Firstgroup Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Firstgroup Bundle

Firstgroup faces significant competitive pressures, from the bargaining power of its diverse customer base to the constant threat of new entrants disrupting its established markets. Understanding these forces is crucial for navigating the transportation sector.

The complete report reveals the real forces shaping Firstgroup’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fuel suppliers wield considerable bargaining power over FirstGroup, a significant public transport operator heavily reliant on fuel. The global nature of fuel markets, often influenced by geopolitical factors and producer cartels like OPEC+, can lead to price volatility that FirstGroup struggles to counter. This dependence means suppliers can dictate terms, impacting FirstGroup's operational costs.

While FirstGroup actively pursues fuel efficiency and invests in alternative energy vehicles, the immediate costs associated with switching its existing large fleet are substantial. This high switching cost reinforces the bargaining power of traditional fuel suppliers, as a rapid transition away from current fuel sources is not economically feasible, leaving FirstGroup with limited leverage in price negotiations.

The bargaining power of suppliers for vehicle manufacturers is significant for FirstGroup. The bus and train manufacturing sector is concentrated, with a few major players like Volvo and Wrightbus for buses, and Hitachi for trains, dominating the market. This consolidation means these suppliers can command higher prices due to their specialized products and the substantial investment in research and development required for these high-value assets.

FirstGroup faces considerable switching costs when dealing with these specialized vehicle suppliers. The long-term nature of contracts and the need for specific, often customized, vehicle types mean that changing suppliers is neither easy nor cheap. This dependency further strengthens the manufacturers' leverage in price negotiations and contract terms, impacting FirstGroup's operational costs.

The bargaining power of labor, specifically for drivers and maintenance staff, is a significant force for FirstGroup. The transport sector, including rail and bus operations, contends with persistent skills shortages and an aging workforce, making skilled personnel like train and bus drivers highly sought after. This scarcity inherently strengthens their negotiating position.

In the UK, particularly within the rail and bus industries, strong trade unions play a pivotal role. These unions can collectively bargain for better wages, improved working conditions, and favorable industrial relations. This was evident in 2023 and early 2024 with ongoing industrial relations challenges impacting FirstGroup's rail division, demonstrating the tangible influence unions wield over operational costs and stability.

Infrastructure Providers (e.g., Network Rail)

FirstGroup's reliance on Network Rail for its UK rail operations means Network Rail holds considerable bargaining power. As the manager of most UK railway infrastructure, Network Rail functions as a natural monopoly. This position allows it to influence key aspects of FirstGroup's operations.

While regulated by the Office of Rail and Road (ORR), Network Rail can set access charges and maintenance standards. For instance, in 2023, Network Rail's operating expenditure was reported to be around £5.7 billion, with significant portions allocated to infrastructure maintenance and renewals. These costs are ultimately passed on to train operating companies like FirstGroup through access charges.

- Network Rail's Monopoly: Operates as the sole provider of essential railway infrastructure access in the UK.

- Access Charges: FirstGroup pays significant access charges to Network Rail for using the network, directly impacting profitability. In the financial year ending 2024, these charges are a major component of operating costs for train operators.

- Maintenance Standards: Network Rail dictates maintenance schedules and quality, which can affect service reliability and punctuality for FirstGroup's services.

Technology and Specialized Equipment Providers

FirstGroup's reliance on advanced technology, such as sophisticated ticketing systems and real-time tracking, can give specialized providers significant bargaining power. These systems often require substantial integration and may involve proprietary technology, leading to high switching costs for FirstGroup.

The ongoing transition to decarbonization, particularly the adoption of electric buses, further concentrates power with manufacturers and infrastructure providers. For instance, the cost of electric buses and charging infrastructure can be considerably higher than traditional diesel models, impacting FirstGroup's capital expenditure and operational costs. In 2023, FirstGroup announced plans to introduce more electric buses, highlighting this dependency.

- Technological Dependence: FirstGroup's operational efficiency is increasingly tied to specialized IT and tracking systems.

- High Integration Costs: Switching providers for these integrated systems can be prohibitively expensive due to customization and proprietary elements.

- Decarbonization Shift: The move to electric vehicles and associated charging infrastructure creates reliance on a smaller pool of specialized manufacturers and energy providers.

