Firstgroup Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

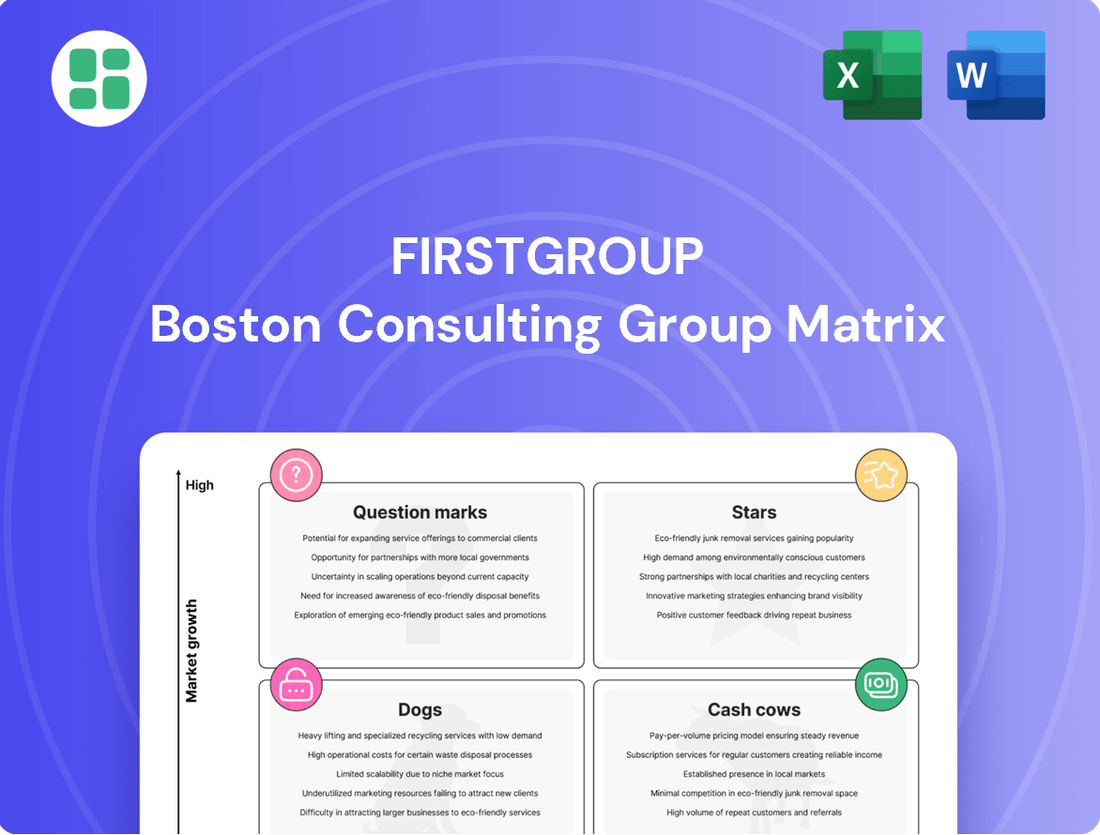

FirstGroup's BCG Matrix reveals a dynamic portfolio, with some divisions potentially acting as Stars and others as Cash Cows. Understand the strategic implications of each quadrant to optimize resource allocation and drive future growth.

This preview offers a glimpse into FirstGroup's market positioning. Unlock the full potential of this analysis by purchasing the complete BCG Matrix, which provides detailed quadrant breakdowns and actionable strategies for each business segment.

Don't miss out on critical insights into FirstGroup's strategic direction. The complete BCG Matrix report delivers a comprehensive view of their product portfolio, empowering you to make informed investment and divestment decisions.

Stars

FirstGroup's open access rail services, particularly Lumo and Hull Trains, are experiencing robust growth, fueled by increasing demand and astute yield management. These operations are a key component of FirstGroup's portfolio, showcasing a strong market position.

The company is making substantial investments to bolster these services, securing additional track access and commissioning new rolling stock to enhance capacity. This strategic expansion underscores their commitment to capturing further market share in this expanding sector.

