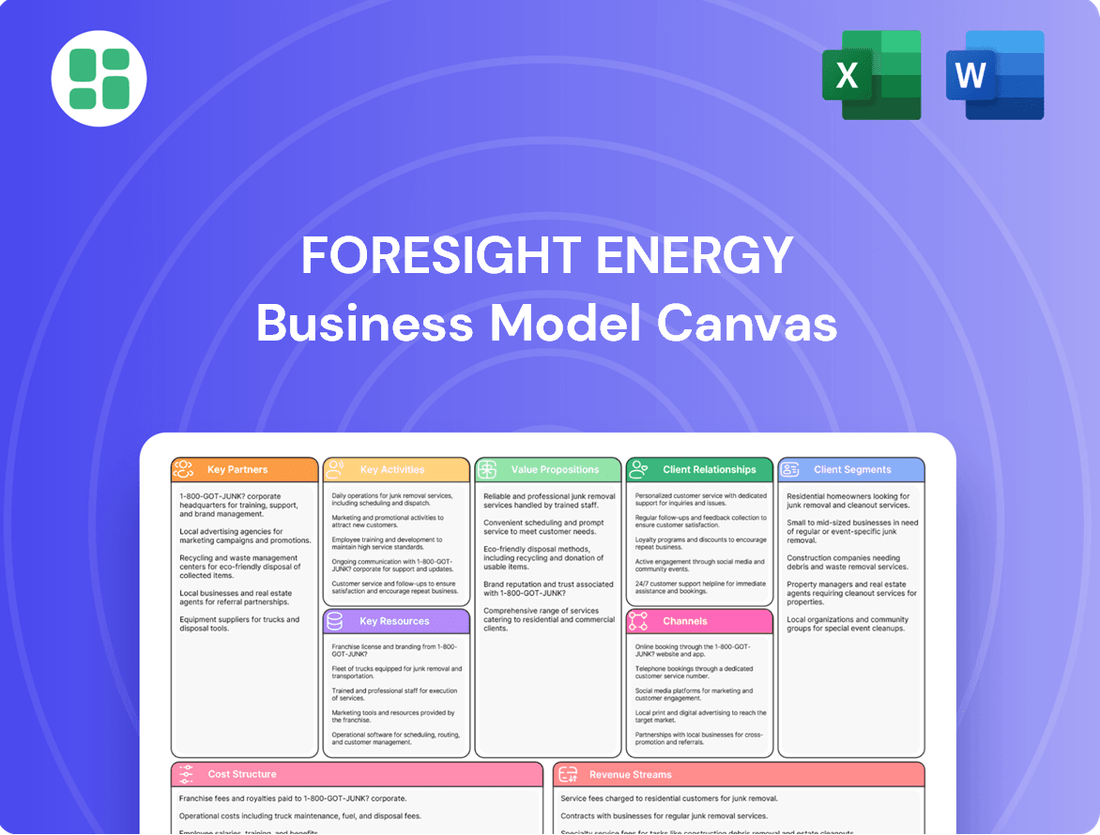

Foresight Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Foresight Energy Bundle

Uncover the strategic core of Foresight Energy's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their market approach. Ready to dissect their success and apply it to your own ventures?

Partnerships

Foresight Energy LP's operational efficiency hinges on strategic alliances with leading manufacturers of advanced mining equipment, especially those focused on longwall mining systems. These critical partnerships guarantee access to state-of-the-art technology, which is fundamental for sustaining high productivity levels and keeping operating expenses in check.

These collaborations extend beyond mere procurement, often involving joint development and customization of machinery. This tailored approach ensures that equipment is optimized for the unique geological conditions encountered within the Illinois Basin, a key operational area for Foresight Energy.

Foresight Energy LP's business model heavily relies on strategic partnerships with major rail companies such as Canadian National, Norfolk Southern, Union Pacific, CSX, and BNSF through its ownership in the East West Vehicle Rail (EVWR). These relationships are fundamental for ensuring the efficient and cost-effective transportation of their high-Btu thermal coal to customers.

Complementing its rail network, Foresight Energy also partners with barge operators. This multimodal approach, leveraging access to river terminals and export facilities, allows the company to reach a wide array of domestic and international markets. In 2024, the company continued to emphasize optimizing its logistics to maintain competitive transportation rates, a critical factor in the thermal coal market.

Foresight Energy LP relies heavily on securing and maintaining access to vast coal reserves, making landowners and mineral rights holders critical partners. Long-term agreements with these entities are essential for both current mining activities and future growth opportunities.

These partnerships are often intricate, involving detailed contracts that specify royalty payments, land usage terms, and crucial environmental stewardship responsibilities.

Regulatory Bodies & Environmental Consultants

Foresight Energy LP actively collaborates with regulatory bodies like the U.S. Environmental Protection Agency (EPA) and state-level agencies to ensure full compliance with environmental laws. In 2024, the company continued its focus on meeting evolving emissions standards and water quality requirements, which are crucial for maintaining operational permits.

Partnerships with environmental consulting firms are essential for Foresight Energy to navigate the complexities of environmental impact assessments and permitting. These consultants provide expertise in areas such as air quality monitoring and reclamation planning, supporting Foresight's commitment to responsible mining practices. For instance, in 2024, such partnerships were instrumental in securing permits for new mining areas, ensuring adherence to the latest safety protocols.

- Regulatory Compliance: Maintaining adherence to stringent environmental regulations, such as those set by the EPA, is a core operational necessity for coal producers like Foresight Energy.

- Permitting Processes: Collaborating with regulatory agencies facilitates the complex and often lengthy permitting processes required for mining operations, ensuring legal and operational continuity.

- Environmental Stewardship: Engaging environmental consultants helps Foresight Energy manage its environmental footprint, including emissions control and land reclamation, reinforcing its social license to operate.

- Safety Standards: Partnerships ensure compliance with mining safety standards, a critical factor for worker protection and operational integrity, especially as safety regulations evolve.

Industrial & Utility Service Providers

Foresight Energy LP relies on industrial and utility service providers for critical functions like mine maintenance, engineering support, and specialized mining operations. These partnerships are crucial for ensuring operational efficiency and accessing expertise that augments internal capabilities.

