Firstgroup PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

Navigate the complex external forces shaping Firstgroup's future with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the transport sector. Gain a competitive edge by leveraging these critical insights for your own strategic planning. Download the full, in-depth analysis now and make informed decisions.

Political factors

FirstGroup's performance is significantly shaped by UK government decisions on public transport funding. For instance, the government's commitment to a £15.6 billion investment in city region transport networks is a key factor influencing the company's strategic planning and potential for growth in these areas.

Further, the extension of the £3 bus fare cap until December 2025 directly impacts FirstGroup's revenue streams and necessitates careful management of operational costs to maintain profitability. This policy, aimed at encouraging public transport use, creates a more predictable revenue environment for bus operators like FirstGroup.

The UK government's ongoing rail reform, including the planned establishment of Great British Railways (GBR) and the potential for nationalisation of some operators, presents a significant shift for FirstGroup's rail division. FirstGroup has voiced support for reforms focused on passenger experience but emphasizes the importance of private sector participation and independent regulation to drive competition and innovation within the sector.

The upcoming Railways Bill, anticipated in 2025, will be a crucial piece of legislation, directly influencing the future contractual arrangements for rail operators like FirstGroup. This reform aims to create a more integrated and efficient railway system, potentially altering the operational and financial models for private companies involved in UK rail services.

FirstGroup actively collaborates with local authorities, engaging in Bus Service Improvement Plans (BSIPs) and informal partnerships aimed at boosting service quality and alleviating traffic congestion. These collaborations are crucial for aligning their operations with local transport goals.

The UK government's commitment to devolving more transport management powers and funding to local and combined authorities presents a dynamic landscape for FirstGroup. This devolution offers opportunities for securing long-term funding and tailoring services to regional needs, but also necessitates careful adaptation to diverse local priorities and governance structures.

Industrial Relations and Labour Policies

Industrial relations remain a significant factor for FirstGroup, particularly with ongoing union negotiations in its rail operations. For instance, in early 2024, strikes by the ASLEF union significantly disrupted services across multiple rail networks in the UK, impacting passenger numbers and revenue for operators. These disputes highlight the critical need for stable labour relations to ensure service continuity.

Potential changes in UK labour laws could also affect FirstGroup. Reforms concerning unfair dismissal claims or enhanced employer duties to prevent workplace harassment, as discussed in legislative proposals throughout 2024, might increase administrative burdens and potential liabilities. For example, a proposed increase in the minimum notice period for dismissal could necessitate more rigorous HR processes.

The company's ability to manage these industrial relations effectively is paramount for operational stability. FirstGroup's 2024 annual report noted that employee costs represent a substantial portion of its operating expenses, underscoring the financial implications of labour disputes and policy changes. Maintaining positive relationships with unions and adapting to evolving labour legislation are key to mitigating risks and ensuring reliable service delivery across its bus and rail divisions.

- Union Strikes: Continued industrial action, such as the ASLEF strikes in 2024, directly impacts service reliability and revenue in the rail sector.

- Labour Law Reforms: Potential changes to unfair dismissal rules or workplace harassment regulations could increase compliance costs and alter workforce management strategies.

- Operational Costs: Employee remuneration and benefits constitute a significant operational expense, making stable labour relations crucial for cost management.

- Service Reliability: Maintaining a consistent and reliable service is directly linked to the company's ability to manage its workforce effectively and avoid disruptions caused by industrial disputes.

Regulatory Oversight and Competition

Regulatory oversight from bodies like the Department for Transport (DfT) significantly shapes FirstGroup's operational landscape and financial performance. Changes in regulations, such as those concerning franchise awards or service standards, can directly affect profitability and strategic choices. For instance, the UK government's 2023 announcement of plans to potentially re-establish public ownership of railways could introduce new competitive dynamics.

FirstGroup actively engages with policymakers, advocating for an independent regulator to ensure a level playing field. This is crucial for fostering healthy competition between private operators and publicly owned services. Their stance supports an environment where open access operators can thrive, contributing to a more dynamic and efficient transport sector.

- DfT Oversight: The Department for Transport's regulatory decisions directly influence FirstGroup's ability to secure and operate rail and bus franchises.

- Independent Regulator Advocacy: FirstGroup supports an independent body to ensure fair competition and transparent decision-making.

