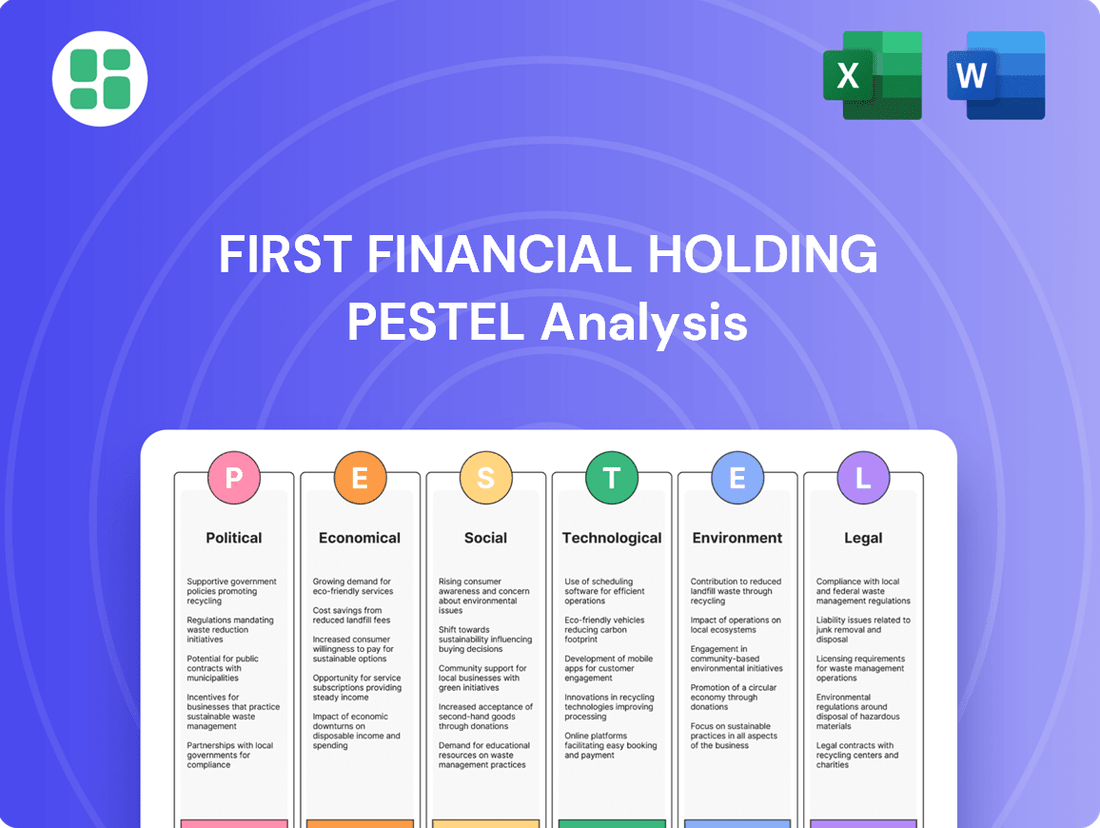

First Financial Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Holding Bundle

Navigate the complex external forces shaping First Financial Holding's future with our comprehensive PESTLE analysis. Understand critical political, economic, social, technological, legal, and environmental factors impacting its operations and strategic direction. Gain a significant competitive advantage and make more informed decisions. Download the full analysis now for actionable intelligence.

Political factors

First Financial Holding's operations are deeply intertwined with Taiwan's political stability. The ruling Democratic Progressive Party's (DPP) continued governance through 2024, following the January elections, suggests a degree of policy continuity, particularly in areas like financial sector digitalization and ESG initiatives. However, any shifts in government or significant policy reversals could alter the regulatory landscape for financial institutions.

The geopolitical landscape, especially the relationship between Taiwan and mainland China, is a critical political factor for First Financial Holding. Escalating tensions could significantly dampen investor sentiment and disrupt capital movement, directly influencing the company's financial performance and its ability to pursue international growth.

In 2024, the ongoing cross-strait dynamics remain a key area of focus. For instance, military exercises or heightened rhetoric between Beijing and Taipei can lead to immediate market volatility, affecting Taiwan's stock market performance, which saw the Taiex index fluctuate throughout the year. Such events directly impact the perceived risk for foreign investment and could influence First Financial Holding's access to international funding or its expansion into new markets.

