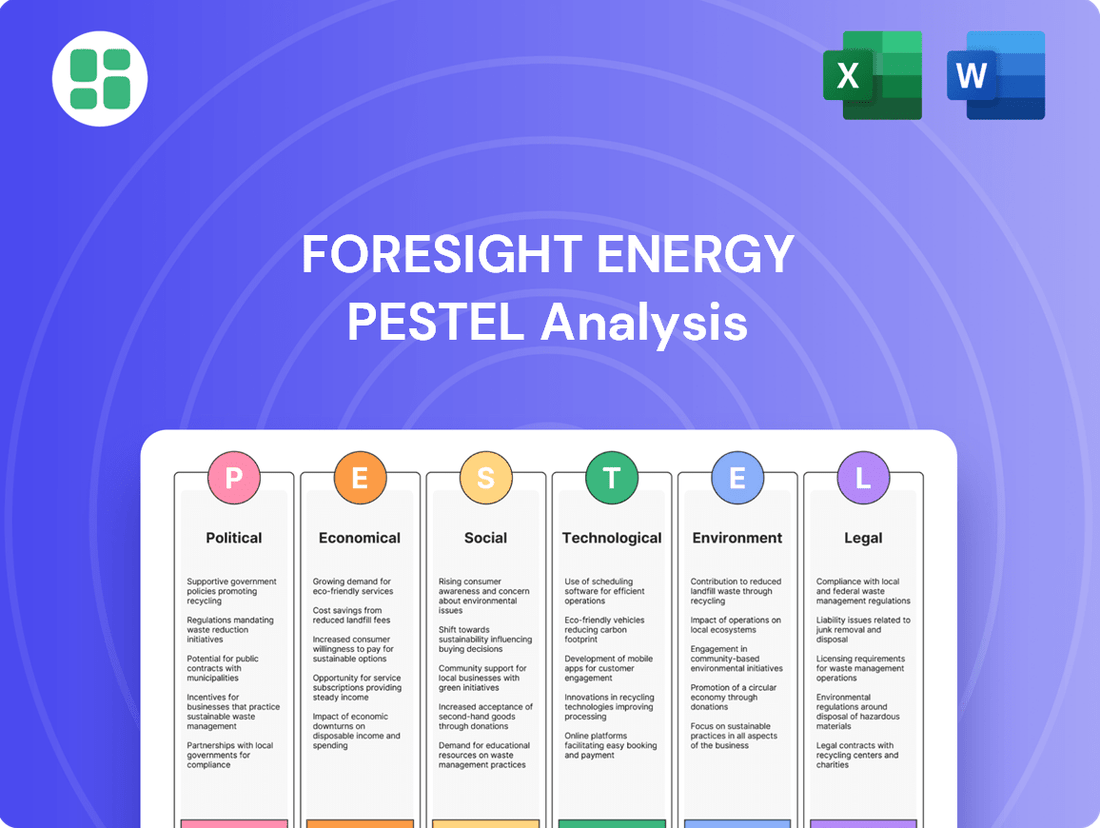

Foresight Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foresight Energy Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping Foresight Energy's trajectory. Our meticulously researched PESTLE analysis provides the critical intelligence you need to anticipate challenges and seize opportunities. Don't navigate the energy landscape blindfolded; download the full report to gain a decisive advantage.

Political factors

Governmental energy policies are a major driver for companies like Foresight Energy LP. In the United States, shifts in policy, particularly under new administrations, can dramatically alter the operating landscape for the coal sector. For instance, executive orders or potential rollbacks of climate regulations can create a more favorable environment for coal production.

However, this is often counterbalanced by state-level initiatives. Many states continue to pursue their own agendas to reduce or halt coal-fired power generation, creating a complex and sometimes contradictory regulatory environment for coal producers. This means Foresight Energy must navigate a patchwork of federal and state regulations, each with its own implications.

For example, the Inflation Reduction Act of 2022, while focused on clean energy, also includes provisions that could indirectly affect coal demand through incentives for renewables and electric vehicles. The precise impact of these evolving policies on coal consumption and production remains a key consideration for Foresight Energy's strategic planning through 2025.

The Environmental Protection Agency (EPA) has finalized significant new regulations for fossil fuel power plants, focusing on greenhouse gases, mercury, and wastewater. These rules, impacting facilities operating in 2024 and beyond, could necessitate costly upgrades like carbon capture technology or lead to the early retirement of some coal-fired plants.

