Fire & Flower PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

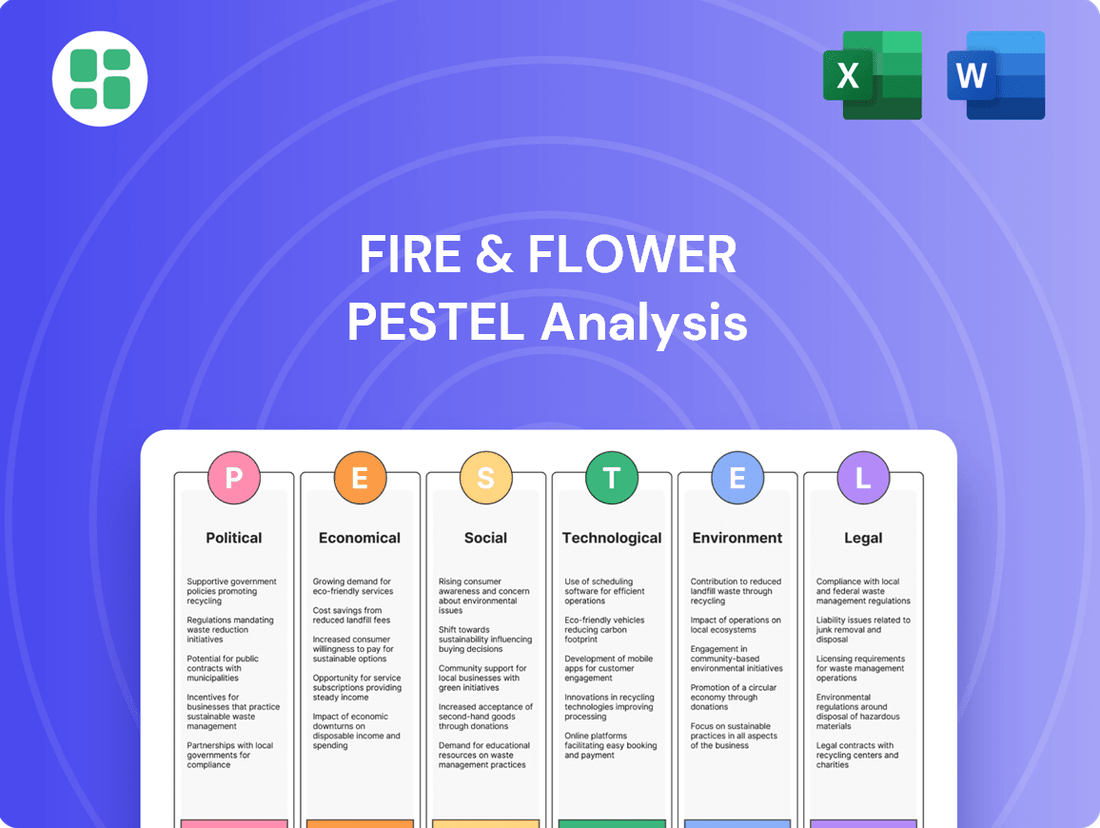

Unlock the full picture of Fire & Flower's operating environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. This detailed report is your key to anticipating market shifts and making informed strategic decisions. Download now for actionable intelligence.

Political factors

Canadian governments are actively shaping the cannabis industry through ongoing regulatory reviews. Health Canada's recent review of the Cannabis Act, for instance, proposed changes to streamline operations and encourage market competition. These evolving policies directly impact how retailers like the former Fire & Flower can operate and plan their strategies.

Provincial regulatory frameworks significantly shape Canada's cannabis retail sector, directly impacting companies like Fire & Flower. Each province dictates its own licensing, distribution models (private, public, or hybrid), and product offerings, creating a complex patchwork of rules. This provincial divergence necessitates tailored operational strategies for businesses aiming for national reach, as exemplified by the challenges Fire & Flower faced in its multi-provincial expansion.

Governments at federal and provincial levels generate considerable income from the legal cannabis sector via excise and sales taxes. For instance, the federal excise tax is set at $1 per gram or 10% of the sale price, whichever is greater. This taxation structure, while a marker of industry legitimacy, presents a significant hurdle for the financial health of legal cannabis enterprises.

