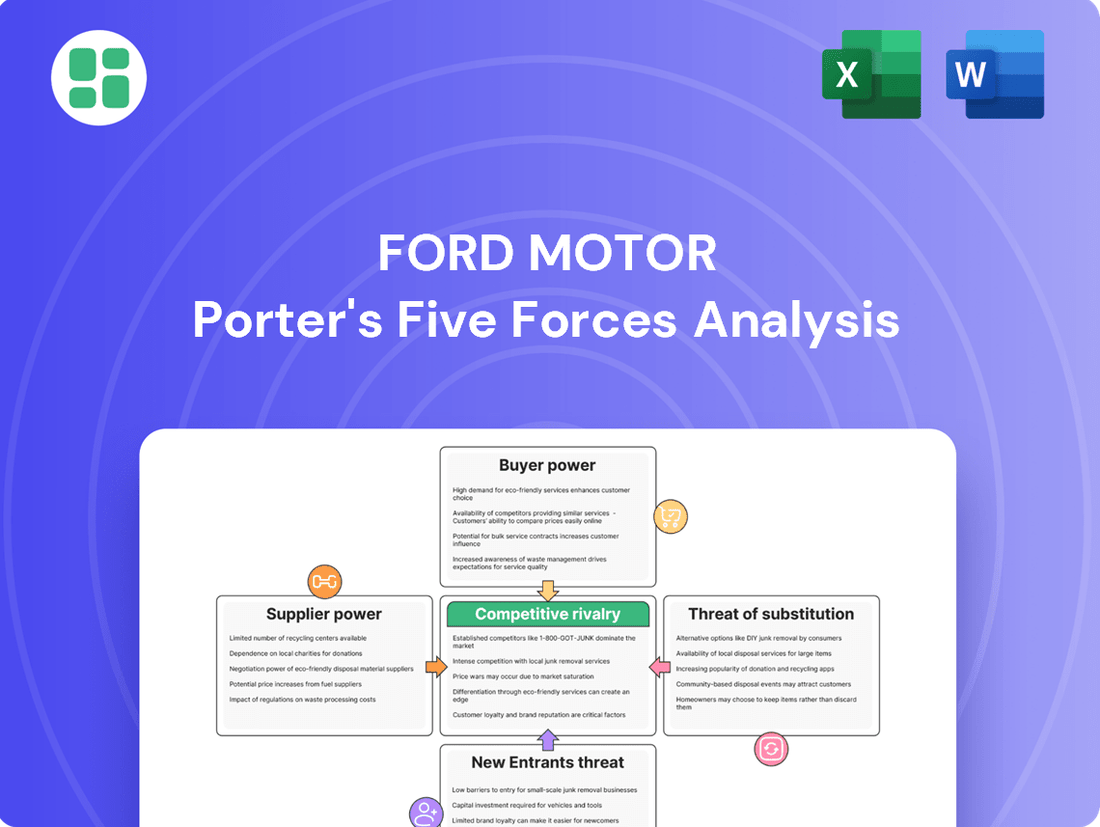

Ford Motor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ford Motor Bundle

Ford Motor faces intense competition, with powerful buyers and a constant threat from new entrants and substitutes. Understanding the intricate interplay of these forces is crucial for navigating the automotive landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ford Motor’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ford's reliance on a select few providers for specialized parts like advanced semiconductors and EV battery cells creates a critical component dependency. This means suppliers hold considerable sway, particularly when global supply chains face disruptions. For instance, the semiconductor shortage in 2021-2022 significantly impacted automotive production worldwide, with many manufacturers, including Ford, experiencing production cuts due to limited chip availability.

This scarcity of essential components, especially in the current geopolitical and economic climate, directly amplifies the bargaining power of these specialized suppliers. When demand for these critical parts outstrips supply, as seen with EV battery materials in 2024, suppliers can dictate terms, potentially leading to higher prices and longer lead times for Ford, impacting its manufacturing efficiency and profitability.

Raw material prices, such as lithium, cobalt, nickel, and steel, are highly volatile. In early 2024, lithium prices experienced a significant drop of over 70% from their 2023 highs, while nickel and cobalt also saw considerable price swings. These fluctuations directly affect Ford's manufacturing costs and profit margins.

Suppliers in these volatile markets can leverage their position by increasing prices, especially during periods of high demand or supply chain disruptions. For instance, geopolitical events or increased demand from other industries can quickly drive up the cost of essential metals, giving suppliers greater bargaining power.

