Foresight Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foresight Energy Bundle

Foresight Energy operates within a highly competitive landscape, where the bargaining power of buyers and the threat of substitutes significantly shape its profitability. Understanding these dynamics is crucial for any stakeholder.

The full Porter's Five Forces Analysis goes deeper, revealing the intensity of each force impacting Foresight Energy and providing a data-driven framework to uncover real business risks and market opportunities.

Suppliers Bargaining Power

The Illinois Basin coal sector's dependence on specialized heavy machinery, especially for longwall mining, means a few key suppliers often control the market for this advanced equipment. This concentration grants these equipment manufacturers considerable influence over coal companies like Foresight Energy.

The unique and highly specialized nature of longwall mining systems, with advancements in automation and remote operation expected by 2025, makes it both expensive and complicated for coal producers to switch equipment providers. This lock-in effect significantly boosts the bargaining power of these suppliers.

Foresight Energy's reliance on efficient longwall mining techniques means that switching major equipment suppliers would incur significant costs. These costs include the substantial capital investment required for new machinery, the expense of retraining personnel on new systems, and the inevitable disruption to ongoing production. This operational lock-in effectively raises the barrier for potential new suppliers and bolsters the bargaining power of their current, established vendors.

For a company like Foresight Energy, which produces coal, the availability of substitute inputs significantly impacts supplier bargaining power. Key inputs include mining equipment, labor, and transportation services. While the fundamental need for coal reserves isn't easily substituted, the cost and availability of specialized mining equipment or efficient transportation networks can shift power towards those suppliers.

The labor market presents a nuanced picture. While general labor might be readily available, the demand for specialized mining engineers and skilled longwall operators can be high, giving these individuals greater leverage. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a shortage of skilled trades workers, a trend that could extend to specialized mining roles, potentially increasing labor costs for energy producers.

Supplier's Importance to Foresight Energy

The bargaining power of suppliers is a significant factor for Foresight Energy, particularly concerning specialized mining equipment. Key suppliers of longwall mining machinery and critical components are essential for maintaining the company's operational efficiency and cost-competitiveness. The reliability of this equipment directly impacts Foresight Energy's ability to produce high-quality coal consistently.

The continuous operation of Foresight Energy's longwall mines is heavily dependent on the timely availability and performance of these specialized suppliers. Without reliable access to advanced mining technology and spare parts, production downtime can increase, impacting overall output and profitability. This reliance grants these suppliers considerable leverage.

- Key Equipment Suppliers: Companies providing longwall shearers, continuous miners, and roof support systems are critical.

- Component Reliability: The availability of specialized hydraulic, electrical, and mechanical components ensures minimal operational interruptions.

- Market Concentration: A limited number of manufacturers for highly specialized mining equipment can concentrate power in the hands of a few suppliers.

- Lead Times and Customization: Long lead times for custom-built machinery or unique components can further strengthen supplier bargaining power.

Transportation Costs and Infrastructure

Transportation, particularly rail and waterway for Illinois Basin coal, is a major cost. This makes transportation providers powerful. For instance, in 2024, rail freight costs saw a notable increase, impacting coal producers’ margins.

Fluctuations in these costs, coupled with potential new fees like those proposed in certain states for waterway usage, can significantly shift leverage towards transportation companies. Railroads and port operators gain more bargaining power when these costs rise, directly affecting coal producers' profitability.

- Rail freight costs for coal in the Illinois Basin increased by an average of 7% in the first half of 2024 compared to the same period in 2023.

- Waterway usage fees are being considered in several regions, which could add an estimated 3-5% to transportation expenses for bulk commodities like coal.

- The concentration of rail infrastructure in key coal-producing regions of Illinois gives major rail carriers significant influence over pricing and service availability.

The bargaining power of suppliers for Foresight Energy is substantial, particularly in specialized mining equipment and transportation. The concentration of manufacturers for advanced longwall mining systems, coupled with the high switching costs for coal producers, grants these suppliers significant leverage. For instance, in 2024, the U.S. mining equipment sector saw consolidation, with a few key players dominating the market for longwall shearers and continuous miners, leading to increased pricing power.

