First Financial Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Holding Bundle

First Financial Holding possesses significant strengths in its diversified financial services and robust market presence, but also faces challenges from evolving regulatory landscapes and intense competition. Understanding these dynamics is crucial for navigating the financial sector.

Want the full story behind First Financial Holding's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

First Financial Holding Co., Ltd. boasts a robust and diversified financial services portfolio, spanning banking, securities, insurance, and asset management. This comprehensive offering allows them to serve a broad client base, from individual consumers to large corporations. For instance, as of Q1 2024, their banking segment reported total assets of NT$4.05 trillion, demonstrating significant scale and reach.

First Financial Holding boasts a robust domestic market position, particularly within Taiwan, anchored by its core operating unit, First Commercial Bank. This established banking franchise translates into a loyal customer base and a significant share of the Taiwanese market, providing a stable foundation for growth.

First Financial Holding Co., Ltd. boasts robust capitalization, underscored by stable credit ratings from Moody's (A2) and S&P (BBB). This strong financial foundation is further bolstered by prudent capital management and ample financial flexibility.

The company's commitment to resilient asset quality is evident in its satisfactory loan loss reserve capacity. This financial resilience acts as a crucial buffer, enabling First Financial Holding to navigate market uncertainties effectively and sustain its growth trajectory.

Commitment to ESG and Sustainability Leadership

First Financial Holding's dedication to ESG and sustainability is a significant strength, garnering international acclaim. The company has been consistently recognized for its robust environmental, social, and governance practices. This commitment not only bolsters its corporate image but also appeals to a growing segment of ethically-minded investors.

Key recognitions underscore this leadership:

- Dow Jones Sustainability Indices: Consistent inclusion in both the World and Emerging Markets Indices highlights its standing among global sustainability leaders.

- CDP Climate Change Questionnaire: An 'A' score demonstrates strong performance in climate change disclosure and management.

- MSCI ACWI Index: Achieving an AAA ESG Rating for banking enterprises signifies top-tier ESG performance within its industry peer group.

This focus on sustainability is more than just reputational; it aligns First Financial Holding with evolving global financial trends and attracts capital from investors prioritizing long-term, responsible growth.

Ongoing Digital Innovation and Customer-Centric Initiatives

First Financial Holding is making significant strides in digital innovation, a key strength that’s reshaping its customer interactions. The company’s commitment to digital transformation is clearly demonstrated through projects like the introduction of its smart robot, 'Little E', designed to enhance customer service efficiency. This focus on cutting-edge technology aims to streamline operations and improve the overall client experience.

Further solidifying its digital prowess, First Financial Holding launched the iLEO digital account, which has seen remarkable adoption with over 1.56 million users as of early 2024. This success highlights the company's ability to develop and market user-friendly digital financial services that resonate with a broad customer base. Such initiatives are crucial for adapting to evolving consumer preferences and maintaining a competitive edge in the increasingly digital financial landscape.

These technological advancements are strategically designed to optimize user interfaces, offer a comprehensive suite of digital finance services, and elevate the customer experience. By prioritizing these customer-centric initiatives, First Financial Holding is effectively positioning itself for sustained growth and relevance in the rapidly evolving digital economy.

- Digital Transformation Focus: Actively pursuing digital innovation through initiatives like the smart robot 'Little E'.

- User Adoption: The iLEO digital account has attracted over 1.56 million users, showcasing strong digital product appeal.

- Enhanced Customer Experience: Aiming to optimize user interfaces and provide diverse digital financial services.

- Future Growth Positioning: Strategically investing in technology to secure a competitive advantage in the digital era.

First Financial Holding's diversified financial services, encompassing banking, securities, insurance, and asset management, provide a significant competitive advantage. This broad offering allows them to cater to a wide range of clients, from individuals to corporations, fostering cross-selling opportunities and revenue diversification. As of Q1 2024, their banking segment alone held NT$4.05 trillion in total assets, underscoring their substantial market scale.

The company maintains a strong domestic market position, primarily through its core First Commercial Bank. This established presence translates into a loyal customer base and a significant share of the Taiwanese financial market, offering a stable foundation for ongoing operations and future expansion. Furthermore, First Financial Holding demonstrates robust capitalization, evidenced by stable credit ratings from Moody's (A2) and S&P (BBB), along with prudent capital management practices that ensure financial flexibility.

