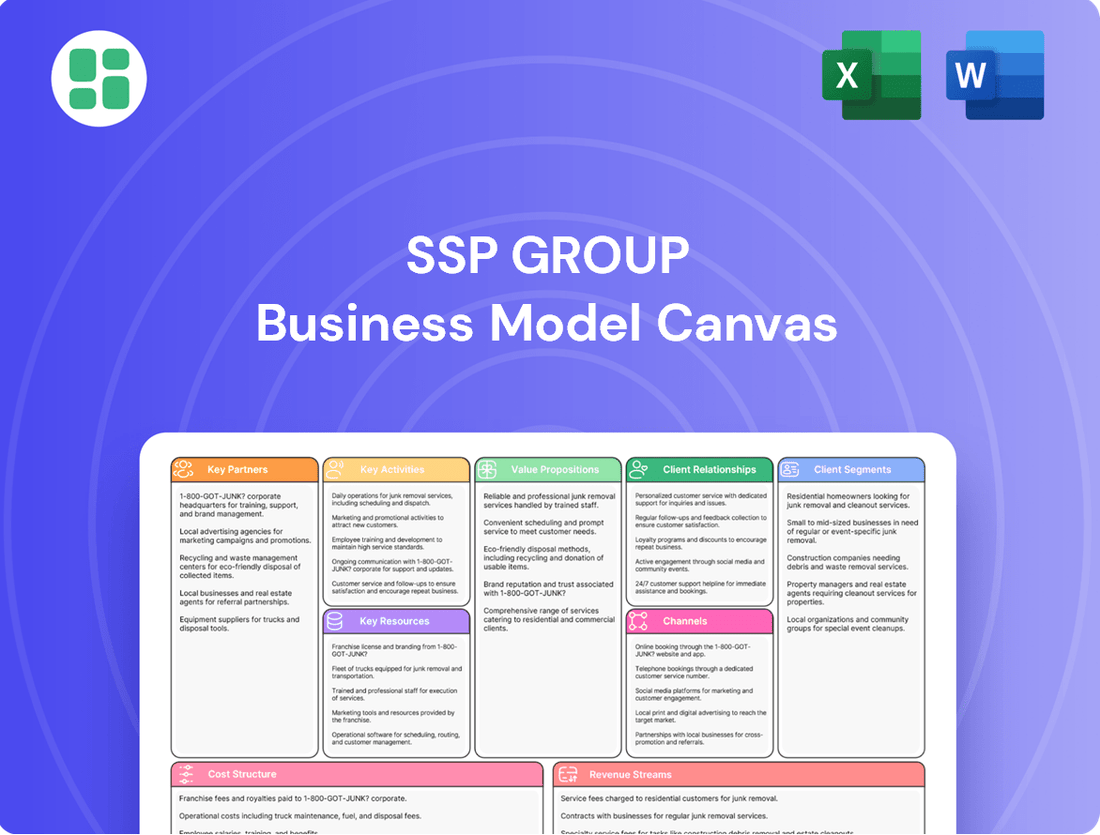

SSP Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SSP Group Bundle

Unlock the strategic blueprint behind SSP Group's thriving business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and revenue streams, offering a clear view of their market dominance. Ideal for anyone seeking to understand operational excellence and growth strategies in the travel retail sector.

Partnerships

SSP Group collaborates closely with airport and railway operators worldwide, securing vital concession contracts to establish and manage their food and beverage operations. These partnerships are the bedrock of SSP's strategy, granting access to prime locations with high passenger traffic.

These long-term agreements are indispensable for SSP, enabling them to deploy their extensive brand portfolio within bustling travel hubs. For instance, SSP secured a significant 10-year contract extension with Spokane International Airport and a renewal at Lanzarote Airport, underscoring the enduring value of these strategic alliances.

SSP Group's key partnerships with international and local brand owners are fundamental to its business model, enabling it to offer a compelling and diverse range of food and beverage options across travel hubs. This includes collaborations with globally recognized names such as Starbucks, Burger King, and Marks & Spencer, providing travelers with familiar and trusted choices. These partnerships are crucial for driving footfall and enhancing customer satisfaction by catering to a wide spectrum of tastes and preferences.

SSP Group actively forms joint ventures to penetrate key markets and harness local knowledge. For instance, their revitalized partnership with Adani Airport Holdings Limited (AAHL) in India is significant. Through this venture, SSP's Travel Food Services (TFS) will oversee food and beverage operations and lounge management across numerous Indian airports.

These strategic alliances are crucial for enhancing market access and broadening SSP's involvement in the food and beverage and airport lounge sectors. In 2024, India's aviation sector continued its robust growth, with passenger traffic showing a strong recovery, underscoring the strategic importance of such partnerships for SSP's expansion.

Suppliers and Logistics Providers

SSP Group relies on a strong network of suppliers and logistics providers to keep its operations running smoothly. These partnerships are crucial for managing the costs of essential food and beverage inputs. In 2024, SSP continued to emphasize ethical sourcing and sustainability across its supply chains, a commitment reinforced by their use of platforms like Sedex for human rights due diligence on suppliers.

Their supplier relationships are diverse, encompassing everything from fresh produce to packaged goods. Efficient logistics are equally important, ensuring timely delivery to SSP's numerous travel hub locations. This intricate web of partnerships directly impacts SSP's ability to offer a consistent and quality product to its customers.

- Supplier Diversity: SSP partners with a wide array of food and beverage producers globally.

- Logistics Network: Essential for timely distribution to airports, train stations, and other travel locations.

- Cost Management: Key focus on negotiating and managing the costs of raw materials and finished goods.

- Ethical Sourcing: Commitment to human rights and sustainability, evidenced by Sedex platform usage.

Technology and Service Providers

SSP collaborates with technology and service providers to boost efficiency and customer satisfaction in its outlets. For instance, in 2024, the food travel group continued its digital transformation efforts, which often involve partnerships with specialized tech firms for point-of-sale systems, inventory management software, and customer loyalty platforms. These collaborations are crucial for implementing new operational tools and supporting digital initiatives across their diverse brands and geographies.

