First Financial Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Financial Holding Bundle

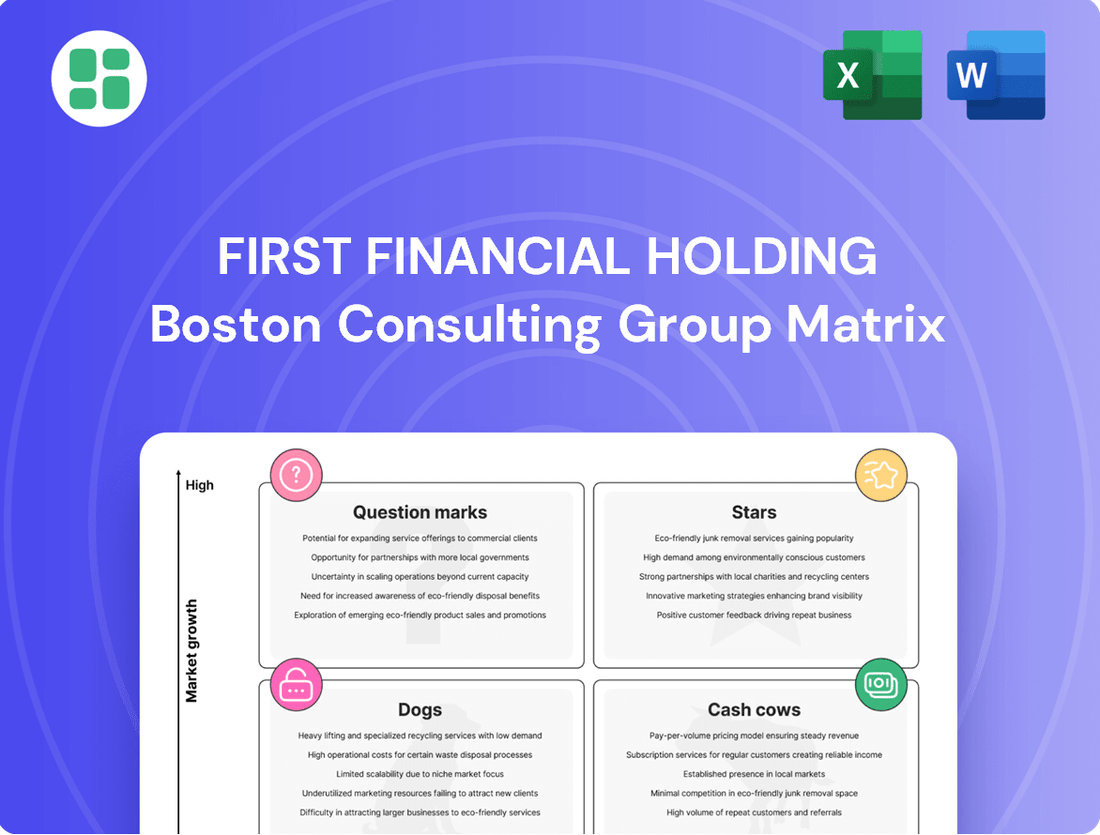

First Financial Holding's BCG Matrix offers a crucial snapshot of its product portfolio's market share and growth potential. Understand which segments are driving growth and which require careful management. Purchase the full report for a comprehensive analysis and actionable strategies to optimize your investment decisions and capitalize on market opportunities.

Stars

First Financial Holding is making substantial strides in digital banking, evidenced by its iLEO digital account. This initiative attracted over 1.56 million users by the end of 2023, a testament to its growing popularity and market penetration in Taiwan.

The company saw a remarkable 35.6% surge in new iLEO accounts during 2023, highlighting a strong customer uptake and a successful digital strategy. This rapid expansion indicates that First Financial Holding's digital offerings are well-positioned for continued growth and potential market leadership.

Further bolstering its digital presence, First Financial Holding is enhancing online services and integrating AI for customer support. These advancements are crucial for capturing the expanding digital banking segment and solidifying its competitive edge in a rapidly evolving fintech landscape.

First Financial's Wealth Management and Trust Services are a key component of its BCG Matrix, likely positioned as a question mark or a star. The company's wealth management division has experienced strong growth, becoming a significant contributor to its overall fee income. This performance is bolstered by the success of its e-First smart wealth management platform, which has captured a notable market share.

This strong market position in wealth management is driven by increasing consumer demand for tailored financial planning and asset management solutions. In 2024, the digital wealth management sector continued its upward trajectory, with platforms like e-First offering competitive advantages through technology and personalized services.