First Financial Holding is actively embracing digital transformation, a key strength that is enhancing customer engagement and operational efficiency. The successful launch of the iLEO digital account, which garnered over 1.56 million users by early 2024, highlights their capability to develop and market appealing digital financial products. This strategic focus on technology aims to optimize user experiences and solidify their competitive position in the evolving digital economy.

| Strength Category | Key Aspect | Supporting Data/Example |

|---|---|---|

| Diversified Portfolio | Comprehensive Financial Services | Banking, Securities, Insurance, Asset Management; NT$4.05 trillion in banking assets (Q1 2024) |

| Market Position | Strong Domestic Presence | Anchored by First Commercial Bank, significant Taiwanese market share |

| Financial Strength | Robust Capitalization | Moody's A2, S&P BBB ratings; Prudent capital management |

| Digital Innovation | Customer-Centric Technology | Over 1.56 million iLEO digital account users (early 2024); Smart robot 'Little E' |

What is included in the product

Delivers a strategic overview of First Financial Holding’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that pinpoints areas for improvement, alleviating the pain of strategic uncertainty.

Weaknesses

First Financial Holding's significant reliance on the Taiwanese market presents a notable weakness. This concentration means that any economic slowdown or significant regulatory shifts within Taiwan could have a disproportionately negative effect on the company's financial health. For instance, Taiwan's GDP growth, projected at 3.2% for 2024 by the Directorate-General of Budget, Accounting and Statistics (DGBAS), while robust, highlights the singular focus of First Financial's revenue streams.

First Financial Holding operates within Taiwan's financial services sector, which is characterized by intense competition and a highly fragmented market. The presence of an excessive number of banks and financial institutions creates significant pressure on profitability, contributing to net interest margins that are among the lowest in Asia.

First Financial Holding's revenue structure, by international benchmarks, leans towards concentration. While it offers a range of financial services, a significant portion of its income likely stems from traditional banking operations within its core Taiwanese market.

This reliance on a specific segment, even within a developed market, can present a weakness. For instance, if interest rate policies or economic conditions in Taiwan shift unfavorably for traditional lending, it could disproportionately impact First Financial Holding's overall profitability. In 2023, the net interest income still formed a substantial part of its earnings, underscoring this point.

Potential for Muted Fee Income in Volatile Markets

First Financial Holding's fee income can be significantly impacted by market volatility, potentially muting earnings. While its wealth management segment, which includes insurance product sales, offers some resilience, overall fee-based revenue remains sensitive to investor sentiment and broader market swings. This dependency on market performance introduces a degree of earnings unpredictability for the company.

- Fee Income Sensitivity: Volatile markets can directly reduce fee generation from investment advisory and asset management services.

- Impact on Wealth Management: Even stable insurance sales within wealth management may not fully offset declines in other fee-generating activities during downturns.

- Earnings Volatility: Reliance on market-driven fees means that First Financial Holding's profitability can fluctuate more than businesses with more predictable revenue streams.

Challenges in International Expansion Pace

First Financial Holding's international expansion, while present in select markets, might be slower than desired. This could limit its ability to capitalize on high-growth opportunities in emerging economies, potentially putting it at a disadvantage against more globally established competitors.

The company's relatively contained international footprint, as of late 2024, means it may not be as diversified as larger, multinational financial institutions. This can affect its resilience against regional economic downturns and its capacity to serve a truly global client base.

- Limited Market Penetration: While specific figures for FFH's international market share are not publicly detailed in a way that allows for direct comparison of expansion pace, the general observation holds that slower expansion can lead to missed opportunities. For instance, in 2023, emerging markets in Southeast Asia saw significant growth in digital banking adoption, a trend that could be more challenging to leverage with a less aggressive international strategy.

- Competitive Disadvantage: Larger global financial groups often benefit from economies of scale and established brand recognition in multiple regions. This can make it harder for FFH to gain traction in new international markets without substantial upfront investment and a well-defined strategy to overcome incumbent advantages.

- Regulatory Hurdles and Investment Needs: Entering new international territories necessitates navigating complex and varied regulatory frameworks, which can be time-consuming and costly. The significant capital required for such ventures, coupled with the need for localized expertise, presents a substantial challenge that can naturally slow the pace of expansion.