These partnerships are essential for staying competitive in the fast-paced food and beverage sector. By integrating advanced technological solutions, SSP can optimize supply chains, personalize customer interactions, and ensure seamless operations, particularly in high-volume travel environments like airports and train stations. For example, investments in data analytics platforms can help them understand consumer preferences better, leading to more targeted promotions and improved product offerings.

- Technology Integration: SSP partners with providers of cloud-based POS systems, AI-driven inventory management, and data analytics tools to enhance operational oversight and decision-making.

- Digital Customer Experience: Collaborations focus on developing and implementing mobile ordering apps, digital payment solutions, and personalized loyalty programs to improve customer engagement and convenience.

- Operational Efficiency: Partnerships extend to providers of back-office software, workforce management tools, and supply chain optimization solutions to streamline processes and reduce costs.

- Innovation in F&B Tech: SSP actively seeks out and works with emerging technology companies to pilot new solutions, such as automated food preparation or advanced customer feedback systems, to drive innovation in the travel food service industry.

SSP Group's key partnerships are critical for its operational success and market reach. These include vital concession agreements with airport and railway operators, granting access to high-traffic locations, and strategic alliances with international and local brand owners to offer a diverse menu. Furthermore, joint ventures, such as the one with Adani Airport Holdings Limited in India, are instrumental for market penetration and localized expertise. The group also relies heavily on a robust network of suppliers and logistics providers for cost management and efficient operations, alongside technology partners to drive digital transformation and enhance customer experience.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| Concession Agreements | Airport & Railway Operators (e.g., Spokane International Airport, Lanzarote Airport) | Prime location access, high passenger traffic | Secured 10-year extension at Spokane; renewal at Lanzarote |

| Brand Collaborations | Global & Local Brands (e.g., Starbucks, Burger King, Marks & Spencer) | Diverse offerings, customer satisfaction, driving footfall | Continual integration of popular brands across global network |

| Joint Ventures | Local Partners (e.g., Adani Airport Holdings Limited in India) | Market penetration, local knowledge, expansion | Revitalized partnership for F&B and lounge management across Indian airports |

| Supplier & Logistics Network | Food Producers, Logistics Providers | Cost management, ethical sourcing, operational efficiency | Emphasis on ethical sourcing (Sedex platform usage); managing input costs |

| Technology & Service Providers | Tech Firms (POS, Inventory, Loyalty Platforms) | Digital transformation, operational efficiency, customer experience | Continued digital transformation efforts, implementing new operational tools |

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The SSP Group Business Model Canvas acts as a pain point reliever by providing a clear, visual representation that streamlines complex business strategies.

It helps teams quickly pinpoint and address operational inefficiencies, saving valuable time and resources.

Activities

A core activity for SSP Group is acquiring and managing food and beverage concessions within travel hubs. This involves actively participating in competitive tender processes and securing favorable, often long-term, contractual agreements with airport and rail operators.

SSP’s commitment to this key activity is evident in recent successes, such as winning new contracts at Spokane International Airport. Furthermore, the renewal of existing agreements, like those in Lanzarote, underscores their ability to maintain and grow their presence in established markets.

The company consistently pursues expansion opportunities, particularly in markets demonstrating robust growth potential. This strategic focus ensures a continuous pipeline of new business and strengthens their overall market position.

SSP Group's core activities revolve around the meticulous operation of a sprawling network of food and beverage outlets. This includes managing thousands of restaurants, cafes, bars, and convenience stores strategically located in high-traffic travel hubs like airports, railway stations, and motorway service areas. Their operational focus is on ensuring seamless day-to-day management across their extensive global footprint.

In 2024, SSP operated over 2,900 outlets spanning across 37 to 38 countries. This vast operational scale demands a constant emphasis on efficiency and a diverse product selection to cater to the varied needs of travelers. Their business model is fundamentally built on providing convenient and quality food and beverage experiences to a mobile customer base.

SSP Group actively cultivates a robust brand portfolio, encompassing globally recognized names, popular local favorites, and unique proprietary concepts. This strategic approach ensures a wide appeal across diverse markets.

A key facet of this activity involves the creation and expansion of SSP's own brands, exemplified by the development of 'Point' for the convenience sector. This internal brand building allows for tailored offerings and greater control over the customer experience.

Furthermore, SSP strategically integrates acquired brands to broaden its market reach and enhance its competitive positioning. The acquisition of brands from Airport Retail Enterprises (ARE) in Australia, for instance, significantly bolsters their presence in key travel hubs.

By meticulously managing this varied brand mix, SSP aims to meet the evolving preferences of a global customer base and capitalize on emerging market opportunities, driving consistent growth and brand loyalty.

Supply Chain and Procurement Management

SSP Group's key activity in supply chain and procurement management is centered on the efficient orchestration of its global network. This involves meticulously sourcing high-quality ingredients and products, a process that directly impacts the customer experience and operational efficiency. A significant focus is placed on cost control across all inputs, from raw materials to labor, aiming to bolster gross margins. For instance, in 2024, SSP continued to refine its procurement strategies, with a stated goal of achieving substantial cost savings through supplier negotiations and volume consolidation, contributing to their target of improving operating profit margins.

The company's approach emphasizes rigorous management of input costs, including food, beverages, and labor, which are pivotal to optimizing gross margins. This detailed cost control is essential for maintaining competitive pricing while ensuring profitability. SSP’s commitment extends to ensuring that all sourcing practices are both ethical and sustainable, reflecting growing consumer demand and corporate responsibility. In 2023, SSP reported that over 90% of its key suppliers met its ethical sourcing standards, a figure they aim to maintain and improve upon in 2024.

- Sourcing Quality: Ensuring the procurement of high-standard ingredients and products is paramount for SSP's food and beverage offerings.

- Cost Control: Rigorous management of input costs, including food, beverage, labor, and overheads, is critical for optimizing gross margins.

- Supplier Relationships: Building and maintaining strong relationships with a diverse global supplier base is key to reliable and cost-effective sourcing.

- Ethical and Sustainable Practices: Integrating ethical considerations and sustainability into procurement processes is a growing priority, aligning with corporate values and consumer expectations.

Operational Efficiency and Investment Return Optimization

SSP Group is intensely focused on enhancing operational efficiency to boost investment returns. A key part of this strategy involves streamlining leadership to cut costs and improve decision-making speed.

