FirstCash Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

FirstCash operates in a market characterized by moderate bargaining power of buyers and suppliers, with a notable threat from substitute financial services. The competitive rivalry within the pawn and lending industry is intense, while the threat of new entrants is somewhat limited by regulatory hurdles and brand loyalty.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FirstCash’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

FirstCash's reliance on unredeemed pawned items for its inventory drastically limits the bargaining power of general merchandise suppliers. Unlike traditional retailers, FirstCash doesn't depend on a constant stream of new goods from external vendors. This unique sourcing model means the company has substantial control over its inventory acquisition costs, primarily through its internal appraisal and lending processes.

FirstCash's need for capital to support its lending operations means capital providers hold some sway. However, the company's robust financial health, evidenced by strong cash flow and record earnings in the first half of 2025, generally allows it to secure favorable terms. This financial strength mitigates the bargaining power of lenders to a moderate level.

FirstCash's core pawn operations exhibit low bargaining power from technology vendors. This is because the fundamental processes and infrastructure for pawnbroking are well-established, meaning standard technology and equipment suppliers have limited leverage. In 2024, FirstCash continued to benefit from this, as its reliance on mature and widely available operational technologies prevented significant dependence on any single vendor, thus aiding in controlling technology-related expenditures within its pawn segment.

Moderate to High Power of Specialized Fintech/Data Suppliers for AFF

The American First Finance (AFF) segment, which offers a tech-forward point-of-sale payment solution, likely depends on specialized providers for its unique underwriting system and online sales features. These could include suppliers of advanced software, data analytics, and cybersecurity. The reliance on these critical technologies for AFF's competitive advantage suggests that suppliers of highly specialized fintech solutions could possess significant bargaining power.

Suppliers of niche fintech solutions are in a strong position if their offerings are essential to AFF's proprietary underwriting or e-commerce operations. The specialized nature of these technologies means that finding alternative providers might be difficult and costly for AFF, thereby increasing the suppliers' leverage. For example, if a particular data analytics platform is key to AFF's risk assessment, that supplier can demand more favorable terms.

- Specialized Technology Dependence: AFF's reliance on proprietary underwriting and e-commerce capabilities necessitates specialized fintech and data suppliers.

- High Switching Costs: The unique nature of these solutions can lead to high costs and complexities for AFF if it needs to switch providers.

- Supplier Leverage: Providers of advanced or niche fintech solutions can exert greater bargaining power due to their critical role in AFF's operations and competitive edge.

- Market Concentration: If the market for these specialized solutions is concentrated among a few providers, their power is further amplified.

High Power of Regulatory Bodies

While not direct suppliers in the traditional sense, government and regulatory bodies wield significant power over FirstCash's operations, particularly in the U.S. and Latin America. These entities dictate crucial aspects of the business, from permissible interest rates to licensing requirements and consumer protection mandates. For instance, in 2024, many U.S. states continued to enforce varying interest rate caps on short-term loans, directly influencing FirstCash's revenue potential.

The constant need to comply with these evolving regulations demands substantial investment in legal counsel, operational adjustments, and reporting infrastructure. This compliance burden effectively grants these 'non-suppliers' considerable leverage, as failure to adhere can result in hefty fines or even operational shutdowns. FirstCash's 2023 annual report highlighted ongoing efforts and associated costs related to regulatory compliance across its operating regions, underscoring this power.

- Regulatory Influence: Governments and regulatory bodies act as powerful forces shaping FirstCash's business model and profitability.

- Impact on Operations: Strict rules on interest rates, licensing, and consumer protection directly affect how FirstCash operates and earns revenue.

- Compliance Costs: Meeting regulatory requirements necessitates significant financial investment, demonstrating the power of these non-traditional suppliers.

- 2024 Context: Ongoing state-level interest rate regulations in the U.S. continue to be a key factor influencing the industry.

FirstCash's unique inventory sourcing, primarily through unredeemed pawned items, significantly diminishes the bargaining power of traditional merchandise suppliers. This internal sourcing model grants the company substantial control over its inventory acquisition costs, as it bypasses the need for ongoing relationships with external vendors for its core product offering.