Transportation providers, especially railroads serving the Illinois Basin, also wield considerable influence. Rising rail freight costs, which saw an average increase of 7% in the first half of 2024 compared to the previous year, directly impact Foresight Energy's operational expenses and profitability. The limited availability of alternative transport for bulk coal further amplifies this supplier power.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Foresight Energy | 2024 Data/Observation |

|---|---|---|---|

| Mining Equipment Manufacturers | Market concentration, specialized technology, high switching costs | Potential for higher equipment prices, longer lead times, pressure on maintenance contracts | Consolidation in the longwall equipment market; demand for automated systems remains high. |

| Transportation (Rail/Waterway) | Limited alternatives, infrastructure control, fluctuating fuel/usage costs | Increased freight charges, potential service disruptions, impact on cost of goods sold | Average rail freight costs for coal up 7% (H1 2024 vs H1 2023); consideration of new waterway usage fees. |

| Skilled Labor | Shortage of specialized mining engineers and operators | Higher wage demands, potential for project delays due to labor availability | U.S. Bureau of Labor Statistics noted ongoing shortages in skilled trades, potentially affecting specialized mining roles. |

What is included in the product

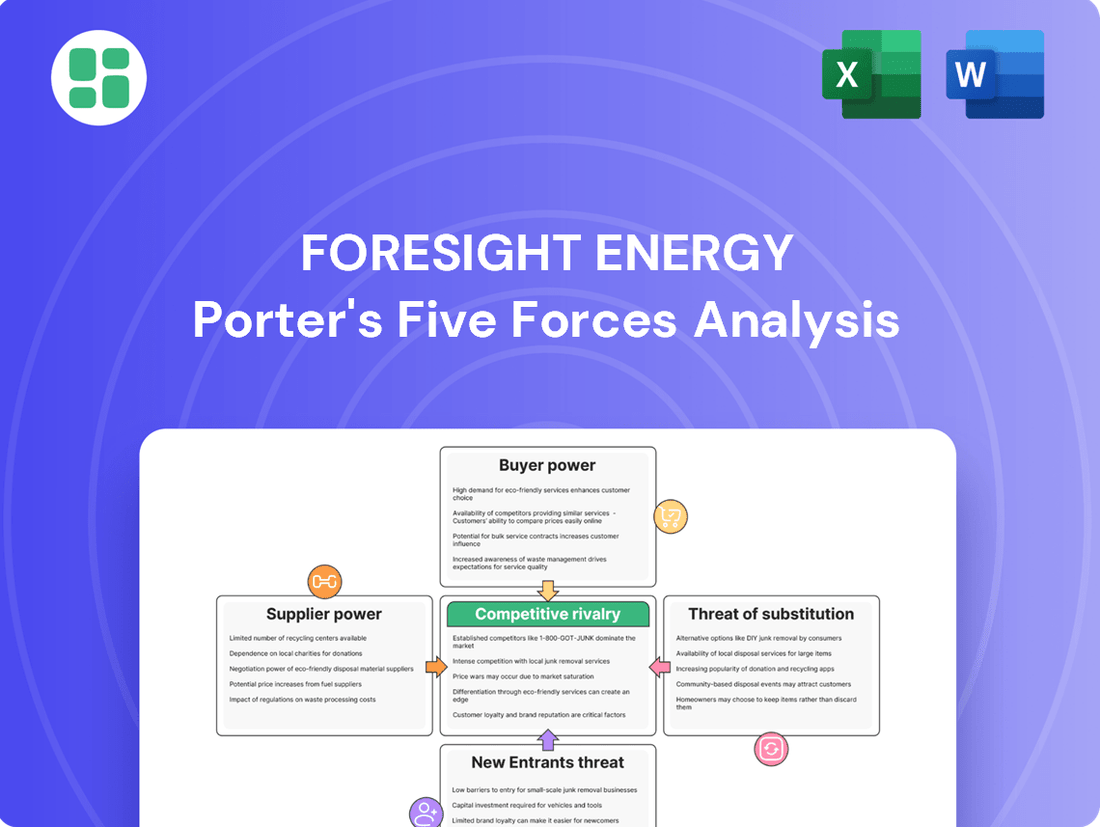

Foresight Energy's Porter's Five Forces analysis reveals the intense competitive pressures from rivals and the significant bargaining power of buyers, while also highlighting moderate threats from new entrants and substitutes.