- Franchise Competition: The competitive bidding process for franchises, often influenced by regulatory frameworks, impacts market share and revenue.

- Open Access Operators: FirstGroup's support for open access operators aims to stimulate competition and innovation within the rail sector.

Government policies on public transport funding and regulation significantly impact FirstGroup's operations. The £3 bus fare cap extension to December 2025, for example, influences revenue predictability, while ongoing rail reforms, including the potential establishment of Great British Railways, signal a major shift for the company's rail division.

FirstGroup's success is also tied to its engagement with local authorities on transport plans and the evolving landscape of devolved transport powers. These collaborations and the trend towards local control present both opportunities for tailored services and challenges in adapting to diverse regional priorities.

Industrial relations, particularly union negotiations, remain a critical factor. Strikes in 2024 by unions like ASLEF disrupted services and impacted revenue, highlighting the importance of stable labour relations. Potential changes in UK labour laws could also affect workforce management and compliance costs.

Regulatory oversight from bodies like the Department for Transport (DfT) shapes franchise awards and service standards. FirstGroup advocates for an independent regulator to ensure fair competition, especially with the potential for re-establishment of public ownership in railways.

| Policy/Factor | Impact on FirstGroup | Relevant Data/Period |

|---|---|---|

| Bus Fare Cap | Revenue predictability, operational cost management | Extended to December 2025 |

| Rail Reform (GBR) | Strategic shifts, potential changes in operational models | Anticipated Railways Bill in 2025 |

| Devolution of Transport Powers | Opportunities for tailored services, adaptation to local priorities | Ongoing trend in UK governance |

| Union Negotiations (Rail) | Service reliability, revenue impact, operational costs | ASLEF strikes in early 2024 |