The bargaining power of suppliers for FirstCash's core pawn operations is generally low. This is due to the mature and widely available nature of the technology and equipment required for pawnbroking. In 2024, FirstCash continued to leverage this by utilizing standard operational technologies, which prevented undue dependence on any single vendor and helped manage expenditures effectively.

However, the American First Finance (AFF) segment presents a different dynamic. AFF's reliance on specialized fintech solutions for its underwriting and e-commerce platforms means that suppliers of these niche technologies can wield considerable bargaining power. The critical nature of these solutions for AFF's competitive edge, coupled with potentially high switching costs, amplifies the leverage of these specialized providers.

| Segment | Supplier Type | Bargaining Power | Reasoning | 2024/2025 Data Impact |

|---|---|---|---|---|

| Pawn Operations | General Merchandise | Low | Internal sourcing of unredeemed items | Consistent cost control over inventory |

| Pawn Operations | Technology Vendors | Low | Mature, widely available technologies | Managed technology expenditures |

| American First Finance (AFF) | Specialized Fintech/Data | High | Proprietary underwriting, e-commerce needs; high switching costs | Potential for higher costs for critical software/analytics |

What is included in the product

This analysis dissects FirstCash's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the pawn industry.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing FirstCash's competitive landscape for agile response.

Customers Bargaining Power

Customers seeking pawn loans, particularly those at FirstCash, often have limited alternatives, which significantly weakens their bargaining power. These individuals frequently represent underserved segments of the population who require immediate cash and may lack access to traditional financial services. For instance, in 2024, the demand for quick, collateral-based lending remains high among consumers facing unexpected expenses and credit limitations.

FirstCash's business model caters to this need by offering loans without credit checks, a crucial factor for many of its clients. This lack of credit requirements, coupled with the urgent nature of their financial needs, means customers are less likely to negotiate terms or interest rates. The company's ability to provide a rapid liquidity solution without the extensive vetting of traditional banks gives it a strong position in setting loan conditions.

Customers of American First Finance (AFF) are experiencing a significant increase in their bargaining power. This is largely driven by the explosion of Buy Now, Pay Later (BNPL) services and other innovative alternative lending options available in the market. For instance, the BNPL market in the U.S. was projected to reach over $60 billion in transaction volume in 2024, offering consumers a wide array of flexible payment choices.

This expanding alternative finance landscape means consumers have more avenues to secure flexible payment solutions, directly impacting AFF. As a result, AFF faces pressure to maintain competitive pricing, attractive terms, and superior service to retain its customer base and attract new ones. The availability of numerous BNPL providers, each vying for market share, empowers consumers to shop around for the best deals.

Many of FirstCash's customers operate under significant financial constraints, which directly translates into a heightened sensitivity to pricing. This includes not only the fees associated with their services but also the interest rates charged and the prices of the retail merchandise offered. In 2023, the average customer income in the communities FirstCash serves often falls below national averages, highlighting this financial vulnerability.

This widespread price sensitivity among its customer base can indirectly put pressure on FirstCash's profit margins. When customers are acutely aware of every dollar, they are more likely to shop around, comparing offerings and actively seeking out the most affordable and accessible options available to them, potentially limiting FirstCash's pricing power.

Limited Switching Costs for Pawn Customers

The bargaining power of customers in the pawn industry, particularly for a company like FirstCash, is significantly influenced by low switching costs. For customers needing quick cash, the effort to move their collateral from one pawn shop to another is minimal. This ease of transition means customers can readily explore different providers if they believe they can secure better loan terms or a higher valuation for their items.

This low friction in customer movement translates to a direct impact on pricing power. Pawn shops must remain competitive to retain their customer base. For instance, if one pawn shop offers a significantly higher loan-to-value ratio or a lower interest rate, customers have little incentive not to switch. This dynamic forces pawn operators to be constantly aware of market rates and customer expectations.

