Foresight Energy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foresight Energy Bundle

Foresight Energy's SWOT analysis reveals a company navigating the complex energy landscape with distinct advantages in its operational efficiency and access to key resources. However, it also faces significant challenges related to market volatility and evolving environmental regulations. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Foresight Energy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Foresight Energy LP commands a formidable asset base with nearly 2 billion tons of coal reserves concentrated in the Illinois Basin. This substantial holding places the company among the most significant coal reserve controllers in the United States.

These reserves are projected to sustain production for over 75 years at present rates, offering exceptional long-term operational security. This longevity ensures a reliable and consistent supply of thermal coal characterized by high British thermal unit (Btu) content and high sulfur levels.

Foresight Energy leverages highly efficient longwall mining systems across its three active mining complexes. This advanced technology, coupled with advantageous geological conditions, positions its underground coal mines as leaders in safety, productivity, and cost-effectiveness within the U.S.

Foresight Energy boasts industry-leading low operating costs, a significant strength derived from its advanced longwall mining methods and favorable geological coal seam conditions. This efficiency translates directly into a competitive delivered cost per British thermal unit (Btu), bolstering its market standing domestically and internationally.

Strategic Transportation Infrastructure

Foresight Energy's mines boast strategic positioning, granting access to both rail and river transportation. This proximity provides significant cost advantages and operational flexibility in moving its coal products.

The company's ownership of a substantial 25 million ton per year barge-loading terminal on the Ohio River is a key asset. This infrastructure directly supports efficient, large-scale distribution.

Furthermore, Foresight's access to export terminal facilities in the Gulf of Mexico broadens its market reach considerably. This allows for participation in international coal markets, diversifying revenue streams and enhancing its competitive edge.

- Strategic mine locations near rail and river access

- 25 million ton/year Ohio River barge terminal ownership

- Access to Gulf of Mexico export terminals

- Enhanced cost competitiveness and market reach

Proven Market for High-Sulfur Coal

Foresight Energy's high-sulfur coal finds a ready market, particularly with electric generating units (EGUs) that are equipped with scrubbers to manage emissions. This specialization ensures a consistent demand from a significant segment of the power generation industry.

The company has a well-established track record in the export arena, having supplied coal to a wide array of international markets since 2008. This extensive global reach, including sales to Europe, South America, India, China, Africa, and the Middle East, underscores the proven demand for their product on a worldwide scale.

- Established Demand: High-sulfur coal is essential for EGUs with scrubber technology, a key market segment.

- Global Footprint: Exports to diverse regions like Europe, Asia, and South America since 2008 highlight international market acceptance.

- Market Resilience: The ongoing need for coal in specific industrial applications, even with energy transitions, provides a stable demand base.

Foresight Energy's significant coal reserves, estimated at nearly 2 billion tons, primarily located in the Illinois Basin, provide exceptional long-term operational security, projected to last over 75 years at current production levels. The company's advanced longwall mining systems are recognized for their safety, productivity, and cost-efficiency, contributing to industry-leading low operating costs per British thermal unit (Btu). This cost advantage is further amplified by strategic mine locations offering direct access to vital rail and river transportation networks.

The company's ownership of a substantial 25 million ton per year barge-loading terminal on the Ohio River is a critical logistical asset, facilitating efficient, large-scale distribution. Additionally, Foresight Energy's access to Gulf of Mexico export terminals broadens its market reach, enabling participation in international coal markets and diversifying revenue streams.

Foresight Energy's high-sulfur coal is specifically suited for electric generating units (EGUs) equipped with scrubbers, ensuring consistent demand from a key market segment. The company has a proven track record in exports since 2008, serving diverse global markets including Europe, Asia, and South America, demonstrating established international market acceptance and resilience.

| Metric | Value | Year | Source |

|---|---|---|---|

| Coal Reserves (Tons) | Nearly 2 Billion | 2024 | Company Filings |

| Operational Longevity | Over 75 Years | 2024 | Company Projections |

| Barge Terminal Capacity (Tons/Year) | 25 Million | 2024 | Company Assets |

| Export Markets Served | Europe, Asia, South America, etc. | Since 2008 | Company History |

What is included in the product

Analyzes Foresight Energy’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for understanding Foresight Energy's competitive landscape, directly addressing the pain of strategic uncertainty.

