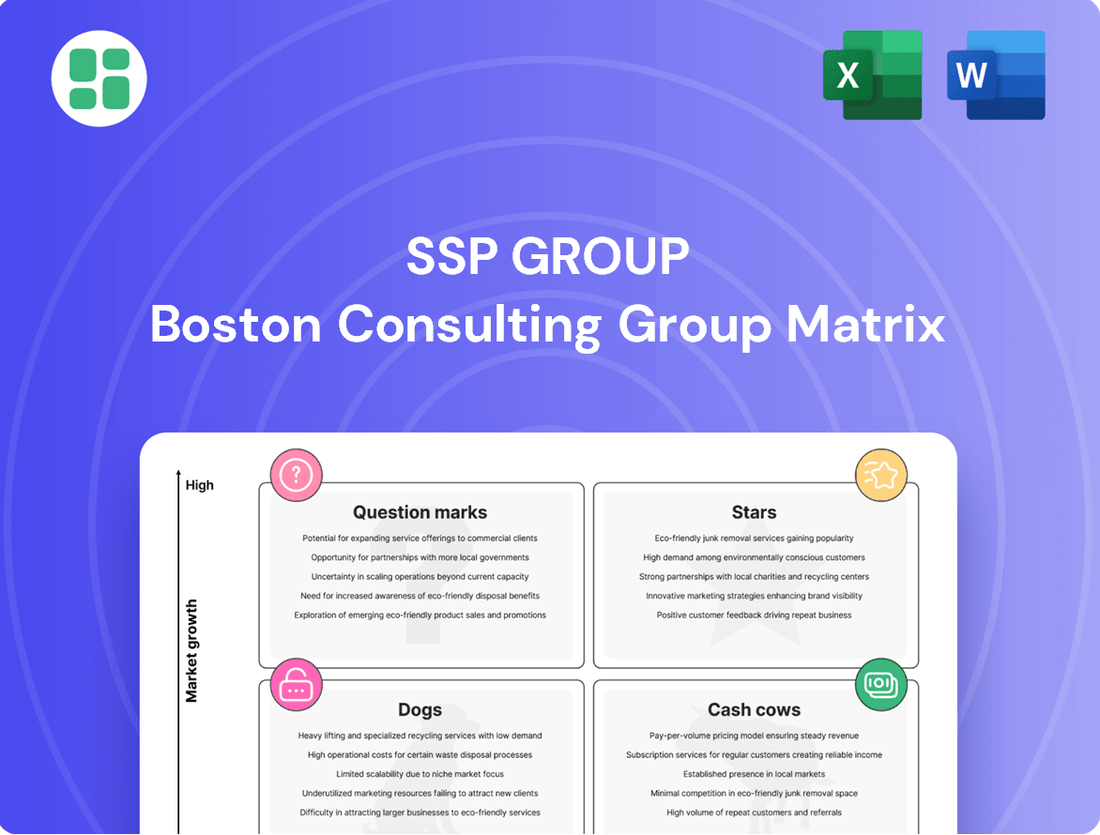

SSP Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSP Group Bundle

Unlock the strategic potential of the SSP Group with a comprehensive BCG Matrix analysis. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear roadmap for resource allocation and future growth. Don't miss out on the insights that will drive your business forward.

Purchase the full BCG Matrix report to gain a detailed understanding of each product's market share and growth rate. This in-depth analysis provides actionable strategies for optimizing your portfolio and maximizing profitability. Elevate your decision-making with data-driven clarity.

Stars

SSP Group's North American segment is a standout performer, demonstrating robust growth. Sales in this region have seen a significant year-on-year increase, fueled by both new contract wins and strategic acquisitions. For instance, the company secured new units at Denver International Airport and successfully acquired Mack II in Atlanta and ECG in Western Canada.

This strong performance in North America highlights SSP's substantial market share within a growing travel food and beverage sector. The region's expansion is a key contributor to the company's overall growth trajectory, underscoring its strategic importance and operational success.