Ford's strategy to manage this involves securing long-term supply agreements and fostering strategic alliances with key material providers. This approach aims to lock in prices and ensure a stable supply, thereby mitigating the impact of market volatility on its operations and financial performance throughout 2024 and beyond.

Unionized labor, notably the United Auto Workers (UAW) in North America, wields considerable bargaining power over automakers like Ford. In 2023, UAW negotiations secured significant wage increases for its members, impacting Ford's labor costs. These negotiations highlight how collective bargaining can directly influence a company's operational expenses and profitability.

Wage and benefit negotiations with unions can lead to substantial cost escalations for Ford. For instance, the UAW contract ratified in late 2023 included substantial pay raises and improved benefits, adding millions to Ford's annual labor expenses. This demonstrates the direct financial impact of strong labor unions on the company's bottom line.

The threat of strikes or labor disputes by organized labor forces can severely disrupt production, showcasing their potent influence. In 2023, the UAW strike against the Detroit Three, including Ford, resulted in billions of dollars in lost revenue and production. This leverage allows unions to push for favorable terms, directly impacting Ford's ability to operate smoothly and meet demand.

Technology and Software Providers

As vehicles increasingly rely on software for everything from infotainment to advanced driver-assistance systems, Ford's dependence on technology and software providers is a significant factor. These specialized companies often possess proprietary technology and deep expertise, which can translate into considerable bargaining power. For instance, the development of advanced autonomous driving features requires specialized AI and sensor software, areas where a few key suppliers dominate.

Ford's integration of these complex software systems necessitates close partnerships, making it difficult and costly to switch suppliers. This deep integration strengthens the suppliers' negotiating position. In 2024, the automotive industry saw continued investment in software development, with companies like Ford allocating billions to these areas, underscoring the critical role and leverage of their software partners.

- Increased Software Dependence: Vehicles are becoming more like computers on wheels, driving up reliance on specialized software suppliers.

- Intellectual Property and Expertise: Tech providers with unique, patented software for areas like AI and connectivity hold significant leverage.

- Deep Integration Challenges: The complexity of integrating advanced software systems makes supplier switching costly and time-consuming for automakers.

- Industry Investment Trends: Billions invested by automakers in 2024 into software development highlight the critical nature and power of these technology partners.

Limited Supplier Alternatives

For specific, highly integrated components, Ford's options for suppliers are often restricted. This limitation is especially pronounced in areas requiring specialized technology or significant R&D investment, such as advanced battery systems for electric vehicles (EVs). For instance, securing reliable and high-quality battery suppliers is critical, and the market for these specialized components remains relatively concentrated.

The difficulty and expense involved in switching suppliers for these critical parts significantly bolster the bargaining power of existing suppliers. Ford faces substantial costs related to re-tooling manufacturing lines and potentially redesigning vehicle architectures if it chooses to change suppliers. This inertia is amplified for legacy components where supplier relationships are long-standing and for new, emerging EV technologies where expertise is scarce.

- Limited Supplier Pool: In 2024, the automotive industry continues to grapple with a concentrated supplier base for critical EV components like semiconductors and battery cells, with only a handful of major global players dominating production.

- High Switching Costs: For a new vehicle platform, the cost of certifying and integrating a new supplier can range from millions to tens of millions of dollars, encompassing engineering, testing, and production line adjustments.

- Proprietary Technology: Suppliers of advanced driver-assistance systems (ADAS) or unique powertrain technologies often hold patents or trade secrets, creating a de facto monopoly for specific functionalities, thereby increasing their leverage.

Ford's reliance on specialized suppliers for critical components like semiconductors and EV batteries means these providers have significant leverage, especially during supply chain disruptions. For example, the semiconductor shortage in 2021-2022 forced production cuts across the industry, highlighting supplier power.

The volatility of raw material prices, such as lithium and nickel, also impacts Ford, with suppliers able to exploit price swings. Ford's strategy to counter this involves long-term agreements and strategic alliances to secure supply and stabilize costs.

Furthermore, unionized labor, like the UAW, wields considerable power through collective bargaining, as demonstrated by the significant wage increases secured in the late 2023 contract, directly impacting Ford's labor expenses.

The increasing dependence on software and technology providers for advanced vehicle features also strengthens supplier bargaining power due to proprietary technology and deep integration challenges, with automakers like Ford investing billions in these areas in 2024.

