erode Fresenius's margins and necessitate continuous innovation to maintain its competitive edge.

- Biosimilar Market Growth: The global biosimilar market is expected to reach over $100 billion by 2028, highlighting the increasing availability and adoption of these alternatives.

- Price Erosion: Biosimilars can lead to price reductions of 30-50% compared to originator biologics, directly impacting revenue streams for companies like Fresenius Kabi.

- Device Commoditization: In certain medical device segments, technological maturity can lead to product commoditization, making it easier for new, lower-cost competitors to emerge.

Digital Health and AI Solutions

The growing availability of digital health platforms and AI-powered solutions presents a significant threat of substitution for Fresenius's traditional offerings. Telemedicine, for instance, can substitute for in-person consultations, potentially reducing the need for some of Fresenius's patient touchpoints. Furthermore, AI in diagnostics and treatment planning could offer alternative pathways to patient care, bypassing some of the established processes where Fresenius operates.

Consider the market for remote patient monitoring. By 2024, the global digital health market was projected to reach hundreds of billions of dollars, with AI's contribution rapidly expanding. This growth indicates a clear trend towards digital alternatives that can perform functions previously handled by traditional healthcare providers. Fresenius's ability to integrate these technologies will be crucial in mitigating this substitution threat.

Specifically, AI-driven diagnostic tools are becoming increasingly sophisticated, potentially offering faster and more accessible alternatives to certain in-vitro diagnostic services or imaging interpretations. This could impact Fresenius's laboratory and diagnostics divisions if these digital solutions gain widespread adoption and are offered independently of larger healthcare systems.

The threat is amplified by the increasing patient and provider acceptance of these new technologies. For example, patient satisfaction with telemedicine appointments has remained high, with many preferring the convenience. This shift in preference could lead to a sustained reduction in demand for services that can be effectively replicated digitally.

Kidney transplantation remains a direct substitute for dialysis, with over 25,000 transplants performed in the US in 2023. Advancements in medical science, such as improved organ donation processes and pharmacological treatments for CKD, also serve as substitutes by potentially delaying or eliminating the need for dialysis.

The rise of biosimilars, with the global market valued at approximately $20.4 billion in 2023, poses a significant threat to Fresenius Kabi's branded pharmaceuticals by offering comparable treatments at lower costs. Similarly, medical devices face substitution from lower-cost, functionally equivalent alternatives, especially as technology matures.

Digital health platforms and AI-powered solutions, including telemedicine and AI diagnostics, are increasingly substituting for traditional in-person consultations and diagnostic services. The global digital health market's rapid expansion by 2024 signifies a growing trend towards digital alternatives that could impact Fresenius's service volumes.

| Substitute Type | Example | Impact on Fresenius | Relevant Data (2023/2024 Estimates) |

|---|---|---|---|

| Medical Procedures | Kidney Transplantation | Reduces demand for dialysis services. | 25,000+ US transplants performed in 2023. |

| Pharmaceuticals | Biosimilars | Erodes market share and pricing power for Kabi. | Global biosimilar market ~$20.4 billion in 2023. |

| Technology | Digital Health Platforms/AI | Replaces in-person consultations and diagnostics. | Global digital health market projected in hundreds of billions by 2024. |

Entrants Threaten

The healthcare sector, where Fresenius operates, presents formidable barriers due to exceptionally high capital requirements. For instance, establishing a new hospital can easily cost hundreds of millions of dollars, encompassing land acquisition, construction, advanced medical equipment, and regulatory compliance. Similarly, developing and manufacturing medical devices or pharmaceuticals necessitates massive investments in research and development, clinical trials, and specialized production facilities, often running into billions of dollars.

The healthcare sector, including Fresenius's markets, is characterized by a stringent regulatory environment. Companies must secure extensive approvals, licenses, and consistently adhere to rigorous quality and safety standards, such as those mandated by the FDA in the US and the EMA in Europe. Navigating this complex web of regulations is both time-consuming and expensive, acting as a significant deterrent for potential new players.

Fresenius leverages significant economies of scale across its diverse operations, including dialysis services, generic pharmaceuticals, and hospital management. This global reach translates into substantial cost advantages in purchasing, production, and logistics. For instance, in 2023, Fresenius Medical Care's revenue reached €21.6 billion, demonstrating the sheer volume that enables these efficiencies. Newcomers would find it challenging to achieve comparable cost structures without matching this scale, hindering their ability to compete on price.

