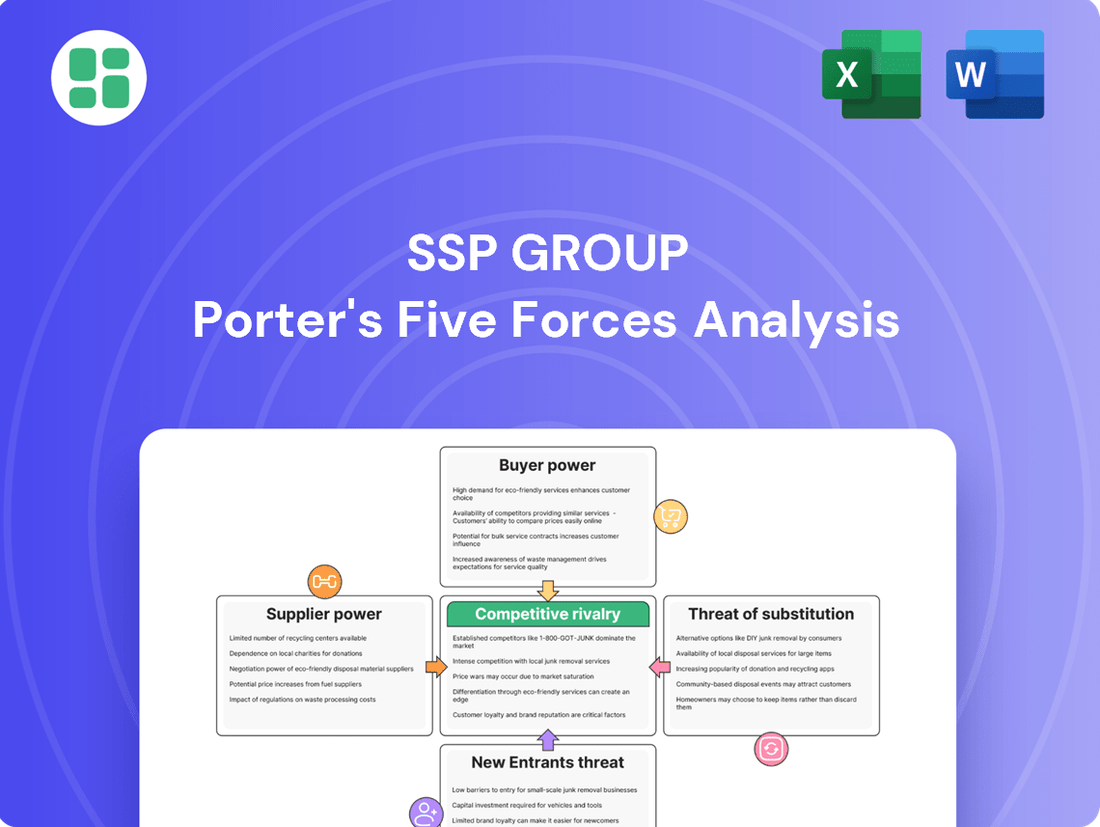

SSP Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSP Group Bundle

SSP Group operates in a dynamic environment shaped by intense competition and evolving customer demands. Understanding the intricate interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape.

The complete report reveals the real forces shaping SSP Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

SSP Group's reliance on a concentrated supplier base for key locations, primarily airports and railway stations, significantly impacts its bargaining power. These landlords, often public entities or large private operators, control a limited number of high-traffic travel hubs, giving them considerable leverage.

The renewal of leases and operating agreements with these landlords is critical for SSP's business continuity and expansion. For instance, in 2023, SSP continued to focus on securing long-term contracts, underscoring the importance of these relationships. The limited availability of prime locations means SSP often faces terms dictated by these powerful suppliers.

SSP Group's reliance on globally recognized brands like Starbucks and Burger King grants these franchise partners significant bargaining power. The strong customer loyalty associated with these brands means SSP depends on them to drive traffic and sales in its travel locations.