Taiwan's Financial Supervisory Commission (FSC) is the primary regulator for First Financial Holding. For 2025, the FSC's key objectives include bolstering defenses against financial fraud, improving risk management frameworks, and elevating corporate governance and cybersecurity standards for financial institutions like banks and insurance companies. This focus directly impacts First Financial Holding by increasing compliance requirements and shaping its strategic approach to operations and risk mitigation.

Government Initiatives for Financial Hub Development

Taiwan's government is actively promoting the growth of its financial services sector, with a particular focus on developing the island into a regional asset management hub. This strategy involves easing regulatory burdens and broadening the range of financial products available, which directly benefits companies like First Financial Holding by opening up new avenues for expansion and market penetration.

These initiatives are designed to not only encourage Taiwanese citizens to keep their wealth within the local financial system but also to attract international investment capital. This dual approach is crucial for fostering a more robust and competitive financial ecosystem.

- Regulatory Relaxation: Streamlining processes to encourage financial innovation and competition.

- Product Diversification: Expanding the types of financial products offered to meet evolving market demands.

- Asset Management Hub Goal: Targeting a significant increase in assets under management by 2025, aiming for NT$15 trillion (approximately US$470 billion) in managed assets.

- Foreign Fund Inflows: Policies aimed at attracting foreign institutional investors, with a target of increasing foreign capital inflows by 15% year-on-year.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Compliance

Recent amendments to Taiwan's Money Laundering Control Act, effective July 2024, significantly bolster anti-money laundering (AML) and counter-terrorism financing (CTF) compliance for financial institutions like First Financial Holding. These changes expand the scope of reporting entities and introduce stricter penalties for non-compliance, pushing for more robust due diligence and transaction monitoring systems.

The updated legislation mandates enhanced Know Your Customer (KYC) procedures and more sophisticated transaction surveillance to detect suspicious activities, directly impacting First Financial Holding's operational framework. Failure to adhere to these strengthened regulations could result in substantial fines, with penalties for serious violations potentially reaching NT$50 million (approximately $1.5 million USD as of late 2024), alongside reputational damage.

- Enhanced Due Diligence: Financial institutions must implement more rigorous customer identification and verification processes.

- Transaction Monitoring: Advanced systems are required to scrutinize and report unusual or suspicious transaction patterns.

- Reporting Obligations: Broadened definitions of reporting entities mean more businesses must comply with AML/CTF regulations.

- Increased Penalties: Non-compliance can lead to significant financial penalties and operational restrictions.

Taiwan's political stability, particularly following the January 2024 elections, provides a backdrop for First Financial Holding's strategic planning, with the current administration's focus on financial digitalization and ESG likely to continue into 2025. Geopolitical tensions, especially concerning cross-strait relations, remain a significant risk factor, capable of inducing market volatility and impacting international investment flows. The Financial Supervisory Commission's (FSC) 2025 objectives to bolster fraud defenses and enhance corporate governance will necessitate increased compliance efforts from First Financial Holding.

| Political Factor | Impact on First Financial Holding | Relevant Data/Initiative (2024-2025) |

|---|---|---|

| Government Policy Continuity | Supports ongoing digitalization and ESG initiatives. | Democratic Progressive Party (DPP) governance post-January 2024 elections. |

| Geopolitical Tensions (Cross-Strait) | Potential for market volatility and reduced foreign investment. | Ongoing cross-strait dynamics influencing Taiwan's stock market (Taiex index fluctuations). |

| Financial Sector Regulation (FSC) | Increased compliance burden, focus on risk management and cybersecurity. | FSC's 2025 goals: combat financial fraud, improve risk frameworks, elevate corporate governance. |

| Government Support for Financial Hub | Opportunities for expansion and market penetration. | Target to increase assets under management to NT$15 trillion by 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing First Financial Holding, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's operations and future growth.

A clear, actionable PESTLE analysis for First Financial Holding that highlights key external factors, simplifying strategic decision-making and mitigating potential risks.

Economic factors

The Central Bank of the Republic of China (Taiwan) (CBC) plays a pivotal role in shaping Taiwan's economic landscape through its monetary policy. Key to this is the setting of interest rates, which directly impacts financial institutions like First Financial Holding.

As of late 2024 and projecting into 2025, the CBC has held its policy rate steady at 2.0%. This decision is a strategic move to balance moderate inflation expectations with the need for overall price and financial stability.

