FirstCash SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

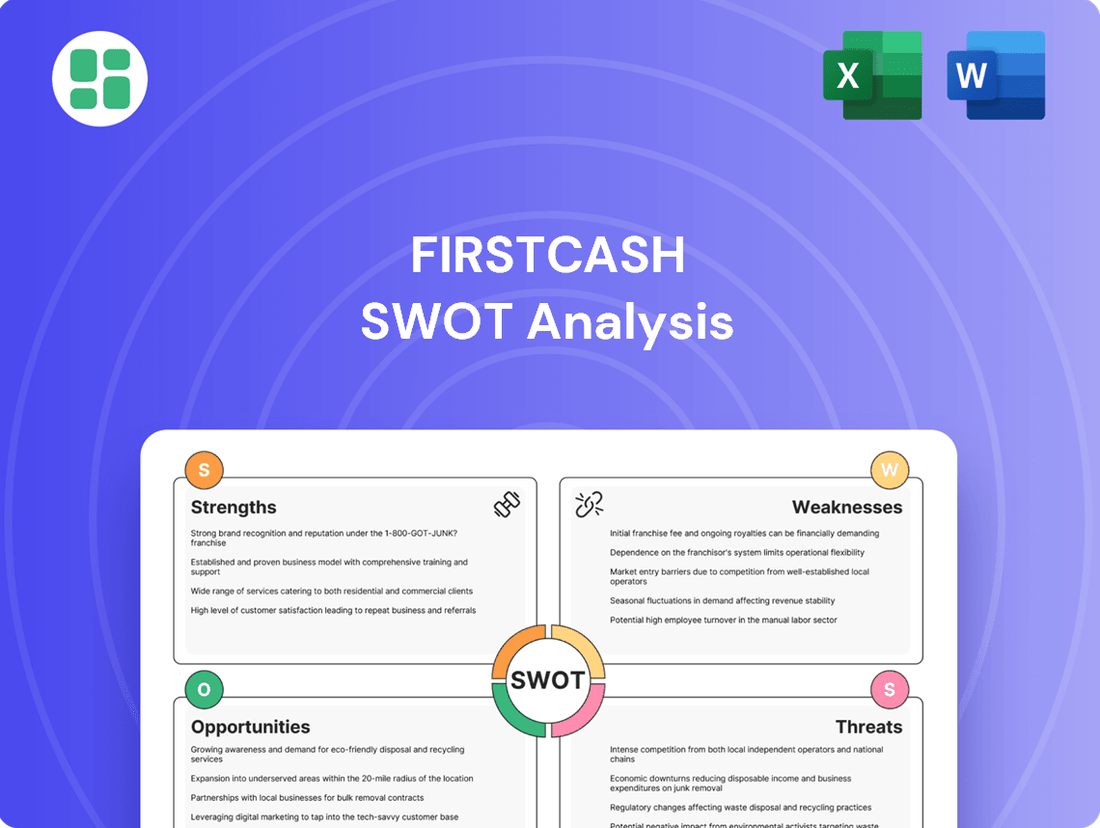

FirstCash, a leader in the pawn industry, boasts strong brand recognition and a vast store network as key strengths. However, it faces potential threats from evolving consumer preferences and increased competition. Our full SWOT analysis delves into these dynamics, providing a comprehensive view of their market position.

Want the full story behind FirstCash’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FirstCash Holdings, Inc. stands as a dominant force in the international pawn industry, operating over 3,000 retail locations. This extensive network, primarily across the U.S. and Latin America, offers significant geographic diversification, buffering the company against localized economic downturns.

The strategic acquisition of H&T Group plc in 2023, a major player in the UK market, further cemented FirstCash's global reach. This move positions FirstCash as the largest publicly traded pawn platform operating across North America, Latin America, and Europe, enhancing its revenue streams and market influence.

FirstCash demonstrated robust financial performance in the second quarter of 2025, reporting a substantial 22% year-over-year increase in net income. This growth was complemented by an impressive 31-36% surge in adjusted earnings per share, underscoring the company's enhanced profitability.

Further solidifying its financial strength, FirstCash recently announced an 11% increase in its quarterly dividend, raising it to $0.42 per share. This consistent return to shareholders reflects the company's operational efficiency and its capacity to generate reliable profits.

FirstCash's strength lies in its robust business model, catering to consumers who often find traditional financial institutions inaccessible. This focus on underserved markets ensures consistent demand for its services.