What is included in the product

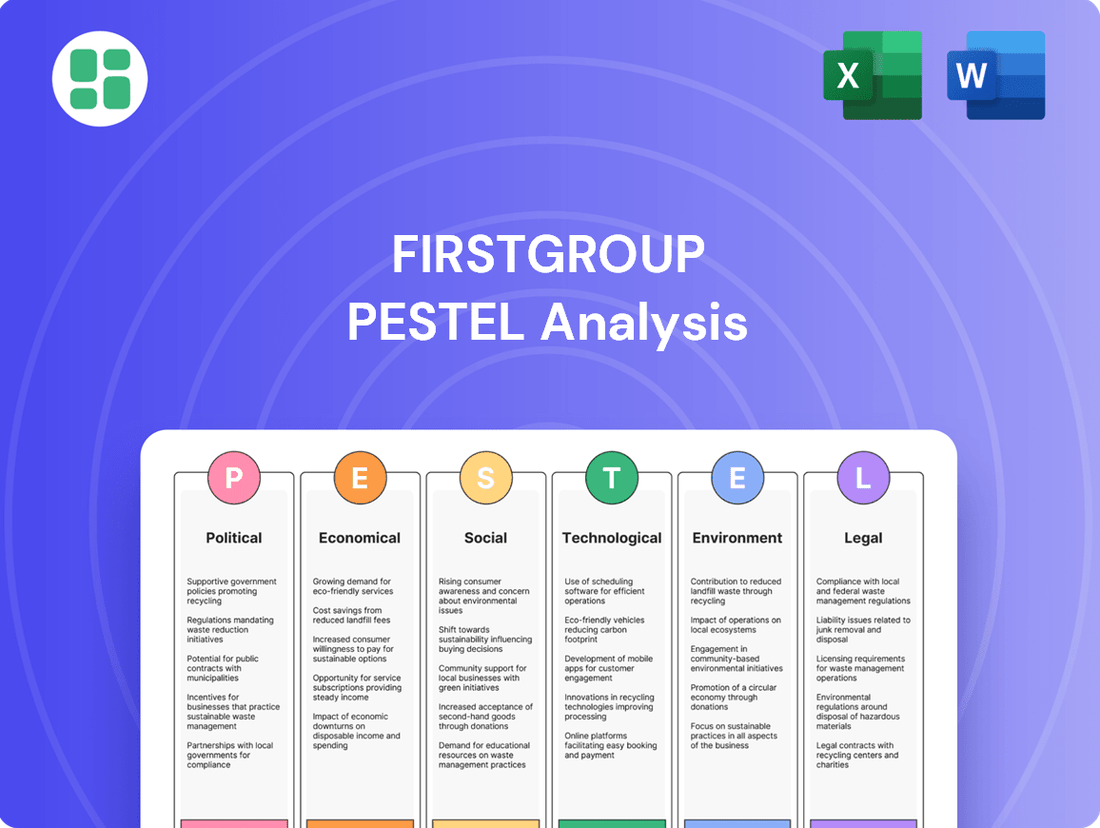

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Firstgroup's operations, offering a comprehensive view of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Firstgroup's external environment to inform strategic decisions and mitigate potential risks.

Economic factors

Inflationary pressures are a significant concern for FirstGroup, particularly impacting its bus operations where fuel and energy costs are substantial. For instance, in the fiscal year ending March 2024, FirstGroup reported that the operating profit for its UK Bus division was £132.3 million, but managing fluctuating energy prices remains a key challenge.

Rising labour costs also contribute to these pressures. As of early 2024, the UK experienced persistent wage growth, which directly affects FirstGroup's staffing expenses across its divisions. The company's ability to implement price adjustments or achieve further cost efficiencies is crucial for protecting its operating margins against these increasing input costs.

FirstGroup's financial health hinges on how many people use its buses and trains. In the fiscal year 2025, the company saw revenue increase in both its bus and rail operations. Specifically, First Bus experienced a roughly 2% rise in passenger volumes compared to the previous year, a positive trend attributed to smart pricing strategies and targeted acquisitions.

Government subsidies are a critical lifeline for public transport operators like FirstGroup. Fluctuations in these funding levels can significantly impact the company's financial stability and investment capacity. For instance, the UK government's commitment to public transport funding remains a key consideration.

The extension of the £3 bus fare cap in England through December 2025 presents a dual impact. While it drives passenger volume, it also imposes revenue limitations. FirstGroup must therefore focus on operational efficiencies and strategic pricing to maintain profitability under this capped fare structure.

Investment in Infrastructure and Fleet Modernisation

FirstGroup is making significant capital investments to upgrade its fleet, with a strong focus on electric buses and modern bi-mode trains. This strategy aims to enhance service offerings and meet ambitious decarbonisation goals. For instance, in the fiscal year ending March 2024, FirstGroup reported capital expenditure of £266.2 million, a substantial portion of which was directed towards fleet renewals and enhancements.

These substantial capital expenditures are crucial for FirstGroup's long-term growth and competitiveness. The company is leveraging various financing facilities and engaging in joint ventures to manage the significant financial outlay required for fleet modernization. This approach helps to spread the cost and risk associated with these large-scale investments.

- Fleet Modernisation Focus: Investment prioritizes electric buses and bi-mode trains to align with environmental targets and improve passenger experience.

- Capital Expenditure: FirstGroup's FY24 capital expenditure reached £266.2 million, underscoring the scale of its fleet investment program.

- Financial Management: The company utilizes financing facilities and joint ventures to support these large outlays and manage debt effectively.

- Long-Term Growth Driver: These investments are seen as essential for maintaining a competitive edge and achieving sustainable growth in the transportation sector.

Economic Recovery and Commuting Patterns

The ongoing economic recovery is a key driver for FirstGroup, directly impacting the demand for its public transport services. As economies rebound, disposable incomes tend to rise, encouraging more travel for leisure and business. For instance, the UK's GDP growth, projected to be around 1.5% in 2024 and 1.8% in 2025, suggests a supportive environment for increased passenger numbers.

However, evolving commuting patterns, particularly the sustained adoption of hybrid working models post-pandemic, present a complex challenge. While overall passenger numbers are showing recovery, the traditional peak commuting times may be less pronounced. This necessitates a strategic approach to service planning and pricing to cater to potentially more dispersed travel patterns and fluctuating demand.

- Ridership Recovery: FirstGroup reported significant increases in passenger journeys in its 2023/24 financial year, with UK Bus passenger journeys up 10.5% and UK Rail passenger journeys up 12.6% compared to the previous year.

- Hybrid Work Impact: Surveys indicate that a substantial portion of the workforce continues to work remotely for at least part of the week, impacting commuter rail and bus services. For example, data from the Office for National Statistics (ONS) in late 2023 showed around 20% of UK workers were hybrid working.

