Firstgroup SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

FirstGroup faces significant opportunities in the evolving transportation sector, but also navigates regulatory complexities and the need for substantial investment. Our comprehensive SWOT analysis dives deep into these dynamics, revealing how their established brand and operational scale present key strengths.

Want to understand the full picture of FirstGroup's market position, from its operational efficiencies to the challenges of decarbonization? Purchase the complete SWOT analysis to gain actionable insights, financial context, and strategic takeaways—ideal for investors, analysts, and industry professionals looking to capitalize on the future of public transport.

Strengths

FirstGroup boasts an extensive UK bus and rail network, operating a vast array of local bus services and long-distance coaches. This significant footprint also includes several key train operating companies across the nation.

This widespread presence allows FirstGroup to connect a multitude of communities, catering to diverse travel needs for commuting, education, health, social activities, and leisure. For instance, in the fiscal year ending March 31, 2024, FirstGroup's UK Bus division transported approximately 1.7 billion passengers.

The sheer breadth of their operations in public transport provides a robust foundation and a significant competitive advantage within the sector.

Firstgroup's financial performance is a significant strength, evidenced by strong results in fiscal year 2025. The company reported an adjusted operating profit of £222.8 million and adjusted earnings per share of 19.4p, showcasing a healthy growth trajectory.

Shareholder value is a key focus, with Firstgroup consistently returning capital. The total dividend for fiscal year 2024 saw a substantial 45% increase compared to fiscal year 2023, complemented by active share buyback programs that further enhance shareholder returns.

FirstGroup's strong commitment to decarbonisation is a significant strength. The company is targeting a completely zero-emission commercial fleet by 2035, demonstrating a clear long-term vision for environmental responsibility.

This commitment is backed by substantial investment and tangible progress. As of FY 2025, over 1,115 zero-emission buses have been deployed, representing 20.5% of their commercial bus fleet, alongside investments in electrified depots and new bi-mode train fleets.

Growth in Open Access Rail Operations

First Rail's open access operations are a significant strength, with services like Hull Trains and Lumo demonstrating robust performance. This success is driven by high customer satisfaction and effective management of ticket pricing, known as yield management. The company is strategically expanding this profitable segment.

Further growth is underpinned by securing new track access rights, allowing First Rail to extend its reach and offer more services. This expansion is further bolstered by a substantial £500 million investment in new rolling stock. Specifically, 14 new UK-manufactured trains are being acquired, which will significantly increase capacity and enable the introduction of new routes and enhanced service frequencies.

- Strong Customer Satisfaction: Hull Trains and Lumo consistently achieve high customer satisfaction scores, indicating effective service delivery.

- Effective Yield Management: The open access operations demonstrate proficiency in optimizing ticket prices to maximize revenue.

- Strategic Expansion: First Rail is actively pursuing growth by acquiring new track access rights for its open access services.

- Significant Investment: A £500 million investment in 14 new UK-built trains will boost capacity and service offerings.

Strategic Acquisitions and Diversification

FirstGroup's strategic acquisitions and diversification efforts are a significant strength. The acquisition of RATP London in February 2025, for instance, substantially boosted its presence in the London bus market.

This expansion, alongside the February 2024 acquisition of York Pullman and securing the contract for the London Cable Car, demonstrates a clear strategy to broaden its service offerings and revenue bases. These moves enhance its market position and resilience.

- February 2025: Acquisition of RATP London, increasing market share in London buses.

- February 2024: Acquisition of York Pullman, diversifying regional operations.

- London Cable Car: Contract secured, adding a unique transport service to its portfolio.

