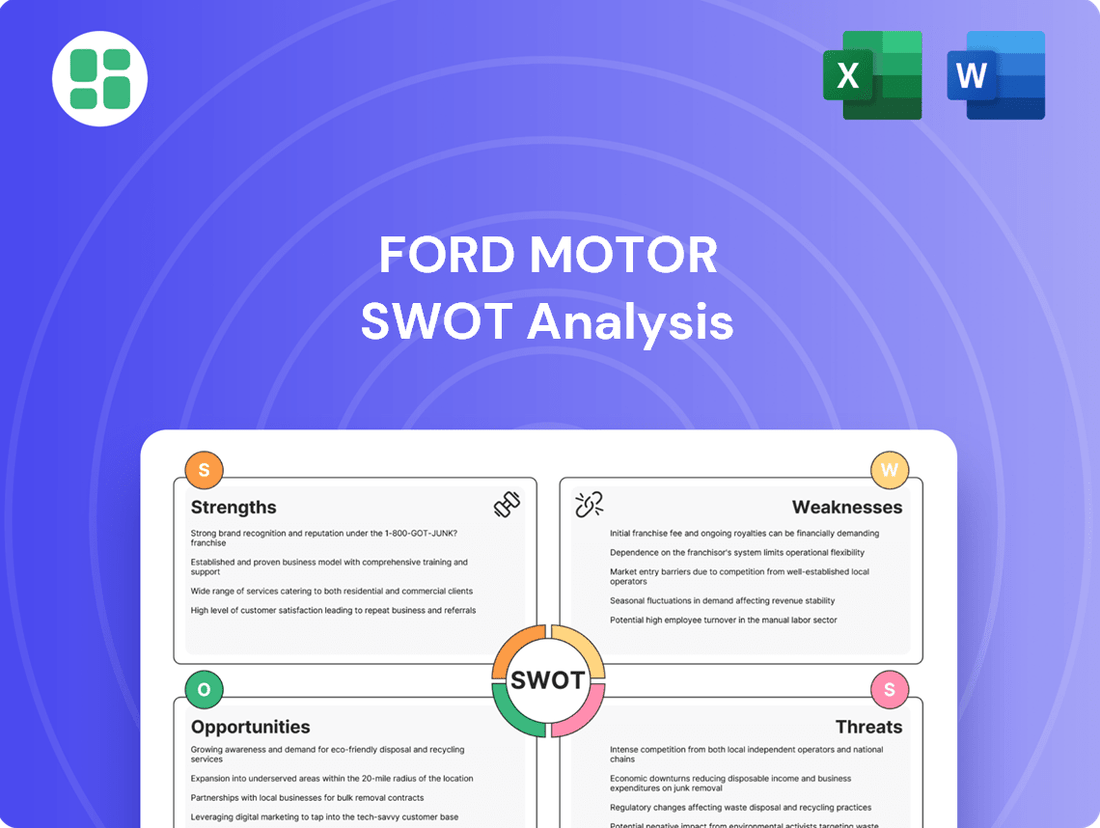

Ford Motor SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Motor Bundle

Ford Motor stands at a pivotal moment, navigating the automotive industry's seismic shift towards electrification and advanced technology. Our analysis reveals their robust brand recognition and manufacturing prowess as key strengths, but also highlights the significant challenges posed by intense competition and the costly transition to EVs.

Want the full story behind Ford's strategic positioning, the opportunities in emerging markets, and the potential threats from new entrants? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Ford's brand recognition is a significant strength, built on over a century of automotive history. This heritage, deeply tied to American manufacturing and reliability, resonates globally. In 2023, Ford reported a revenue of $176.1 billion, demonstrating the enduring market presence that its strong brand allows.

Ford boasts a remarkably diverse product portfolio, encompassing everything from its iconic F-Series trucks, which consistently lead sales in North America, to a wide array of SUVs, commercial vans, and the prestigious Lincoln luxury line. This broad offering ensures Ford can appeal to a vast spectrum of consumers and business needs.