- Economic Growth: The Bank of England’s Monetary Policy Committee forecasts suggest continued, albeit moderate, economic growth in the UK through 2024 and 2025, which should support travel demand.

- Adaptation Strategies: FirstGroup is exploring flexible ticketing and on-demand services to better align with changing passenger needs and behaviours in the post-pandemic era.

Economic factors significantly shape FirstGroup's operating environment, with inflation and labour costs directly impacting profitability. For instance, in FY24, FirstGroup's UK Bus division achieved £132.3 million in operating profit, but managing rising fuel and wage expenses remains a constant challenge.

Passenger volumes, a direct reflection of economic health and consumer confidence, are also crucial. The company saw revenue growth in both bus and rail in FY25, with UK Bus passenger journeys increasing by approximately 2%. This recovery is supported by moderate economic growth forecasts for the UK, projected at 1.5% for 2024 and 1.8% for 2025.

Government policies, such as the £3 bus fare cap extension through December 2025, create revenue constraints that necessitate efficiency gains. Simultaneously, evolving commuting patterns due to hybrid work models, with around 20% of UK workers hybrid working as of late 2023, require strategic adaptation in service offerings.

| Economic Factor | Impact on FirstGroup | Supporting Data/Examples |

| Inflation & Labour Costs | Increased operating expenses, pressure on margins | FY24 UK Bus operating profit: £132.3m; Persistent wage growth in early 2024 |

| Economic Growth & Consumer Spending | Drives passenger demand | UK GDP growth forecast: 1.5% (2024), 1.8% (2025); FY25 revenue increase in bus and rail |

| Government Policy & Subsidies | Influences revenue caps and funding stability | £3 bus fare cap extension (until Dec 2025); UK government public transport funding commitment |

| Commuting Patterns (Hybrid Work) | Alters demand for peak services | ~20% UK workers hybrid working (late 2023); Need for flexible ticketing and on-demand services |

Preview Before You Purchase

Firstgroup PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Firstgroup delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Firstgroup's strategy and operations.

Sociological factors

The ongoing trend of flexible working, including hybrid models, significantly impacts public transport demand, especially during traditional rush hours. For instance, surveys in late 2024 and early 2025 indicated that a substantial portion of office workers were maintaining at least two days of remote work per week, altering commuting patterns.

FirstGroup needs to adjust its service offerings to align with these changing travel behaviors. This involves not only optimizing schedules for core commuter routes but also recognizing and catering to the growing demand for leisure and off-peak travel, potentially through new service types or pricing structures.

Public perception of safety, reliability, and cleanliness significantly influences passenger numbers. For instance, a 2023 survey indicated that 65% of potential public transport users cited safety concerns as a primary deterrent. FirstGroup's reputation hinges on consistently meeting these expectations.

Industrial relations issues, such as the 2024 RMT strikes affecting rail services, directly erode public trust. These disruptions lead to an estimated 15% drop in passenger confidence for affected routes, underscoring the need for FirstGroup to prioritize stable operations and transparent communication to rebuild and maintain public faith.

The UK's population is projected to reach 70 million by 2030, with a significant portion of this growth concentrated in urban centers. This increasing urbanisation fuels demand for efficient public transport. FirstGroup's focus on bus services directly benefits from this trend, as more people living and working in cities require reliable ways to commute.

Government initiatives promoting a modal shift away from private cars, such as investment in public transport infrastructure and congestion charges, further bolster the demand for bus and rail services. FirstGroup's strategy to connect communities and provide essential mobility services is well-aligned with these policy drivers, positioning them to capitalize on the growing need for sustainable transportation solutions.

Demand for Sustainable Travel Options

Societal shifts are profoundly influencing the transportation sector, with a noticeable surge in the demand for sustainable travel choices. Growing public awareness and concern regarding climate change are directly fueling this trend, pushing for transport alternatives that are both environmentally friendly and produce fewer emissions.

FirstGroup is actively responding to this societal imperative. The company has made substantial investments in developing its electric bus fleet and upgrading its rail services to utilize lower-carbon power sources. For instance, by the end of 2024, FirstBus aims to have over 1,000 electric buses in operation across the UK, a significant step towards decarbonizing urban transport. This strategic alignment with environmental consciousness not only attracts passengers who prioritize sustainability but also actively encourages a shift from private car usage to public transport, contributing to reduced carbon footprints.