Weaknesses

Foresight Energy's significant dependence on the thermal coal market presents a major weakness. The company's business model is primarily built around producing and selling thermal coal, which faces declining demand in the U.S. power sector. This decline is driven by the accelerating energy transition and a broader shift towards cleaner energy sources.

While some U.S. coal-fired power plants have seen temporary delays in their retirement schedules extending into 2025, the overarching trend remains a substantial move away from coal. This long-term structural shift directly impacts the market demand for Foresight Energy's core product, creating considerable business risk.

Foresight Energy, like much of the coal industry, operates under a microscope of strict environmental regulations. These rules, especially those from the EPA regarding emissions and wastewater, are constantly evolving. For instance, new mandates are pushing coal-fired power plants to invest heavily in emission capture technology, or risk closure.

While there's ongoing discussion about potential regulatory rollbacks, the undeniable trajectory points towards escalating compliance costs for coal producers. This creates a significant financial burden and operational uncertainty for companies like Foresight Energy, directly impacting profitability and strategic planning.

Foresight Energy's competitiveness is highly susceptible to fluctuations in natural gas prices. When natural gas is cheaper, it directly impacts the economic viability of thermal coal for power generation, making coal less attractive to utilities. This dynamic poses a significant challenge for the company's market position.

While a stabilization or modest increase in natural gas prices anticipated for 2025 might offer some breathing room, the inherent volatility of this commodity remains a persistent external risk. For instance, in early 2024, spot natural gas prices at Henry Hub dipped below $2.00 per MMBtu, a level that significantly pressures coal economics.

Illinois Basin Market Challenges

The Illinois Basin coal market faces significant headwinds, with both domestic and export demand showing moderation. This has resulted in a noticeable dip in spot physical coal prices, and forecasts suggest limited upward price movement throughout 2024.

The long-term outlook for Illinois Basin coal production is particularly concerning. Projections indicate a substantial decline of over 40% by 2040, signaling a challenging domestic market environment for the region's coal output.

- Decreased Demand: Both domestic and international markets have shown reduced appetite for Illinois Basin coal.

- Price Pressure: Spot physical coal prices have fallen, with little expectation of recovery in the near term.

- Production Decline: Forecasts predict a significant drop in Illinois Basin production, exceeding 40% by 2040.

- Challenging Outlook: These factors combine to present a difficult long-term scenario for the region's coal industry.

Public Perception and ESG Pressures

The coal industry, including companies like Foresight Energy, grapples with a deeply negative public image, amplified by growing Environmental, Social, and Governance (ESG) demands. This sentiment translates into tangible business challenges, impacting everything from capital access to workforce recruitment. For instance, in 2024, many institutional investors are divesting from fossil fuels, with some estimates suggesting over $1 trillion globally has been committed to such divestment strategies, making it harder for coal companies to secure necessary funding.

These ESG pressures create significant hurdles for maintaining a social license to operate. Stakeholders, including regulators, communities, and increasingly, employees, are prioritizing sustainability. As renewable energy sources continue their rapid expansion, with global renewable capacity additions projected to grow by over 10% in 2025 compared to 2024, the competitive landscape shifts, further marginalizing traditional fossil fuels and complicating efforts to attract and retain talent.

- Negative Public Perception: Coal is widely viewed as a primary contributor to climate change, leading to public opposition and regulatory scrutiny.

- Investor ESG Scrutiny: A growing number of investment funds and financial institutions are integrating ESG factors, often leading to exclusion policies for coal companies.

- Financing Challenges: Difficulty in securing loans and equity can increase the cost of capital and limit expansion or operational investment opportunities.

- Talent Acquisition: Younger generations of skilled workers often prefer to work for companies with strong sustainability credentials, creating a talent gap for the coal sector.

Foresight Energy's reliance on thermal coal makes it vulnerable to the ongoing energy transition. The U.S. power sector's shift away from coal, driven by environmental concerns and the growth of renewables, directly reduces demand for the company's primary product. This trend is expected to continue, with coal's share in electricity generation projected to further decline in 2025.