First Bus London Operations are a strong contender in the BCG matrix, likely categorized as a Star. The recent £90 million acquisition of RATP London significantly boosted its market share to around 12% in the high-growth London bus market.

This strategic expansion is projected to deliver substantial annual revenues and maintain robust operating margins. It clearly demonstrates First Bus's ambition to lead in this crucial urban transport sector.

FirstGroup's zero-emission bus fleet expansion is a significant investment, aiming for over 1,100 electric buses in operation by March 2025. This strategic move positions them as a strong contender in the burgeoning green transport market. The company's commitment to decarbonization through significant infrastructure upgrades, including depot electrification, is a key driver of their growth.

Growth in Adjacent Bus Services

First Bus's adjacent services segment has experienced robust expansion, fueled by securing new contracts and strategic acquisitions. This diversification allows FirstGroup to move beyond conventional bus operations into specialized transport, tapping into lucrative growth areas. These ventures effectively utilize existing resources while exploring new market avenues.

In 2024, First Bus's adjacent services, including areas like school transport and private hire, demonstrated strong performance. For instance, the company reported a notable increase in revenue from these specialized contracts, contributing significantly to overall group profitability. This growth highlights the strategic importance of these diversified offerings.

- Revenue Surge: First Bus's adjacent services saw a substantial revenue uplift in 2024, exceeding previous year's figures due to new contract wins.

- Strategic Acquisitions: The segment's growth was further bolstered by the successful integration of smaller, specialized transport providers, enhancing service capabilities.

- Market Penetration: These services are successfully penetrating high-growth sectors, diversifying FirstGroup's revenue streams beyond traditional public transport.

Digital Transformation and Customer Innovation

FirstGroup is actively investing in digital transformation to innovate the customer experience. This includes implementing advanced journey planning software, real-time vehicle tracking, and flexible ticketing solutions such as LumoFlex and Superfare. These digital enhancements are designed to make travel more convenient and appealing, particularly for a market segment that prioritizes seamless digital integration.

The company's strategic focus on technology aims to boost operational efficiency and attract new passengers. For example, in the fiscal year ending March 2024, FirstGroup reported a 5% increase in passenger numbers across its UK bus operations, partly attributed to digital initiatives that improve service reliability and accessibility. This investment in digital capabilities is crucial for maintaining a competitive edge in the evolving transportation landscape.

- Digital Investment: FirstGroup is deploying new journey planning software and real-time tracking systems.

- Customer Innovation: Flexible ticketing options like LumoFlex and Superfare are enhancing customer choice.

- Market Impact: These innovations target a growing demand for convenience and digital integration in travel.

- Performance: FirstGroup saw a 5% rise in UK bus passenger numbers in FY24, with digital solutions contributing to this growth.

First Bus London Operations, significantly strengthened by the £90 million acquisition of RATP London, now holds approximately 12% of the London bus market. This strategic move positions it as a Star in the BCG matrix, capitalizing on the high-growth potential of this urban transport sector.

The company's commitment to expanding its zero-emission fleet, aiming for over 1,100 electric buses by March 2025, further solidifies its Star status. Investments in depot electrification and infrastructure upgrades are key to this growth, aligning with market trends towards sustainable transportation.

First Bus's adjacent services, encompassing school transport and private hire, demonstrated robust performance in 2024. This segment's growth, driven by new contract wins and strategic acquisitions of smaller transport providers, diversifies revenue streams and penetrates high-growth niche markets, reinforcing its Star classification.

Digital transformation efforts, including advanced journey planning and real-time tracking, are enhancing customer experience and operational efficiency. These innovations, coupled with flexible ticketing options, contributed to a 5% increase in UK bus passenger numbers in FY24, underscoring the segment's strong market position and growth trajectory.

| Segment | BCG Category | Key Growth Drivers | 2024 Performance Highlight | Strategic Focus |

|---|---|---|---|---|

| First Bus London | Star | Market share increase via acquisition (RATP London) | ~12% London market share | High-growth urban transport |

| Zero-Emission Bus Fleet | Star | Investment in electric buses, depot electrification | Target: >1,100 electric buses by Mar 2025 | Decarbonization, sustainable transport |

| Adjacent Services | Star | New contracts, strategic acquisitions, niche market penetration | Notable revenue increase from specialized contracts | Revenue diversification, specialized transport |

| Digital Transformation | Star | Customer experience enhancement, operational efficiency | 5% passenger growth in UK bus ops (FY24) | Convenience, digital integration |

What is included in the product

Strategic analysis of Firstgroup's divisions across the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

A clear BCG Matrix visualizes Firstgroup's portfolio, easing the pain of resource allocation by highlighting Stars and Cash Cows.

