FirstCash PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FirstCash Bundle

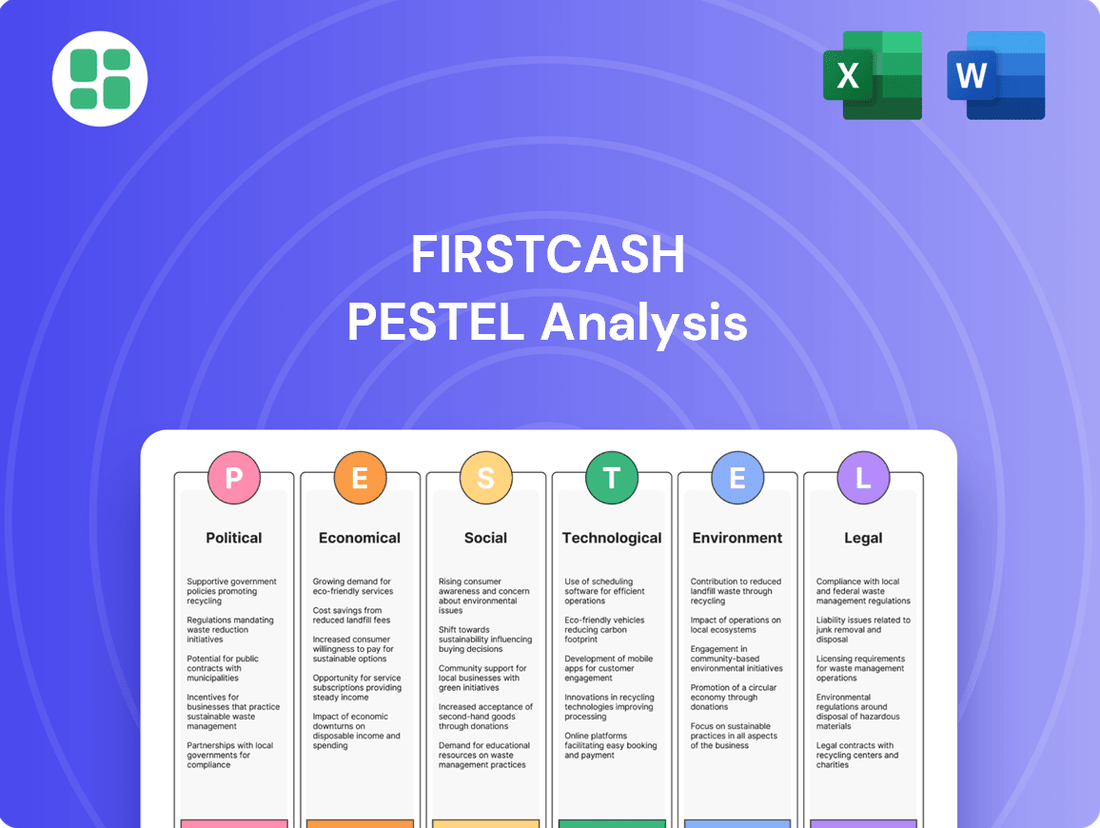

Navigate the complex external forces impacting FirstCash with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social attitudes, technological advancements, environmental regulations, and legal frameworks are shaping its business landscape. Gain a strategic advantage by identifying opportunities and mitigating risks with these expert-level insights. Download the full version now and equip yourself with the intelligence to make informed decisions.

Political factors

Government regulation, especially concerning lending practices, directly shapes FirstCash's operational landscape. Bodies like the U.S. Consumer Financial Protection Bureau (CFPB) are key influencers.

The CFPB's ongoing scrutiny of 'Unfair, Deceptive, or Abusive Acts and Practices' (UDAAP) necessitates that FirstCash maintains utmost transparency and fairness in all its lending activities to avoid penalties and maintain customer trust.

New regulatory requirements, such as the nonbank registration mandates set to take effect in April 2025, introduce additional compliance complexities and costs for FirstCash, requiring careful navigation of evolving legal frameworks.

FirstCash's significant presence in Latin America exposes it to the region's varied political landscapes. For instance, Mexico, a key market, has seen shifts in its regulatory approach to financial services. In 2023, Mexico's economic growth was projected at 2.4%, but political sentiment can influence fiscal policies impacting consumer spending and credit availability, which are crucial for FirstCash's business model.