The company is actively working to reduce its overall cost base. This includes scrutinizing expenditures and identifying areas for savings, which directly contributes to improved margins.

Optimizing the performance of recent major investments is a critical activity. SSP aims to ensure these investments are generating the expected returns and contributing positively to cash conversion.

Strategic capital allocation and ongoing cost reduction programs are central to their approach. For instance, SSP's 2024 interim results showed a focus on disciplined investment, with capital expenditure managed to support growth while maintaining financial prudence.

- Streamlined Leadership: Simplifying management structures to enhance agility and reduce overhead.

- Cost Base Reduction: Implementing targeted programs to lower operating expenses across the business.

- Investment Performance Optimization: Maximizing returns from recent significant capital investments.

- Strategic Capital Allocation: Prioritizing investments that offer the highest potential for growth and shareholder value.

SSP Group's key activities are centered on securing and managing food and beverage concessions in travel environments, operating a vast network of outlets, and cultivating a diverse brand portfolio. They also focus on efficient supply chain management and continuous operational efficiency improvements.

In 2024, SSP operated over 2,900 outlets across 37-38 countries, highlighting the scale of their operations. The company's strategy involves winning new contracts, such as at Spokane International Airport, and renewing existing ones, like in Lanzarote, to ensure sustained growth and market presence.

Their brand strategy includes developing proprietary brands like 'Point' and integrating acquired brands, such as those from Airport Retail Enterprises (ARE), to enhance market reach and customer appeal.

SSP's supply chain management emphasizes cost control, with a goal of achieving substantial savings through supplier negotiations and volume consolidation, contributing to improved operating profit margins.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Concession Management | Acquiring and managing F&B concessions in travel hubs. | Winning new contracts (e.g., Spokane Int'l Airport), renewing existing ones (e.g., Lanzarote). |

| Outlet Operations | Operating a large network of F&B outlets globally. | Over 2,900 outlets in 37-38 countries. |

| Brand Portfolio Management | Developing and managing a mix of global, local, and proprietary brands. | Expansion of proprietary brands like 'Point', integration of acquired brands (e.g., ARE). |

| Supply Chain & Procurement | Sourcing ingredients and products efficiently with cost control. | Focus on cost savings through supplier negotiations and volume consolidation. Over 90% of key suppliers met ethical sourcing standards in 2023. |

| Operational Efficiency | Streamlining operations and reducing costs to improve returns. | Disciplined capital expenditure, cost base reduction programs. |

Preview Before You Purchase

Business Model Canvas

The SSP Group Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same comprehensive Business Model Canvas, ensuring you get exactly what you see.

Resources

SSP Group's global network of travel locations is a cornerstone of its business. As of late 2024, they operate more than 2,900 food and beverage outlets in approximately 37 countries, strategically positioned in high-traffic travel hubs like airports and railway stations. This extensive physical presence is a critical asset, enabling them to cater to millions of travelers annually.

The company's growth strategy heavily emphasizes expansion in key regions. SSP is actively pursuing opportunities in markets demonstrating robust growth, particularly in North America and the Asia Pacific. This focus aims to capitalize on increasing travel volumes and diversify their geographical footprint, reinforcing their position as a global leader in travel food and beverage services.

SSP Group's strength lies in its extensive portfolio, boasting over 550 international, national, and local brands. This vast selection ensures a wide appeal to diverse customer preferences, particularly within the travel sector.

The company also leverages its own successful proprietary brands, including UrbanCrave, Nippon Ramen, Upper Crust, Camden Food Co, and Point. These in-house concepts are crucial intellectual property, allowing SSP to offer unique and tailored experiences.

These brands are specifically developed and curated for travel environments, providing both variety and convenience. This strategic approach to brand management is a cornerstone of SSP Group's business model, driving customer satisfaction and operational efficiency.

SSP Group's strength lies in its vast and skilled workforce, numbering around 43,000 individuals. This extensive team includes operational staff, specialized culinary professionals, and experienced management, all vital for maintaining high service standards.

The expertise of these employees in handling complex food and beverage operations, particularly within the demanding, high-volume travel sector, is a cornerstone of the business. This human capital is a critical resource for SSP.

Concession Contracts and Licenses

SSP Group's business model heavily relies on long-term concession contracts and licenses with airport and railway operators. These agreements are crucial intangible assets, securing SSP's presence in high-traffic travel hubs. For instance, in 2024, SSP continued to operate numerous sites across major international airports and railway stations, demonstrating the ongoing value of these partnerships.

These concessions, often lasting for a decade or more, offer significant stability and predictability to SSP's revenue streams. This long-term visibility is a cornerstone of their strategic planning and investment decisions. The ability to secure and renew these licenses is a key competitive advantage.

- Concession Contracts: Long-term agreements granting rights to operate food and beverage outlets in travel locations.

- Licenses: Permissions to use specific brands or operate within regulated environments.

- Strategic Importance: These secure prime locations, providing consistent customer access and revenue.

- Renewal Focus: SSP actively manages and renews these contracts to maintain its market position.

Financial Capital and Investment Capacity

SSP Group's access to financial capital is a cornerstone of its ability to execute ambitious growth strategies. This financial muscle allows for substantial investment in key areas such as opening new outlets, modernizing existing ones, and pursuing strategic acquisitions. For instance, the acquisition of Airport Retail Enterprises (ARE) in Australia and the Midfield Concessions Enterprise in Denver highlights SSP's capacity to leverage financial resources for significant expansion and market penetration.

This investment capacity directly fuels SSP's global expansion efforts. By securing the necessary funding, the company can enter new markets and strengthen its presence in existing ones, ultimately driving overall revenue growth. In 2024, SSP continued to invest in its operational capabilities and brand portfolio, aiming to capitalize on the post-pandemic recovery in travel and leisure.

- Access to capital enables funding for new unit openings and refurbishments.

- Strategic acquisitions, like ARE and Midfield Concessions, are facilitated by strong financial backing.

- Investment capacity is crucial for expanding SSP's global footprint.

- Financial resources are essential for driving sustained business growth and market share.

