Fire & Flower Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

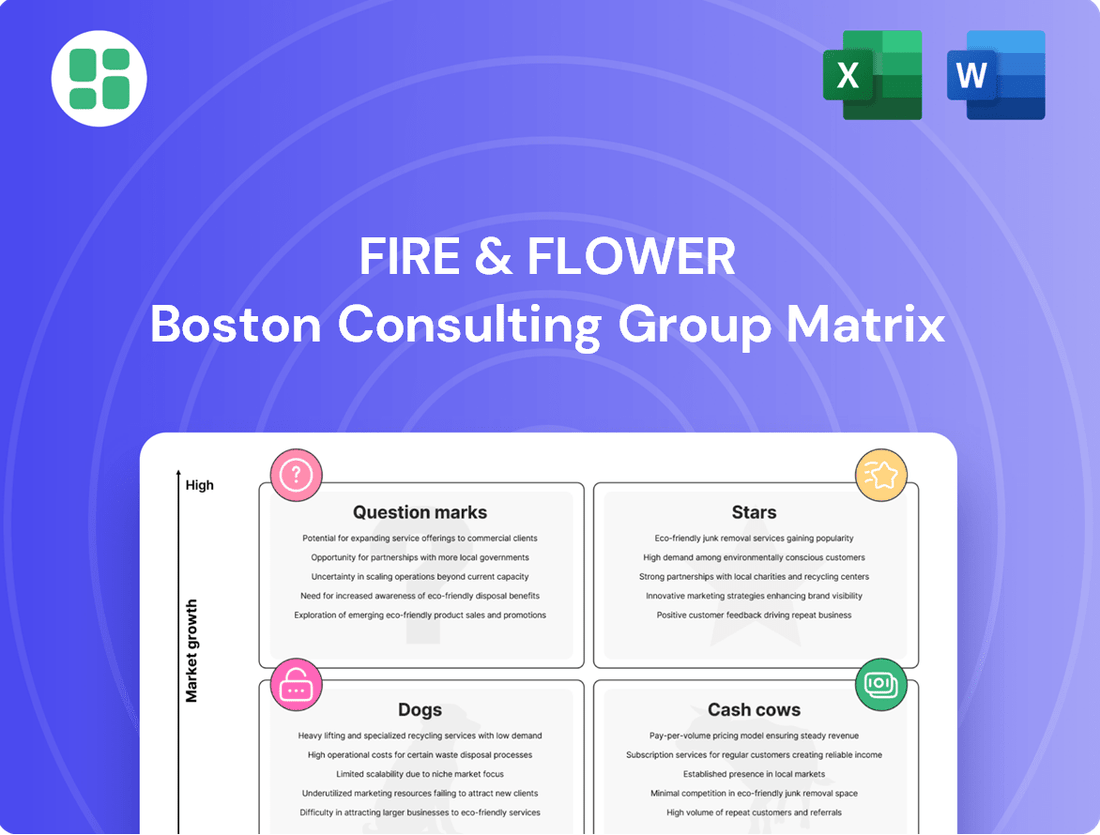

Curious about Fire & Flower's market position? See which of their offerings are potential Stars, Cash Cows, Dogs, or Question Marks in this insightful preview.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of their product portfolio's performance and receive actionable strategies to optimize your own business decisions.

Stars

The Hifyre™ digital platform, encompassing Hifyre IQ, ONE, and SPARK, represented a crucial proprietary asset for Fire & Flower. It served as a bridge connecting consumers to cannabis products while simultaneously generating valuable data analytics designed to enhance customer experiences.

This platform held substantial promise for high growth within the rapidly expanding cannabis technology sector. It offered real-time sales data and deep consumer insights, which are absolutely vital for navigating and understanding the market landscape effectively.

Hifyre's innovative approach and its capacity to deliver personalized customer journeys positioned it as a potential frontrunner in cannabis tech solutions. This innovative edge attracted significant strategic interest, notably from partners such as Couche-Tard.

Fire & Flower's strategic placement of corporate retail stores within high-traffic Circle K locations, especially in Ontario and Alberta, was a key growth driver. This approach capitalized on Couche-Tard's existing customer base and prime real estate to rapidly expand market presence in the burgeoning cannabis sector.

By 2024, the Canadian cannabis market experienced a deceleration in its growth trajectory. However, Fire & Flower's co-location strategy aimed to tap into pockets of strong regional demand, leveraging the convenience store traffic to secure market share even amidst broader market cooling.

Fire & Flower's strategic early market entry into key provinces like Alberta, Saskatchewan, and Ontario was crucial. This allowed them to secure prime retail locations and build brand awareness before competitors. By the end of 2023, Fire & Flower operated over 100 stores across Canada, with a significant portion concentrated in these early-access provinces, reflecting this foundational strategy.