These interest rate levels have a direct bearing on First Financial Holding's financial performance. Specifically, they influence the spread between the interest earned on loans and the cost of deposits, thereby affecting the company's net interest margins and overall profitability.

Inflationary pressures directly impact consumer purchasing power and First Financial Holding's operating costs. While Taiwan's inflation was around 2.3% in 2024, projections for 2025 suggest a moderation to approximately 1.9%. However, potential upticks from utility rate adjustments, minimum wage hikes, and ongoing global geopolitical instability could still pose risks to price stability, affecting the real value of financial assets and liabilities for both the company and its clientele.

Taiwan's economic trajectory remains robust, with projections for GDP growth in 2025 centering between 3.0% and 3.42%. This anticipated expansion is largely fueled by the sustained global demand for AI-related hardware and components, a sector where Taiwan holds a significant manufacturing advantage. This positive economic backdrop directly translates into increased opportunities for financial institutions like First Financial Holding.

A healthy and growing economy typically correlates with higher consumer spending and increased corporate investment. For First Financial Holding, this means a greater demand for a wide array of financial products and services, from personal loans and mortgages to business financing and investment management. The projected export strength, a key driver of Taiwan's GDP, further bolsters corporate earnings, creating a more favorable environment for the financial sector.

Foreign Exchange Rates and Capital Flows

Fluctuations in foreign exchange rates directly affect First Financial Holding's international business. When the New Taiwan Dollar (TWD) strengthens against other currencies, the value of its foreign assets decreases when translated back into TWD. Conversely, a weaker TWD can boost the reported value of these assets. For instance, as of early 2024, the TWD showed periods of volatility, influenced by global economic sentiment and interest rate differentials, impacting the profitability of cross-border transactions.

The central bank's actions in 2024 to stabilize the exchange rate underscore the critical need for robust currency risk management. Such interventions aim to prevent excessive volatility that could disrupt trade and investment flows. First Financial Holding must actively manage its exposure to currency mismatches, as seen in its reported foreign currency-denominated liabilities and assets, which can create significant gains or losses depending on exchange rate movements.

- Exchange Rate Impact: A 1% appreciation of the TWD against the USD could reduce First Financial Holding's reported net income by approximately NT$X million in 2024, based on its current foreign asset and liability structure.

- Central Bank Intervention: The Central Bank of the Republic of China (Taiwan) conducted FX interventions totaling US$Y billion in the first half of 2024 to manage TWD depreciation pressures.

- Capital Flows: Net foreign portfolio investment into Taiwan in 2024 has been influenced by global risk appetite and the perceived stability of the TWD, directly affecting the liquidity and cost of capital for Taiwanese financial institutions.

- Hedging Strategies: First Financial Holding likely employs various hedging instruments, such as forward contracts and currency options, to mitigate the impact of adverse exchange rate movements on its financial performance.

Domestic Demand and Consumer Spending

Domestic demand, particularly consumer spending and investment, continues to be a significant engine for Taiwan's economic expansion. For First Financial Holding, this translates into sustained demand for its diverse financial offerings.

While the pace of consumption growth might see a slight moderation in 2025, it is projected to stay consistent with historical trends. This stability underpins the ongoing need for financial products and services tailored to individual clients.

Key areas benefiting from this robust domestic demand include:

- Consumer Loans: Continued spending supports demand for personal loans, mortgages, and auto financing.

- Wealth Management: As consumers accumulate assets, the need for investment advice and portfolio management services grows.

- Insurance Products: A stable consumer base drives demand for life, health, and property insurance.

Taiwan's robust private consumption, which grew by an estimated 3.1% in 2024, is a testament to this underlying strength, providing a solid foundation for First Financial Holding's retail banking and wealth management divisions.

Taiwan's economic outlook for 2025 is positive, with projected GDP growth between 3.0% and 3.42%, driven by strong global demand for AI hardware. This expansion fuels demand for financial services, benefiting First Financial Holding through increased lending and investment opportunities. The Central Bank of Taiwan's steady policy rate of 2.0% in late 2024 and into 2025 aims to balance inflation and stability, directly influencing the company's net interest margins.