Fuel suppliers hold significant sway over FirstGroup due to the company's substantial reliance on diesel and other fuels for its vast bus and train fleets. Geopolitical events and actions by organizations like OPEC+ can cause unpredictable price hikes, which FirstGroup finds difficult to offset. This dependence allows fuel providers to dictate terms, directly impacting FirstGroup's operational expenses.

The market for specialized vehicles, such as buses and trains, is dominated by a few key manufacturers. This consolidation grants these suppliers considerable bargaining power, enabling them to command higher prices for their products. FirstGroup's need for customized, high-value assets means switching suppliers is costly and complex, further strengthening the manufacturers' negotiating position.

Skilled labor, particularly bus and train drivers, represents another area where supplier bargaining power is evident for FirstGroup. Persistent shortages of qualified personnel in the transport sector enhance the negotiating leverage of these workers. In the UK, the influence of strong trade unions in the rail and bus industries can lead to demands for improved wages and conditions, as seen in industrial relations challenges during 2023 and early 2024.

FirstGroup's dependence on Network Rail for UK rail operations is substantial. Network Rail, as the owner and operator of most of the UK's railway infrastructure, acts as a natural monopoly. This gives it considerable power to influence FirstGroup's operations through access charges and maintenance standards, with operating expenditures for Network Rail in 2023 around £5.7 billion, influencing costs passed to operators.

| Supplier Type | Bargaining Power Factors | Impact on FirstGroup | 2023/2024 Data/Context |

|---|---|---|---|

| Fuel Suppliers | Market volatility, geopolitical factors, producer cartels | Price increases, higher operational costs | Global fuel price fluctuations impacting operating expenses. |

| Vehicle Manufacturers | Market concentration, specialized products, high R&D costs | Higher vehicle purchase prices, high switching costs | Concentrated market with few major bus/train manufacturers. |

| Labor (Drivers/Staff) | Skills shortages, aging workforce, trade union influence | Wage pressures, potential industrial action, increased labor costs | Ongoing industrial relations challenges in the rail sector. |

| Network Rail | Monopoly on infrastructure, access charges, maintenance control | Significant operating costs via access charges, service reliability impact | Network Rail's 2023 operating expenditure of ~£5.7 billion. |

| Technology Providers | Proprietary systems, high integration costs, specialized knowledge | Dependency on specific systems, high costs to change providers | Increasing reliance on advanced ticketing and tracking systems. |

| Decarbonization Providers | Specialized EV manufacturers, charging infrastructure providers | Higher capital expenditure for electric fleets, reliance on new tech providers | FirstGroup's plans to increase electric bus fleet in 2023. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Firstgroup's bus and rail operations.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Firstgroup.

Customers Bargaining Power

Individual passengers, whether commuting or traveling for leisure, typically possess limited direct bargaining power. The cost of a single ticket is relatively low, and the sheer volume of individual transactions means one passenger's decision has minimal impact. However, this changes when considering them as a collective group. Their sensitivity to price, the reliability of services, and overall quality is quite high, particularly as more alternative transportation choices emerge and government policies influence pricing. For instance, the introduction of a £3 fare cap in England starting January 2025 directly constrains FirstGroup's ability to adjust prices and impacts their revenue per mile, demonstrating a significant, albeit indirect, form of customer power.

Local authorities and the Department for Transport (DfT) wield considerable influence, especially over FirstGroup's contracted bus services and rail franchises. These bodies dictate crucial aspects like service quality, ticket pricing, and the level of financial support provided. For instance, in 2024, the UK government continued its commitment to bus service improvements, allocating significant funding that directly shapes the operational landscape for companies like FirstGroup.

For contracted services like school buses or corporate shuttle services, clients such as schools or large businesses possess moderate bargaining power. These entities often engage in tender processes, enabling them to solicit and compare multiple bids. This competition allows them to negotiate favorable terms, focusing on price, service quality, and specific operational needs. For instance, in 2024, the transportation sector saw increased competition among service providers, potentially amplifying client leverage.

Passenger Groups and Advocacy Bodies

Passenger groups and transport advocacy bodies, while not direct purchasers of tickets, hold considerable sway over FirstGroup. Their ability to mobilize public opinion and lobby government officials can directly impact the company's operating environment. For instance, campaigns focused on fare affordability or service reliability can lead to regulatory interventions or shifts in public perception that influence passenger choices.