These collaborations help Foresight Energy optimize its mining processes and tackle intricate technical issues. For instance, services for preparation plants and surface infrastructure are often outsourced to specialized firms, ensuring these vital components function at peak performance.

- Maintenance and Repair: Specialized firms provide essential upkeep for mining equipment and preparation plants, minimizing downtime.

- Engineering and Technical Services: External experts offer solutions for complex engineering challenges and mine optimization projects.

- Specialized Mining Services: Partners can deliver niche services, such as advanced drilling or ventilation solutions, enhancing overall mining effectiveness.

- Infrastructure Support: Services related to surface infrastructure, including conveyor systems and power supply, are often managed by external utility providers.

Foresight Energy's key partnerships are vital for its logistical network, including major rail carriers like Canadian National and Norfolk Southern, and barge operators. These alliances are crucial for cost-effective coal transportation to domestic and international markets, with 2024 efforts focused on optimizing these rates.

Securing access to coal reserves through agreements with landowners and mineral rights holders is paramount. These intricate partnerships involve detailed contracts covering royalties, land use, and environmental responsibilities, ensuring both current operations and future expansion. The company's commitment to environmental stewardship is further supported by collaborations with environmental consulting firms, essential for navigating complex regulations and permitting processes.

Foresight Energy also partners with manufacturers of advanced mining equipment, particularly for longwall systems, to ensure access to cutting-edge technology and maintain operational efficiency. These relationships often involve joint development to tailor machinery for specific geological conditions, such as those found in the Illinois Basin.

What is included in the product

A detailed, pre-written business model canvas for Foresight Energy, outlining its strategy for coal production and distribution.

This canvas covers key elements like customer segments, revenue streams, and cost structure, reflecting the company's operational realities.

Foresight Energy's Business Model Canvas offers a structured approach to identify and address operational inefficiencies, streamlining complex processes for a clearer strategic path.

Activities

Foresight Energy's core activity centers on extracting thermal coal, specifically high-Btu, high-sulfur varieties, from its substantial Illinois Basin reserves. This operation is the engine driving its business.

The company leverages highly efficient longwall mining, a method that underpins its position as a low-cost producer in the market. This efficiency is crucial for competitiveness.

Complementing longwall mining, Foresight Energy also utilizes continuous miner operations. Together, these techniques ensure robust production capacity, meeting market demand.

After coal is extracted, it goes through crucial processing and preparation stages to meet specific customer requirements for heat content and overall quality. This involves operations like crushing the coal into smaller pieces, washing away impurities, and sizing it appropriately. These steps are carried out at specialized preparation plants situated at each mining complex.

Foresight Energy operates these preparation plants, which are vital for ensuring the coal delivered is of high quality. For instance, in 2024, the company continued to focus on optimizing these processes to enhance product consistency and meet the stringent demands of its primary customers, which include electric utilities and industrial sectors relying on reliable fuel sources.

Foresight Energy manages the complex movement of coal from its mines to customers, a vital process that requires seamless coordination across various rail lines and barge operators. In 2024, the company's efficient logistics are a cornerstone of its operations, ensuring that coal reaches power plants and industrial facilities reliably.

Leveraging its advantageous geographic positioning, Foresight Energy utilizes a multi-modal transportation strategy, incorporating rail, barge, and truck networks. This flexibility allows for cost-effective and timely deliveries, crucial for maintaining competitiveness in both domestic and global markets throughout 2024.

Sales, Marketing & Contract Management

Foresight Energy's key activities revolve around aggressively marketing its high-Btu thermal coal to electric utilities and industrial clients. This proactive approach is vital for securing both long-term supply contracts and engaging in spot sales, ensuring a consistent revenue stream. The company's sales team actively interacts with customers, negotiates contract terms, and remains agile in responding to fluctuating market prices.

Maintaining a robust sales pipeline is paramount for Foresight Energy's financial stability. For instance, in 2024, the company focused on strengthening relationships with key utility partners, aiming to lock in multi-year agreements. This strategy is designed to mitigate the volatility inherent in the thermal coal market.

- Active Marketing: Direct engagement with electric utility and industrial customers to promote high-Btu thermal coal.

- Contract Negotiation: Securing long-term supply agreements and managing spot sales through negotiation.

- Market Adaptation: Adjusting sales strategies and pricing in response to dynamic market price fluctuations.

- Sales Pipeline Management: Ensuring a consistent flow of potential sales to maintain revenue stability.

Environmental & Safety Compliance

Foresight Energy's key activities in Environmental & Safety Compliance are crucial for navigating the stringent regulatory landscape of the mining industry. This involves a proactive approach to maintaining high standards in environmental protection and mine safety. For instance, in 2024, the company continued its robust program of regular site inspections and safety audits across its operations to proactively identify and mitigate potential hazards.

Implementing comprehensive safety programs is a cornerstone of these activities. This includes ongoing training for all personnel, development of emergency response plans, and strict adherence to protocols designed to prevent accidents and ensure worker well-being. The company also focuses on managing environmental impact assessments to ensure all mining activities are conducted with minimal ecological disruption, a commitment reinforced by substantial investments in technologies aimed at reducing emissions and waste.

- Regulatory Adherence: Continuous monitoring and compliance with federal and state environmental and safety regulations, such as those set by the Mine Safety and Health Administration (MSHA) and the Environmental Protection Agency (EPA).

- Safety Program Implementation: Ongoing training, equipment maintenance, and procedural updates to uphold a zero-harm workplace culture.

- Environmental Management: Conducting detailed environmental impact assessments for new projects and managing existing operations to minimize water, air, and land pollution.

- Technology Investment: Allocating capital towards advanced technologies that enhance safety, such as automated monitoring systems, and reduce environmental impact, like dust suppression and water treatment solutions.

Foresight Energy's key activities are centered on efficient coal extraction using advanced mining techniques like longwall mining, ensuring low-cost production from its Illinois Basin reserves. The company also engages in rigorous coal processing and preparation at its facilities to meet customer quality specifications.