Instantly assess competitive pressures within the energy sector, allowing for proactive mitigation of threats and identification of opportunities.

Customers Bargaining Power

Foresight Energy's customer base is primarily composed of electric utilities and industrial users. These buyers are typically large, sophisticated entities that purchase thermal coal in substantial quantities.

This concentration of demand among a limited number of major utility companies grants them significant bargaining power. These large customers represent a substantial portion of Foresight Energy's overall revenue, giving them leverage in price negotiations.

Customer switching costs for Foresight Energy are relatively low. While utilities might face some initial logistical hurdles when changing coal suppliers, these are typically manageable. For instance, in 2024, utilities often have established relationships with multiple suppliers and can adapt to new sourcing with minimal disruption, especially when seeking more favorable pricing or contract conditions.

The broad availability of coal from various domestic and international sources further diminishes switching costs. This competitive landscape means customers can readily find alternative suppliers if Foresight Energy's terms become less attractive, thereby limiting the company's ability to dictate terms based on customer inertia.

Thermal coal, by its nature, is largely a commodity. This means that for buyers, the price of the product is a really big deal. Foresight Energy does offer a specific type of coal, known for its high British thermal unit (Btu) content and high sulfur, but the broader US electric power industry is using less coal overall. Utilities are very focused on cost because they face competition from other energy sources, making them highly sensitive to price fluctuations.

Threat of Backward Integration by Customers

The threat of customers backward integrating into coal mining is quite low for companies like Foresight Energy. This is primarily because establishing and running large-scale, longwall coal mining operations requires immense capital investment, highly specialized technical knowledge, and navigating complex regulatory environments. For instance, the capital expenditure for a new underground mine can easily run into hundreds of millions of dollars, a significant barrier for most industrial or utility customers.

This low likelihood of backward integration means that customers have less leverage to dictate terms by threatening to produce their own coal. Consequently, this factor contributes to a slightly reduced bargaining power for customers in their dealings with coal suppliers.

- Low Capital Barriers for Customers: The immense capital required for coal mining, often exceeding hundreds of millions of dollars for advanced operations, deters most industrial and utility customers from backward integration.

- Specialized Expertise and Regulatory Hurdles: Operating complex mining equipment and complying with stringent environmental and safety regulations demand specialized skills and knowledge that are not typically core competencies for energy consumers.

- Reduced Customer Leverage: The difficulty for customers to mine their own coal means they have less power to negotiate lower prices or more favorable contract terms by threatening to bring production in-house.

Customer's Ability to Substitute

The bargaining power of Foresight Energy's customers is significantly amplified by the increasing viability and competitiveness of alternative energy sources. The growing adoption of solar and wind power, coupled with the fluctuating prices of natural gas, provides utility companies with greater flexibility to switch away from coal. This shift directly impacts Foresight Energy's ability to dictate terms, as customers can more readily reduce their dependence on coal-fired power.

By 2024, renewable energy sources are increasingly challenging traditional fuels. For instance, the U.S. Energy Information Administration reported that renewable energy sources, excluding hydropower, accounted for approximately 13% of utility-scale electricity generation in 2023, a figure expected to continue its upward trajectory. This growing market share for renewables means utility customers have more options, lessening their reliance on any single supplier like Foresight Energy.

- Increased Renewable Energy Penetration: Renewables are becoming a more cost-effective and reliable power source.

- Natural Gas Price Volatility: Fluctuations in natural gas prices offer utilities an alternative to coal.

- Customer Substitution Options: Utilities can more easily shift electricity generation to natural gas or renewables.

- Reduced Dependence on Coal: This trend directly weakens the bargaining power of coal suppliers like Foresight Energy.

