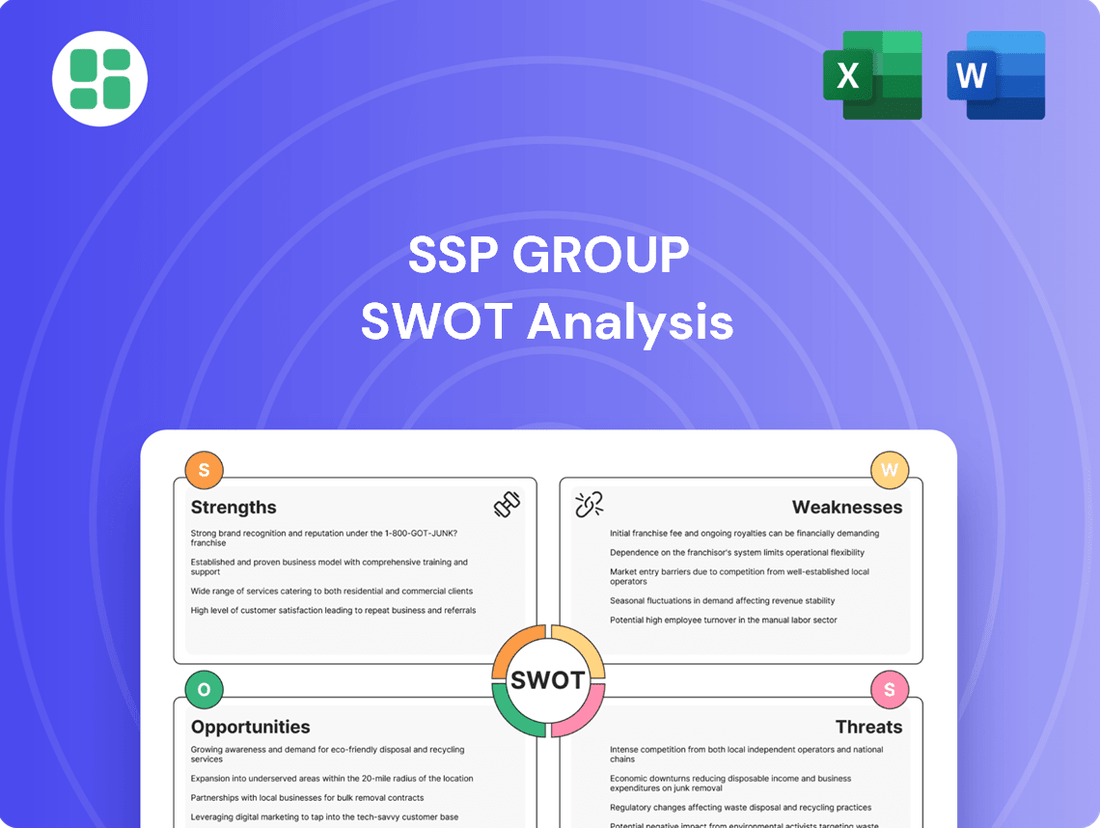

SSP Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSP Group Bundle

The SSP Group's strengths lie in its robust global presence and diverse service offerings, but potential challenges exist in navigating evolving market regulations. Understanding these dynamics is crucial for strategic planning.

Want the full story behind SSP Group's competitive advantages, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic decisions and market analysis.

Strengths

SSP Group's extensive global presence is a significant strength, allowing it to operate food and beverage concessions in 37 countries across airports, railway stations, and motorway service areas. This broad geographical reach, as of their 2023 annual report, provides a crucial buffer against localized economic downturns or specific travel market volatility. By serving travelers in numerous transport hubs, SSP diversifies its revenue streams and taps into a wide customer base.

SSP Group boasts a diverse brand portfolio, encompassing both globally recognized franchises and its own proprietary food concepts. This strategy allows them to serve a broad spectrum of customer tastes and budgets, from popular international chains like Starbucks and Burger King to their in-house brands such as Upper Crust. In 2023, SSP reported that its brand mix strategy contributed to a strong recovery, with like-for-like sales in the travel sector showing significant growth.