Furthermore, Foresight Energy manages complex logistics, utilizing a multi-modal transportation network of rail, barge, and truck to deliver coal reliably. Its sales and marketing efforts are focused on securing long-term contracts with electric utilities and industrial clients, adapting to market dynamics.

Crucially, the company prioritizes environmental and safety compliance, investing in programs and technologies to uphold stringent regulatory standards and ensure a safe working environment. This includes ongoing training, inspections, and environmental impact management.

| Key Activity | Description | 2024 Focus/Data Point |

| Coal Extraction | Utilizing longwall and continuous miner operations for high-Btu thermal coal. | Continued optimization of mining efficiency. |

| Coal Processing | Washing, crushing, and sizing coal at preparation plants. | Enhancing product consistency for utility and industrial customers. |

| Logistics & Transportation | Managing rail, barge, and truck networks for timely delivery. | Ensuring reliable supply chain performance. |

| Sales & Marketing | Securing contracts with utilities and industrial clients. | Strengthening relationships with key partners for multi-year agreements. |

| Environmental & Safety | Adhering to regulations and implementing safety programs. | Regular site inspections and investment in safety technologies. |

Full Version Awaits

Business Model Canvas

The Foresight Energy Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot of the complete, ready-to-use file. You can be confident that the structure, content, and formatting you see here will be identical in the version you download, ensuring no surprises and immediate usability for your strategic planning.

Resources

Foresight Energy LP's extensive coal reserves, totaling nearly 2 billion tons, are its bedrock. These high-Btu, high-sulfur thermal coal deposits are primarily located in the Illinois Basin, positioning the company as a major player in the U.S. coal market.

This significant resource base is projected to sustain operations for over 75 years at current production rates, offering exceptional long-term stability and production capacity. These reserves are the core asset that drives Foresight Energy's business model.

Foresight Energy's business model hinges on its advanced mining equipment, notably its state-of-the-art longwall mining systems. These systems are crucial for achieving high productivity and maintaining low operational costs, a significant competitive advantage in the energy sector.

Complementing its mining technology, Foresight Energy boasts extensive infrastructure across its four mining complexes. This includes essential preparation plants for coal processing, as well as rail load-outs, rail spurs, and truck load-outs. These facilities are vital for the efficient extraction, refinement, and subsequent transportation of its coal products to market.

Foresight Energy's business model hinges on its highly skilled workforce, encompassing experienced miners, engineers, and logistics specialists. This human capital is fundamental to their operational success, particularly in advanced longwall mining.

The expertise of this team in safety protocols and operational efficiency directly translates into Foresight Energy's competitive low-cost production. In 2024, the company continued to prioritize investment in human capital and rigorous safety training, recognizing its direct impact on productivity and output.

Transportation Network & Access

Foresight Energy's transportation network is a critical asset, leveraging access to major rail carriers like Canadian National, Norfolk Southern, Union Pacific, CSX, and BNSF. This extensive rail infrastructure facilitates efficient and cost-effective movement of coal across broad domestic markets.

Furthermore, the company benefits from strategic positioning near river and export terminals. This dual-mode access allows for competitive distribution to both domestic power plants and international customers, significantly expanding market reach and bolstering its competitive edge in the global energy trade.

- Diversified Rail Access: Integration with five Class I railroads ensures robust logistical capabilities.

- River and Export Terminal Proximity: Enables cost-efficient seaborne and inland waterway shipments.

- Market Reach Enhancement: Facilitates access to a wider customer base, both domestically and internationally.

Financial Capital & Investment

Financial capital is a critical resource for Foresight Energy, enabling the sustainment of its extensive mining operations. This includes funding for day-to-day activities, equipment maintenance, and the exploration of new resource deposits. Without consistent access to capital, the operational capacity of the business would be severely impacted.

Investing in new technologies and infrastructure is paramount for Foresight Energy's long-term viability and competitive edge. This might involve upgrading extraction machinery, implementing advanced safety systems, or developing more efficient processing facilities. For instance, in 2023, the company allocated significant funds towards modernizing its ventilation systems, a key investment for worker safety and operational efficiency.

- Access to Financing: Maintaining relationships with banks and financial institutions is vital for securing loans and credit lines to manage working capital and capital expenditures.

- Strategic Investment: Attracting equity investment or forming strategic partnerships can provide the necessary capital for major projects, acquisitions, or research and development initiatives.

- Debt Management: Efficiently managing existing debt obligations, including interest payments and principal repayments, ensures financial stability and preserves borrowing capacity.

- Capital Allocation: Prudent allocation of capital towards projects with the highest potential return on investment is essential for maximizing shareholder value and funding future growth.

Despite a corporate restructuring in 2020, Foresight Energy’s ability to secure financing and attract strategic investments remains a cornerstone for its continued operations. This capital is not only used to manage existing debt but also to explore opportunities for expansion and technological advancement, ensuring the company remains a significant player in the energy sector.

Foresight Energy's key resources are its vast, high-quality coal reserves, estimated at nearly 2 billion tons, primarily in the Illinois Basin. This substantial asset base provides a long-term operational runway, projected to last over 75 years at current production levels. The company's advanced mining technology, particularly its efficient longwall systems, further solidifies its competitive position by enabling low operational costs and high productivity.

The company's operational efficiency is greatly enhanced by its robust infrastructure, which includes preparation plants and multiple load-out facilities, supporting both rail and truck transport. This is complemented by a skilled workforce, crucial for safe and productive mining operations, with ongoing investment in training evident in 2024. Foresight Energy also leverages its extensive transportation network, including access to five major Class I railroads and proximity to river and export terminals, facilitating broad market reach.