Foresight Energy's customers, primarily large utility companies and industrial users, possess substantial bargaining power. Their ability to negotiate favorable terms is enhanced by the commodity nature of thermal coal and the availability of numerous alternative suppliers, both domestically and internationally. The low switching costs for these buyers, coupled with the increasing competitiveness of renewable energy sources and natural gas, further empower them to demand lower prices and more advantageous contract conditions.

| Factor | Impact on Bargaining Power | Supporting Data/Context (as of 2024) |

| Customer Concentration | High | Large utilities represent a significant portion of Foresight Energy's revenue, granting them leverage. |

| Switching Costs | Low | Utilities can readily find alternative suppliers due to established relationships and manageable logistical adjustments. |

| Product Differentiation | Low | Thermal coal is largely a commodity; price is a primary driver for utilities facing competition from other energy sources. |

| Threat of Backward Integration | Very Low | Capital investment for mining operations can exceed hundreds of millions of dollars, a significant barrier for customers. |

| Availability of Substitutes | High | Renewable energy sources (e.g., solar, wind) are increasingly competitive. Renewables (excluding hydro) accounted for ~13% of US utility-scale generation in 2023, a trend continuing upwards. Natural gas prices also offer an alternative. |

Same Document Delivered

Foresight Energy Porter's Five Forces Analysis

This preview showcases the complete Foresight Energy Porter's Five Forces Analysis, mirroring the exact document you will receive upon purchase. The detailed analysis of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products is fully formatted and ready for your immediate use. You are viewing the actual, professionally prepared report, ensuring no discrepancies between the preview and your purchased file.

Rivalry Among Competitors

The US thermal coal industry is in a state of structural decline, with projections showing reduced production and consumption. This shrinking market naturally fuels more intense competition among the remaining players as they vie for a diminished share of demand.

Foresight Energy faces significant competitive rivalry within the Illinois Basin, an area populated by numerous major coal producers. This landscape includes large, established corporations and smaller, more regional mining operations, creating a dynamic and often intense competitive environment.

Thermal coal, the core product for companies like Foresight Energy, is largely a commodity. This means that, for the most part, it's difficult to tell one supplier's coal apart from another's, making price the main factor in buying decisions. In 2024, this undifferentiated nature means intense competition, as buyers can easily switch to the cheapest option.

While Foresight Energy’s coal, characterized by its high British thermal unit (Btu) content and high sulfur, does offer some quality differences, the fundamental commodity status of thermal coal means customers generally face low switching costs. This ease of switching between suppliers directly fuels competitive rivalry, as suppliers must constantly vie for market share through pricing and operational efficiency.

High Fixed Costs and Exit Barriers

The coal mining sector, especially operations like longwall mining, demands substantial upfront investment in machinery, land, and essential infrastructure. For instance, a single longwall shearer can cost upwards of $10 million, and the supporting equipment adds millions more.

These high fixed costs, combined with considerable environmental cleanup obligations and union agreements, create formidable exit barriers. Companies find it extremely difficult to leave the market, forcing them to continue operating and competing fiercely, even when market conditions are unfavorable.

- High Capital Expenditure: The initial investment for mining equipment and infrastructure can run into hundreds of millions of dollars.

- Environmental Remediation Costs: Companies face significant financial liabilities for land reclamation and pollution control, often running into tens or hundreds of millions per site.

- Union Agreements: Long-term labor contracts and associated benefits can represent substantial fixed costs that are difficult to shed.

- Asset Specificity: Mining equipment is highly specialized and has limited resale value outside the industry, making divestment challenging.

Strategic Stakes and Past Performance

The coal industry is experiencing a significant downturn, with declining demand creating high strategic stakes for companies. This pressure to maintain market share and profitability is particularly acute for firms like Foresight Energy, which has navigated past restructuring efforts.

Foresight Energy's situation highlights the intense need to optimize operations and secure vital contracts within this contracting market. For instance, in 2023, U.S. coal production saw a decline, with the Energy Information Administration (EIA) reporting a decrease in total coal output compared to previous years, underscoring the challenging environment.

- Declining Coal Demand: The overall market for coal continues to contract, impacting revenue streams and profitability.

- High Strategic Stakes: Companies must focus on efficiency and market positioning to survive and thrive.

- Foresight Energy's Challenges: Past restructuring indicates a need for robust operational strategies and secure contractual agreements.