The company faces significant compliance costs associated with evolving environmental regulations, particularly concerning emissions and wastewater. While specific new mandates for 2025 are still being finalized, the general direction is towards stricter controls, increasing operational expenses for coal producers.

Fluctuations in natural gas prices pose a constant threat to coal's competitiveness. When natural gas prices are low, as they were in early 2024 with Henry Hub spot prices dipping below $2.00 per MMBtu, it makes coal a less attractive option for power generation.

The Illinois Basin market, a key region for Foresight Energy, is experiencing declining demand and falling spot prices. Projections indicate a substantial production decrease in this region, potentially exceeding 40% by 2040, signaling a challenging long-term outlook for the company's core market.

Negative public perception and increasing ESG demands create financing and talent acquisition challenges. Global ESG commitments are estimated to exceed $1 trillion, with many investors divesting from fossil fuels, making capital harder to secure. Additionally, the preference for sustainable employers among younger talent pools can impact workforce development.

What You See Is What You Get

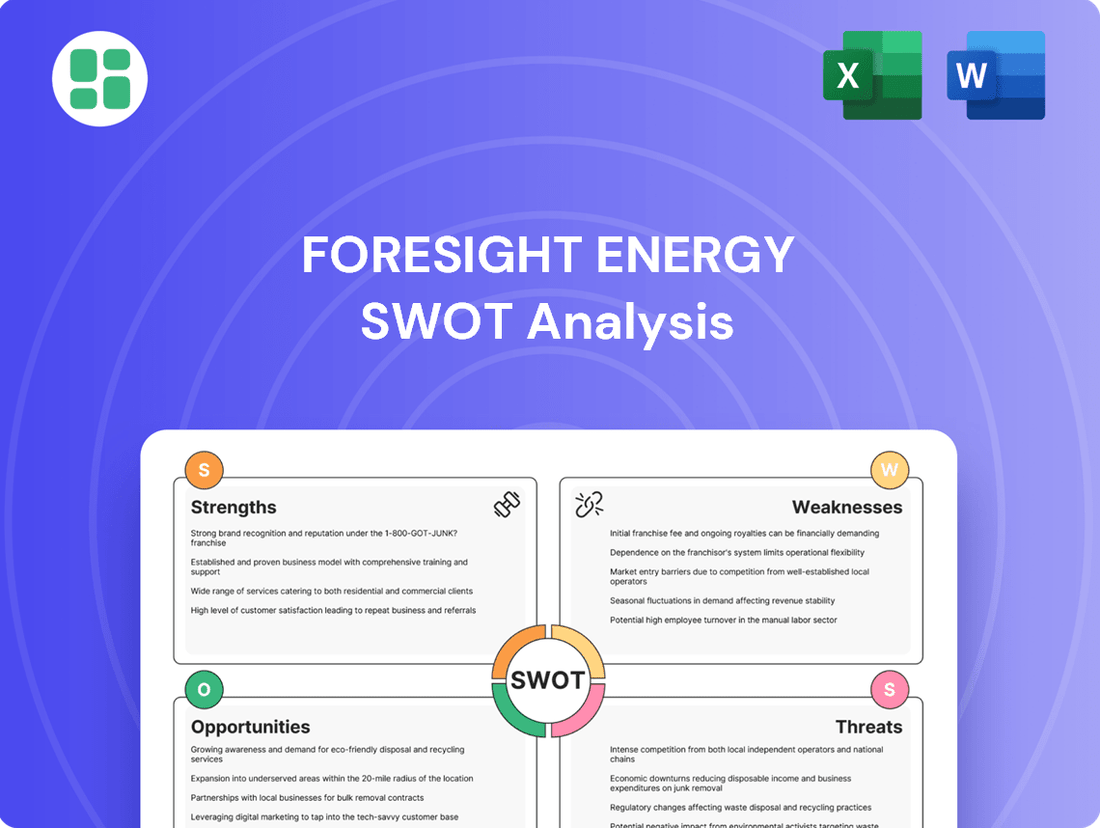

Foresight Energy SWOT Analysis

This is the actual Foresight Energy SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at the company's internal strengths and weaknesses, as well as external opportunities and threats. This detailed breakdown is essential for strategic planning.