SSP Group's key resources encompass its extensive physical network of over 2,900 outlets across 37 countries as of late 2024, strategically located in travel hubs. This is complemented by a vast brand portfolio, featuring over 550 international, national, and local brands, alongside successful proprietary brands like UrbanCrave and Upper Crust. The company also relies on its approximately 43,000 skilled employees and crucial long-term concession contracts and licenses with airport and railway operators, which ensure prime location access and revenue stability.

| Resource Type | Description | Key Data/Example (as of late 2024) |

| Physical Network | Food and beverage outlets in travel locations | Over 2,900 outlets in ~37 countries |

| Brand Portfolio | Owned and licensed brands | Over 550 brands, including proprietary ones like Upper Crust |

| Human Capital | Skilled workforce | Approximately 43,000 employees |

| Concession Contracts/Licenses | Agreements for operating rights | Long-term contracts securing prime travel hub locations |

Value Propositions

SSP Group provides travelers with a broad spectrum of food and beverage choices, encompassing everything from fast-casual eateries and coffee shops to bars and full-service restaurants. This diverse offering ensures there's something to satisfy every palate and occasion.

By integrating globally recognized brands alongside popular local eateries and their own unique concepts, SSP guarantees both variety and a high standard of quality across its outlets. This strategic mix appeals to a wide range of customer preferences.

In 2023, SSP reported that its brand portfolio included over 50 international and local brands, serving millions of customers daily across numerous airports and railway stations worldwide. This extensive selection directly addresses the varied tastes and dietary requirements of travelers.

SSP Group excels at offering convenient and speedy food and beverage solutions precisely where travelers need them most: in high-footfall travel hubs like airports and railway stations. This strategic placement caters directly to the time-sensitive nature of transit, ensuring passengers can grab a quick bite or drink without significant delays. For instance, in 2024, SSP continued to expand its presence in major European airports, with many outlets designed for rapid service to meet the demands of busy schedules.

SSP Group significantly boosts commercial returns for travel landlords, like airport and railway operators, by expertly managing their food and beverage offerings. They leverage their deep understanding of concessions to bring in sought-after brands and increase passenger spending, directly benefiting the landlords' bottom line.

In 2024, SSP's focus on operational efficiency and brand curation continues to be a key driver for landlords. For instance, their strategic brand partnerships and tailored food and beverage solutions are designed to maximize dwell time and spend per passenger, contributing to the overall financial health of travel hubs.

Enhanced Passenger Experience

SSP Group significantly elevates the passenger journey by providing a diverse and appealing selection of food and beverage choices, making travel more pleasant and fostering customer satisfaction and loyalty. For instance, in 2023, SSP reported a strong performance, with total sales reaching £3.0 billion, indicating robust demand for their offerings across travel hubs.

Their commitment to innovation is evident in the continuous introduction and enhancement of concepts. A prime example is the recent upgrade at Bournemouth Airport, where new F&B outlets were introduced to better serve travelers. This strategic approach aims to transform the often-mundane experience of waiting at airports into a more enjoyable part of the trip.

- Diverse Offerings: A wide range of food and beverage options catering to various tastes and dietary needs.

- Customer Satisfaction: Focus on creating positive experiences that encourage repeat business and build brand loyalty.

- Concept Innovation: Regularly introducing new and improved F&B concepts to enhance the travel environment.

- Strategic Partnerships: Collaborating with airports and brands to deliver unique and convenient passenger services.

Local and Authentic Culinary Experiences

SSP Group increasingly weaves local and chef-driven culinary ideas into its portfolio, shining a spotlight on regional flavors. This commitment allows travelers to savor genuine local tastes, a prime example being the launch of Zona Tacos and Tortas at Spokane International Airport. This strategy injects a distinct cultural richness into the travel dining journey.

This focus on authenticity offers a compelling value proposition by connecting travelers with the heart of a destination through its food. For instance, in 2023, SSP reported a significant increase in customer satisfaction scores related to the variety and authenticity of its food offerings across its European operations. This trend is expected to continue as consumer demand for unique, local experiences grows.

- Authentic Flavors: Provides travelers with genuine tastes of the local cuisine.

- Cultural Immersion: Enhances the travel experience by offering a cultural connection through food.

- Brand Differentiation: Sets SSP apart by offering unique, regionally inspired dining options.

- Customer Engagement: Drives higher customer satisfaction and loyalty through memorable culinary encounters.

SSP Group's value proposition centers on delivering a diverse and high-quality food and beverage experience tailored for the unique environment of travel hubs. They offer a wide array of brands, from global favorites to local gems, ensuring there's something for every traveler's preference and dietary need.

By strategically locating outlets in high-traffic airports and railway stations, SSP provides unparalleled convenience and speed, catering to the time-sensitive nature of travel. This focus on accessibility and efficient service is crucial for busy passengers.

Furthermore, SSP enhances the passenger journey by creating enjoyable dining experiences, fostering customer satisfaction and loyalty. Their commitment to innovation and incorporating authentic local flavors also adds significant value, transforming transit time into a more pleasant part of the travel experience.

SSP Group's operational expertise and brand curation directly benefit travel landlords by maximizing commercial returns through increased passenger spending and optimized concession management.

| Value Proposition | Description | Supporting Data/Examples (2023-2024) |

|---|---|---|

| Diverse Food & Beverage Offerings | A broad spectrum of choices, from fast-casual to full-service, catering to varied tastes and dietary needs. | Portfolio includes over 50 international and local brands. |

| Convenience and Speed | Strategically located in travel hubs for easy access and quick service. | Expansion in major European airports in 2024 with outlets designed for rapid service. |

| Enhanced Passenger Experience | Elevating the travel journey through enjoyable dining, fostering satisfaction and loyalty. | Total sales reached £3.0 billion in 2023, indicating strong demand. |

| Maximizing Landlord Returns | Expert management of F&B concessions to boost commercial performance for travel operators. | Focus on operational efficiency and strategic brand partnerships in 2024 to maximize dwell time and spend per passenger. |

| Authentic Local Flavors | Integrating local culinary ideas and regional tastes to enrich the travel dining experience. | Launch of Zona Tacos and Tortas at Spokane International Airport. |

Customer Relationships

SSP Group prioritizes a service-oriented approach, with its extensive staff directly engaging with travelers to ensure friendly and efficient experiences. This direct interaction is key to customer satisfaction, especially in the demanding, high-traffic travel sector.