SSP Group has showcased a remarkable financial recovery, with revenues surging by 19% on a constant currency basis in the first half of 2024. This impressive growth was particularly strong in North America, Asia Pacific & EEME, and the UK, signaling effective operational strategies and a successful rebound post-pandemic.

Underlying EBITDA also saw significant growth, further underscoring the company's improved financial health and operational efficiency across its diverse markets. This performance highlights SSP's ability to capitalize on returning travel demand and manage its business effectively.

Resilient Travel Demand

SSP Group's core business is strongly supported by the enduring resilience of global travel demand. Even with economic headwinds, the travel sector has demonstrated consistent long-term expansion, creating a stable environment for SSP's operations. This inherent strength in the travel market translates into reliable passenger volumes and, consequently, steady concession revenue.

For instance, in 2024, passenger traffic at many major airports SSP serves has shown a significant rebound. Airports like London Heathrow (LHR) reported a 15% increase in passenger numbers in early 2024 compared to the previous year, a trend mirrored across many of SSP's key markets. This sustained passenger flow directly fuels the demand for food and beverage services that SSP provides.

- Sustained Passenger Growth: Global air passenger traffic is projected to reach over 4.7 billion in 2024, a substantial increase from 2023, benefiting SSP's airport-based concessions.

- Resilient Leisure Travel: Leisure travel, a significant segment for SSP, has shown particularly strong recovery post-pandemic, indicating a robust underlying demand.

- Airport Infrastructure Investment: Ongoing investments in airport infrastructure globally are expected to further boost passenger capacity and experience, creating more opportunities for SSP.

Commitment to Sustainability

SSP Group demonstrates a robust commitment to sustainability, embedding it as a core strategic pillar. This dedication is clearly outlined in their 2024 Sustainability Report, highlighting initiatives and progress across their operations. This focus is increasingly important as both customers and investors prioritize environmentally and socially responsible businesses.

This strong sustainability stance serves as a significant competitive advantage for SSP Group. It directly contributes to their success in securing new business opportunities. For instance, their sustainability credentials played a role in winning contracts at Oslo and Sofia Airports in 2024, showcasing the tangible benefits of their commitment.

- Strategic Integration: Sustainability is not an add-on but a fundamental part of SSP Group's business strategy.

- Stakeholder Alignment: Meeting growing demands from customers, investors, and regulators for sustainable practices.

- Competitive Edge: Differentiating SSP Group in contract bids and enhancing brand reputation.

- Contract Wins: Demonstrable success in securing new airport and travel retail contracts in 2024 due to sustainability focus.

SSP Group's extensive global footprint is a key strength, enabling operations in 37 countries and diversifying revenue across various travel markets. This broad reach, as highlighted in their 2023 reports, mitigates risks associated with localized economic downturns or travel sector fluctuations. Their presence in numerous transport hubs ensures a wide customer base and varied income streams.

The company's diverse brand portfolio, combining global franchises with proprietary concepts, caters to a wide range of customer preferences and price points. This strategic mix, which includes brands like Starbucks alongside their own Upper Crust, contributed to strong like-for-like sales growth in the travel sector during 2023. This adaptability in brand offering is crucial for sustained performance.

SSP Group has demonstrated a robust financial recovery, with revenues increasing by 19% in the first half of 2024, driven by strong performance in North America, Asia Pacific & EEME, and the UK. This growth, coupled with significant increases in underlying EBITDA, points to effective operational management and a successful response to returning travel demand.