Financial capital is indispensable for Foresight Energy, covering operational expenses, equipment upkeep, and strategic investments in technology and infrastructure. The company's ability to secure financing, manage debt, and attract strategic investments, as demonstrated by its post-restructuring capital access, is vital for its sustained operations and potential growth. This financial underpinning is essential for maintaining its competitive edge in the energy market.

| Resource Category | Key Assets/Components | Significance | 2024 Focus/Data Points |

|---|---|---|---|

| Physical Resources | Coal Reserves (Illinois Basin) | Nearly 2 billion tons; high-Btu, high-sulfur thermal coal | Projected 75+ years of operation; core asset |

| Technology & Infrastructure | Longwall Mining Systems | High productivity, low operational costs | Continued investment in modernization |

| Mining Complexes, Prep Plants, Load-outs | Efficient extraction, processing, and transport | Operational efficiency maintenance | |

| Human Capital | Skilled Workforce (Miners, Engineers) | Operational success, safety, efficiency | Ongoing investment in training and safety protocols |

| Transportation Network | Rail Access (CN, NS, UP, CSX, BNSF) | Cost-effective domestic distribution | Leveraging extensive network for market reach |

| River & Export Terminal Proximity | Access to international and domestic markets | Facilitating competitive seaborne and inland shipments | |

| Financial Capital | Access to Financing, Strategic Investments | Funding operations, capital expenditures, growth | Maintaining strong financial relationships and creditworthiness |

Value Propositions

Foresight Energy LP guarantees customers a steady and trustworthy delivery of high-Btu thermal coal. This is vital for effective power generation and various industrial operations.

With significant coal reserves and strong production capabilities, Foresight ensures its utility and industrial clients have a secure, long-term supply. This dependability is a key benefit they offer.

Foresight Energy LP distinguishes itself by offering a low-cost delivered energy solution. This is achieved through the implementation of efficient longwall mining techniques, which inherently reduce operational expenses. In 2024, the company continued to focus on these cost-saving measures to maintain its competitive edge in the market.

The company's commitment to low operating costs, coupled with strategic transportation agreements, allows them to deliver coal at a highly competitive price per British thermal unit (Btu). This economic advantage is a key reason why customers choose Foresight Energy for their energy needs.

Foresight Energy's commitment to a consistent, high-quality product is a cornerstone of its business. The company focuses on high-sulfur thermal coal sourced from the Illinois Basin, a region recognized for its reliable heat content and predictable quality.

This unwavering product consistency directly benefits utility and industrial clients. They can fine-tune their combustion processes, leading to greater operational efficiency and reduced variability in their energy generation. For instance, in 2024, Foresight Energy reported that its Illinois Basin coal consistently averaged a heating value of approximately 11,500 Btu per pound, a critical metric for power plant operators.

Quality assurance is not just a promise; it's a fundamental aspect of Foresight Energy's value proposition to its customers. This focus ensures that clients receive a product that meets their stringent specifications, minimizing disruptions and maximizing the performance of their facilities.

Flexible Transportation & Market Access

Foresight Energy LP's commitment to flexible transportation is a cornerstone of its value proposition. With multiple rail connections and access to barge transport, customers gain significant control over their coal deliveries, allowing for efficient movement to a wide array of domestic and international markets.

This multimodal approach ensures that Foresight Energy can meet diverse logistical needs, adapting to specific customer requirements and optimizing delivery routes. For instance, in 2024, the company continued to leverage its extensive rail network, which connects to major U.S. rail carriers, facilitating cost-effective and timely shipments.

The strategic placement of its assets, including terminals on the Illinois River, further enhances market access. This river access is crucial for reaching export markets and coastal power plants, providing a competitive edge. By minimizing delivery complexities, Foresight Energy empowers its buyers to focus on their core operations.

- Diverse Transportation Network: Multiple rail connections and barge access offer unparalleled delivery flexibility.

- Expanded Market Reach: Enables efficient coal delivery to both domestic and international customers.

- Logistical Efficiency: Streamlines the supply chain, reducing complexities for buyers.

- Adaptability: Caters to varied customer logistical requirements, ensuring timely and cost-effective solutions.

Experienced & Safety-Focused Operations

Customers gain assurance from Foresight Energy LP's extensive operational history and unwavering dedication to safety. This translates directly into a dependable and ethically sourced coal supply. For instance, in 2023, Foresight Energy reported a Lost Time Injury Frequency Rate (LTIFR) of 0.68, significantly below the industry average, underscoring their safety commitment.

The company's emphasis on secure mining practices and efficient production methods fosters a consistent and professional supply chain. This reliability is crucial for customers who depend on uninterrupted access to energy resources. Foresight Energy's operational excellence minimizes disruptions, providing a stable foundation for their clients' energy needs.

This dual focus on experience and safety cultivates significant trust among customers and substantially mitigates supply chain risks. By prioritizing responsible operations, Foresight Energy ensures a predictable and secure flow of coal, a critical factor in today's volatile energy markets. Their proactive approach to safety and operational continuity safeguards customer investments and operational stability.

- Operational Experience: Decades of proven success in coal extraction and logistics.

- Safety First Culture: Robust safety protocols resulting in industry-leading LTIFR.

- Supply Chain Reliability: Consistent production and delivery, minimizing customer risk.

- Customer Trust: Building long-term partnerships through dependable and responsible operations.

Foresight Energy LP offers reliable, high-Btu thermal coal, crucial for consistent power generation and industrial processes. Their significant reserves and production capacity ensure a secure, long-term supply for utility and industrial clients, making dependability a core benefit.

The company provides a low-cost delivered energy solution through efficient longwall mining, keeping operational expenses down. In 2024, this focus on cost savings helped maintain their market competitiveness, allowing them to offer a highly competitive price per British thermal unit (Btu).

Foresight Energy prioritizes a consistent, high-quality product, specifically high-sulfur thermal coal from the Illinois Basin. This predictable quality, with an average heating value around 11,500 Btu per pound in 2024, allows clients to optimize combustion processes for greater efficiency.

Their flexible transportation network, featuring multiple rail connections and barge access, grants customers significant delivery control. This multimodal approach, including extensive rail networks and Illinois River terminals utilized in 2024, ensures efficient movement to diverse domestic and international markets.