Cash Cows

FirstGroup's Department for Transport (DfT) contracted train operating companies, such as Avanti West Coast and Great Western Railway, are firmly established in their markets. These operations are characterized by their maturity and significant market share within their operational areas.

These contracts provide a steady stream of adjusted operating profits, primarily through management fees, even as some transition towards public ownership. This stability makes them a dependable source of substantial cash flow for the Group.

For the fiscal year ending March 31, 2024, FirstGroup reported that its UK rail division, encompassing these DfT contracts, contributed £120 million in adjusted operating profit. This demonstrates the consistent financial performance of these mature "cash cow" assets.

FirstGroup's established regional bus networks, primarily outside London, are the bedrock of its operations, functioning as classic Cash Cows within the BCG matrix. These networks boast significant market share in numerous local areas, reflecting their maturity and dominance. For instance, in the fiscal year ending March 2024, FirstGroup reported that its UK Bus division generated revenue of £1,456 million, a testament to the consistent demand for these essential services.

These mature services are characterized by their ability to generate consistent revenue and profit, a result of ongoing operational efficiencies and effective yield management strategies. The company's focus on optimizing routes, fleet utilization, and fare structures ensures these networks remain profitable. This steady profit generation is crucial, providing the essential cash flow needed to support other, more growth-oriented segments of the business.

FirstGroup's proactive management of legacy pension obligations, especially from its former North American operations, has demonstrably reduced financial liabilities. This careful handling of substantial long-term commitments, such as the $1.5 billion pension deficit reported in their 2023 annual results, effectively preserves capital.

By diligently addressing these commitments, FirstGroup improves its balance sheet, which directly contributes to enhanced cash flow and overall financial stability. This strategic approach to managing past liabilities positions the company for greater financial flexibility moving forward.

Strategic Share Buyback Programmes

FirstGroup's consistent execution of substantial share buyback programmes, such as those observed in 2024, highlights its robust cash generation capabilities. These initiatives signal a financial strength that allows for capital returns to shareholders over and above core operational and investment requirements.

These buybacks are a clear indicator of FirstGroup's commitment to enhancing shareholder value. By efficiently allocating excess capital, the company demonstrates a healthy financial position and a strategic focus on rewarding its investors.

- Strong Cash Generation: FirstGroup's ability to fund significant share buybacks in 2024 underscores its capacity to generate substantial cash flow.

- Shareholder Value Enhancement: The buyback programmes directly return capital to shareholders, boosting earnings per share and signaling financial health.

- Efficient Capital Allocation: These actions reflect a strategic approach to managing capital, prioritizing shareholder returns when operational needs are met.

Robust Balance Sheet and Cash Conversion

FirstGroup's robust balance sheet and impressive cash conversion are key indicators of its financial health. The company has made significant strides in reducing its adjusted net debt, demonstrating a commitment to deleveraging and strengthening its financial foundation. This fiscal discipline is crucial for navigating market fluctuations and supporting future growth initiatives.

The company’s ability to convert profits into actual cash is exceptionally strong. This high cash conversion rate means that earnings are effectively translating into readily available funds. For instance, in the fiscal year ending March 2024, FirstGroup reported a strong free cash flow, enabling further debt reduction and investment flexibility.

- Strong Financial Health: FirstGroup maintains a robust balance sheet, evidenced by its consistent reduction in adjusted net debt.

- High Cash Conversion: The company excels at converting its earnings into cash, providing financial flexibility.

- Strategic Investment Capacity: This financial strength allows FirstGroup to fund growth opportunities in key areas like its rail and bus divisions.

- Operational Efficiency: The high cash conversion underscores the profitability and efficiency of its core business operations.