FirstGroup's extensive UK network, encompassing both bus and rail services, provides a substantial operational advantage. This broad reach allows the company to serve millions of passengers annually, as evidenced by the 1.7 billion passengers transported by its UK Bus division in the fiscal year ending March 31, 2024. Their financial health is also robust, with an adjusted operating profit of £222.8 million reported for fiscal year 2025, alongside a significant 45% increase in dividends for fiscal year 2024. This strong performance is further enhanced by strategic investments in decarbonization, with over 1,115 zero-emission buses deployed by FY 2025, representing 20.5% of their commercial bus fleet.

| Metric | Value (FY 2024/2025) | Significance |

|---|---|---|

| UK Bus Passengers | ~1.7 billion (FY ending Mar 2024) | Demonstrates extensive market penetration and operational scale. |

| Adjusted Operating Profit | £222.8 million (FY 2025) | Indicates strong financial performance and profitability. |

| Dividend Increase | 45% (FY 2024 vs FY 2023) | Highlights commitment to shareholder returns and confidence in future earnings. |

| Zero-Emission Buses Deployed | 1,115+ (as of FY 2025) | Shows progress towards environmental goals and investment in sustainable transport. |

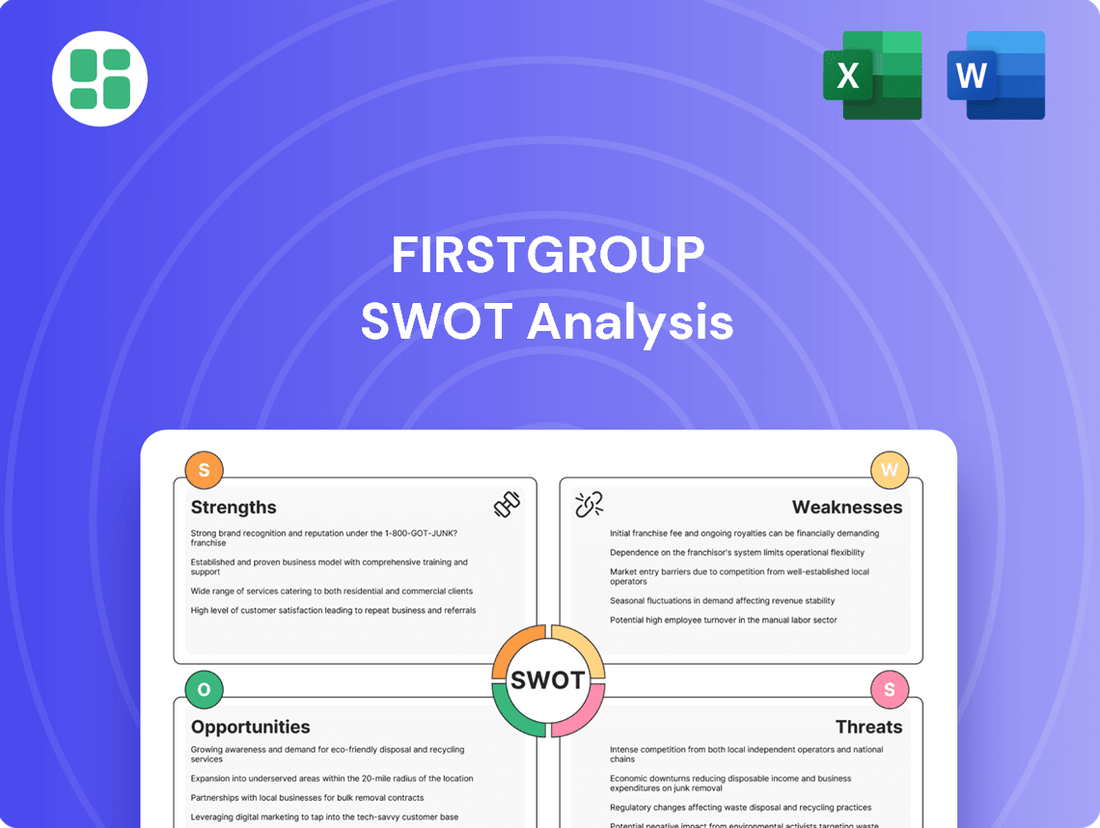

What is included in the product

Delivers a strategic overview of Firstgroup’s internal and external business factors, highlighting its strengths in public transport operations and opportunities in evolving mobility markets, while also acknowledging weaknesses in fleet modernization and threats from economic downturns.

Offers a clear, actionable SWOT framework to identify and address Firstgroup's operational challenges and market vulnerabilities.