These groups often champion issues such as fare caps, service frequency, accessibility for disabled passengers, and environmental sustainability. Their advocacy can result in public pressure that compels FirstGroup to adjust its pricing strategies or invest in service improvements. For example, in 2024, several passenger advocacy groups in the UK actively campaigned for greater transparency in bus fare structures, highlighting potential disparities and advocating for simpler, fairer pricing models.

- Public Pressure: Passenger groups can generate negative publicity through protests and social media campaigns, impacting FirstGroup's brand image.

- Lobbying Efforts: Advocacy bodies engage with policymakers to influence regulations concerning service standards, subsidies, and fare policies.

- Impact on Reputation: Persistent criticism from these groups can erode public trust and make it harder for FirstGroup to secure new contracts or maintain existing ones.

- Influence on Investment: Concerns raised by advocacy groups about environmental impact can push for investments in greener fleets, affecting capital expenditure.

Digital Platforms and Aggregators

Digital platforms and aggregators are increasingly centralizing customer access to transportation. Integrated ticketing and travel planning apps, a trend that gained significant traction throughout 2024, offer consumers a consolidated view of various travel options. This aggregation could empower customers by providing greater price transparency and convenience.

While the UK's regulated public transport sector offers some insulation, the potential for these platforms to build substantial user bases means they could exert influence over operators like FirstGroup. This influence might manifest in demands for preferential pricing or access to customer data. For instance, in 2024, several new multi-modal journey planners saw increased adoption, indicating a growing customer preference for consolidated booking experiences.

- Centralized Access: Apps like Citymapper and Google Maps continued to enhance their integrated ticketing features in 2024, offering users a single point of access for planning and purchasing journeys across different operators.

- Potential for Price Pressure: As user numbers grow, these platforms could leverage their reach to negotiate better terms or influence pricing structures, though regulatory oversight in the UK public transport market currently limits this impact.

- Data Sharing Demands: Aggregators may seek access to operator data to improve their services, creating a dynamic where operators must balance data utility with competitive concerns.

Customers, particularly individual passengers, exert limited direct bargaining power due to the low cost of single tickets and the sheer volume of transactions. However, their collective sensitivity to price and service quality, amplified by emerging alternatives and government policies, grants them significant indirect influence. The £3 fare cap introduced in England from January 2025 is a prime example, directly capping FirstGroup's pricing flexibility and impacting revenue streams.

Local authorities and government bodies like the Department for Transport (DfT) hold substantial power, dictating service standards, pricing, and financial support for contracted services. In 2024, continued government investment in bus service improvements directly shaped the operational environment for FirstGroup, underscoring this significant customer influence.

Corporate clients and educational institutions, when procuring contracted services, possess moderate bargaining power through tender processes. This competition allows them to negotiate terms based on price and service specifics. The increased competition among transport providers in 2024 further bolstered client leverage.

| Customer Type | Bargaining Power Level | Key Influencing Factors | 2024/2025 Impact Example |

|---|---|---|---|

| Individual Passengers | Low (Direct), High (Collective) | Price sensitivity, service quality, alternative options, government policy | £3 fare cap (Jan 2025) |

| Local Authorities/DfT | High | Contractual terms, service specifications, subsidies, regulatory frameworks | Continued funding for bus service improvements (2024) |

| Contracted Service Clients (Schools, Corporates) | Moderate | Tender processes, competition among providers, price, service quality | Increased provider competition in 2024 |

| Passenger Groups/Advocacy Bodies | Moderate (Indirect) | Public opinion, lobbying, media campaigns | Campaigns for fare transparency and affordability |