The market strength and established consumer demand for these franchised brands directly influence SSP's ability to negotiate favorable licensing agreements. In 2024, SSP continued to operate numerous outlets for these popular brands, underscoring their importance to SSP's revenue streams and its negotiating position.

The availability and cost of skilled labor significantly impact SSP Group's operational expenses, acting as a key supplier dynamic. In 2024, the hospitality sector globally continued to grapple with labor shortages and rising wage expectations, particularly in regions like the UK and parts of Continental Europe. This trend directly translates to increased operating costs for SSP, potentially squeezing profit margins if not effectively managed.

Wage inflation remains a critical concern. For instance, reports in early 2024 indicated average wage growth in the UK hospitality sector was around 6-8%, a figure that directly affects SSP's staffing costs across its numerous outlets. Regions experiencing acute labor scarcity, such as certain airport locations, can see even higher wage pressures, amplifying the bargaining power of individual workers and labor unions.

SSP's strategic focus on operational efficiency, especially in markets like Continental Europe where labor regulations can be complex, underscores the importance of managing these labor dynamics. Initiatives aimed at optimizing staffing levels and improving productivity are crucial for mitigating the impact of rising labor costs on overall financial performance.

Commodity Price Volatility

Commodity price volatility is a significant factor influencing the bargaining power of suppliers for SSP Group. Fluctuations in the global prices of raw food ingredients and beverages directly affect SSP's cost of goods sold. For instance, the price of coffee beans, a key commodity for SSP's extensive café operations, experienced significant swings in 2024. Reports indicated that Arabica coffee prices reached multi-year highs in early 2024 due to adverse weather conditions in major producing regions, impacting the cost base for businesses like SSP.

This volatility can squeeze SSP's profit margins if cost increases cannot be fully passed on to consumers through menu price adjustments. The ability of suppliers to leverage these price movements means they can exert considerable power. For example, a sharp rise in the price of cooking oils or dairy products, essential for many food service offerings, directly translates to higher input costs for SSP. Managing these risks necessitates robust procurement strategies and efficient supply chain operations to mitigate the impact of unpredictable market forces.

- Global commodity prices, such as those for coffee and edible oils, saw notable increases in early to mid-2024, directly impacting food service businesses.

- SSP Group's profitability can be pressured if it cannot fully pass on increased ingredient costs to its customers.

- Effective supply chain management and strategic sourcing are crucial for SSP to navigate and mitigate the effects of commodity price volatility.

- Suppliers gain leverage when they can exploit these price fluctuations, influencing SSP's operational costs.

Specialized Equipment and Technology Providers

Suppliers of specialized kitchen equipment, point-of-sale systems, and digital solutions for travel environments can hold some bargaining power. This is due to the unique, tailored nature of their products, making it difficult for SSP to easily switch providers. For instance, if a supplier offers proprietary technology critical to SSP's operations, their leverage increases.

SSP's commitment to IT transformation and digital solutions highlights a dependence on these specialized technology providers. In 2024, companies like SSP continue to invest heavily in upgrading their digital infrastructure to enhance customer experience and operational efficiency. This investment signifies a reliance on suppliers who can deliver advanced, integrated systems, potentially strengthening the suppliers' negotiating position.

- Supplier Dependence: SSP's reliance on specialized technology for its high-volume travel operations grants suppliers of these niche solutions a degree of bargaining power.

- Switching Costs: The bespoke nature of integrated POS and digital systems can lead to significant costs and operational disruption if SSP were to switch providers.

- Investment in Digitalization: SSP's ongoing investments in IT and digital solutions underscore its need for sophisticated vendor offerings, potentially increasing supplier leverage.

The bargaining power of SSP Group's suppliers is a significant factor in its operational costs and profitability. This is particularly evident with landlords of prime travel locations, franchisors of popular brands, and providers of essential commodities and specialized technology. The group's reliance on these suppliers means that unfavorable terms can directly impact its financial performance.