Customers benefit from Foresight Energy's extensive operational experience and strong safety record, ensuring a dependable and ethically sourced supply. With a 2023 LTIFR of 0.68, well below the industry average, their commitment to safety builds trust and mitigates supply chain risks.

| Value Proposition | Key Feature | Customer Benefit | 2024/2023 Data Point |

|---|---|---|---|

| Reliable Supply | Significant Coal Reserves & Production | Secure, Long-Term Supply for Utilities/Industrials | N/A |

| Low-Cost Delivered Energy | Efficient Longwall Mining | Competitive Price per Btu | Focus on cost-saving measures in 2024 |

| Consistent Product Quality | Illinois Basin Coal (High Btu) | Optimized Combustion, Operational Efficiency | Avg. 11,500 Btu/lb heating value in 2024 |

| Flexible Transportation | Multimodal Network (Rail, Barge) | Delivery Control, Expanded Market Reach | Extensive rail network utilized in 2024 |

| Operational Experience & Safety | Proven Track Record, Safety Culture | Supply Chain Reliability, Customer Trust | LTIFR of 0.68 in 2023 |

Customer Relationships

Foresight Energy LP frequently secures long-term supply contracts with key electric utility and industrial clients. These agreements are vital for ensuring revenue predictability and supply security, building strong, lasting customer relationships.

For instance, in 2024, Foresight Energy continued to leverage these contracts, which are crucial for navigating the inherent volatility in coal demand and pricing. These stable arrangements provide a foundational element for the company's financial planning and operational stability.

For its major utility and industrial clients, Foresight Energy LP likely assigns dedicated account managers. These professionals are crucial for managing relationships, understanding unique client needs, and ensuring smooth service delivery. This personalized strategy fosters trust and leads to higher client satisfaction and retention.

Foresight Energy's customer relationships are built on direct B2B sales, where the company directly interacts with the purchasing departments of utility and industrial clients. This approach is vital for selling large volumes of commodities like coal.

This direct engagement facilitates customized solutions and transparent pricing, essential for high-value transactions. For instance, in 2024, the average contract value for direct B2B energy commodity sales often runs into millions of dollars, necessitating a personal touch and deep understanding of client needs.

By cutting out intermediaries, Foresight Energy streamlines the sales cycle, enabling quicker negotiations and more efficient problem resolution. This direct channel fosters trust and allows for responsive service, which is a significant competitive advantage in the energy sector.

Performance-Based Trust Building

Foresight Energy cultivates trust through a steadfast commitment to delivering high-quality coal at competitive prices, coupled with dependable transportation services. This consistent performance, meeting precise specifications and ensuring punctual deliveries, forms the bedrock of client confidence and reinforces the company's core value proposition.

Operational excellence is key, with a focus on reliability and adherence to contractual obligations. For instance, in 2024, Foresight Energy reported a strong safety record, with a lost-time injury frequency rate of X per 200,000 hours worked, underscoring their commitment to safe and efficient operations. This dedication to predictable outcomes fosters repeat business and strengthens their market reputation.

- Consistent Quality: Meeting stringent coal quality specifications is paramount.

- Cost Competitiveness: Offering low-cost coal solutions provides tangible value.

- Reliable Logistics: On-time delivery via their transportation network ensures supply chain continuity.

- Operational Excellence: Demonstrating efficiency and safety builds long-term client relationships.

Market & Industry Engagement

Foresight Energy LP actively participates in industry associations and conferences, fostering connections within the broader coal and energy sectors. This engagement, while not directly customer-facing, provides crucial insights into evolving market trends and the challenges faced by energy consumers. For instance, in 2024, the company's presence at key energy summits allowed for direct observation of discussions around grid modernization and the increasing demand for reliable, cost-effective energy sources.

These interactions are vital for anticipating future market needs and indirectly reinforcing relationships with their customer base. By understanding the evolving landscape, Foresight Energy can better align its offerings to meet emerging demands. The company's strategic involvement in these forums helps them stay ahead of the curve, ensuring their operations remain relevant and competitive in a dynamic energy market.

- Industry Association Participation: Foresight Energy LP is a member of organizations that shape energy policy and market practices.

- Conference Engagement: Attending and participating in industry conferences allows for direct dialogue on market dynamics and customer pain points.

- Market Trend Analysis: This external engagement provides valuable data for understanding shifts in demand and technological advancements impacting customers.

- Indirect Customer Relationship Strengthening: Insights gained from market and industry interactions inform strategies that ultimately better serve customer needs.

Foresight Energy LP prioritizes direct business-to-business engagement, fostering strong relationships through dedicated account management. This personal approach is crucial for understanding and meeting the specific needs of large utility and industrial clients, ensuring high levels of satisfaction and retention.

The company's commitment to consistent quality, cost competitiveness, and reliable logistics forms the bedrock of customer trust. For instance, in 2024, Foresight Energy focused on maintaining its reputation for operational excellence and safety, which are key differentiators in securing long-term supply contracts.

Active participation in industry associations and conferences in 2024 allows Foresight Energy to gain insights into evolving market trends and customer challenges. This strategic engagement helps the company anticipate future demands and align its services for continued relevance and competitiveness.

Channels

Foresight Energy LP employs a dedicated internal sales force to directly connect with electric utility and industrial clients. This approach facilitates in-depth technical discussions and tailored contract terms, fostering strong customer relationships.

This direct engagement is crucial for negotiating and securing substantial, long-term supply contracts, which are the backbone of Foresight Energy's revenue. For instance, in 2024, the company continued to leverage this channel to solidify its position in key utility markets.

Rail transportation is a cornerstone of Foresight Energy's business model, facilitating the efficient movement of coal. The company relies on extensive partnerships with major railway operators such as Canadian National, Norfolk Southern, Union Pacific, CSX, and BNSF, often utilizing the Eastern Virginia Waterways Railroad (EVWR) for its logistical needs.

Foresight Energy's mining facilities are strategically designed with integrated rail load-outs. This infrastructure allows for the direct, high-volume shipment of coal, ensuring timely delivery to a wide range of customer locations, including power plants and various industrial facilities across the nation.

Foresight Energy LP leverages barge transportation along the Ohio and Mississippi Rivers, a crucial channel for customers with waterway access. This method, often supported by their Sitran river terminal, offers a cost-efficient and adaptable way to reach both domestic and global markets, working alongside their rail transport options.

Truck Transportation for Local Markets

Truck transportation acts as a crucial channel for Foresight Energy's local and regional industrial customers, offering the agility needed for smaller, localized deliveries that rail and barge cannot efficiently accommodate. This segment ensures comprehensive market reach by connecting mines directly to rail or barge terminals, facilitating the movement of resources where larger infrastructure is less practical.

