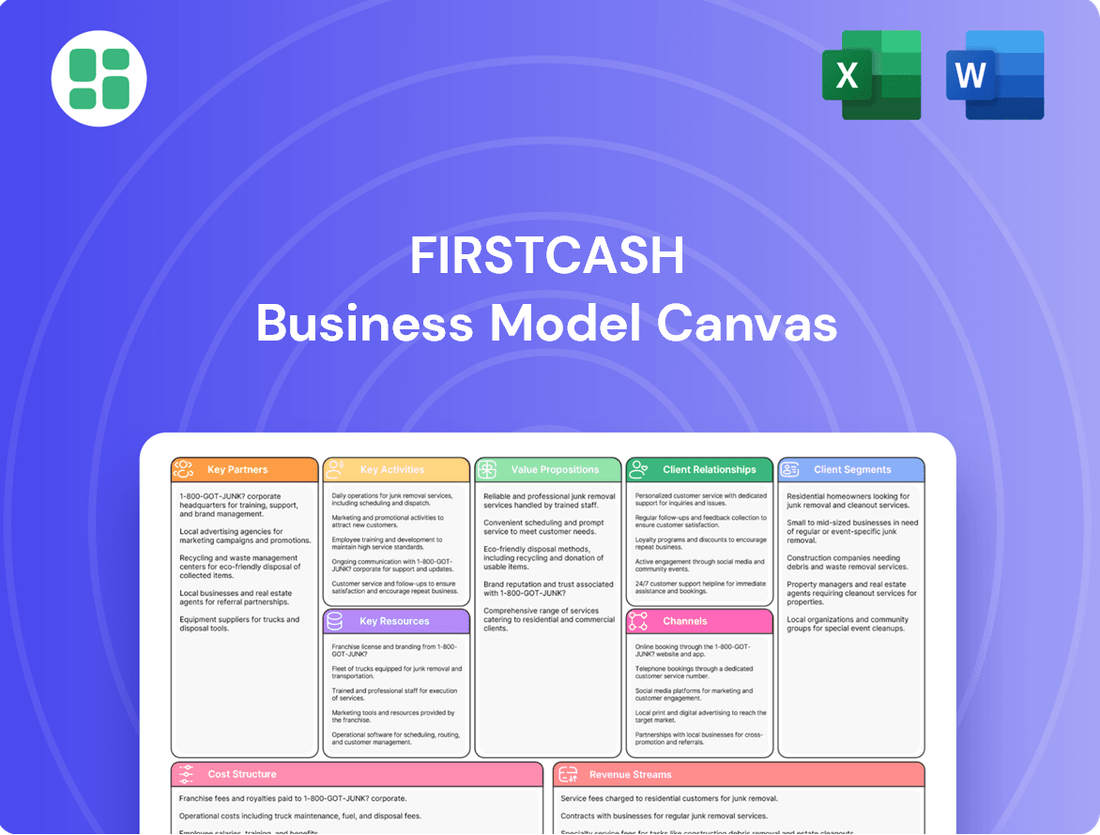

FirstCash Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

Discover the core components of FirstCash's successful business model with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance.

Unlock the strategic blueprint behind FirstCash's operations. Our full Business Model Canvas provides an in-depth look at their key resources, activities, and cost structure, perfect for anyone seeking to understand their competitive advantage.

See how FirstCash effectively leverages partnerships and channels to deliver value. The complete Business Model Canvas offers a strategic overview, ideal for entrepreneurs and analysts looking to replicate or adapt proven business strategies.

Partnerships

FirstCash collaborates with technology providers to enhance its operational backbone, including pawn management and point-of-sale systems. These partnerships are crucial for streamlining financial transactions and ensuring robust data security across its extensive store network. For instance, in 2024, FirstCash continued to invest in upgrading its digital infrastructure, aiming to improve transaction speed and data integrity, which is paramount in the financial services sector.

FirstCash's collaborations with payment processing companies are essential for its American First Finance segment, allowing for a wide array of payment options. These partnerships ensure that customer payments, including crucial installment plans, are processed smoothly and efficiently.

These payment processors provide the secure and reliable backbone for both FirstCash's physical store transactions and its online customer interactions. In 2024, the company continued to leverage these relationships to maintain a robust transaction infrastructure, facilitating millions of payments annually.

FirstCash, operating within the heavily regulated pawn and financial services sector, maintains crucial relationships with governmental bodies and specialized compliance consultants. These partnerships are essential for navigating and adhering to a complex web of local, state, and federal statutes that govern their business activities. For instance, in 2024, FirstCash continued its focus on robust compliance programs, recognizing that staying abreast of evolving regulations, such as those related to anti-money laundering (AML) and customer identification, is paramount to its continued success and risk mitigation.

Retail Merchants (for American First Finance)

For its American First Finance segment, FirstCash collaborates with a broad network of retail merchants. These partnerships are crucial for deploying point-of-sale payment solutions directly where consumers shop.

Retailers integrate American First Finance's flexible financing options into their sales process. This allows them to attract a wider customer base by offering payment alternatives previously unavailable, thereby boosting their sales volume. For instance, in 2023, FirstCash's consumer finance segment, which includes American First Finance, saw its total revenue grow by 10.8% year-over-year, reaching $1.04 billion, indicating the success of these merchant relationships.

This strategic alliance creates a mutually beneficial ecosystem. Merchants gain access to new customers and increased sales, while FirstCash expands its reach and transaction volume.

- Merchant Network Expansion: FirstCash actively cultivates relationships with a diverse range of retail merchants to offer its financing services at the point of sale.

- Customer Base Growth: By integrating American First Finance, retailers can cater to customers seeking flexible payment options, thereby broadening their appeal and potential sales.