What is included in the product

Analyzes how supplier power, buyer bargaining, new entrants, substitutes, and rivalry shape Ford Motor's competitive environment and profitability.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Ford.

Customers Bargaining Power

Automotive customers, faced with substantial vehicle costs and rising interest rates in 2024, demonstrated heightened price sensitivity. This trend compelled them to actively hunt for the most advantageous deals. For instance, average new car prices remained elevated, with some reports indicating figures north of $48,000 for much of 2024, making affordability a key concern.

The automotive market in 2024 was characterized by a vast array of competing models. Buyers could readily compare prices and features across traditional gasoline-powered vehicles, hybrids, and a growing selection of electric vehicles. This abundance of choice directly amplified customer bargaining power, as switching costs between brands and models are relatively low.

Ford, like its competitors, had to contend with this intense price sensitivity. The need to offer competitive pricing, attractive financing options, and various incentives in 2024 directly impacted profit margins. For example, manufacturer incentives and rebates, a common tactic to stimulate demand, can significantly reduce the per-vehicle profit for automakers.

The automotive market is incredibly crowded, with manufacturers worldwide offering a vast selection of vehicles. This means customers have plenty of choices, from compact cars to large SUVs and the rapidly expanding electric vehicle (EV) segment. For instance, in 2024, the global automotive market is expected to see sales of over 80 million vehicles, with a significant portion representing diverse models and brands.

This abundance of options directly translates to increased bargaining power for customers. If Ford's vehicles don't align with a buyer's needs or price expectations, they can easily find comparable alternatives from competitors. This ease of switching brands puts considerable pressure on Ford to remain competitive in terms of features, quality, and pricing.

Ford's customers wield significant bargaining power due to readily available information. Online reviews, comparison sites, and automotive publications empower buyers to meticulously research vehicle performance, reliability, safety, and resale value. For instance, in 2024, consumer satisfaction scores for new vehicles, as reported by J.D. Power, heavily influence purchasing decisions and dealer negotiations.

Low Switching Costs for Buyers

While buying a car represents a substantial financial commitment, the cost and complexity for a consumer to switch brands for their next purchase are quite low. There are no significant penalties or intricate procedures that tie a buyer to a specific manufacturer once they are in the market for a new vehicle. This ease of transition significantly boosts buyer power.

This low switching cost means Ford must consistently work to earn and maintain customer loyalty. For instance, in 2023, the average transaction price for a new vehicle in the U.S. hovered around $47,000, a significant outlay that makes buyers more sensitive to competitive offerings and incentives when it's time for their next purchase. This underscores the importance of competitive pricing and attractive features for Ford to retain its customer base.

- Low Switching Costs: Buyers face minimal financial or procedural barriers when moving from one auto brand to another for their next vehicle purchase.

- Customer Loyalty is Earned: Ford must actively compete on price, quality, and innovation to keep customers from defecting to rivals.

- Impact on Pricing: The ease of switching puts pressure on Ford to offer compelling value propositions to prevent customer loss.

- Market Dynamics: In 2023, the average new vehicle price in the US was approximately $47,000, highlighting the significant investment and the resulting buyer sensitivity to competitive offers.

Impact of Financing and Economic Conditions

The bargaining power of customers is significantly amplified by financing and economic conditions. In 2024, with interest rates remaining a key consideration for car buyers, the cost of automotive financing directly influences purchasing power. For instance, if the Federal Reserve maintains a higher interest rate environment, monthly payments on new Fords increase, giving customers more leverage to negotiate prices or seek alternatives.

Economic uncertainty further empowers customers. During periods of potential recession or job market instability, consumers tend to be more cautious with large purchases like vehicles. This caution translates into a stronger customer position, as they are more likely to delay purchases, opt for more affordable models, or explore the used car market, thereby pressuring Ford to offer incentives.

- Financing Costs: Higher interest rates in 2024 make car loans more expensive, reducing affordability and increasing customer bargaining power.

- Economic Uncertainty: Concerns about inflation and job security in 2024 lead customers to delay purchases or seek lower-priced options, strengthening their negotiating position.

- Ford Credit's Role: While Ford Motor Credit Company offers financing, its effectiveness can be limited by widespread economic downturns, leaving customers with more power.

- Alternative Options: The availability of used cars and competitor financing deals in 2024 provides customers with viable alternatives, further enhancing their bargaining leverage against Ford.