Opportunities

While domestic coal demand in developed nations has seen a downturn, the outlook for global coal consumption remains robust, especially in Asian markets. Countries like India and China are projected to continue their reliance on coal for energy generation in the near to medium term, driving significant export opportunities.

Foresight Energy is well-positioned to leverage this growing Asian demand. Its established infrastructure, including competitive transportation rates and access to crucial export terminals, allows the company to efficiently serve these international markets. For instance, in 2023, India's coal imports reached approximately 233 million tonnes, a figure expected to remain strong, presenting a substantial market for Foresight Energy's offerings.

Concerns about grid reliability and increasing electricity needs have prompted delays in some planned coal plant shutdowns, especially in areas like the Midcontinent Independent System Operator (MISO). This trend could sustain domestic coal demand for the near to medium future, providing a temporary benefit for producers.

Foresight Energy's standing as one of the Illinois Basin's lowest-cost coal producers provides a significant advantage. This operational efficiency allows them to compete effectively, even when coal markets face headwinds or when natural gas prices are particularly attractive, potentially enabling market share gains.

This cost leadership is crucial. For instance, in 2024, while many energy sectors experienced volatility, Foresight's ability to produce coal at a lower cost point than many competitors means they can maintain profitability or even expand their reach when demand fluctuates, offering a resilient value proposition.

Technological Advancements in Carbon Management

The ongoing development of carbon capture and storage (CCS) technologies, spurred by evolving environmental regulations like those from the EPA, represents a significant opportunity for coal producers willing to make the necessary investments. While initial implementation costs for CCS can be substantial, this technological push could create a niche for coal within the future energy landscape, particularly if the technology's economic feasibility improves or if it gains substantial government backing.

This technological advancement opens doors for companies like Foresight Energy to potentially adapt and continue operations. For instance, the global CCS market is projected to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, driven by climate targets. This growth trajectory indicates a potential market for coal if it can be effectively decarbonized.

- Economic Viability of CCS: Continued R&D and economies of scale could lower CCS costs, making it more attractive for coal power plants.

- Government Incentives: Tax credits, grants, and regulatory support for CCS deployment can significantly improve the financial case for coal producers.

- New Revenue Streams: Captured CO2 can potentially be used for enhanced oil recovery or in industrial processes, creating additional revenue opportunities.

- Market Access: Companies successfully integrating CCS may retain access to markets that are increasingly prioritizing lower-carbon energy sources.

Strategic Acquisitions or Consolidation

Challenging market conditions in the coal sector present a fertile ground for strategic acquisitions. Foresight Energy, leveraging its robust reserve base and cost-efficient operations, is well-positioned to explore acquiring distressed assets or merging with competitors. This could significantly bolster its market standing and expand its operational reach.

The ongoing consolidation trend in the coal industry, driven by economic pressures and shifting energy landscapes, creates opportunities for Foresight Energy. By strategically acquiring struggling entities or engaging in mergers, the company can enhance its competitive advantage. For instance, if a competitor faces financial distress, Foresight Energy's strong financial footing could enable a favorable acquisition, potentially increasing its market share. As of early 2024, several smaller coal producers have faced bankruptcy proceedings, highlighting the potential for such strategic moves.

- Acquisition of distressed coal assets: Potential to gain reserves at lower valuations.

- Merger with complementary businesses: Opportunities to achieve economies of scale and operational synergies.

- Strengthening market position: Increased market share and bargaining power through consolidation.

Global demand for coal, particularly from Asian economies like India and China, continues to present significant export opportunities for Foresight Energy. These nations' projected reliance on coal for energy generation through 2025 and beyond underscores the sustained international market for the company's products. For instance, India's coal imports in 2023 neared 233 million tonnes, a volume expected to persist, offering a substantial customer base.

The potential for carbon capture and storage (CCS) technologies to decarbonize coal power offers a forward-looking avenue. As the global CCS market is anticipated to expand significantly by the early 2030s, driven by climate goals, Foresight Energy could benefit from investments in these technologies, potentially creating new revenue streams and market access for its products.

The ongoing consolidation within the coal industry, evidenced by several smaller producers facing financial challenges in early 2024, creates strategic acquisition opportunities. Foresight Energy, with its cost-efficient operations, is positioned to acquire distressed assets, thereby strengthening its market position and expanding its operational footprint.