Brand Recognition and Customer Loyalty (Spark Perks)

The Spark Perks program, integrated within the Hifyre platform, stood as Canada's largest cannabis membership initiative. This demonstrated a significant base of loyal customers, crucial for sustained growth.

This program provided exclusive benefits and discounts, which actively engaged customers. It also yielded valuable insights into consumer purchasing habits and preferences.

A strong loyalty program like Spark Perks is a key indicator of a star product. It signifies high market acceptance and the potential for continued revenue expansion.

- Spark Perks: Canada's largest cannabis member program, part of Hifyre.

- Customer Loyalty: Fostered through exclusive perks and discounts.

- Data Insights: Valuable consumer behavior data collected.

- Star Product Indicator: High market adoption and growth potential.

Potential for International Expansion Leveraging Partner Network

Fire & Flower's international expansion ambitions, particularly leveraging Alimentation Couche-Tard's global network, position it as a potential Star. As new cannabis markets open in the United States and Europe, Fire & Flower's established retail and digital models could see significant growth beyond Canada.

This strategic partnership offers a pathway to tap into high-growth international opportunities. For instance, by mid-2024, several US states were progressing with adult-use cannabis legalization, and European markets were also showing increased regulatory movement.

- Global Reach: Alimentation Couche-Tard operates over 14,000 convenience stores worldwide, providing Fire & Flower with an unparalleled platform for international market entry.

- Emerging Markets: The potential for high growth in newly legalized cannabis markets in the US and Europe, as seen with states like New York and Germany advancing their frameworks in 2024, is a key driver.

- Scalable Models: Fire & Flower's retail and digital infrastructure is designed for scalability, allowing for adaptation to diverse international regulatory environments.

- Strategic Advantage: This expansion, if successful, could significantly boost Fire & Flower's revenue streams and market share, solidifying its Star status in the BCG matrix.

Fire & Flower's international expansion, particularly through its partnership with Alimentation Couche-Tard, positions it as a Star in the BCG matrix. This strategy leverages Couche-Tard's vast global network, which spans over 14,000 stores worldwide, offering a significant advantage for entering new cannabis markets.

The potential for high growth in emerging markets, such as the United States and Europe, is substantial. By mid-2024, several US states were advancing adult-use cannabis legalization, and European markets were also showing increased regulatory movement, creating fertile ground for expansion.

Fire & Flower's scalable retail and digital models are well-suited to adapt to diverse international regulatory environments. This strategic positioning could lead to significant revenue growth and increased market share, reinforcing its Star status.

| Strategic Initiative | Key Partner | Global Network Size | Market Potential | Growth Driver |

|---|---|---|---|---|

| International Expansion | Alimentation Couche-Tard | 14,000+ stores | US & Europe (legalizing markets) | Scalable models, regulatory adaptation |

What is included in the product

This BCG Matrix overview highlights Fire & Flower's product portfolio, identifying which units to invest in, hold, or divest based on market share and growth.

The Fire & Flower BCG Matrix provides a clear, visual overview of each business unit's position, easing the pain of strategic uncertainty.

Cash Cows

Fire & Flower's established corporate retail network, comprising 92 stores as of March 2023, represents a significant asset. These locations, particularly those in more mature markets, likely contribute consistent cash flow with reduced reinvestment needs, acting as a stable revenue generator.

Certain Fire & Flower store formats, particularly those in prime urban locations or with established, loyal customer bases, likely operate as Cash Cows. These formats would demonstrate a strong competitive advantage, translating into high profit margins with minimal need for aggressive marketing or promotional spending. For example, by July 2024, Fire & Flower reported continued strong performance in its larger format stores, which typically benefit from greater brand recognition and economies of scale.

These high-performing locations act as reliable cash generators for Fire & Flower, providing consistent profitability that can fund other strategic initiatives or investments. Their efficient operations and established customer loyalty reduce the need for significant capital expenditure, allowing them to generate substantial free cash flow. This consistent income stream is crucial for supporting the company's growth and innovation efforts.

As Fire & Flower's retail operations matured in provinces like Alberta and Saskatchewan, the company honed its processes, leading to reduced cost of sales and a healthier gross margin. For instance, by Q1 2024, Fire & Flower reported a gross profit margin of 28.7%, a testament to these ongoing efficiency efforts in established markets.

These operational improvements, combined with a solid market share in these specific Canadian regions, enabled these segments to generate significant cash flow. This cash generation required very little additional investment, solidifying their position as cash cows within the company's portfolio.

Wholesale Distribution in Stable Regions

Fire & Flower's wholesale distribution arm in Saskatchewan could be considered a cash cow. This is because it likely possesses a high market share within a mature, stable market, generating consistent cash flow with minimal reinvestment needs. For instance, in Q1 2023, while revenue saw a slight dip, the established nature of this segment suggests a reliable income stream.

Cash cows are vital for funding other business units. They represent established products or services with significant market share in low-growth industries. These operations are characterized by strong profitability and require limited capital expenditure to maintain their position.