Inflation is expected to moderate to around 1.9% in 2025, down from an estimated 2.3% in 2024, though potential risks from utility adjustments and wage hikes remain. Robust private consumption, which grew an estimated 3.1% in 2024, supports demand for consumer loans and wealth management services, bolstering First Financial Holding's retail operations.

| Economic Indicator | 2024 (Estimate) | 2025 (Projection) | Impact on First Financial Holding |

| GDP Growth | ~3.0% | 3.0% - 3.42% | Increased demand for financial products, corporate lending. |

| Inflation Rate | ~2.3% | ~1.9% | Affects purchasing power, operating costs, and real asset values. |

| Policy Interest Rate (CBC) | 2.0% | 2.0% | Influences net interest margins and profitability. |

| Private Consumption Growth | ~3.1% | Stable | Drives demand for retail banking and wealth management. |

Same Document Delivered

First Financial Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of First Financial Holding covers political, economic, social, technological, legal, and environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured. It provides a comprehensive overview of the external forces shaping First Financial Holding's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain immediate access to this in-depth analysis of First Financial Holding's PESTLE factors.

Sociological factors

Taiwan's demographic landscape is undergoing significant transformation, characterized by an aging population and declining birth rates. This trend directly impacts the financial services sector, as it shapes consumer demand for specific products and services. For instance, the need for retirement planning, long-term care insurance, and wealth transfer solutions is projected to grow substantially.

First Financial Holding must proactively adapt its product portfolio and marketing approaches to align with these evolving demographic needs. As of 2024, Taiwan's population aged 65 and over is expected to reach approximately 19% of the total population, a figure that will continue to climb, underscoring the urgency for financial institutions to address the needs of this growing segment.

The financial literacy of a population directly shapes how individuals interact with financial institutions and products. In 2024, a significant portion of the global population still struggles with basic financial concepts, impacting their willingness to adopt complex financial instruments offered by companies like First Financial Holding.

Governments worldwide are increasingly investing in financial education programs. For instance, initiatives aimed at improving digital payment adoption in emerging markets, which saw a notable surge in 2023 and is projected to continue through 2025, directly influence how First Financial Holding must strategize its service delivery and customer engagement to meet evolving consumer expectations.

The financial sector, particularly with the rapid integration of fintech and artificial intelligence, demands a highly skilled workforce. First Financial Holding's success hinges on its ability to attract and retain top talent in specialized fields like AI, data analytics, and cybersecurity, which are critical for driving innovation and maintaining a competitive edge in the evolving market.

In Taiwan, the competitive landscape for skilled professionals is further shaped by inter-industry wage differentials. Attracting and retaining talent in these crucial, high-demand areas requires First Financial Holding to offer compensation packages that are competitive not only within the financial industry but also across other sectors actively seeking similar expertise.

Customer Expectations for Digital Services

Customers now demand intuitive and personalized digital financial services, a trend that intensified significantly leading up to 2025. This shift means financial institutions must prioritize user experience across all digital touchpoints.

First Financial Holding needs to invest heavily in its digital infrastructure, including robust mobile banking applications and streamlined online platforms, to stay competitive. Failure to meet these evolving expectations could lead to customer attrition and hinder new customer acquisition.

For instance, a 2024 survey indicated that over 70% of banking customers prefer using mobile apps for their daily transactions. This highlights the critical need for First Financial Holding to ensure its digital offerings are not only functional but also exceptionally user-friendly and secure.

- Digital Preference: Over 70% of banking customers favored mobile app usage for transactions in 2024.

- Personalization Demand: Consumers expect tailored financial advice and product offerings delivered digitally.

- Seamless Experience: Customers value integrated digital journeys, from account opening to ongoing service.

- Security Assurance: Trust in digital platforms is paramount, requiring strong cybersecurity measures.

Social Responsibility and Public Trust

Societal expectations for financial institutions to operate ethically and contribute to social welfare are increasingly prominent. This translates to a demand for transparency, strong data security, and active community involvement, all crucial for First Financial Holding's reputation and sustained success.

Maintaining public trust is paramount. For instance, in 2024, consumer surveys indicated that over 70% of individuals consider a company's ethical practices when choosing financial services. First Financial Holding's commitment to these principles directly impacts its ability to attract and retain customers.

Key areas influencing public trust include:

- Ethical Conduct: Adherence to fair lending practices and transparent fee structures.

- Data Privacy: Robust cybersecurity measures to protect sensitive customer information, a growing concern highlighted by a 2025 report showing a 15% increase in reported data breaches targeting financial institutions.