Same Document Delivered

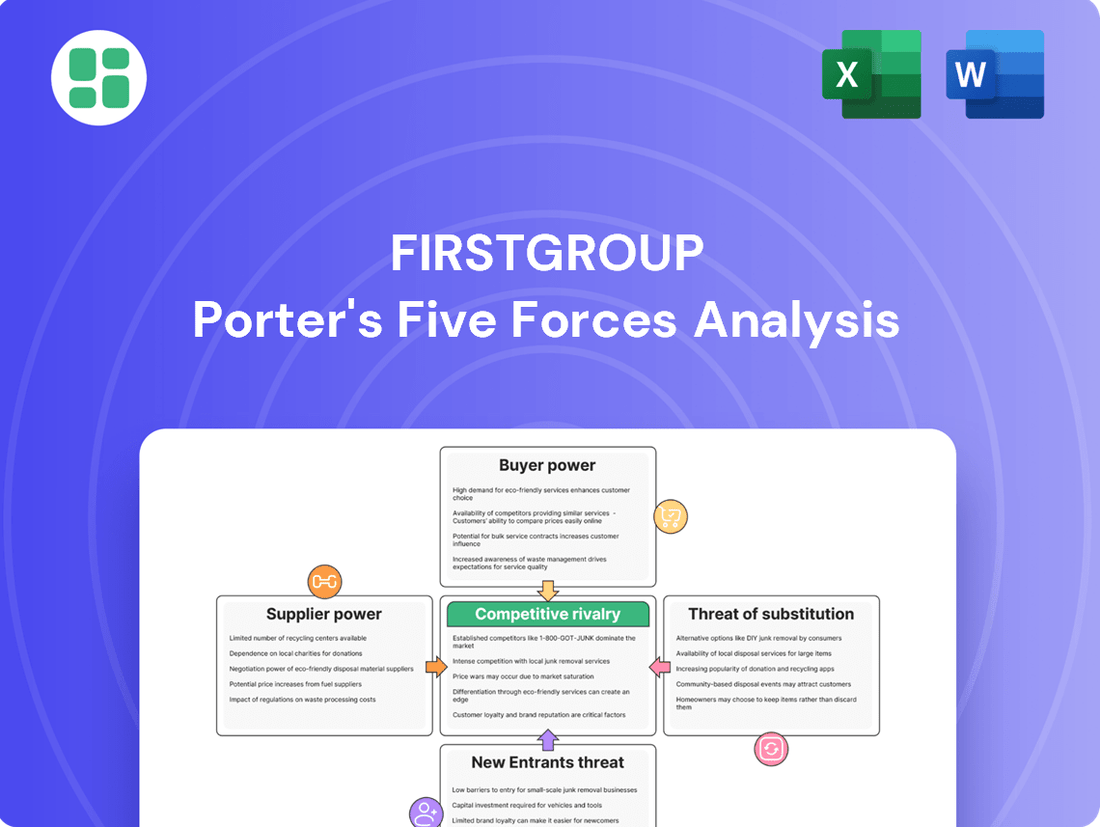

Firstgroup Porter's Five Forces Analysis

This preview showcases the complete Firstgroup Porter's Five Forces Analysis, detailing the competitive landscape of the transport sector. You're viewing the exact, professionally formatted document that will be delivered instantly upon purchase, offering a comprehensive understanding of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Rivalry Among Competitors

FirstGroup operates in a highly competitive UK transport landscape, facing significant rivalry from established players like Go-Ahead, Stagecoach, and Arriva. These companies vie for passengers and contracts across both bus and rail sectors. For instance, in the 2023 fiscal year, Stagecoach reported revenue of £1.2 billion, highlighting the scale of competition FirstGroup contends with.

The competition extends to securing lucrative rail franchises and local bus service contracts, where operators bid against each other. Even with industry consolidation, the battle for market share and profitable routes remains intense. This dynamic pressure necessitates continuous efficiency improvements and service innovation from FirstGroup to maintain its competitive edge.

The bus market, particularly for non-contracted services, exhibits significant fragmentation. While large companies like FirstGroup operate, numerous smaller, independent bus operators also compete. These local players often leverage lower overheads and strong community relationships to offer competitive pricing and specialized services on particular routes.

FirstGroup faces intense competition for government contracts and franchises, a critical revenue source, especially in its rail division. The bidding process is rigorous, demanding detailed proposals on service standards, operational efficiency, and capital investment plans.

The landscape is further shaped by evolving government policy; for instance, the Passenger Railway Services (Public Ownership) Act 2024 signals a potential shift, with some rail services moving to public ownership, directly impacting the competitive dynamics for private operators like FirstGroup.

Price and Service Differentiation

Competitive rivalry within the transport sector is intense, fueled by both price wars and a strong emphasis on service improvements. Companies are vying for passengers by enhancing reliability, increasing service frequency, and elevating the overall customer experience. Technological integration, such as real-time tracking and mobile ticketing, is becoming a standard expectation.