The APAC & EEME region is a significant growth engine for SSP Group, with strong like-for-like sales contributing to its expansion. Acquisitions, such as Airport Retail Enterprises (ARE) in Australia, have further bolstered this performance.

Key markets like Australia, Hong Kong, and Egypt are showing robust performance, indicating broad-based strength across the region. SSP is strategically investing in this area to build scale, with a particular focus on Saudi Arabia, a market experiencing rapid growth in travel.

SSP Group is actively expanding its footprint by winning new contracts in rapidly growing travel hubs. For instance, a significant 10-year agreement at Liverpool John Lennon Airport and a substantial new venture at Jeddah Airport in Saudi Arabia, encompassing 26 outlets, highlight this strategic focus.

These wins are particularly impactful in developing or expanding airports, positioning SSP to capitalize on burgeoning travel demand. By securing these high-growth opportunities early, the company is solidifying its market presence in key regions.

Strategic Investment in Digital Solutions

SSP Group's strategic investment in digital solutions places it firmly within the Stars category of the BCG matrix. The company's commitment to enhancing customer experience and driving sales through digital channels is evident in its rapid expansion of digital ordering points, which have reached approximately 700 units globally. This digital push is not just about reach; it's about performance, with digital ordering's average transaction value (ATV) outperforming traditional tills by a significant 20% worldwide.

This focus on digital innovation is particularly impactful within the travel food and beverage sector, a segment experiencing rapid evolution. By embracing digital ordering, SSP is positioning itself as a leader in this high-growth area, effectively catering to the preferences of modern travelers and simultaneously boosting operational efficiency.

- Digital Ordering Points: Approximately 700 units globally.

- ATV Outperformance: Digital ordering ATV is 20% higher than traditional tills.

- Market Position: Leading in the high-growth, evolving travel F&B segment.

- Strategic Impact: Enhances customer experience, drives sales, and increases efficiency.

Premium Concepts in Growing Hubs

SSP Group's strategy to elevate its offerings in high-traffic travel locations is evident in its introduction of premium concepts. For instance, the launch of 'The Reserve' at Dublin Airport's Terminal 2 exemplifies this push into higher-value market segments. This move aligns with a growing traveler demand for more sophisticated and enjoyable airport experiences.

These premium food and beverage outlets are positioned to capture a significant share of a growing market. By focusing on elevated experiences, SSP aims to attract travelers willing to spend more for quality and convenience. This strategic placement in bustling hubs like Dublin Airport allows for substantial customer reach.

- Premium Concept Launch: SSP introduced 'The Reserve' at Dublin Airport's Terminal 2, targeting higher-value customer segments.

- Market Alignment: This strategy caters to the increasing traveler preference for enhanced airport dining experiences.

- Growth Potential: Premium offerings in busy travel hubs represent a significant growth opportunity for SSP.

- Market Share Capture: Successful implementation of these concepts can lead to a substantial increase in SSP's market share within these key locations.

SSP Group's investment in digital innovation and premium concepts positions its key operations as Stars in the BCG matrix. The company's substantial global rollout of approximately 700 digital ordering points, which see a 20% higher average transaction value than traditional tills, demonstrates strong market share in a high-growth digital segment. Furthermore, the introduction of premium concepts like 'The Reserve' at Dublin Airport taps into evolving traveler preferences for elevated experiences, suggesting significant potential in these higher-value market segments.

| BCG Category | SSP Group Segment/Initiative | Key Performance Indicators (as of latest available data, including 2024 trends) | Strategic Rationale |

|---|---|---|---|

| Stars | Digital Ordering & Technology | ~700 digital ordering points globally; 20% higher ATV than traditional tills. | Capitalizes on evolving consumer behavior and drives sales efficiency in a rapidly growing digital landscape. |

| Stars | Premium Concepts (e.g., 'The Reserve') | Successful launches in key airports like Dublin; aligns with growing demand for enhanced travel experiences. | Targets higher-value customer segments and captures increased spending in premium airport locations. |

What is included in the product

The SSP Group BCG Matrix categorizes business units by market share and growth rate, guiding investment decisions.