The substantial tax burden directly impacts pricing, creating a competitive disadvantage for legal retailers when measured against the illicit market. This dynamic makes it challenging for legitimate businesses to attract consumers who may find lower prices in the unregulated space, thereby affecting overall market growth and profitability for companies like Fire & Flower.

Illicit Market Competition and Enforcement

The illicit cannabis market remains a persistent adversary for legal retailers like Fire & Flower. This unregulated sector often undercuts legal prices by sidestepping taxes and compliance costs, directly impacting Fire & Flower's revenue streams and market share. For instance, in 2023, industry reports suggested the illicit market still captured a significant portion of total cannabis sales in Canada, though precise figures vary by province.

Governments are stepping up efforts to curb this illegal trade. New legislative measures, such as those aimed at restricting the advertising and promotion of illicit cannabis products, are being implemented. These enforcement actions are crucial for leveling the playing field and ensuring that legal businesses can compete effectively. The ongoing struggle against the shadow market directly affects Fire & Flower's financial performance and strategic planning.

Key aspects of this illicit market competition and enforcement include:

- Price Discrepancy: Illicit market products are often priced 20-30% lower than legal alternatives, a major draw for price-sensitive consumers.

- Enforcement Focus: Governments are dedicating more resources to policing illegal sales, including crackdowns on unlicensed dispensaries and online sales.

- Regulatory Burden: Legal retailers face significant compliance costs, including product testing, packaging, and licensing fees, which the illicit market bypasses entirely.

- Market Erosion: The continued presence of the illicit market erodes the tax base and hinders the growth and profitability of legitimate cannabis businesses like Fire & Flower.

Public Health and Safety Mandates

Government policies are strongly influenced by public health and safety goals, especially regarding preventing underage cannabis use and avoiding incentives for consumption. This translates into stringent rules for advertising, packaging, and the strength of cannabis products, which can stifle marketing innovation and make it harder for legal retailers to stand out.

For example, Health Canada's regulations under the Cannabis Act, updated in 2023, continue to emphasize public health. While some administrative burdens are being eased, the fundamental commitment to protecting public health remains a significant driver for all companies in the cannabis sector, including Fire & Flower.

- Advertising Restrictions: Limits on how cannabis products can be promoted, impacting brand visibility.

- Packaging Requirements: Mandates for child-resistant packaging and plain labeling, affecting product appeal.

- Potency Controls: Caps on THC levels in certain product categories, influencing product development.

Government policies continue to be a major force in shaping the cannabis landscape. The federal government's excise tax on cannabis, set at $1 per gram or 10% of the sale price, directly impacts pricing and profitability for retailers. Provincial regulations also vary significantly, affecting licensing, distribution, and product availability, requiring companies like Fire & Flower to navigate a complex regulatory environment.

What is included in the product

This PESTLE analysis for Fire & Flower examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations and growth. It provides a comprehensive understanding of the external landscape, identifying key drivers and potential challenges for strategic decision-making.

The Fire & Flower PESTLE analysis offers a pain point reliever by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders are aligned on external factors impacting the business.

Economic factors

The Canadian cannabis retail landscape has become crowded, with too many stores opening too quickly. This oversupply has driven down prices, particularly for dried cannabis flower, making it harder for companies to turn a profit.

This intense competition and price compression directly affected Fire & Flower's financial health, contributing to its reported financial challenges. For instance, the overall Canadian cannabis market experienced a revenue dip in 2024, a clear indicator of these economic headwinds.

Cannabis retailers, including Fire & Flower, grapple with significant operational expenses. These costs encompass prime retail real estate leases, employee wages, and the complex, ongoing burden of regulatory compliance. For instance, in 2023, the legal cannabis industry continued to see high overheads impacting bottom lines across the sector.

These elevated costs, coupled with intense price competition and the persistent threat from the illicit market, create a difficult environment for achieving consistent profitability. Many legal cannabis operators have struggled to turn a profit due to these combined pressures.

Fire & Flower's own financial journey reflects these challenges; the company underwent significant restructuring in late 2023 and early 2024, a move directly linked to substantial operational costs and resulting losses that impacted its profitability.