The company's resilience is evident in its financial performance, with same-store pawn receivables experiencing a significant 13% increase in both the U.S. and Latin America during the recent reporting periods. This growth underscores the essential nature of their offerings, especially when economic conditions tighten and alternative credit sources are scarce.

Diversified Service Offerings

FirstCash's diversified service offerings extend well beyond traditional pawn loans and merchandise sales. The company actively operates American First Finance (AFF), a segment dedicated to point-of-sale (POS) payment solutions. This strategic expansion into retail finance is a key strength.

AFF has demonstrated robust performance, with significant growth in originations. Notably, this segment experienced a substantial 46% increase in earnings for the first quarter of 2024, highlighting its contribution to FirstCash's overall profitability. This diversification across pawn operations and retail finance effectively broadens the company's revenue streams.

- Diversified Revenue Streams: Operations include traditional pawn services alongside a growing point-of-sale finance segment (AFF).

- AFF Segment Growth: American First Finance saw a significant 46% increase in segment earnings in Q1 2024.

- Reduced Reliance: Diversification mitigates dependence on any single product or service, enhancing stability.

Strong Cash Flow and Disciplined Capital Allocation

FirstCash exhibits robust financial performance, evidenced by its impressive cash flow generation. For the trailing twelve months ending June 30, 2025, the company reported $555 million in operating cash flows, alongside $267 million in adjusted free cash flows. This consistent cash generation underpins its ability to pursue growth opportunities and reward shareholders.

The company’s strength lies in its disciplined approach to capital allocation. FirstCash consistently returns value to its investors through regular dividend payments and strategic share repurchase programs. This financial prudence ensures that capital is deployed effectively, further solidifying its strong market position and enhancing long-term shareholder value.

- Strong Operating Cash Flow: $555 million for the trailing twelve months ending June 30, 2025.

- Significant Free Cash Flow: $267 million in adjusted free cash flows for the same period.

- Disciplined Capital Allocation: Consistent dividend payments and share repurchases.

- Shareholder Value Enhancement: Strong cash generation supports growth and returns capital.

FirstCash's core strength is its expansive international footprint, operating over 3,000 locations across the U.S., Latin America, and Europe following the 2023 acquisition of H&T Group. This diversification provides significant resilience against regional economic fluctuations.

The company's business model effectively serves an often-underserved customer base, ensuring consistent demand for its pawn and retail finance services. This focus on accessibility for consumers outside traditional banking channels is a key differentiator.

Financially, FirstCash demonstrates robust performance, with a 22% year-over-year increase in net income and a 31-36% surge in adjusted EPS reported for Q2 2025. This is further supported by strong operating cash flow of $555 million and adjusted free cash flow of $267 million for the twelve months ending June 30, 2025.

| Metric | Value (TTM ending June 30, 2025) | Significance |

|---|---|---|

| Operating Cash Flow | $555 million | Indicates strong cash generation from core operations. |

| Adjusted Free Cash Flow | $267 million | Highlights cash available after capital expenditures, supporting growth and shareholder returns. |

| Same-Store Pawn Receivables Growth | 13% (U.S. & Latin America) | Demonstrates consistent demand and operational effectiveness in core pawn services. |

| American First Finance (AFF) Earnings Growth | 46% (Q1 2024) | Shows significant expansion and profitability in the retail finance segment. |

What is included in the product

Analyzes FirstCash’s competitive position through key internal and external factors, highlighting its strong brand and market presence alongside potential regulatory challenges and economic vulnerabilities.

Offers a clear, actionable framework to address FirstCash's competitive challenges and leverage its market strengths.

Weaknesses

The alternative financial services sector, which includes pawn shops and point-of-sale lending, is subject to continuous regulatory examination. This environment can result in higher operating costs and restrictions on the types of products FirstCash can offer its customers.

FirstCash recently resolved a significant legal matter, settling with the Consumer Financial Protection Bureau (CFPB) for $11 million due to violations of the Military Lending Act. This settlement highlights FirstCash's exposure to potential future compliance expenses and ongoing legal challenges.

FirstCash's substantial debt burden presents a notable weakness. As of the second quarter of 2025, the company carried $1.68 billion in total long-term debt, resulting in a consolidated debt ratio of 2.5:1. This leverage, even with some fixed-rate components, exposes FirstCash to considerable financial risk should interest rates climb or its cash flow falter.

The pawn industry often faces a public perception challenge, sometimes viewed negatively due to historical stereotypes or misunderstandings about its services. This stigma can hinder FirstCash's ability to attract a wider range of customers or enter new markets, potentially impacting its brand appeal and growth beyond its current customer segments.