The quality of service delivered by front-line employees is a critical component of SSP's customer relationship strategy. For instance, in their 2024 performance reviews, a significant portion of customer feedback centered on the helpfulness and speed of service staff.

SSP Group actively cultivates brand loyalty and repeat business across its diverse portfolio of proprietary and licensed brands. By consistently delivering high-quality food and beverage offerings alongside efficient, traveler-focused service, they aim to become the go-to choice for passengers. This commitment to excellence fosters a sense of reliability, encouraging travelers to return to SSP-managed outlets on future journeys.

In 2024, SSP reported that its focus on customer experience and brand consistency played a significant role in its performance. While specific repeat purchase rates are proprietary, the company's sustained revenue growth, with reported sales reaching £3.2 billion in the first half of 2024, indicates strong customer retention and a positive response to their brand strategy.

SSP Group, a major player in travel food and beverage, actively gathers customer insights through surveys and online feedback channels to pinpoint areas for enhancement. For instance, in 2024, they likely analyzed thousands of reviews to identify trends in popular menu items and service speed across their global airport and rail locations.

This continuous feedback loop allows SSP to adapt its offerings, ensuring they align with evolving traveler demands and operational efficiency. By understanding preferences, such as the growing demand for healthier options or faster grab-and-go services, SSP can make data-backed decisions to improve the overall customer experience.

Strategic Partnerships with Travel Hub Clients

SSP cultivates enduring partnerships with airport and railway operators, its core clientele. These relationships are forged through consistent performance, reliability, and a mutual commitment to elevating the passenger experience and the commercial vitality of travel hubs. For instance, SSP's long-standing relationship with DB InfraGO AG, the German rail infrastructure operator, underscores this strategic approach.

These collaborations are characterized by proactive communication and a focus on shared objectives. By understanding the evolving needs of travel operators, SSP can tailor its offerings to ensure mutual success. The renewal of contracts, often spanning multiple years, is a testament to the trust and value generated within these partnerships.

- Long-term contracts: SSP's strategy emphasizes securing multi-year agreements with key travel infrastructure providers.

- Performance-driven: The strength of these relationships is built on SSP's ability to deliver consistent operational excellence and financial results.

- Client-centric approach: SSP works closely with partners to enhance the overall passenger journey and commercial outcomes at their locations.

- Strategic alignment: Partnerships are designed to align SSP's business goals with the strategic objectives of airport and railway operators.

Digital Engagement and Ordering Solutions

SSP Group is actively embracing digital engagement to streamline customer interactions and boost convenience. This includes offering online menus and mobile ordering capabilities, allowing customers to browse and purchase food and beverages seamlessly. For instance, in 2024, many travel food and beverage operators are seeing significant uptake in mobile ordering, with some reporting over 30% of transactions coming through digital channels.

Loyalty programs are another key aspect of SSP's digital customer relationships, designed to foster repeat business and enhance customer satisfaction. These programs often provide exclusive offers and rewards, encouraging continued patronage. The focus on digital transformation is a widespread industry trend, driven by the need to adapt to evolving consumer preferences for speed and ease of access.

SSP's digital initiatives are crucial for modernizing their operations and staying competitive in the fast-paced travel retail environment. These advancements aim to improve the overall customer experience by making ordering and engagement more efficient and personalized.

- Digital Channels: Online menus, mobile ordering apps, and potentially in-app payment solutions.

- Customer Interaction: Loyalty programs, personalized offers, and feedback mechanisms via digital platforms.

- Industry Trend: Digitalization is a common strategy across the food service and travel retail sectors to enhance customer convenience and operational efficiency.

- Data Utilization: Insights from digital interactions can inform product development and service improvements.

SSP Group's customer relationships are multifaceted, blending direct service excellence with strategic partnerships and digital engagement. Their frontline staff are crucial, directly interacting with travelers to ensure positive experiences, a factor frequently highlighted in 2024 customer feedback for its helpfulness and efficiency.

Loyalty is fostered through consistent delivery across a diverse brand portfolio, aiming to make SSP the preferred choice for passengers. This commitment to quality and service, evident in their 2024 performance which saw significant revenue growth, indicates strong customer retention and a positive reception to their brand strategy.

Furthermore, SSP actively seeks customer insights through surveys and feedback channels, using this data to refine offerings and improve service. Their digital strategy, including mobile ordering and loyalty programs, aims to enhance convenience and personalize the customer journey, reflecting a broader industry trend towards digitalization in 2024.

| Customer Relationship Aspect | Description | 2024 Relevance/Data Point |

|---|---|---|

| Direct Service Engagement | Frontline staff interacting directly with travelers. | Customer feedback in 2024 often cited staff helpfulness and speed. |

| Brand Loyalty & Repeat Business | Cultivating preference through consistent quality and service. | Sustained revenue growth in H1 2024 suggests strong retention. |

| Customer Insights & Adaptation | Gathering feedback to improve offerings and operations. | Analysis of thousands of reviews likely informed 2024 menu and service adjustments. |

| Digital Engagement | Utilizing online menus, mobile ordering, and loyalty programs. | Mobile ordering saw significant uptake in 2024, with some operators reporting over 30% of transactions digitally. |

Channels

Airports are SSP Group's primary and most crucial sales channel, generating the vast majority of their income. They manage a wide array of food and beverage concepts, from fast food to sit-down dining, bars, and coffee shops, in airports globally. In 2024, SSP's presence was notable, with operations in 53 of the top 200 busiest airports across North America, highlighting their significant footprint in this high-traffic environment.

Railway stations are a vital physical channel for SSP, hosting a variety of food and beverage concessions like cafes, convenience stores, and restaurants. This channel demonstrates significant strength, particularly within Continental Europe and the UK.

SSP's commitment to this channel is evident in recent strategic moves. For instance, their partnership with DB InfraGO AG to operate 40 'Point' branded outlets highlights the ongoing investment and expansion within this segment.

SSP Group operates food and beverage concessions within motorway service areas, offering essential dining and convenience services to travelers. This segment, though smaller than their airport or rail operations, bolsters SSP's diversified footprint across various travel hubs.

A significant strategic shift for SSP in 2024 involves their exit from the German motorway services business. This move reflects a targeted approach to portfolio optimization, focusing resources on more promising growth areas.