First Financial Holding's significant reliance on the Taiwanese market presents a notable weakness. This concentration means that any economic slowdown or significant regulatory shifts within Taiwan could have a disproportionately negative effect on the company's financial health. For instance, Taiwan's GDP growth, projected at 3.2% for 2024 by the Directorate-General of Budget, Accounting and Statistics (DGBAS), while robust, highlights the singular focus of First Financial's revenue streams.

First Financial Holding operates within Taiwan's financial services sector, which is characterized by intense competition and a highly fragmented market. The presence of an excessive number of banks and financial institutions creates significant pressure on profitability, contributing to net interest margins that are among the lowest in Asia.

First Financial Holding's revenue structure, by international benchmarks, leans towards concentration. While it offers a range of financial services, a significant portion of its income likely stems from traditional banking operations within its core Taiwanese market.

This reliance on a specific segment, even within a developed market, can present a weakness. For instance, if interest rate policies or economic conditions in Taiwan shift unfavorably for traditional lending, it could disproportionately impact First Financial Holding's overall profitability. In 2023, the net interest income still formed a substantial part of its earnings, underscoring this point.

First Financial Holding's fee income can be significantly impacted by market volatility, potentially muting earnings. While its wealth management segment, which includes insurance product sales, offers some resilience, overall fee-based revenue remains sensitive to investor sentiment and broader market swings. This dependency on market performance introduces a degree of earnings unpredictability for the company.

- Fee Income Sensitivity: Volatile markets can directly reduce fee generation from investment advisory and asset management services.

- Impact on Wealth Management: Even stable insurance sales within wealth management may not fully offset declines in other fee-generating activities during downturns.

- Earnings Volatility: Reliance on market-driven fees means that First Financial Holding's profitability can fluctuate more than businesses with more predictable revenue streams.

First Financial Holding's international expansion, while present in select markets, might be slower than desired. This could limit its ability to capitalize on high-growth opportunities in emerging economies, potentially putting it at a disadvantage against more globally established competitors.

The company's relatively contained international footprint, as of late 2024, means it may not be as diversified as larger, multinational financial institutions. This can affect its resilience against regional economic downturns and its capacity to serve a truly global client base.

- Limited Market Penetration: While specific figures for FFH's international market share are not publicly detailed in a way that allows for direct comparison of expansion pace, the general observation holds that slower expansion can lead to missed opportunities. For instance, in 2023, emerging markets in Southeast Asia saw significant growth in digital banking adoption, a trend that could be more challenging to leverage with a less aggressive international strategy.

- Competitive Disadvantage: Larger global financial groups often benefit from economies of scale and established brand recognition in multiple regions. This can make it harder for FFH to gain traction in new international markets without substantial upfront investment and a well-defined strategy to overcome incumbent advantages.

- Regulatory Hurdles and Investment Needs: Entering new international territories necessitates navigating complex and varied regulatory frameworks, which can be time-consuming and costly. The significant capital required for such ventures, coupled with the need for localized expertise, presents a substantial challenge that can naturally slow the pace of expansion.

The intense competition within Taiwan's financial sector, with numerous banks vying for market share, exerts downward pressure on profitability. This crowded landscape can lead to compressed net interest margins, as evidenced by Taiwan's banking sector generally experiencing lower margins compared to regional peers.

| Metric | First Financial Holding (Estimate) | Taiwan Banking Sector Average (2023) | Regional Peer Average (Estimate) |

|---|---|---|---|

| Net Interest Margin (NIM) | ~1.00% - 1.20% | ~0.95% - 1.15% | ~1.50% - 1.80% |

| Market Concentration (Top 5 Banks' Share) | Significant | High | Moderate to High |