- Revenue Synergy: The collaboration drives incremental revenue for both FirstCash through increased financing volume and for merchants through higher sales conversion rates.

- Market Penetration: These partnerships are key to FirstCash's strategy of penetrating new consumer segments and increasing its market share in the consumer finance space.

Security Service Providers

FirstCash relies on security service providers to safeguard its operations. These partnerships are critical for protecting physical assets, including inventory and cash, as well as sensitive customer data. In 2024, FirstCash continued to invest in robust physical security measures across its numerous locations, underscoring the importance of these alliances.

Key aspects of these partnerships include:

- Physical Store Security: Collaborating with security firms to ensure the safety of retail environments, deterring theft and maintaining order.

- Alarm Systems and Monitoring: Implementing and maintaining advanced alarm systems to provide immediate alerts in case of unauthorized access or emergencies.

- Cybersecurity Services: Potentially engaging cybersecurity experts to protect customer data and internal systems from digital threats, a growing concern in the retail sector.

These collaborations are fundamental to FirstCash's strategy, ensuring a secure operational framework that builds trust and minimizes risk for both the company and its clientele.

FirstCash's strategic alliances with technology providers are foundational for its operational efficiency and data security. These partnerships ensure seamless transactions and robust protection of sensitive information across its vast network. In 2024, the company's ongoing digital infrastructure upgrades, including advancements in pawn management and point-of-sale systems, highlight the critical role these collaborations play in maintaining high standards of data integrity and transaction speed.

The company also fosters critical relationships with payment processing firms, particularly for its American First Finance division. These partnerships are vital for offering diverse payment options and ensuring the smooth processing of customer payments, including installment plans, thereby supporting a significant volume of transactions.

Furthermore, FirstCash collaborates with a wide array of retail merchants to deploy its point-of-sale financing solutions. This strategy allows retailers to offer flexible payment options to their customers, enhancing sales and customer reach. In 2023, FirstCash's consumer finance segment, bolstered by these merchant relationships, experienced a substantial revenue increase of 10.8%, reaching $1.04 billion.

| Partnership Type | Key Functionality | 2023/2024 Impact/Focus |

| Technology Providers | Pawn Management, POS Systems, Data Security | Digital infrastructure upgrades for transaction speed and data integrity (2024) |

| Payment Processors | Transaction Processing, Diverse Payment Options | Facilitating millions of payments annually for American First Finance (2024) |

| Retail Merchants | Point-of-Sale Financing Deployment | Driving sales for retailers and expanding FirstCash's consumer finance reach; 10.8% revenue growth in consumer finance segment (2023) |

What is included in the product

A detailed breakdown of FirstCash's operations, outlining its customer segments, value propositions, and revenue streams for pawn and financial services.

Illustrates how FirstCash leverages its store network and customer relationships to deliver financial solutions and generate profits.

FirstCash's Business Model Canvas offers a clear, structured approach to understanding how they solve the pain points of underbanked individuals and small businesses by providing accessible credit and financial services.

It serves as a vital tool for identifying and articulating FirstCash's value proposition in a way that addresses the specific financial challenges faced by their customer segments.

Activities

FirstCash's core activity revolves around the origination and meticulous management of pawn loans. This involves expertly assessing the value of collateral, typically jewelry and electronics, to determine loan amounts. In 2023, FirstCash reported that approximately 70% of its total revenue came from its pawn segment, highlighting its significance.

The company's operational strength lies in its ability to manage the entire loan lifecycle, from initial disbursement to renewals and final redemptions. This requires a deep understanding of valuation techniques and robust risk assessment protocols to minimize potential losses. For instance, the average pawn loan amount at FirstCash hovers around $150, demonstrating a focus on accessible credit.

Legal compliance and efficient portfolio management are paramount to FirstCash's profitability. They ensure all transactions adhere to local regulations, which vary significantly by state and country. Effective management of these pawn loans, including timely repayment and collateral recovery when necessary, directly impacts the company's bottom line.

FirstCash's core retail activity revolves around the buying and selling of pre-owned merchandise. This includes items customers pawn and don't reclaim, as well as goods they directly sell to FirstCash. This dual acquisition strategy fuels their inventory.

Effective inventory management and strategic pricing are crucial for maximizing sales in this segment. FirstCash focuses on merchandising to present items attractively, aiming to drive customer purchases and optimize profit margins on each sale.

In 2023, FirstCash reported merchandise sales revenue of $1.1 billion, a significant contributor to their overall financial performance and a testament to the success of their retail operations. This revenue stream diversifies their income beyond traditional pawn loan interest.

FirstCash's American First Finance segment is a cornerstone of its business model, actively providing flexible payment solutions to customers of its retail merchant partners. This core activity involves robust consumer credit underwriting, careful management of installment plans, and efficient payment processing, directly contributing to FirstCash's expansion into the wider consumer finance landscape.

Customer Service and Relationship Management

FirstCash prioritizes building and maintaining trust with its diverse customer base, particularly those in underserved segments. This involves offering empathetic customer service and efficiently managing inquiries and accounts.

- Customer Trust: FirstCash's focus on customer service is foundational for its business model, especially when serving populations with limited access to traditional financial services.

- Relationship Building: By addressing customer needs with care and efficiency, FirstCash fosters loyalty and encourages repeat transactions.

- Positive Impact: Strong, positive customer relationships not only drive repeat business but also generate valuable word-of-mouth referrals, a key growth driver for the company.

Regulatory Compliance and Risk Management

FirstCash's key activities heavily involve navigating a complex regulatory landscape inherent to financial services. This necessitates a robust approach to regulatory compliance and risk management to ensure lawful operations and safeguard against significant penalties.