- Market Pressures: The competitive landscape intensifies as companies vie for a shrinking pool of demand.

The thermal coal market is highly competitive due to its commodity nature, meaning price is the primary differentiator. Foresight Energy operates in the Illinois Basin, a region with numerous large and small coal producers, intensifying rivalry. The shrinking demand for thermal coal, evidenced by declining U.S. production figures, further exacerbates competition as companies fight for a smaller market share.

| Metric | 2023 Data (Estimate/Actual) | 2024 Projection |

|---|---|---|

| U.S. Thermal Coal Production (Million Short Tons) | 510 (EIA estimate) | 490-500 |

| Illinois Basin Production Share | Significant, but facing decline | Continued pressure |

| Average Thermal Coal Price (USD/Ton) | $25-35 (Varies by quality/region) | $22-32 |

SSubstitutes Threaten

The threat of substitutes for coal in electricity generation is intensifying, particularly from natural gas and renewables. These alternatives are increasingly offering a compelling price-performance trade-off. For instance, in 2024, renewable energy sources like solar and wind saw substantial growth, with their operational costs often undercutting those of existing coal-fired power plants.

Electric utilities, Foresight Energy's main customers, are increasingly likely to switch from coal. This shift is fueled by the availability of more economical alternatives, stricter environmental rules on emissions, and a growing commitment to sustainability by both the public and corporations. In 2024, the cost of renewable energy sources like solar and wind continued to fall, making them more competitive with coal-fired power generation.

The threat of substitutes for Foresight Energy's offerings is significant, largely due to the widespread availability and increasing accessibility of alternatives. Natural gas, a primary substitute, benefits from an extensive and well-established pipeline infrastructure, ensuring reliable and broad distribution. In 2024, the U.S. natural gas pipeline network spanned over 300,000 miles, facilitating easy access for consumers.

Renewable energy technologies, such as solar and wind power, are also rapidly deploying across the energy grid, presenting a growing substitute threat. Government incentives, including tax credits and grants, continue to bolster the attractiveness and economic viability of these renewable sources. For instance, in 2024, the U.S. saw significant growth in renewable energy capacity, with solar installations alone adding an estimated 30 GW, driven by supportive policies.

Relative Price Trends of Substitutes

The declining cost of renewable energy sources presents a significant threat of substitution for traditional energy providers like Foresight Energy. While natural gas prices can be volatile, the long-term trend for solar and wind power has seen substantial cost reductions.

For instance, the levelized cost of energy (LCOE) for utility-scale solar photovoltaic (PV) projects in the US has dropped dramatically. In 2023, it was estimated to be around $25-$50 per megawatt-hour (MWh), a stark contrast to the operating costs of older fossil fuel plants. This economic advantage makes new renewable installations increasingly competitive, even against existing, less efficient coal facilities, further driving the substitution away from traditional fuels.

- Decreasing Renewable Costs: The LCOE for solar PV has fallen significantly, making it more economical than many existing fossil fuel power plants.

- Wind Power Competitiveness: Similarly, onshore wind power LCOE in the US averaged around $25-$40 per MWh in 2023, posing a direct substitute threat.

- Accelerated Shift: These cost trends are accelerating the transition away from coal and, to a lesser extent, natural gas in power generation.

Regulatory and Environmental Pressure

The threat of substitutes for Foresight Energy, particularly in its coal operations, is escalating due to mounting regulatory and environmental pressures. Stricter rules from bodies like the Environmental Protection Agency (EPA) are directly impacting the cost-effectiveness of coal-fired power generation.

For instance, new EPA regulations targeting carbon pollution and wastewater discharge from coal plants are forcing significant operational adjustments. These mandates often necessitate substantial capital outlays for technologies like carbon capture or lead to the premature retirement of existing coal-fired assets. This financial burden makes alternative energy sources increasingly competitive.

In 2024, the landscape for coal power is marked by these increasing compliance costs. Utilities are actively evaluating the economic viability of their coal fleets against cleaner, more adaptable energy substitutes. The trend indicates a clear shift, driven by both regulatory mandates and the inherent cost advantages of alternatives when factoring in environmental compliance.

