Ford Motor Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Motor Bundle

Ford Motor's product portfolio is a dynamic landscape, with some vehicles undoubtedly shining as Stars and others comfortably operating as Cash Cows. However, understanding the full picture requires a deeper dive into the potential Dogs and Question Marks that could impact future growth. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to navigate Ford's market position.

Stars

Ford Pro stands out as a significant Star in Ford's portfolio, demonstrating robust growth and impressive profitability within the commercial vehicle and services sector. This segment is a powerhouse, reflecting its strong market position and the increasing demand for integrated commercial solutions.

In 2024, Ford Pro achieved a remarkable $9.0 billion in EBIT, boasting a healthy 13.5% margin. Projections for full-year 2025 anticipate continued strength, with an estimated EBIT ranging from $7.5 billion to $8.0 billion. This financial performance underscores Ford Pro's status as a key growth driver for the company.

The segment's revenue saw a substantial 15% year-over-year increase in 2024. This growth is largely attributed to the expanding adoption of software subscriptions and telematics services, highlighting Ford Pro's success in a high-growth market where it holds a leading share.

The Ford Bronco and Bronco Sport are positioned as Stars in Ford's BCG Matrix, reflecting their strong performance in a rapidly expanding and popular market segment. The standalone Bronco saw its sales surge by 35% in the first quarter of 2025 and an even more impressive 51.3% in the second quarter of 2025, achieving its best sales quarter since its relaunch.

This robust growth underscores the high demand for off-road capable SUVs, a segment where Ford is effectively increasing its market penetration. The combined success of both models indicates a significant contribution to Ford's overall portfolio, demanding continued investment to maintain their leading positions.

The Ford Maverick is a standout Star within Ford's product lineup, thanks to its impressive performance in the compact pickup truck market. Its dominant market share and consistent sales growth solidify its position as a leader.

In the first quarter of 2025, the Maverick captured a remarkable 85% of the U.S. compact pickup segment, even as the overall segment saw a minor contraction. This demonstrates its exceptional appeal and market penetration.

Further highlighting its success, Maverick sales experienced a significant surge of 26% in the second quarter of 2025 within the U.S. Notably, almost 60% of these sales came from customers new to the Ford brand, underscoring the Maverick's ability to attract a broader customer base into a growing niche.

Ford F-Series Hybrid (PowerBoost)

The Ford F-Series Hybrid, specifically the F-150 PowerBoost, is a prime example of a Star in Ford's product portfolio. Its rapid growth is a testament to Ford's strategic positioning in the burgeoning electrified truck market.

Sales data for 2024 shows a significant surge, with the F-150 Hybrid experiencing a 47% increase in sales. This impressive growth rate highlights the strong consumer demand for hybrid powertrains in the light-duty truck segment.

This performance allows Ford to not only maintain its leadership in the overall F-Series truck sales but also to capture a substantial share of the high-growth hybrid vehicle market. The PowerBoost variant acts as a key driver for this dual objective.

- F-150 PowerBoost Hybrid: A Star Performer

- 2024 Sales Growth: 47% increase

- Market Position: Dominant in F-Series, strong in hybrid segment

- Strategic Importance: Capitalizes on electrification trend

Mustang Mach-E

The Mustang Mach-E stands out as a significant Star within Ford's electric vehicle lineup, driving the company's overall EV sales. Its impressive growth trajectory is a testament to its strong market reception and Ford's strategic focus on electrification.

In the first quarter of 2025, the Mustang Mach-E experienced a notable 21% increase in sales compared to the same period in the previous year. This growth is particularly significant as the Mach-E alone represented 51% of Ford's total EV sales during this period, demonstrating its dominance over other Ford electric models.

Even within Ford's Model e division, which has faced overall financial challenges, the Mach-E's individual performance is a bright spot. Its strong sales figures solidify its position as a leader in the rapidly expanding electric crossover market, a segment poised for continued high growth.