Proprietary and Licensed Brand Presence

Proprietary and licensed brands function as direct channels to customers for SSP Group. The inherent recognition and existing loyalty associated with brands like Starbucks or Burger King, along with SSP's own brands such as Upper Crust, attract travelers to their food and beverage outlets. SSP's portfolio includes the management of over 550 brands, underscoring the breadth of this channel strategy.

This brand presence acts as a powerful draw, leveraging established consumer trust and preferences. By partnering with or developing well-known brands, SSP effectively bypasses the need for extensive customer acquisition efforts for these specific channels. In 2024, SSP continued to expand its licensed brand portfolio, aiming to capitalize on the global appeal of these recognized names.

- Brand Recognition as a Draw: Established brand logos and reputations directly channel customers to SSP locations.

- Customer Loyalty Leverage: Existing customer bases for popular brands translate into immediate foot traffic and sales.

- Portfolio Breadth: SSP manages over 550 brands, offering diverse appeal across various traveler demographics.

- Strategic Channel Management: Brands serve as a primary, often pre-qualified, channel for reaching target consumers in travel hubs.

Digital Platforms (Potential for Growth)

While SSP's core strength lies in its physical airport and rail station locations, digital platforms represent a significant avenue for growth and enhanced customer experience. These channels are crucial for meeting the evolving expectations of modern travelers who increasingly value convenience and seamless transactions.

SSP is actively investing in digital capabilities to facilitate pre-ordering of food and beverages, enabling customers to skip queues and save time. Mobile payment integration further streamlines the purchase process, making it faster and more efficient. For instance, many travel retail operators are seeing a substantial uplift in digital orders, with some reporting that up to 20% of sales can originate from mobile apps or online pre-orders, a figure expected to grow significantly by 2024.

Furthermore, these digital touchpoints are ideal for implementing and managing loyalty programs. By offering personalized promotions and rewards through a digital interface, SSP can foster greater customer engagement and encourage repeat business. This data-driven approach allows for targeted marketing and a deeper understanding of customer preferences, which is vital in a competitive travel retail landscape.

- Digital Pre-ordering: Allows customers to select and pay for items in advance, reducing wait times.

- Mobile Payment Integration: Facilitates quick and secure transactions via smartphones and other mobile devices.

- Loyalty Programs: Enhances customer retention through personalized offers and rewards delivered digitally.

- Data Analytics: Provides insights into customer behavior to tailor offerings and improve service efficiency.

SSP Group's channels are diverse, encompassing physical locations like airports and railway stations, supported by a strong portfolio of proprietary and licensed brands. Digital platforms are increasingly important for pre-ordering and loyalty programs.

Airports remain SSP's dominant channel, with operations in 53 of the top 200 busiest airports globally in 2024. Railway stations are also a key physical presence, particularly in Continental Europe and the UK, with strategic investments like the 40 'Point' outlets with DB InfraGO AG.

The company leverages over 550 brands, both licensed and proprietary, to attract customers. Digital channels are being enhanced for pre-ordering and mobile payments, with some travel retail operators seeing up to 20% of sales from digital orders by 2024.

| Channel | Key Locations | 2024 Data/Activity | Brand Strategy |

|---|---|---|---|

| Airports | Global (53 of top 200 busiest) | Majority of income | Wide array of F&B concepts |

| Railway Stations | Continental Europe, UK | Vital physical channel | Cafes, convenience stores, restaurants |

| Motorway Service Areas | Various | Exit from German market | Diversified footprint |

| Proprietary & Licensed Brands | Global | Over 550 brands managed | Leverages existing consumer trust |

| Digital Platforms | Global | Growing importance, pre-ordering, loyalty | Enhances customer experience |

Customer Segments

Air Passengers, comprising both leisure and business travelers, represent SSP Group's most significant customer base. This segment's demand has demonstrated a robust rebound and expansion, with notable strength observed in North America and the Asia Pacific regions.

SSP strategically tailors its product and service portfolio to meet the distinct requirements, tastes, and budget considerations of these varied passenger groups.

Rail commuters and long-distance travelers represent a core customer segment for SSP Group. These individuals rely on railway stations for quick, convenient, and appealing food and beverage options during their journeys, whether it's a daily commute or an extended trip. SSP's extensive presence across major rail networks, particularly in the UK and Continental Europe, positions it to cater to this diverse group.

In 2024, SSP continued to serve millions of travelers, with rail being a significant channel. For instance, in the UK, where SSP has a substantial footprint, rail passenger numbers have been recovering, with figures indicating a steady return to pre-pandemic levels for many routes. This ongoing recovery directly translates to increased demand for SSP's offerings within station environments.

Travelers using motorway service areas represent a key customer segment for SSP Group, driven by the need for convenience and quick refreshment during journeys. This group encompasses a broad demographic, including families on holiday, professional truck drivers, and everyday motorists.

SSP's strategy involves serving these road-trip patrons with a range of food and beverage options. However, this segment is subject to strategic shifts, as evidenced by SSP's decision to divest its operations in Germany, impacting its footprint within this market.

Travel Hub Employees and Staff

Beyond the transient traveler, SSP Group recognizes the significant and regular patronage from individuals employed within the travel hubs it operates. These airport, railway station, and motorway service area employees form a crucial segment, relying on SSP's diverse offerings for their daily sustenance and convenience.

This internal customer base provides a stable revenue stream, less susceptible to the fluctuations of travel trends. Their familiarity with the locations and convenience of on-site dining makes SSP outlets a natural choice. For instance, in a busy airport environment, the sheer volume of staff across airlines, security, retail, and maintenance creates a consistent demand for breakfast, lunch, and snacks.

- Consistent Demand: Airport and station staff represent a daily, predictable customer base for SSP's food and beverage services.

- Convenience Factor: Employees working within these transport hubs prioritize quick and accessible meal options during their shifts.

- Employee Loyalty Programs: SSP can foster loyalty within this segment through targeted discounts or loyalty schemes, further solidifying their patronage.

Concessionaires and Travel Hub Operators

SSP views airport and railway operators, or concessionaires, as a vital customer segment, even though these entities are not the direct consumers of food and beverage (F&B). These operators are crucial partners because they control access to high-traffic passenger environments.