The Canadian cannabis industry is experiencing significant consolidation, driven by economic pressures and a quest for profitability. This has resulted in larger entities acquiring smaller or financially challenged businesses, a trend anticipated to persist through 2025 as companies aim to bolster their market standing and operational efficiencies.

Fire & Flower's acquisition by Fika Cannabis, following its creditor protection filing, directly illustrates this ongoing consolidation. This move underscores the sector's dynamic where market players are actively seeking strategic alliances and acquisitions to navigate the challenging economic landscape and enhance their competitive edge.

Consumer Spending Patterns and Product Shifts

Consumer spending on legal cannabis is dynamic, with evolving product preferences significantly influencing retail sales. While dried flower maintains its position as a strong seller, there's a clear upward trend in demand for alternative formats. This includes a growing appetite for pre-rolls and inhaled extracts, indicating a diversification in consumer choices.

Retailers need to be agile, adjusting their inventory management and marketing strategies to align with these shifting consumer preferences. For instance, data from early 2024 suggests that while dried flower still accounts for a substantial portion of sales, the market share of vapes and edibles has seen consistent growth. This adaptation is crucial for maintaining sales volumes and optimizing revenue streams in a competitive landscape.

- Shifting Product Demand: Increased consumer interest in pre-rolls and inhaled extracts alongside traditional dried cannabis.

- Retailer Adaptation: The necessity for retailers to adjust inventory and marketing to meet evolving consumer preferences.

- Sales Impact: Changes in product popularity directly influence overall sales volumes and revenue generation for cannabis businesses.

- Market Diversification: A growing preference for convenient and alternative cannabis consumption methods.

Impact of Illicit Market on Revenue

The illicit cannabis market continues to siphon considerable revenue away from legal operations, including Fire & Flower. This underground sector, unburdened by taxes and regulatory compliance costs, can undercut legal prices, thereby drawing in price-sensitive consumers. For instance, in 2023, Statistics Canada data indicated that while the legal cannabis market continued to grow, the illicit market still represented a significant portion of total sales, impacting the growth trajectory of regulated businesses.

This persistent competition directly curtails the sales volume and market share achievable by licensed retailers. The ability of illicit operators to avoid taxes and quality control measures allows them to offer products at substantially lower price points, a key factor for a segment of the consumer base. This dynamic forces legal businesses to operate with thinner margins or risk losing customers to the cheaper, albeit unregulated, alternatives.

- The illicit market's price advantage directly impacts legal retailers' revenue streams.

- Regulatory and tax burdens on legal businesses create an uneven playing field.

- Consumer preference for lower prices can drive demand towards the illicit sector.

The Canadian cannabis market faces economic headwinds, including oversupply and price compression, impacting profitability for retailers like Fire & Flower. Despite a growing legal market, high operational costs such as rent and wages, alongside the persistent illicit market, continue to challenge financial performance.

Consumer preferences are evolving, with a notable increase in demand for pre-rolls and vapes, requiring retailers to adapt their product offerings. This shift, coupled with the economic pressures, is driving industry consolidation, as seen with Fire & Flower's acquisition by Fika Cannabis.

In 2023, the legal cannabis industry grappled with high overheads, affecting bottom lines. Data from early 2024 indicated that while dried flower remains a strong seller, vapes and edibles have seen consistent growth, necessitating agile inventory management.

The illicit market's ability to offer lower prices due to tax and regulatory avoidance remains a significant challenge for legal operators. Statistics Canada data from 2023 highlighted that the illicit market still captured a substantial portion of total sales, directly impacting the growth of regulated businesses.

Preview the Actual Deliverable

Fire & Flower PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fire & Flower delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the cannabis retailer. You'll gain a clear understanding of the external forces shaping their business environment.

Sociological factors

Public perception of cannabis is steadily shifting, with a growing number of people viewing it more favorably as legal markets mature. This destigmatization is crucial, as it opens the door for a wider range of consumers, including older adults, to explore cannabis products. For instance, a 2024 survey indicated that over 60% of adults in Canada now view cannabis use as acceptable, a significant increase from previous years.