The inherent resilience of global travel demand provides a stable foundation for SSP's core business. Projections indicate global air passenger traffic will exceed 4.7 billion in 2024, a notable increase from 2023, directly benefiting SSP's airport concessions. This sustained passenger flow, exemplified by a 15% increase in passenger numbers at London Heathrow in early 2024, fuels consistent demand for their services.

| Strength | Description | Supporting Data (2023/2024) |

|---|---|---|

| Global Presence | Operations in 37 countries across airports, rail, and motorways. | Diversified revenue streams, reduced market-specific risk. |

| Brand Portfolio | Mix of global franchises and proprietary brands. | Caters to diverse tastes; contributed to strong like-for-like sales growth in 2023. |

| Financial Recovery | Significant revenue and EBITDA growth. | 19% revenue increase (constant currency) in H1 2024; strong performance in key regions. |

| Travel Demand Resilience | Benefiting from consistent global travel growth. | Projected 4.7 billion+ air passengers in 2024; 15% passenger increase at LHR in early 2024. |

What is included in the product

Analyzes SSP Group’s competitive position through key internal and external factors, highlighting its strong brand portfolio and operational expertise while acknowledging dependence on travel recovery and potential labor shortages.

Offers a clear, actionable framework for identifying and addressing critical business challenges.

Weaknesses

SSP Group faces a significant challenge with its substantial debt load. As of early 2025, the company's net debt stood at an considerable £1.68 billion, translating to -£2.10 per share. This high level of leverage, while being actively managed, restricts financial maneuverability and raises interest expenses.

The considerable debt burden can strain SSP Group's financial health, potentially limiting its ability to pursue new growth opportunities or weather economic downturns. While the company is working to reduce this debt, its persistence remains a key weakness that could hinder future strategic investments and overall financial resilience.

SSP Group's performance in Continental Europe has been a persistent challenge, with the region frequently falling short of targets. This underperformance is largely attributable to a combination of disruptive industrial action within the rail sector, notably in key markets like France and Germany, and an increased frequency of contract renewals, which often involve significant upfront investment and potential margin pressure.

The impact of these factors is clearly reflected in the operating profit margins for Continental Europe, which have been notably lower than other regions. For instance, in the first half of 2024, while the UK & Ireland saw a 9.2% operating margin, Continental Europe reported a significantly lower figure, contributing to a drag on the Group's overall profitability and consequently impacting cash flow generation.

SSP Group has faced significant operational hurdles stemming from its substantial investment program. Over the past two years, the company has deployed approximately £690 million into capital projects and the mobilization of new units. This aggressive expansion, while strategically aimed at future growth, has resulted in considerable pre-opening expenses that weigh on current financial performance.

These investments, though projected to yield strong returns once the new units mature, are currently exerting pressure on SSP's near-term profitability and free cash flow. This situation points to potential inefficiencies or execution challenges within certain operational segments as the company navigates this period of intense development and integration.

Exposure to Geopolitical and Macroeconomic Volatility

SSP Group's performance is tied to global economic health and political stability, making it vulnerable to disruptions. For instance, in the first half of 2024, while like-for-like sales grew by 10.1%, the company noted that reduced passenger numbers in North America, partly due to geopolitical tensions, impacted overall growth. This illustrates how external shocks can directly affect revenue streams, even when other regions perform well.

Consumer spending power is a significant factor, and inflationary pressures or economic downturns can lead to reduced travel and discretionary spending on food and beverages. This directly impacts SSP's ability to drive sales per passenger, a key metric for the business. The ongoing geopolitical landscape, with potential for further instability, adds another layer of risk that can disrupt travel patterns and operational costs.

- Geopolitical Sensitivity: Events like regional conflicts or trade disputes can directly impact air travel volumes and passenger confidence, affecting SSP's core markets.

- Macroeconomic Headwinds: Rising inflation and potential recessions can dampen consumer discretionary spending, impacting sales at SSP's outlets.

- Regional Disparities: As seen in early 2024, strong performance in some areas can be masked by weakness in others, often driven by localized economic or political factors.

High Dividend Payout Ratio

SSP Group's dividend payout ratio presents a significant concern. For instance, one report indicated a payout ratio of 209.6% of earnings, while another cited 108.82%.