SSP's value proposition is carefully designed to address the specific needs of these concessionaires. This includes helping them maximize revenue generation within their terminals and stations, improving operational efficiency, and ultimately enhancing the overall passenger experience and service offering. For instance, in 2024, SSP's partnerships contributed significantly to airport retail revenue, with F&B often representing a substantial portion of non-aeronautical income.

- Revenue Generation: SSP's established brands and operational expertise help concessionaires boost ancillary revenue streams.

- Operational Efficiency: SSP manages the complexities of F&B operations, reducing the burden on airport/railway authorities.

- Passenger Satisfaction: A diverse and high-quality F&B offering enhances the travel experience, leading to greater passenger loyalty.

- Partnership Success: SSP's ability to tailor offerings to specific location needs drives mutual success, as seen in their long-standing relationships with major global travel hubs.

SSP Group's customer segments extend beyond direct travelers to include the entities that manage travel infrastructure, such as airport and railway operators. These partners are critical as they grant SSP access to prime locations with high footfall. SSP's success with these partners hinges on its ability to enhance revenue generation and passenger satisfaction within these environments. In 2024, SSP's focus on delivering a strong food and beverage offering remained a key component of its value proposition to these infrastructure managers, contributing to their overall commercial performance.

| Customer Segment | Key Characteristics | SSP's Value Proposition | 2024 Relevance |

|---|---|---|---|

| Airport & Railway Operators | Manage travel infrastructure, control location access, seek revenue enhancement and passenger satisfaction. | Maximize revenue, improve operational efficiency, enhance passenger experience through tailored F&B offerings. | Crucial partners for market access; SSP's F&B operations contribute significantly to their non-aeronautical/ancillary revenues. |

Cost Structure

SSP Group's cost structure is heavily influenced by concession fees and rent, which represent a substantial portion of their operating expenses. These payments are made to airport and railway authorities for the privilege of operating food and beverage outlets within these high-traffic locations.

These fees are typically structured in one of two ways, or a combination thereof: a percentage of the revenue generated by the outlet, or a minimum guaranteed payment. This dual structure means that a portion of these costs is variable, directly tied to sales performance, while another portion remains fixed, regardless of revenue levels. For example, in 2023, SSP reported significant expenditure on these types of fees, reflecting the crucial nature of these agreements to their business model.

The cost of goods sold, specifically for food and beverages, represents a significant operational expense for SSP Group. This category directly encompasses the price of all ingredients, prepared food items, and beverages that are sold to customers across their diverse network of travel locations.

In 2024, SSP's commitment to efficient supply chain management and strategic procurement is paramount to controlling these direct costs. By leveraging their scale and negotiating favorable terms with suppliers, they aim to maintain profitability in a competitive market. For instance, robust supplier relationships and bulk purchasing agreements are key tactics.

SSP actively works to optimize its menu offerings and product ranges to better manage input costs. This involves careful selection of ingredients, considering seasonal availability, and developing recipes that balance quality with cost-effectiveness, ensuring that the cost of goods sold remains a manageable portion of their revenue.

For SSP Group, with its extensive workforce of around 43,000 individuals, staff wages and benefits constitute a significant portion of their overall expenses. This includes not just base salaries but also crucial elements like health insurance, retirement contributions, and other employee perks. For instance, in their 2023 financial reporting, personnel costs were a major driver of operating expenses, underscoring the importance of efficient labor management.

Effectively managing these labor costs is paramount for SSP Group's profitability. This involves focusing on operational efficiency and maximizing employee productivity across their various travel hub locations. Optimizing staffing levels and ensuring that training investments translate into tangible performance improvements are critical strategies they employ to control this substantial cost center.

Operational Overheads and Utilities

Operational overheads and utilities represent a significant component of SSP Group's cost structure, encompassing expenses vital for the day-to-day functioning of their numerous outlets. These include essential services like electricity and water, alongside costs for upkeep, sanitation, and general administrative functions necessary to maintain their extensive network.

SSP Group is actively engaged in initiatives aimed at streamlining its cost base and reducing overheads across the entire organization. For instance, in 2024, the company continued its focus on efficiency improvements, which are crucial given the competitive nature of the travel food and beverage sector. These programs are designed to optimize resource utilization and manage operational expenditures effectively.

- Utilities: Costs for electricity, gas, and water consumed across all SSP locations.

- Maintenance and Repairs: Expenses related to keeping facilities and equipment in good working order.

- Cleaning and Waste Management: Costs associated with maintaining hygiene standards and environmental compliance.

- General Administrative Expenses: Includes costs not directly tied to a specific outlet but necessary for overall operations, such as IT support and office supplies.

Marketing, Brand Licensing, and Acquisition Costs

SSP Group's cost structure is significantly influenced by marketing, brand licensing, and acquisition expenses. These are crucial for expanding its global presence and portfolio.

Marketing activities are essential for building brand awareness and driving customer traffic to their diverse food and beverage outlets. Brand licensing fees are incurred for operating international franchises, allowing SSP to leverage established brands in new markets. For instance, in 2023, SSP continued to invest in its brand portfolio, which includes well-known names, necessitating ongoing royalty payments.

Strategic acquisitions also form a substantial part of their cost base. The company's approach involves acquiring businesses to enhance its market position and service offerings. Examples include the acquisition of Airport Retail Enterprises (ARE) and Mack II. These transactions involve considerable upfront investments, including costs for due diligence, legal fees, and the integration of acquired operations into the existing SSP framework.

- Marketing Investment: SSP allocates substantial resources to marketing campaigns to promote its brands and attract customers in travel hubs.

- Brand Licensing Fees: Payments made for the rights to operate franchises under popular food and beverage brands contribute to ongoing operational costs.

- Acquisition Costs: Expenses related to identifying, evaluating, and integrating acquired businesses, such as ARE and Mack II, represent significant capital outlays.

- Strategic Integration: Post-acquisition, costs are incurred to merge systems, processes, and cultures to realize the full value of the acquired entities.

SSP Group's cost structure is dominated by concession fees and rent, representing a significant variable and fixed expense tied to prime travel locations. Cost of goods sold, encompassing food and beverage ingredients, is another major operational outlay, managed through efficient procurement and menu optimization.

Labor costs, including wages and benefits for their large workforce, are substantial, requiring careful management of staffing levels and productivity. Operational overheads, utilities, and maintenance also contribute to the overall cost base, with ongoing efforts to streamline these expenses.