This evolving acceptance directly impacts purchasing habits, with consumers becoming more comfortable visiting licensed dispensaries and trying a variety of legal cannabis products. This trend is particularly evident in the sales figures from 2024, where provinces with more established legal frameworks saw a notable uptick in new customer registrations, suggesting a broader demographic engagement.

Retailers like Fire & Flower are positioned to benefit significantly from this societal shift. As more consumers overcome past stigmas, they are more likely to seek out regulated and tested products, driving traffic and sales for compliant businesses. The expansion of product categories and the increasing normalization of cannabis use are key drivers in this expanding market.

Consumers are increasingly prioritizing wellness and unique experiences, viewing cannabis as more than just recreational. This trend is fueling demand for products like edibles and topicals designed for specific health benefits or sensory experiences. For instance, by early 2024, the global wellness market reached an estimated $5.6 trillion, with cannabis-infused wellness products capturing a growing segment of this expansive industry.

Retailers like Fire & Flower need to adapt by curating diverse product portfolios that cater to these evolving preferences. This includes highlighting product quality, detailing unique strain characteristics, and ensuring a premium customer experience that resonates with consumers seeking both therapeutic and experiential benefits from cannabis.

Cannabis consumption patterns show a clear generational divide, with Millennials currently leading the market in purchasing power, closely followed by Gen Z. This demographic shift is a key factor for companies like Fire & Flower.

While younger consumers, particularly Gen Z, are increasingly exploring cannabis products, their purchasing habits often involve more frequent, smaller transactions. For instance, by late 2024, data indicated that while Millennials represented a significant portion of overall spending, Gen Z was showing a faster growth rate in adoption and purchase frequency.

Retailers must adapt to these evolving trends. Fire & Flower, for example, needs to consider how to cater to both the higher average transaction values of older demographics and the frequent, lower-spend purchases of younger consumers through targeted promotions and product assortments.

Importance of Product Safety and Legal Sourcing

A substantial segment of Canadian cannabis consumers places a high value on product safety and legal sourcing. This is a key sociological driver influencing purchasing behavior, with consumers actively seeking out regulated and tested products. This preference directly benefits licensed retailers like Fire & Flower, as it fosters trust and encourages a shift away from illicit markets.

For instance, in 2024, surveys indicated that over 70% of Canadian cannabis users preferred purchasing from legal dispensaries specifically due to the guarantees of product safety and compliance with regulations. This consumer demand for assurance is a powerful sociological factor that licensed businesses can capitalize on.

Fire & Flower's business model inherently aligns with this sociological trend by emphasizing its commitment to legal sourcing and product integrity. This focus on lawful operations and quality control resonates with consumers, building brand loyalty and differentiating it from less regulated competitors.

- Consumer Preference for Safety: A significant majority of Canadian cannabis consumers prioritize product safety and legality.

- Trust in Licensed Retailers: Consumers choose legal channels for assurance of tested and regulated products.

- Fire & Flower's Alignment: The company's focus on lawful sales directly addresses this key sociological driver.

- Market Shift: Consumer demand for safety is a catalyst for moving away from illicit cannabis sources.

Social Responsibility and Community Integration

As the cannabis sector matures, Fire & Flower, like its peers, faces increasing pressure to embody social responsibility and actively engage with local communities. This commitment translates into adopting ethical advertising, ensuring no promotion targets underage individuals, and actively contributing to local economic development through job creation and partnerships.

For instance, Fire & Flower's community initiatives, such as supporting local charities or participating in public health awareness campaigns, can significantly bolster its brand image. In 2024, companies demonstrating strong ESG (Environmental, Social, and Governance) performance are increasingly favored by investors, with a significant portion of capital allocated to firms with proven community integration strategies.

- Responsible Advertising: Adherence to strict guidelines preventing appeals to minors is paramount for maintaining public trust and regulatory compliance.

- Community Contribution: Active participation in local economic development, including job creation and support for community programs, enhances brand reputation.

- ESG Investment Trends: Investors in 2024 are increasingly prioritizing companies with robust social responsibility frameworks, impacting capital allocation.

- Brand Reputation: Positive community integration and a commitment to social responsibility directly correlate with stronger brand loyalty and consumer trust.