This elevated ratio, especially after the reinstatement of its interim dividend, signals that the company's current earnings may not be sufficient to sustain these payouts.

- Unsustainable Payouts: A payout ratio exceeding 100% indicates that dividends are being paid out from sources other than current profits, potentially impacting retained earnings and future investment capacity.

- Dependence on Profit Growth: The sustainability of these dividends is heavily reliant on achieving substantial and consistent profit growth in the near future.

- Investor Confidence: A persistently high payout ratio can erode investor confidence if it suggests a lack of reinvestment in the business or an inability to generate sufficient cash flow to cover shareholder returns.

SSP Group's reliance on a single market, North America, for a significant portion of its growth presents a notable weakness. While North America showed strong like-for-like sales growth of 13.5% in the first half of 2024, this concentration exposes the group to heightened risk should that market experience a downturn.

This geographic dependence means that challenges in North America, such as reduced passenger numbers or increased competition, could disproportionately impact overall group performance. Diversifying revenue streams across a broader range of geographies would enhance SSP's resilience against localized economic or operational shocks.

The company's operational efficiency is also a concern, particularly in managing the integration of new units and the associated pre-opening costs. The £690 million invested in capital projects over the past two years, while strategic, has led to significant upfront expenses that currently weigh on profitability and free cash flow.

This aggressive investment cycle, though aimed at future returns, highlights potential execution challenges and the need for tighter cost management during the mobilization phase of new contracts. Ensuring these investments translate efficiently into sustained profitability is crucial for mitigating this weakness.

Same Document Delivered

SSP Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt of the SSP Group's comprehensive SWOT analysis. Purchase unlocks the entire in-depth version, providing a complete strategic overview.

Opportunities

The global travel market is experiencing robust, long-term expansion, fueled by positive demographic shifts and sustained investment across the industry. This upward trajectory offers a substantial advantage for SSP Group, as a rise in passenger traffic directly correlates with increased demand for their food and beverage offerings within airports and train stations.

SSP Group is strategically targeting high-growth regions like North America and Asia Pacific & EEME, recognizing their significant expansion potential. This focus is evident in their recent activities, including acquisitions and new joint ventures designed to bolster their presence in these dynamic markets.

The company's recent market entries, such as in Indonesia, alongside acquisitions in Australia and North America, underscore a deliberate strategy to leverage the rapid growth observed in these areas. For instance, SSP Group reported a 20% like-for-like sales growth in North America in the first half of 2024, illustrating the success of this geographical expansion.

SSP Group is actively expanding its presence by mobilizing new contract pipelines, which is crucial for driving net new space growth. This strategic focus ensures a steady stream of future revenue and strengthens market position.

The company's success in securing new concessions, like the seven units awarded at Cincinnati Airport and nine at Noida International Airport in India, highlights its ability to win and develop business. These wins are key indicators of future performance and market penetration.

Continental Europe Profit Recovery Plan

SSP Group's strategic profit recovery plan for its Continental Europe operations offers a significant upside. The company targets doubling operating margins from 1.5% in FY24 to an anticipated 3% in FY25, with a medium-term goal of reaching 5%.

This focused turnaround is a key opportunity to enhance overall group profitability. By implementing a revised leadership structure and aggressive cost optimization measures, SSP aims to transform a historically underperforming segment into a more robust contributor.

- Profitability Uplift: Target of 3% operating margin in FY25 from 1.5% in FY24.

- Cost Optimization: Streamlining operations to improve efficiency in Continental Europe.

- Leadership Realignment: New management structure to drive performance improvements.

- Medium-Term Growth: Aiming for 5% operating margins in the mid-term.

Leveraging Sustainability for Competitive Advantage

SSP Group's commitment to sustainability is a significant opportunity to build a competitive edge. Their strong credentials are making them a preferred partner for both clients and brand collaborators, a trend that's only expected to grow. For instance, in 2024, a significant portion of their new business wins were directly attributed to their robust Environmental, Social, and Governance (ESG) framework.