Ongoing legislative efforts to bolster consumer protection are a significant political factor for FirstCash. These efforts often focus on capping interest rates, regulating fees, and clarifying loan terms, all of which directly impact the core of FirstCash's business operations.

For instance, California's SB 1198, enacted in 2023, revised allowable fees for pawnbrokers, illustrating how state-level legislative changes can reshape the operating landscape. Such adjustments necessitate continuous monitoring and adaptation by companies like FirstCash to ensure compliance.

Strict adherence to these evolving consumer protection laws is paramount for FirstCash to maintain its operating licenses and avoid costly legal penalties, underscoring the importance of a proactive approach to regulatory changes.

Advocacy by Industry Associations

Industry associations like the National Pawnbrokers Association (NPA) play a crucial role by lobbying lawmakers. They highlight how pawn shops serve as a vital financial resource for consumers, particularly those with limited access to traditional banking services. This advocacy aims to ensure that legislation supports the industry's ability to offer immediate, small-dollar loans.

These advocacy efforts focus on the essential nature of pawn services as a financial safety net for many individuals. By emphasizing the non-recourse aspect of these loans, associations seek to prevent regulations that could unduly restrict access to this form of credit. For example, lobbying can help to counter proposals that might impose excessive capital requirements or licensing burdens on pawn businesses.

- NPA's advocacy highlights the role of pawn shops in providing over $1 billion in short-term credit annually to consumers nationwide.

- The association emphasizes that pawn loans, averaging around $150 in 2024, offer a crucial alternative to predatory lending for many.

- Lobbying efforts by groups like the NPA aim to educate policymakers on the industry's compliance with consumer protection laws.

Fiscal and Monetary Policy Impacts

Government fiscal and monetary policies significantly influence the demand for FirstCash's services. Decisions by central banks, such as interest rate adjustments and inflation control measures, indirectly shape consumer spending and the need for alternative financial solutions. For instance, persistent high inflation and tight credit conditions, prevalent in 2023 and continuing into early 2024, can drive more individuals towards pawn loans and short-term financing options offered by FirstCash. Conversely, potential interest rate cuts later in 2024 or 2025 might alter consumer borrowing behavior.

The Federal Reserve's approach to inflation management, aiming to bring it down towards its 2% target, has led to elevated interest rates. This environment can increase the appeal of pawn services as consumers face higher costs for traditional credit. As of early 2024, inflation rates, while showing signs of moderating, remained above the Fed's target, supporting the demand for services like those provided by FirstCash. The economic outlook for 2024 and 2025 will be crucial in determining the trajectory of these policies and their subsequent impact.

- Inflationary Pressures: Elevated inflation in 2023 and early 2024 increased the cost of living, potentially boosting demand for pawn services as consumers seek quick cash.

- Interest Rate Environment: Higher interest rates set by central banks can make traditional credit more expensive, making FirstCash's offerings comparatively more attractive.

- Monetary Policy Shifts: Anticipated or actual interest rate cuts in late 2024 or 2025 could influence consumer borrowing patterns and the overall demand for short-term financing.

- Economic Stability: Broader fiscal policies aimed at economic stability and growth will indirectly affect consumer confidence and their willingness to engage in credit-based transactions.

Government regulations, particularly those focused on consumer protection and lending practices, are a significant political factor for FirstCash. The U.S. Consumer Financial Protection Bureau (CFPB) actively monitors for 'Unfair, Deceptive, or Abusive Acts and Practices' (UDAAP), requiring FirstCash to maintain high standards of transparency. New compliance mandates, such as nonbank registration requirements effective April 2025, add complexity and cost, necessitating careful adaptation to evolving legal frameworks.

FirstCash's operations in Latin America, especially Mexico, are subject to diverse political influences. While Mexico's economy showed projected growth in 2023, political sentiment can impact fiscal policies, affecting consumer spending and credit availability. Legislative efforts to cap interest rates and regulate fees, like California's SB 1198 in 2023 for pawnbrokers, directly influence FirstCash's core business, demanding continuous monitoring and compliance.

Industry advocacy groups, such as the National Pawnbrokers Association (NPA), play a vital role by lobbying lawmakers to highlight the essential financial services provided by pawn shops. These efforts aim to ensure regulations support the industry's ability to offer small-dollar loans, with the NPA noting that pawn shops provide over $1 billion in short-term credit annually, with average pawn loans around $150 in 2024.