This strategic diversification significantly mitigates the company's dependence on any single vehicle segment. For instance, while trucks are a major revenue driver, strong performance in SUVs and commercial vehicles provides a crucial buffer during economic downturns or shifts in consumer preferences, as seen in the ongoing demand for utility vehicles in 2024.

By catering to different market segments, from work trucks to family SUVs and premium sedans, Ford builds inherent resilience into its business model. This ability to serve varied customer needs allows the company to better navigate and adapt to the dynamic nature of the automotive market, a key advantage as the industry evolves towards electrification and new mobility solutions.

Ford boasts an extensive global manufacturing and distribution network, a significant strength that underpins its operational capabilities. This vast infrastructure includes numerous production facilities strategically located across continents and a widespread network of dealerships. In 2023, Ford operated 15 major manufacturing facilities in North America alone, contributing to its substantial production output.

This global footprint allows Ford to achieve economies of scale in production and sourcing, thereby reducing per-unit costs. Furthermore, it facilitates efficient logistics and enables localized manufacturing to cater to specific regional market demands and regulatory environments. For instance, Ford's investment in its BlueOval City complex in Tennessee, a $5.6 billion project, highlights its commitment to expanding and modernizing its manufacturing capabilities for future vehicle production.

Significant Presence in Commercial Vehicle Market

Ford commands a substantial share of the commercial vehicle market, a strength amplified by its iconic Transit vans and F-Series trucks. These vehicles are indispensable to businesses and fleet operators, contributing significantly to Ford's revenue. The dedicated Ford Pro division is a testament to this focus, delivering consistent and profitable income with impressive mid-teen profit margins.

This robust commercial segment fosters deep customer relationships, creating fertile ground for expanding into lucrative areas like connected services and software subscriptions. For instance, Ford Pro's software and services revenue is projected to grow substantially, building on the loyalty established by its dependable vehicle offerings. This strategic advantage positions Ford favorably for sustained growth and increased profitability in the commercial sector.

- Dominant Commercial Vehicle Portfolio: Ford's Transit and F-Series are staples in the commercial sector, ensuring consistent demand.

- Ford Pro Profitability: The commercial division, Ford Pro, consistently achieves mid-teen profit margins, highlighting its financial strength.

- Recurring Revenue Streams: The commercial segment provides stable and predictable revenue, bolstered by opportunities in services and software.

- Strong Customer Relationships: Deep ties with commercial clients facilitate cross-selling and upselling of new offerings.

Ford Motor Credit Company (Financial Services Arm)

Ford Motor Credit Company (FMCC) is a significant strength, acting as Ford's captive finance arm. It directly fuels vehicle sales by offering essential financing and leasing options to both dealerships and retail customers of Ford and Lincoln brands. This captive nature provides a distinct competitive advantage, enabling flexible financial solutions that can drive demand.

FMCC is a substantial revenue generator for the parent company. In the first half of 2025, Ford Credit reported a notable increase in earnings before taxes, demonstrating its robust financial performance and positive contribution to Ford's overall profitability. This financial services segment is crucial for smoothing out sales cycles and supporting the broader automotive business.

- Facilitates Sales: Provides vital financing and leasing for Ford and Lincoln vehicles.

- Revenue Generation: Contributes significantly to Ford's overall earnings.

- Competitive Edge: Offers flexible financial solutions, enhancing customer appeal.

- Profitability Driver: Reported increased earnings before taxes in Q1 and Q2 2025.

Ford's extensive global manufacturing and distribution network is a key strength, enabling efficient production and market reach. This vast infrastructure, including numerous production facilities worldwide, allows for economies of scale and localized adaptation to market needs. For example, Ford's significant investment in its BlueOval City complex in Tennessee, a $5.6 billion project, underscores its commitment to enhancing these capabilities for future vehicle production.

| Manufacturing Footprint | Key Initiatives | Impact |

| Global Facilities | BlueOval City (Tennessee) | Economies of Scale, Localized Production |

| North American Operations | Investment in EV Production | Cost Reduction, Market Responsiveness |

| Supply Chain Integration | Strategic Partnerships | Operational Efficiency, Innovation |

What is included in the product

Delivers a strategic overview of Ford Motor’s internal and external business factors, highlighting its established brand, manufacturing prowess, and the challenges of transitioning to EVs and navigating global economic shifts.