- Community Investment: Initiatives supporting local economic development and financial literacy programs.

- Environmental, Social, and Governance (ESG) Performance: Demonstrating commitment to sustainability and social responsibility, with investors increasingly prioritizing ESG factors in their allocation decisions.

Societal trends like increasing financial literacy and evolving customer expectations for digital-first, personalized services are key considerations for First Financial Holding. The demand for ethical operations and robust data security is also paramount, with a 2025 report indicating a 15% rise in data breaches targeting financial firms, making trust a critical differentiator.

Taiwan's demographic shift towards an aging population, with those aged 65+ projected to be around 19% of the population in 2024, necessitates a focus on retirement and wealth management solutions. Furthermore, the preference for mobile banking, with over 70% of customers favoring apps for transactions in 2024, highlights the need for enhanced digital offerings.

| Societal Factor | 2024/2025 Trend | Impact on First Financial Holding |

| Aging Population | ~19% aged 65+ in 2024 | Increased demand for retirement and wealth transfer products. |

| Digital Preference | >70% prefer mobile banking (2024) | Requires investment in user-friendly, secure digital platforms. |

| Ethical Expectations | 70%+ consider ethics in financial choices (2024) | Emphasis on transparency, data privacy, and community involvement is crucial for trust. |

| Financial Literacy | Varied levels globally, focus on education initiatives | Need for accessible financial education and simplified product offerings. |

Technological factors

Taiwan's financial sector is embracing digital transformation, with a significant majority of banks, over 90%, integrating advanced technologies such as AI and big data. This push aims to boost operational efficiency and enhance customer interactions.

First Financial Holding needs to maintain its commitment to developing robust digital banking platforms, user-friendly mobile applications, and comprehensive online services to remain competitive in this evolving landscape.

Artificial intelligence is rapidly transforming financial services, enhancing everything from customer interactions with intelligent chatbots to sophisticated risk management and fraud detection systems. Taiwanese banks, including those within First Financial Holding's sphere, are actively exploring and piloting Generative AI technologies. Expect widespread adoption and large-scale applications within the next one to three years, a trend that will demand substantial investment and forward-thinking strategic adjustments for First Financial Holding.

As financial services increasingly move online, the risk of cyberattacks and data breaches escalates significantly. First Financial Holding must therefore dedicate substantial resources to fortifying its cybersecurity infrastructure and data protection measures to shield customer information and preserve its reputation. The Financial Supervisory Commission (FSC) has indeed identified cybersecurity management as a critical priority for 2025, underscoring the sector-wide importance of this issue.

Blockchain and Distributed Ledger Technology (DLT)

The rise of blockchain and distributed ledger technology (DLT), especially within decentralized finance (DeFi) and virtual assets, creates significant opportunities and challenges for First Financial Holding. DeFi 2.0, with its focus on improved scalability and security, requires careful monitoring. First Financial Holding must evaluate how these advancements might disrupt conventional financial services and payment infrastructures.

The global DeFi market capitalization reached an estimated $100 billion in early 2024, highlighting its growing influence. This rapid expansion necessitates that First Financial Holding actively assesses the integration potential and regulatory implications of these technologies. Understanding the evolving landscape of virtual assets is crucial for strategic positioning.

Key considerations for First Financial Holding include:

- Assessing the impact of DeFi on traditional lending and borrowing models.

- Evaluating the security and regulatory compliance of blockchain-based payment solutions.

- Exploring opportunities for tokenization of assets to enhance liquidity and accessibility.

- Monitoring the development and adoption rates of central bank digital currencies (CBDCs).

Cloud Computing and Outsourcing Management

The Financial Supervisory Commission (FSC) has implemented a risk-based framework for cloud outsourcing management for financial institutions. This framework mandates that banks like First Financial Holding thoroughly assess risks associated with cloud services and establish robust controls for any outsourced functions. This directly influences how First Financial Holding can utilize cloud technology for enhanced efficiency and scalability, while simultaneously prioritizing regulatory adherence and the stringent security of customer data.

Technological advancements, particularly in cloud computing and outsourcing, present both opportunities and challenges. First Financial Holding can leverage these for cost savings and agility. For instance, in 2024, many financial firms reported significant cost reductions through cloud migration. However, the FSC's oversight means that any adoption must be carefully managed to meet compliance standards.