FirstGroup's UK rail operations, including Avanti West Coast and Great Western Railway, are mature and hold significant market share, acting as dependable cash cows. These DfT-contracted services generate steady adjusted operating profits, primarily through management fees, contributing £120 million in fiscal year 2024.

The company's established regional bus networks outside London also function as classic cash cows, boasting strong market share and generating £1,456 million in revenue for fiscal year 2024. These operations are characterized by consistent revenue and profit due to operational efficiencies and yield management.

FirstGroup's financial strength is further evidenced by its robust balance sheet and high cash conversion rates, enabling substantial share buybacks in 2024 and a consistent reduction in adjusted net debt.

| Segment | BCG Category | FY24 Adjusted Operating Profit | FY24 Revenue |

|---|---|---|---|

| UK Rail (DfT Contracts) | Cash Cow | £120 million | N/A (primarily management fees) |

| UK Bus (Regional) | Cash Cow | N/A (contributes to overall profit) | £1,456 million |

Preview = Final Product

Firstgroup BCG Matrix

The Firstgroup BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no incomplete sections, and no demo content – just the complete, professionally designed strategic analysis ready for your immediate use.

What you see is the actual, final Firstgroup BCG Matrix report that will be delivered to you upon completion of your purchase. This comprehensive analysis is crafted for clarity and strategic insight, ensuring you receive the exact same high-quality document for your business planning needs.

This preview accurately represents the complete Firstgroup BCG Matrix document that you will download after purchase. You can be confident that the file delivered will be precisely as displayed, offering a ready-to-use strategic tool without any hidden surprises.

The Firstgroup BCG Matrix you are reviewing is the exact file that will be yours once you complete your purchase. This means the professional layout and comprehensive data you see are precisely what you will receive, enabling immediate application to your strategic decision-making.

Dogs

Underperforming or declining regional bus routes within Firstgroup's portfolio likely fall into the 'Dog' category of the BCG Matrix. These routes, characterized by low growth and low market share, often operate in areas experiencing reduced passenger numbers or facing stiff competition from other transport modes. For instance, in 2024, many rural bus services across the UK continued to grapple with these challenges, with some routes seeing passenger numbers drop by over 10% year-on-year, according to industry reports.

Managing these 'Dog' routes necessitates a strategic focus on efficiency and cost control. Firstgroup would likely implement continuous network optimization, potentially consolidating services or adjusting schedules to minimize operational expenses. The objective is often to achieve break-even operations rather than substantial profit generation, ensuring these essential services remain sustainable without becoming a significant drain on company resources.

FirstGroup's legacy rail franchises, such as South Western Railway, are in a transitional phase, moving towards public ownership. This shift signifies a declining strategic importance for these operations within FirstGroup's broader portfolio.

Historically dominant, these franchises now represent low-growth, low-market-share assets. Their contribution to FirstGroup's future growth is anticipated to be minimal, placing them in the 'dog' category of the BCG matrix.

FirstGroup's non-electrified diesel bus fleet, while still substantial, represents a category with significant challenges. As of early 2024, a considerable portion of their fleet operates on diesel, a technology increasingly scrutinized due to environmental concerns and evolving regulations. This positions these assets as low-growth, facing potential operational cost increases and a decline in long-term value as the market pivots towards cleaner transportation solutions.

Services Highly Susceptible to Industrial Action

Certain rail operations within Firstgroup have been particularly vulnerable to industrial action. These disruptions, stemming from complex labor relations, have directly impacted service reliability. For instance, in 2024, several rail franchises experienced significant strike days, leading to widespread cancellations and passenger inconvenience.

These ongoing industrial relations challenges create an inherently unstable operating environment for these services. This instability can deter passengers, leading to a potential decline in ridership and, consequently, affecting revenue streams. The unpredictable nature of these disputes also makes long-term planning and investment more difficult.

The impact of such disruptions contributes to a scenario of low growth for these specific rail operations. When services are frequently interrupted, it erodes customer confidence and can lead to a gradual loss of market share to more reliable competitors. This situation places these services firmly in the 'question mark' or 'dog' quadrant of the BCG matrix, requiring careful strategic consideration.