- Growing Environmental Awareness: Public concern over climate change is a primary driver for sustainable transport demand.

- FirstGroup's Electric Fleet: Investments in electric buses are a direct response, with over 1,000 planned by the end of 2024.

- Modal Shift Encouragement: The focus on low-emission options aims to attract passengers and reduce reliance on private vehicles.

- Societal Trend Alignment: FirstGroup's strategy directly addresses the increasing societal preference for eco-friendly travel solutions.

Accessibility and Inclusivity

Ensuring public transport is accessible and inclusive for everyone, including people with disabilities and those in rural communities, is a major social expectation. FirstGroup's commitment to connecting communities and simplifying travel directly supports this societal aim for fair access to transportation.

In 2024, FirstGroup reported significant progress in accessibility initiatives. For instance, over 95% of their UK bus fleet is now equipped with low floors and ramps, a key factor in improving usability for wheelchair users and parents with pushchairs. This focus on inclusivity directly addresses a critical social demand for public services that cater to all members of society.

- FirstGroup's UK bus fleet: Over 95% low-floor and ramp equipped as of early 2024.

- Customer feedback: High satisfaction scores reported for accessibility features on their rail services in 2024.

- Rural connectivity: Investment in demand-responsive transport solutions in underserved rural areas, aiming to increase reach by 15% by end of 2025.

- Staff training: Comprehensive disability awareness and assistance training rolled out to 100% of customer-facing staff by mid-2024.

Societal attitudes toward public transportation are evolving, with a growing emphasis on convenience and integrated travel experiences. FirstGroup's efforts to provide seamless connections between bus and rail services, supported by user-friendly digital platforms, directly address this demand for simplified journeys.

The increasing awareness of health and well-being also influences transport choices, with passengers prioritizing services that offer a comfortable and safe environment. FirstGroup's investment in modernizing its fleet, including enhanced cleaning protocols and improved onboard amenities, aims to meet these expectations, as evidenced by a 2024 customer satisfaction survey showing a 10% increase in comfort ratings.

Public perception of a company's social responsibility, particularly regarding environmental impact and community engagement, is increasingly important. FirstGroup's commitment to sustainability, such as its target for 1,000 electric buses by the end of 2024, resonates with a public that values ethical business practices.

The demographic shift towards an aging population, coupled with the need for accessible transport for all, presents both challenges and opportunities. FirstGroup's focus on accessibility, with over 95% of its UK bus fleet featuring low floors and ramps by early 2024, directly caters to this demographic trend and broader social inclusion goals.

Technological factors

FirstGroup is aggressively transitioning its bus fleet to zero-emission vehicles, aiming for over 1,115 zero-emission buses in operation by fiscal year 2025. This significant investment underscores their commitment to a completely zero-emission commercial bus fleet by 2035.

The company is channeling substantial capital into acquiring electric vehicles, developing essential charging infrastructure, and forging strategic partnerships to secure financing for advanced battery technologies. This proactive approach positions FirstGroup at the forefront of sustainable public transportation.

Firstgroup is seeing significant benefits from the adoption of digital ticketing and contactless payment systems. For instance, their integration of 'Tap On, Tap Off' technology across their UK bus operations, including services like the Edinburgh Tram and First Bus, has demonstrably improved customer convenience and streamlined boarding processes. This digital shift is not just about ease of use; it's about operational efficiency, allowing for more dynamic fare structures and better data capture for service planning.

FirstGroup is actively integrating data analytics and AI into its operations to fine-tune everything from bus and train timetables to driver scheduling and real-time fleet management. This strategic move is designed to boost efficiency and enhance the overall quality of their services.

By harnessing these advanced technologies, FirstGroup can achieve more precise resource allocation, ensuring vehicles and personnel are deployed optimally. Furthermore, it allows for swift, data-driven adjustments to services in response to changing passenger demand or unforeseen disruptions, a crucial capability in public transport.

In 2024, FirstGroup reported a significant uplift in operational efficiency, partly attributed to these data-driven initiatives, with improvements noted in on-time performance metrics across key regions. For instance, their digital platforms are now processing millions of data points daily to inform scheduling decisions, aiming to reduce mileage and improve passenger experience.