Consider the broader financial landscape as well. Customers aren't solely limited to pawn shops for short-term loans. They can also access payday loans, title loans, or even borrow from friends and family. This availability of alternatives further amplifies customer bargaining power, as they have multiple avenues to explore when seeking immediate funds.

- Low Switching Costs: Customers face minimal barriers when moving between different pawn providers, allowing for easy comparison of terms.

- Price Sensitivity: The ease of switching makes customers more sensitive to pricing, including loan-to-value ratios and interest rates offered.

- Alternative Options: Customers can explore other short-term lending options like payday loans or title loans, increasing their overall bargaining power.

Growing Digital Options Enhance Customer Choice

The rise of digital platforms and mobile applications within the pawn and alternative lending industries significantly boosts customer choice. For instance, by mid-2024, a substantial percentage of consumers were actively using comparison websites and apps to research financial services, including those offered by companies like FirstCash.

This increased accessibility to information and a wider array of lending options directly translates to greater bargaining power for customers. They can now effortlessly compare interest rates, fees, and terms from multiple providers, putting pressure on individual companies to offer more competitive terms.

- Digital Adoption: By 2024, over 60% of consumers surveyed indicated they had used at least one digital comparison tool for financial products in the past year.

- Information Transparency: Online reviews and readily available service details empower customers to make more informed decisions, reducing information asymmetry.

- Market Reach: Digital channels allow customers to easily explore providers beyond their immediate geographic location, broadening their options and strengthening their negotiating position.

FirstCash customers generally have low bargaining power due to limited alternatives and high price sensitivity. Many rely on pawn services for immediate cash, making them less likely to negotiate terms. In 2023, the average income in areas served by FirstCash was below national averages, underscoring this price sensitivity.

The ease with which customers can switch between pawn providers, coupled with the availability of alternative lending options like payday loans, further limits FirstCash's pricing power. Digital platforms in 2024 also empower customers by increasing transparency and access to comparative information, forcing companies to remain competitive.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2023/2024) |

|---|---|---|

| Limited Alternatives | Weakens power | High demand for immediate cash among underserved segments. |

| Price Sensitivity | Increases power | Average customer income in served communities below national averages (2023). |

| Low Switching Costs | Increases power | Minimal effort to move collateral between pawn shops. |

| Alternative Lending Options | Increases power | BNPL market projected to exceed $60 billion in transaction volume (2024). |

| Digital Information Access | Increases power | Significant consumer use of comparison tools for financial services (mid-2024). |