Revenue Decline in Q2 2025

FirstCash's Q2 2025 performance, while showing overall strong earnings, did present a slight revenue dip. Total revenue for the quarter was $830.6 million, a marginal decrease from $831.0 million reported in Q2 2024. This minor decline, even with continued profitability, suggests potential headwinds in specific business areas or market dynamics that require careful observation.

While the revenue figure represents a small change, it's crucial to analyze the underlying drivers. A sustained trend of revenue stagnation or decline, even if earnings per share remain robust due to cost management or other factors, could indicate:

- Slowing customer demand in key markets.

- Increased competition impacting market share.

- Challenges in specific product or service categories.

- Potential for future margin compression if revenue doesn't rebound.

Sensitivity to Economic Conditions

FirstCash's performance is closely tied to the broader economic climate. While recessions can boost demand for pawn services as consumers seek quick cash, a severe or prolonged downturn poses risks. For instance, if economic hardship intensifies, customers may find it increasingly difficult to redeem their pawned items. This could lead to a buildup of inventory for FirstCash, potentially resulting in losses when that merchandise is eventually sold. This creates a delicate balance where economic weakness can be both a driver of business and a source of significant financial strain.

The company's sensitivity to economic shifts is a notable weakness. Consider the impact on their inventory: if more customers default on loans due to widespread financial distress, FirstCash would be left with more unsold goods. This could tie up capital and reduce profitability. For example, during periods of high unemployment, the ability of individuals to repay loans on their valuable possessions decreases, directly affecting FirstCash's asset management and revenue streams.

- Economic Downturns: While short-term economic weakness can increase loan volume, prolonged severe recessions may lead to higher inventory write-offs.

- Customer Default Risk: Increased unemployment and financial hardship directly correlate with a higher likelihood of customers being unable to redeem pawned items.

- Inventory Management Challenges: A surge in unredeemed collateral can strain FirstCash's ability to manage and liquidate inventory effectively, impacting profitability.

FirstCash faces significant regulatory scrutiny, as evidenced by its $11 million settlement with the CFPB for Military Lending Act violations in early 2025. This highlights ongoing compliance costs and potential future legal challenges. The company's substantial debt, totaling $1.68 billion in long-term debt as of Q2 2025 with a 2.5:1 debt ratio, exposes it to considerable financial risk from interest rate fluctuations or cash flow disruptions.

A slight revenue dip in Q2 2025, from $831.0 million in Q2 2024 to $830.6 million, suggests potential market headwinds or slowing customer demand. Furthermore, the pawn industry's negative public perception can limit customer acquisition and market expansion.

| Weakness | Description | Impact | Data Point |

| Regulatory Compliance | Subject to continuous examination, leading to higher operating costs and product restrictions. | Increased expenses, limited service offerings. | $11 million CFPB settlement (early 2025). |

| High Debt Levels | Significant long-term debt burden. | Financial risk, vulnerability to interest rate changes. | $1.68 billion long-term debt (Q2 2025); 2.5:1 debt ratio. |

| Revenue Stagnation | Marginal revenue decrease in Q2 2025. | Potential headwinds, requires analysis of underlying drivers. | Q2 2025 revenue: $830.6 million (vs. $831.0 million in Q2 2024). |

| Public Perception | Negative stereotypes associated with the pawn industry. | Hinders customer acquisition and market expansion. | N/A (Qualitative) |

Preview Before You Purchase

FirstCash SWOT Analysis

This is the same FirstCash SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report on FirstCash's strengths, weaknesses, opportunities, and threats.

Opportunities

FirstCash's acquisition of H&T Group plc in the UK is a game-changer, instantly making it the largest publicly traded pawn platform worldwide. This move opens doors to significant market share gains in a new, major territory.

This international expansion offers a golden opportunity to achieve greater economies of scale and streamline operations across previously untapped regions, boosting overall efficiency and profitability.

The global pawn market is expected to see consistent growth, with projections suggesting a compound annual growth rate (CAGR) between 2.1% and 4.7% starting in 2025. This steady upward trend presents a significant opportunity for companies like FirstCash.

Beyond traditional pawnbroking, the alternative financing sector is experiencing a boom. This expansion is fueled by a growing need for credit options that are readily available and often facilitated through digital platforms, making it easier for a wider range of consumers to access funds.

FirstCash is strategically positioned to benefit from these overarching industry movements. By leveraging its established presence and adapting to evolving consumer preferences for accessible and digital financial solutions, the company can effectively tap into the expanding alternative finance and pawn markets.