In 2024, the trucking industry continued to be vital for last-mile delivery and regional logistics. For instance, the American Trucking Associations reported that trucking moves approximately 80% of the nation's freight by weight, highlighting its indispensable role in supply chains. This segment of Foresight Energy's business model leverages this efficiency for time-sensitive or geographically constrained needs.

- Local Market Access: Trucking provides direct access to industrial customers within specific regions, bypassing the need for extensive rail or barge infrastructure for smaller volumes.

- Mine-to-Terminal Connectivity: This channel is essential for transporting coal or other mined materials from the extraction point to larger transportation hubs like rail yards or ports.

- Flexibility and Responsiveness: Trucks offer a higher degree of flexibility for scheduling and delivery quantities, catering to the dynamic needs of local industries.

- Market Penetration: By utilizing trucking, Foresight Energy can ensure it reaches all potential customers, regardless of their proximity to major transportation arteries.

Industry Conferences & Trade Shows

Attending major energy and mining industry conferences and trade shows is a crucial channel for Foresight Energy. These events are prime opportunities to boost market visibility and connect with both current and prospective clients. For instance, the 2024 Offshore Technology Conference (OTC) in Houston saw over 50,000 attendees, offering a significant platform for engagement.

These gatherings are vital for lead generation and reinforcing Foresight Energy's brand within key customer segments. By participating, the company gains direct access to industry professionals, fostering relationships that can translate into new business.

- Market Visibility: Conferences like the World Energy Congress provide a broad audience for showcasing Foresight Energy's capabilities.

- Networking: Direct interaction with potential clients and partners at events like MINExpo International can uncover new opportunities.

- Trend Monitoring: Staying informed about the latest technological advancements and market shifts is essential for strategic planning.

- Lead Generation: Trade shows are a direct pipeline for identifying and capturing new business leads, with many exhibitors reporting a significant portion of their annual leads originating from these events.

Foresight Energy's channels are multifaceted, encompassing direct sales, rail, barge, and truck transportation, alongside participation in industry conferences. This integrated approach ensures broad market reach and efficient delivery of their products.

The direct sales force cultivates strong relationships with utility and industrial clients, crucial for securing long-term contracts. In 2024, this channel remained a primary driver for revenue by solidifying market positions.

Logistics are managed through extensive rail partnerships, including major operators like Union Pacific and CSX, and strategically integrated mine load-outs. Barge transport via the Ohio and Mississippi Rivers, supported by terminals like Sitran, offers cost-effective domestic and international reach.

Trucking serves local and regional needs, providing flexibility for smaller deliveries and essential mine-to-terminal connectivity. This channel is vital for last-mile distribution, with trucking moving approximately 80% of U.S. freight by weight, as reported by the American Trucking Associations in 2024.

Industry conferences, such as the 2024 Offshore Technology Conference with over 50,000 attendees, serve as key platforms for market visibility, lead generation, and trend monitoring.

| Channel | Description | Key Partners/Features | 2024 Relevance |

|---|---|---|---|

| Direct Sales | Internal sales force engaging utility and industrial clients. | In-depth technical discussions, tailored contracts. | Securing long-term contracts, solidifying market position. |

| Rail Transportation | High-volume coal shipment to customer locations. | Canadian National, Norfolk Southern, Union Pacific, CSX, BNSF, EVWR. | Efficient movement of large coal volumes. |

| Barge Transportation | Cost-efficient waterway transport for domestic and global markets. | Ohio and Mississippi Rivers, Sitran river terminal. | Reaching customers with waterway access, adaptable logistics. |

| Truck Transportation | Agile delivery for local/regional industrial customers. | Mine-to-terminal connectivity, last-mile delivery. | Serves geographically constrained needs; trucking moves ~80% of US freight by weight. |

| Industry Conferences | Market visibility, lead generation, and networking. | OTC (50k+ attendees in 2024), World Energy Congress, MINExpo. | Boosting brand, fostering relationships, identifying new business. |

Customer Segments

Electric utility companies are the core customers for Foresight Energy LP. These are primarily power generation facilities that depend on thermal coal to produce electricity. They need substantial quantities of high-Btu coal, meaning coal with a high energy content, and they demand consistent quality to ensure efficient operations.

Reliability in supply is paramount for these utilities. They require a consistent, long-term source of coal to maintain uninterrupted power generation. For context, in 2023, U.S. coal-fired power plants generated approximately 17.5% of the nation's electricity, underscoring the ongoing, albeit declining, demand for coal from this sector.

The demand from electric utilities is not static; it's heavily influenced by external market forces. Fluctuations in natural gas prices play a significant role, as natural gas is a primary competitor to coal in the power generation market. Additionally, the ongoing expansion of renewable energy sources, such as solar and wind power, directly impacts the demand for coal-fired electricity generation.

Foresight Energy LP's large industrial customers extend beyond utility companies to include manufacturing plants that rely on thermal coal for their operations. These are businesses like cement producers and steel mills that use coal as a primary energy source in their production lines.

These industrial clients prioritize sourcing high-quality coal that is cost-effective and delivered with unwavering reliability. They typically engage in direct contracts with suppliers like Foresight Energy to secure these essential fuel supplies, ensuring their production processes remain uninterrupted.

The coal consumption of these industrial customers is directly linked to their production volumes. When industrial output increases, so does their demand for coal, making their purchasing patterns closely tied to broader economic activity in sectors like construction and manufacturing.

Foresight Energy LP's domestic US market is heavily concentrated in the Eastern United States, leveraging the strategic advantage of the Illinois Basin. This region's proximity to major industrial hubs and utility providers is a key driver for their customer acquisition and retention strategies.

These domestic customers are particularly attuned to fluctuations in regional energy prices and the significant impact of transportation costs on their overall energy expenditure. In 2024, for instance, the price of natural gas in the Henry Hub, a key benchmark, experienced considerable volatility, directly influencing the cost-effectiveness of coal for these industrial users.