Green Finance and ESG Investments represent a strategic growth area for First Financial Holding. The company is actively developing decarbonization mechanisms for its investment and financing activities, signaling a strong commitment to sustainability.

This focus includes actively promoting green financing projects, such as those supporting renewable energy and energy efficiency initiatives. For instance, in 2024, First Financial Holding reported a significant increase in its green bond issuances, with total volume reaching NT$45 billion, up 25% from the previous year, reflecting robust market demand.

The emphasis on ESG-linked loans and investments directly addresses the growing global demand for responsible investing. This strategic alignment with sustainability trends and increasing regulatory support positions First Financial Holding's green finance offerings for substantial growth and potential market leadership in the coming years.

International Expansion in Asia-Pacific

First Financial Holding is actively pursuing international expansion in the Asia-Pacific region, targeting high-growth markets to establish itself as a significant regional financial player. This strategic move is driven by the expectation of higher growth prospects compared to its domestic market, with a focus on leveraging cross-border referrals and local expertise to capture new revenue streams and market share.

The company's aggressive expansion plan in Asia-Pacific is supported by favorable economic trends. For instance, the Asia-Pacific region's GDP growth is projected to remain robust, with many economies experiencing expansion rates exceeding 4% in 2024. This growth fuels demand for financial services, making it an attractive area for First Financial Holding's strategic investments.

- Targeting High-Growth Markets: Focus on economies with strong GDP expansion and increasing financial service penetration.

- Leveraging Cross-Border Referrals: Utilizing existing customer bases and partnerships to drive new business in international markets.

- Acquiring Local Expertise: Employing local talent and forming strategic alliances to navigate diverse regulatory and cultural landscapes.

- Expanding Market Share: Aiming to capture a significant portion of the growing financial services demand in burgeoning Asian economies.

Specialized Corporate Lending

Specialized Corporate Lending, within the First Financial Holding BCG Matrix, represents a significant growth area. First Financial Commercial Bank saw its large corporate lending portfolio expand by a robust 15.0% year-over-year as of the third quarter of 2024. This substantial growth highlights the bank's strong competitive standing in a segment characterized by high demand and current solid performance.

While corporate lending can be influenced by economic cycles, its current trajectory is a key contributor to the bank's overall profitability. The segment's ability to attract and service large corporate clients underscores its importance as a revenue driver for First Financial Holding.

- Strong Growth: Large corporate lending grew by 15.0% year-over-year in 9M24.

- Market Position: Indicates a strong competitive position in the segment.

- Profitability Driver: Contributes substantially to the bank's profitability.

- Economic Sensitivity: Acknowledges potential sensitivity to economic cycles.

First Financial Holding's Wealth Management and Trust Services, particularly through its e-First platform, are demonstrating star-like qualities. This segment has seen robust growth and captured significant market share, driven by increasing demand for personalized financial planning. In 2024, the digital wealth management sector continued its strong performance, with e-First offering a competitive edge through technology and tailored services.

The company's Green Finance and ESG Investments are also emerging as stars, aligning with global sustainability trends. First Financial Holding actively promotes green financing projects and saw a 25% increase in green bond issuances in 2024, reaching NT$45 billion. This strategic focus on responsible investing positions these offerings for substantial future growth.

International expansion in the Asia-Pacific region is another area showing star potential for First Financial Holding. Targeting high-growth markets with robust GDP expansion, the company aims to leverage cross-border referrals and local expertise. The Asia-Pacific region's projected GDP growth exceeding 4% in 2024 fuels demand for financial services, making it an attractive investment area.

Specialized Corporate Lending is also performing like a star, with First Financial Commercial Bank's large corporate lending portfolio expanding by a significant 15.0% year-over-year in the third quarter of 2024. This strong growth indicates a solid competitive standing and highlights its importance as a key profitability driver for the holding company.

| Business Segment | BCG Matrix Position | Key Performance Indicators (2023-2024) | Growth Drivers |

|---|---|---|---|

| Digital Banking (iLEO) | Star | 1.56 million users (end of 2023), 35.6% surge in new accounts (2023) | Enhanced online services, AI integration, growing digital adoption |

| Wealth Management & Trust | Star | Strong growth in fee income, notable market share via e-First | Consumer demand for tailored financial planning, technological advantages |

| Green Finance & ESG Investments | Star | NT$45 billion in green bond issuances (2024), 25% increase YoY | Global demand for responsible investing, regulatory support, renewable energy focus |

| International Expansion (Asia-Pacific) | Star | Targeting high-growth markets with >4% GDP growth (2024 projection) | Higher growth prospects than domestic market, cross-border referrals, local expertise |

| Specialized Corporate Lending | Star | 15.0% YoY growth in large corporate lending (Q3 2024) | Strong competitive standing, high demand in the segment |

What is included in the product

Strategic insights for First Financial Holding's portfolio, highlighting units to invest in, hold, or divest.