Customers in 2024 faced elevated vehicle prices, with average new car prices consistently above $48,000, making them highly sensitive to cost. This price sensitivity, coupled with a vast array of competing models across gasoline, hybrid, and electric segments, significantly amplified their bargaining power. The ease with which consumers could compare features and prices across numerous brands meant switching costs were minimal, forcing Ford to offer competitive pricing and incentives to attract and retain buyers.

| Factor | Impact on Ford | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | Increased pressure on profit margins | Average new car prices > $48,000 |

| Availability of Alternatives | Reduced customer loyalty, increased negotiation leverage | Abundant models across powertrain types |

| Information Accessibility | Empowered buyers to negotiate effectively | High reliance on online reviews and comparison sites |

| Switching Costs | Low, allowing easy brand defection | Minimal financial or procedural barriers |

Preview Before You Purchase

Ford Motor Porter's Five Forces Analysis

This preview showcases the complete Ford Motor Company Porter's Five Forces Analysis, detailing the competitive landscape including threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and intensity of rivalry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you'll receive immediately after purchase, ensuring no surprises and full immediate usability for your strategic planning needs.

Rivalry Among Competitors

The global automotive landscape is fiercely contested by a handful of major multinational corporations like Toyota, Volkswagen, General Motors, Stellantis, and Hyundai-Kia. These giants wield substantial financial muscle, advanced research and development expertise, and expansive worldwide sales and service infrastructures. This concentration of power fuels aggressive competition, pushing Ford to continually enhance its product offerings and operational efficiencies to maintain its market position.

The automotive industry is witnessing a significant shift with the emergence of specialized electric vehicle (EV) manufacturers. Companies like Tesla, Rivian, and Lucid, alongside a growing number of Chinese EV brands, are dramatically intensifying competition, especially within the EV market. These new entrants often boast distinct business models, leverage advanced technological capabilities, and demonstrate quicker innovation cycles, posing a considerable challenge to established automakers such as Ford.

Ford's substantial investment and rapid expansion into the EV sector are a direct strategic response to this evolving competitive environment. For instance, Ford invested $50 billion in EVs and battery production through 2026, aiming to produce 2 million EVs annually by the end of 2026. This aggressive stance underscores the pressure from these EV specialists, who are reshaping consumer expectations and market dynamics with their focused approach and technological prowess.

Automotive manufacturers, including Ford, frequently employ aggressive pricing and incentives like discounts and low-interest financing to capture market share in the highly competitive auto industry. This intense price competition directly impacts profitability by potentially compressing profit margins for all players.

In 2024, the automotive sector continued to see significant promotional activity. For instance, average incentives on new vehicles in the US hovered around $2,000 in early 2024, a figure that can fluctuate based on inventory levels and demand. Ford, like its rivals, must navigate these pricing pressures to maintain its competitive standing while safeguarding its financial health, particularly when economic conditions become less favorable.

High Fixed Costs and Capacity Utilization

The automotive sector, including Ford, is characterized by substantial fixed costs. Think about the massive investments in factories, advanced robotics, and ongoing research and development for new models and technologies. These aren't small numbers; for instance, Ford invested billions in its new battery plants and EV development leading up to 2024.

These high fixed costs create a powerful incentive for manufacturers to produce at high volumes. Operating below optimal capacity means those fixed costs are spread over fewer units, significantly increasing the cost per vehicle. This constant drive for economies of scale and efficient capacity utilization puts immense pressure on companies like Ford.

- Automotive Industry Fixed Costs: Billions of dollars are required for manufacturing infrastructure and R&D.

- Capacity Utilization Pressure: Companies aim for high production volumes to lower per-unit costs.

- Impact on Competition: The need to sell vehicles can intensify price competition and promotional activities.

- Ford's EV Investment: Significant capital expenditure in 2023-2024 for electric vehicle production capacity.

Rapid Technological Advancements

The automotive industry is experiencing a seismic shift, with electric vehicles (EVs), autonomous driving, and connected car technologies rapidly reshaping the competitive landscape. Ford, like its peers, is navigating this transformation. In 2024, significant investments are being poured into R&D for these emerging areas. For instance, Ford announced plans to invest billions in EV and battery technology development through 2025, underscoring the intense pressure to innovate.

This technological race means companies that fail to adapt quickly risk obsolescence. The pace of development in areas like battery efficiency and autonomous software is relentless. Ford's strategy, therefore, must prioritize agile development and strategic partnerships to keep pace with competitors who are aggressively pushing these boundaries.