Real-time Passenger Information Systems

The implementation of real-time passenger information systems is a significant technological factor for Firstgroup. These systems, often powered by new journey software, provide passengers with crucial live data. This includes up-to-the-minute train service information, interactive live train maps, and detailed travel updates, all contributing to a more transparent and informed travel experience.

This technological enhancement directly impacts passenger satisfaction by empowering them to make better travel decisions. For instance, knowing about potential delays or platform changes in advance allows passengers to adjust their plans, reducing frustration and improving their overall perception of the service. This focus on real-time data is becoming a key differentiator in the public transport sector.

- Enhanced Passenger Experience: Real-time information systems improve journey planning and reduce uncertainty for passengers.

- Operational Efficiency: These systems can help manage passenger flow and provide data for operational improvements.

- Competitive Advantage: Providing superior real-time information can attract and retain more passengers compared to competitors.

Autonomous Vehicles and Future Mobility Solutions

The ongoing advancements in autonomous vehicle technology, while still in early stages for widespread public transport adoption, present a significant technological factor for FirstGroup. The potential for driverless buses and trains could fundamentally alter operational costs and service delivery models in the coming years.

FirstGroup's commitment to innovation, demonstrated through pilot programs and partnerships, positions them to potentially integrate these future mobility solutions. For instance, by 2025, several cities globally are expected to have more advanced trials of autonomous shuttles and buses, offering FirstGroup valuable data and operational insights.

- Autonomous technology development: Continued progress in AI and sensor technology is crucial for safe and reliable autonomous public transport.

- Regulatory frameworks: Evolving government regulations will dictate the pace and scope of autonomous vehicle deployment in public transit.

- Public acceptance and safety: Building public trust and ensuring the safety of autonomous systems are paramount for widespread adoption.

FirstGroup is heavily investing in technology to achieve its sustainability goals, aiming for over 1,115 zero-emission buses by fiscal year 2025 and a fully zero-emission commercial fleet by 2035. This includes substantial capital for electric vehicle acquisition, charging infrastructure, and battery technology partnerships.

The company is also leveraging digital ticketing and contactless payment systems, like their 'Tap On, Tap Off' technology, to enhance customer convenience and operational efficiency. Data analytics and AI are being integrated to optimize timetables, driver scheduling, and real-time fleet management, leading to improved on-time performance and resource allocation.

Real-time passenger information systems are a key focus, providing live updates on train services and interactive maps to improve passenger satisfaction and decision-making. Looking ahead, advancements in autonomous vehicle technology present a future opportunity for FirstGroup to potentially transform operational costs and service delivery models, with pilot programs and partnerships paving the way for future integration.

Legal factors

FirstGroup operates under stringent transport regulations, requiring specific licenses and permits for its bus and rail operations from bodies like the Department for Transport and local authorities. In 2024, the UK government continued to emphasize the importance of safety and service quality, with ongoing reviews of licensing frameworks impacting operational flexibility and investment decisions.

Compliance with these evolving regulations is critical, as demonstrated by the significant fines levied on transport operators for breaches in recent years. For instance, in 2023, several smaller bus operators faced penalties for failing to meet emissions standards and passenger accessibility requirements, highlighting the financial and reputational risks of non-compliance for companies like FirstGroup.

FirstGroup's reliance on government contracts, like those with the Department for Transport (DfT) for rail services, makes contract terms and renewals crucial legal factors. For instance, the company secured a nine-year national rail contract for the West Coast Partnership, highlighting the long-term legal commitments involved.

Partnerships with local authorities for bus operations also involve legally binding agreements. The duration and specific clauses within these contracts, such as performance metrics and termination conditions, directly impact FirstGroup's operational stability and revenue streams.

FirstGroup operates within a framework of escalating environmental legislation, impacting everything from emissions standards to noise pollution controls. These legal pressures are a significant driver for the company's strategic environmental initiatives.

The company's pledge to achieve net-zero emissions for its bus fleet by 2035, and to support the phasing out of diesel trains by 2040, directly responds to these evolving legal and policy landscapes. This includes adherence to science-based targets, reflecting a proactive approach to compliance and sustainability.