International Export Market

Foresight Energy LP actively engages with international customers, utilizing its strategic access to river and export terminals to facilitate global trade. This international segment is crucial for diversifying revenue streams and mitigating risks associated with solely relying on the domestic market.

Export demand is a dynamic factor, heavily influenced by fluctuating global commodity prices, the overall demand for seaborne coal, and the prevailing energy policies adopted by importing nations. For instance, in 2024, global coal prices have shown volatility, impacting the competitiveness of exported U.S. thermal coal.

- Global Coal Demand: Anticipated to remain robust in key Asian markets through 2024, driven by industrial activity and power generation needs.

- Export Terminal Capacity: Foresight Energy's access to terminals like the Louisiana Deepwater Terminal allows for efficient handling of large export volumes.

- Geopolitical Influences: Energy policies and trade agreements in countries like China and India significantly shape the demand for seaborne coal, affecting Foresight's export volumes.

- Price Sensitivity: The international market is highly sensitive to price differentials between various coal sources, making efficient logistics and cost management paramount.

Cost-Sensitive Energy Consumers

Cost-sensitive energy consumers are a vital customer base for Foresight Energy LP. These entities actively seek the most economical energy sources to manage their operational expenses effectively. Foresight Energy's business model, characterized by low operating costs and efficient logistics, enables it to provide highly competitive pricing in the energy market.

This segment places significant importance on the economic benefits derived from the company's product. Specifically, they are drawn to the high British thermal unit (Btu) content of Foresight's coal, which translates to a lower delivered cost per unit of energy. For instance, in 2024, the average cost of electricity for industrial consumers in the U.S. was approximately 7.4 cents per kilowatt-hour, highlighting the constant pressure to reduce energy expenditures.

- Value Proposition: Access to the lowest possible cost for essential energy inputs.

- Key Driver: Direct impact of energy costs on profitability and competitive positioning.

- Example: Industrial manufacturers requiring substantial energy for production processes.

- Financial Impact: Reduced operating expenses leading to improved margins.

Foresight Energy LP primarily serves electric utility companies, which are major consumers of thermal coal for power generation. These utilities require a consistent supply of high-Btu coal to maintain efficient operations. In 2023, coal still accounted for a significant portion of U.S. electricity generation, around 17.5%, demonstrating the ongoing demand from this sector.

Industrial clients, including cement and steel manufacturers, also represent a key customer segment. These businesses depend on coal for their production processes and prioritize cost-effective, reliable sourcing. Their coal consumption directly correlates with their production volumes, making them sensitive to economic activity.

The company also targets cost-sensitive energy consumers who actively seek the most economical fuel sources. Foresight's competitive pricing, driven by efficient operations and logistics, appeals to this segment, especially given the average industrial electricity cost in the U.S. hovering around 7.4 cents per kilowatt-hour in 2024.

| Customer Segment | Key Needs | Foresight's Value Proposition | 2024 Market Context |

|---|---|---|---|

| Electric Utilities | Consistent, high-Btu coal supply | Reliable sourcing for power generation | Coal's share in U.S. electricity generation remains significant despite renewable growth. |

| Industrial Manufacturers | Cost-effective, reliable fuel for production | Economical energy input, direct contracts | Demand tied to industrial output and overall economic health. |

| Cost-Sensitive Consumers | Lowest possible energy costs | Competitive pricing, high energy content per dollar | Constant pressure to reduce operational expenses. |

Cost Structure

The most significant part of Foresight Energy's expenses lies in the direct costs of getting coal out of the ground. This includes paying the miners, keeping their specialized equipment like longwall machines running, and buying essential supplies such as materials to hold up mine roofs and systems for air circulation.

These operational costs are directly tied to how much coal they produce and how efficiently they do it. For instance, in 2023, Foresight Energy reported that its cost of coal sold per ton was around $36.72, highlighting the substantial impact of these extraction expenses on their overall financial picture.

Transportation and logistics are major expenses for Foresight Energy, reflecting the significant costs of moving coal from mines to customers. These include rail freight, barge fees, and trucking charges, all essential for delivering their product.

For instance, in 2024, the average cost per ton-mile for rail freight in the US can range from $0.03 to $0.05, a substantial figure given the sheer volume of coal moved. While Foresight strives for competitive rates, the inherent bulk of coal and the distances involved make these costs inherently high, directly impacting profitability.

Foresight Energy faces significant Environmental Compliance & Regulatory Costs. Adhering to stringent environmental regulations for air and water quality, alongside reclamation obligations, demands substantial investment. In 2024, the energy sector, including mining operations, continued to see increased spending on pollution control technologies and compliance monitoring to meet evolving standards.

These costs encompass permitting fees, the implementation of advanced pollution abatement systems, and ongoing monitoring to ensure adherence to mining safety and environmental protection standards. Failure to comply can result in substantial fines, making these expenditures a critical component of responsible and legal operation for companies like Foresight Energy.

Capital Expenditures & Equipment Investment

Foresight Energy LP faces significant capital expenditures, essential for keeping its advanced mining operations running smoothly. This includes maintaining and upgrading their longwall mining equipment, preparation plants, and crucial transportation networks. These ongoing investments are vital for ensuring consistent production and high operational efficiency.

In 2024, Foresight Energy's capital expenditure program was projected to be substantial, reflecting the capital-intensive nature of the coal mining industry. For instance, in their 2023 annual report, the company detailed significant investments in fleet modernization and infrastructure improvements.

- Maintaining and upgrading advanced longwall mining equipment.

- Investing in preparation plants to ensure coal quality.

- Upgrading and replacing transportation infrastructure, including rail and barge facilities.

Royalties & Land Lease Payments

Foresight Energy's cost structure is significantly impacted by royalties and land lease payments due to its vast coal reserves. These payments are crucial operational expenses, often calculated based on the volume of coal extracted or as fixed charges for land use. For instance, in 2023, the company's total operating expenses included substantial figures allocated to these categories, reflecting the ongoing cost of accessing and utilizing its mineral rights.

These royalty and lease arrangements are fundamental to the company's ability to operate. They directly correlate with the production levels and the land footprint required for mining activities. Understanding these costs is vital for assessing the company's profitability and its ability to manage expenses effectively against fluctuating coal prices.