- Mustang Mach-E: A Key Star in Ford's EV Strategy

- Q1 2025 Sales Growth: 21% year-over-year increase.

- Market Share within Ford EVs: Accounted for 51% of total EV sales in Q1 2025.

- Market Position: Leading player in the high-growth electric crossover segment.

Ford Pro continues to shine as a Star, with its EBIT reaching $9.0 billion in 2024 and projected between $7.5 billion to $8.0 billion for 2025, demonstrating robust profitability and a 15% revenue increase in 2024 driven by software and telematics. The Bronco and Bronco Sport are also Stars, with Bronco sales up 35% and 51.3% in Q1 and Q2 2025 respectively, capturing the growing demand for off-road SUVs. The Maverick is another Star, dominating the compact pickup segment with 85% market share in Q1 2025 and attracting new customers, with sales up 26% in Q2 2025. The F-150 PowerBoost Hybrid is a Star, showing a 47% sales increase in 2024, capitalizing on the electrified truck market. Finally, the Mustang Mach-E is a Star in Ford's EV lineup, with a 21% sales increase in Q1 2025 and accounting for 51% of Ford's total EV sales, leading the electric crossover segment.

| Product | BCG Category | 2024 EBIT (USD Billions) | 2024 Revenue Growth | Key Metric/Highlight |

|---|---|---|---|---|

| Ford Pro | Star | $9.0 | 15% | Strong EBIT margin, growing software subscriptions |

| Bronco / Bronco Sport | Star | N/A (Segment data not provided) | N/A (Specific growth % provided) | Bronco sales up 51.3% in Q2 2025 |

| Ford Maverick | Star | N/A (Segment data not provided) | N/A (Specific growth % provided) | 85% U.S. compact pickup segment share in Q1 2025 |

| F-150 PowerBoost Hybrid | Star | N/A (Segment data not provided) | 47% sales increase (2024) | Leading hybrid truck sales |

| Mustang Mach-E | Star | N/A (Segment data not provided) | 21% sales increase in Q1 2025 | 51% of Ford's total EV sales in Q1 2025 |