- Increased Operational Costs: Environmental regulations add substantial expenses for coal plants, impacting profitability.

- Investment in New Technologies: Compliance often requires investment in costly carbon capture or pollution control systems.

- Plant Retirement: The economic pressure may force the closure of older, less efficient coal facilities.

- Substitutes Become More Attractive: Renewable energy sources and natural gas offer a more predictable and often lower-cost alternative in the face of these regulations.

The threat of substitutes for coal is significant and growing, driven by the increasing cost-competitiveness and availability of alternatives. Natural gas, with its extensive pipeline infrastructure, remains a readily accessible substitute. In 2024, the U.S. boasts over 300,000 miles of natural gas pipelines, ensuring broad distribution and ease of access for consumers.

Renewable energy sources like solar and wind are rapidly gaining ground, further intensifying this threat. Supportive government policies and declining technology costs are making them increasingly attractive. For example, in 2024, solar installations added an estimated 30 GW in the U.S., buoyed by tax credits and grants.

The economic advantage of renewables is becoming undeniable. By 2023, the levelized cost of energy (LCOE) for utility-scale solar PV in the U.S. was around $25-$50 per MWh, while onshore wind averaged $25-$40 per MWh. These figures often undercut the operating costs of older coal-fired plants, accelerating the shift away from coal.

| Energy Source | Estimated LCOE (2023, US $/MWh) | Key Substitute Advantage |

|---|---|---|

| Coal (Operating Costs) | Varies (often higher than new renewables) | Established infrastructure |

| Natural Gas | Varies (price volatility) | Extensive pipeline network (300,000+ miles in US) |

| Solar PV (Utility-Scale) | $25 - $50 | Declining costs, environmental benefits |

| Onshore Wind | $25 - $40 | Declining costs, environmental benefits |

Entrants Threaten

Entering the thermal coal mining sector, particularly with advanced longwall mining, demands substantial capital. This includes significant outlays for acquiring mineral reserves, purchasing specialized heavy machinery like continuous miners and roof supports, and developing essential infrastructure such as processing plants and transportation networks. For instance, establishing a new, large-scale thermal coal mine in regions like the Powder River Basin historically required hundreds of millions, if not billions, of dollars in upfront investment.

Established coal producers like Foresight Energy benefit from deep-rooted relationships with major electric utilities and industrial consumers, giving them a significant edge. These existing ties ensure consistent demand and predictable sales volumes, a crucial advantage in a competitive market.

Newcomers would struggle to replicate this established network, facing considerable hurdles in securing reliable and cost-effective access to these vital customer bases. The difficulty in forging these crucial relationships presents a substantial barrier to entry.

Furthermore, Foresight Energy's established transportation contracts with railroads and barge operators are a key differentiator. These agreements guarantee efficient and economical movement of coal, a critical factor in overall profitability and customer satisfaction.

Entrants would find it challenging and expensive to negotiate similar transportation agreements, potentially facing higher logistics costs that would impact their competitiveness. The established infrastructure and contractual advantages of incumbents like Foresight Energy create a formidable barrier to new market participants.

Foresight Energy's extensive longwall mining operations are a significant source of economies of scale, enabling them to produce coal at a considerably lower cost per ton than smaller competitors. This cost advantage is a major barrier to entry for potential new players in the market.

New entrants would need to make massive upfront investments to match Foresight Energy's production volume and operational efficiency. Without achieving similar economies of scale, new companies would face higher per-unit costs, making it difficult to compete on price, especially in a market sensitive to cost fluctuations.

For instance, a new entrant would need to secure substantial capital for land acquisition, advanced mining equipment, and infrastructure, likely running into hundreds of millions of dollars, to even approach Foresight's operational footprint. This capital requirement, coupled with the need to achieve high output quickly, presents a formidable challenge.

Regulatory and Environmental Hurdles

The coal mining sector faces significant barriers to entry due to extensive regulatory oversight. New companies must navigate complex permitting processes, adhere to rigorous safety standards, and comply with demanding land reclamation obligations. For instance, in 2024, the U.S. Department of the Interior continued to emphasize environmental review for new mining projects, potentially extending approval timelines for any new entrants.