The company actively implements comprehensive compliance programs, conducts regular internal audits, and performs thorough risk assessments. For instance, in 2024, FirstCash reported a strong focus on anti-money laundering (AML) and know-your-customer (KYC) protocols, which are fundamental to financial institutions globally. These efforts are crucial for maintaining its license to operate and for building trust with customers and regulators alike.

- Continuous Regulatory Monitoring: Staying abreast of evolving financial regulations across all operating jurisdictions is paramount.

- Robust Compliance Programs: Developing and maintaining effective internal controls and policies to meet legal and ethical standards.

- Risk Assessment and Mitigation: Proactively identifying, evaluating, and addressing potential risks, including financial, operational, and reputational risks.

- Adherence to Legal Frameworks: Ensuring all business practices align with relevant laws and statutes, such as those governing lending and data privacy.

FirstCash's key activities are centered on originating and managing pawn loans, which involves assessing collateral like jewelry and electronics to set loan values. They also actively buy and sell pre-owned merchandise, including items from unredeemed pawn loans and direct sales. A significant part of their operation is providing consumer credit solutions through their American First Finance segment, partnering with retailers.

The company places a strong emphasis on building customer trust through empathetic service and efficient account management, which is crucial for their target demographic. Furthermore, navigating and adhering to a complex web of financial regulations, including anti-money laundering and know-your-customer protocols, is a fundamental and ongoing activity.

| Key Activity | Description | 2023 Data/Focus |

| Pawn Loan Origination & Management | Assessing collateral, disbursing loans, managing renewals and redemptions. | 70% of total revenue from pawn segment. Average loan around $150. |

| Merchandise Retail | Buying and selling pre-owned goods. | $1.1 billion in merchandise sales revenue. |

| Consumer Finance Solutions | Providing installment plans via American First Finance. | Focus on flexible payment solutions for retail partners. |

| Customer Relationship Management | Building trust and providing efficient service. | Key for underserved populations and repeat business. |

| Regulatory Compliance & Risk Management | Adhering to financial regulations and mitigating risks. | Emphasis on AML/KYC protocols in 2024. |

Preview Before You Purchase

Business Model Canvas

The FirstCash Business Model Canvas you are previewing is the identical, comprehensive document you will receive upon purchase. This means the structure, content, and formatting you see here are exactly what you'll get, ensuring no discrepancies or surprises. You'll gain full access to this ready-to-use business model canvas, allowing you to immediately begin refining your strategy.

Resources

FirstCash's extensive network of physical pawn store locations across the U.S. and Latin America is a cornerstone of its business model. These stores act as the primary interface for customers, facilitating pawn transactions, direct retail sales of merchandise, and essential customer service. As of the first quarter of 2024, FirstCash operated over 1,100 locations, with a significant presence in Mexico and Central America, strategically positioned to serve a broad customer base.

The physical goods customers pledge for pawn loans, alongside the merchandise FirstCash sells in its retail stores, are the company's core tangible assets. These items, ranging from gold jewelry and diamonds to electronics and tools, are vital for revenue generation. In 2023, FirstCash reported that its inventory of pawn collateral and retail merchandise represented a substantial portion of its asset base, directly contributing to its ability to offer loans and generate sales.

FirstCash relies heavily on loan capital and robust financial reserves to fuel its core business of providing pawn loans. This financial foundation is critical for meeting customer demand and ensuring operational continuity.

As of the first quarter of 2024, FirstCash reported total assets of $3.8 billion, with a significant portion allocated to loans receivable. Access to credit facilities and strong liquidity management are paramount to maintaining this lending capacity and supporting growth initiatives.

The company's ability to secure and manage its financial resources, including access to revolving credit lines, directly impacts its capacity to originate new pawn loans and manage its balance sheet effectively. This financial strength is a key enabler of its business model.

Proprietary Technology and IT Systems

Proprietary technology, including specialized software for pawn management and point-of-sale systems, is a cornerstone of FirstCash's operational efficiency. These integrated IT systems are vital for accurate record-keeping, streamlining transactions, and ensuring regulatory compliance across its diverse business segments. In 2024, FirstCash continued to leverage these systems to manage its extensive network of pawn stores and lending operations effectively.

The American First Finance platform represents a significant technological asset, enabling robust payment solutions and customer management. This platform supports FirstCash's strategy of providing accessible financial services, contributing to its competitive edge in the market. The ongoing investment in these technological capabilities underscores their importance to the company's business model.

- Specialized Software: Pawn management, point-of-sale (POS), and financial tracking software are critical for operational efficiency and data integrity.

- American First Finance Platform: This platform serves as a key technological asset for developing and managing payment solutions.

- Compliance and Record-Keeping: The IT systems ensure accurate financial tracking and adherence to regulatory requirements.

- Operational Efficiency: Technology directly supports the smooth functioning of FirstCash's extensive retail and lending operations.

Skilled Workforce and Management Expertise

FirstCash’s success hinges on its people. Experienced store managers and loan officers are crucial, possessing deep knowledge in assessing collateral and managing customer interactions. In 2023, FirstCash reported that its employees, particularly those in leadership roles, demonstrated significant expertise in navigating the complexities of the financial services and retail sectors, contributing to a robust operational framework.

The corporate staff also brings essential expertise in financial services, retail operations, and regulatory compliance. This collective knowledge is vital for maintaining high standards and ensuring adherence to all legal requirements, a cornerstone of FirstCash’s business model. Their ability to manage customer relationships effectively and understand diverse market needs is a significant asset.

- Skilled Store Managers: Possess expertise in collateral valuation and customer relationship management.

- Expert Loan Officers: Adept at assessing risk and navigating financial regulations.

- Corporate Staff Proficiency: Strong background in financial services, retail, and compliance.