Weaknesses

Firstgroup's rail division has been particularly susceptible to industrial relations challenges. These ongoing disputes can significantly disrupt services, directly impacting the company's financial performance and operational efficiency.

For instance, in the fiscal year ending March 2024, Firstgroup reported that industrial action, primarily within its rail operations, led to a notable impact on service reliability and passenger experience, contributing to an increase in operational costs.

Such disputes not only cause immediate financial strain through lost revenue and increased expenses but also erode passenger trust, potentially leading to a long-term decline in ridership and a less stable operating environment for the company.

FirstGroup's reliance on government contracts, particularly for its UK rail operations, makes it vulnerable to shifts in public policy and funding. In the fiscal year ending March 2024, the company's rail division generated a substantial portion of its revenue, highlighting this dependency. Changes in contract terms or a reduction in subsidies could directly impact profitability and operational stability.

The ongoing discussions and potential renationalisation of UK railways introduce a significant layer of long-term uncertainty. This policy direction could fundamentally alter the landscape for private operators like FirstGroup, potentially leading to the loss of existing franchises or a renegotiation of terms that may not be as favorable.

Government-imposed bus fare caps, while boosting passenger numbers, can significantly strain operators like First Bus. For instance, the impact of fare caps in H2 2025 led to a noticeable reduction in funding for First Bus, highlighting the delicate balance between affordability and financial sustainability.

This funding reduction directly affects profit margins. If the subsidies or compensation provided do not fully offset the revenue lost from capped fares, First Bus faces a challenge in maintaining profitable operations and reinvesting in its services.

High Initial Investment for Decarbonisation

Firstgroup faces a significant hurdle in its sustainability drive due to the high initial investment required for decarbonisation. Transitioning to a zero-emission fleet and electrifying infrastructure demands substantial upfront capital. For instance, the company has committed to investing £250 million in new electric buses by 2024 and aims for a fully zero-emission bus fleet by 2035. While government grants and co-funding initiatives are available, the sheer scale of this investment can strain Firstgroup's balance sheet and potentially impact its short-to-medium term profitability as it manages these large capital expenditures.

The financial commitment to decarbonisation presents a notable weakness for Firstgroup.

- Substantial Upfront Capital: The shift to electric vehicles and charging infrastructure requires significant initial spending.

- Balance Sheet Strain: Large capital outlays can put pressure on the company's financial resources.

- Profitability Impact: High investment costs may affect short-to-medium term financial performance.

- Reliance on External Funding: While government co-funding assists, the overall funding gap remains considerable.

Potential for Slowed Revenue Growth

While FirstGroup has shown signs of recovery, some analysts project a potential slowdown in revenue growth. Forecasts suggest a contraction of approximately 7.2% in the upcoming year, which is a less favorable outlook compared to the wider industry. This suggests that sustaining the current momentum might be difficult in a dynamic and competitive market.

This potential for slowed revenue growth presents a key weakness for FirstGroup.

- Projected Revenue Contraction: Analysts anticipate a 7.2% revenue decrease in the next fiscal year.

- Industry Underperformance: This projected decline is steeper than the anticipated growth in the broader transportation sector.

- Competitive Pressures: The evolving market landscape and competition could hinder FirstGroup's ability to achieve robust, sustained growth.

FirstGroup's significant reliance on government contracts, particularly in its UK rail operations, exposes it to policy shifts and funding changes. For instance, in the fiscal year ending March 2024, the rail division contributed a substantial portion of revenue, underscoring this dependency. Alterations in contract terms or reduced subsidies could directly impact profitability and operational stability.

The potential for UK railway renationalisation introduces considerable long-term uncertainty. This policy direction could fundamentally reshape the environment for private operators like FirstGroup, potentially leading to franchise loss or less favorable renegotiated terms.

Government-imposed bus fare caps, while increasing passenger numbers, can squeeze operators like First Bus. The impact of fare caps in H2 2025 resulted in a noticeable reduction in funding for First Bus, illustrating the challenge of balancing affordability with financial sustainability.