The SSP Group BCG Matrix offers clarity by visually categorizing business units, alleviating the pain of uncertain strategic resource allocation.

Cash Cows

SSP Group's established concessions in mature airports are prime examples of Cash Cows. These are long-standing contracts in major global hubs like London Heathrow and large US airports, generating very stable revenue. For instance, in 2024, SSP continued to benefit from its significant presence in these high-traffic locations, which offer a consistent customer base.

These mature airport locations boast high and predictable passenger traffic, ensuring a reliable customer base for SSP. This allows the company to maintain a strong market share within a low-growth, established market segment. The stability of these operations is a key contributor to SSP's overall financial performance.

SSP Group's operation of globally recognized licensed brands like Starbucks, Burger King, and Costa Coffee in high-traffic travel hubs is a prime example of a Cash Cow in their BCG Matrix. These brands benefit from immense built-in customer loyalty and consistent demand, meaning they generate substantial revenue with minimal need for extensive marketing spend.

In 2024, the travel food and beverage sector continued to see strong recovery, with SSP Group reporting that its licensed brands were key drivers of this growth. For instance, the company's extensive network of Starbucks outlets in airports globally consistently outperformed expectations, reflecting the brand's enduring appeal and SSP's efficient operational model for these high-volume locations.

SSP's core convenience retail offerings are a prime example of a Cash Cow. These outlets, strategically located in busy travel hubs like airports and train stations, cater to a consistent demand for essential and quick purchases. Their high turnover and stable profit margins mean they require little in the way of new investment, reliably generating cash flow within a mature market segment.

Efficient Operational Models in Key Regions

Regions such as the UK exemplify SSP Group's efficient operational models. In 2024, the UK market continued to exhibit robust like-for-like sales growth, coupled with a noticeable improvement in operating margins. This performance highlights the effectiveness of their optimized cost structures and strong execution capabilities in mature markets.

These mature markets, including the UK, are critical cash cows for SSP. Their ability to generate substantial and reliable cash flow is vital for funding the group's investments in other strategic areas. The consistent performance in these regions underscores their importance to SSP's overall financial health and strategic flexibility.

- UK's Like-for-Like Sales Growth: Continued strong performance in 2024.

- Improved Operating Margins: Demonstrates enhanced efficiency.

- Optimized Cost Bases: Key factor in cash generation.

- Reliable Cash Flow Generation: Supports investment in other ventures.

Long-Term Contracts with Major Transport Hubs

SSP Group's long-term contracts with major transport hubs are prime examples of its cash cow assets. For instance, the company secured a significant 10-year extension at Liverpool John Lennon Airport. This type of agreement guarantees predictable and stable revenue for an extended duration, reinforcing SSP's market position in vital locations.

These stable revenue streams are characteristic of cash cows, which generate consistent financial returns with minimal investment. This predictability allows SSP to allocate resources efficiently to other areas of its business. In 2023, SSP reported a total revenue of £3,077 million, showcasing the substantial financial contribution from its established operations.

- Secure Revenue: Long-term contracts, like the 10-year deal at Liverpool John Lennon Airport, provide a predictable income stream.

- Dominant Presence: These agreements solidify SSP's position in key travel locations, a hallmark of cash cow businesses.

- Financial Stability: Consistent returns from these contracts contribute significantly to the group's overall financial health.

- Strategic Foundation: The stability allows for strategic reinvestment and growth initiatives in other business segments.