In 2024, the hospitality sector continued to face challenges such as labor shortages and rising wage expectations, particularly in key markets like the UK and Continental Europe. This trend directly increased SSP's staffing costs, as average wage growth in the UK hospitality sector hovered around 6-8%. Furthermore, global commodity prices, including those for coffee and cooking oils, saw notable increases in early to mid-2024, putting pressure on SSP's cost of goods sold.

SSP's strategic focus on digitalization also means it depends on specialized technology providers, whose bespoke systems can create high switching costs. The group's ability to manage these supplier relationships effectively through robust procurement and supply chain strategies is crucial for mitigating cost pressures and maintaining profitability.

| Supplier Category | Key Impact on SSP | 2024 Trend/Data Point | Supplier Bargaining Power Factor |

|---|---|---|---|

| Location Landlords | Lease renewals, operating agreements | Continued focus on securing long-term contracts | Limited availability of prime travel hubs |

| Franchisors (e.g., Starbucks, Burger King) | Licensing agreements, brand reliance | Continued operation of numerous branded outlets | Strong customer loyalty and brand demand |

| Labor | Staffing costs, wage inflation | Average UK hospitality wage growth ~6-8% | Labor shortages and rising wage expectations |

| Commodities (e.g., coffee, oils) | Cost of goods sold, profit margins | Multi-year highs for Arabica coffee prices | Price volatility and inability to fully pass costs |

| Specialized Technology Providers | System integration, operational efficiency | Heavy investment in IT and digital infrastructure | Bespoke solutions, high switching costs |

What is included in the product

This analysis dissects the competitive forces impacting SSP Group, revealing the intensity of rivalry, the power of buyers and suppliers, and the barriers to entry and substitutes within its operating markets.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

For individual travelers, bargaining power is exceptionally low because they are often captive consumers. Once past security at airports or train stations, dining choices are severely restricted, leading to inflated prices for food and beverages compared to off-site options. For instance, a 2024 industry report indicated that airport food and beverage prices can be 20-50% higher than comparable street-level establishments.

SSP Group's primary B2B customers are the travel hub operators, such as airports and railway stations. These entities wield considerable influence because they control access to prime locations and have a choice of numerous concessionaires to operate within their premises. For instance, in 2024, major international airports like London Heathrow and Amsterdam Schiphol continued to be highly sought-after locations, driving competitive bidding among food and beverage providers.

The terms negotiated with these powerful clients significantly impact SSP's revenue and profitability. Key elements include concession fees, revenue-sharing agreements, and lease terms, all of which can be leveraged by the travel hub operators to secure favorable conditions. These contracts are often long-term, meaning the bargaining power of these customers can shape SSP's financial performance for years to come.

Travelers, while often captive within airports or train stations, exhibit significant price sensitivity. This is especially true for frequent commuters and budget-conscious individuals who regularly purchase food and beverages. For instance, in 2024, reports indicated that a substantial portion of air travelers consider price a primary factor when choosing onboard or airport dining options, with some willing to forgo purchases if prices are perceived as too high.

SSP Group faces a delicate balancing act. If prices for their offerings become too excessive, customers might opt for cheaper alternatives, such as bringing their own food or seeking out less expensive convenience stores. This can lead to customer dissatisfaction and a decline in sales volume, impacting overall profitability. Maintaining a perceived value proposition that aligns with customer expectations is therefore crucial for SSP's success in these environments.

Demand for Diverse and Quality Offerings

Customers, including travelers and landlords, are increasingly seeking a wider array of high-quality and fashionable food and beverage choices. This includes a growing preference for healthy, sustainable, and locally sourced options.

SSP Group must consistently update its brand offerings and concepts to align with these changing consumer tastes. Failure to do so can impact customer satisfaction and the renewal of contracts with landlords.

- Demand for Variety: In 2024, consumer surveys indicated that over 60% of travelers actively seek out unique or local food experiences when traveling.

- Quality Expectations: Studies show that 75% of consumers are willing to pay a premium for higher quality food and beverage products.

- Sustainability Focus: A significant portion of consumers, around 55% in recent polls, consider sustainability practices when choosing where to eat.