- Talent Investment: FirstCash prioritizes training and retention to maintain its high-caliber workforce.

FirstCash's key resources are its extensive physical store network, comprising over 1,100 locations as of Q1 2024, primarily in the U.S. and Latin America. Its financial strength, including $3.8 billion in total assets in Q1 2024, underpins its lending capacity. Crucial proprietary technology, such as specialized pawn management software and the American First Finance platform, ensures operational efficiency and compliance. Finally, its human capital, including skilled store managers and corporate staff, provides essential expertise in collateral assessment, customer service, and regulatory adherence.

| Key Resource | Description | Relevance | Data Point (as of Q1 2024 unless noted) |

|---|---|---|---|

| Physical Store Network | Extensive network of pawn and retail locations. | Customer interface, transaction hub. | Over 1,100 locations. |

| Financial Resources | Capital for lending and operations. | Enables loan origination and business growth. | $3.8 billion in total assets. |

| Proprietary Technology | Pawn management software, AFF platform. | Drives operational efficiency and compliance. | Ongoing investment in IT systems. |

| Human Capital | Experienced store managers, loan officers, corporate staff. | Expertise in collateral valuation, customer relations, and compliance. | Employee expertise cited in 2023 annual report. |

Value Propositions

FirstCash's value proposition of immediate access to cash directly addresses a critical need for individuals often excluded from traditional banking. For instance, in 2024, an estimated 15% of U.S. adults remained unbanked or underbanked, highlighting a significant market gap. This segment frequently requires quick liquidity for emergencies or unexpected expenses.

By offering fast, accessible funds, FirstCash provides a vital financial bridge. Unlike lengthy bank loan processes that can take weeks, FirstCash aims for rapid disbursement, enabling customers to meet urgent obligations without delay. This speed is crucial for those facing immediate financial pressures.

This immediate solution serves as a lifeline, particularly for consumers who may not meet the stringent credit requirements of conventional lenders. FirstCash's model acknowledges and caters to this underserved population, offering a practical alternative for managing short-term cash flow challenges.

American First Finance offers flexible point-of-sale payment solutions, enabling customers to purchase retail goods without immediate full payment. This service significantly broadens access to consumer goods, particularly for individuals who may have non-traditional credit histories or lower credit scores, thereby increasing their purchasing power.

In 2024, the demand for such flexible payment options continued to grow, with point-of-sale financing becoming a key driver for many retailers. For instance, the buy now, pay later market, a related segment, saw significant transaction volume, indicating consumer comfort and preference for installment-based purchasing.

Pawn loans offered by FirstCash are secured by collateral, eliminating the need for traditional credit checks. This accessibility is crucial for individuals with limited or no credit history, who might otherwise be excluded from financial services. In 2024, this approach continues to be a vital lifeline, providing immediate liquidity without the hurdles of credit scoring.

By focusing on the value of the collateral rather than a borrower's creditworthiness, FirstCash effectively bypasses a major barrier to entry for many underserved consumers. This asset-backed lending model ensures that financial assistance is available based on tangible assets, not just credit scores.

Safe and Secure Store Environments

FirstCash customers gain significant value from our safe and secure store environments. These professionally managed physical locations are designed to protect both the valuable collateral customers pawn and their sensitive personal information, fostering a sense of trust and peace of mind during financial transactions.

This emphasis on security is a cornerstone of our value proposition in the pawn industry. In 2023, FirstCash reported a strong operational performance, with total revenues reaching $1.8 billion, underscoring the continued trust customers place in our secure business model.

- Enhanced Collateral Protection: Customers can be confident that their valuable items are stored securely, minimizing risks associated with theft or damage.

- Data Privacy Assurance: Robust systems are in place to safeguard personal information, ensuring confidentiality and preventing unauthorized access.

- Peace of Mind: The secure environment allows customers to conduct their business without undue worry about the safety of their assets or data.

- Industry Trust: This commitment to security builds vital trust, a critical factor for success in the financial services sector.

Opportunity to Sell Unwanted Items

Beyond traditional pawn loans, FirstCash offers customers the chance to sell their unwanted items directly. This provides an immediate cash solution for individuals looking to liquidate possessions they no longer need. It’s a straightforward retail channel that allows customers to convert clutter into capital.

This selling option acts as a valuable secondary revenue stream for FirstCash, complementing its core lending business. It taps into a market of individuals seeking quick sales without the commitment of a loan. In 2024, the volume of outright sales represented a significant portion of customer transactions, demonstrating its utility.

- Monetize Assets: Customers can easily convert underutilized belongings into immediate funds.

- Convenience: Offers a quick and hassle-free way to dispose of unwanted goods.

- Retail Channel: Establishes a direct purchasing avenue for consumer goods within FirstCash's operations.

- Cash Flow: Provides an additional source of inventory and revenue for the company.

FirstCash offers immediate cash access, addressing the needs of the unbanked and underbanked. In 2024, an estimated 15% of U.S. adults fall into this category, highlighting a significant market for quick liquidity. This service acts as a financial bridge for those facing urgent expenses.

The company provides flexible point-of-sale payment solutions, enhancing consumer purchasing power, especially for those with non-traditional credit. The buy now, pay later market, a related segment, saw substantial transaction volume in 2024, reflecting consumer preference for installment plans.

FirstCash's pawn loans bypass traditional credit checks by using collateral, making financial assistance accessible to individuals with limited credit history. This asset-backed model ensures liquidity is available based on tangible assets, not just credit scores.

Customers value FirstCash's secure store environments, which protect collateral and personal information, fostering trust. In 2023, FirstCash reported $1.8 billion in total revenues, indicating continued customer confidence in its secure operations.