FirstGroup faces a substantial hurdle in its sustainability efforts due to the high initial investment required for decarbonisation. The transition to a zero-emission fleet and infrastructure electrification demands significant upfront capital. For example, the company's commitment to invest £250 million in new electric buses by 2024 and achieve a fully zero-emission bus fleet by 2035, while supported by government grants, can strain its balance sheet and affect short-to-medium term profitability.

Analysts project a potential slowdown in revenue growth for FirstGroup, with forecasts suggesting a contraction of approximately 7.2% in the upcoming fiscal year, which is less favorable than the wider industry outlook.

Same Document Delivered

Firstgroup SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The UK public transportation market is experiencing robust growth, with projections indicating a compound annual growth rate of 7.9% between 2024 and 2030. This expansion is expected to drive market revenue to USD 15,735.5 million by 2030.

This significant market expansion presents a prime opportunity for FirstGroup to capitalize on increasing passenger demand. By leveraging this trend, the company can focus on boosting passenger volumes across its services and solidifying its market share within the growing sector.

The accelerating global push for decarbonization presents a significant opportunity for FirstGroup. With continued government support for zero-emission transport, such as the UK's ZEBRA scheme, FirstGroup is well-positioned to expand its fleet of electric buses and explore other sustainable solutions like bi-mode trains.

By strategically investing in and deploying these greener technologies, FirstGroup can solidify its leadership in the environmentally conscious transport sector, potentially capturing a larger share of a rapidly growing market. For instance, the company's commitment to electrifying its bus fleet, aiming for 100% zero-emission by 2035, aligns directly with these market trends.

FirstGroup's open access rail operations, exemplified by Lumo and Hull Trains, are demonstrating strong performance, with Lumo reportedly carrying over 1.5 million passengers since its launch in October 2021. Securing new track access rights further solidifies the opportunity to scale these successful, high-margin services, contributing significantly to revenue growth.

The bus division is also poised for expansion through strategic bolt-on acquisitions and contract extensions in adjacent services. This approach diversifies revenue streams and strengthens FirstGroup's market position, as seen in their continued success in securing new bus contracts, such as the recent award of the West Yorkshire Combined Authority contract for 2024.

Digitalisation and Enhanced Customer Experience

Firstgroup can leverage digitalisation to significantly improve customer experience and boost demand for its services. Implementing new digital technologies, such as user-friendly apps for journey planning and flexible ticketing options, directly addresses evolving consumer expectations. This focus on a smoother, more convenient customer journey is crucial for attracting and retaining passengers in a competitive market.

Investing in digital solutions not only enhances passenger satisfaction but also drives operational efficiency. For instance, real-time information systems and contactless payment options streamline operations and reduce friction points for travellers. By making public transport more accessible and appealing through technology, Firstgroup can tap into a broader demographic, including younger, tech-savvy individuals.

The company's commitment to digital transformation is evident in its ongoing projects. In 2024, Firstbus reported a significant increase in app usage for ticket purchases, indicating a positive customer response to digital offerings. This trend is expected to continue, with further enhancements planned for 2025 to include more personalised journey planning and integrated mobility solutions.

Key opportunities arising from digitalisation include:

- Enhanced Customer Convenience: Offering seamless booking, payment, and real-time updates via mobile applications.

- Increased Ridership: Attracting new passengers through improved accessibility and user-friendly digital interfaces.

- Operational Efficiencies: Streamlining processes like ticketing and passenger information management through technology.

- Data-Driven Insights: Utilizing customer data to tailor services and improve route planning, leading to better resource allocation.

Leveraging Strong Balance Sheet for Growth and Returns

FirstGroup's robust financial position, marked by a significant reduction in net debt and consistent positive cash flow, offers substantial strategic advantages. As of the fiscal year ending March 2024, FirstGroup reported a net debt of £1.1 billion, a notable decrease from previous years, underscoring their commitment to deleveraging. This financial health provides the flexibility to pursue growth opportunities, such as strategic acquisitions within the transport sector and investments in decarbonisation technologies, aligning with evolving market demands.

The company's strong balance sheet also facilitates continued returns to shareholders, enhancing investor confidence and attracting further capital. For instance, FirstGroup announced a share buyback program in early 2024, demonstrating their ability to reward investors while reinvesting in the business. This financial discipline and strategic capital allocation are crucial for sustained growth and market leadership in the competitive transportation industry.