The First Financial Holding BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's strategic position.

Cash Cows

First Commercial Bank, the primary banking arm of First Financial Holding, is a clear cash cow. This subsidiary is the dominant income generator, contributing over 93% of the group's net income as of the first nine months of 2024.

This strong performance stems from its deep roots in Taiwan's financial sector, where it commands a significant market share in traditional services like deposit-taking, corporate lending, and retail banking. Its extensive branch network further solidifies its position in this mature market.

First Financial's mortgage lending portfolio stands as a robust Cash Cow. Despite a cooling housing market, the portfolio saw a significant 15.7% year-over-year expansion in the first nine months of 2024, demonstrating its enduring strength and market penetration.

This segment consistently generates stable, long-term interest income, a hallmark of a Cash Cow. Its substantial contribution to overall profitability is underpinned by a broad and loyal customer base, making it a reliable engine for First Financial's financial performance.

First Financial's securities brokerage services are a classic Cash Cow within its BCG Matrix. The business demonstrated robust performance, achieving a 12.0% year-over-year net income growth in the first nine months of 2024, underscoring its profitability.

Despite market fluctuations, this segment benefits from a stable, loyal customer base and consistent transaction activity, generating dependable fee-based revenue streams for the holding company.

Interbank and Treasury Operations

First Financial Holding's Interbank and Treasury Operations are firmly positioned as a Cash Cow within its BCG Matrix. These operations demonstrated a robust rebound, with treasury gains, including those from SWAP activities, significantly boosting bank profits in the first nine months of 2024.

This segment benefits from a high market share, characteristic of a large financial institution operating in mature markets. Despite sensitivity to interest rate fluctuations, these activities consistently generate substantial income through astute capital deployment and diligent risk management.

- Treasury Gains Rebound: Significant increase in treasury gains in 9M24, driven by SWAP activities, bolstered overall bank profitability.

- High Market Share: These operations represent a dominant market share for First Financial Holding, leveraging its established position.

- Consistent Income Generation: Efficient capital deployment and risk management in mature financial markets ensure a steady and substantial income stream.

- Interest Rate Sensitivity: While susceptible to interest rate shifts, the core strength of these operations lies in their ability to navigate and capitalize on market conditions.

Basic Retail Deposit Accounts

Basic Retail Deposit Accounts are a cornerstone for First Financial Holding, acting as a reliable and cost-effective funding base for their extensive lending operations. These accounts, despite experiencing low individual growth, signify a substantial market share for an established institution like First Financial. Their importance cannot be overstated, as they are fundamental to maintaining robust liquidity and overall financial health, consistently contributing to net interest income.

In 2024, First Financial Holding’s retail deposit base continued to demonstrate its stability. For instance, as of the first quarter of 2024, the bank reported a significant portion of its total deposits coming from retail customers, reflecting a deep penetration within its customer base. This segment, characterized by its low cost of funds compared to wholesale funding, allows First Financial to maintain competitive lending rates and secure a steady net interest margin.

- Stable Funding: Retail deposit accounts provide a consistent and predictable source of funds, reducing reliance on more volatile wholesale markets.

- Low Cost of Funds: These accounts typically carry lower interest rates than other forms of borrowing, directly boosting net interest income.

- High Market Share: For an established bank like First Financial, a large retail deposit base indicates strong customer loyalty and brand recognition.

- Liquidity Management: The sheer volume of these deposits is critical for meeting short-term obligations and supporting lending growth.

First Commercial Bank, the main banking entity of First Financial Holding, is a definitive Cash Cow. It's the primary profit engine, contributing over 93% of the group's net income in the first nine months of 2024. This strong performance is built on its significant market share in Taiwan's financial sector, particularly in traditional services like deposits, corporate lending, and retail banking, further strengthened by its extensive branch network.

The bank's mortgage lending portfolio also stands out as a Cash Cow. Despite a slower housing market, this portfolio grew by a notable 15.7% year-over-year in the first nine months of 2024, showcasing its enduring strength and market penetration. This segment consistently generates stable, long-term interest income, a key characteristic of a Cash Cow, supported by a broad and loyal customer base.