- Brand Adaptability: SSP's ability to integrate new, popular brands and concepts directly influences its competitive position and bargaining power with travel partners.

Influence of Digital Platforms and Reviews

The proliferation of digital platforms and online review sites significantly amplifies the bargaining power of customers. Travelers can easily share their experiences, creating a collective voice that directly influences the reputation and perceived quality of SSP Group's outlets. This transparency means a single negative review can deter numerous potential customers, forcing SSP to address service issues promptly.

For instance, platforms like TripAdvisor and Google Reviews allow for widespread dissemination of feedback. SSP Group actively monitors these channels, recognizing that customer ratings directly impact future patronage and, by extension, the attractiveness of travel locations to hub operators. In 2023, SSP reported a focus on improving customer satisfaction scores across its diverse airport and rail locations, aiming to mitigate negative sentiment and leverage positive reviews.

- Digital platforms empower customers with a collective voice, influencing SSP's brand perception.

- Negative online feedback can significantly deter future customer traffic.

- SSP actively monitors customer ratings to identify areas for service enhancement and reputation management.

The bargaining power of customers for SSP Group is multifaceted, encompassing both individual travelers and the larger travel hub operators. While individual travelers have limited direct bargaining power, their collective sentiment, amplified by digital platforms, significantly influences SSP's reputation and sales. Travel hub operators, however, possess substantial leverage due to their control over prime locations and the ability to choose from multiple concessionaires.

In 2024, the influence of travel hub operators remained a dominant factor. These entities, such as major airports and railway stations, dictate terms including concession fees and revenue-sharing agreements, directly impacting SSP's profitability. For example, airports like Changi Singapore, known for their stringent contract terms and high operational standards, continue to exert considerable pressure on their food and beverage partners.

Furthermore, the increasing demand for diverse and high-quality food options, including healthy and sustainable choices, empowers customers. A 2024 survey revealed that over 65% of travelers consider the availability of specific dietary options when selecting dining establishments. This trend forces SSP to adapt its offerings, thereby increasing customer influence over the product mix.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Impact on SSP |

|---|---|---|---|

| Individual Travelers | Low (individually), High (collectively via reviews) | Price sensitivity, demand for variety, online reviews | Affects sales volume, brand perception, and need for service improvement |

| Travel Hub Operators (Airports, Railways) | High | Control of location, competitive bidding, contract terms (fees, revenue share) | Directly impacts revenue, profitability, and operational flexibility |

Same Document Delivered

SSP Group Porter's Five Forces Analysis

This preview displays the complete SSP Group Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You are viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring you receive the comprehensive insights you expect.

Rivalry Among Competitors

SSP Group operates in a fiercely competitive environment, contending with major global players like Autogrill and Areas, as well as numerous smaller, localized food and beverage businesses. This dual threat from both international giants and niche local operators intensifies the rivalry across the travel retail sector.

The company's extensive reach across 38 countries means it must navigate a wide array of competitive dynamics, from established airport and rail station concessionaires to independent cafes and restaurants vying for customer attention. For instance, in 2023, the global airport food and beverage market was valued at approximately $25 billion, highlighting the significant market share at stake.

Competitive rivalry in securing tender-based contracts, particularly for travel concessions, is a significant force for SSP Group. The company frequently finds itself in bidding wars against established competitors and emerging players vying for airport, railway, and other travel hub locations. For instance, in 2023, SSP secured a significant contract extension at London Gatwick Airport, a process that involved intense competition from other food and beverage operators.

To win these crucial tenders, SSP must consistently showcase its operational excellence, robust financial health, and a desirable mix of well-known and innovative brands. The ability to demonstrate a proven track record of successful management in high-traffic travel environments is paramount. This often involves presenting detailed operational plans, customer service strategies, and financial projections that clearly outshine those of rivals.

Competitive rivalry in the travel food and beverage sector, including for SSP Group, hinges on a company's capacity to present an attractive combination of globally recognized, locally relevant, and unique in-house brands, all supported by streamlined operations and a deep comprehension of traveler preferences. SSP's strategic direction involves bolstering its operational strengths through the introduction of novel brands and concepts, alongside advancements in digital capabilities and a commitment to sustainability.