Preview the Actual Deliverable

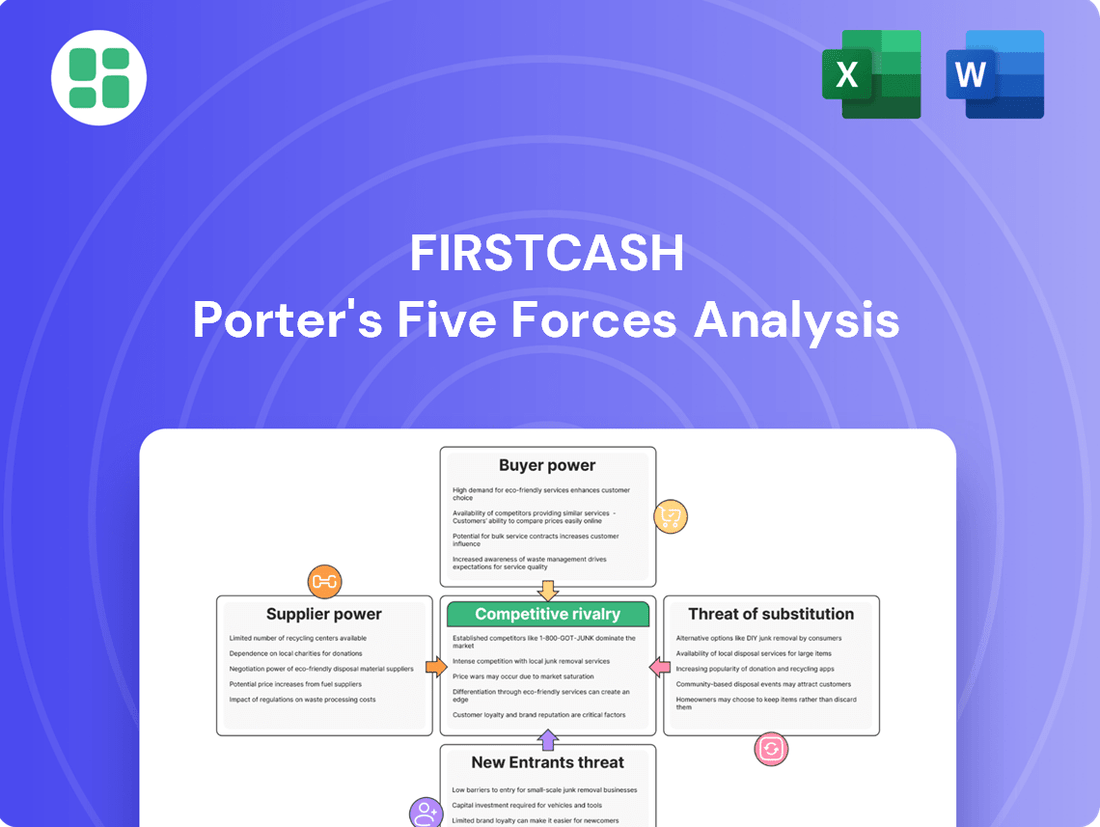

FirstCash Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis for FirstCash you'll receive immediately after purchase—no surprises, no placeholders. It meticulously details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive document is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The pawn industry, though growing, sees intense competition. Major players like FirstCash and EZCorp operate alongside numerous smaller, local pawn shops. This crowded landscape means rivalry is fierce, with success often hinging on factors like prime locations and consistently fair appraisals.

Customer service and the interest rates offered on pawn loans are also critical battlegrounds. In 2023, FirstCash reported revenue of $2.1 billion, demonstrating its scale, while EZCorp's revenue reached $578.7 million, highlighting the significant market presence of these larger entities. However, the sheer number of smaller competitors means that even these giants must constantly differentiate themselves to maintain market share.

FirstCash's American First Finance division contends with intensifying competition from digital lenders and fintech innovators. These platforms, offering everything from personal loans to buy-now-pay-later (BNPL) options, are rapidly gaining market share, particularly among consumers seeking quick credit solutions.

The fintech lending sector is booming, with many companies leveraging technology to offer streamlined application processes and faster funding. For instance, the U.S. online lending market was projected to reach over $300 billion by 2024, indicating a substantial and growing competitive threat.

FirstCash faces significant competition in its merchandise sales segment, going beyond traditional pawn shops. Retailers specializing in second-hand goods, alongside burgeoning online marketplaces and consignment stores, vie for consumer attention. This diverse competitive landscape means FirstCash must continually adapt to evolving consumer preferences and digital trends.

The proliferation of e-commerce platforms has dramatically amplified this rivalry. Consumers now have unprecedented access to a vast array of used items, making it easier than ever to buy and sell pre-owned jewelry, electronics, and various other merchandise. For instance, the global second-hand apparel market alone was projected to reach $77 billion in 2025, highlighting the scale of this growing sector.

Regional and Local Market Specifics

Competitive rivalry for FirstCash is not uniform; it shifts based on the specific regional and local markets it operates within. This means the intensity of competition can be quite different from one place to another.

In both the U.S. and Latin America, FirstCash encounters a patchwork of distinct local market conditions. These include varying regulatory landscapes, unique consumer preferences, and different economic factors, all of which contribute to a fluctuating level of competitive pressure across its various operating territories.

For instance, in 2024, FirstCash's U.S. operations might face competition from a multitude of national retailers and specialized lenders, whereas in certain Latin American countries, the competitive set could be dominated by informal lenders and smaller, localized pawn shops.

This geographical variation in competitive intensity directly impacts FirstCash's market share and pricing strategies. The company must adapt its approach to suit the specific competitive environment of each region to maintain its performance.

- U.S. Market: Faces competition from national retailers, online lenders, and traditional financial institutions.