Furthermore, the industry is increasingly shaped by evolving environmental policies designed to curb coal usage. New entrants must be prepared to invest heavily in compliance and adapt to shifting governmental priorities, which can be a substantial deterrent. This regulatory landscape, coupled with the capital intensity of establishing new mining operations, significantly raises the threat of new entrants.

- Stringent Permitting: New coal mines require extensive environmental impact assessments and permits, a process that can take years and significant financial investment.

- Evolving Environmental Policies: Governments globally are implementing stricter regulations on emissions and land use, impacting the viability of new coal operations.

- Reclamation Costs: Companies are legally obligated to restore mined land, a costly undertaking that adds to the upfront and ongoing expenses for any new player.

- Safety Standards: Adherence to high safety protocols in mining is mandatory, requiring substantial investment in training and equipment for new entrants.

Incumbency Advantages and Brand Loyalty

While brand loyalty isn't a major factor in the thermal coal market, Foresight Energy benefits from incumbency advantages. Established operational efficiencies and a strong reputation for reliable supply, exemplified by their low-cost, high-quality coal, create significant barriers for new entrants. For instance, in 2024, the thermal coal industry continued to face regulatory pressures and a shift towards renewables, making new capital investment less appealing.

- Incumbency Advantage: Foresight Energy's existing infrastructure and operational expertise, honed over years of production, offer a cost advantage that new mines would struggle to match initially.

- Reputation for Reliability: A proven track record of consistent delivery and quality, crucial for power plant operations, builds trust and makes it harder for new, unproven suppliers to gain traction.

- Declining Market Attractiveness: With global energy transitions accelerating, the long-term outlook for thermal coal is diminishing, reducing the incentive for new companies to enter the market despite potential short-term gains.

The threat of new entrants in the thermal coal mining sector, particularly for companies like Foresight Energy, is significantly mitigated by extremely high capital requirements. Establishing a new, large-scale thermal coal mine demands hundreds of millions, if not billions, of dollars for mineral rights, heavy machinery, and infrastructure. This financial barrier is a primary deterrent for potential new players. Furthermore, securing established customer relationships and transportation contracts, which Foresight Energy possesses, presents a formidable challenge for newcomers aiming to compete on reliability and cost.

The regulatory environment also acts as a substantial barrier. New entrants must navigate complex and lengthy permitting processes, stringent safety standards, and demanding land reclamation obligations. For instance, in 2024, environmental reviews for new mining projects continued to be rigorous, potentially extending approval timelines. The evolving landscape of environmental policies, pushing for reduced coal usage, further discourages new investment due to compliance costs and uncertain future demand.

Economies of scale achieved through extensive longwall mining operations, like those of Foresight Energy, create a significant cost advantage. New entrants would need to make massive upfront investments to match production volumes and operational efficiency, making it difficult to compete on price. The overall declining attractiveness of the thermal coal market due to the global energy transition further reduces the incentive for new companies to enter, despite potential short-term opportunities.

| Barrier Type | Description | Impact on New Entrants | Foresight Energy Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment for reserves, machinery, and infrastructure. | Prohibitive for many potential entrants. | Established infrastructure and operational scale. |

| Customer Relationships | Deep-rooted ties with utilities and industrial consumers. | Difficulty securing consistent demand and predictable sales. | Guaranteed sales volumes and predictable revenue streams. |

| Transportation Contracts | Established agreements for efficient and economical coal movement. | Higher logistics costs and reduced competitiveness. | Lower per-unit transportation costs and reliable delivery. |

| Regulatory Hurdles | Complex permitting, safety standards, and reclamation obligations. | Lengthy approval times, increased compliance costs. | Existing compliance infrastructure and expertise. |

| Economies of Scale | Lower per-ton production costs due to high output. | Higher per-unit costs, difficulty competing on price. | Significant cost advantage and pricing power. |

Porter's Five Forces Analysis Data Sources

Our Foresight Energy Porter's Five Forces analysis is built upon a foundation of publicly available information, including SEC filings, annual reports, and industry-specific trade publications. This approach ensures a comprehensive understanding of the competitive landscape.