- Electric Powertrain Development: Companies are investing heavily, with the global EV market projected to reach trillions by the late 2020s, demanding continuous innovation in battery technology and charging infrastructure.

- Autonomous Driving Progress: Significant R&D spending is allocated to AI and sensor technology, with companies aiming for Level 4 and Level 5 autonomy, creating intense competition for talent and intellectual property.

- Connectivity and Digital Services: The integration of advanced software, over-the-air updates, and subscription-based services is becoming a key differentiator, requiring ongoing investment in cybersecurity and user experience.

- R&D Investment Intensity: Major automakers are dedicating substantial portions of their revenue to R&D, with figures often exceeding 5% of sales, highlighting the critical need for continuous technological advancement to remain competitive.

Competitive rivalry within the automotive sector is exceptionally intense, driven by a few dominant global players and disruptive new entrants, particularly in the electric vehicle (EV) space. Ford faces constant pressure to innovate and optimize operations to maintain its market share against both established giants and agile EV startups. This dynamic environment necessitates significant investments in new technologies and aggressive strategies to manage costs and capture consumer interest.

In 2024, the automotive market continues to be shaped by aggressive pricing and promotional activities, with average incentives on new vehicles in the US fluctuating but remaining a key tactic. Ford's substantial investments, such as the $50 billion allocated to EVs and battery production through 2026, reflect the high stakes of this competition. The industry's high fixed costs also compel manufacturers to pursue high-volume production, further intensifying the drive for sales and market presence.

| Key Competitor Actions | Impact on Ford | 2024 Data/Trends |

| Aggressive Pricing & Incentives | Pressure on profit margins, need for efficient cost structures | Average US new vehicle incentives around $2,000 (early 2024) |

| EV Market Disruption | Need for rapid EV development and market penetration | Ford investing $50 billion in EVs through 2026 |

| Technological Innovation (AI, Autonomy) | Requires significant R&D investment to stay competitive | Automakers dedicating >5% of sales to R&D |

| High Fixed Costs & Volume Pressure | Incentive to maintain high production capacity and sales | Billions invested in new battery plants and EV development |

SSubstitutes Threaten

The expansion of public transportation, such as the significant investments in light rail and bus rapid transit in cities like Los Angeles and Seattle, offers a compelling alternative to personal car ownership. In 2024, many urban centers are seeing increased ridership as these systems become more efficient and accessible.

This trend directly challenges the necessity of owning a Ford vehicle, especially for daily commutes in densely populated areas where traffic congestion and parking costs are high. As public transit becomes a more attractive and cost-effective option, it can reduce the demand for new car sales, impacting Ford's market share in these key urban markets.

The rise of ride-sharing and mobility services presents a significant threat to traditional automakers like Ford. Platforms such as Uber and Lyft, along with emerging car-sharing and subscription models, provide compelling alternatives to owning a vehicle. For instance, in 2023, Uber reported over 1.5 billion trips globally, highlighting the scale of this shift.

These services directly address consumer desires for convenience and cost-effectiveness, especially in urban areas where parking and maintenance are burdensome. This can directly impact new car sales, particularly among younger demographics who are increasingly embracing these flexible transportation solutions over outright ownership.

The growing popularity of micro-mobility solutions like e-scooters and bike-sharing presents a significant threat to traditional automotive sales, particularly for smaller urban vehicles. These alternatives offer cost-effective and convenient options for short trips, reducing the need for car ownership in densely populated areas. For instance, by mid-2024, cities globally saw a substantial increase in micro-mobility usage for daily commutes, with some reports indicating a 15% year-over-year growth in shared e-scooter rides in major metropolitan areas.

This shift directly impacts Ford's potential sales of compact cars and city-focused models. As more individuals opt for these greener, more agile transport methods for errands and short commutes, the demand for entry-level vehicles could diminish. By the end of 2024, it's projected that over 30% of urban commuters in select cities might utilize micro-mobility for at least one trip per week, a trend that directly eats into the market share previously held by small cars.

Shifting Consumer Preferences Towards Sustainability

A significant portion of consumers are increasingly prioritizing sustainable and eco-friendly transportation. This growing preference could steer individuals towards alternatives like public transit, cycling, or even walking, especially when environmental concerns like carbon emissions and city traffic are paramount. While Ford is investing heavily in electric vehicles (EVs) to counter this trend, the fundamental shift in consumer values still presents a substitute threat to their traditional internal combustion engine vehicle sales.