Threats

The accelerated shift to renewable energy presents a substantial threat to traditional fossil fuel industries like coal. Renewable sources, particularly solar and wind, have seen dramatic cost reductions, making them increasingly competitive. In 2024, renewables actually surpassed coal power generation in the United States, a trend projected to continue with renewables becoming the dominant power source by 2025.

This ongoing transition directly translates to continued closures of coal-fired power plants. The economic viability of coal is diminishing rapidly as cleaner, cheaper alternatives gain market share, forcing operators to retire assets prematurely.

New and reconsidered Environmental Protection Agency (EPA) regulations, especially those focused on greenhouse gas emissions and coal ash disposal, present significant compliance burdens for coal producers like Foresight Energy. These evolving rules can necessitate substantial investments in abatement technologies or even lead to the premature closure of coal-fired power plants, directly impacting demand for coal.

The long-term outlook for thermal coal in the U.S. electric power sector points to a sustained decrease, even with potential brief upticks. The U.S. Energy Information Administration (EIA) forecasts a substantial reduction in coal-fired power generation by 2050, with coal's contribution to the global electricity mix expected to reach its lowest point since 1974.

Volatile Commodity Prices and Oversupply

The thermal coal market is currently grappling with significant headwinds, including subdued global demand and an oversupply of inventory. This has led to a notable decline in spot physical coal prices, directly impacting revenue streams for companies like Foresight Energy.

While 2025 is projected to be a transition year with some price stabilization expected, the outlook for 2026 and 2027 suggests a continued downward trend in coal prices. This forecast poses a direct threat to Foresight Energy's profitability and financial performance.

- Subdued Global Demand: Lower industrial activity and a shift towards cleaner energy sources are dampening demand for thermal coal.

- Surplus Inventory: High stock levels across the supply chain are putting downward pressure on prices.

- Declining Spot Prices: Physical coal prices have seen a significant drop, directly impacting immediate revenue.

- Future Price Decline: Projections indicate further price erosion in the medium term, threatening long-term profitability.

Legacy Environmental Liabilities and Mine Closures

The coal industry, including companies like Foresight Energy, faces significant threats from legacy environmental liabilities and the costs associated with mine closures. As of late 2024, the regulatory landscape continues to emphasize stringent reclamation standards, placing a substantial financial burden on operators to remediate former mining sites. These costs can be particularly acute for companies operating in regions with extensive historical mining activity.

In Illinois, for example, a substantial number of acres, estimated in the tens of thousands, are currently designated for coal mine cleanup. The challenge of securing adequate funding for this reclamation is a persistent issue, especially when companies face financial distress or bankruptcy. This creates a potential for future financial strain or reputational damage for any entities involved in such operations.

Key considerations for Foresight Energy regarding these threats include:

- Ongoing Regulatory Scrutiny: Environmental agencies are increasingly focused on enforcing reclamation requirements, potentially leading to higher compliance costs.

- Financial Risk of Non-Compliance: Failure to meet reclamation obligations can result in substantial fines and legal liabilities.

- Market Perception: Companies with significant unfunded environmental liabilities may face negative investor sentiment and difficulty accessing capital.

- Bankruptcy Implications: The potential for bankruptcy can leave reclamation obligations to state funds or taxpayers, highlighting the long-term financial consequences.

The increasing competitiveness of renewable energy sources like solar and wind poses a direct threat to coal demand. By 2024, renewables surpassed coal for U.S. power generation, a trend expected to accelerate, pushing coal into further decline.

Stricter environmental regulations from bodies like the EPA, particularly concerning emissions and waste disposal, necessitate costly upgrades or plant closures, directly impacting coal consumption. The U.S. Energy Information Administration projects a significant drop in coal's share of electricity generation by 2050.

The thermal coal market faces headwinds from weak global demand and excess inventory, leading to falling spot prices. Projections for 2026 and 2027 suggest this price erosion will continue, impacting Foresight Energy's profitability.

Legacy environmental liabilities and the costs of mine reclamation present ongoing financial risks. In late 2024, reclamation standards remain stringent, requiring substantial investment, with thousands of acres in states like Illinois needing cleanup, potentially straining company finances.

SWOT Analysis Data Sources

This Foresight Energy SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and data-driven assessment.