What is included in the product

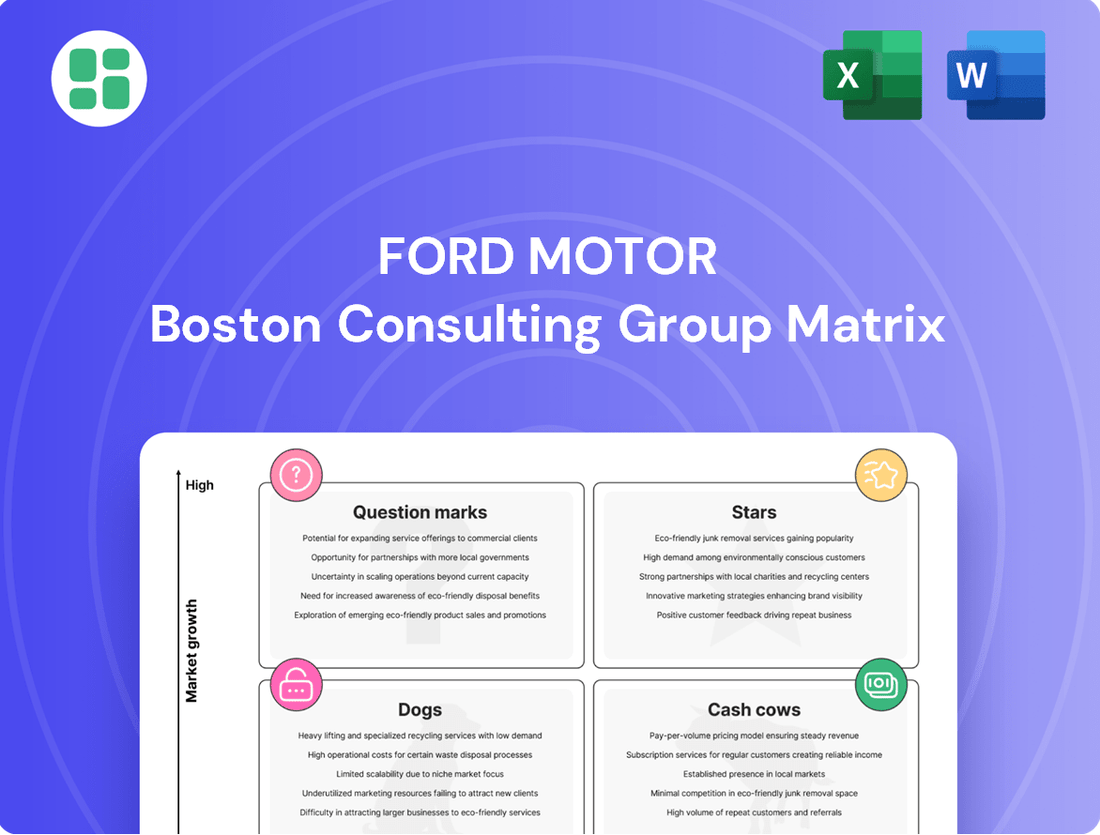

The Ford Motor BCG Matrix analyzes its product portfolio, categorizing vehicles as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment decisions.

The Ford Motor BCG Matrix offers a clear, visual overview of its business units, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

The Ford F-Series, with its robust internal combustion engine (ICE) offerings and overall truck dominance, stands as Ford's undisputed Cash Cow. This iconic lineup has held the title of America's best-selling truck for an incredible 48 years running, and the best-selling vehicle overall for 43 years, a testament to its enduring appeal and consistent sales performance.

In 2024, the F-Series continued its reign, achieving sales of 765,649 units in the U.S. alone. This remarkable volume, even within a mature market segment, underscores its ability to generate substantial revenue and consistent cash flow, solidifying its position as a critical profit driver for the company.

The Ford Blue segment, encompassing traditional internal combustion engine (ICE) and hybrid vehicles, is a powerful Cash Cow for the automaker. In 2024, this segment achieved a stable revenue of $101.9 billion, while generating a robust Earnings Before Interest and Taxes (EBIT) of $5.3 billion.

Despite a projected slight decrease in EBIT to between $3.5 billion and $4.0 billion for 2025, Ford Blue remains a cornerstone of profitability. It consistently provides the substantial profits and cash flow necessary to fuel Ford's strategic investments in new technologies and future growth areas.

Ford Motor Credit Company stands as a prime example of a Cash Cow within Ford's broader portfolio. Its core business of automotive financing and leasing consistently generates substantial profits, providing a stable and predictable revenue stream for the parent company.

In 2024, Ford Motor Credit reported earnings before taxes (EBT) of $1.7 billion, marking a significant $323 million increase. Projections for full-year 2025 indicate this figure is expected to climb to approximately $2.0 billion, underscoring its robust performance and continued contribution to Ford's financial health.

Ford Transit and Commercial Vans (ICE)

The Ford Transit and its commercial van counterparts are undeniably Cash Cows for Ford. They have consistently dominated the commercial van market, holding a leading position for an impressive 46 years straight. This enduring strength is a testament to their reliability and widespread adoption by businesses.

In 2024, Ford's commercial vans captured approximately half of the entire full-size van segment. This significant market share translates into stable, high-volume sales, even within a mature industry. The established reputation of these vehicles means Ford can often rely on their existing market position with less need for heavy promotional spending.

- Dominant Market Share: Ford Transit and commercial vans have led the segment for 46 consecutive years.

- 2024 Segment Snapshot: These vehicles accounted for roughly 50% of the full-size van market in 2024.

- Mature Market Stability: Consistent, high-volume sales are generated in a well-established market.

- Low Promotional Need: Their strong brand recognition reduces the necessity for extensive marketing investments.