- Vulnerability to Strikes: Rail operations have historically been prone to industrial disputes, impacting service delivery.

- Impact on Passenger Numbers: Strikes and disruptions directly lead to reduced passenger volumes and revenue loss.

- Unstable Operating Environment: Frequent labor challenges create uncertainty, hindering growth and market share.

- BCG Matrix Placement: These factors often position affected rail services as 'dogs' due to low growth and potential market share erosion.

Former North American Businesses

FirstGroup's divestment of its North American businesses, including First Student, First Transit, and Greyhound, clearly positions them as Dogs in the BCG Matrix. These operations were sold off in 2021 for approximately $4.6 billion, a move aimed at significantly reducing the company's debt burden and sharpening its strategic focus on its core UK operations.

The sale underscored that these North American units were perceived as having limited growth potential and minimal synergy with FirstGroup's evolving strategic direction. They were capital-intensive, demanding resources without generating the robust returns needed to fuel FirstGroup's future growth ambitions.

- Divestment Rationale: Reduction of debt and strategic focus on UK core businesses.

- Asset Classification: Low-growth, low-synergy assets.

- Capital Allocation: Consumed capital without sufficient returns.

- Sale Proceeds: Approximately $4.6 billion in 2021.

FirstGroup's former North American operations, such as First Student and Greyhound, were classified as Dogs due to their divestment in 2021. These businesses were sold for approximately $4.6 billion, signaling their limited growth prospects and lack of strategic alignment with FirstGroup's UK focus. The sale aimed to deleverage the company and redirect resources to more promising ventures.

Similarly, underperforming or declining regional bus routes in the UK, especially those in rural areas experiencing reduced ridership, are categorized as Dogs. These routes often struggle with low market share and minimal growth, necessitating stringent cost control to remain sustainable. For instance, some rural routes saw over a 10% drop in passenger numbers in 2024.

Certain legacy rail franchises, now transitioning to public ownership, also fit the Dog profile. Their historical dominance has waned, leaving them with low growth and market share, making them less attractive for future investment within the company's portfolio.

The non-electrified diesel bus fleet faces similar challenges. With increasing environmental scrutiny and regulatory pressures, these assets represent low-growth potential, facing rising operational costs and declining long-term value as the market shifts towards cleaner technologies.

| Business Segment | BCG Category | Key Characteristics | Relevant Data/Events |

|---|---|---|---|

| North American Operations (First Student, Greyhound) | Dogs | Divested in 2021; low growth potential; lack of strategic synergy | Sale proceeds: ~$4.6 billion (2021) |

| Underperforming Regional Bus Routes (UK) | Dogs | Low market share; declining passenger numbers; high competition | Rural routes saw >10% passenger decline in 2024 |

| Legacy Rail Franchises (e.g., South Western Railway) | Dogs | Transitioning to public ownership; declining strategic importance | |

| Non-electrified Diesel Bus Fleet | Dogs | Facing environmental scrutiny; rising operational costs; declining long-term value | Significant portion of fleet still diesel-powered (early 2024) |

Question Marks

FirstGroup's applications for new open access rail services, including routes like London to Hereford and London to Stirling, position them in what are considered question mark segments. These are areas with high growth potential but currently minimal or no existing market share for the company. The success of these ventures, such as the proposed London-Hereford service, will depend heavily on securing regulatory approval and gaining traction with passengers.

FirstGroup is actively eyeing future UK rail and bus franchising bids, aiming to enter high-growth markets where it currently has no presence. These opportunities represent significant expansion potential, but they come with considerable upfront investment in proposal development and the capital required to operate new services.

The company's strategy involves a calculated risk, as winning these bids is not guaranteed, and the investment in proposals is substantial. For instance, the UK government has outlined plans for significant investment in public transport infrastructure, with new franchising models for bus services being rolled out in various regions, offering fertile ground for FirstGroup to establish new market share.

FirstGroup's investment in new digital ticketing systems and app features represents a potential growth area, aiming to enhance customer experience and operational efficiency. While these innovations are being rolled out, their full-scale adoption across the entire customer base and integration across all services are still developing, indicating a current phase of market penetration growth.