FirstCash can leverage technological advancements to boost efficiency and expand its customer base. Embracing online pawn services and digital lending platforms, as seen with the broader industry trend towards mobile applications, opens doors for new product offerings and a better customer experience.

The company's operational efficiency can be significantly improved through AI-driven risk assessment tools. This digital transformation aligns with the pawn industry's shift towards increased digital transactions, offering avenues for growth.

Expanding Demand from Underbanked Consumers

A significant portion of the global population, estimated to be around 1.4 billion adults as of 2023, remains unbanked or underbanked, highlighting a substantial market for financial services. This demographic often faces financial insecurity, driving a consistent demand for short-term borrowing solutions. FirstCash's business model, which centers on providing accessible and rapid cash advances without the rigorous credit assessments typical of traditional banks, is well-positioned to capitalize on this persistent need. The company's ability to serve these consumers directly translates into a continuous avenue for growth.

FirstCash's strategic focus on the underbanked segment presents a compelling opportunity. In 2024, the global market for payday loans and similar short-term credit is projected to continue its expansion, driven by economic uncertainties and the increasing reliance on flexible financing options. For instance, in the United States alone, millions of consumers turn to short-term loans annually to cover unexpected expenses or bridge income gaps. FirstCash's established network and customer-centric approach allow it to tap into this demand effectively.

- Global Underbanked Population: Approximately 1.4 billion adults worldwide lacked access to formal financial services in 2023, creating a vast untapped market.

- Demand for Short-Term Credit: Financial insecurity and the need for immediate liquidity continue to fuel demand for accessible short-term borrowing options.

- FirstCash's Value Proposition: The company offers quick, convenient cash solutions, bypassing traditional credit hurdles, which resonates strongly with the target demographic.

- Market Growth Potential: The ongoing economic climate and evolving consumer financial habits suggest a sustained and growing market for FirstCash's services.

Diversification within POS Payment Solutions

The American First Finance (AFF) segment is actively broadening its merchant partnerships beyond traditional furniture retail into promising areas like automotive and elective medical services. This diversification strategy is crucial for mitigating risks associated with over-reliance on any single market sector, thereby strengthening AFF's overall market position and resilience.

Further opportunities lie in capitalizing on the increasing transaction volumes and the expanding network of merchant partners. For instance, in the first quarter of 2024, AFF reported a 14% increase in its total customer base, demonstrating robust growth in its service reach.

- Expanding into new verticals: Automotive and elective medical sectors offer significant growth potential, reducing dependence on the furniture industry.

- Increasing transaction volumes: Higher usage across existing and new merchant partners directly translates to revenue growth.

- Growing merchant network: Adding more locations and partners expands the accessibility and reach of AFF's payment solutions.

FirstCash's acquisition of H&T Group plc in the UK positions it as the largest publicly traded pawn platform globally, creating an immediate opportunity for substantial market share expansion in a new, key territory.

This international move allows for greater economies of scale and operational efficiencies across new regions, enhancing overall profitability. The global pawn market is projected to grow with a CAGR between 2.1% and 4.7% from 2025, presenting a steady upward trend for FirstCash.

The company can leverage technological advancements, such as online pawn services and digital lending platforms, to boost efficiency and attract a wider customer base, aligning with the industry's shift towards mobile applications and digital transactions.

FirstCash is well-positioned to serve the approximately 1.4 billion unbanked or underbanked adults globally as of 2023, who often require accessible, short-term borrowing solutions. The American First Finance segment is also expanding its merchant partnerships into automotive and elective medical services, diversifying its revenue streams and strengthening its market position.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| International Expansion (UK Market) | Acquisition of H&T Group plc makes FirstCash the largest publicly traded pawn platform globally, enabling significant market share gains. | Largest publicly traded pawn platform worldwide. |

| Economies of Scale | Streamlining operations across new international regions can boost efficiency and profitability. | Global pawn market projected CAGR of 2.1%-4.7% from 2025. |

| Digital Transformation | Embracing online pawn services and digital lending platforms can enhance customer experience and expand offerings. | Industry trend towards mobile applications and digital transactions. |

| Serving the Underbanked | Capitalizing on the consistent demand from the unbanked/underbanked population for accessible short-term credit. | ~1.4 billion unbanked/underbanked adults globally (2023). |

| AFF Vertical Expansion | Broadening merchant partnerships into automotive and elective medical services. | AFF Q1 2024 customer base increased by 14%. |

Threats

The alternative finance sector, including companies like FirstCash, faces a growing challenge from evolving regulations in the U.S. and abroad. New rules, such as the Servicemember Civil Relief Act (SCRA) and potential state-level regulations impacting interest rate caps, could force adjustments to product offerings and pricing strategies.