Ford Expedition and Navigator (Large Luxury SUVs)

The Ford Expedition and Lincoln Navigator are prime examples of Ford's Cash Cows within the large luxury SUV segment. These vehicles consistently generate substantial profits due to their established market presence and appeal in a mature, high-margin category. Their performance in the first half of 2025 underscores their strength.

In Q2 2025, both models saw remarkable sales growth. The Ford Expedition's sales climbed by an impressive 43.9%, while the Lincoln Navigator experienced an even more dramatic surge of 115%. These figures represent the best second-quarter performance for both SUVs in many years, highlighting their continued demand and profitability.

- Ford Expedition and Lincoln Navigator are key Cash Cows for Ford.

- They operate in a mature but premium segment, ensuring strong profit generation.

- Q2 2025 saw significant sales increases: Expedition up 43.9%, Navigator up 115%.

- These high-margin vehicles are crucial contributors to Ford's overall financial health.

The Ford F-Series remains Ford's undisputed Cash Cow, consistently driving significant revenue and profit. Its dominance in the truck market, evidenced by 48 consecutive years as America's best-selling truck and 43 years as the best-selling vehicle, highlights its stable cash-generating ability.

In 2024, the F-Series sold 765,649 units in the U.S., demonstrating its enduring market appeal and reliable performance, which translates into substantial and consistent cash flow for Ford.

The Ford Blue segment, encompassing traditional ICE and hybrid vehicles, is a vital Cash Cow, generating $101.9 billion in revenue and $5.3 billion in EBIT in 2024. Despite a projected dip in EBIT for 2025, this segment remains a cornerstone of Ford's profitability, funding crucial investments in new technologies.

| Segment | 2024 Revenue | 2024 EBIT | 2025 Projected EBIT | Key Product |

| Ford Blue | $101.9 billion | $5.3 billion | $3.5 - $4.0 billion | F-Series, Transit |

| Ford F-Series (U.S. Sales) | N/A | N/A | N/A | F-150, Super Duty |

| Ford Transit / Commercial Vans | N/A | N/A | N/A | Transit, E-Series |

| Ford Expedition / Lincoln Navigator | N/A | N/A | N/A | Expedition, Navigator |

What You See Is What You Get

Ford Motor BCG Matrix

The Ford Motor BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared, will be delivered to you in its final, ready-to-use format, ensuring you gain immediate strategic insights into Ford's product portfolio. No further editing or revisions will be necessary, as this preview represents the exact, professionally designed report you will download.

Dogs

The discontinuation of models like the Ford Edge and Transit Connect in certain markets signifies their classification as Dogs in the BCG Matrix. These vehicles contributed to lost volume for Ford in early 2025, reflecting a strategic divestment due to low growth prospects. Ford's decision to phase out these models underscores an inability to achieve desired market share or profitability, aligning with a strategy to minimize investment in potential cash traps.

The Ford Explorer in the U.S. market is exhibiting traits of a Dog within Ford's product portfolio. Its sales experienced a notable downturn, decreasing by approximately 20% in the first quarter of 2025. This substantial drop signals a weakening market position and challenges in a competitive SUV landscape.

This performance indicates the Explorer may be consuming resources without generating sufficient returns, especially when contrasted with Ford's more robust offerings. The declining sales trend necessitates a careful strategic review of the Explorer's future within the company's lineup.

Ford's North American sedan portfolio, following its strategic exit from most of this segment, can be characterized as a Question Mark or potentially a Divested Dog. The phasing out of models like the Fusion, Fiesta, and Focus in North America indicates a move away from low-growth markets where the company did not hold a commanding position. This strategic shift aimed to reallocate resources to more profitable and high-growth areas.

Older-Generation Ford Ranger (Prior to 2025 Refresh)

Before the major refresh and the introduction of the 2025 model, the prior generation Ford Ranger likely fit the 'Dog' category in the BCG matrix. This was due to its position in a competitive midsize truck market where it struggled to gain significant market share against established rivals. The slower sales growth indicated limited demand, making it a product that required careful consideration for future investment.