Beyond operational enhancements, sustainability is a key battleground. Significant investments are being made in zero-emission fleets, with companies like FirstGroup actively pursuing these greener alternatives. This focus not only appeals to environmentally aware consumers but also aligns with stringent government regulations and targets, further intensifying the competitive landscape.

- Price Competition: Operators frequently adjust fares to attract and retain customers.

- Service Differentiation: Improvements in reliability, frequency, and customer experience are crucial.

- Technological Advancements: Real-time information and mobile ticketing are key differentiators.

- Sustainability Focus: Investments in zero-emission vehicles are becoming a competitive necessity.

Industry Growth and Consolidation

While the UK bus market saw a growth in registrations in 2024, the broader public transport sector navigates a complex environment of challenges and opportunities. This dynamic landscape fuels strategic maneuvers among industry players.

Consolidation is a key trend, exemplified by FirstGroup's acquisition of RATP London. This move highlights a deliberate strategy to counter competitive pressures and bolster market share within the sector.

The ongoing pursuit of operational efficiency and economies of scale continues to be a significant force shaping the competitive dynamics within the industry.

- Market Growth: UK bus registrations showed an increase in 2024, signaling a positive trend in vehicle acquisition.

- Consolidation Driver: FirstGroup's acquisition of RATP London for an estimated £50 million in 2024 demonstrates a clear consolidation strategy.

- Efficiency Focus: Companies are actively seeking greater efficiency and scale to remain competitive.

- Competitive Landscape: The industry's structure is evolving as firms respond to market pressures and growth opportunities.

Competitive rivalry within the UK transport sector remains a defining characteristic for FirstGroup. Companies like Stagecoach, with its reported revenue of £1.2 billion in fiscal year 2023, and Arriva are direct competitors for both bus passengers and lucrative rail franchises. The intense bidding for government contracts and local bus service agreements, coupled with a fragmented bus market featuring numerous smaller operators, ensures constant pressure on pricing and service delivery.

| Competitor | 2023 Revenue (Est.) | Key Business Areas |

|---|---|---|

| Stagecoach | £1.2 billion | Bus and Rail |

| Arriva | Not Publicly Disclosed (Part of Deutsche Bahn) | Bus and Rail |

| Go-Ahead | £1.3 billion | Bus and Rail |

SSubstitutes Threaten

Private cars remain a potent substitute for Firstgroup's public transport services, especially for journeys outside major city centers where public transport coverage can be less frequent. The convenience of door-to-door travel and personal flexibility offered by private vehicles is a strong draw for many consumers.

In 2024, the average UK household expenditure on transport, including private vehicle running costs, continued to be a significant portion of disposable income. While fluctuating fuel prices can sometimes temper private car use, the underlying appeal of personal mobility remains high, directly impacting demand for bus and rail travel.

For shorter journeys, walking and cycling are increasingly viable and promoted substitutes for traditional public transport. Government initiatives in 2024 continue to focus on improving cycling infrastructure and promoting active travel, making these options more attractive. For instance, the UK government's Gear Change plan aims to significantly boost cycling and walking, with continued investment in cycle lanes and pedestrian zones.

The growth in cycle mode share, even post-pandemic, underscores a tangible shift in travel habits for certain distances. In 2023, cycling accounted for an average of 2.2% of all trips in Great Britain, a figure that has seen steady growth over the past decade, demonstrating the increasing appeal of this substitute for commuting and leisure.

Ride-sharing platforms like Uber and Bolt, along with traditional taxis, present a significant threat of substitutes for Firstgroup's bus and rail services. These alternatives offer on-demand flexibility, especially appealing for shorter trips or in areas where public transport options are less frequent. While often pricier per person, their convenience can make them competitive, particularly for group travel or when time is a critical factor.

Remote Work and E-commerce

The sustained rise of remote work and the expansion of e-commerce present a formidable threat of substitutes for Firstgroup's passenger transport services. These trends fundamentally alter commuting habits and shopping behaviors, diminishing the reliance on traditional public transport for daily journeys and retail activities.

This shift is not a temporary blip. By late 2023, studies indicated that a significant portion of the workforce continued to embrace hybrid or fully remote models, a stark contrast to pre-pandemic norms. For instance, data from the U.S. Bureau of Labor Statistics in early 2024 showed that remote work arrangements remained substantially higher than in 2019, directly impacting the ridership numbers for commuter rail and bus services.