For instance, the EPA's new emission standards for existing coal-fired power plants, finalized in April 2024, aim to reduce CO2 emissions by 62% by 2030 compared to 2005 levels for new plants, and by 42% for existing plants by 2032. This directly influences the operational viability and future demand for thermal coal.

International climate agreements, like the Paris Agreement, are increasingly shaping global energy demand. While countries such as China and India remain significant coal consumers, with China's coal consumption reaching an estimated 4.2 billion tonnes in 2023, the global shift towards decarbonization puts pressure on coal's long-term viability.

Trade policies tied to these agreements can impact coal exports, with potential tariffs or restrictions on carbon-intensive fuels. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, could make coal imports more expensive for EU member states, potentially diverting trade flows.

Subsidies and Tax Incentives

Government policies, particularly subsidies and tax incentives, significantly shape the energy sector. Changes in these incentives can dramatically shift the competitive balance between traditional energy sources like coal and renewables. For example, the Inflation Reduction Act (IRA) of 2022 provides substantial tax credits for clean energy technologies.

These credits can make previously uneconomical technologies, such as carbon capture, utilization, and storage (CCUS), more financially attractive for coal-fired power plants. The IRA allocated over $370 billion in climate and energy investments, including extended and enhanced tax credits for renewable energy and CCUS. This could potentially extend the operational life of some coal plants by providing pathways to reduce their environmental footprint.

- IRA Tax Credits: The IRA offers a 4254(d)(1) credit for CCUS facilities, increasing to $854(d)(1) if prevailing wage and apprenticeship requirements are met.

- Renewable Energy Growth: The act also extends and enhances tax credits for solar and wind power, further incentivizing the shift away from fossil fuels.

- Economic Viability: These incentives directly impact the economic viability of coal plant operations by either supporting emissions reduction technologies or by making renewable alternatives more cost-competitive.

Geopolitical Stability and Energy Security

Geopolitical instability and the drive for national energy security are significantly influencing the role of domestic coal production. Even with a global shift towards renewable energy sources, immediate concerns about energy reliability, particularly in light of volatile natural gas prices and rising electricity demand, could offer a temporary boost to coal's importance. For instance, in 2024, several European nations increased their reliance on coal-fired power plants to ensure grid stability amidst geopolitical tensions impacting gas supplies.

This dynamic creates a complex landscape for energy policy. While the long-term trend favors decarbonization, the short-to-medium term might see governments prioritizing energy security through all available domestic resources, including coal.

- Energy Security Concerns: Geopolitical events in 2024, such as conflicts impacting major energy-producing regions, heightened concerns about reliable energy access for many nations.

- Natural Gas Volatility: Fluctuations in global natural gas prices throughout 2024 and early 2025 have made coal a more economically viable, albeit environmentally problematic, alternative for some utilities.

- Increased Electricity Demand: A rebound in industrial activity and electrification trends in 2024 contributed to higher overall electricity demand, putting pressure on existing generation capacity and potentially favoring readily available domestic coal.

Governmental policies, including regulations and incentives, profoundly shape the energy market for companies like Foresight Energy. The EPA's finalized emission standards in April 2024, targeting significant CO2 reductions from coal plants by 2032, directly impact operational viability and future coal demand.

The Inflation Reduction Act of 2022, with its substantial clean energy investments, including tax credits for carbon capture, could influence coal plant economics. International agreements and trade policies, such as the EU's Carbon Border Adjustment Mechanism, also introduce complexities for coal exports.

Geopolitical events in 2024 have heightened energy security concerns, leading some nations to increase reliance on domestic coal for grid stability, even as the long-term trend favors decarbonization.

| Policy/Factor | Impact on Coal | Relevant Period | Data Point |

|---|---|---|---|

| EPA Emission Standards | Requires costly upgrades or early retirement for coal plants | Finalized April 2024, impacting operations 2024 onwards | Targeting 62% CO2 reduction by 2030 for new plants |

| Inflation Reduction Act (IRA) | Incentivizes CCUS and renewables, potentially affecting coal competitiveness | 2022 onwards | Over $370 billion in climate/energy investments |

| EU Carbon Border Adjustment Mechanism (CBAM) | Could increase coal import costs into the EU | Transitional phase began Oct 2023 | Aims to price carbon in imports |

| Energy Security Concerns | Temporary boost to domestic coal reliance for grid stability | 2024 | Several European nations increased coal use |

What is included in the product

This Foresight Energy PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic direction.