- Latin America Market: Encounters a mix of formal financial services and a significant presence of informal lenders and smaller pawn operations.

- Regulatory Impact: Different licensing requirements and consumer protection laws in various regions can alter the competitive playing field.

- Consumer Behavior: Localized consumer preferences for payment methods and credit access influence the type and intensity of competition.

Diversification as a Competitive Strategy

FirstCash's expansion into point-of-sale (POS) payment solutions via American First Finance represents a significant strategic pivot. This diversification aims to tap into broader consumer finance markets, moving beyond its core pawn operations. The company reported that for the fiscal year ended December 31, 2023, its total revenue reached $2.1 billion, demonstrating its substantial existing market presence.

This move into POS financing, however, intensifies competitive rivalry. FirstCash now contends with a different set of players, including established fintech companies and other alternative lenders specializing in consumer credit at the point of sale. These competitors often possess strong technological infrastructure and established customer bases within the digital payment ecosystem.

The increased competition in the POS payment space means FirstCash must differentiate itself effectively. Success will hinge on its ability to offer compelling value propositions, potentially through competitive interest rates, user-friendly platforms, and strong customer service. For instance, by Q1 2024, the POS lending sector saw significant growth, with transaction volumes in the US alone projected to exceed $5 trillion annually.

- Diversification into POS payments via American First Finance broadens revenue streams.

- This strategy exposes FirstCash to new competitors in the consumer finance sector.

- The POS lending market is highly competitive, featuring established fintech players.

- FirstCash's 2023 revenue was $2.1 billion, indicating a solid foundation for expansion.

FirstCash operates in a highly competitive environment, facing rivals ranging from large national chains to numerous smaller, local pawn shops. This intense rivalry is driven by factors like prime locations, fair appraisals, and competitive interest rates on loans. In 2023, FirstCash reported $2.1 billion in revenue, while competitor EZCorp posted $578.7 million, illustrating the scale of larger players within this crowded market.

| Competitor | 2023 Revenue (Approx.) | Key Competitive Factor |

|---|---|---|

| FirstCash | $2.1 billion | Scale, Prime Locations, Diversified Services |

| EZCorp | $578.7 million | Market Presence, Pawn Operations |

| Local Pawn Shops | Varies Widely | Local Relationships, Niche Merchandise |

| Fintech Lenders (e.g., Online Lenders, BNPL) | Growing Market Share (>$300 billion projected for US online lending by 2024) | Digital Convenience, Speed, Accessibility |

| Second-hand Retailers & Online Marketplaces | Significant Market Size (Global second-hand apparel market projected at $77 billion by 2025) | Variety of Goods, Price Competitiveness, Online Reach |

SSubstitutes Threaten

The most significant threat to FirstCash comes from the rapidly expanding alternative lending market. Platforms offering peer-to-peer loans, online personal loans, and installment loans are increasingly providing consumers with quick access to funds, often requiring less paperwork than traditional lenders.

These alternative options directly challenge FirstCash's core business by offering similar services, sometimes with greater convenience. For instance, the online lending market saw substantial growth, with the U.S. online personal loan market projected to reach over $200 billion by 2025, demonstrating the scale of this competitive force.

Buy Now, Pay Later (BNPL) services present a significant threat, especially to FirstCash's American First Finance division. These payment options allow consumers to acquire goods and spread payments over time, often without interest, directly competing with traditional lease-to-own and retail financing for consumer products.

The BNPL market has seen explosive growth. For instance, in 2023, the global BNPL market was valued at approximately $133.7 billion and is projected to reach $3.1 trillion by 2030, showcasing a compound annual growth rate of over 50%. This rapid expansion means more consumers may opt for BNPL over lease-to-own, potentially impacting FirstCash's customer acquisition and retention.

For certain customers, traditional financial institutions like banks and credit unions present a viable substitute. These entities offer products such as personal loans, credit cards, and lines of credit, which can appeal to consumers who may have previously relied on FirstCash. As economic conditions improve or individual creditworthiness increases, some customers might find these mainstream options more attractive.