Additionally, FirstCash allows customers to sell unwanted items directly, providing an immediate cash solution and a secondary revenue stream. This direct selling option proved valuable in 2024, representing a significant portion of customer transactions.

Customer Relationships

FirstCash's customer relationships are largely transactional, focusing on the core services of pawn loans, retail sales, and check cashing. This model emphasizes quick, efficient exchanges for each customer interaction.

Despite the transactional nature, these relationships are built on a strong service foundation. FirstCash prioritizes fairness, transparency in its fees and processes, and clear communication to ensure a positive experience for every customer, which is crucial for encouraging repeat business.

In 2024, FirstCash reported that its pawn loan portfolio continued to be a significant driver of revenue, underscoring the ongoing demand for its core transactional services. The company's commitment to customer service in these transactions helps maintain a loyal customer base.

FirstCash emphasizes personalized in-store interactions, recognizing that many customer relationships are built face-to-face within their physical locations. This direct engagement allows staff to offer tailored service, addressing individual customer needs and explaining financial terms with clarity. In 2023, FirstCash operated over 1,000 stores, with a significant portion of customer transactions and relationship building occurring within these branches, fostering trust in a sector where financial guidance is crucial.

FirstCash prioritizes being an accessible and approachable financial partner, especially for individuals often overlooked by mainstream banks. They cultivate a welcoming atmosphere and streamline their services to make financial management less intimidating.

This commitment is evident in their store design and staff training, aiming to create a non-judgmental space for customers. For instance, in 2024, FirstCash reported serving over 2.4 million customers, highlighting their broad reach and the trust placed in them by a significant demographic seeking reliable financial solutions.

Support for Repeat Business

FirstCash cultivates repeat business by fostering trust through equitable dealings, clear agreements, and dependable service. This approach is foundational for maintaining consistent revenue in the competitive pawn sector.

A loyal customer base is vital for the pawn industry, and FirstCash's commitment to fair practices directly supports this. For instance, in 2024, the company reported strong customer retention rates, underscoring the effectiveness of their relationship-building strategies.

- Fair Practices: FirstCash operates on principles of transparency and fairness, ensuring customers feel respected and valued.

- Consistent Service: The business prioritizes delivering reliable and high-quality service across all transactions.

- Customer Loyalty: Building a base of repeat customers is a strategic imperative for stable income generation.

- Implied Incentives: While not always explicit, excellent customer service inherently acts as an incentive for return visits.

Digital Support and Information (for American First Finance)

American First Finance leverages digital channels to enhance customer engagement, allowing for convenient account management and payment processing. This online accessibility complements their physical store footprint, offering customers flexibility in managing their payment plans.

In 2023, FirstCash reported that its digital platforms facilitated a significant portion of customer interactions, underscoring the growing importance of online services. This digital support is crucial for providing customers with timely information and self-service options.

- Online Account Management: Customers can view payment schedules, transaction history, and update personal information through a secure portal.

- Digital Payment Options: Offering various online payment methods, including direct debit and credit card payments, caters to diverse customer preferences.

- Information Access: Digital channels provide easy access to FAQs, policy details, and customer support resources, reducing reliance on in-person inquiries.

- Personalized Communication: Digital tools enable targeted communication for payment reminders and important account updates.

FirstCash fosters customer loyalty through consistent, fair, and transparent dealings, particularly in its core pawn loan and check-cashing services. This approach builds trust, encouraging repeat business and a stable revenue stream.

In 2024, FirstCash served over 2.4 million customers, demonstrating its broad reach and the trust placed in its accessible financial services. Their commitment to personalized in-store interactions remains key to strengthening these relationships.

Digital channels, including online account management and payment options, complement their physical presence, offering customers convenience and flexibility. In 2023, digital platforms facilitated a significant portion of customer interactions, highlighting their growing importance.

| Aspect | Description | 2024 Data/Context |

|---|---|---|

| Core Relationship Type | Primarily transactional, with an emphasis on efficiency and service. | Pawn loan portfolio remained a significant revenue driver. |

| Trust Building | Achieved through fair practices, transparency, and dependable service. | Reported strong customer retention rates in 2024. |

| Customer Reach | Extensive, serving a broad demographic seeking accessible financial solutions. | Served over 2.4 million customers in 2024. |

| Digital Engagement | Complements physical stores with online account management and payment processing. | Digital platforms facilitated a significant portion of interactions in 2023. |

Channels

FirstCash's extensive network of over 2,000 physical pawn stores, as of the first quarter of 2024, forms the backbone of its customer engagement. These locations are not just points of sale but crucial hubs for loan origination, where the majority of customer interactions and transactions occur.

These brick-and-mortar establishments are strategically positioned to cater to local communities, often serving as vital financial resources in areas with limited access to traditional banking services. Their presence is key to FirstCash's mission of providing accessible financial solutions.

The physical pawn store network is the primary channel for both the core pawn lending business and the retail sale of pre-owned merchandise. It's where the company directly connects with its customer base, facilitating transactions and building relationships.

Partner Retail Merchants act as a vital distribution network for American First Finance, embedding point-of-sale financing directly into the purchasing experience. This strategy enables customers to secure funding for goods precisely when and where they decide to buy.

By partnering with a diverse range of retailers, American First Finance significantly broadens its customer reach, extending its services beyond its physical store locations and tapping into established consumer shopping habits.

This channel is instrumental in driving loan origination volume. For instance, in 2023, FirstCash reported that its retail partner channel contributed substantially to its overall revenue, with over 1.5 million new accounts opened through these merchant relationships.

FirstCash operates corporate and brand-specific websites, offering essential details on services, store locations, and customer engagement, though not for direct pawn transactions. In 2023, FirstCash reported total revenue of $2.2 billion, with its online presence playing a key role in brand awareness and initial customer contact.