These regulatory shifts translate directly into higher compliance expenses for FirstCash. The need to adapt systems, train staff, and ensure adherence to new mandates adds significant operational costs, potentially impacting the company's bottom line and flexibility in its business model.

The alternative financing sector is seeing a surge of new fintech entrants and established banks offering products for credit-constrained customers, directly challenging FirstCash’s market position. This intensified competition, particularly within its Retail POS Payment Solutions, could indeed squeeze growth prospects and profitability as more entities vie for the same customer base.

A robust economic recovery presents a potential challenge for FirstCash. As the economy strengthens, consumers are likely to find more traditional credit options available, potentially reducing their reliance on pawn and short-term lending services. This shift could translate to lower transaction volumes for FirstCash, impacting its core revenue streams.

Reputational Risk and Negative Public Scrutiny

FirstCash faces significant reputational risks due to its business model, which often involves short-term, high-interest loans. Negative public perception regarding lending practices and customer treatment can damage its brand image. For instance, the company agreed to pay $25 million in 2022 to settle a Consumer Financial Protection Bureau (CFPB) lawsuit alleging unfair and deceptive practices, including misleading customers about loan terms and fees. This settlement highlights past issues that can fuel ongoing scrutiny.

Such past litigation and ongoing public concern can erode customer trust, making it harder to attract and retain clients. Investor confidence may also waver, impacting share price and the company's ability to raise capital. Furthermore, negative sentiment can influence legislative bodies, potentially leading to stricter regulations that could impact FirstCash's operations and profitability.

- Reputational Vulnerability: FirstCash's core business of offering short-term, high-cost loans inherently attracts scrutiny regarding its fairness and customer impact.

- Impact of Past Actions: The $25 million CFPB settlement in 2022 serves as a concrete example of how past practices can lead to significant financial penalties and reputational damage.

- Erosion of Trust: Negative public perception can directly affect customer acquisition and retention, as well as investor sentiment, potentially leading to a lower market valuation.

- Regulatory Pressure: Public and governmental disapproval often translates into increased regulatory oversight and potentially restrictive legislation, posing a direct threat to business operations.

Currency Fluctuations in International Markets

FirstCash's significant presence in Latin America, particularly in countries like Mexico, makes it highly susceptible to currency fluctuations. For instance, a weakening of the Mexican peso against the U.S. dollar can directly reduce the reported U.S. dollar value of earnings generated from its Mexican operations, even if the business performs well in local currency terms.

This exposure to foreign exchange volatility poses a considerable threat to FirstCash's overall financial performance. Unfavorable currency movements can erode the profitability of its international segments, impacting consolidated earnings and potentially affecting investor confidence. For example, during periods of significant peso depreciation, the translation of local profits into U.S. dollars can show a marked decline.

- Exposure to Latin American Currencies: A substantial portion of FirstCash's revenue and profit originates from operations in Latin America, exposing the company to the inherent volatility of regional currencies.

- Impact on Reported Earnings: Adverse movements in exchange rates, such as a stronger U.S. dollar relative to currencies like the Mexican peso, can negatively impact the U.S. dollar translation of profits generated in local markets.

- Risk of Profit Erosion: Even strong local currency sales performance can be offset by currency depreciation, leading to a reduction in the actual U.S. dollar profitability reported by FirstCash.

The company faces intense competition from both fintech startups and traditional banks entering the alternative finance space, particularly in its retail point-of-sale payment solutions. This increased competition could limit FirstCash's market share and profitability as more players vie for credit-constrained customers.

A strengthening economy poses a threat as consumers gain access to more conventional credit options, potentially reducing their need for pawn and short-term lending services. This shift could lead to decreased transaction volumes for FirstCash, impacting its primary revenue streams.

FirstCash's business model, centered on short-term, high-interest loans, carries significant reputational risks. Past issues, such as the $25 million settlement with the CFPB in 2022 for alleged unfair practices, highlight ongoing scrutiny that can erode customer and investor trust, potentially leading to stricter regulations.

Significant exposure to Latin American currencies, especially the Mexican peso, presents a threat due to potential adverse exchange rate movements. A weaker peso can reduce the U.S. dollar value of earnings from Mexican operations, impacting overall reported profitability and investor confidence.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including FirstCash's official financial filings, comprehensive market research reports, and expert analyses from financial industry professionals.