Public perception of cannabis continues to evolve positively, with a 2024 survey showing over 60% of Canadians viewing cannabis use as acceptable, a notable increase that broadens the consumer base. This growing acceptance encourages more individuals, including older demographics, to explore legal cannabis products, positively impacting sales for licensed retailers. Fire & Flower benefits as consumers increasingly seek regulated and tested products, driving traffic and sales for compliant businesses.

Technological factors

Digital retail platforms are foundational for contemporary cannabis sales, facilitating online orders, customer interaction, and streamlined inventory. Fire & Flower's Hifyre™ platform was central to their strategy, aiming to link consumers with cannabis products and enhance their shopping journey through data analytics.

The company reported that in the third quarter of 2024, their digital channels contributed a significant portion of their revenue, underscoring the importance of e-commerce integration. Continued investment in integrated point-of-sale (POS) systems and robust online storefronts is vital for maintaining a competitive edge in the dynamic retail environment.

Fire & Flower, like many in the retail sector, is increasingly leveraging data analytics to deeply understand its customer base. By analyzing purchasing patterns, online engagement, and loyalty program data, the company can identify emerging trends and individual preferences. This allows for highly personalized product recommendations and tailored marketing campaigns, directly impacting customer satisfaction.

In 2024, the retail industry saw a significant push towards data-driven personalization. For instance, reports indicate that companies employing advanced analytics saw an average increase of 10-15% in customer retention rates. Fire & Flower's investment in these technologies aims to mirror this success, optimizing inventory management based on predicted demand and refining its rewards program to better incentivize repeat business.

Technological advancements are significantly reshaping supply chain management and traceability, especially crucial for industries like cannabis. Blockchain, for instance, is poised to offer unprecedented transparency in Fire & Flower's supply chain, enabling consumers to verify product origins and quality. This technology aims to bolster trust and ensure compliance.

The adoption of sophisticated tracking systems is paramount for maintaining regulatory adherence and operational integrity within the cannabis sector. For example, Canada’s Cannabis Tracking System (CTS) mandates detailed reporting from cultivation to sale, highlighting the need for robust technological solutions to manage this complexity efficiently. These systems are vital for Fire & Flower to navigate evolving legal landscapes and operational demands.

AI-Powered Retail Tools and Personalization

The retail sector is increasingly leveraging AI, with companies like Fire & Flower exploring AI-powered budtender applications. These tools aim to provide personalized product recommendations, significantly enhancing the in-store customer journey. For instance, by analyzing purchasing history and preferences, AI can suggest relevant cannabis products, mirroring advancements seen in other retail sectors where AI-driven personalization has boosted sales by an average of 10-15%.

Beyond direct customer interaction, AI and automation are transforming the cannabis supply chain. Innovations are being implemented in cultivation to optimize growing conditions, leading to improved crop quality and yield. This technological integration is crucial for efficiency, with some studies suggesting AI in agriculture can increase yields by up to 20%, a benefit that can translate to cost savings and better product availability for retailers.

These technological advancements empower retailers to offer highly tailored services while simultaneously boosting operational efficiency. The ability to personalize customer experiences and streamline cultivation processes through AI represents a significant competitive advantage in the evolving cannabis market.

- AI-powered tools enhance customer personalization in retail, potentially increasing sales.

- Automation in cultivation improves crop yields and quality.

- These technologies drive operational efficiency and tailored customer services.

Technological Adaptation for Regulatory Compliance

Technological adaptation is crucial for cannabis retailers like Fire & Flower to meet stringent regulatory demands. For instance, compliant point-of-sale (POS) systems are essential for tracking sales and inventory according to provincial regulations, such as Ontario's cannabis tracking system. Digital platforms must also integrate robust age verification measures and adhere to strict advertising and promotional restrictions to avoid fines.

Fire & Flower, like other licensed cannabis retailers, relies on technology to ensure ongoing compliance. This includes systems that manage customer purchase limits, which are critical in provinces like Alberta where daily purchase limits are enforced. Failure to accurately track and report can lead to significant penalties, underscoring the importance of sophisticated, compliant technology solutions.