- FSC Cloud Outsourcing Framework: Mandates risk assessment and control implementation for financial institutions.

- Efficiency and Scalability: Cloud adoption allows for greater operational flexibility and growth potential.

- Data Security and Compliance: Key considerations for First Financial Holding in leveraging cloud technologies.

The financial sector's rapid digital transformation, with over 90% of Taiwanese banks adopting AI and big data by 2024, necessitates First Financial Holding's continued investment in digital platforms and mobile services to stay competitive.

Generative AI is poised for widespread adoption in financial services within the next 1-3 years, impacting customer interaction, risk management, and fraud detection, requiring significant strategic adjustments and investment from First Financial Holding.

The escalating risk of cyberattacks and data breaches, identified as a critical priority by the Financial Supervisory Commission (FSC) for 2025, demands First Financial Holding bolster its cybersecurity infrastructure and data protection measures.

The burgeoning DeFi market, valued at an estimated $100 billion in early 2024, presents both opportunities and challenges for First Financial Holding, particularly regarding blockchain-based payment solutions and asset tokenization.

| Technology Area | Key Trend (2024-2025) | Impact on First Financial Holding | Data/Stat | Actionable Insight |

|---|---|---|---|---|

| Digital Transformation | AI & Big Data Integration | Enhanced operational efficiency, improved customer experience | >90% of Taiwanese banks adopting AI/Big Data (2024) | Continue investing in user-friendly digital platforms and mobile apps. |

| Artificial Intelligence | Generative AI Adoption | Revolutionized customer service, risk management, fraud detection | Widespread adoption expected within 1-3 years | Prepare for substantial investment and strategic adaptation to GenAI. |

| Cybersecurity | Increased Cyber Threats | Heightened risk of data breaches and attacks | FSC identifies cybersecurity as a critical priority for 2025 | Fortify cybersecurity infrastructure and data protection measures. |

| Blockchain & DeFi | DeFi Market Growth | Disruption of traditional finance, new payment infrastructure | DeFi market cap ~$100 billion (early 2024) | Evaluate DeFi integration, blockchain payment security, and asset tokenization. |

| Cloud Computing | Cloud Outsourcing Framework | Opportunities for cost savings and agility, but with strict compliance | FSC mandates risk-based framework for cloud outsourcing | Carefully manage cloud adoption to meet compliance and data security standards. |

Legal factors

First Financial Holding operates under Taiwan's stringent banking and securities regulations, which dictate capital adequacy ratios, internal control frameworks, and corporate governance practices. For instance, as of early 2024, Taiwan's Financial Supervisory Commission (FSC) maintains rigorous oversight on these aspects to ensure financial stability.

The evolving regulatory landscape, particularly concerning digital finance and automated investment advisory services, demands ongoing adaptation from First Financial Holding. Amendments enacted in late 2023, for example, have introduced new compliance requirements for fintech integration, impacting how the company develops and deploys its technological solutions.

The Money Laundering Control Act saw significant amendments in July 2024, tightening Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These changes specifically target virtual asset service providers (VASPs), imposing stricter compliance obligations. First Financial Holding must ensure its existing AML/CTF frameworks, encompassing Know Your Customer (KYC) procedures and suspicious transaction reporting mechanisms, are not only robust but also fully compliant with these updated legal requirements.

As digital transactions surge, data privacy laws are tightening globally. First Financial Holding must adhere to regulations safeguarding personal data and consumer rights, a trend underscored by the Financial Supervisory Commission's (FSC) 2025 focus on enhancing financial consumer protection, which explicitly includes robust personal data protection measures.

Fintech-Specific Regulations and Regulatory Sandbox

Taiwan's Financial Technology Development and Innovation Experiment Act establishes a regulatory sandbox, offering a controlled environment for fintech companies to test novel products and services. This framework is crucial for First Financial Holding as it navigates the evolving fintech landscape, presenting opportunities to pilot new offerings and gather market feedback before a full-scale launch.

First Financial Holding must actively engage with these fintech-specific regulations, ensuring compliance while strategically utilizing the sandbox. For instance, the sandbox could facilitate the testing of AI-driven customer service bots or blockchain-based payment solutions, allowing for real-world validation within a regulated, low-risk setting. As of early 2024, Taiwan's Financial Supervisory Commission (FSC) has been actively encouraging participation in the sandbox, with a notable increase in approved experimental projects across various financial sectors.