- Reduced Net Debt: FirstGroup's net debt stood at £1.1 billion for the fiscal year ending March 2024, providing increased financial maneuverability.

- Positive Cash Generation: Consistent positive cash flow enables funding for growth initiatives and shareholder returns.

- Strategic Flexibility: The strong balance sheet supports investments in acquisitions and decarbonisation efforts, crucial for future competitiveness.

- Investor Attraction: Demonstrated financial strength and commitment to shareholder returns make FirstGroup an attractive investment proposition.

The UK public transportation market is experiencing robust growth, projected to reach USD 15,735.5 million by 2030, offering FirstGroup a significant opportunity to increase passenger volumes and market share.

The global shift towards decarbonization, supported by initiatives like the UK's ZEBRA scheme, positions FirstGroup to expand its electric bus fleet and sustainable transport solutions, aligning with its 2035 zero-emission target.

FirstGroup's successful open access rail operations, such as Lumo which has carried over 1.5 million passengers since its 2021 launch, present a clear avenue for scaling high-margin services by securing new track access rights.

Digitalization offers a pathway to enhance customer experience through user-friendly apps and flexible ticketing, as evidenced by increased app usage for ticket purchases in 2024, which is expected to drive higher ridership and operational efficiencies.

| Opportunity Area | Key Metric/Fact | Impact |

|---|---|---|

| Market Growth | UK Public Transport Market to reach USD 15,735.5M by 2030 (7.9% CAGR 2024-2030) | Increased passenger demand and revenue potential |

| Decarbonization | FirstGroup's 2035 Zero-Emission Bus Target | Leadership in sustainable transport, market share capture |

| Open Access Rail | Lumo carried over 1.5M passengers since Oct 2021 | Scalable, high-margin service growth |

| Digitalization | Increased app usage for ticket purchases in 2024 | Enhanced customer experience, increased ridership, operational efficiency |

Threats

The UK government's intention to bring national rail contracts back under public ownership presents a substantial risk to FirstGroup's rail operations. With South Western Railway scheduled for transition in May 2025, this policy shift signals a potential contraction in the market for private rail operators, directly impacting FirstGroup's established franchise model and future earnings from these large-scale agreements.

Firstgroup operates in a fiercely competitive public transport landscape, facing pressure from numerous national and regional operators seeking lucrative contracts and passenger share. This intense rivalry can limit pricing power and necessitate significant investment in service quality and fleet modernization to maintain market position.

Market volatility presents a significant threat, with fluctuating fuel prices directly impacting operational costs. For instance, Brent crude oil prices saw considerable swings throughout 2024, affecting Firstgroup's expenditure. Economic downturns also pose a risk, as reduced disposable income can lead to fewer passenger journeys, thereby impacting revenue streams and overall profitability for the company.

Persistent industrial disputes and difficulties in securing staff, especially for critical operational positions like bus and train drivers, pose a significant threat. These issues can directly result in service interruptions and drive up labor expenses, impacting profitability. For instance, in the UK, the transport sector has seen numerous strikes impacting services throughout 2023 and into early 2024, leading to substantial operational and financial strain for companies like Firstgroup.

Furthermore, an aging workforce coupled with a projected scarcity of skilled workers by 2030 presents a long-term challenge to maintaining operational capacity. This demographic shift could exacerbate recruitment and retention issues, potentially limiting service expansion and increasing training costs to bridge the skills gap.

Regulatory Changes and Licensing Restrictions

Changes in transport regulations, such as potential licensing restrictions for heavier zero-emission minibuses, could present a hurdle for Firstgroup's adoption of greener fleet technologies in specific operational areas. This evolving regulatory environment necessitates ongoing investment in compliance and can necessitate adjustments to long-term fleet modernization strategies.

For instance, if new regulations in the UK, a key market for Firstgroup, mandate specific battery weight limits or charging infrastructure standards for zero-emission buses, this could impact the feasibility and cost of deploying certain vehicle types. The company's strategic plans for fleet upgrades, aiming for significant reductions in carbon emissions by 2030, could be directly affected by such policy shifts.