- POS System Compliance: Ensuring POS systems meet provincial tracking mandates, like those in place in Ontario and British Columbia, is non-negotiable for legal operation.

- Digital Platform Integrity: Implementing secure age verification and adhering to promotional restrictions on websites and apps prevents regulatory breaches.

- Inventory Management Technology: Advanced software is necessary to monitor and report cannabis inventory accurately, aligning with government tracking requirements.

Fire & Flower's Hifyre™ platform highlights the critical role of digital retail in cannabis sales, facilitating online orders and customer engagement. In Q3 2024, digital channels significantly contributed to revenue, demonstrating the necessity of robust e-commerce integration for competitive advantage.

The company leverages data analytics to understand customer behavior, personalizing recommendations and marketing. In 2024, data-driven personalization boosted customer retention by 10-15% for many retailers, a trend Fire & Flower aims to replicate to optimize inventory and loyalty programs.

AI-powered tools, like virtual budtenders, enhance the in-store experience by offering personalized product suggestions, mirroring retail trends where AI has increased sales by 10-15%. Furthermore, AI and automation are improving cultivation efficiency, with potential yield increases of up to 20%.

Technological adaptation is vital for regulatory compliance, with POS systems needing to adhere to provincial tracking mandates, such as those in Ontario. Secure age verification and adherence to promotional restrictions on digital platforms are crucial to avoid penalties.

Legal factors

Operating a cannabis retail business in Canada involves navigating a stringent legal landscape, demanding both federal and provincial licenses. This includes obtaining specific authorizations from Health Canada for cultivation, processing, and sales, alongside strict adherence to provincial rules governing everything from store placement and security protocols to day-to-day operations.

For Fire & Flower, meeting these multi-jurisdictional legal obligations presented a significant challenge, particularly during its rapid growth phases. For instance, in 2023, Fire & Flower operated across multiple Canadian provinces, each with its unique set of cannabis retail regulations, underscoring the complexity of maintaining compliance.

The Cannabis Act in Canada places significant restrictions on advertising and promotion. These rules prohibit any marketing that appeals to young people, uses testimonials, or features depictions of people or animals. For instance, the promotion of cannabis accessories is also heavily regulated, meaning brands must be creative within strict boundaries.

These stringent advertising laws directly impact how legal cannabis retailers can build their brands and reach consumers. Navigating these regulations is crucial, as violations can lead to substantial fines or even imprisonment. Ontario, for example, has introduced measures to further penalize illegal cannabis advertising, underscoring the seriousness of compliance.

Cannabis product packaging and labeling in Canada are governed by stringent regulations aimed at public health and safety, especially concerning minors. These rules mandate plain packaging, prominent health warnings, and clear disclosure of cannabinoid content, making compliance a complex legal hurdle for retailers like Fire & Flower.

Recent amendments by Health Canada in 2024 have sought to simplify some packaging requirements, but the legal landscape remains dynamic. For instance, regulations around the display of THC and CBD levels on packaging continue to be a focal point, requiring retailers to stay updated on evolving legal interpretations and enforcement.

Intellectual Property and Brand Protection

In the evolving cannabis sector, protecting intellectual property like Fire & Flower's Hifyre™ digital platform, brand elements, and unique product formulations is paramount. Navigating trademark, patent, and copyright laws is vital for maintaining a competitive edge and deterring infringement. As of early 2024, the legal framework for IP in cannabis continues to mature, offering both avenues for growth and potential hurdles.

The development and enforcement of intellectual property rights are critical for companies like Fire & Flower. For instance, securing trademarks for brand names and logos prevents competitors from using similar identifiers, thereby protecting brand recognition and customer loyalty. The company's investment in its proprietary Hifyre™ technology underscores the importance of digital IP protection in the modern retail environment.

- Brand Protection: Safeguarding trademarks for names and logos is essential for customer recognition and trust in the cannabis market.

- Product Innovation: Patents can protect novel product formulations and delivery systems, creating a significant competitive advantage.

- Digital Assets: Copyright and patent protection for platforms like Hifyre™ are crucial for maintaining proprietary technology and user experience.

- Legal Evolution: Staying abreast of the developing IP laws in the cannabis industry is key to mitigating risks and capitalizing on opportunities.