- Regulatory Sandbox: Taiwan's Financial Technology Development and Innovation Experiment Act provides a testing ground for new fintech innovations.

- Compliance Burden: First Financial Holding must ensure adherence to these specialized fintech regulations.

- Strategic Leverage: The sandbox can be a valuable tool for piloting and validating new financial products and services.

- Market Validation: Testing in a controlled environment allows for early feedback and risk mitigation for First Financial Holding's new ventures.

ESG Disclosure Requirements and Green Finance Regulations

Taiwan is stepping up its ESG game, with companies needing to align with international standards like IFRS S1 and S2 starting in 2025. This means more comprehensive ESG data will be part of regular financial reporting, directly affecting how firms like First Financial Holding present their sustainability efforts. This shift is driven by a global push for greater transparency in environmental, social, and governance matters.

The Financial Supervisory Commission's (FSC) Green Finance Action Plan 3.0 is also a major player here. It actively nudges financial institutions to weave ESG and climate considerations into their core operations and investment choices. For First Financial Holding, this translates to a strategic imperative to integrate these factors, influencing everything from lending practices to portfolio management and risk assessment.

- Mandatory ESG Disclosure: Taiwan's adoption of IFRS S1 and S2 in 2025 mandates the integration of ESG information into financial statements.

- Green Finance Push: FSC's Green Finance Action Plan 3.0 encourages financial institutions to embed ESG and climate data into their decision-making processes.

- Impact on First Financial Holding: These regulations will shape the company's reporting obligations and investment strategies, demanding a more robust approach to sustainability.

Taiwan's legal framework significantly shapes First Financial Holding's operations, particularly through stringent banking and securities regulations enforced by the Financial Supervisory Commission (FSC). Recent amendments in late 2023, for instance, have introduced new compliance requirements for fintech integration, impacting the company's technological development. Furthermore, the Money Laundering Control Act's July 2024 amendments impose stricter Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) obligations, especially for virtual asset service providers, necessitating robust Know Your Customer (KYC) procedures.

The evolving legal landscape also includes a strong emphasis on data privacy, with the FSC highlighting enhanced financial consumer protection for 2025, which includes stringent personal data protection measures. Taiwan's Financial Technology Development and Innovation Experiment Act provides a regulatory sandbox, allowing First Financial Holding to test new fintech products like AI-driven customer service bots within a controlled environment, a move actively encouraged by the FSC with an increasing number of approved projects as of early 2024.

Additionally, Taiwan's adoption of IFRS S1 and S2 from 2025 mandates more comprehensive ESG data disclosure, directly impacting how First Financial Holding reports its sustainability efforts. This aligns with the FSC's Green Finance Action Plan 3.0, which actively promotes the integration of ESG and climate considerations into financial institutions' core operations and investment strategies, influencing lending practices and portfolio management.

Environmental factors

Climate change presents significant physical risks, such as increased frequency and intensity of typhoons impacting Taiwan, and transition risks stemming from global policy shifts towards a low-carbon economy. For First Financial Holding, this means a critical need to evaluate how extreme weather events could affect its assets and liabilities, and how the transition to greener industries might impact its loan portfolios and investment strategies.

In 2024, the financial sector is increasingly focusing on climate-related scenario analysis to understand potential impacts. For instance, a severe typhoon could disrupt business operations for clients, leading to increased non-performing loans. Similarly, a rapid acceleration in carbon pricing could devalue investments in carbon-intensive sectors, requiring proactive risk management and portfolio adjustments.

The global shift towards Environmental, Social, and Governance (ESG) investing is accelerating, with sustainable finance becoming a cornerstone of modern investment strategies. This trend significantly influences financial institutions like First Financial Holding, driving demand for sustainable investment products and necessitating the integration of ESG criteria into core lending and asset management operations.

By Q1 2024, global ESG assets under management were projected to reach $37.5 trillion, underscoring the immense market opportunity and pressure for financial firms to adapt. First Financial Holding must navigate this landscape by offering environmentally conscious investment options and embedding ESG risk assessments into its credit and investment decision-making processes to remain competitive and meet evolving investor expectations.

Taiwan's government is strongly advocating for green finance, evidenced by initiatives like the NT$10 billion green growth fund. This fund is specifically earmarked for industries focused on net-zero emissions and sustainability, signaling a clear policy direction.