It provides a comprehensive overview of the external forces shaping the energy sector, offering insights for strategic decision-making.

The Foresight Energy PESTLE analysis provides a clear and concise overview of external factors, simplifying complex market dynamics for faster decision-making and strategic alignment.

Economic factors

Fluctuations in natural gas prices directly impact the competitiveness of thermal coal in electricity generation. When natural gas prices surge, coal-fired power plants become more economically viable, potentially boosting demand for coal. For instance, throughout much of 2024, natural gas prices saw significant volatility, with benchmarks like the Henry Hub experiencing periods of elevated pricing, which in turn supported coal demand in the US power sector.

Conversely, periods of lower natural gas prices exert downward pressure on coal demand. As gas becomes cheaper, utilities often switch from coal to natural gas for power generation, thereby reducing coal consumption. This dynamic was evident in early 2025, where forecasts indicated a potential easing of natural gas prices, suggesting a challenging environment for coal producers reliant on the power generation market.

Overall electricity demand is projected to grow, driven by the increasing adoption of electric vehicles and the massive energy needs of data centers. This rising demand acts as a significant factor for the energy sector, potentially influencing short-term coal consumption even as the long-term energy transition continues.

For instance, global electricity demand is expected to increase by approximately 20% between 2023 and 2026, according to the International Energy Agency. This surge, particularly from data centers and electrification efforts, could temporarily bolster the need for existing generation capacity, including coal-fired power plants, before renewable sources fully meet the expanded demand.

The escalating adoption of solar and wind power, coupled with a resurgence in hydropower, is demonstrably curbing coal consumption, especially within the power generation industry. For instance, in 2024, renewable energy sources are projected to account for a substantial portion of new electricity capacity additions globally, directly impacting demand for fossil fuels.

This growing market dominance by renewables presents a persistent economic hurdle for coal producers. As the cost-competitiveness of solar and wind continues to improve, with levelized costs of electricity for utility-scale solar PV falling by an estimated 8-10% in 2024 compared to 2023, the economic viability of coal-fired power plants is increasingly challenged.

Global Thermal Coal Demand and Exports

While thermal coal use is declining in regions like the United States and Europe, global demand, particularly from developing Asian economies such as China and India, continues to be robust. This sustained demand in Asia presents a significant economic factor for companies like Foresight Energy.

Foresight Energy's export capabilities are therefore crucial, with the potential to tap into these expanding Asian markets. This export focus could be a primary driver of revenue growth for the company in the coming years, especially as domestic demand in some traditional markets wanes.

- Global thermal coal demand is projected to remain strong, driven by Asian power generation needs.

- China's coal consumption, for instance, accounted for approximately 50% of global coal use in 2023, with imports playing a vital role.

- India's energy demand is also on the rise, with coal expected to remain a significant part of its energy mix through 2025 and beyond.

- Foresight Energy's ability to competitively export to these regions will directly impact its financial performance.

Operational Costs and Profitability

Foresight Energy, like many in the energy sector, is grappling with rising operational costs. Inflationary pressures throughout 2024 and into early 2025 have notably impacted the Illinois Basin, leading to increased expenses per barrel. This environment makes maintaining its reputation for low-cost production absolutely vital for sustained profitability.

The challenge is compounded by declining domestic demand for coal, a core product for Foresight Energy, and the ever-present increase in regulatory burdens. These factors squeeze margins, making efficiency paramount. For instance, in 2024, the average cost of extraction for coal in the US saw an uptick, a trend that continued into early 2025, directly affecting companies like Foresight.

- Inflationary Pressures: Rising costs for labor, equipment, and materials directly impact extraction expenses.

- Declining Demand: Lower domestic consumption of coal puts pressure on sales volumes and pricing power.

- Regulatory Compliance: Increasing environmental and safety regulations add to operational overhead.

- Cost Management: Foresight's ability to keep its cost per ton competitive is critical for profitability amid these headwinds.

Global thermal coal demand is projected to remain strong, driven by Asian power generation needs, with China's consumption accounting for about 50% of the global total in 2023. India's energy demand is also rising, and coal is expected to remain a significant part of its energy mix through 2025. Foresight Energy's ability to competitively export to these regions will directly impact its financial performance.

Preview Before You Purchase

Foresight Energy PESTLE Analysis

The Foresight Energy PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors influencing Foresight Energy.

Sociological factors

Public awareness of climate change, fueled by environmental activism, increasingly casts coal in a negative light. This sentiment directly impacts consumer choices and investor behavior, creating significant headwinds for companies like Foresight Energy.