For instance, in 2024, global EV sales continued their upward trajectory, capturing a larger market share. This indicates that consumers are actively seeking out lower-emission options, which directly impacts demand for gasoline-powered vehicles. Ford's own EV sales figures, while growing, still represent a smaller portion of their overall revenue compared to their legacy products, highlighting the ongoing challenge.

- Growing Environmental Consciousness: Surveys in 2024 consistently showed a rise in consumer concern over climate change, directly influencing purchasing decisions in the automotive sector.

- Rise of Micro-mobility and Public Transport: Increased investment and improvement in urban public transportation networks and the popularity of e-bikes and scooters offer viable alternatives for shorter commutes, especially in densely populated areas.

- Fuel Efficiency Standards: More stringent government regulations on fuel economy for traditional vehicles, implemented or planned through 2024 and beyond, make less efficient alternatives less attractive and more costly to own.

- Total Cost of Ownership: For some consumers, the long-term cost savings associated with EVs, including lower fuel and maintenance expenses, are becoming a more compelling factor than the initial purchase price, further driving the substitution away from traditional vehicles.

Work-from-Home and Digitalization Trends

The rise of work-from-home and increased digitalization significantly impacts the demand for personal vehicles, a key substitute for traditional car ownership. As more services move online, the necessity for daily commutes diminishes for a substantial portion of the workforce.

This trend directly affects the automotive industry by reducing the frequency of vehicle replacement and potentially decreasing the number of cars owned per household. For instance, in 2024, surveys indicated that a significant percentage of employees who transitioned to remote work during the pandemic continued to do so at least part-time, altering long-term commuting patterns.

- Reduced Commuting Needs: With remote work, fewer people drive to offices daily, lessening the reliance on personal vehicles.

- Digital Service Adoption: Online shopping, virtual meetings, and digital entertainment further decrease the need for physical travel.

- Impact on Vehicle Replacement Cycles: Less frequent use can lead to longer ownership periods, slowing down new car sales.

- Shifting Household Vehicle Demand: Households may opt for fewer vehicles if multiple members can work remotely or share transportation.

The threat of substitutes for Ford vehicles is significant, driven by evolving consumer preferences and technological advancements. Public transportation, ride-sharing, and micro-mobility options offer increasingly viable alternatives, particularly in urban environments. These substitutes reduce the necessity of personal car ownership, impacting Ford's sales volume.

The shift towards sustainability and the rise of electric vehicles (EVs) also present a substitute threat, as consumers prioritize eco-friendly options. Furthermore, the normalization of remote work has reduced commuting needs, further diminishing the reliance on traditional vehicles.

By mid-2024, global EV sales continued to grow, capturing a larger market share, while ride-sharing platforms like Uber facilitated billions of trips. These trends directly challenge Ford's traditional business model.

| Substitute Category | Examples | Impact on Ford | 2024 Trend/Data Point |

|---|---|---|---|

| Public Transportation | Light rail, Bus rapid transit | Reduced demand for personal vehicles in urban areas | Increased ridership in cities like Los Angeles and Seattle |

| Mobility Services | Ride-sharing (Uber, Lyft), Car-sharing | Decreased new car sales, especially among younger demographics | Uber reported over 1.5 billion trips globally in 2023 |

| Micro-mobility | E-scooters, Bike-sharing | Lower demand for compact and city-focused vehicles | 15% year-over-year growth in shared e-scooter rides in major metros by mid-2024 |

| Sustainable Alternatives | Electric Vehicles (EVs), Cycling, Walking | Shift away from internal combustion engine vehicles | Global EV sales continued upward trajectory in 2024 |

| Remote Work & Digitalization | Work-from-home policies, Online services | Reduced commuting, potentially fewer vehicles per household | Significant percentage of employees continued remote work part-time in 2024 |

Entrants Threaten

The automotive sector requires staggering upfront investments. Think about the billions needed for R&D, building factories, specialized machinery, and setting up dealerships. This high capital intensity acts as a major roadblock for any newcomer wanting to challenge established giants like Ford.

For instance, developing a new vehicle platform can cost upwards of $2 billion. Then there's the cost of retooling factories for new models, which can run into hundreds of millions of dollars. These massive financial requirements mean that only well-funded entities can even consider entering the market, and even then, the risk is substantial.