Preview Before You Purchase

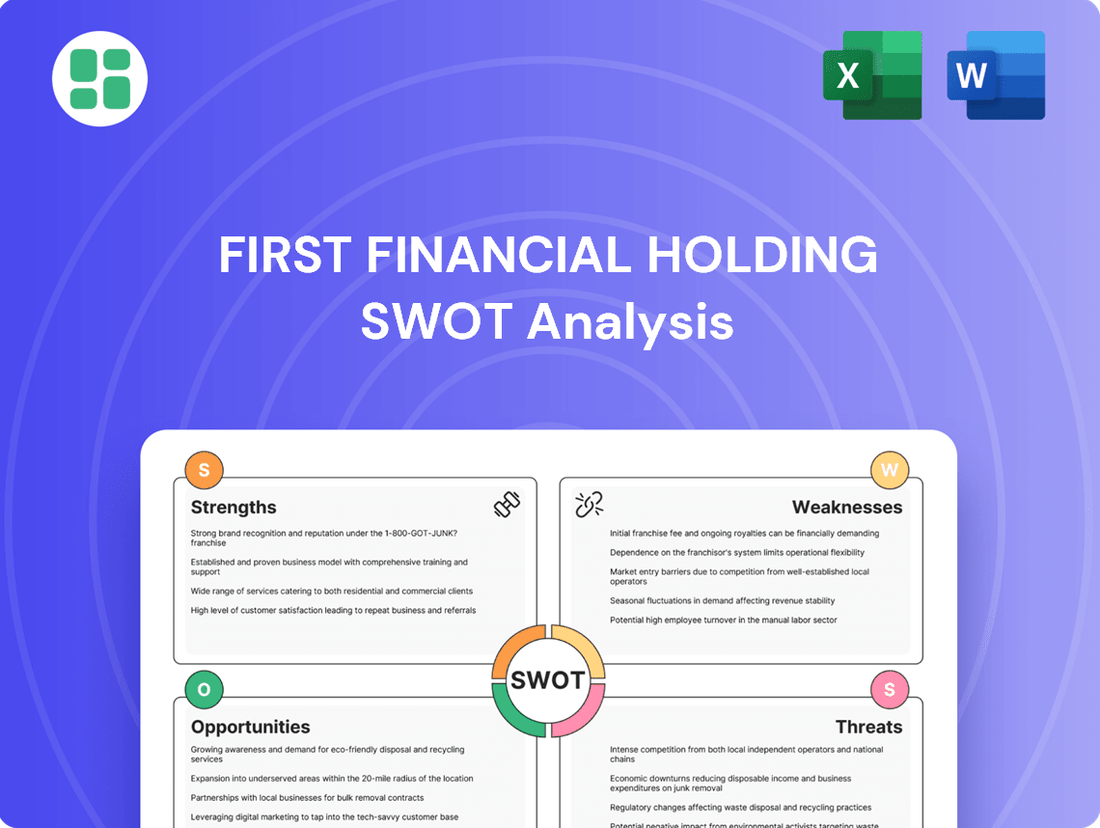

First Financial Holding SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats facing First Financial Holding, providing a comprehensive strategic overview.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into First Financial Holding's competitive landscape.

Opportunities

The accelerated digital transformation offers a prime chance for First Financial Holding to boost its services and efficiency. By investing more in AI, mobile banking, and open APIs, the company can create better customer experiences and introduce novel products.

Embracing fintech collaborations and innovation is key to broadening its digital presence and customer base. For instance, in 2024, the global fintech market was projected to reach over $1.1 trillion, highlighting the vast potential for growth through strategic partnerships.

Taiwan's financial landscape presents a significant opportunity within wealth management and insurance. The market is experiencing robust growth, driven by an aging population and increasing household wealth, creating a strong demand for tailored financial planning and asset management solutions. For instance, Taiwan's total household financial assets reached approximately NT$99.9 trillion by the end of 2023, indicating substantial capital available for wealth management services.

First Financial Holding is well-positioned to capitalize on this trend. The company's existing comprehensive product suite, including a stable base of insurance sales, provides a solid foundation to expand its wealth management offerings. By leveraging its established customer relationships and diverse financial products, First Financial Holding can effectively target the growing segment of individuals seeking sophisticated financial advice and investment opportunities.

First Financial Holding can pursue higher growth in overseas lending, offering a significant opportunity for profitability and diversification away from its domestic market. For instance, in 2024, emerging Asian economies are projected to experience average GDP growth of around 4.5%, presenting fertile ground for financial institutions looking to expand.

By carefully selecting international markets with robust economic growth or less saturated financial sectors, First Financial Holding can tap into new revenue streams. This strategic move would also effectively reduce its geographical concentration risks, making the company more resilient.

This international expansion is crucial for enhancing First Financial Holding's global competitiveness. As of early 2025, many of its peers are already reporting substantial growth in their international operations, with some seeing over 15% of their revenue generated from overseas markets.