Societal pressure is a powerful force, compelling policymakers to favor cleaner energy alternatives. For instance, in 2024, renewable energy sources saw substantial investment growth, outstripping fossil fuels in many developed nations, a trend expected to accelerate through 2025.

Sociological factors are significantly reshaping the energy landscape, particularly for coal mining. ESG compliance is no longer a niche consideration but a critical factor for accessing capital and maintaining a positive brand image. For instance, in 2024, a significant portion of new infrastructure projects requiring external financing are mandating robust ESG frameworks, making it harder for companies with poor environmental or social track records to secure funding.

Investor and consumer demand for higher ESG standards and greater transparency is a powerful sociological driver. This pressure is leading many coal mining firms to re-evaluate their public stances on climate change, not out of genuine commitment, but to mitigate potential legal liabilities and reputational damage. By scaling back overt climate activism, companies aim to avoid scrutiny that could lead to divestment or regulatory action.

The shift from coal to cleaner energy sources like solar and wind has a profound effect on local communities. For instance, in 2023, the U.S. coal mining industry employed approximately 40,000 people, a number that has been steadily declining. This transition can lead to significant job losses in regions historically dependent on coal, impacting local economies and social structures.

While the renewable energy sector is creating new employment opportunities, such as the estimated 130,000 jobs in solar installation and maintenance in the U.S. as of late 2024, these new roles may not always be in the same geographic areas or require the same skill sets as traditional coal jobs. This mismatch necessitates robust retraining programs and economic diversification initiatives to support communities through this energy transition, ensuring a just transition for affected workers and their families.

Health Concerns and Public Health Advocacy

Growing awareness of the health consequences linked to air pollution, particularly from sources like coal-fired power plants, fuels robust public health advocacy. Concerns over emissions such as mercury, sulfur dioxide, and particulate matter have a direct impact on respiratory and cardiovascular health, leading to increased healthcare costs and reduced quality of life.

This heightened public and professional advocacy translates into significant pressure for more stringent environmental regulations. For instance, in 2024, the World Health Organization (WHO) updated its air quality guidelines, recommending even lower levels for pollutants like PM2.5, which will likely influence future regulatory targets for energy companies.

Consequently, there's a growing demand for cleaner energy alternatives. By 2025, projections indicate a continued global shift towards renewables, driven partly by these health concerns. The International Energy Agency (IEA) reported in late 2024 that renewable energy sources accounted for over 30% of global electricity generation, a figure expected to climb as health-driven policy and public opinion coalesce.

- Health Impacts: Coal plant emissions contribute to asthma, bronchitis, and heart disease, increasing healthcare burdens.

- Regulatory Pressure: Public health advocacy directly influences the implementation and tightening of environmental standards for power generation.

- Market Shift: Consumer and governmental demand for cleaner air accelerates investment in and adoption of renewable energy technologies.

- Economic Costs: The societal cost of pollution-related illnesses is substantial, making cleaner energy a more economically viable long-term solution.

Labor Relations and Workforce Transition

The coal industry grapples with complex labor relations as the workforce navigates a significant transition away from declining coal demand. This shift necessitates careful management to ensure fairness and support for affected employees.

Facilitating an equitable transition is paramount, with retraining programs for roles in emerging energy sectors like renewables or advanced manufacturing being a key social consideration. For instance, as of late 2024, many regions historically reliant on coal mining are seeing increased investment in solar and wind energy projects, creating new job opportunities that require different skill sets.

- Workforce Transition Challenges: Coal mining employment in the United States has seen a steady decline, with figures from the Energy Information Administration (EIA) showing a substantial drop over the past decade, impacting thousands of workers.

- Retraining Initiatives: Government and private sector partnerships are crucial for developing and funding retraining programs. Some programs in 2024 reported successful placement rates of over 70% for former coal miners into new careers.

- Social Impact: The economic and social fabric of communities built around coal mining is deeply affected, requiring comprehensive support beyond just job training, including community development and economic diversification strategies.

Public sentiment increasingly favors cleaner energy, driven by growing awareness of climate change and its health impacts. This societal shift directly influences investor decisions and policy direction, creating a challenging environment for coal companies like Foresight Energy.

The demand for higher Environmental, Social, and Governance (ESG) standards is a significant sociological factor. In 2024, a large percentage of new infrastructure projects requiring external capital mandated robust ESG frameworks, making it difficult for companies with poor environmental records to secure funding.