Government fiscal and monetary policies directly impact demand for FirstCash's services. Central bank decisions on interest rates and inflation control, such as the Federal Reserve's efforts to manage inflation towards a 2% target, influence consumer borrowing behavior. Elevated interest rates in 2023 and early 2024, while showing signs of moderation, can make pawn services more attractive compared to traditional credit, with potential rate cuts in late 2024 or 2025 being a key factor to watch.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting FirstCash, providing a comprehensive overview of the external forces shaping its business environment.

A FirstCash PESTLE analysis serves as a pain point reliever by offering a clear, summarized version of external factors, enabling quick referencing during meetings and facilitating informed strategic decisions.

Economic factors

Persistent inflation and the rising cost of living are directly fueling demand for FirstCash's services. As everyday expenses increase, more individuals turn to pawn loans for immediate cash to cover essential needs. This dynamic is a key driver for the company's business model.

FirstCash has seen a tangible impact on its pawn receivables due to these economic pressures. For instance, in the first quarter of 2024, the company reported a 9% increase in total revenue to $541.6 million, with U.S. same-store revenue growing by 6%. This growth is directly attributable to consumers needing quick financial solutions.

Looking ahead, the outlook for 2025 suggests this trend will continue. FirstCash anticipates sustained demand for its services as many households continue to navigate higher prices for goods and services, reinforcing the importance of accessible credit options like those offered by FirstCash.

While FirstCash isn't a traditional bank, its business is definitely shaped by interest rates. When the Federal Reserve adjusts its benchmark rates, it impacts how much it costs FirstCash to get the money it lends out. For instance, the Federal Reserve kept its target range for the federal funds rate at 5.25% to 5.50% throughout much of 2024, a level that increases borrowing costs for companies like FirstCash.

This environment also affects consumers. Higher interest rates on credit cards or traditional loans can make those options less appealing, potentially driving more people to seek out pawn services for quick cash. This dynamic is crucial as it can increase demand for FirstCash's core offerings when mainstream credit becomes more expensive.

A tightening of traditional credit markets, where banks and other lenders become more restrictive with loans, significantly benefits FirstCash. For instance, the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) indicated in Q4 2024 that a net percentage of banks reported tightening standards for commercial and industrial loans, a trend that often extends to consumer credit.

Many of FirstCash's customers are unbanked or underbanked and lack access to conventional banking services, making pawn loans and point-of-sale (POS) solutions a crucial resource when traditional credit is scarce. This dynamic continues to drive growth in the subprime lending market, with an estimated 140 million Americans considered unbanked or underbanked, relying on alternative financial services.

Unemployment Rates and Income Levels

Unemployment and income levels are key drivers for FirstCash's services. In 2024, the U.S. unemployment rate hovered around 3.9%, a relatively low figure historically. However, within specific demographic groups or regions, unemployment can be higher, creating a consistent need for short-term financial solutions.

Stagnant or declining real income levels for certain segments of the population directly correlate with increased demand for payday loans and similar financial products. When individuals struggle to meet basic expenses due to insufficient income, they often turn to lenders like FirstCash for immediate liquidity. This is particularly true for underserved populations who may have limited access to traditional banking services.

- U.S. Unemployment Rate (2024 Average): Approximately 3.9%.

- Impact on Demand: Higher unemployment in specific regions or demographics fuels demand for short-term loans.

- Income Stagnation: When incomes don't keep pace with living costs, the need for quick cash solutions rises.

- FirstCash's Niche: The company's model is built to serve individuals needing rapid financial assistance, often bypassing traditional credit hurdles.

Currency Fluctuations in Latin America

FirstCash's substantial presence in Latin America means it's directly exposed to currency fluctuations. When local currencies like the Mexican peso or Brazilian real weaken against the U.S. dollar, FirstCash's reported revenues and profits can shrink when converted back. This volatility directly impacts its financial performance and, consequently, investor returns.

For instance, in 2023, several Latin American currencies experienced significant depreciation against the dollar. The Argentine peso saw a dramatic decline, and while FirstCash's direct exposure might vary by country, such widespread movements create headwinds. These fluctuations can make it harder to predict and manage earnings, adding a layer of risk for the company and its shareholders.

- Impact on Reported Earnings: A weaker peso or real directly reduces the USD value of sales and profits generated in those countries.