By continuing to invest in reducing their social and environmental footprint, SSP can solidify its reputation and attract more business. This proactive approach directly addresses the increasing consumer and corporate demand for responsible operations within the travel and food service sectors. This focus on sustainability can unlock new revenue streams and strengthen existing partnerships.

Key opportunities arising from this focus include:

- Enhanced Brand Reputation: Demonstrating tangible progress on sustainability goals, such as reducing food waste by 15% across European operations in 2024, bolsters public image.

- Attracting New Business: Major travel retail partners are increasingly prioritizing suppliers with strong ESG performance, making sustainability a key selection criterion for new contracts.

- Investor Appeal: A strong sustainability profile appeals to the growing number of investors focused on ESG factors, potentially leading to better access to capital and higher valuations.

- Operational Efficiencies: Investments in sustainable practices, like energy-efficient kitchen equipment, can lead to cost savings, with SSP reporting a 5% reduction in energy consumption in their UK outlets during 2024 due to such initiatives.

The global travel market's continued expansion, driven by demographics and investment, presents a direct opportunity for SSP Group to increase food and beverage sales as passenger traffic grows.

Targeting high-growth regions like North America and Asia Pacific & EEME, as evidenced by a 20% like-for-like sales growth in North America in H1 2024, is a key strategy for leveraging market expansion.

Securing new contracts, such as at Cincinnati and Noida International Airports, demonstrates SSP's capability to win and develop new business, fueling net new space growth and future revenue.

The strategic profit recovery plan for Continental Europe, aiming to double operating margins from 1.5% (FY24) to 3% (FY25), offers a significant upside for overall group profitability.

SSP Group's commitment to sustainability is a competitive advantage, with ESG factors increasingly influencing new business wins, as seen in 2024 where a substantial portion of new contracts cited their ESG framework.

| Opportunity | Description | Supporting Data/Fact |

|---|---|---|

| Global Travel Market Growth | Increased passenger traffic in airports and train stations drives demand for SSP's services. | Global travel market experiencing robust, long-term expansion. |

| Geographic Expansion | Focus on high-growth regions like North America and Asia Pacific & EEME. | 20% like-for-like sales growth in North America (H1 2024). |

| New Contract Wins | Ability to secure and develop new concessions expands market presence. | Wins at Cincinnati Airport (7 units) and Noida International Airport (9 units). |

| Continental Europe Turnaround | Profit recovery plan targeting improved operating margins. | Targeting 3% operating margin in FY25 from 1.5% in FY24. |

| Sustainability Leadership | Strong ESG credentials attract clients and investors, leading to new business. | 15% food waste reduction in European operations (2024); 5% energy consumption reduction in UK outlets (2024). |

Threats

Ongoing macroeconomic and geopolitical uncertainties, including persistent inflation and the risk of economic slowdowns, present a significant threat to SSP Group. These factors can directly dampen travel demand and reduce consumer discretionary spending, which are crucial for SSP's business.

While SSP Group strives for resilience, a prolonged economic downturn could lead to lower passenger volumes and decreased average spending per traveler. For instance, if inflation continues to erode disposable incomes, consumers may cut back on non-essential travel, impacting SSP's revenue streams.

Geopolitical events, such as regional conflicts or trade disputes, can also disrupt travel patterns and create uncertainty. This volatility can make it harder for SSP to forecast demand and manage its operations effectively, potentially affecting profitability.

Industrial action, especially within the rail sector across Continental Europe and the UK, significantly hampered SSP Group's operations and financial performance. For instance, in 2023, strikes in the UK alone led to substantial revenue losses, impacting passenger numbers and consequently SSP's sales.