The transition from coal to renewables impacts communities, leading to job losses in traditional mining areas. While the renewable sector created an estimated 130,000 U.S. jobs in solar installation and maintenance by late 2024, these often require different skills and are not always located in former coal regions.

| Factor | Impact on Coal Industry | 2024/2025 Data Point |

|---|---|---|

| Climate Change Awareness | Negative public perception, investor divestment | Renewable energy investment growth outpaced fossil fuels in many developed nations in 2024. |

| ESG Demands | Difficulty in securing capital, reputational risk | Significant portion of new infrastructure projects in 2024 required strong ESG frameworks for financing. |

| Community Transition | Job displacement in coal regions | U.S. coal mining employed ~40,000 in 2023; solar/wind jobs growing, requiring retraining. |

| Health Concerns | Pressure for stricter regulations, shift to cleaner energy | WHO updated air quality guidelines in 2024, recommending lower pollutant levels. |

Technological factors

Technological advancements in carbon capture and storage (CCS) are becoming increasingly critical for the long-term viability of coal-fired power plants. As regulatory pressures mount, the efficiency and economic feasibility of these CCS systems will directly determine whether these plants can continue operating.

New regulations, potentially coming into effect in 2024 or 2025, may mandate the use of CCS technology to curb carbon emissions from coal facilities. The success of this transition hinges on the development of more cost-effective and efficient CCS solutions, with current pilot projects aiming for capture costs below $50 per ton of CO2 by the late 2020s.

Foresight Energy leverages advanced longwall mining, a highly efficient method for extracting coal. This technique involves a continuous cutting process, maximizing output from a single panel.

Ongoing technological advancements are set to further revolutionize longwall mining. Expect increased integration of automation, robotics, and artificial intelligence to boost safety and operational efficiency. For instance, in 2024, the mining industry saw significant investment in AI-driven predictive maintenance for heavy equipment, aiming to reduce downtime and improve productivity by an estimated 10-15%.

The application of data analytics in longwall operations is crucial for optimizing extraction. By analyzing real-time data from sensors, companies like Foresight Energy can identify bottlenecks and improve seam utilization, potentially increasing recovery rates by up to 5% in the 2024-2025 period.

The cost of solar photovoltaic (PV) power has seen a dramatic decrease, with global weighted-average levelized costs of electricity falling by around 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA). Similarly, wind power costs have also declined significantly, making these sources increasingly competitive against coal.

This technological advancement is directly impacting coal's position in the global energy landscape. For instance, in 2023, renewable energy sources accounted for over 50% of new power capacity additions globally, further marginalizing coal in new energy infrastructure development.

As solar and wind technologies continue to improve in efficiency and become more integrated into national grids, they are accelerating the transition away from coal-fired power generation, influencing investment decisions and energy policy worldwide.

Energy Storage Solutions

Advances in energy storage, particularly battery technology, are significantly enhancing the reliability of renewable energy sources. This progress is crucial for integrating intermittent sources like solar and wind power into the existing grid infrastructure, making them more viable alternatives.

These improvements in storage directly impact the demand for traditional baseload power. As renewables become more dependable due to better storage, the reliance on coal-fired power plants for consistent energy supply diminishes, accelerating coal's long-term decline.

For instance, the global energy storage market, excluding pumped hydro, was projected to reach over $100 billion by 2025, with lithium-ion batteries dominating. By the end of 2024, global battery storage capacity is expected to exceed 100 GW, a substantial leap that supports higher renewable penetration rates.

- Battery Technology Advancements: Innovations in lithium-ion, solid-state, and flow batteries are increasing energy density and reducing costs, making storage more accessible.

- Grid Integration: Enhanced storage solutions enable smoother integration of variable renewable energy sources, improving grid stability and reducing curtailment.

- Reduced Reliance on Fossil Fuels: The growing effectiveness of energy storage directly challenges the need for baseload power from coal, contributing to its phasing out.

- Market Growth: The energy storage sector is experiencing rapid expansion, with significant investments pouring into research, development, and deployment, signaling a major shift in the energy landscape.

Digitalization and Automation in Mining

The mining industry is rapidly embracing digitalization and automation, with technologies like artificial intelligence (AI) and advanced robotics significantly boosting operational efficiency and safety. Companies are leveraging these advancements for everything from predictive maintenance on heavy machinery to optimizing the extraction of coal and other resources. For example, by 2024, it’s estimated that the global mining automation market will reach over $7 billion, highlighting the substantial investment in these areas.