- Hedging Costs: FirstCash may incur costs to hedge against currency risks, impacting its profitability.

- Competitive Landscape: Currency shifts can alter the competitive pricing power of FirstCash relative to local competitors.

- Investment Valuation: Fluctuating exchange rates can affect the perceived value of FirstCash's Latin American assets and future cash flows.

Persistent inflation and the rising cost of living continue to bolster demand for FirstCash's services, as consumers increasingly rely on pawn loans for immediate financial needs. This trend is evident in FirstCash's financial results, with U.S. same-store revenue seeing a 6% increase in Q1 2024, contributing to a 9% overall revenue growth to $541.6 million.

Preview Before You Purchase

FirstCash PESTLE Analysis

The preview you see here is the exact FirstCash PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting FirstCash, providing valuable strategic insights.

What you’re previewing here is the actual file, offering a detailed breakdown of the external forces shaping FirstCash's business landscape.

Sociological factors

FirstCash's core customer base consists of unbanked and underbanked individuals, a demographic often excluded from traditional banking services. This reliance on alternative financial solutions highlights a persistent societal need for accessible cash management, particularly in regions like the U.S. and Latin America. In the U.S. alone, approximately 5.9 million households remained unbanked in 2022, underscoring the substantial market FirstCash taps into.

Societal views on pawn services are shifting. While a historical stigma persists, younger demographics, like Gen Z, show greater acceptance of pawn shops, viewing them as viable options for accessing funds and acquiring pre-owned items. This openness is a significant trend, especially as these consumers prioritize affordability and sustainability.

Industry initiatives are actively working to reframe the image of pawn businesses. By emphasizing their regulated operations and the legitimate financial services they provide, associations aim to build trust and counter outdated negative perceptions. This focus on responsible lending is crucial for broader social acceptance.

For instance, in 2024, the Pawn & Jewelry industry saw continued growth, with many consumers turning to pawn services for short-term liquidity, particularly during periods of economic uncertainty. This demonstrates a practical, rather than purely stigmatized, approach to utilizing these financial tools.

Consumer financial literacy significantly shapes how individuals approach short-term credit. In 2024, a survey revealed that only 33% of adults felt very confident in their financial knowledge, impacting their ability to navigate credit options. FirstCash's core clientele often requires rapid access to funds, highlighting a demand for services that bypass the often lengthy and intricate procedures of conventional banks.

The straightforward nature and speed of pawn transactions directly address these immediate financial requirements. For instance, the average pawn loan amount in 2023 was around $150, demonstrating its use for smaller, urgent needs. This accessibility makes FirstCash a vital resource for those facing unexpected expenses and lacking traditional credit access.

Income Inequality and Economic Disparity

Widening income inequality, a persistent global trend, directly impacts FirstCash by potentially expanding its customer base. As economic disparities grow, more individuals and families may find themselves needing accessible, short-term financial solutions to navigate daily expenses or unexpected financial shocks. This socioeconomic reality fuels the demand for the services FirstCash provides.

The demand for small-dollar loans is intrinsically linked to these broader economic trends. For instance, in the United States, a significant portion of the population lives paycheck to paycheck. Data from the Federal Reserve's 2023 Survey of Household Economics and Decisionmaking indicated that approximately 37% of adults reported being unable to cover a $400 emergency expense using cash or its equivalent. This highlights a substantial market segment that could turn to companies like FirstCash.

- Growing Need for Short-Term Credit: Economic disparities mean more households struggle with unexpected expenses, increasing reliance on services like FirstCash.

- Customer Base Expansion: Widening income gaps can broaden the addressable market for instant cash and small-dollar loan providers.

- Socioeconomic Indicator: The demand for payday loans and similar financial products often serves as a direct reflection of underlying economic insecurity.

- Impact on Consumer Behavior: Financial precarity drives consumers towards immediate liquidity solutions, even at a higher cost.

Demographic Shifts and Urbanization

Demographic shifts are fundamentally reshaping markets, and for FirstCash, understanding these changes is crucial. Population growth, particularly in urban centers, directly influences the concentration of their core customer base. For instance, as of 2024, global urbanization continues its upward trend, with projections indicating that by 2050, nearly 70% of the world's population will reside in urban areas. This trend is particularly relevant to FirstCash, as pawn shops historically see higher market penetration in densely populated urban environments.