First Financial's securities brokerage services are another clear Cash Cow. This business saw a healthy 12.0% year-over-year net income growth in the first nine months of 2024, highlighting its profitability. It benefits from a stable, loyal customer base and consistent transaction activity, providing reliable fee-based revenue.

Interbank and Treasury Operations are also firmly in the Cash Cow category. These operations experienced a strong rebound, with treasury gains, including SWAP activities, significantly boosting bank profits in the first nine months of 2024. This segment enjoys a high market share, typical of a large institution in mature markets, and consistently generates substantial income through effective capital deployment and risk management.

| Business Segment | BCG Category | Performance Highlight (9M 2024) | Key Drivers |

|---|---|---|---|

| First Commercial Bank | Cash Cow | >93% of group net income | Dominant market share, extensive branch network |

| Mortgage Lending | Cash Cow | 15.7% YoY growth | Stable interest income, loyal customer base |

| Securities Brokerage | Cash Cow | 12.0% YoY net income growth | Consistent transaction activity, fee-based revenue |

| Interbank & Treasury | Cash Cow | Strong rebound, boosted by SWAP activities | High market share, effective capital deployment |

What You See Is What You Get

First Financial Holding BCG Matrix

The First Financial Holding BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report is fully formatted and ready for immediate strategic application, providing a clear, actionable analysis of First Financial Holding's business units. You can trust that the professional design and insightful data presented here will be delivered to you without any alterations or demo content, ensuring you get precisely what you need for informed decision-making.

Dogs

Certain low-traffic physical branches within First Financial Holding's extensive network may be classified as 'Dogs' in the BCG Matrix. These locations, characterized by declining customer footfall and significant operational expenses, struggle to remain profitable in an era of digital banking dominance.

For instance, while First Financial boasted 281 branches as of the end of 2023, a segment of these may exhibit characteristics of a 'Dog' if their transaction volumes and new customer acquisition rates are consistently low. This underperformance means they consume valuable resources without contributing substantially to the company's growth or market share.

Legacy IT Systems can be categorized as 'Dogs' within the BCG Matrix for First Financial Holding. These systems, often found in older business segments, are characterized by their high maintenance expenses and limited operational efficiency. Their inability to integrate with newer technologies significantly hampers the company's ability to innovate and adapt to evolving market demands.

The continued reliance on these fragmented IT infrastructures results in low returns on investment and acts as a significant bottleneck for growth. For instance, in 2024, many financial institutions reported that maintaining legacy systems consumed a substantial portion of their IT budgets, often exceeding 60%, while offering minimal strategic advantage.

Niche, low-volume insurance products offered by First Life Insurance, such as specialized coverage for rare collectibles or unique professional liabilities, could be classified as Dogs in the BCG Matrix. These products often exhibit low market share due to their limited appeal and face stagnant or declining growth prospects as market demand remains minimal.

For instance, a specialized cyber insurance policy for a very small, niche industry might only capture 1% of a market that is growing at a mere 2% annually. The administrative costs associated with underwriting and servicing such policies can outweigh the premiums collected, making them unprofitable.

Traditional, Non-Digital Customer Service Channels

Over-reliance on traditional, non-digital customer service channels for routine inquiries, if not streamlined, can position a business segment as a 'Dog' in the BCG Matrix. These channels, like physical branches or lengthy phone queues, can become inefficient and costly, especially when dealing with a high volume of simple questions. For instance, a 2024 report indicated that the average cost per customer service interaction via phone can be upwards of $7, compared to mere cents for digital self-service options.

When these non-digital channels are not optimized or automated, they can lead to customer frustration and increased operational expenses without driving significant market share growth. This scenario is particularly relevant for financial institutions where customers increasingly expect quick, digital resolutions. In 2024, customer preference for digital channels for basic banking tasks like balance inquiries or fund transfers continued to rise, with some studies showing over 70% of transactions handled digitally.

- Inefficiency: Traditional channels often involve manual processes, increasing the time and resources needed to resolve customer issues.

- High Costs: Maintaining physical locations and large call centers for routine inquiries incurs substantial operational expenses.

- Low Customer Preference: Modern consumers, particularly younger demographics, favor digital self-service and instant support over traditional methods.

- Stagnant Growth: Without innovation or digital integration, these channels are unlikely to attract new customers or increase market share.