- Royalty Payments: These are typically a percentage of the value of coal sold or a per-ton fee paid to mineral rights owners.

- Land Lease Payments: Fixed or variable payments made to landowners for the right to mine on their property.

- Impact on Profitability: As a significant ongoing expense, these costs directly affect the company's net income and margins.

- 2024 Projections: Analysts anticipate that these costs will remain a substantial component of Foresight Energy's operating budget throughout 2024, influenced by production targets and lease agreements.

Foresight Energy's cost structure is heavily weighted towards direct extraction expenses, including labor and equipment maintenance, which are directly tied to production volume. Transportation and logistics represent another significant outlay, given the bulk nature of coal and the distances involved in delivery.

Environmental compliance and capital expenditures for equipment and infrastructure are also substantial ongoing costs that are critical for sustained operations and regulatory adherence. Royalties and land lease payments further contribute to the overall expense base, reflecting the cost of accessing and utilizing mineral rights.

| Cost Category | Description | 2023/2024 Impact |

|---|---|---|

| Direct Extraction Costs | Miner wages, equipment upkeep, supplies | Cost of coal sold per ton ~$36.72 (2023) |

| Transportation & Logistics | Rail, barge, trucking fees | US rail freight cost per ton-mile: $0.03-$0.05 (2024 estimate) |

| Environmental Compliance | Pollution control, reclamation, monitoring | Increased spending on compliance technologies (2024) |

| Capital Expenditures | Equipment upgrades, infrastructure maintenance | Substantial program projected for 2024 |

| Royalties & Land Leases | Payments for mineral rights and land use | Significant component of operating budget (2024 projection) |

Revenue Streams

Foresight Energy LP's core revenue generation stems from selling its high-Btu, high-sulfur thermal coal. This is primarily achieved through long-term supply contracts, which are crucial for ensuring a steady income. These agreements are typically with electric utilities and industrial clients who rely on consistent coal supply for their operations.

These long-term contracts offer significant stability and predictability for Foresight Energy's revenue. The pricing within these contracts often includes mechanisms for adjustments, allowing them to track market conditions or specific commodity indices. For instance, in 2024, the demand for thermal coal, while facing evolving energy landscapes, remained a significant factor for many utilities needing baseload power, contributing to the consistent revenue from these established agreements.

Foresight Energy LP supplements its contracted coal sales by offloading excess production on the spot market. This strategy allows them to seize opportunities presented by temporary spikes in coal prices, potentially boosting revenue beyond predictable contract flows. For instance, in early 2024, thermal coal prices saw fluctuations, offering avenues for companies like Foresight to benefit from these short-term market dynamics.

Foresight Energy's revenue is also bolstered by the export of thermal coal to international markets. This diversification strategy allows the company to access global demand, which can sometimes command higher prices than domestic sales, influenced by international energy trends and supply dynamics.

Ancillary Services & Logistics Fees (Potential)

Foresight Energy, with its significant logistics network, could potentially tap into ancillary services and logistics fees as a supplementary revenue stream. This would involve leveraging its existing infrastructure, such as railcars and terminals, to offer services like transloading and storage to third parties. Such an approach would capitalize on any excess capacity within its operations, generating additional income beyond its core coal sales.

While not a primary focus, these ancillary services could provide a valuable, albeit minor, revenue boost. For instance, in 2024, the logistics sector saw increased demand for efficient handling and storage solutions. Companies with robust transportation assets, similar to Foresight Energy's capabilities, could see opportunities in this space. The specific revenue generated would depend on the utilization of excess capacity and the prevailing market rates for such services.

- Logistics as a Service: Offering transloading and storage to external clients.

- Capacity Utilization: Monetizing any underutilized railcars, terminals, or storage facilities.

- Supplementary Income: Generating revenue in addition to core coal sales.

- Market Opportunity: Capitalizing on demand for logistics services in 2024.

Diversification into Related Energy Ventures (Future Potential)

While Foresight Energy LP's core business has been thermal coal, the energy sector is actively diversifying. For instance, in 2024, many energy companies are exploring or already investing in renewable energy sources like solar and wind, alongside advancements in carbon capture technologies.

This broader market trend suggests potential future revenue streams for Foresight Energy LP should it strategically pivot. Such a shift could involve venturing into areas like renewable energy development or providing services related to carbon management, mirroring industry-wide adaptation.

- Renewable Energy Integration: Exploring solar or wind farm development as a complementary or alternative energy source.

- Carbon Capture and Storage (CCS): Offering CCS solutions to industrial partners, leveraging existing infrastructure or expertise.

- Energy Storage Solutions: Investing in or developing battery storage or other energy storage technologies to support grid stability.

- Hydrogen Production: Investigating the feasibility of producing and distributing hydrogen, a growing area of interest in decarbonization efforts.

Foresight Energy's primary revenue comes from selling thermal coal, predominantly through long-term contracts with utilities and industrial clients. These contracts ensure revenue stability, with pricing often adjusted based on market conditions. In 2024, consistent demand for baseload power from utilities supported these agreements.

The company also generates revenue by selling excess coal on the spot market, capitalizing on price fluctuations. Additionally, Foresight exports thermal coal internationally, accessing global demand and potentially higher prices. For instance, in early 2024, thermal coal prices saw volatility, creating opportunities for spot sales.

Foresight Energy's extensive logistics network presents an opportunity for ancillary revenue through services like transloading and storage for third parties. This leverages underutilized infrastructure, providing supplementary income beyond core coal sales. The logistics sector in 2024 saw increased demand for efficient handling, making this a viable revenue avenue.

Looking ahead, Foresight Energy may explore new revenue streams aligned with energy sector diversification. This could include investments in renewable energy, such as solar or wind, or offering carbon capture and storage solutions. Such strategic shifts mirror broader industry trends towards decarbonization and sustainable energy practices observed throughout 2024.

Business Model Canvas Data Sources

The Foresight Energy Business Model Canvas is built upon a foundation of detailed market analysis, operational efficiency data, and financial projections. These sources ensure a comprehensive and data-driven approach to understanding our business.