Changes in age distribution also play a significant role. As the median age shifts in various regions, FirstCash needs to adapt its services and marketing to appeal to different generational needs. For example, in many developed nations, an aging population might require different financial solutions compared to a younger, more mobile demographic. This understanding is key for strategic store placement and effective market expansion efforts.

- Urbanization Trends: By 2024, over 57% of the global population lives in urban areas, a figure expected to rise, increasing the density of FirstCash's target demographic in key markets.

- Age Distribution Impact: Shifts in age demographics, such as the growing Gen Z and Millennial populations, require tailored financial product offerings and accessible digital platforms.

- Market Concentration: Urban areas, with higher population density and often greater economic volatility, represent prime locations for pawn operations, making demographic shifts within these zones critical for FirstCash's expansion strategy.

- Consumer Behavior Adaptation: Evolving consumer needs driven by demographic changes necessitate flexible service models and localized marketing campaigns to maintain relevance and market share.

Societal attitudes towards financial inclusion continue to evolve, with a growing recognition of the need for accessible financial services for the unbanked and underbanked. This trend directly benefits FirstCash, as its business model caters precisely to this demographic. In 2024, the demand for short-term, accessible credit remained high, with many individuals seeking alternatives to traditional banking due to complex requirements or lengthy approval processes.

The perception of pawn services is also shifting, with younger generations showing increased openness to them as a legitimate financial tool. This is partly driven by a greater emphasis on sustainability and the circular economy, where pre-owned goods are valued. For instance, the resale market for various goods, including jewelry and electronics, continued to expand in 2024, aligning with the pawn industry's core offerings.

Consumer financial literacy remains a key factor, with a significant portion of the population still lacking confidence in managing their finances. This gap creates a persistent need for straightforward financial solutions. In 2024, data suggested that many households still struggled with unexpected expenses, with a notable percentage unable to cover a $400 emergency without borrowing. This socioeconomic reality underscores the ongoing relevance of FirstCash's services.

The growing income inequality globally is a significant sociological factor that directly impacts FirstCash's potential customer base. As economic disparities widen, more individuals and families may find themselves in need of accessible, short-term financial solutions to manage daily expenses or unexpected financial challenges. This trend fuels the demand for the services FirstCash provides, making it a vital resource for those facing economic precarity.

Technological factors

The financial services sector is rapidly digitizing, with online pawn services and mobile loan applications becoming increasingly common. This shift is a major technological factor influencing companies like FirstCash. For instance, by mid-2024, a significant portion of financial transactions, estimated to be over 60% for many consumer lending services, were already being initiated or completed digitally, highlighting the growing importance of online platforms.

FirstCash can leverage these digital advancements to improve customer experience and broaden its customer base. Mobile applications, in particular, streamline the loan application process, making it more accessible and efficient. Digital appraisal methods also offer a faster and potentially more accurate way to assess collateral, reducing operational bottlenecks and enhancing service speed.

FirstCash's American First Finance segment heavily relies on advanced point-of-sale (POS) payment technologies. These include sophisticated underwriting models that process applications rapidly, aiming for quick approvals for consumers. This technological backbone is essential for building and maintaining its merchant network.

The ongoing enhancement of these POS solutions, such as integrating more robust e-commerce functionalities, directly impacts FirstCash's ability to attract and retain merchants. By offering seamless and efficient payment experiences, the company strengthens its value proposition to businesses looking to offer flexible payment options to their customers.

FirstCash is increasingly leveraging data analytics and AI to refine its credit assessment and risk management processes. These advanced technologies enable more precise valuations of pawned collateral, leading to smarter lending decisions and a deeper understanding of customer behavior and emerging market trends. For instance, by analyzing vast datasets, FirstCash can identify patterns that predict default risk with greater accuracy, potentially reducing losses. The company's investment in these areas is crucial for enhancing operational efficiency and mitigating financial exposure in a competitive landscape.

Cybersecurity and Data Privacy

As FirstCash increasingly relies on digital platforms for transactions and customer interactions, cybersecurity and data privacy become critical technological factors. The company must invest in advanced security infrastructure to safeguard sensitive financial data from evolving cyber threats. A significant data breach could lead to substantial financial penalties and erode customer confidence, impacting future business. For instance, global cybersecurity spending was projected to reach $270 billion in 2024, highlighting the increasing importance of this area for all businesses, including FirstCash.