Corporate Restructuring and Insolvency Laws

Companies in financial difficulty within Canada's cannabis industry operate under specific corporate restructuring and insolvency legislation, notably the Companies' Creditors Arrangement Act (CCAA). Fire & Flower's decision to seek creditor protection under the CCAA in June 2023 exemplifies this, enabling a court-supervised process to reorganize its operations and financial obligations.

These legal frameworks govern critical actions like acquisitions, the divestiture of assets, and the settlement of outstanding debts when a company faces significant financial strain.

- CCAA Filing: Fire & Flower filed for creditor protection under the CCAA in June 2023, a significant legal event impacting its operational and financial restructuring.

- Court Supervision: The CCAA process ensures that any restructuring, asset sales, or debt resolutions are conducted under the oversight of the court.

- Industry Impact: Such legal processes are crucial for managing financial distress and can influence the competitive landscape and ownership structures within the Canadian cannabis sector.

The legal framework for cannabis retail in Canada is complex, requiring adherence to federal and provincial licensing and operational rules. Fire & Flower's operations across multiple provinces in 2023 highlighted the challenge of multi-jurisdictional compliance.

Strict advertising regulations limit how cannabis retailers can promote their brands, with a focus on preventing appeal to youth and prohibiting testimonials. This necessitates creative marketing strategies within tight legal boundaries.

Packaging and labeling laws, updated by Health Canada in 2024, mandate plain packaging and clear health warnings, impacting brand presentation and requiring constant vigilance on evolving legal interpretations.

Intellectual property protection, particularly for digital assets like Fire & Flower's Hifyre™ platform, is crucial for competitive advantage, with IP laws in the cannabis sector continuing to mature.

Financial distress in the Canadian cannabis industry is managed under legislation like the Companies' Creditors Arrangement Act (CCAA), as demonstrated by Fire & Flower's June 2023 filing, which subjects restructuring to court supervision.

Environmental factors

The legal cannabis industry, including retailers like Fire & Flower, faces a significant challenge with packaging waste. Strict regulations mandating child-resistant and tamper-evident features often necessitate the use of plastics and other materials that contribute to this waste stream. For instance, in 2023, the U.S. cannabis industry alone was estimated to generate thousands of tons of plastic waste annually, largely from packaging.

There's a clear market push and increasing consumer demand for more sustainable packaging solutions. This trend is influencing how companies approach their product presentation and environmental impact. Many consumers are actively seeking out brands that demonstrate a commitment to eco-friendly practices.

Encouragingly, regulatory bodies are starting to adapt. Amendments to existing rules are being considered and implemented in various jurisdictions, offering greater flexibility for cannabis retailers. This potential for regulatory change could allow companies like Fire & Flower to explore and adopt more sustainable packaging materials and designs, thereby reducing their environmental footprint and aligning with market expectations.

While Fire & Flower primarily operates as a retailer, the cannabis industry's overall environmental impact, especially concerning its carbon footprint, is a significant factor. Cultivation, particularly indoor grows, is a major energy consumer, and the transportation of products throughout the supply chain also adds to emissions. For instance, a 2023 report indicated that cannabis cultivation in the US could account for up to 1% of the nation's total electricity consumption, highlighting the energy intensity of the sector.

Although Fire & Flower itself doesn't directly control cultivation practices, there's a growing expectation for retailers to demonstrate due diligence regarding their supply chains' sustainability. This means considering and potentially prioritizing products sourced from growers who employ more environmentally friendly methods, such as those utilizing renewable energy or water-efficient techniques.

Cannabis cultivation, particularly large-scale operations, demands significant water resources and produces considerable agricultural waste. While Fire & Flower itself isn't a grower, its operations are intrinsically linked to this environmentally sensitive sector. The industry is under growing pressure to adopt more sustainable practices, reflecting a broader trend toward environmental responsibility.

For instance, studies indicate that cannabis cultivation can consume thousands of gallons of water per pound of dried flower produced, raising concerns about water scarcity in certain regions. Furthermore, the disposal of plant waste, including stems and leaves, presents a challenge, with many jurisdictions implementing regulations for proper management to prevent environmental contamination and promote recycling or composting initiatives.