SSP Group's established airport concessions, particularly in mature markets like the UK, function as its cash cows. These operations benefit from high passenger traffic and long-term contracts, ensuring stable revenue streams with limited growth potential but high profitability. For example, in 2024, SSP continued to leverage its strong presence in major hubs, contributing significantly to the group's financial stability.

These mature segments, characterized by their established market share and consistent demand, require minimal investment for maintenance. They generate substantial and predictable cash flow, which is crucial for funding growth initiatives in other business areas. SSP's UK operations, for instance, demonstrated robust like-for-like sales growth and improved operating margins in 2024, underscoring their cash-generating capabilities.

| Business Segment | BCG Category | Key Characteristics | 2024 Performance Highlight |

|---|---|---|---|

| Mature Airport Concessions (e.g., UK) | Cash Cow | High passenger traffic, long-term contracts, stable revenue, low growth | Strong like-for-like sales growth and improved operating margins |

| Globally Licensed Brands (e.g., Starbucks) | Cash Cow | Strong brand loyalty, consistent demand, high volume, brand recognition | Key drivers of revenue growth, outperforming expectations |

| Core Convenience Retail | Cash Cow | Strategic locations, high turnover, essential purchases, steady profit margins | Reliable cash flow generation from established, high-traffic outlets |

Preview = Final Product

SSP Group BCG Matrix

The preview you see is the complete SSP Group BCG Matrix document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content—just the fully developed strategic analysis ready for your immediate use. You can be confident that the detailed insights and professional formatting you are currently viewing will be identically delivered to you after completing your purchase, ensuring a seamless transition from preview to application.

Dogs

SSP Group has identified its Continental European operations, specifically in France and Germany, as a significant underperformer. This segment experienced revenues falling short of targets and operating profit erosion due to a sluggish post-pandemic recovery, industrial action, and subdued trading at motorway service areas.

The company is actively implementing a comprehensive turnaround strategy for these areas. A key element involves exiting the German motorway services market, a move that underscores the low-growth, low-market-share nature of these particular businesses within SSP's portfolio.

Certain outdated proprietary food concepts or past brand partnerships might be struggling to connect with today's travelers. For example, a concept like a specific branded fast-food chain that was popular a decade ago may now see declining sales and a reduced market share in airport locations. If these units aren't refreshed or sold off, they can lock up valuable capital and operational resources without delivering adequate profits, clearly placing them in the 'dog' category of the BCG matrix.

Concessions in regional airports or railway stations facing declining passenger traffic are typically classified as Dogs in the SSP Group BCG Matrix. These are markets with very little growth. For instance, if a specific regional airport saw a passenger decline of 5% year-over-year in 2024, SSP's operations there would likely fall into this category.

When SSP has a minimal market share within these shrinking locations, these concessions become Dogs. They contribute little to overall cash flow and offer scant prospects for future expansion or profitability. Imagine a scenario where SSP's market share in a declining secondary airport dropped from 10% to 7% in 2024, further solidifying its Dog status.

Segments with High Competition and Low Differentiation

In the highly commoditized areas of travel and food services, SSP Group faces significant challenges where differentiating its offerings or competing on price proves difficult. These segments, often characterized by low market share and minimal profitability, can become cash traps, draining resources without yielding substantial returns.

For instance, in 2024, the casual dining sector within travel hubs continued to experience intense competition. SSP's units operating in these environments, particularly those focused on generic quick-service offerings, often struggle to command premium pricing. This lack of differentiation means that even with high customer traffic, margins remain thin, making it hard to generate significant profits.

- Low Market Share: Units in these segments may hold a small percentage of the overall market, indicating a struggle to capture customer loyalty or a significant portion of demand.

- Minimal Profitability: High operating costs coupled with intense price pressure often result in very low profit margins, sometimes barely covering expenses.

- Cash Traps: These operations can consume capital for maintenance and operations without generating sufficient cash flow to justify further investment or provide a return.

- Difficulty in Turnaround: The inherent nature of commoditized markets makes it challenging to implement strategies that significantly improve performance or create a competitive advantage.