These technological shifts are fundamentally altering the landscape of mining operations, leading to more streamlined processes and reduced human exposure to hazardous environments. The integration of AI, in particular, allows for better data analysis, enabling more informed decision-making and improved resource management. This trend is expected to continue, with further innovations in autonomous haulage systems and AI-driven geological surveying anticipated.

- Increased Efficiency: Automation can reduce downtime and improve the speed of mining operations.

- Enhanced Safety: Remote operation and AI-powered monitoring minimize risks for human workers.

- Data-Driven Decisions: AI and digitalization provide insights for better resource extraction and maintenance.

- Market Growth: The mining automation market is projected for significant expansion, indicating strong industry adoption.

Technological advancements are reshaping the energy sector, impacting coal's future. Innovations in carbon capture and storage (CCS) are crucial for coal plants, with targets aiming for capture costs below $50 per ton of CO2 by the late 2020s. Meanwhile, the plummeting costs of solar and wind power, which fell by 89% and significantly respectively between 2010 and 2022, are making them increasingly competitive, with renewables accounting for over 50% of new global power capacity additions in 2023.

Energy storage, particularly battery technology, is enhancing renewable energy reliability. Global battery storage capacity is expected to exceed 100 GW by the end of 2024, supporting higher renewable penetration and reducing the need for coal as a baseload power source. Furthermore, the mining industry is seeing substantial investment in automation, with the global mining automation market projected to exceed $7 billion by 2024, boosting efficiency and safety through AI and robotics.

| Technology Area | Key Advancement/Trend | Impact on Coal/Foresight Energy | Relevant Data/Projection |

| Carbon Capture & Storage (CCS) | Increased efficiency and cost reduction | Determines long-term viability of coal plants; potential regulatory mandates | Target capture costs < $50/ton CO2 by late 2020s |

| Renewable Energy Costs | Dramatic cost declines in solar PV and wind | Increased competitiveness against coal; reduced demand for coal power | Solar PV costs down ~89% (2010-2022); Renewables >50% of new capacity additions (2023) |

| Energy Storage | Improved battery technology (lithium-ion, solid-state) | Enhances renewable reliability, reducing reliance on coal baseload | Global battery storage capacity >100 GW by end of 2024 |

| Mining Automation & AI | Digitalization, robotics, AI integration | Boosts operational efficiency, safety, and data-driven decisions in mining | Global mining automation market >$7 billion by 2024 |

Legal factors

The Environmental Protection Agency's (EPA) stringent final rules on greenhouse gas emissions and mercury and air toxics standards for fossil fuel-fired power plants create significant legal hurdles for coal consumers. These regulations mandate substantial emission reductions, often requiring costly upgrades or leading to plant closures, which directly impacts the demand for coal, particularly high-sulfur varieties.

New Environmental Protection Agency (EPA) rules are tightening wastewater discharge standards for coal-fired power plants, directly impacting operations under the Clean Water Act. These regulations are designed to significantly reduce the release of toxic metals and other harmful pollutants into waterways.

For companies like Foresight Energy, these stricter standards translate into increased compliance costs and greater operational complexity. The financial burden of upgrading treatment facilities or altering operational processes to meet these new benchmarks is a significant factor in the 2024-2025 outlook.

Federal regulations, such as the EPA's Coal Combustion Residuals Rule (40 CFR Part 257 and 261), mandate strict requirements for the safe disposal and management of coal ash in landfills and surface impoundments. These rules require extensive groundwater monitoring, corrective actions for any detected contamination, and specific closure procedures, all of which directly increase operational expenses for companies like Foresight Energy.

In 2024, the financial impact of these regulations is significant, with compliance costs for monitoring and potential remediation adding to the overall cost of coal-fired power generation. For instance, companies are investing in new lined landfills and upgrading existing impoundments to meet stringent containment standards, a capital expenditure that directly affects profitability and the long-term viability of coal assets.

Mining Safety and Health Laws

Mining safety and health laws, such as those enforced by the Mine Safety and Health Administration (MSHA), are critical for coal operations. These regulations, both federal and state, set stringent standards for how mines must be run to protect workers. Failure to comply can result in significant fines and even jeopardize a company's ability to operate.

In 2023, MSHA reported over $20 million in civil penalties issued for safety violations across the mining industry. For companies like Foresight Energy, adhering to these rules is not just about avoiding penalties; it's fundamental to worker well-being and maintaining their operational licenses. The focus remains on preventing accidents and ensuring a safe working environment.