Adherence to stringent data privacy regulations, such as GDPR and CCPA, is also a key technological consideration. These regulations dictate how customer data is collected, stored, and processed, with non-compliance resulting in hefty fines. FirstCash's ability to maintain robust data protection protocols is essential for its continued operation and expansion in a digital-first environment.

- Cybersecurity Investment: FirstCash must allocate significant resources to protect against data breaches and cyberattacks.

- Data Privacy Compliance: Strict adherence to global data privacy laws is crucial to avoid legal repercussions and maintain customer trust.

- Reputational Risk: A failure in cybersecurity or data privacy can severely damage FirstCash's brand image and customer loyalty.

Automation and Inventory Management Systems

FirstCash is increasingly leveraging advanced automation and inventory management systems to streamline its pawn shop operations. These technologies are crucial for optimizing stock levels, which directly impacts profitability by minimizing holding costs and reducing the risk of obsolescence. For instance, implementing smart inventory systems allows for real-time tracking of merchandise, providing valuable data for pricing and sales strategies. This efficiency gain is paramount in a business model that relies on rapid inventory turnover.

The adoption of automation extends to enhancing security and compliance. Technologies such as biometric authentication for customer identification and secure digital record-keeping are becoming standard. This not only safeguards assets but also ensures adherence to regulatory requirements, a critical aspect of the financial services industry. By automating these processes, FirstCash can reduce operational overhead and minimize the potential for human error, leading to a more robust and secure business environment.

- Inventory Optimization: Advanced systems allow for better tracking of pawned items, leading to more efficient management of collateral and potential resale inventory.

- Enhanced Security: Biometric and digital solutions bolster compliance and reduce risks associated with handling valuable goods and customer data.

- Operational Efficiency: Automation in tasks like item logging and customer verification speeds up transactions and reduces labor costs.

Technological advancements are reshaping the financial services landscape, and FirstCash is actively integrating digital solutions to enhance its operations. The company's American First Finance segment, for example, relies on sophisticated point-of-sale (POS) payment technologies and rapid underwriting models to serve its merchant network. By mid-2024, over 60% of consumer lending transactions were digitally initiated, underscoring the importance of these platforms.

FirstCash is also leveraging data analytics and AI for more accurate credit assessments and risk management, with investments in these areas crucial for operational efficiency. Furthermore, the company is adopting automation in its pawn shop operations, utilizing advanced inventory management systems and biometric authentication for enhanced security and compliance. These technological shifts are vital for FirstCash to maintain its competitive edge and improve customer experiences.

Legal factors

FirstCash navigates a dense regulatory landscape, with pawn and lending laws varying significantly across its operating regions in the U.S. and Latin America. These regulations dictate everything from permissible interest rates and fees to disclosure requirements and collateral handling, directly impacting profitability and operational strategy. For instance, in Texas, where FirstCash has a substantial presence, pawn interest rates are capped, influencing the revenue generated per transaction.

The Consumer Financial Protection Bureau (CFPB) plays a crucial role in overseeing companies like FirstCash, focusing intently on safeguarding consumers and ensuring fair business practices. This oversight means FirstCash must remain vigilant about compliance, especially with evolving regulations. For instance, the CFPB's ongoing examination of UDAAP (Unfair, Deceptive, or Abusive Acts or Practices) requires robust internal controls and transparent customer interactions. In 2023, the CFPB reported over 1.5 million consumer complaints, highlighting the agency's active role in market supervision.

FirstCash operates in a landscape increasingly shaped by data privacy and security laws. As digital transactions and data collection grow, compliance with regulations like the California Consumer Privacy Act (CCPA) and similar evolving state-specific acts in the U.S., alongside regional data protection laws in Latin America, becomes paramount. Failure to adhere can result in significant penalties, impacting financial performance and brand reputation.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Laws

As a financial service provider, FirstCash operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These laws are crucial for preventing illegal financial activities and ensuring the integrity of the financial system. For instance, the Bank Secrecy Act (BSA) in the United States, which underpins many AML efforts, requires financial institutions to report suspicious activity. Failure to comply can result in significant penalties, including hefty fines and reputational damage.