- Regulatory Uncertainty: Evolving government policies on emissions and vehicle types can create uncertainty for fleet investment decisions.

- Increased Compliance Costs: Adapting to new licensing or operational rules for greener vehicles may require additional capital expenditure.

- Operational Constraints: Restrictions on certain vehicle classes could limit service offerings or necessitate alternative, potentially more expensive, solutions.

Economic Headwinds and Inflationary Pressures

Persistent inflation in 2024 and into 2025 poses a significant threat by driving up essential operating expenses for FirstGroup. Costs for fuel, vehicle maintenance, and labor are all susceptible to these upward pressures, directly impacting the company's bottom line and potentially squeezing profit margins. For instance, if average fuel prices were to increase by 10% year-over-year in 2025, this alone could add tens of millions to FirstGroup's annual expenditure.

Furthermore, the broader economic climate presents a substantial risk. A potential economic slowdown or recession in key markets during 2024-2025 could dampen consumer confidence and discretionary spending. This would likely translate into reduced passenger volumes across both leisure and commuter services, leading to lower ticket sales and overall revenue for FirstGroup's bus and rail operations.

Specific economic headwinds include:

- Rising energy costs: Continued high oil prices directly inflate fuel expenses, a major component of operating costs.

- Wage inflation: Competition for skilled labor in the transport sector may necessitate higher wages, increasing personnel costs.

- Reduced discretionary income: Economic uncertainty can lead consumers to cut back on non-essential travel, impacting passenger numbers.

- Interest rate sensitivity: Higher interest rates can increase the cost of borrowing for capital investments and debt servicing.

The UK government's move to bring national rail contracts back under public ownership represents a significant threat, with South Western Railway slated for transition in May 2025. This policy shift directly impacts FirstGroup's established franchise model and its future earnings from large-scale rail agreements.

Intense competition from other transport operators can limit pricing power and necessitate ongoing investment in service quality and fleet upgrades. Market volatility, particularly in fuel prices, and potential economic downturns that reduce passenger numbers also pose considerable risks to revenue and profitability.

Labor challenges, including industrial disputes and difficulties in recruiting and retaining staff, can lead to service disruptions and increased operational costs. An aging workforce and a projected scarcity of skilled transport workers by 2030 further compound these issues, potentially limiting service expansion and increasing training expenses.

Regulatory uncertainty, especially concerning emissions standards and vehicle types for greener fleets, could impact investment decisions and increase compliance costs. For instance, new regulations on battery weight limits for zero-emission buses might affect FirstGroup's fleet modernization plans, potentially requiring adjustments to their strategy for achieving carbon emission reductions by 2030.

Persistent inflation throughout 2024 and into 2025 is a direct threat, driving up essential operating expenses like fuel, maintenance, and labor. A potential economic slowdown or recession in key markets during this period could also dampen consumer spending and reduce passenger volumes, negatively impacting ticket sales and overall revenue for both bus and rail operations.

| Threat Category | Specific Risk | Impact on FirstGroup | Example/Data Point (2024-2025) |

| Government Policy | Nationalization of Rail Contracts | Loss of rail franchises, reduced revenue | South Western Railway transition in May 2025 |

| Competition | Intense Market Rivalry | Reduced pricing power, increased investment needs | Ongoing bids for new bus and rail contracts |

| Economic Factors | Fuel Price Volatility & Economic Slowdown | Increased operating costs, decreased passenger numbers | Brent crude oil price fluctuations in 2024; potential recession fears impacting travel |

| Labor Issues | Staff Shortages & Industrial Disputes | Service disruptions, higher labor costs | UK transport sector strikes impacting services in 2023-2024 |

| Regulatory Changes | Environmental Regulations for Fleets | Increased compliance costs, potential operational constraints | Potential new UK regulations on zero-emission bus specifications |

SWOT Analysis Data Sources

This analysis leverages robust data from Firstgroup's official financial reports, comprehensive industry market research, and expert commentary from transportation sector analysts to provide a thorough strategic overview.