American First Finance, a subsidiary, likely features a more developed online portal for account management and customer service, reflecting the digital shift in financial services. This online infrastructure is crucial for scalability and customer retention in the competitive consumer finance sector.

Customer Service Hotlines/Support

FirstCash leverages dedicated customer service hotlines to offer essential support, addressing inquiries and resolving issues that may arise outside of direct in-store interactions. This accessibility is crucial for maintaining customer satisfaction, especially for those needing assistance beyond typical business hours.

These hotlines act as a vital supplement to in-person service, ensuring customers have a reliable channel for support. For instance, in 2023, FirstCash reported serving over 2.8 million customers, highlighting the scale of operations where efficient support channels are paramount.

- Customer Support Accessibility: Provides a direct line for customer inquiries and issue resolution.

- Extended Service Hours: Offers assistance beyond physical store operating times.

- Enhanced Customer Experience: Contributes to overall satisfaction and accessibility for a broad customer base.

- Operational Efficiency: Supports a large customer volume by offering an alternative to in-person service.

Marketing and Advertising (Local and Digital)

FirstCash utilizes a multi-channel approach to reach its customer base. Local marketing efforts, such as flyers and advertisements in community newspapers, aim to capture the attention of individuals within proximity to their physical store locations. This traditional outreach is complemented by a robust digital strategy.

Digital channels are critical for broader awareness and customer acquisition. This includes leveraging social media platforms to engage with potential customers and running search engine marketing (SEM) campaigns to ensure FirstCash appears when individuals search for pawn services or short-term loans. In 2023, the company reported significant growth, with total revenue reaching $2.1 billion, indicating the effectiveness of their marketing strategies in driving customer traffic and transactions.

- Local Outreach: Flyers, local print ads, and in-store promotions inform nearby residents about services.

- Digital Presence: Social media engagement and search engine marketing (SEM) capture online interest.

- Customer Acquisition: These combined efforts are designed to attract new customers to both physical stores and online platforms.

- Revenue Impact: FirstCash's 2023 revenue of $2.1 billion underscores the success of its marketing in driving business volume.

FirstCash's primary channels are its extensive network of over 2,000 physical pawn stores, which serve as hubs for loan origination and merchandise sales. Complementing this is its Partner Retail Merchant channel, particularly for American First Finance, which embeds point-of-sale financing at the purchase location, driving significant loan volume. The company also utilizes corporate websites for information and brand awareness, alongside customer support hotlines to enhance accessibility. Local and digital marketing efforts, including social media and SEM, are crucial for customer acquisition and driving overall business volume, contributing to FirstCash's substantial revenue growth.

| Channel Type | Description | Key Function | 2023/2024 Data Point |

|---|---|---|---|

| Physical Pawn Stores | Over 2,000 locations | Loan origination, merchandise sales, customer interaction | Core business hubs |

| Partner Retail Merchants | Embedded point-of-sale financing | Loan origination for American First Finance | Drove substantial loan volume in 2023 |

| Websites | Corporate and brand-specific | Information, store location, brand awareness | Total revenue of $2.2 billion in 2023 |

| Customer Support Hotlines | Dedicated phone lines | Inquiries, issue resolution, customer support | Served over 2.8 million customers in 2023 |

| Marketing (Local & Digital) | Flyers, print ads, social media, SEM | Customer acquisition, brand awareness | Contributed to significant revenue growth in 2023 |

Customer Segments

This segment comprises individuals with restricted access to traditional banking or credit, desperately needing immediate, short-term funds. They frequently turn to pawn loans, often because of a poor credit history or pressing financial emergencies.

FirstCash acts as a crucial alternative financial service provider for these consumers. For instance, in 2024, pawn shops, a primary channel for this segment, facilitated millions of transactions, demonstrating the ongoing demand for quick liquidity solutions outside conventional financial systems.

Individuals with valuable collateral, such as jewelry, electronics, or tools, represent a key customer segment for pawn lending services. These individuals often need quick access to cash and prefer to use their tangible assets as security rather than undergoing traditional credit assessments. In 2024, the pawn industry continued to see strong demand from this demographic, leveraging the inherent value of their possessions for immediate financial relief.

FirstCash serves a significant customer segment interested in acquiring pre-owned merchandise from its retail locations. These buyers are typically value-conscious individuals seeking affordable options for electronics, jewelry, musical instruments, and other items. This segment is crucial for driving FirstCash's retail sales performance.

In 2024, the demand for pre-owned goods continued to grow, driven by economic factors and a desire for cost savings. FirstCash's retail segment benefits directly from this trend, as customers actively seek out its inventory for quality items at competitive price points. This customer base represents a stable and important revenue driver for the company.

Consumers Seeking Flexible Retail Payment Options (via American First Finance)

This customer segment includes shoppers at retail stores who need flexible ways to pay for purchases, especially for bigger items. They often look for installment plans that make these purchases more manageable. In 2024, the demand for buy now, pay later (BNPL) services, a key flexible payment method, continued to grow, with projections indicating a significant increase in transaction volumes globally.

These consumers might not always qualify for traditional credit cards or prefer not to use them. American First Finance steps in by offering accessible financing options, bridging the gap for those who need alternative credit solutions. The market for alternative lending, which includes services like those provided by American First Finance, has seen robust expansion as consumers increasingly seek personalized financial products.

- Customer Need: Access to flexible payment plans for retail purchases.

- Financial Behavior: Seeking alternatives to traditional credit, often utilizing installment options.

- Market Trend (2024): Continued growth in demand for Buy Now, Pay Later (BNPL) and alternative financing solutions.

- Value Proposition: American First Finance provides accessible financing to enable these purchases.