Expired or Unprofitable Contract Renewals

Expired or unprofitable contract renewals in the SSP Group's portfolio are classified as 'Dogs' within the BCG Matrix. These are business segments or contracts that are no longer generating sufficient returns or are facing significant challenges that make continued investment unattractive. For instance, if a contract renewal in a specific region offers unfavorable terms due to increased local competition or a downturn in the market, SSP might strategically decide not to renew. This decision is aimed at divesting these underperforming assets and reallocating capital to more promising areas of the business.

In 2024, SSP Group has been actively reviewing its global contract portfolio. A notable example could be a cluster of airport retail concessions in a European country where passenger traffic has stagnated, leading to reduced sales volumes and profitability for SSP. If the renewal terms offered by the airport authority do not adequately reflect the current market conditions or the increased operational costs, SSP may choose to exit these specific contracts. This strategic pruning helps maintain a healthier overall business portfolio.

- Divestment of Low-Performing Contracts: SSP Group prioritizes exiting contracts where renewal terms are unfavorable or profitability has significantly declined, aligning with the 'Dog' quadrant of the BCG Matrix.

- Resource Reallocation: By phasing out unprofitable contracts, SSP frees up financial and operational resources that can be redirected towards high-growth potential business units or new market opportunities.

- Market Realities in 2024: The decision to not renew is often driven by factors such as intensified competition, shifts in consumer spending, or unfavorable economic conditions in specific geographic locations, impacting the viability of existing agreements.

SSP Group's 'Dogs' represent business segments with low market share in low-growth markets, often characterized by minimal profitability and serving as cash traps. These are typically concessions in declining regional airports or railway stations, or outdated proprietary food concepts struggling to resonate with modern travelers. For instance, a 2024 scenario might involve a regional airport concession where SSP holds only 7% market share and passenger traffic has declined by 5% year-over-year, firmly placing it in the Dog category.

The company actively manages these by divesting unprofitable contracts, such as those with unfavorable renewal terms due to increased competition or market downturns, thereby reallocating capital to more promising ventures. This strategic pruning is crucial, especially in 2024, where intensified competition and shifts in consumer spending impact the viability of existing agreements in specific locations.

| BCG Category | SSP Group Examples | Characteristics | 2024 Market Dynamics |

|---|---|---|---|

| Dogs | Continental European operations (France, Germany) | Low market share, low growth, minimal profitability, cash traps | Sluggish post-pandemic recovery, industrial action, subdued trading |

| Dogs | Exited German motorway services | Low growth, low market share, unprofitable | Strategic divestment to focus on higher potential areas |

| Dogs | Outdated proprietary food concepts | Struggling to connect with travelers, declining sales | Intense competition in travel hubs, difficulty commanding premium pricing |

| Dogs | Expired/unprofitable contract renewals | Unfavorable terms, declining profitability | Increased local competition, market downturns impacting viability |

Question Marks

SSP Group's planned IPO of its Indian travel food business, Travel Food Services (TFS), positions TFS as a potential question mark within the BCG matrix. India's aviation sector is experiencing robust growth, with passenger traffic projected to reach 520 million by 2025, presenting a significant opportunity for TFS.

However, SSP's reduced stake in the new joint venture, dropping from 44% to 25%, introduces uncertainty. This dilution means SSP has less direct influence and consolidation power over TFS's operations, potentially impacting its ability to fully capitalize on the high-growth Indian market and its future market share relative to competitors.

SSP Group is actively exploring and trialing novel food concepts designed to meet shifting consumer preferences. These initiatives, focusing on areas like plant-based alternatives and reduced-waste packaging, are positioned as potential high-growth areas. For instance, the global plant-based food market was valued at over $29.7 billion in 2023 and is projected to reach $162 billion by 2030, indicating substantial future demand.