Furthermore, Fresenius benefits from an established experience curve, particularly in its core dialysis business. Years of operational refinement and process optimization have likely led to lower per-unit costs and improved quality. This accumulated knowledge and efficiency, honed over decades, creates a formidable barrier for any new entrant attempting to enter the market and quickly achieve similar levels of operational expertise and cost-effectiveness.

Brand Reputation and Customer Loyalty

The threat of new entrants in the healthcare sector, particularly for companies like Fresenius, is significantly mitigated by the paramount importance of brand reputation and established customer loyalty. In this industry, where patient well-being is at stake, trust is not easily earned. Fresenius has cultivated decades of credibility through consistent delivery of high-quality medical products and services, fostering deep-rooted relationships with healthcare providers and patients alike.

Newcomers must overcome a substantial hurdle in replicating this level of trust and loyalty. For instance, in 2024, the healthcare industry continued to see a strong preference for established brands, with surveys indicating that over 70% of patients prioritize brand recognition and positive past experiences when choosing healthcare providers or medical equipment. This makes it incredibly difficult for new entrants to gain a foothold and attract customers away from a company with a proven track record and a strong, positive brand image.

- Brand Reputation: Fresenius's long-standing presence and commitment to quality have built a formidable brand reputation, a significant barrier for new entrants.

- Customer Loyalty: Decades of trust translate into strong customer loyalty among both healthcare providers and patients, making it challenging for new competitors to win market share.

- Credibility Challenge: New entrants face the considerable task of establishing credibility and demonstrating reliability in a market where established players have proven their mettle over many years.

Access to Distribution Channels and Networks

New companies entering the medical device and healthcare services market face significant hurdles in securing access to crucial distribution channels and established networks. Building these relationships, which often involve long-term contracts and trust, takes considerable time and resources.

Fresenius, a major player, leverages its well-established global sales force and existing agreements with hospitals, clinics, and government agencies. This extensive infrastructure provides a substantial competitive advantage, making it difficult for new entrants to compete on distribution reach and efficiency. For instance, in 2023, Fresenius Medical Care reported €21.2 billion in revenue, underscoring the scale of its operations and the depth of its market penetration, which is facilitated by its robust distribution network.

The difficulty in replicating Fresenius's integrated service models and extensive network means that new entrants often struggle to achieve the same level of market access and customer engagement. This can lead to higher initial operating costs and slower revenue growth for newcomers.

- Established Relationships: New entrants must invest heavily in building trust and securing contracts with healthcare providers, a process that can take years.

- Global Reach: Fresenius's existing global sales force and distribution infrastructure are difficult and costly for new companies to replicate, limiting their immediate market access.

- Integrated Services: The company's integrated service models, which bundle products and support, create a sticky customer base that is hard for competitors to penetrate.

The threat of new entrants in Fresenius's markets is generally low, primarily due to the substantial capital investment required to enter. Establishing new healthcare facilities or developing medical technologies demands billions in R&D, manufacturing, and regulatory compliance, acting as a significant deterrent.

Moreover, the highly regulated nature of the healthcare sector, with stringent FDA and EMA approvals, presents a complex and costly barrier. Fresenius also benefits from significant economies of scale, with Fresenius Medical Care's €21.6 billion revenue in 2023 enabling cost advantages that new entrants struggle to match.

The established brand reputation and customer loyalty are also key deterrents. In 2024, over 70% of patients still prioritize brand recognition, making it difficult for newcomers to gain trust against Fresenius's proven track record.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High costs for R&D, facilities, and equipment (billions of dollars) | Significant deterrent due to investment scale |

| Regulatory Hurdles | Complex and costly approvals (FDA, EMA) | Time-consuming and expensive to navigate |

| Economies of Scale | Cost advantages from large-scale operations (e.g., Fresenius Medical Care's €21.6B 2023 revenue) | New entrants struggle to match cost structures |

| Brand Reputation & Loyalty | Established trust and preference (70%+ patient preference for recognized brands in 2024) | Difficult for newcomers to build credibility and market share |

Porter's Five Forces Analysis Data Sources

Our Fresenius Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from Fresenius's annual reports, investor presentations, and SEC filings. We also leverage industry-specific market research reports and analyses from reputable financial institutions to provide a comprehensive view of the competitive landscape.