Ford's established brand loyalty, cultivated over a century, presents a significant barrier to new entrants. Decades of building trust in quality, reliability, and service mean customers often stick with familiar brands. For instance, in 2024, Ford continued to leverage its strong heritage, with models like the F-150 remaining a top seller, demonstrating persistent consumer preference.

The automotive sector faces a formidable barrier to entry due to its intricate web of regulatory and safety standards. Newcomers must contend with rigorous mandates concerning vehicle safety, emissions, and environmental impact, which differ significantly across global markets. For instance, in 2024, the European Union's Euro 7 emissions standards continue to push for cleaner vehicles, requiring substantial investment in research and development for compliance. Navigating these complex, region-specific requirements necessitates extensive testing and certification, adding considerable cost and time to market entry, thus deterring many potential new players.

Extensive Distribution and Service Networks

Ford's extensive global network of dealerships, service centers, and parts supply chains presents a formidable barrier to new entrants. This established infrastructure ensures widespread customer access and robust after-sales support, a critical factor in the automotive industry.

Establishing a comparable distribution and service network requires immense logistical and financial investment, making it exceptionally difficult for newcomers to compete effectively. For instance, in 2024, the cost to establish a new dealership can range from several million to tens of millions of dollars, depending on location and scale.

- Global Reach: Ford operates over 6,500 dealerships worldwide, offering a significant advantage in customer accessibility.

- Service Infrastructure: The company maintains a vast network of service centers, facilitating efficient maintenance and repairs, which is crucial for customer retention.

- Supply Chain Integration: Ford's integrated parts supply chain ensures availability and timely delivery, reducing operational costs and improving customer satisfaction.

Technological and Supply Chain Expertise

The threat of new entrants in the automotive sector is significantly constrained by the immense technological and supply chain expertise required. Designing, engineering, and manufacturing complex vehicles demands deep knowledge across diverse fields like powertrain, electronics, and software. For instance, developing advanced driver-assistance systems (ADAS) alone requires substantial investment in R&D and specialized talent.

Managing a global supply chain for millions of components is another formidable barrier. New players struggle to replicate the established supplier relationships and operational efficiencies that incumbents like Ford have cultivated over decades. In 2023, Ford reported approximately $176 billion in revenue, a testament to its vast operational scale and established supply network, which would be incredibly difficult for a newcomer to match.

- High Capital Investment: Establishing the necessary research, development, and manufacturing infrastructure demands billions of dollars.

- Proprietary Technology: Incumbents possess patents and trade secrets in areas like battery technology and autonomous driving.

- Established Supplier Networks: Long-standing relationships ensure reliable access to critical components, often at favorable terms.

- Economies of Scale: Existing manufacturers benefit from lower per-unit costs due to high production volumes.

The automotive industry presents a very high barrier to entry for new companies, largely due to the enormous capital required. Developing new vehicle platforms and retooling factories can cost billions of dollars, a sum few new entrants can realistically afford. For example, the average cost to develop a new car model can exceed $2 billion, and this doesn't include the ongoing investment in manufacturing and distribution.

Ford's established brand loyalty, built over a century, also makes it difficult for newcomers to gain market share. Consumers often trust well-known brands, and in 2024, Ford's continued success with models like the F-150 highlights this persistent preference. Overcoming this ingrained customer trust requires significant marketing and product differentiation efforts from any new player.

The complex web of global regulations, including stringent emissions and safety standards, adds another layer of difficulty for new entrants. Complying with these varied requirements, such as the EU's Euro 7 standards in 2024, necessitates substantial investment in research and development, further deterring potential challengers.

Ford's extensive global dealership and service network is a significant competitive advantage. Establishing a comparable infrastructure, which includes millions in dealership setup costs in 2024, is a massive undertaking that new entrants find exceptionally hard to replicate, impacting customer accessibility and after-sales support.

| Barrier Type | Estimated Cost/Factor | Impact on New Entrants |

|---|---|---|

| Capital Investment (R&D, Manufacturing) | $2 billion+ per vehicle platform | Extremely high, limits potential entrants |

| Brand Loyalty & Reputation | Centuries of cultivation | Difficult to overcome; requires significant marketing |

| Regulatory Compliance (Safety, Emissions) | Substantial R&D for standards like Euro 7 (2024) | Adds significant cost and time to market entry |

| Distribution & Service Network | Millions to tens of millions per dealership (2024) | Requires vast logistical and financial investment |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ford Motor Company is built upon a foundation of robust data, including Ford's annual reports, SEC filings, and investor relations materials.