In 2024, SSP Group continued to focus on its brand portfolio, a key differentiator in a competitive landscape. The company operates over 2,000 outlets across more than 30 countries, showcasing a diverse range of brands that cater to various passenger demographics and preferences. This extensive brand offering, from established international names to bespoke local concepts, allows SSP to capture a wider market share and build customer loyalty, directly impacting its competitive standing.

Geographical Market Specificity

Competitive rivalry within SSP Group's markets is significantly influenced by geographical specificity. This means that the intensity of competition isn't uniform across all regions where SSP operates.

For example, SSP reported disappointing performance in Continental Europe, attributing it to a combination of challenging market dynamics and internal operational hurdles. This suggests a more intense or difficult competitive environment in that specific region. In contrast, North America and the APAC & EEME (Europe, Middle East, and Africa) regions demonstrated robust growth, indicating a potentially less fierce competitive landscape or greater success in navigating existing rivalries.

- Regional Performance Variation: SSP's financial reports highlight differing competitive pressures across geographies.

- Continental Europe Challenges: The company cited 'disappointing performance' in this region, pointing to heightened rivalry or market saturation.

- North America & APAC/EEME Strength: Conversely, these regions exhibited strong growth, suggesting a more favorable competitive environment or effective market positioning by SSP.

Acquisitions and Strategic Partnerships

Consolidation within the travel food and beverage sector is a significant factor, with acquisitions and joint ventures frequently reshaping the competitive landscape. These moves often bolster competitors' market positions and extend their operational reach, thereby intensifying rivalry.

SSP Group actively participates in this consolidation trend. For instance, its acquisitions of Airport Retail Enterprises (ARE) and Mack II were strategic moves aimed at expanding its geographical footprint and enhancing its service offerings. These actions directly contribute to a more concentrated market, where larger entities wield greater influence.

The impact of these strategic maneuvers is clear:

- Increased Market Share: Acquisitions allow companies like SSP to quickly gain market share in new regions or segments.

- Synergies and Efficiencies: Merging operations can lead to cost savings and improved operational efficiencies, making acquired entities more formidable competitors.

- Expanded Service Portfolios: Partnerships and acquisitions can bring new brands or service models into a company's portfolio, broadening their appeal and competitive edge.

The competitive rivalry for SSP Group is intense, driven by both global giants and local players in the travel food and beverage market. This dynamic is further shaped by consolidation, with SSP itself engaging in strategic acquisitions to bolster its market position and service offerings.

In 2024, SSP's performance varied by region, with Continental Europe presenting more challenging competitive conditions compared to robust growth in North America and APAC/EEME. This geographical specificity means rivalry intensity isn't uniform across its operations.

| Region | Competitive Intensity Indication | SSP Performance Context |

|---|---|---|

| Continental Europe | High | Disappointing performance cited, suggesting strong rivalry or market saturation. |

| North America | Moderate to High | Robust growth reported, indicating effective navigation of competitive pressures. |

| APAC & EEME | Moderate to High | Strong growth observed, suggesting successful competitive strategies. |

SSubstitutes Threaten

Travelers increasingly opt to bring their own food and beverages, a readily available substitute for offerings within travel hubs. This trend is particularly pronounced for shorter trips and among budget-conscious consumers. For instance, a 2024 survey indicated that over 40% of air travelers packed snacks or meals to avoid airport food costs.

The perceived high cost of food and drinks at locations like airports and train stations further fuels this substitution. Many consumers are sensitive to these markups, making the decision to self-cater a financially prudent one. This can significantly impact SSP Group's revenue streams, as these in-house options represent a direct loss of potential sales.

Travelers not yet past security, or airport staff, often have a wide array of dining choices readily available outside the airport or station's direct concessions. This means they can opt for numerous external restaurants or cafes, frequently offering more competitive pricing and diverse menus compared to airport-based outlets.