These digital initiatives are positioned as question marks within the BCG matrix due to their high growth potential but currently low market share in terms of widespread, complete adoption. For instance, in 2024, while app usage has seen an increase, the complete transition of all passenger segments to these digital platforms is ongoing, meaning the revenue generated from them is still building relative to the overall market size for ticketing solutions.

Expansion into New Niche Adjacent Services

FirstGroup's strategy involves expanding into niche adjacent services through smaller, bolt-on acquisitions. These moves are designed to tap into high-growth potential markets, even though their immediate impact on the group's overall market share is modest.

These acquisitions function as exploratory investments, allowing FirstGroup to test and scale promising ventures. For instance, in 2024, the company continued its focus on integrating acquisitions in areas like specialized transport solutions and technology-driven mobility services, aiming to build a stronger presence in these emerging sectors.

- Targeting High-Growth Niches: FirstGroup identifies and acquires businesses in specialized sectors with significant growth prospects.

- Low Current Market Share Contribution: While strategically important, these niche services currently represent a small portion of the group's total market share.

- Exploratory and Scalable Investments: The acquisitions are viewed as opportunities to explore new revenue streams and scale successful concepts.

- Focus on 2024 Acquisitions: Continued integration of smaller acquisitions in 2024 aimed at enhancing capabilities in areas like demand-responsive transport and fleet management.

Exploration of European Open Access Rail Market

FirstGroup is actively exploring opportunities in the European open access rail market as it continues to liberalize. This represents a significant potential growth area, tapping into entirely new geographical markets where the company currently has no existing footprint.

This strategic move positions FirstGroup to enter a market characterized by high growth potential but also inherent uncertainty and an expected low initial market share, fitting the profile of a question mark in a BCG matrix.

- Market Liberalization: The ongoing deregulation of European rail networks creates new avenues for private operators to compete on existing infrastructure.

- Growth Potential: Open access models can unlock significant passenger and freight volume growth in under-served or inefficiently operated routes.

- Geographic Expansion: This initiative signifies FirstGroup's ambition to diversify beyond its core UK operations into new, potentially lucrative European territories.

- Investment Horizon: As a question mark, this segment will require substantial upfront investment with an uncertain return timeline, demanding careful strategic management.

Question Marks represent new ventures with high growth potential but low market share for FirstGroup. These segments require significant investment and careful management to determine if they can become Stars or if they will falter. The company's strategic focus on these areas signals an ambition for future expansion and market leadership.

FirstGroup's UK open access rail applications, like the proposed London to Hereford route, are prime examples of Question Marks. While these ventures offer substantial growth prospects, they currently hold minimal market share and face the challenge of securing regulatory approval and passenger adoption. The company's ongoing investment in digital ticketing and app development also falls into this category, aiming for broader customer penetration and revenue generation.

FirstGroup's strategic acquisitions of smaller, niche businesses in 2024, such as those in specialized transport solutions, are also classified as Question Marks. These moves are designed to tap into high-growth potential markets, even though their immediate contribution to the group's overall market share is modest. The success of these ventures hinges on their ability to scale and integrate effectively within the broader FirstGroup portfolio.

The company's exploration of European open access rail markets signifies a strategic push into new territories with high growth potential but no current footprint, fitting the BCG Question Mark profile. This requires substantial upfront investment with an uncertain return timeline, demanding careful strategic management to navigate market liberalization and competition.

| Segment | Growth Potential | Market Share | Investment Required | Current Status |

|---|---|---|---|---|

| UK Open Access Rail (e.g., London-Hereford) | High | Low/None | Significant | Application/Development Phase |

| Digital Ticketing & App Features | High | Developing | Moderate | Rollout & Adoption Phase |

| Niche Acquisitions (e.g., Specialized Transport) | High | Low | Moderate | Integration & Scaling Phase |

| European Open Access Rail | High | None | Significant | Exploratory Phase |

BCG Matrix Data Sources

Our Firstgroup BCG Matrix is informed by comprehensive data, including financial reports, market share analysis, and industry growth projections to provide strategic clarity.