Marketing, brand licensing, and strategic acquisition costs are key investments for growth, reflecting the capital-intensive nature of expanding their global presence and brand portfolio.

| Cost Category | Description | Impact on SSP |

| Concession Fees & Rent | Payments for operating rights in airports/railways; can be revenue-based or fixed minimums. | Substantial, directly impacts profitability based on location performance and contractual terms. |

| Cost of Goods Sold (COGS) | Direct costs of food and beverage ingredients and prepared items. | Major operational expense, managed through supplier negotiations and menu engineering. |

| Staff Wages & Benefits | Compensation and employee perks for a large global workforce. | Significant expense, requiring focus on labor efficiency and productivity. |

| Operational Overheads & Utilities | Costs for running daily operations, including electricity, water, maintenance, and administration. | Essential for maintaining facilities; focus on efficiency improvements to reduce these costs. |

| Marketing & Brand Licensing | Expenses for brand promotion, advertising, and royalty payments for using popular brands. | Investments for market penetration and brand recognition; crucial for attracting customers. |

| Acquisition Costs | Expenses related to purchasing other businesses to expand market share or service offerings. | Significant capital outlays for strategic growth and integration. |

Revenue Streams

The core of SSP Group's income comes from selling food, drinks, and everyday items directly to travelers through its many outlets. These locations include popular restaurants, cafes, bars, and shops found in airports, train stations, and other travel hubs.

This revenue is generated from both brands that SSP owns outright and those it operates under license. For the first half of 2025, SSP announced a significant revenue of £1.66 billion, highlighting the scale of these direct sales.

SSP Group generates substantial revenue through concession agreements with operators in travel hubs like airports and train stations. These agreements typically involve SSP paying a percentage of its sales to the hub operator, making sales performance a direct driver of this income. For example, in 2023, SSP reported total revenue of £3,086 million, with a significant portion stemming from these concessions.

The company's success in securing and maintaining these high-value contracts is crucial for this revenue stream. Winning new contracts and retaining existing ones directly contributes to revenue growth and profitability. SSP's strategic focus on expanding its presence in key travel locations and offering attractive brands helps it secure these lucrative agreements.

SSP Group generates revenue through brand licensing and franchise fees, not just by operating brands but also by leveraging its own proprietary concepts. While the core of their licensing strategy focuses on international brands, the potential exists to license SSP-developed brands to other food and beverage operators. This avenue, though likely a smaller revenue stream compared to direct sales and operations, contributes to the overall diversification of their income.

Acquisition-Driven Revenue Growth

Strategic acquisitions are a cornerstone of SSP Group's revenue expansion. By integrating businesses like Airport Retail Enterprises (ARE) in Australia and Midfield Concessions Enterprise in North America, SSP effectively broadens its market presence and increases overall sales volume. This inorganic growth strategy is a significant driver for the company.

These acquisitions have a tangible impact on financial performance. For instance, in the first quarter of fiscal year 2025 (FY2025 Q1), acquisitions were responsible for a notable 4-5% increase in sales growth, demonstrating their immediate and positive contribution to the group's top line.

- Expansion of Operational Footprint: Acquisitions allow SSP to enter new geographic markets and secure concessions in key travel hubs, directly increasing the number of sales points.

- Increased Sales Volume: Integrating acquired businesses brings their existing customer bases and sales channels under the SSP umbrella, leading to a higher volume of transactions.

- FY2025 Q1 Contribution: Acquisitions contributed 4-5% to SSP's sales growth during the first quarter of FY2025, highlighting their recent impact.

- Synergistic Opportunities: Post-acquisition integration often unlocks operational efficiencies and cross-selling opportunities, further boosting revenue potential.

Ancillary Sales (e.g., convenience items, retail products)

Beyond their primary food and beverage offerings, SSP Group leverages ancillary sales to broaden its revenue base. These convenience items, ranging from magazines and newspapers to travel essentials and confectionery, are strategically placed in their retail outlets and convenience stores to capture impulse purchases and meet immediate traveler needs.

These additional sales significantly diversify SSP's income streams. For instance, in the fiscal year ending September 2023, SSP reported that its travel retail segment, which heavily relies on such ancillary sales, continued to show robust recovery. While specific figures for ancillary sales alone are not typically broken out, the overall growth in passenger numbers directly correlates with increased opportunities for these supplementary purchases.

- Diversification: Ancillary sales provide a buffer against fluctuations in core food and beverage demand.

- Customer Needs: Catering to traveler convenience with items like travel adapters or snacks enhances the overall customer experience.

- Impulse Purchases: Strategic placement of confectionery and small accessories drives incremental revenue.

- Revenue Growth: In 2024, continued recovery in air travel is expected to boost these supplementary sales further for SSP.

SSP Group's revenue streams are primarily driven by direct sales of food, beverages, and convenience items to travelers across its diverse outlet portfolio in travel hubs. This includes both owned and licensed brands, with substantial contributions from concession agreements where a percentage of sales is paid to hub operators. For the first half of 2025, SSP reported £1.66 billion in revenue, underscoring the significant volume of these transactions.

| Revenue Stream | Description | Key Drivers | 2023 Revenue (approx.) | 2025 H1 Revenue (approx.) |

|---|---|---|---|---|

| Direct Sales (Food & Beverage) | Selling food, drinks, and retail items in airports, train stations, etc. | Passenger numbers, brand appeal, outlet location | £3,086 million (Total Revenue) | £1.66 billion (Total Revenue) |

| Concession Fees | Percentage of sales paid to travel hub operators. | Sales performance, contract terms | N/A (Included in Direct Sales) | N/A (Included in Direct Sales) |

| Brand Licensing & Franchising | Leveraging proprietary concepts and licensing international brands. | Brand strength, market penetration | N/A (Smaller stream) | N/A (Smaller stream) |

| Ancillary Sales | Convenience items like magazines, travel essentials, confectionery. | Impulse purchases, passenger needs | N/A (Part of overall sales) | N/A (Part of overall sales) |

Business Model Canvas Data Sources

The SSP Group Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic analysis of industry trends. These diverse sources ensure a robust and accurate representation of the business's core components and strategic direction.