FirstCash's adherence to these regulations involves robust identity verification processes for its customers and vigilant transaction monitoring. This proactive approach helps in identifying and reporting any suspicious financial behavior, thereby contributing to broader efforts against financial crime. The Financial Crimes Enforcement Network (FinCEN) in the U.S. actively enforces these regulations, with institutions facing penalties for non-compliance. For example, in 2023, various financial institutions were fined billions of dollars for AML and KYC violations, underscoring the critical importance of these measures.

- Regulatory Framework: FirstCash must comply with AML and KYC laws to prevent financial crimes and maintain operational legitimacy.

- Compliance Measures: Key practices include thorough customer identity verification and ongoing transaction monitoring to detect illicit activities.

- Enforcement and Penalties: Non-compliance can lead to severe legal repercussions, including substantial fines and damage to brand reputation, as seen in numerous enforcement actions by financial regulators globally.

- Industry Impact: The global focus on combating financial crime means AML/KYC compliance is a continuous and evolving requirement for all financial service providers like FirstCash.

Labor Laws and Minimum Wage Regulations

Changes in labor laws, such as potential increases in federal or state minimum wages and mandated benefit programs, directly impact FirstCash's operating expenses. Given its significant retail workforce, these regulatory shifts can affect profitability and necessitate adjustments to staffing and compensation strategies. For instance, if the federal minimum wage were to rise to $15 per hour, it would significantly increase payroll costs for many of FirstCash's entry-level positions across its numerous locations.

These evolving regulations require proactive management to mitigate financial strain. FirstCash must continually assess the impact of new labor mandates on its cost structure and operational efficiency.

- Federal Minimum Wage: As of my last update, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted higher minimums.

- State-Level Increases: Several states are projected to increase their minimum wages in 2024 and 2025, with some reaching $15 or more. For example, California's minimum wage is scheduled to reach $16 per hour in 2024.

- Mandated Benefits: Growing trends in mandated paid sick leave and family leave policies in various states add to employer overhead.

- Impact on Labor Costs: A widespread increase in minimum wage could add tens of millions of dollars annually to FirstCash's labor expenses, depending on the number of employees affected and the magnitude of the wage hike.

FirstCash operates under a complex web of consumer protection laws that govern lending practices, including interest rate caps and disclosure requirements, which vary by state and country. These regulations directly influence revenue streams and operational strategies, as seen in Texas's capped pawn interest rates. The Consumer Financial Protection Bureau (CFPB) actively monitors companies like FirstCash, with its focus on preventing unfair, deceptive, or abusive acts or practices (UDAAP) demanding constant compliance vigilance. In 2023, the CFPB received over 1.5 million consumer complaints, underscoring its significant oversight role.

Data privacy laws, such as the California Consumer Privacy Act (CCPA) and similar regulations in Latin America, are increasingly critical for FirstCash due to its handling of customer data. Non-compliance with these evolving privacy mandates can lead to substantial penalties and reputational damage. Furthermore, stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, enforced by bodies like the U.S. Financial Crimes Enforcement Network (FinCEN), necessitate robust identity verification and transaction monitoring to prevent financial crime. Billions in fines were levied against financial institutions in 2023 for AML/KYC violations, highlighting the severity of non-compliance.

Changes in labor laws, particularly minimum wage increases and mandated benefits, directly impact FirstCash's operating costs. With a significant retail workforce, these regulatory shifts can affect profitability and require strategic adjustments to compensation and staffing. For example, many states are projected to increase their minimum wages in 2024 and 2025, with California reaching $16 per hour in 2024, and growing trends in mandated paid leave policies add to employer overhead. A federal minimum wage hike to $15 per hour could add tens of millions annually to FirstCash's labor expenses.

| Legal Factor | Impact on FirstCash | Key Regulations/Examples |

|---|---|---|

| Consumer Protection Laws | Dictates lending terms, fees, and disclosure, affecting revenue and strategy. | Texas pawn interest rate caps; CFPB's UDAAP oversight. |

| Data Privacy Laws | Requires strict data handling and security protocols, with penalties for breaches. | CCPA in California; evolving state-specific and Latin American data protection laws. |

| AML/KYC Regulations | Mandates customer verification and transaction monitoring to prevent financial crime. | Bank Secrecy Act (BSA); FinCEN enforcement actions. |

| Labor Laws | Influences payroll costs through minimum wage hikes and mandated benefits. | Projected state minimum wage increases (e.g., California to $16/hr in 2024); mandated paid sick/family leave. |

Environmental factors

FirstCash, while not directly involved in manufacturing, is subject to growing demands for Environmental, Social, and Governance (ESG) reporting. As a publicly traded financial institution, investors and regulators expect greater transparency on sustainability practices. This pressure is amplified by new directives such as the Corporate Sustainability Reporting Directive (CSRD) and evolving global IFRS sustainability standards, pushing for disclosures even on indirect environmental impacts.