Direct Sale of Goods

Consumers can bypass pawn shops by selling their goods directly through various channels. Online marketplaces like eBay and Facebook Marketplace allow individuals to reach a broad audience, potentially fetching higher prices than a pawn shop might offer. For instance, in 2023, eBay reported over 1.5 billion listings, showcasing the vast reach of direct selling platforms.

Local consignment shops and specialized buyers also present viable alternatives. Jewelers, for example, offer a direct route for selling precious metals and stones, often providing immediate payment. Similarly, electronics stores can purchase used devices, giving consumers another option for quick cash without the interest rates associated with pawn loans. This direct sale of goods represents a significant substitute for the services offered by pawn businesses.

The threat of substitutes is amplified by the ease and accessibility of these alternative selling methods. Consumers seeking liquidity are increasingly exploring these options, which can offer:

- Potentially higher selling prices

- Faster transaction times for some items

- Avoidance of pawn loan fees and interest

- Greater control over the selling process

Informal Lending and Family/Friend Support

For individuals facing immediate cash needs, informal lending and support from friends or family represent a significant, albeit non-commercial, substitute for services like those offered by FirstCash. This alternative is often interest-free and readily accessible, particularly for FirstCash's core customer base who may have limited access to traditional banking services.

While not a direct competitive threat in the traditional sense, the prevalence of this informal network can influence demand for short-term, small-dollar loans. For instance, in 2023, a significant portion of the U.S. population reported relying on personal networks for financial assistance during emergencies. This highlights the underlying need that FirstCash aims to fulfill, but also the alternative channels available.

- Informal Lending: Borrowing from friends and family is a common, often interest-free, alternative for immediate cash needs.

- Target Demographic: This informal support system is particularly relevant for FirstCash's customer base, who may have fewer traditional financial options.

- Impact on Demand: The availability of personal financial networks can influence the demand for short-term loan services.

- Prevalence: Data from 2023 indicated that a notable percentage of individuals turned to personal networks for emergency financial support, underscoring the significance of this substitute.

The threat of substitutes for FirstCash is substantial, stemming from a variety of alternative lending and payment solutions. Online lenders and Buy Now, Pay Later (BNPL) services are particularly disruptive, offering consumers faster, more convenient access to credit and installment payments, respectively. For example, the global BNPL market's projected growth to $3.1 trillion by 2030 highlights its increasing dominance.

Traditional financial institutions also pose a threat, as improved economic conditions or creditworthiness can steer customers towards banks and credit unions for personal loans and credit cards. Furthermore, consumers can bypass pawn shops by selling items directly through online marketplaces like eBay, which boasted over 1.5 billion listings in 2023, or through specialized local buyers, often securing better prices and faster transactions.

| Substitute Type | Key Features | Impact on FirstCash | 2023/2024 Data Point |

|---|---|---|---|

| Online Lenders | Fast approvals, minimal paperwork | Direct competition for personal loans | U.S. online personal loan market projected >$200B by 2025 |

| BNPL Services | Interest-free installments for purchases | Threat to retail financing (American First Finance) | Global BNPL market valued ~$133.7B in 2023 |

| Direct Selling Platforms | Higher selling prices, direct consumer access | Alternative to pawn services for asset liquidation | eBay had >1.5 billion listings in 2023 |

| Informal Lending | Interest-free, readily available from personal networks | Reduces demand for short-term loans | Significant portion of individuals relied on personal networks for emergency funds in 2023 |

Entrants Threaten

The pawn industry faces substantial hurdles for newcomers due to rigorous federal, state, and local regulations and licensing mandates. These requirements necessitate significant upfront investment in compliance and operational setup, effectively deterring many potential entrants.

For instance, in 2024, many states require pawn brokers to obtain specific licenses, often involving background checks and fees that can range from hundreds to thousands of dollars annually. These regulations, designed to curb illicit activities and safeguard consumers, create a high cost of entry, limiting the threat of new competitors.