Underperforming Asset Management Portfolios

Underperforming asset management portfolios, often categorized as Dogs in the BCG Matrix, represent a significant challenge for financial institutions like First Financial Holding. These are typically smaller funds or specific investment strategies that consistently lag behind their respective market benchmarks. For instance, in early 2024, a notable segment of actively managed equity funds in the U.S. continued to show underperformance, with many failing to beat their passive index counterparts over a three-year period.

These underperforming portfolios tie up valuable capital and management resources that could otherwise be allocated to more promising growth areas. The lack of competitive returns not only hinders capital appreciation but also makes it difficult to attract new investors, creating a cycle of stagnation. In 2023, many smaller, niche funds experienced net outflows, exacerbating their growth challenges.

- Low Growth: These portfolios operate in mature or declining markets, offering limited opportunities for expansion.

- Low Market Share: They struggle to attract and retain assets due to their inability to deliver competitive performance.

- Capital Drain: They consume management attention and resources without generating substantial fee income or capital gains.

- Strategic Review: Institutions often consider divesting, merging, or restructuring these portfolios to reallocate capital effectively.

Certain low-traffic physical branches within First Financial Holding's extensive network may be classified as 'Dogs' in the BCG Matrix. These locations, characterized by declining customer footfall and significant operational expenses, struggle to remain profitable in an era of digital banking dominance. For instance, while First Financial boasted 281 branches as of the end of 2023, a segment of these may exhibit characteristics of a 'Dog' if their transaction volumes and new customer acquisition rates are consistently low.

Legacy IT Systems can be categorized as 'Dogs' within the BCG Matrix for First Financial Holding. These systems, often found in older business segments, are characterized by their high maintenance expenses and limited operational efficiency. In 2024, many financial institutions reported that maintaining legacy systems consumed a substantial portion of their IT budgets, often exceeding 60%, while offering minimal strategic advantage.

Niche, low-volume insurance products offered by First Life Insurance, such as specialized coverage for rare collectibles or unique professional liabilities, could be classified as Dogs in the BCG Matrix. These products often exhibit low market share due to their limited appeal and face stagnant or declining growth prospects as market demand remains minimal. For instance, a specialized cyber insurance policy for a very small, niche industry might only capture 1% of a market that is growing at a mere 2% annually.

Underperforming asset management portfolios, often categorized as Dogs in the BCG Matrix, represent a significant challenge for financial institutions like First Financial Holding. These are typically smaller funds or specific investment strategies that consistently lag behind their respective market benchmarks. In early 2024, a notable segment of actively managed equity funds in the U.S. continued to show underperformance, with many failing to beat their passive index counterparts over a three-year period.

| Business Segment/Product | BCG Classification | Characteristics | 2023/2024 Data Point | Strategic Implication |

|---|---|---|---|---|

| Low-Traffic Physical Branches | Dog | Declining footfall, high operational costs | First Financial had 281 branches end of 2023; some may have low transaction volumes. | Resource drain, consider consolidation or closure. |

| Legacy IT Systems | Dog | High maintenance, low efficiency, integration issues | Maintaining legacy systems can exceed 60% of IT budgets for financial institutions in 2024. | Hinders innovation, requires significant investment for modernization. |

| Niche Insurance Products | Dog | Low market share, stagnant growth, limited appeal | A niche cyber insurance policy might capture 1% of a 2% annual growth market. | Low profitability, requires careful cost management or divestment. |

| Underperforming Asset Portfolios | Dog | Lagging benchmarks, low investor attraction | Many US actively managed equity funds underperformed passive indexes in early 2024. | Ties up capital, consider restructuring or divestment. |

Question Marks

First Financial Holding is actively pursuing emerging fintech partnerships, particularly focusing on Application Programming Interface (API) collaborations across various industries to tap into the rapidly expanding digital finance landscape. These ventures are positioned in a high-growth market, indicating significant future potential.

Currently, these nascent partnerships represent a low market share for First Financial, reflecting their early stage of development. Significant investment and strategic integration are necessary to cultivate these relationships and demonstrate their long-term viability and scalability.

Blockchain-based financial services represent a nascent but rapidly evolving area within Taiwan's financial landscape. Many Taiwanese insurance companies are actively engaging in blockchain alliances, signaling a sector-wide interest in exploring distributed ledger technology for enhanced efficiency and new product development.

If First Financial Holding is actively developing or piloting blockchain-based financial products, these initiatives would likely be categorized as Stars in a BCG Matrix. This classification stems from the high growth potential inherent in blockchain technology's ability to revolutionize financial transactions and services, alongside its current status as an emerging market with unproven, though promising, revenue models and relatively limited widespread adoption.