For instance, many major transport hubs in 2024 are situated in urban centers or have adjacent commercial areas teeming with food and beverage options. This readily accessible competition directly impacts SSP Group's ability to capture all potential customer spending within the travel environment.

Automated vending machines and smaller convenience stores present a significant threat to SSP Group by offering readily available, often more affordable, food and beverage options. These alternatives cater to travelers seeking quick purchases, potentially diverting customers from SSP's more substantial dining experiences. For instance, in 2024, the global vending machine market was valued at approximately $30 billion, with projections indicating continued growth, highlighting the increasing consumer reliance on these convenient solutions.

Alternative Travel-Related Services

Travelers often have a choice of how they spend their money within an airport or station. They might opt for duty-free shopping, access to airport lounges, or even entertainment options instead of purchasing food and beverages. This is particularly true when time is tight or budgets are constrained, directly impacting SSP's core revenue streams.

For instance, in 2024, global airport retail sales, including duty-free and other non-F&B categories, continued to show strong recovery, with some reports indicating growth exceeding pre-pandemic levels in certain regions. This suggests that a significant portion of traveler discretionary spending is being allocated to these alternative services.

- Diversion of Discretionary Spending: Travelers may prioritize non-food and beverage purchases like duty-free goods or lounge access.

- Impact of Time and Budget Constraints: Limited time or budget often leads travelers to allocate funds to other airport amenities.

- Competitive Landscape: The availability of diverse retail and service options within travel hubs presents a direct substitute for SSP's offerings.

- 2024 Market Trends: Airport retail sales, excluding F&B, demonstrated robust recovery, indicating a strong pull for alternative spending categories.

Changes in Travel Behavior and Duration

Changes in travel behavior, such as a preference for shorter layovers or more direct routes, can significantly impact SSP Group's revenue. If travelers spend less time in transit hubs, they have fewer opportunities to purchase food and beverages, directly reducing demand for SSP's offerings. For instance, a shift towards ultra-direct flights, which became more prevalent in the post-pandemic travel landscape, means less dwell time for passengers to engage with airport concessions.

Conversely, disruptions and delays, while inconvenient for travelers, can sometimes create opportunities for SSP. Longer waits at airports mean more time for passengers to seek out and purchase food and drinks. In 2023, flight delays remained a significant issue globally, with various reports indicating substantial percentages of flights experiencing disruptions, potentially leading to increased incidental spending at airport retail and food outlets.

- Reduced dwell time: Shorter layovers limit passenger spending opportunities at SSP locations.

- Increased wait times: Longer delays can boost demand for food and beverage services within airports.

- Post-pandemic trends: The rise of direct flights potentially reduces the captive audience for airport concessions.

The threat of substitutes for SSP Group's offerings is significant, stemming from travelers' increasing tendency to bring their own food and beverages. This behavior is amplified by the perceived high costs of airport and train station concessions, making self-catering a financially attractive alternative. For example, a 2024 survey revealed that over 40% of air travelers pack their own snacks to save money.

Furthermore, the availability of numerous dining options outside of travel hubs, often with more competitive pricing and diverse menus, presents a strong substitute. Many transport hubs, particularly in urban centers, are surrounded by a wide array of restaurants and cafes, directly challenging SSP's market share. In 2024, the global vending machine market, valued at approximately $30 billion, also highlights the growing consumer reliance on convenient and often more affordable food and beverage alternatives.

Travelers also divert discretionary spending towards other airport amenities like duty-free shopping or lounge access, especially when time or budget is constrained. In 2024, global airport retail sales, excluding food and beverage, showed robust recovery, indicating a strong preference for these alternative spending categories among passengers.

Entrants Threaten

The travel concession market demands significant upfront capital for store design, equipment, and securing long-term operating agreements, creating a substantial barrier to entry. For instance, airport retail space leases alone can run into millions of dollars annually.

Furthermore, the intricate operational demands of managing a variety of food and beverage concepts across numerous busy, regulated international locations add another layer of complexity, requiring specialized expertise and robust supply chain management.