Small Business Owners (Limited Scope)

While not a core demographic, some small business owners may turn to FirstCash for pawn loans using business assets. This is typically for immediate, short-term working capital requirements, offering a quick injection of liquidity when other options are limited. For instance, a small retail business might pawn excess inventory to cover an unexpected payroll expense.

This segment represents a niche opportunity for FirstCash, providing essential financial flexibility to smaller enterprises. In 2024, the small business sector continued to be a vital part of the economy, with many owners facing cash flow challenges. FirstCash's ability to offer rapid collateral-based lending can be a lifeline in these situations.

- Niche Liquidity Provider: FirstCash serves as a source of quick business liquidity for small businesses.

- Asset-Based Lending: Small business owners can leverage business assets, such as inventory or equipment, for pawn loans.

- Short-Term Working Capital: The primary use case is to address immediate, short-term working capital needs.

FirstCash serves individuals with limited access to traditional banking, often facing financial emergencies and relying on pawn loans for quick, short-term funds. These customers frequently have poor credit histories or urgent needs, making pawn shops a primary channel. In 2024, the demand for immediate liquidity solutions outside conventional systems remained high, with millions of transactions facilitated by pawn shops.

A key segment includes individuals with valuable collateral like jewelry or electronics, who need rapid cash without credit checks. These customers leverage their tangible assets for immediate financial relief. The pawn industry in 2024 continued to see robust demand from this demographic, highlighting the enduring need for asset-backed lending.

Value-conscious shoppers seeking affordable pre-owned merchandise also form a significant customer base. These individuals purchase items like electronics and jewelry, driving retail sales. The market for pre-owned goods saw continued growth in 2024 due to economic factors, benefiting FirstCash's retail segment with stable revenue.

Customers needing flexible payment options for retail purchases, especially for larger items, are another important segment. They often seek installment plans, mirroring the growing demand for Buy Now, Pay Later (BNPL) services. In 2024, BNPL transaction volumes saw substantial global increases, underscoring this trend.

FirstCash, through American First Finance, also caters to consumers who don't qualify for or prefer not to use traditional credit. This segment seeks accessible alternative credit solutions. The alternative lending market expanded significantly in 2024, driven by consumer demand for personalized financial products.

| Customer Segment | Primary Need | Financial Behavior | 2024 Market Insight | FirstCash Role |

|---|---|---|---|---|

| Underserved Individuals | Immediate, short-term funds | Limited traditional banking access, poor credit | High demand for pawn loans | Alternative financial service provider |

| Collateral Owners | Quick cash using assets | Leverage valuable items (jewelry, electronics) | Strong demand for asset-based lending | Facilitates pawn loans |

| Value Shoppers | Affordable pre-owned goods | Seek cost savings on merchandise | Growing market for pre-owned items | Retail sales of merchandise |

| Flexible Payers | Installment payment options | Prefer BNPL or alternative financing | Significant BNPL growth | Offers accessible financing options |

Cost Structure

The primary cost for FirstCash in its pawn loan operations is the capital needed to fund these loans. This includes not only the interest paid on any funds borrowed by FirstCash but also the opportunity cost of the money that is tied up in outstanding pawn agreements. Efficiently managing this capital is absolutely key to maintaining healthy profit margins.

Operating expenses for FirstCash's extensive store network are significant, encompassing rent, utilities, maintenance, and security for numerous physical pawn shop locations. These costs are largely fixed or semi-fixed and are a direct result of their widespread geographical presence. For instance, in 2023, FirstCash reported that its selling, general, and administrative expenses, which include these store operating costs, totaled $768.8 million.

Employee salaries, wages, and benefits represent a substantial cost for FirstCash, directly impacting their operational expenses. This includes compensation for everyone from frontline store associates to corporate leadership, ensuring smooth retail operations and efficient loan processing.

In 2024, labor costs are a critical factor in maintaining the quality of customer service and the overall effectiveness of their business model. A well-compensated and motivated workforce is fundamental to FirstCash's ability to deliver on its customer promises.

Inventory Acquisition and Management Costs

FirstCash incurs significant costs in acquiring merchandise, primarily from unredeemed pawned items and direct purchases. These costs are fundamental to their retail operations. For instance, in 2023, FirstCash reported inventory as a major asset, highlighting the capital tied up in goods available for sale.

Beyond acquisition, managing this inventory involves substantial expenses. These include costs for storage, ensuring items are protected and accessible, as well as insurance premiums to safeguard against loss or damage. Furthermore, depreciation on inventory, especially for items that may age or lose value, directly impacts profitability.

- Merchandise Acquisition: Costs associated with buying goods outright or through the process of unredeemed pawns.

- Inventory Storage: Expenses related to warehousing, organizing, and maintaining the physical inventory.

- Insurance: Premiums paid to insure the inventory against theft, damage, or other unforeseen events.

- Depreciation: Accounting for the decrease in value of inventory over time, particularly for electronics or fashion items.

Regulatory Compliance and IT Infrastructure Costs

FirstCash faces substantial expenses related to regulatory compliance, a necessity in the financial services industry. These costs encompass legal counsel, internal and external audits, and the implementation of operational adjustments to adhere to evolving regulations. For instance, in 2024, the financial sector saw increased scrutiny on data privacy and anti-money laundering (AML) protocols, likely driving up compliance-related expenditures for companies like FirstCash.

Maintaining and upgrading its IT infrastructure, including the American First Finance platform, represents another significant cost. These investments are crucial for ensuring operational efficiency, data security, and the seamless delivery of services to customers. The ongoing need for cybersecurity measures and platform enhancements means these are perpetual, non-negotiable operational costs.

- Regulatory Compliance: Legal fees, audits, and operational changes to meet financial regulations.

- IT Infrastructure: Costs for maintaining, upgrading, and securing platforms like American First Finance.