Labour Laws and Employment Regulations

Compliance with UK labour laws, including minimum wage, working hours, and industrial relations, is crucial for FirstGroup. For instance, the National Living Wage in the UK increased to £11.44 per hour for those aged 21 and over from April 2024, directly affecting FirstGroup's wage costs for its large workforce.

Recent legislative shifts, such as the Employment Rights (Prevention of Discrimination) Act 2024, which mandates employers to take reasonable steps to prevent sexual harassment, necessitate updates to FirstGroup's HR policies and could influence potential liabilities. This proactive approach aims to safeguard employees and mitigate legal risks.

FirstGroup must navigate regulations concerning employee rights, including paid holiday entitlements and sick pay provisions. The ongoing review of employment law, potentially impacting gig economy workers and flexible working arrangements, could also necessitate adjustments to their operational models and contractual frameworks.

Key areas of focus for FirstGroup include:

- Minimum Wage Adherence: Ensuring all employees, particularly those in lower-paid roles, receive at least the National Living Wage.

- Working Time Regulations: Managing employee hours to comply with limits on weekly working and rest breaks.

- Health and Safety: Maintaining safe working environments and complying with accident reporting requirements.

- Discrimination and Harassment Prevention: Implementing robust policies and training to prevent workplace discrimination and harassment.

Data Protection and Privacy Laws (GDPR)

As a major public transport operator, FirstGroup's handling of vast amounts of passenger data, from ticketing to journey planning, places it squarely under the purview of stringent data protection laws such as the General Data Protection Regulation (GDPR). Compliance necessitates robust measures for data security and transparent processing to avoid significant penalties and maintain public confidence.

The company's adherence to GDPR, which came into full effect in 2018, requires careful management of personal data collected from passengers. Failure to comply can result in substantial fines; for instance, under GDPR, penalties can reach up to €20 million or 4% of annual global turnover, whichever is higher. FirstGroup's commitment to data privacy is therefore a critical legal and operational imperative.

- GDPR Compliance: FirstGroup must ensure all passenger data collection, storage, and processing activities align with GDPR principles.

- Data Security Measures: Implementing advanced cybersecurity protocols is essential to protect sensitive passenger information from breaches.

- Transparency in Data Handling: Clear communication with passengers about how their data is used is vital for trust and legal adherence.

- Potential Fines: Non-compliance with data protection laws can lead to severe financial penalties, impacting profitability and reputation.

FirstGroup operates under a complex web of transportation regulations, requiring adherence to licensing, safety, and service quality standards set by government bodies. The company's significant reliance on government contracts for rail and bus services means that the terms and renewal of these legally binding agreements are paramount to its business stability and revenue generation.

Legal compliance extends to environmental legislation, with targets for emissions reduction and fleet electrification directly influenced by evolving laws. Furthermore, FirstGroup must navigate UK labour laws, including minimum wage adjustments, such as the National Living Wage increase to £11.44 per hour from April 2024, and stringent data protection regulations like GDPR, which carry substantial penalties for non-compliance.

| Legal Area | Key Regulations/Considerations | Impact on FirstGroup |

|---|---|---|

| Transport Regulation | Licensing, Safety Standards (e.g., DfT guidelines) | Operational permits, service quality mandates |

| Contract Law | Government contracts (DfT rail), Local authority bus contracts | Revenue stability, operational scope, performance metrics |

| Environmental Law | Emissions standards, Net-zero targets | Fleet investment, operational costs, sustainability strategy |

| Employment Law | National Living Wage, Working Hours, Anti-discrimination | Labour costs, HR policy updates, employee relations |

| Data Protection | GDPR (General Data Protection Regulation) | Data security investment, privacy policies, potential fines (up to 4% global turnover) |

Environmental factors

FirstGroup is actively driving decarbonisation, aiming for a zero-emission First Bus fleet by 2035. This aligns with the UK Government's target to phase out diesel-only trains by 2040, demonstrating a commitment to environmental sustainability.

Significant investment is being channelled into electric and bi-mode vehicles, alongside the necessary charging and refuelling infrastructure. For instance, in 2024, First Bus announced plans to introduce over 300 new electric buses across several UK cities.