- Reduced Commuting Needs: Increased remote work directly cuts the demand for daily travel to physical workplaces, a core revenue driver for bus and rail operators.

- E-commerce Dominance: The convenience of online shopping reduces the need for physical trips to retail centers, impacting passenger journeys to shopping districts.

- Behavioral Shift: These lifestyle changes are proving sticky, with many consumers and employees preferring flexible arrangements, making a full return to pre-pandemic travel patterns unlikely.

- Impact on Revenue: Consequently, Firstgroup faces a structural decline in passenger numbers for services historically reliant on commuting and retail-related travel.

Alternative Public Transport Modes

Within the broader public transport landscape, alternative modes like trams and underground networks present a direct threat. For instance, the London Underground, a significant rail network, competes with FirstGroup's bus and rail operations for commuter journeys. In 2023, Transport for London reported over 1.2 billion passenger journeys on the Underground, highlighting its substantial reach.

Inter-city coach services, some operated by FirstGroup itself, also function as substitutes. These can offer a more flexible or cost-effective alternative for certain long-distance travel needs compared to rail. The UK coach market saw a significant recovery post-pandemic, with many operators reporting increased passenger numbers as travel confidence returned.

Furthermore, the push for integrated national transport strategies aims to better utilize and connect these various modes. This can lead to more seamless journeys that might bypass traditional FirstGroup services. For example, a traveler might combine a regional train with a local tram, reducing reliance on a single bus or rail operator for the entire trip.

- Trams and underground networks offer direct competition for urban and suburban travel.

- Inter-city coaches can substitute for longer-distance rail journeys.

- Integrated transport planning can facilitate modal shifts away from single operators.

- The London Underground alone saw over 1.2 billion passenger journeys in 2023.

The threat of substitutes for Firstgroup is substantial, encompassing private cars, active travel, ride-sharing, and even other public transport modes. The convenience and flexibility of private vehicles remain a strong draw, while government support for cycling and walking makes these healthier alternatives more appealing for shorter trips. In 2023, cycling accounted for 2.2% of all trips in Great Britain, a growing trend.

Ride-sharing services and taxis offer on-demand convenience, particularly for specific journey types or locations where public transport is less frequent. Furthermore, the persistent trend of remote and hybrid work, which continued to impact commuting patterns significantly into 2024, directly reduces the demand for daily public transport services. E-commerce also plays a role by decreasing the need for travel to retail destinations.

| Substitute Type | Key Features | Impact on Firstgroup | 2024 Relevance |

| Private Cars | Door-to-door convenience, flexibility | Directly competes for passenger journeys | High, despite fuel costs |

| Active Travel (Walking/Cycling) | Health benefits, environmental appeal, cost-free | Reduces demand for short public transport trips | Growing, supported by infrastructure investment |

| Ride-Sharing/Taxis | On-demand, flexible, convenient for specific needs | Competes for shorter trips and when time is critical | Significant, especially in urban areas |

| Remote/Hybrid Work | Reduced need for daily commuting | Structural decline in commuter revenue | Persistent trend impacting ridership |

| E-commerce | Convenience, avoids travel to retail | Reduces journeys to shopping districts | Continued growth in online retail |

Entrants Threaten

Entering the public transport sector, particularly rail and extensive bus networks, demands significant upfront capital. This includes substantial investment in fleets of vehicles, maintenance depots, and advanced operational technology. For instance, the cost of acquiring modern, often zero-emission, buses or trains, coupled with the necessary supporting infrastructure, presents a formidable obstacle for potential new competitors.

The UK public transport sector presents significant barriers to entry due to stringent regulatory requirements. New companies must secure numerous licenses and safety certifications, along with adhering to complex operational standards, a process that can be both time-consuming and financially demanding.

Securing rail franchises or bus route contracts involves navigating extensive regulatory frameworks. For instance, in 2024, the Department for Transport continues to manage a competitive tendering process for rail franchises, where demonstrating compliance with safety, service, and financial stability criteria is paramount for any aspiring operator.

Established operators like FirstGroup benefit from existing access to key infrastructure, such as extensive train track networks and strategically located bus depots. This existing infrastructure provides a significant cost advantage and operational efficiency that new entrants would struggle to replicate quickly. For instance, securing rights to operate on busy rail lines or obtaining prime depot locations often involves lengthy regulatory processes and substantial upfront investment, acting as a considerable barrier.