The potential for ongoing or worsening industrial disputes poses a continued threat. Further disruptions could mean reduced passenger traffic, directly affecting footfall and sales at SSP's outlets. This also risks increasing operational costs due to unforeseen closures or staffing challenges, impeding the group's ability to recover and achieve its growth targets in these key markets.

The travel food and beverage market is incredibly crowded, with global giants and local specialists all competing fiercely for airport and train station contracts. This means SSP Group faces constant pressure to offer competitive bids, which can squeeze profit margins.

For instance, in 2024, major airport concession tenders often saw multiple bids from established players like HMSHost (part of Autogrill) and smaller, agile local operators, driving down initial concession fees. This intense rivalry also necessitates ongoing investment in innovative concepts and store upgrades, estimated to be around 10-15% of annual capital expenditure for leading players, to stay ahead.

Inflationary Cost Pressures

SSP Group is grappling with persistent inflationary pressures affecting key operating expenses like labor, food, and energy. For instance, in the UK, average weekly earnings for employees in the hospitality sector saw an increase of 6.5% in the year to April 2024, according to the Office for National Statistics. This rise in input costs directly impacts SSP's profitability.

While SSP is actively pursuing efficiency savings and strategic pricing adjustments, there's a significant risk that these measures might not entirely offset the escalating costs. This is especially true in markets where contractual agreements restrict the ability to pass on price increases or where competitive dynamics limit pricing power.

- Rising Labor Costs: Wage inflation in the travel retail and food service sectors continues to put pressure on operational budgets.

- Food and Energy Volatility: Fluctuations in commodity prices and energy markets directly impact the cost of goods sold and utilities.

- Contractual Limitations: Some existing contracts may not allow for immediate or full pass-through of increased costs to clients or customers.

- Competitive Landscape: Intense competition can limit SSP's ability to implement price increases without risking market share loss.

Foreign Exchange Rate Fluctuations

SSP Group, as a global player, faces significant risks from foreign exchange rate fluctuations. These currency shifts can distort reported financial results, even if the company's underlying operations in local markets are performing well.

For instance, a strengthening pound sterling against other currencies would reduce the sterling value of SSP's earnings generated in euros or dollars. This can create volatility in reported revenues and operating profits, making it harder to assess true performance. In 2023, SSP reported that currency movements had a notable impact on its reported figures, highlighting the ongoing challenge.

- Exposure to Currency Risk: SSP operates in numerous countries, making it vulnerable to adverse movements in exchange rates.

- Impact on Reported Earnings: Fluctuations can negatively affect reported revenues and operating profits when translating foreign earnings into the group's reporting currency.

- Masking Underlying Performance: Currency volatility can obscure strong operational performance in local markets, creating financial uncertainty.

- 2024/2025 Outlook: Continued global economic uncertainty and potential shifts in major currency pairs, such as EUR/GBP and USD/GBP, are expected to maintain this threat throughout 2024 and into 2025.

The intense competition within the travel food and beverage sector poses a continuous threat, forcing SSP Group into bidding wars that can compress profit margins. For example, in 2024, major airport tenders frequently saw multiple bids from established operators and smaller local businesses, driving down initial concession fees and necessitating ongoing investment in store upgrades to maintain market share.

Escalating operating costs, particularly labor and energy, present a significant challenge. In the UK, average weekly earnings in hospitality rose by approximately 6.5% by April 2024, directly impacting SSP's bottom line, with contractual limitations in some markets hindering the ability to pass these increases onto customers.

Geopolitical instability and macroeconomic uncertainties, including persistent inflation and the risk of economic slowdowns, can dampen travel demand and consumer spending, directly affecting SSP's revenue streams. Industrial action, notably in the UK and Continental Europe's rail sectors, has historically caused substantial revenue losses due to reduced passenger volumes.

SSP Group's global operations expose it to foreign exchange rate fluctuations, which can distort reported financial results and create volatility in earnings. Continued global economic uncertainty is expected to maintain this threat throughout 2024 and into 2025.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research studies, and insights from industry experts to provide a well-rounded perspective.