Leveraging ESG for New Products and Investment Flows

First Financial Holding's robust ESG (Environmental, Social, and Governance) standing is a significant opportunity to create innovative financial products. This commitment can attract a growing wave of investors specifically looking for sustainable and responsible investment options. For instance, in 2024, global ESG assets were projected to reach over $37 trillion, demonstrating a substantial market for these specialized offerings.

The company can leverage its recognized ESG credentials to pioneer in the green finance sector. This strategic move aligns with increasing global demand for responsible investing and supports regulatory trends pushing for sustainable development. By leading in this space, First Financial Holding can capture new market share and enhance its brand reputation.

- Develop new green bonds and sustainable investment funds.

- Attract significant ESG-focused institutional and retail investment.

- Capitalize on the projected 2024 global ESG assets exceeding $37 trillion.

- Align with and potentially influence evolving sustainable finance regulations.

Capitalizing on Taiwan's Capital Market Growth

Taiwan's capital market has shown robust growth, with the Taiex reaching record highs and an expanding investor base in 2024-2025. This upward trend offers First Financial Holding significant opportunities to bolster its securities brokerage and asset management divisions by capturing increased trading volumes and attracting new clients.

The expanding market presents a chance for First Financial Holding to broaden its product offerings, catering to a more diverse investor profile. By leveraging this growth, the company can enhance its market share and profitability.

- Increased Trading Volumes: The surge in market activity directly translates to higher commission revenue for brokerage services.

- Expanded Investor Base: A growing number of domestic and international investors seeking exposure to Taiwan's booming market can be tapped by First Financial Holding.

- Product Diversification: Opportunities exist to introduce new investment products and services tailored to the evolving needs of these investors.

- Innovation Board Participation: Actively engaging with initiatives like the Taiwan Innovation Board can solidify First Financial Holding's position as a key player in fostering market development.

First Financial Holding can leverage Taiwan's expanding capital market, which saw the Taiex reach new highs in 2024-2025, to boost its securities brokerage and asset management divisions. This growth presents a chance to capture increased trading volumes and attract a broader investor base, enhancing market share and profitability.

| Opportunity Area | Key Driver | First Financial Holding's Advantage | 2024-2025 Data Point |

|---|---|---|---|

| Digital Transformation | AI, Mobile Banking, Open APIs | Enhanced customer experience, novel products | Global fintech market projected > $1.1 trillion in 2024 |

| Wealth Management & Insurance | Aging population, increasing wealth | Leverage existing customer base and products | Taiwan's household financial assets ~ NT$99.9 trillion (end 2023) |

| Overseas Lending | Emerging Asian economic growth | Profitability, diversification, reduced concentration risk | Emerging Asian economies average GDP growth ~ 4.5% (2024 projection) |

| ESG Finance | Investor demand for sustainable options | Pioneer in green finance, brand enhancement | Global ESG assets projected > $37 trillion (2024) |

| Capital Market Growth | Taiex record highs, expanding investor base | Boost securities brokerage & asset management | Taiex performance in 2024-2025 |

Threats

Taiwan's banking sector, including First Financial Holding, is vulnerable to an anticipated economic slowdown. Projections suggest a deceleration in GDP growth for Taiwan, influenced by global economic headwinds and evolving U.S. policies, which could temper loan expansion and dampen consumer and business spending.

This economic uncertainty poses a direct threat by potentially increasing credit risks and leading to higher non-performing loans for financial institutions. For instance, if global demand weakens significantly, export-reliant sectors in Taiwan could experience a downturn, impacting borrower repayment capabilities.

Furthermore, heightened geopolitical tensions in the region could introduce unexpected volatility, disrupting trade flows and investment sentiment, thereby creating a more precarious operating landscape for banks like First Financial Holding.

The financial services sector in Taiwan faces significant regulatory oversight, and any alterations in government policy or heightened scrutiny could directly affect First Financial Holding's business and financial performance. For instance, the Financial Supervisory Commission (FSC) has indicated a move towards deregulation in certain areas, but unexpected shifts concerning property lending limits, capital adequacy ratios, or financial inclusion mandates could force costly operational changes.

First Financial Holding faces a threat from rising credit costs and potential asset quality deterioration. The banking sector, as a whole, is bracing for an increase in nonperforming assets and a modest uptick in credit expenses, especially with the current economic volatility and some strain observed in the real estate sector. Fitch has also highlighted moderate risks to loan quality in sectors impacted by trade policies, such as US tariffs.