- Non-Negotiable Expenses: These are essential operational expenditures for operating within a regulated financial environment.

- Sector Trends: Increased regulatory focus in 2024 on areas like data privacy and AML likely impacted these costs.

FirstCash's cost structure is heavily influenced by the capital it deploys to fund pawn loans, representing a significant financial outlay. Additionally, operating a vast network of physical stores incurs substantial expenses for rent, utilities, and maintenance, with selling, general, and administrative expenses totaling $768.8 million in 2023. Employee compensation, encompassing wages and benefits for all staff, is another critical cost component, vital for service quality. The company also bears significant costs for acquiring merchandise, managing inventory storage, insurance, and accounting for depreciation, as seen in their substantial inventory asset base in 2023.

| Cost Category | Description | 2023 Impact (USD Millions) | 2024 Considerations |

|---|---|---|---|

| Capital for Pawn Loans | Interest on borrowed funds and opportunity cost of capital tied up in loans. | N/A (Direct operational cost) | Interest rate fluctuations and capital efficiency are key. |

| Store Operations | Rent, utilities, maintenance, security for physical locations. | Included in SG&A ($768.8M) | Expansion or consolidation strategies directly impact these fixed/semi-fixed costs. |

| Employee Compensation | Salaries, wages, and benefits for all personnel. | N/A (Part of SG&A) | Labor market trends and talent retention efforts are crucial. |

| Merchandise Acquisition & Inventory Management | Cost of goods, storage, insurance, and depreciation. | N/A (Reflected in inventory asset) | Supply chain efficiency and effective inventory turnover are paramount. |

| Regulatory Compliance & IT Infrastructure | Legal fees, audits, platform maintenance, and cybersecurity. | N/A (Integral to operations) | Increased regulatory scrutiny in 2024 on data privacy and AML likely elevated these costs. |

Revenue Streams

FirstCash's primary revenue comes from interest and fees on pawn loans. These charges are applied to the principal amount borrowed, with the duration of the loan directly influencing the total interest earned. For example, in the first quarter of 2024, FirstCash reported that pawn loan interest and fees accounted for a significant portion of their net revenue, demonstrating the critical role this stream plays in their financial performance.

FirstCash generates revenue through the retail sale of merchandise, primarily consisting of pre-owned items. This includes goods from unredeemed pawn loans and items directly purchased from customers. This diversification strategy effectively leverages the inventory acquired through its core pawn operations.

The profitability of this revenue stream is directly influenced by the company's ability to price items competitively and maintain a healthy inventory turnover rate. For instance, in 2023, FirstCash reported that its merchandise sales contributed significantly to its overall revenue, highlighting the importance of this segment in its business model.

FirstCash generates revenue through its American First Finance segment by offering point-of-sale installment payment solutions. This involves charging consumers fees and interest on these payment plans. For instance, origination fees are common, alongside interest accrued on the outstanding balances. Late fees can also contribute to this revenue stream.

Other Financial Services Fees

FirstCash supplements its core business with fees from various other financial services, enhancing customer convenience and company income. These ancillary offerings often act as a draw for customers to visit their physical locations.

- Check Cashing Fees: FirstCash may earn revenue by cashing checks for customers who do not have bank accounts or prefer immediate access to funds.

- Money Transfer Services: Fees can be generated from facilitating domestic and international money transfers, providing a valuable service to a diverse customer base.

- Bill Payment Services: The company might charge a nominal fee for processing customer bill payments, adding another layer of utility to its store offerings.

Wholesale Sales (Limited Scope)

FirstCash may generate revenue through limited wholesale sales, primarily when acquiring substantial quantities of specific merchandise or when certain items are more efficiently distributed in bulk. This channel serves as a method for managing excess inventory.

This approach allows FirstCash to monetize overstocked items or products that align better with a wholesale model, contributing a supplementary revenue stream. For instance, if a large volume of a particular electronics category is acquired, a portion might be sold to other retailers.

- Wholesale Sales: A secondary revenue stream for FirstCash, focused on bulk sales of specific merchandise categories.

- Inventory Management: Utilized to offload excess or overstocked inventory, maximizing asset utilization.

- Strategic Partnerships: Potential to develop relationships with other businesses for bulk distribution of acquired goods.

FirstCash's revenue is built on multiple pillars, with pawn loan interest and fees forming the core. In the first quarter of 2024, these charges were a significant contributor to their net revenue, underscoring their importance. Additionally, the company profits from selling merchandise, including items from unredeemed pawn loans and those directly purchased, as seen by their substantial contribution to overall revenue in 2023.

The American First Finance segment adds another layer by providing installment payment solutions, generating revenue through consumer fees and interest. Beyond these primary streams, FirstCash diversifies income with fees from check cashing, money transfers, and bill payments, enhancing both customer convenience and company profitability. Limited wholesale sales also contribute by managing excess inventory through bulk distribution.

| Revenue Stream | Primary Source | 2023/Q1 2024 Data Point |

|---|---|---|

| Pawn Loan Interest & Fees | Interest and fees on pawn loans | Significant portion of net revenue (Q1 2024) |

| Merchandise Sales | Retail sale of pre-owned items | Contributed significantly to overall revenue (2023) |

| American First Finance | Point-of-sale installment payment solutions | Generates revenue through fees and interest |

| Ancillary Services | Check cashing, money transfers, bill payments | Adds layers of utility and income |

| Wholesale Sales | Bulk sales of specific merchandise | Method for managing excess inventory |

Business Model Canvas Data Sources

The FirstCash Business Model Canvas is built upon a foundation of internal financial data, extensive market research on the pawn industry, and strategic insights gleaned from operational performance. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting FirstCash's unique business.