FirstCash's extensive network of over 2,000 retail locations across the United States, Mexico, and Central America contributes to its environmental footprint. These stores consume energy for lighting, HVAC, and operations, and generate waste from packaging and daily business activities. Managing these elements efficiently can lead to cost savings and bolster the company's reputation for sustainability.

Climate change presents tangible threats to FirstCash's physical infrastructure. The escalating frequency and severity of extreme weather events, such as hurricanes and floods, directly impact store locations, particularly in disaster-prone areas. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, a record number. This can cause significant operational disruptions, property damage, and ultimately, higher insurance premiums for the company.

Electronic Waste Management

FirstCash's involvement in the electronics market necessitates careful consideration of electronic waste management. As consumers increasingly upgrade their devices, the volume of e-waste continues to grow, presenting both an environmental challenge and an opportunity for responsible business practices. Proper recycling and disposal are crucial to minimize the release of hazardous materials into the environment.

The global e-waste problem is significant. In 2023, the world generated an estimated 62 million metric tons of e-waste, a figure projected to rise. By adopting best practices in handling used electronics, FirstCash can mitigate its environmental footprint and demonstrate strong corporate social responsibility. This includes partnering with certified e-waste recyclers and educating customers on responsible disposal options.

- Growing E-Waste Volume: Global e-waste is expected to reach 74 million metric tons by 2030, highlighting the urgency for effective management.

- Hazardous Components: Electronics contain materials like lead, mercury, and cadmium, which can harm ecosystems if not disposed of properly.

- Regulatory Landscape: Many regions are implementing stricter regulations on e-waste, requiring businesses like FirstCash to comply with specific recycling and disposal standards.

- Reputational Benefits: Proactive e-waste management can enhance FirstCash's brand image, attracting environmentally conscious consumers and investors.

Supply Chain Sustainability (for Merchandise)

While FirstCash's core business revolves around pre-owned items, any new merchandise integrated into its retail operations or sourced for American First Finance could face scrutiny regarding supply chain sustainability. This involves ensuring that the sourcing of these new goods adheres to ethical labor practices and environmental responsibility, even if the volume is limited.

The increasing global focus on Environmental, Social, and Governance (ESG) factors means that even for a company like FirstCash, demonstrating responsible sourcing practices for new merchandise is becoming crucial. This aligns with evolving consumer preferences and potential future regulatory landscapes that may penalize less sustainable supply chains.

For instance, in 2024, many retail companies are actively reporting on their supply chain transparency, with some aiming for significant portions of their sourced goods to meet specific sustainability criteria. While specific data for FirstCash's new merchandise sourcing isn't publicly detailed, the broader industry trend suggests a growing expectation for such practices.

- Ethical Sourcing: Ensuring fair labor practices and safe working conditions for all individuals involved in the production of any new merchandise.

- Environmental Impact: Minimizing the ecological footprint associated with the production and transportation of new goods, such as reducing waste and carbon emissions.

- Regulatory Compliance: Staying ahead of potential future regulations concerning supply chain transparency and sustainability standards for imported or domestically sourced goods.

- Brand Reputation: Proactively addressing supply chain sustainability can enhance FirstCash's brand image and appeal to a wider customer base concerned with corporate responsibility.

FirstCash's environmental considerations extend to its numerous retail locations, which consume energy and generate waste. The company is also increasingly subject to ESG reporting demands, reflecting a broader industry shift towards sustainability transparency. The escalating frequency of extreme weather events, with 2023 seeing a record 28 billion-dollar weather and climate disasters in the U.S. according to NOAA, poses a direct risk to physical stores, potentially causing disruptions and increasing operational costs.

PESTLE Analysis Data Sources

Our FirstCash PESTLE Analysis is built on a robust foundation of data from official government publications, reputable financial news outlets, and leading market research firms. We integrate economic indicators, regulatory updates, and technological trend reports to provide a comprehensive view.