Financial institutions, including First Financial Holding, are being actively encouraged to extend credit to green projects and support Taiwan's ambitious net-zero transition goal by 2050. This regulatory environment creates a significant opportunity for the company to broaden its portfolio of green financial products and services.

Carbon Pricing and Emissions Regulations

Taiwan's introduction of a domestic carbon fee mechanism in 2025 is a significant environmental shift, directly impacting businesses by embedding the cost of emissions. This move aligns Taiwan with global carbon pricing trends, creating a new financial consideration for industries and potentially influencing First Financial Holding's approach to corporate lending and its own sustainability initiatives.

The carbon fee will incentivize companies to reduce their carbon footprint, which could lead to changes in investment strategies and operational efficiencies across various sectors. For First Financial Holding, this means a closer examination of the environmental performance of its clients and a potential adjustment in risk assessments for carbon-intensive industries.

- Carbon Fee Implementation: Taiwan's domestic carbon fee mechanism is set to officially begin in 2025.

- Economic Alignment: This policy aims to integrate Taiwan's economy with the international carbon market.

- Business Impact: The fee introduces a direct cost for emissions, encouraging carbon reduction efforts by businesses.

- Financial Sector Influence: This may affect First Financial Holding's corporate lending decisions and operational sustainability practices.

Corporate Social Responsibility (CSR) and Environmental Reputation

Beyond simply meeting environmental regulations, there's a growing expectation for companies like First Financial Holding to actively showcase their commitment to corporate social responsibility and a healthy environmental impact. This goes beyond basic compliance, pushing for proactive measures.

First Financial Holding's dedication to environmental stewardship and sustainable operations can significantly bolster its public image. A strong environmental reputation can attract clients who prioritize sustainability and foster better relationships with all stakeholders, including investors and the community.

For instance, as of early 2025, many financial institutions are reporting increased customer preference for banks with demonstrable ESG (Environmental, Social, and Governance) commitments. First Financial Holding's initiatives in green financing and carbon footprint reduction are key differentiators in this evolving market.

- Enhanced Brand Image: A positive environmental reputation attracts socially conscious consumers and investors.

- Client Acquisition: Growing demand for sustainable financial products can lead to new customer segments.

- Risk Mitigation: Proactive environmental management can reduce the risk of fines and reputational damage.

- Stakeholder Engagement: Strong CSR practices improve trust and loyalty among investors, employees, and the public.

The increasing frequency of extreme weather events, such as typhoons in Taiwan, poses direct physical risks to First Financial Holding's assets and operations. Simultaneously, the global push for a low-carbon economy introduces transition risks, impacting loan portfolios and investment strategies as industries shift. By Q1 2024, the financial sector's focus on climate scenario analysis highlighted potential impacts, like increased non-performing loans from weather-related business disruptions.

Taiwan's commitment to green finance, exemplified by a NT$10 billion green growth fund, actively encourages financial institutions like First Financial Holding to support net-zero initiatives. The upcoming domestic carbon fee, effective in 2025, will directly incentivize businesses to reduce emissions, influencing lending decisions and risk assessments for carbon-intensive sectors.

By early 2025, a notable trend shows growing customer preference for financial institutions with demonstrable ESG commitments. First Financial Holding's proactive environmental stewardship and green financing initiatives serve as key differentiators, enhancing brand image and attracting clients who prioritize sustainability.

| Environmental Factor | Impact on First Financial Holding | Key Data/Initiative |

|---|---|---|

| Climate Change & Extreme Weather | Physical risk to assets, potential increase in non-performing loans due to client disruptions. | Increased frequency/intensity of typhoons in Taiwan. |

| Low-Carbon Transition | Transition risk for carbon-intensive investments, need for portfolio adjustments. | Global policy shifts towards decarbonization. |

| Green Finance & ESG | Opportunity for growth in sustainable products, enhanced brand image, client acquisition. | Taiwan's NT$10 billion green growth fund; growing customer preference for ESG-committed banks (early 2025 data). |

| Carbon Pricing | Influences corporate lending decisions, requires updated risk assessments for affected industries. | Taiwan's domestic carbon fee mechanism set to begin in 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for First Financial Holding is meticulously crafted using data from official financial regulatory bodies, reputable economic forecasting agencies, and leading industry publications. We incorporate insights from governmental reports on technological advancements and legal frameworks to ensure a comprehensive understanding of the macro-environment.