New entrants would face substantial challenges in securing desirable routes and track access rights. These rights are frequently limited and are allocated through competitive bidding processes or directly by regulatory bodies, which often favor incumbent operators with proven track records and existing commitments. In the UK rail sector, for example, securing access to the national rail network for new passenger services involves complex negotiations and can be subject to capacity constraints, making it difficult for newcomers to establish a competitive foothold.

Economies of Scale and Experience

Incumbent operators like Firstgroup leverage significant economies of scale, particularly in areas like fleet procurement and maintenance. This allows them to spread fixed costs over a larger operational base, leading to lower per-unit costs. For instance, bulk purchasing of buses or trains can secure substantial discounts, a benefit new entrants would find hard to replicate initially.

New entrants face a steep challenge in matching the cost efficiencies of established players. Without the same scale, their procurement costs will likely be higher, and they may not achieve the same level of network optimization. This cost disadvantage makes it difficult for them to compete effectively on price, a critical factor in the public transportation sector.

Furthermore, operational experience plays a crucial role. Firstgroup has refined its maintenance schedules, route planning, and driver training over many years. This accumulated expertise translates into smoother operations and potentially fewer disruptions, contributing to a higher service quality that is difficult for a newcomer to immediately match.

- Economies of Scale: Incumbent operators benefit from bulk purchasing power, reducing costs for vehicles, fuel, and maintenance.

- Operational Experience: Years of operation lead to optimized route planning, efficient maintenance, and established supply chains.

- Network Effects: Established networks of routes and depots provide logistical advantages that are costly and time-consuming to build from scratch.

- Brand Recognition: A long-standing presence builds customer trust and brand loyalty, which new entrants must overcome.

Brand Loyalty and Network Effects

Existing operators like FirstGroup benefit from significant brand loyalty. Years of consistent service have cultivated trust and familiarity among passengers, making them less likely to switch to a new provider. This loyalty is reinforced by established networks and integrated ticketing systems that offer convenience.

Network effects also play a crucial role. The more routes and services a company like FirstGroup offers, the more valuable its network becomes to passengers. For instance, FirstGroup's extensive UK bus network in 2024, serving millions of passengers daily, creates a strong barrier to entry for newcomers who would need to replicate this reach and connectivity.

- Established Brand Recognition: FirstGroup's long-standing presence fosters customer trust and preference.

- Passenger Familiarity: Reliance on known routes, schedules, and ticketing systems deters switching.

- Network Value: The extensive connectivity offered by established players is difficult and costly to replicate.

- High Marketing Costs: New entrants face substantial investment needs for brand building and service development to challenge incumbents.

The threat of new entrants in the public transport sector, particularly for established players like FirstGroup, is generally low due to substantial barriers. These include massive capital requirements for fleets and infrastructure, stringent regulatory hurdles requiring extensive licensing and certifications, and the difficulty in securing essential route and track access rights. Furthermore, existing operators benefit from established economies of scale in procurement and operations, along with the significant advantage of brand recognition and network effects that foster customer loyalty.

| Barrier Type | Description | Example for FirstGroup (2024) |

|---|---|---|

| Capital Requirements | High upfront investment in vehicles, depots, and technology. | Acquisition of a new fleet of zero-emission buses or modern train carriages can cost millions. |

| Regulatory Hurdles | Complex licensing, safety certifications, and compliance with operational standards. | Securing a new bus operating license involves detailed safety and environmental checks. |

| Infrastructure Access | Difficulty in obtaining rights to operate on existing rail networks or secure prime depot locations. | Negotiating track access for new rail services can face capacity constraints and high fees. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to bulk purchasing and operational efficiency. | FirstGroup's large-scale procurement of fuel and spare parts leads to significant cost savings compared to smaller operators. |

| Brand Loyalty & Network Effects | Established customer trust and the value of extensive route networks deter new entrants. | FirstGroup's extensive UK bus network, serving millions daily, provides a competitive advantage through connectivity and convenience. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Firstgroup is built upon a foundation of robust data, including Firstgroup's annual reports and investor presentations, alongside industry-specific market research from firms like Statista and IBISWorld. This blend ensures a comprehensive understanding of competitive dynamics.