Offers a clear, actionable framework to identify and address Ford's competitive challenges and internal weaknesses.

Weaknesses

Ford is pouring billions into its electric vehicle (EV) transition, a necessary but risky move. The company reported a $4.7 billion loss in its Model e division for 2023, highlighting the current unprofitability of this ambitious shift. While the long-term potential is there, the immediate financial strain and uncertain market acceptance of EVs represent a significant weakness.

This massive investment in EV development and manufacturing, estimated to be over $50 billion through 2026, could strain Ford's financial flexibility if the market adoption of EVs proves slower than projected or if profitability targets aren't met. The company has already recalibrated its EV strategy, scaling back some production targets to prioritize profitability over sheer volume, a testament to the challenges in this evolving sector.

Ford's continued reliance on traditional internal combustion engine (ICE) vehicle sales, particularly its highly profitable truck and SUV segments, presents a significant weakness. Despite substantial investments in electric vehicles (EVs), a large percentage of Ford's current revenue and profit still originates from these gasoline-powered models. This dependency makes the company vulnerable to shifts in consumer preferences away from ICE vehicles, increasingly stringent environmental regulations globally, and volatility in fuel prices. For instance, while the Ford Blue division, which houses the ICE business, remained profitable through much of 2023 and early 2024, some reports indicated a dip in its earnings in certain recent quarters, highlighting the inherent risks in this traditional revenue stream.

The electric vehicle (EV) and autonomous vehicle (AV) sectors are incredibly crowded. Ford is up against established giants like General Motors and Volkswagen, alongside nimble disruptors such as Tesla, Rivian, and numerous Chinese manufacturers like BYD, all aggressively pursuing market dominance. This fierce competition makes it difficult for Ford to stand out and requires continuous innovation in battery technology, software, and charging infrastructure to keep pace.

Ford's ability to differentiate its EV and AV products is a significant hurdle. Competitors are pushing boundaries with longer ranges, faster charging, and advanced self-driving capabilities, often at competitive price points. For instance, Tesla's Supercharger network and its Autopilot system have set high benchmarks. Ford must constantly invest heavily in R&D to match or exceed these advancements, which can strain resources and impact profitability.

The pressure from these rivals directly impacts Ford's margins and its strategic positioning in these crucial future markets. As of Q1 2024, Ford reported its EV division, Ford Model e, incurred a loss of $1.3 billion, highlighting the cost of competing. This intense rivalry means Ford must carefully balance investment in new technologies with the need to achieve profitability, a delicate act in a rapidly evolving automotive landscape.

Product Recalls and Quality Issues

Ford has experienced significant financial strain and reputational damage from numerous product recalls and escalating warranty expenses. The company has consistently ranked high in U.S. industry recalls over recent years, leading to substantial costs. For instance, in 2023, Ford issued several major recalls impacting hundreds of thousands of vehicles, contributing to increased warranty reserves.

These quality concerns directly affect Ford's bottom line and customer loyalty. Effectively tackling these persistent quality problems and their associated financial burdens is paramount for enhancing profitability and rebuilding customer trust.

- Leading Recalls: Ford has frequently topped U.S. industry recall lists, incurring significant associated costs.

- Financial Impact: Rising warranty claims directly reduce profit margins and impact financial performance.

- Reputational Damage: Frequent recalls can erode consumer confidence and harm brand image.

- Operational Focus: Addressing quality issues is a critical operational challenge for improving profitability.

Supply Chain Vulnerabilities and Tariffs

Ford's extensive reliance on a global supply chain, particularly for critical components like semiconductors, has led to significant production disruptions. The company faced notable impacts from these shortages throughout 2024, affecting vehicle output and delivery schedules.