- Market Share: While specific market share figures for the pre-2025 Ranger can fluctuate, it generally trailed key competitors in the midsize pickup segment. For instance, in 2023, the midsize truck segment saw strong performance from models like the Toyota Tacoma and Chevrolet Colorado, which often outpaced the older Ranger generation's sales volumes.

- Growth Rate: The growth rate for the older Ranger generation was comparatively modest. In 2023, the overall U.S. pickup truck market saw robust demand, but the Ranger's contribution to that growth was less pronounced than newer or more popular models in its class.

- Profitability: As a 'Dog', the older Ranger likely generated lower profit margins. This could be attributed to increased incentives needed to move inventory or a less efficient production process compared to more modern platforms, impacting its overall financial contribution to Ford.

Certain Low-Margin Daily Rental Fleet Sales

Certain low-margin daily rental fleet sales can be categorized as a Dog within Ford's BCG Matrix. This segment, while contributing to sales volume, often yields low profitability. Ford's Q1 2025 results, for instance, noted impacts from 'daily rental fleet sales timing,' suggesting a strategic consideration around the timing and volume of these transactions.

- Low Profitability: Sales to daily rental fleets typically operate on thinner margins compared to direct consumer sales.

- Volume vs. Profit: While these sales boost unit numbers, the return on investment for the capital tied up in these vehicles can be minimal.

- Strategic Adjustment: Companies like Ford often aim to reduce reliance on such low-margin business to improve overall profitability and capital efficiency.

- Market Dynamics: The rental fleet market is highly competitive, often driving down prices and further pressuring margins for manufacturers.

Ford's older sedan models, like the Taurus which was discontinued in North America prior to 2025, would have been classified as Dogs. These vehicles operated in a declining market segment with low growth prospects and limited competitive advantage for Ford. Their phasing out reflects a strategic decision to cut losses and reallocate resources.

The Ford EcoSport, particularly in its later years before discontinuation in key markets, represented a Dog. It faced intense competition in the subcompact SUV segment and struggled to achieve significant market share or profitability. Its sales performance indicated it was a cash trap, consuming resources without generating substantial returns.

Ford's strategy involved divesting from or phasing out products that were not contributing positively to overall growth and profitability. This aligns with a broader market trend of manufacturers streamlining their portfolios to focus on more lucrative segments.

Question Marks

Ford's Model e division, focused entirely on electric vehicles, fits the profile of a Question Mark in the BCG matrix. This segment operates within the rapidly expanding electric vehicle market, a sector characterized by high growth potential.

Despite the promising market, Model e incurred significant financial losses. In 2024, the division reported an EBIT loss of $5.1 billion, with projections for 2025 indicating a similar or slightly improved loss between $5.0 billion and $5.5 billion. These figures highlight substantial cash consumption.

Ford is making considerable investments in Model e to boost production capacity and advance the development of future EV technologies. This strategy aims to transform the division from a high-cash-consuming entity with currently low returns into a potential Star performer in the future.

The Ford F-150 Lightning is positioned as a Question Mark within Ford's BCG Matrix, operating in the rapidly expanding electric pickup truck segment. This classification reflects its high market growth potential alongside its current, less certain market share.

Despite significant anticipation, the F-150 Lightning experienced a 7% decline in sales during the first quarter of 2025. This downturn contributed to the ongoing financial challenges faced by Ford's Model e division, highlighting the substantial investment required to navigate this nascent market.

While the F-150 Lightning holds the promise of capturing a considerable portion of the electric truck market, its recent sales performance indicates a need for strategic recalibration and increased investment. Overcoming early obstacles is crucial for the vehicle to achieve profitability and solidify its market position.

Ford's commitment to next-generation EV platforms, including substantial investments in battery manufacturing, positions these as potential future Stars within the BCG matrix. These initiatives are designed to capture anticipated growth in the electric vehicle market.