These nascent concepts, while holding significant promise for future market share, currently represent a small portion of SSP's overall revenue. Bringing these innovations to scale requires substantial upfront investment in research, development, and market testing. This investment profile, characterized by high potential but low current penetration, aligns perfectly with the 'question mark' classification within the BCG matrix.

SSP Group's entry into emerging travel infrastructure projects, like new airport terminals or high-speed rail lines in developing regions, represents a classic 'Question Mark' in the BCG Matrix. These ventures offer significant growth potential as passenger traffic is expected to rise substantially in these nascent hubs.

While the outlook is promising, these projects typically begin with a low market share and profitability for SSP. Success hinges on the long-term passenger adoption and overall growth trajectory of these new travel corridors, making them inherently risky but potentially rewarding investments.

Advanced Digital Transformation Investments

Advanced digital transformation investments, such as AI-driven personalization and sophisticated customer analytics, represent a significant opportunity for high growth within the travel retail sector. These initiatives have the potential to fundamentally alter operational efficiency and customer engagement, moving beyond basic digital ordering systems.

For SSP Group, these advanced digital ventures are likely in their nascent stages of market penetration and profitability. This means they require considerable upfront capital investment to develop, implement, and scale effectively. The potential for high returns exists, but it is coupled with the inherent risks associated with pioneering new technologies and business models.

- High Growth Potential: Investments in AI and advanced analytics can unlock new revenue streams and enhance customer loyalty, driving significant top-line growth.

- Low Current Penetration/Profitability: These advanced digital solutions are often in early adoption phases, meaning their immediate impact on SSP's profitability might be limited due to development costs and unproven market acceptance.

- Substantial Capital Requirements: Scaling AI-driven services and complex analytics platforms demands significant investment in technology infrastructure, data science talent, and ongoing research and development.

- Strategic Importance: Despite the costs, these investments are crucial for SSP to maintain a competitive edge and adapt to evolving consumer expectations in the digital age.

Exploration of Niche or Untapped Travel F&B Segments

SSP Group's foray into niche travel food and beverage segments, like catering to specific dietary needs or launching pop-up experiences, signifies a strategic move into areas with high growth potential but currently low market penetration. These ventures, while demanding substantial upfront investment and careful market positioning, aim to capture a significant share of an evolving travel landscape. For instance, the demand for plant-based and gluten-free options in travel hubs is steadily increasing, presenting a clear opportunity for specialized offerings.

These niche segments, while representing a smaller portion of SSP's current revenue, are crucial for future diversification and competitive advantage, aligning with the characteristics of a question mark in the BCG matrix. The company's ability to adapt and innovate in these emerging areas will be key to unlocking their full value.

- Focus on Specialized Dietary Needs: Growing consumer demand for vegan, gluten-free, and allergen-free options in airports and on trains.

- Pop-Up Concepts and Experiential Dining: Introducing temporary, themed food stalls or chef collaborations to create unique passenger experiences.

- Expansion into New Transport Modes: Targeting underserved F&B opportunities on specific cruise lines or within large-scale event venues.

- Investment in Innovation: Allocating resources for research and development to create scalable and profitable niche F&B solutions.

SSP Group's strategic investments in emerging markets and new travel infrastructure projects, such as airport expansions in developing regions, are prime examples of 'Question Marks' in the BCG matrix. These ventures offer substantial growth potential due to projected increases in passenger traffic, with global air passenger traffic expected to surpass 4.7 billion in 2024. However, they typically begin with a low market share and profitability for SSP, making their long-term success dependent on passenger adoption and the overall growth of these new travel corridors.

These initiatives require significant upfront capital and carry inherent risks, but they also present the opportunity to establish a strong foothold in future high-growth travel hubs. SSP's ability to navigate these early stages, adapt to local market dynamics, and effectively scale operations will be crucial in transforming these question marks into successful Stars or Cash Cows.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer feedback, and competitive analysis, to accurately position each business unit.