The deeply integrated international sourcing model leaves Ford susceptible to fluctuations in trade policies and geopolitical instability. Tariffs, in particular, pose a substantial risk, with projections indicating a significant negative impact on Ford's Earnings Before Interest and Taxes (EBIT) in 2025.

- Global Supply Chain Dependence: Ford's production is heavily influenced by international sourcing, creating vulnerabilities to disruptions.

- Semiconductor Shortages: The company has experienced production halts due to ongoing semiconductor availability issues.

- Tariff Impact: Tariffs are expected to negatively affect Ford's EBIT by an estimated $1 billion in 2025.

- Geopolitical Risks: Trade policy changes and international events can directly impact Ford's operational efficiency and costs.

Ford's substantial investment in its electric vehicle (EV) transition, while strategic, presents a significant financial weakness. The company reported a substantial $4.7 billion loss in its Model e division for 2023, underscoring the current unprofitability of this ambitious shift. This heavy expenditure, projected to exceed $50 billion through 2026, could strain financial resources if EV market adoption lags or profitability targets aren't met, as evidenced by Ford's recent recalibration of production targets to prioritize profitability.

Ford's continued reliance on profitable internal combustion engine (ICE) vehicles is a double-edged sword, making it vulnerable to evolving consumer preferences and stricter environmental regulations. While the ICE segment, Ford Blue, remained a profit driver through much of 2023 and early 2024, any significant downturn in this segment could severely impact overall financial health. This dependency means Ford must navigate a delicate balance between investing in the future of EVs and maintaining the profitability of its current core business.

Ford faces intense competition in the rapidly growing EV and autonomous vehicle (AV) markets, challenging its ability to differentiate its offerings. Competitors are pushing advancements in battery technology, range, and charging infrastructure, often at competitive price points. For instance, Tesla's established Supercharger network and its Autopilot system set high benchmarks that Ford must continually strive to match or surpass, requiring significant and ongoing R&D investment that can impact margins.

The company's ongoing struggles with product quality and associated recalls represent a persistent weakness. Ford has frequently been among the leaders in U.S. industry recalls, incurring substantial costs and potential damage to its brand reputation. For example, numerous significant recalls in 2023 alone led to increased warranty reserves, directly impacting profitability and the crucial task of rebuilding consumer trust.

| Weakness Category | Description | Financial Impact (Illustrative) | Competitive Context |

| EV Transition Costs | Significant losses in the Model e division; heavy investment required. | $4.7 billion loss in Model e (2023); $50+ billion investment planned through 2026. | Competitors like Tesla are more established in profitable EV markets. |

| ICE Dependency | Reliance on profitable gasoline vehicles makes it vulnerable to market shifts. | Potential margin compression if ICE sales decline significantly. | Increasing regulatory pressure and consumer interest in EVs. |

| Competitive Landscape | Difficulty differentiating EV/AV products against established and new players. | $1.3 billion loss in Model e (Q1 2024) reflects competitive R&D costs. | Tesla's charging network and advanced driver-assistance systems set high standards. |

| Product Quality & Recalls | Frequent recalls lead to high warranty expenses and reputational damage. | Increased warranty reserves impacting profitability; potential loss of customer loyalty. | Consistent high ranking in industry recall data erodes consumer confidence. |

Preview Before You Purchase

Ford Motor SWOT Analysis

The preview you see is the same document the customer will receive after purchasing, offering a transparent look at the Ford Motor SWOT analysis. This ensures you know exactly what you're getting—a comprehensive and professionally structured report. Purchase unlocks the entire in-depth version, ready for your strategic planning.

Opportunities

The global electric vehicle (EV) market is experiencing a surge in demand, fueled by growing environmental awareness, supportive government policies, and ongoing innovation. This presents a significant opportunity for Ford to expand its presence and secure a substantial market share.

By broadening its EV offerings and prioritizing accessible, mass-market models, Ford can capitalize on this expanding sector. For instance, Ford's Mustang Mach-E saw a notable increase in sales, contributing to its overall EV strategy.