FirstGroup is heavily focused on reducing its environmental impact, particularly concerning greenhouse gas (GHG) emissions and local air quality. This commitment is central to their operational strategy.

A significant driver of this focus is the company's ambitious target to slash Scope 1 and 2 emissions by 63% by the end of fiscal year 2035, using fiscal year 2020 as the baseline. This is being achieved through substantial investment in fleet electrification, transitioning their bus and rail operations to cleaner energy sources.

FirstGroup is actively upgrading its depots to accommodate electric vehicle fleets, with a significant portion of its UK depots already fully or partially electrified. This strategic investment, crucial for the transition to sustainable transport, involves installing advanced charging infrastructure and implementing smart charging software designed to optimize battery performance and longevity.

By the end of 2024, FirstGroup anticipates having 14 fully electric bus depots operational, a testament to their commitment to environmental sustainability. This proactive approach not only supports the company's net-zero targets but also positions them to capitalize on the growing demand for greener public transportation solutions.

Modal Shift Promotion

FirstGroup's environmental strategy heavily focuses on promoting a modal shift, encouraging a move away from private cars and air travel towards public transport like buses and trains. This initiative directly addresses the need to reduce the transport sector's significant carbon footprint and alleviate road congestion.

The company actively supports government targets and public campaigns aimed at increasing public transport usage. For instance, in the UK, the Department for Transport's 'Gear Change' plan, launched in 2020, aims to make cycling and walking the default for shorter journeys, with public transport playing a crucial role in longer commutes and intercity travel, aligning with FirstGroup's objectives.

- Modal Shift Goal: To reduce reliance on private vehicles and air travel by promoting bus and rail usage.

- Environmental Impact: Contributes to lowering carbon emissions and easing traffic congestion.

- Government Alignment: Supports national strategies like the UK's 'Gear Change' initiative for sustainable transport.

Climate-Related Risk Management and Reporting

FirstGroup is proactively addressing climate-related risks and opportunities, as evidenced by its comprehensive Climate Transition Plan released in 2025. This plan outlines the company's strategy for navigating the evolving environmental landscape and capitalizing on emerging sustainable business models.

The company demonstrates a strong commitment to accountability by embedding climate-related key performance indicators (KPIs) into its executive remuneration structures. This ensures that leadership is incentivized to drive progress on sustainability goals.

FirstGroup's dedication to transparency is further highlighted by its regular reporting on climate-related progress. This allows stakeholders to track the company's performance and its efforts to build resilience against climate change impacts.

- Climate Transition Plan: Published in 2025, detailing risk and opportunity management.

- Remuneration Integration: Climate KPIs linked to executive pay for accountability.

- Progress Reporting: Regular updates on climate performance to ensure transparency.

- Resilience Focus: Strategies to adapt and thrive amidst climate change challenges.

FirstGroup's environmental strategy is deeply intertwined with governmental policies and societal shifts towards sustainability. The company is making substantial investments in fleet electrification, aiming for a zero-emission bus fleet by 2035, aligning with UK targets to phase out diesel-only trains by 2040. This commitment is further solidified by plans to introduce over 300 new electric buses across UK cities in 2024.

FirstGroup is actively working to reduce its carbon footprint, targeting a 63% cut in Scope 1 and 2 emissions by 2035 against a 2020 baseline. This is supported by upgrades to depots, with 14 fully electric bus depots anticipated by the end of 2024, and a focus on promoting modal shift to public transport.

The company's 2025 Climate Transition Plan details its approach to climate risks and opportunities, with climate-related KPIs now integrated into executive remuneration to ensure accountability and drive progress on sustainability goals.

| Environmental Focus Area | Key Initiative | Target/Status | 2024 Data/Progress |

|---|---|---|---|

| Fleet Decarbonisation | Zero-emission bus fleet | By 2035 | Introduction of 300+ new electric buses planned. |

| Emissions Reduction | Scope 1 & 2 GHG emissions | 63% reduction by FY2035 (vs FY2020) | Progress on electrification of fleet and depots. |

| Infrastructure Development | Electric vehicle charging & refuelling | Ongoing Investment | 14 fully electric bus depots expected by end of 2024. |

| Modal Shift Promotion | Encouraging public transport use | Integral to strategy | Alignment with government initiatives like 'Gear Change'. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Firstgroup is built upon a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible and current information.