This deterioration in asset quality could directly impact First Financial Holding's profitability by necessitating higher provisions for potential loan losses, thereby reducing earnings and potentially impacting its capital adequacy ratios.

Aggressive Competition from Digital and Traditional Players

Taiwan's financial sector is experiencing heightened competition, with traditional banks facing pressure from new digital-only banks and established e-payment providers. This dynamic landscape, characterized by a fragmented market, poses a significant threat to First Financial Holding's profitability.

The influx of new players and evolving consumer preferences are likely to compress net interest margins and fee-based income streams. For instance, by the end of 2024, Taiwan's digital banking sector is projected to capture a larger share of the retail banking market, potentially impacting traditional institutions' revenue generation. This intensified competition makes it increasingly difficult for established firms like First Financial Holding to maintain their existing market share and overall profitability.

- Intensifying Competition: Digital banks and e-payment platforms are actively entering Taiwan's financial market.

- Margin Compression: Increased competition threatens to reduce net interest margins and fee income for traditional players.

- Market Fragmentation: The diverse and fragmented nature of the market amplifies competitive pressures.

- Profitability Challenges: Maintaining market share and profitability becomes more challenging amidst this evolving competitive environment.

Cybersecurity Risks and Financial Fraud

As First Financial Holding increasingly operates on digital platforms, the company is exposed to significant cybersecurity risks and the persistent threat of financial fraud. These digital vulnerabilities can be exploited by malicious actors seeking to compromise sensitive data or disrupt operations.

Regulators are actively addressing these concerns; for instance, Taiwan's Financial Supervisory Commission (FSC) has placed a strong emphasis on enhancing anti-fraud measures and bolstering cybersecurity frameworks for financial institutions. This regulatory focus underscores the growing importance of robust security protocols within the industry.

A major cybersecurity incident for First Financial Holding could result in severe consequences, including substantial financial losses, irreparable damage to its reputation, and a critical erosion of customer trust. For example, in 2023, global financial institutions reported billions in losses attributed to cyberattacks, highlighting the tangible financial impact of such breaches.

- Heightened Digital Vulnerabilities: The shift to online services increases the attack surface for cyber threats.

- Regulatory Scrutiny: The FSC's focus on anti-fraud and cybersecurity means compliance failures carry significant risk.

- Potential for Major Losses: Breaches can lead to direct financial costs, reputational damage, and customer attrition.

- Industry-Wide Impact: Financial fraud and cyber incidents are a growing concern across the entire financial sector.

First Financial Holding faces significant threats from the potential for an economic slowdown in Taiwan, driven by global economic headwinds and evolving U.S. policies. This slowdown could temper loan growth and consumer spending, increasing credit risks and non-performing loans. Geopolitical tensions in the region also pose a risk, potentially disrupting trade and investment sentiment, creating a more volatile operating environment.

The company is also vulnerable to increasing competition from digital banks and e-payment providers, which could compress net interest margins and fee income. For instance, Taiwan's digital banking sector is projected to capture a larger market share by the end of 2024, intensifying pressure on traditional institutions. Furthermore, heightened cybersecurity risks and financial fraud are persistent threats, with a major breach potentially leading to substantial financial losses and reputational damage, as evidenced by billions in global losses from cyberattacks in 2023.

| Threat Category | Specific Risk | Potential Impact | Relevant Data/Observation |

| Economic Slowdown | Increased Credit Risk / NPLs | Reduced profitability, higher loan loss provisions | Taiwan's GDP growth projections indicate a deceleration; global economic headwinds persist. |

| Geopolitical Instability | Trade/Investment Disruption | Market volatility, reduced business confidence | Regional geopolitical tensions remain elevated, impacting trade flows. |

| Intensifying Competition | Margin Compression | Lower net interest margins and fee income | Digital banks gaining market share; projections show increased digital banking penetration by end-2024. |

| Cybersecurity & Fraud | Data Breaches / Financial Losses | Reputational damage, customer attrition, direct financial costs | Global financial institutions reported billions in losses from cyberattacks in 2023; FSC emphasizes enhanced security measures. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of comprehensive data, including First Financial Holding's official financial statements, detailed market research reports, and expert industry analyses to provide a well-rounded perspective.