Ford is actively optimizing its battery supply chain and manufacturing processes to reduce costs and ensure eligibility for crucial government incentives, a move that will be vital for competitive pricing in the 2024-2025 period.

Ford is well-positioned to capitalize on the growing connected vehicle market, offering a significant opportunity for recurring revenue. This includes subscription services for advanced in-car features, seamless over-the-air software updates, and valuable data-driven insights for drivers. These connected services can transform the ownership experience, fostering deeper customer engagement.

The company's commercial division, Ford Pro, is already demonstrating the financial viability of this strategy. In the first quarter of 2024, Ford Pro reported a substantial adjusted EBIT of $1.0 billion, with software and services contributing significantly to this performance. This success highlights the potential for broader application across Ford's entire vehicle lineup.

By developing a robust and integrated software platform, Ford can cultivate enhanced customer loyalty and unlock entirely new, high-margin revenue streams. This strategic focus on software monetization not only diversifies income but also strengthens the company's competitive advantage in an increasingly digital automotive landscape.

Ford's significant investment in autonomous driving technology, including its Argo AI partnership (though later dissolved, the foundational research remains), presents a substantial long-term growth avenue. This focus could unlock new revenue streams through services like autonomous ride-hailing and delivery, reshaping urban mobility.

The company's ongoing development of AI and machine learning for self-driving systems aims to enhance vehicle safety and efficiency. Innovations like BlueCruise, Ford's hands-free highway driving assist, and advancements in Vehicle-to-Everything (V2X) communication are critical components of this strategy, positioning Ford for the future of transportation.

Emerging Markets Expansion

Many emerging economies offer substantial untapped potential for vehicle sales, driven by growing disposable incomes and rapid urbanization. For instance, in 2024, countries like India and Brazil are projected to see continued economic growth, which directly translates to increased consumer demand for automobiles.

Ford can strategically expand its footprint in these dynamic markets by introducing vehicle models specifically designed to meet local preferences and price points, while also utilizing its established global manufacturing network. This approach allows for cost efficiencies and quicker market penetration.

Despite potential hurdles such as regulatory differences or infrastructure challenges in certain regions, these emerging markets represent significant opportunities for Ford to achieve market share expansion and geographic diversification. By 2025, it's anticipated that emerging markets will account for a larger percentage of global auto sales growth.

- Untapped Demand: Rising middle classes in countries like Vietnam and Indonesia are creating new customer bases for vehicles.

- Tailored Offerings: Ford can adapt its product lines, potentially focusing on more affordable and fuel-efficient models for these markets.

- Global Synergies: Leveraging existing manufacturing expertise and supply chains can reduce costs associated with entering new territories.

- Diversification Benefits: Expanding into emerging markets can offset slower growth in more mature automotive sectors.

Strategic Partnerships and Collaborations

Strategic partnerships offer a powerful avenue for Ford to accelerate its innovation, particularly in the rapidly evolving electric vehicle (EV) and autonomous driving sectors. By teaming up with technology firms, battery suppliers, or even other automotive manufacturers, Ford can significantly reduce its research and development expenditures and distribute the inherent risks associated with pioneering new technologies. This collaborative approach allows Ford to tap into specialized knowledge and intellectual property, thereby bolstering its competitive edge and expanding its market presence.

Ford has already begun to implement this strategy, notably by shifting some of its battery production and actively exploring joint ventures. For instance, in 2023, Ford announced a joint venture with SK On for battery manufacturing, aiming to produce millions of battery cells annually. This move is projected to contribute to Ford's goal of producing 2 million EVs annually by the end of 2026. Furthermore, collaborations with companies like Google for advanced software and data analytics are crucial for enhancing the connected car experience and developing sophisticated autonomous driving systems.

- Accelerated EV Development: Partnerships with battery manufacturers like SK On are critical for securing supply chains and driving down costs for Ford's ambitious EV production targets.