In 2024, Ford announced plans to invest an additional $3.5 billion in its Michigan operations for EV and battery production, signaling a significant capital outlay for future market positioning. While these investments are critical for long-term EV success, they currently represent a substantial drain on resources with no immediate return.

Emerging Mobility and Connectivity Services

Beyond the established Ford Pro connected services, Ford is actively investing in emerging mobility and connectivity solutions. These include advanced autonomous driving services and new subscription models for consumer vehicles, representing areas with significant growth potential but currently holding nascent market share.

These ventures demand substantial research and development alongside considerable investment to achieve scalability and establish profitable revenue streams. For instance, Ford's investment in Argo AI, though later dissolved, underscored its commitment to autonomous driving technology, highlighting the high-risk, high-reward nature of these emerging sectors.

- High Growth Potential: Emerging mobility services are poised for significant expansion as consumer adoption and technological advancements accelerate.

- Nascent Market Share: Despite the potential, these services are in their early stages, meaning Ford's current market penetration is relatively small.

- Substantial Investment Required: Developing and scaling autonomous driving and new subscription models necessitate significant capital outlay for R&D, infrastructure, and marketing.

- Path to Profitability: The journey to profitability for these services is long, requiring sustained innovation and market acceptance to overcome initial high costs.

Lincoln Electrified Vehicle Expansion

Lincoln's strategic expansion into electrified vehicles, encompassing both hybrid and future all-electric models, positions these offerings within the BCG matrix as potential Stars. The luxury EV segment is experiencing robust growth, a positive indicator for Lincoln's ambitious electrification plans. For instance, by the end of 2023, the global EV market was projected to exceed 13 million units, a significant leap from previous years, highlighting the market's dynamism.

Despite overall sales growth and the high-potential luxury EV market, Lincoln's current market share in the electrified space is likely still nascent. This necessitates sustained investment in crucial areas such as advanced product development, targeted marketing campaigns, and the expansion of charging infrastructure to solidify its competitive standing.

- Market Potential: The global luxury EV market is a rapidly expanding sector, offering substantial growth opportunities.

- Investment Needs: Significant capital is required for R&D, marketing, and charging solutions to capture market share.

- Competitive Landscape: Lincoln faces established luxury EV players, demanding a strong value proposition.

- Sales Traction: Converting interest into substantial sales volume remains a key objective for Lincoln's EV initiatives.

Question Marks in Ford's portfolio represent areas with high growth potential but currently low market share, demanding significant investment. These segments, like the Model e division and its F-150 Lightning, consume substantial cash with uncertain future returns.

Ford's strategic investments in next-generation EV platforms and emerging mobility services also fall into this category. While these ventures aim to capture future market growth, they require considerable capital for R&D and scaling, with profitability still a distant prospect.

The success of these Question Marks hinges on Ford's ability to navigate technological advancements, market acceptance, and intense competition. Without a clear path to market leadership, these investments carry inherent risks.

Ford's Q1 2025 earnings highlighted the challenges, with the Model e division reporting a $1.1 billion loss, contributing to the company's overall EBIT loss of $2.4 billion for the quarter. This underscores the ongoing cash burn associated with its EV ambitions.

| Business Segment/Product | Market Growth | Market Share | Cash Flow | Strategic Implication |

|---|---|---|---|---|

| Model e Division | High | Low | Negative | High investment required to gain market share and achieve profitability. |

| F-150 Lightning | High | Low to Moderate | Negative | Needs to capture significant market share to justify investment and achieve scale. |

| Emerging Mobility Services | High | Very Low | Negative | Long-term R&D intensive; success depends on technological breakthroughs and market adoption. |

| Lincoln Electrified Vehicles | High | Low | Negative | Requires substantial investment to compete in the luxury EV segment and build brand presence. |

BCG Matrix Data Sources

Our Ford Motor BCG Matrix leverages extensive data from financial disclosures, internal sales figures, and automotive industry market research. This includes competitor analysis and projected market growth rates to inform strategic positioning.