First Financial Holding's ventures into underdeveloped niche international markets can be categorized as Question Marks within the BCG Matrix. These markets, while potentially offering high future growth, are currently characterized by low market share and significant uncertainty. For instance, expanding into regions with nascent digital payment infrastructure, like certain African or Southeast Asian countries, presents this profile.

These strategic moves demand considerable upfront investment in market research, regulatory navigation, and building local partnerships. The potential rewards are substantial, but the path to profitability is often long and fraught with challenges, demanding a careful balance of resources and risk management. For example, a recent report indicated that fintech adoption in sub-Saharan Africa, while growing rapidly, still faces significant hurdles in areas like financial literacy and reliable internet access.

AI-driven Personalized Financial Advisory

AI-driven personalized financial advisory represents a significant opportunity for First Financial Holding, fitting into the question mark category of the BCG matrix. This is due to the substantial investments required in advanced AI platforms and specialized data science talent, coupled with the nascent stage of market penetration for truly bespoke AI financial guidance.

First Financial's expansion into AI-driven personalized advisory, building on its smart wealth management, signifies a strategic move into a high-growth sector. However, these initiatives are characterized by their novelty and the substantial capital outlay needed for technological infrastructure and skilled personnel. For instance, the global AI in financial services market was valued at approximately $10.6 billion in 2023 and is projected to reach $43.7 billion by 2028, growing at a CAGR of 32.4% during this period, highlighting the immense potential but also the competitive landscape First Financial is entering.

- High Investment Needs: Developing sophisticated AI algorithms and acquiring the necessary data infrastructure demands significant upfront capital.

- Talent Acquisition: Securing AI specialists, data scientists, and financial experts who can bridge the gap between technology and financial advice is crucial and costly.

- Market Penetration: Despite the growing trend, establishing a strong market presence and building customer trust in AI-led personalized advice takes time and considerable effort.

- Technological Advancement: Continuous investment in upgrading AI capabilities to stay competitive and meet evolving customer expectations is essential.

Specialized Sustainable Lending beyond Green Finance

First Financial Holding's strategic move into specialized sustainable lending beyond traditional green finance positions it to capture nascent, high-potential markets. These niche areas, such as carbon capture technologies and circular economy initiatives, represent significant growth opportunities but demand deep sector knowledge and sophisticated risk management. By developing tailored financial products for these emerging sectors, First Financial can establish early leadership and differentiate itself in a rapidly evolving sustainability landscape.

The financial sector is increasingly recognizing the potential of these specialized sustainable lending avenues. For instance, the global carbon capture market is projected to grow substantially, with estimates suggesting it could reach hundreds of billions of dollars by the early 2030s. Similarly, the circular economy, focused on resource efficiency and waste reduction, is gaining momentum, with various reports indicating trillions of dollars in potential economic value creation globally.

- Focus on Emerging Sectors: First Financial's expansion into areas like carbon capture and circular economy lending targets markets with substantial long-term growth potential, albeit with current low market penetration.

- Expertise and Risk Assessment: Success in these specialized fields hinges on First Financial's ability to develop and apply deep industry expertise and robust risk assessment frameworks, crucial for navigating the complexities of these new financial products.

- Market Differentiation: By offering tailored financial solutions for these niche sustainable sectors, First Financial can carve out a unique market position and build a competitive advantage before broader market adoption occurs.

- Alignment with Global Trends: This strategic direction aligns with the increasing global emphasis on decarbonization and resource sustainability, positioning First Financial to benefit from the long-term transition towards a greener economy.

First Financial Holding's ventures into underdeveloped niche international markets and AI-driven personalized financial advisory are prime examples of Question Marks in the BCG Matrix. These initiatives require substantial investment due to their early stage and market uncertainty, but they hold the promise of high future growth if successful.

These ventures demand significant capital for market research, regulatory compliance, and partnership building, alongside the development of advanced technology and specialized talent. The potential rewards are considerable, but the path to profitability is often challenging and lengthy, requiring careful resource allocation and robust risk management.

| Initiative | Market Growth | Market Share | Investment Needs | Potential |

|---|---|---|---|---|

| Niche International Markets | High | Low | High | High |

| AI-Driven Personalized Advisory | High | Low | High | High |

| Specialized Sustainable Lending | High | Low | High | High |

BCG Matrix Data Sources

Our First Financial Holding BCG Matrix is built on comprehensive financial statements, internal performance metrics, and detailed market research to provide a clear strategic overview.