- Shared R&D Costs: Collaborations in areas like autonomous driving technology allow Ford to share the substantial investment required, making innovation more financially sustainable.

- Access to Expertise: Joint ventures with tech companies provide access to specialized software and AI capabilities, essential for the next generation of connected and self-driving vehicles.

- Risk Mitigation: By sharing the development burden, Ford can mitigate risks associated with unproven technologies, ensuring a more stable path to market for new automotive innovations.

The global electric vehicle (EV) market is experiencing robust growth, with projections indicating continued expansion through 2025. Ford's strategic investments in EV production and technology position it to capture a significant share of this burgeoning market. For example, Ford aims to produce 2 million EVs annually by the end of 2026, a testament to its commitment to this sector.

Ford's commercial vehicle division, Ford Pro, demonstrates a clear opportunity in connected services and software monetization. In Q1 2024, Ford Pro achieved an adjusted EBIT of $1.0 billion, with software and services playing a key role. This success highlights the potential for recurring revenue streams across Ford's broader product portfolio.

Emerging markets present substantial untapped demand for automobiles, driven by economic growth and increasing urbanization. Countries in Asia and Latin America are expected to contribute significantly to global auto sales growth by 2025, offering Ford avenues for geographic diversification and market share expansion.

Strategic partnerships, such as the joint venture with SK On for battery manufacturing, allow Ford to accelerate EV development and manage R&D costs effectively. These collaborations are crucial for securing supply chains and accessing specialized expertise in areas like autonomous driving technology.

Threats

Ford faces a formidable challenge from both legacy automakers aggressively pivoting to electric vehicles (EVs) and agile new startups disrupting the market. For instance, by the end of 2024, many established players aim to have a significantly expanded EV portfolio, directly challenging Ford’s market position. This heightened competition is likely to trigger price wars, potentially eroding Ford's market share and squeezing profit margins.

Economic downturns, characterized by recessions, elevated inflation, or climbing interest rates, pose a significant threat to Ford. These conditions directly diminish consumer purchasing power, leading to reduced demand for new vehicles, particularly Ford's more profitable trucks and SUVs. For instance, in early 2024, persistent inflation and interest rate hikes continued to pressure consumer budgets, impacting discretionary spending on big-ticket items like automobiles.

Ford's financial performance is intrinsically linked to these macroeconomic shifts and overall consumer confidence. A sustained economic slowdown or recession could drastically curtail sales volumes, directly affecting Ford's revenue streams and profitability. The automotive sector is notoriously cyclical, and a prolonged downturn could lead to substantial financial strain for the company.

Governments globally are tightening emission rules and pushing for electric vehicle (EV) adoption, forcing significant investment in new tech and manufacturing. For instance, by 2030, California aims for 100% zero-emission vehicle sales, impacting companies like Ford. Failure to comply can lead to substantial fines and market access limitations.

Ford must navigate a complex web of varying international regulations, a constant challenge that demands agile product development and compliance strategies. For example, the EU's CO2 emission targets for new cars are becoming progressively stricter, requiring automakers to significantly reduce their fleet's average emissions.

Supply Chain Disruptions

Ford, like many automakers, faces persistent threats from ongoing global supply chain vulnerabilities. Shortages of crucial components, particularly semiconductors, continue to impact production. For instance, during the first quarter of 2024, the automotive industry still grappled with semiconductor availability, though improvements were noted compared to prior years. This scarcity directly limits Ford's ability to manufacture vehicles at its desired capacity.

These disruptions translate into tangible financial and operational challenges for Ford. Reduced output means fewer vehicles to sell, directly affecting revenue. Furthermore, the increased costs associated with securing limited components and managing logistical bottlenecks can significantly erode profit margins. Ford reported in early 2024 that while semiconductor supply had stabilized somewhat, the overall cost of raw materials, including those for EV batteries, remained elevated, impacting their cost of goods sold.