- Federal and State Regulations: MSHA's Federal Mine Safety and Health Act of 1977 and equivalent state laws mandate specific safety protocols.

- Compliance Costs: Companies must invest in training, equipment, and safety personnel to meet these standards.

- Enforcement and Penalties: Violations can lead to substantial fines, with penalties varying based on the severity and history of non-compliance.

- Worker Safety: The ultimate goal is to reduce mining-related injuries and fatalities, a key performance indicator for the industry.

Antitrust and ESG-Related Litigation

The heightened focus on environmental, social, and governance (ESG) factors is leading to new legal challenges. For instance, lawsuits have emerged accusing asset managers of colluding to restrict coal production, a move framed as a 'climate cartel'. This type of litigation directly impacts companies in the coal industry, creating significant legal and operational risks.

These legal battles can reshape investment decisions and force companies to adapt their business strategies. For example, the ongoing scrutiny around ESG claims and potential antitrust violations could deter investment in sectors perceived as lagging in environmental performance or engaging in anti-competitive practices related to climate goals. This trend suggests a need for greater transparency and compliance in how ESG commitments are implemented.

- Increased Litigation Risk: Lawsuits alleging 'climate cartels' and anti-competitive behavior in ESG initiatives pose a direct legal threat to companies, particularly in carbon-intensive sectors like coal.

- Impact on Investment: Legal challenges can deter investors, leading to reduced capital availability and potentially lower valuations for companies facing such scrutiny. In 2024, the debate around greenwashing and the legal ramifications for misleading ESG claims intensified, with several high-profile cases making their way through the courts.

- Strategic Realignments: Companies may need to revise their ESG strategies and operational plans to mitigate legal risks and maintain investor confidence amidst evolving regulatory and judicial landscapes.

Stricter EPA regulations on emissions and wastewater discharge from coal-fired power plants are increasing compliance costs for companies like Foresight Energy in 2024-2025. These rules necessitate significant investments in upgrades or can lead to plant closures, impacting coal demand.

Federal laws like the CCR Rule mandate costly safe disposal of coal ash, requiring groundwater monitoring and corrective actions. In 2024, compliance costs for these measures are substantial, impacting profitability and the viability of coal assets.

Mining safety laws enforced by MSHA are paramount; non-compliance incurs hefty fines and operational risks. In 2023, MSHA issued over $20 million in penalties for safety violations across the mining sector.

ESG-related litigation, such as accusations of 'climate cartels', presents new legal challenges. In 2024, heightened scrutiny of ESG claims and potential antitrust violations could deter investment in carbon-intensive industries.

Environmental factors

The intensifying global focus on climate change is a critical environmental factor shaping the energy landscape. This concern directly translates into policies and market shifts pushing for substantial reductions in carbon emissions, impacting companies like Foresight Energy, a significant thermal coal producer.

Foresight Energy LP is under considerable pressure due to worldwide and domestic initiatives aimed at decarbonizing the energy sector. For instance, in 2023, global CO2 emissions from energy combustion reached an estimated 36.8 billion tonnes, underscoring the scale of the challenge and the regulatory environment Foresight operates within.

Coal mining and processing are inherently water-intensive operations. Environmental regulations are increasingly stringent, focusing on both the volume of water used and the quality of discharged water. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Effluent Limitation Guidelines (ELGs) for the coal mining industry, requiring advanced treatment for wastewater to remove pollutants such as heavy metals and suspended solids.

Compliance with these water usage and discharge regulations is paramount for companies like Foresight Energy. Failure to meet standards, particularly regarding the discharge of toxic metals like selenium and mercury, can result in significant environmental penalties, operational shutdowns, and damage to corporate reputation. In 2025, the ongoing scrutiny of water quality means that investments in advanced water treatment technologies are not just a cost but a necessity for maintaining operational permits and long-term viability.

Foresight Energy's mining operations, particularly those employing longwall mining, inherently lead to significant land disturbance. This necessitates substantial investment in post-mining land reclamation to restore affected areas and protect biodiversity, a process mandated by stringent environmental regulations.

These reclamation efforts represent a considerable long-term cost for Foresight Energy. For instance, in 2023, the company reported $175 million in asset retirement obligations, a figure largely driven by its land reclamation commitments, reflecting the ongoing financial burden associated with environmental stewardship.