Operating a consumer finance platform like American First Finance demands significant capital to fund loans and manage receivables. In 2023, the company reported total assets of $1.4 billion, illustrating the scale of investment required. New entrants must secure substantial financial backing to establish a competitive presence, acting as a considerable barrier.

FirstCash benefits from substantial brand recognition and a deeply ingrained trust among its customer base, particularly in the markets it serves. This is reinforced by its extensive network of over 3,000 retail locations, a critical asset that new competitors would find incredibly difficult and costly to replicate.

The significant investment required to establish a comparable brand presence and physical footprint acts as a formidable barrier. For instance, replicating FirstCash's established network would likely necessitate billions in capital expenditure, a hurdle that deters many potential new entrants from even considering the market.

Technological and Data Sophistication (for Fintech)

For new entrants in the fintech lending arena, the need to build advanced, proprietary underwriting algorithms, secure digital transaction platforms, and powerful data analysis tools presents a significant hurdle. This is particularly true as artificial intelligence and big data continue to reshape financial services. For instance, companies must invest heavily in the infrastructure and talent required to compete with established players like American First Finance, who leverage these technologies extensively.

The capital expenditure for creating and maintaining these sophisticated technological assets can be substantial, deterring many potential new entrants. Furthermore, the pace of technological evolution in fintech means that continuous investment is necessary to remain competitive. This ongoing commitment to innovation acts as a formidable barrier to entry in the digital lending market.

- High R&D Investment: Fintech lending requires significant upfront and ongoing investment in research and development for AI-driven credit scoring and fraud detection.

- Data Security Compliance: Meeting stringent data privacy and security regulations (e.g., GDPR, CCPA) necessitates robust cybersecurity infrastructure, adding to costs.

- Talent Acquisition: Attracting and retaining skilled data scientists, AI engineers, and cybersecurity experts is crucial and competitive, driving up labor costs.

Market Saturation in Mature Pawn Markets

While the overall pawn industry shows growth, some established physical pawn markets are becoming quite saturated. This saturation makes it challenging for new brick-and-mortar pawn shops to secure prime locations or capture significant market share. For instance, in 2024, the number of licensed pawn shops in major metropolitan areas remained relatively stable, indicating limited new physical store openings.

This environment naturally pushes aspiring entrants to explore alternative avenues. They are increasingly looking towards online pawn models, which bypass the geographical limitations of physical retail. Additionally, new players often focus on niche segments within the pawn market, such as specialized collectibles or electronics, to differentiate themselves.

- Market Saturation: Established physical pawn markets may be reaching capacity, limiting opportunities for new entrants.

- Location Challenges: Finding profitable locations and gaining market share becomes more difficult in saturated areas.

- Shift to Online: New entrants are increasingly adopting online models to overcome physical market limitations.

- Niche Specialization: Focusing on specific product categories or customer segments is a common strategy for new players.

The threat of new entrants for FirstCash is significantly mitigated by high regulatory barriers and substantial capital requirements. Navigating the complex web of federal, state, and local licensing, as seen with annual fees potentially reaching thousands of dollars in 2024, demands considerable investment and expertise. Furthermore, the need for substantial capital to fund operations, as evidenced by American First Finance's $1.4 billion in total assets in 2023, deters many aspiring competitors.

Established brand recognition and an extensive physical network, comprising over 3,000 locations for FirstCash, present a formidable challenge for newcomers. Replicating this scale would necessitate billions in capital expenditure, a prohibitive cost for most potential entrants. Similarly, in the fintech lending space, the demand for advanced AI algorithms, secure platforms, and skilled talent requires significant, ongoing investment, making it difficult for new players to compete effectively.

While some physical pawn markets face saturation, limiting new brick-and-mortar openings in 2024, this trend also pushes new entrants towards online models or niche specialization. These strategies aim to circumvent established physical barriers, but still require considerable technological investment and market differentiation to succeed against established players.

Porter's Five Forces Analysis Data Sources

Our FirstCash Porter's Five Forces analysis is built upon a foundation of comprehensive data, including FirstCash's annual reports and SEC filings, alongside industry-specific market research from reputable firms like IBISWorld and Statista.