The threat is compounded by external factors such as geopolitical events and evolving trade policies. These can create sudden and unpredictable shifts in the availability and cost of raw materials and finished components. For example, ongoing tensions in Eastern Europe and trade disputes involving key manufacturing regions can introduce new logistical hurdles and price volatility, making it difficult for Ford to forecast production and costs accurately.

- Semiconductor Shortages: While easing, these remain a concern impacting production volumes.

- Raw Material Costs: Elevated prices for battery materials like lithium and cobalt continue to pressure manufacturing costs for EVs.

- Logistical Bottlenecks: Port congestion and shipping capacity issues, though improving, can still cause delays and increase transportation expenses.

- Geopolitical Instability: Trade wars, regional conflicts, and shifting international relations can disrupt the flow of parts and materials.

Rising Raw Material Costs

Ford faces a significant threat from the volatile pricing of essential raw materials. The costs for components vital to electric vehicles, like lithium, cobalt, and nickel, have seen substantial fluctuations. Similarly, the price of steel and aluminum, crucial for traditional vehicle manufacturing, is also subject to market swings.

These price spikes directly inflate Ford's production expenses, impacting its ability to maintain profitability, particularly as it expands its electric vehicle offerings. For instance, the average price of lithium carbonate, a key battery ingredient, experienced a significant surge in late 2023 and early 2024, though it has shown some stabilization more recently. This volatility makes long-term cost forecasting and maintaining competitive pricing challenging for Ford.

- Lithium Price Volatility: Lithium prices, a critical component for EV batteries, have shown considerable ups and downs, impacting battery pack costs.

- Steel and Aluminum Costs: Fluctuations in the prices of steel and aluminum directly affect the manufacturing cost of vehicle bodies and chassis.

- Impact on EV Margins: Rising raw material expenses can squeeze profit margins on Ford's increasingly important electric vehicle models.

- Supply Chain Management: Effectively managing these input costs is paramount for Ford to offer competitive pricing and ensure healthy financial returns.

Ford faces intense competition from both established automakers and new EV startups, leading to potential price wars and market share erosion. For example, by the end of 2024, many legacy manufacturers are expected to significantly expand their EV lineups, directly challenging Ford's market position. This competitive pressure could force price reductions, impacting Ford's profitability.

Economic downturns, including inflation and high interest rates, reduce consumer purchasing power, hurting demand for vehicles like Ford's trucks and SUVs. Persistent inflation and interest rate hikes in early 2024 continued to strain consumer budgets, affecting spending on large purchases. A prolonged economic slowdown could significantly impact Ford's sales volumes and revenue.

Stricter government emission regulations and mandates for EV adoption necessitate substantial investments in new technologies and manufacturing capabilities. California's 2030 goal for 100% zero-emission vehicle sales exemplifies this trend, posing compliance challenges and potential market access limitations for non-compliant automakers like Ford.

Supply chain disruptions, particularly semiconductor shortages, continue to limit Ford's production capacity. While semiconductor availability showed some improvement in early 2024, the overall cost of raw materials for EV batteries remained elevated, impacting manufacturing expenses. Geopolitical events and trade policies can further exacerbate these supply chain vulnerabilities, leading to price volatility and production uncertainties.

| Threat Area | Description | Impact on Ford | Example Data/Trend |

|---|---|---|---|

| Intensified Competition | Legacy automakers and EV startups are expanding offerings. | Potential price wars, market share erosion. | By end of 2024, many established players to have expanded EV portfolios. |

| Economic Downturns | Inflation, high interest rates reduce consumer spending. | Lower demand for vehicles, particularly profitable trucks/SUVs. | Early 2024: Persistent inflation and rate hikes pressured consumer budgets. |

| Regulatory Changes | Stricter emission standards and EV mandates. | Requires significant investment in new tech, risk of fines. | California's 2030 goal for 100% zero-emission vehicle sales. |

| Supply Chain Vulnerabilities | Semiconductor shortages, raw material cost volatility. | Limited production, increased manufacturing costs. | Early 2024: Elevated costs for battery materials like lithium noted. |

SWOT Analysis Data Sources

This Ford Motor SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.