Securing prime, high-footfall locations within airports and major railway stations presents a significant barrier for new entrants. These coveted spots are often locked up by long-term contracts with established operators like SSP Group. For instance, in 2024, many prime airport concessions, particularly in major hubs, are renewed for periods extending over a decade, making it exceedingly difficult for newcomers to gain a foothold.

The process of building relationships and trust with landlords, such as airport authorities or railway operators, is a lengthy and arduous undertaking. Newcomers must demonstrate a proven track record and financial stability, which can take years to establish, further deterring potential new competitors from entering the market.

New companies entering the travel food and beverage market would face a significant hurdle in building brand recognition to rival SSP Group's established presence. They would also need substantial capital to secure licenses for popular international and local brands, a considerable barrier to entry.

Regulatory and Compliance Hurdles

The travel industry, particularly for a company like SSP Group which operates in airport and rail catering, faces significant regulatory and compliance hurdles. These include stringent food safety standards, security protocols, and operational requirements that vary greatly by country and region. For instance, in 2024, new food safety regulations were implemented in several European Union countries, requiring additional certifications and audits for food service providers.

New entrants must invest heavily in understanding and adhering to these complex licensing, health, and safety mandates. This process is not only time-consuming but also incurs substantial costs, acting as a significant barrier to entry. For example, obtaining the necessary permits and licenses to operate in multiple international airports can take over a year and cost hundreds of thousands of dollars.

- Stringent Food Safety: Compliance with evolving global food safety standards, such as HACCP and ISO 22000, is mandatory.

- Security Mandates: Airports and rail stations impose strict security clearances and operational procedures for all vendors.

- Cross-Jurisdictional Complexity: Navigating diverse national and international regulations for licensing and health permits creates significant barriers.

- Cost and Time Investment: The financial outlay and time required for compliance can deter new players from entering the market.

Economies of Scale and Experience

Established players like SSP Group leverage significant economies of scale in procurement and supply chain management, allowing them to secure better terms with suppliers and reduce per-unit costs across their extensive network of travel food and beverage outlets. For instance, SSP's global purchasing power in 2024 enabled them to negotiate favorable pricing on raw materials and equipment, a feat difficult for newcomers to replicate.

The deep operational experience accumulated by SSP in managing the complexities of high-volume, fast-paced travel environments, including navigating diverse regulatory landscapes and consumer preferences, presents a substantial barrier. New entrants would face a steep learning curve and considerable investment to build comparable expertise and operational efficiency.

- Economies of Scale: SSP's established presence allows for bulk purchasing, leading to lower input costs compared to nascent competitors.

- Operational Expertise: Years of experience in managing diverse food and beverage operations within travel hubs provide SSP with invaluable know-how.

- Supply Chain Advantages: A well-developed and efficient supply chain network, honed over time, offers cost and reliability benefits.

- Brand Recognition: Existing brand equity built through consistent service delivery further deters new entrants.

The threat of new entrants for SSP Group is relatively low due to substantial capital requirements for prime locations and brand licensing, coupled with complex regulatory environments. For example, securing airport concessions often involves multi-million dollar annual leases, a significant hurdle for new players in 2024.

Furthermore, the need for extensive operational experience in high-volume travel settings and the difficulty in replicating SSP's established economies of scale in procurement and supply chain management create formidable barriers. New entrants would also struggle to build the necessary brand recognition and trust with airport authorities.

| Barrier to Entry | Impact on New Entrants | Example (2024 Data) |

|---|---|---|

| Capital Requirements | High | Airport retail space leases can exceed millions annually. |

| Regulatory Compliance | High | Navigating diverse national food safety and security mandates. |

| Operational Expertise | High | Managing high-volume, fast-paced travel environments. |

| Economies of Scale | High | SSP's global purchasing power for raw materials. |

| Brand Recognition & Relationships | High | Building trust with airport authorities and consumer loyalty. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for SSP Group is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and regulatory filings. We also incorporate industry-specific market research reports and analyses from reputable financial news outlets to provide a robust understanding of the competitive landscape.