Coal Ash Management and Contamination Risks

The management of coal ash, also known as coal combustion residuals (CCR), presents significant environmental challenges for companies like Foresight Energy. These materials can pose risks of groundwater contamination if not properly managed, leading to potential ecological damage and costly remediation efforts. As of 2024, the U.S. Environmental Protection Agency (EPA) continues to refine regulations for CCR disposal, impacting operational costs and requiring advanced containment strategies.

Stricter regulatory frameworks for coal ash disposal and the management of legacy sites are a key environmental factor. These regulations necessitate robust management units, such as lined landfills and impoundments, along with continuous monitoring systems to prevent the leaching of contaminants into surrounding water sources. The financial burden associated with compliance and ongoing environmental stewardship remains a critical consideration for the industry.

Key considerations for coal ash management include:

- Regulatory Compliance: Adhering to evolving EPA regulations for CCR disposal and groundwater protection.

- Legacy Site Management: Addressing environmental risks associated with historical coal ash disposal sites.

- Monitoring and Remediation: Implementing comprehensive monitoring programs and preparing for potential remediation activities.

- Operational Costs: Factoring in the increased expenses for advanced containment and management technologies.

Air Quality and Particulate Matter Control

Beyond greenhouse gases like carbon dioxide, coal mining and combustion release significant amounts of particulate matter (PM2.5 and PM10) and other harmful air pollutants such as sulfur dioxide and nitrogen oxides. These emissions directly impact local and regional air quality, posing risks to public health by contributing to respiratory and cardiovascular diseases.

Environmental regulations are increasingly stringent, pushing companies like Foresight Energy to invest heavily in advanced pollution control technologies. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce regulations like the Clean Air Act, which sets limits on emissions from power plants and industrial facilities. In 2024, ongoing reviews and potential updates to National Ambient Air Quality Standards (NAAQS) for PM2.5 could necessitate further upgrades to emissions capture systems at mines and processing plants, potentially increasing operational costs.

These investments are critical for compliance and maintaining a social license to operate. Failure to meet emission standards can result in substantial fines and operational shutdowns. For example, in 2023, several coal companies faced penalties for exceeding permitted emission levels. Foresight Energy, like its peers, must allocate capital towards:

- Installation and maintenance of baghouses and electrostatic precipitators to capture particulate matter.

- Implementation of flue gas desulfurization (FGD) systems to reduce sulfur dioxide emissions.

- Adoption of selective catalytic reduction (SCR) or selective non-catalytic reduction (SNCR) for NOx control.

- Continuous emissions monitoring systems (CEMS) to ensure ongoing compliance and data reporting.

The global push for decarbonization, driven by climate change concerns, significantly impacts coal producers like Foresight Energy. In 2023, global CO2 emissions from energy reached approximately 36.8 billion tonnes, highlighting the scale of the environmental challenge and regulatory pressures.

Stringent water usage and discharge regulations, such as the EPA's Effluent Limitation Guidelines for coal mining, require advanced wastewater treatment to remove pollutants. Failure to comply can lead to hefty penalties and operational disruptions.

Coal ash management is another critical environmental factor, with evolving EPA regulations demanding robust containment and monitoring to prevent groundwater contamination. These compliance measures represent a significant ongoing operational cost.

Furthermore, air quality regulations under the Clean Air Act mandate investments in pollution control technologies to mitigate emissions of particulate matter, sulfur dioxide, and nitrogen oxides. Potential updates to National Ambient Air Quality Standards in 2024 could necessitate further upgrades, impacting operational expenses.

| Environmental Factor | Impact on Foresight Energy | Relevant Data/Regulation (2023-2025) |

| Climate Change & Decarbonization | Pressure to reduce carbon footprint; potential market shifts away from coal. | Global CO2 emissions from energy: ~36.8 billion tonnes (2023). |

| Water Management | Strict regulations on water usage and discharge quality; investment in treatment technologies. | EPA Effluent Limitation Guidelines (ELGs) for coal mining enforced (2024). |

| Coal Ash Management | Need for advanced containment and monitoring to prevent contamination; compliance costs. | Ongoing refinement of EPA CCR disposal regulations (2024). |

| Air Quality | Investment in pollution control technologies to meet emission standards. | Potential updates to NAAQS for PM2.5 (2024) may require further upgrades. |

PESTLE Analysis Data Sources

Our Foresight Energy PESTLE Analysis is meticulously constructed using data from official government energy departments, reputable financial institutions, and leading industry associations. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the energy sector.