Environmental Regulations and Compliance

Cannabis retailers like Fire & Flower face a growing landscape of environmental regulations. These cover crucial areas such as responsible waste disposal, optimizing energy efficiency in cultivation and retail spaces, and increasingly, water usage management. Failure to comply can result in significant penalties and operational disruptions.

The emphasis on environmental sustainability is becoming a core component of federal cannabis licensing and compliance. This means companies are actively being pushed to integrate greener practices throughout their operations. For instance, by 2024, many jurisdictions are implementing stricter guidelines for packaging materials and waste reduction, impacting how retailers like Fire & Flower manage their supply chain and in-store operations.

Adhering to these environmental mandates is not just about avoiding fines; it’s about fostering responsible corporate citizenship. Companies that demonstrate a commitment to sustainability often see a positive impact on their public image, potentially attracting environmentally conscious consumers and investors. Fire & Flower's commitment to reducing its carbon footprint, for example, could be a key differentiator in the competitive Canadian market.

- Waste Management: Regulations often dictate how cannabis plant waste, packaging, and other materials must be disposed of, with a focus on preventing environmental contamination.

- Energy Efficiency: Requirements may include mandates for energy-efficient lighting, HVAC systems, and operational practices to reduce the carbon footprint of retail and cultivation facilities.

- Water Conservation: As water scarcity becomes a concern in certain regions, regulations may emerge or be strengthened regarding water usage in cannabis operations, particularly for cultivation.

- Packaging Standards: Environmental considerations are increasingly influencing packaging requirements, pushing for recyclable, compostable, or reduced-plastic materials.

Climate Change and Extreme Weather Impacts

Climate change poses significant risks to Fire & Flower. Extreme weather events, from droughts to floods, can devastate cannabis crops, impacting the entire supply chain. This can lead to increased product costs and reduced availability for retailers like Fire & Flower.

For instance, in 2023, parts of Canada experienced severe drought conditions, affecting agricultural yields. While Fire & Flower is a retailer and not a grower, these disruptions translate to potential price volatility and supply shortages in the cannabis market. The company must therefore focus on building robust and adaptable supply chain strategies.

- Supply Chain Vulnerability: Extreme weather can directly impact the availability of cannabis products, leading to potential stockouts.

- Price Volatility: Crop damage due to climate events can drive up wholesale prices, affecting retail margins.

- Operational Disruptions: While less direct, severe weather can impact transportation and logistics, delaying product delivery to stores.

- Increased Costs: Retailers may face higher costs for sourcing products if climate-related issues reduce overall supply.

Environmental factors significantly impact Fire & Flower's operations, primarily through packaging waste and the carbon footprint of cannabis cultivation. Strict regulations often mandate materials that contribute to waste, while consumer demand for sustainability is growing. The industry's reliance on energy-intensive indoor grows and transportation also presents environmental challenges.

Climate change introduces risks like supply chain disruptions due to extreme weather, potentially affecting product availability and prices for Fire & Flower. The company must navigate increasing environmental regulations concerning waste disposal, energy efficiency, and water conservation, with compliance being crucial for maintaining a positive public image and avoiding penalties.

| Environmental Factor | Impact on Fire & Flower | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Packaging Waste | Regulatory compliance and consumer expectations for eco-friendly options. | Estimated thousands of tons of plastic waste from U.S. cannabis packaging annually (2023). Growing consumer preference for recyclable/compostable materials. |

| Carbon Footprint (Cultivation & Transport) | Indirect impact on supply chain costs and availability; pressure for supply chain due diligence. | Cannabis cultivation potentially consuming up to 1% of U.S. electricity (2023). Water usage can be thousands of gallons per pound of flower. |

| Climate Change & Extreme Weather | Supply chain vulnerability, price volatility, and potential operational disruptions. | Regions experiencing droughts or floods in 2023 impacted agricultural yields, leading to price fluctuations in the cannabis market. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fire & Flower is informed by a robust blend of official government publications, reputable financial news outlets, and comprehensive industry-specific market research reports. This ensures a well-rounded understanding of the political, economic, social, technological, legal, and environmental factors impacting the cannabis retail sector.