- High Market Share: Dominant position in the Saskatchewan wholesale distribution market.

- Stable Market: Operates in a low-growth, predictable industry environment.

- Consistent Cash Flow: Generates reliable profits with limited need for aggressive investment.

- Funding Potential: Profits can be redirected to support other business segments, like Stars or Question Marks.

Data Monetization from Hifyre IQ

Hifyre IQ's data monetization, stemming from Fire & Flower's Hifyre platform, represents a potential cash cow. This segment leverages the established user base and transaction data generated by Hifyre, transforming it into valuable market insights and trend analysis for a diverse clientele.

The continuous sale of these data insights and market intelligence reports, once the analytical infrastructure was in place, offers a low-cost, high-margin revenue stream. This recurring revenue from an established product and service supports its classification as a cash cow within the BCG matrix, indicating a strong position in a mature market.

- Hifyre IQ's revenue is derived from selling aggregated, anonymized data insights and market intelligence reports.

- The mature data analytics market suggests a stable demand for such services, contributing to consistent revenue generation.

- The low marginal cost of delivering existing data analytics products enhances profitability, characteristic of a cash cow.

- Fire & Flower reported approximately $217.5 million in revenue for the fiscal year ending March 31, 2024, with Hifyre IQ contributing to the overall financial performance through its data services.

Fire & Flower's established retail locations, particularly those in mature markets like Alberta and Saskatchewan, function as cash cows. These stores benefit from high market share and operational efficiencies, leading to consistent profitability with minimal need for reinvestment. For instance, by Q1 2024, Fire & Flower achieved a gross profit margin of 28.7%, reflecting strong performance in these established segments.

The wholesale distribution arm in Saskatchewan also operates as a cash cow, holding a dominant position in a stable market. This segment generates reliable cash flow, which can then be allocated to support other growth areas within the company. Despite a slight revenue dip in Q1 2023, its established nature ensures a steady income stream.

Hifyre IQ, Fire & Flower's data monetization arm, is another key cash cow. By leveraging the Hifyre platform's user data, it provides high-margin market intelligence. The company reported total revenue of approximately $217.5 million for the fiscal year ending March 31, 2024, with Hifyre IQ contributing to this overall financial strength through its data services.

| Business Segment | Market Position | Cash Flow Generation | Reinvestment Needs |

|---|---|---|---|

| Established Retail Stores (e.g., Alberta, Saskatchewan) | High Market Share | Consistent & Strong | Low |

| Saskatchewan Wholesale Distribution | Dominant | Reliable | Minimal |

| Hifyre IQ (Data Monetization) | Established User Base & Data Assets | High Margin, Recurring | Low (post-infrastructure) |

What You’re Viewing Is Included

Fire & Flower BCG Matrix

The Fire & Flower BCG Matrix preview you're viewing is the complete, unadulterated document you'll receive upon purchase. This means you're seeing the exact analysis, formatting, and strategic insights that will be yours to leverage immediately. No watermarks or sample data will mar the final report, ensuring a professional and actionable resource for your business planning.

Dogs

Fire & Flower, navigating the competitive cannabis retail landscape, experienced underperformance in some locations. These stores, often found in saturated markets with limited growth potential, struggled to gain significant market share. In 2024, the company continued to assess its retail footprint, with underperforming locations representing a drain on resources.

Fire & Flower's wholesale and logistics operations are currently facing significant headwinds. In the first quarter of 2023, this segment saw a decline in both revenue and gross profit. Furthermore, fiscal year 2022 concluded with a negative Adjusted EBITDA for these operations, signaling underlying profitability issues.

These financial results point to a struggle with low market share and profitability within a demanding market. If these wholesale and logistics activities cannot achieve greater efficiency or capture a more substantial market presence, they risk being classified as a dog in the BCG matrix. This classification would mean they are consuming capital without delivering sufficient returns.

Unprofitable Ancillary Ventures represent areas where Fire & Flower has invested resources but hasn't seen a positive return. These are typically smaller, experimental initiatives or product lines that didn't capture consumer interest or demand. For example, if Fire & Flower launched a line of branded cannabis-infused beverages in 2023 that saw very low sales, it would be classified here.

These ventures, while perhaps intended to diversify revenue streams or test new markets, ultimately consumed capital and management attention without yielding significant financial benefits. In 2024, the company's focus has been on streamlining operations, meaning such underperforming ancillary ventures would likely be a priority for divestment or closure to reallocate resources to more promising areas.

Stores in Declining Regional Markets

Fire & Flower stores situated in regions experiencing a downturn, such as Ontario and British Columbia, which saw notable year-over-year declines in cannabis sales in 2024, would be classified as Dogs. These stores, particularly those with already minimal market share in these challenging provincial markets, face significant hurdles to profitability.

The adverse market conditions and fierce local competition in these areas make it difficult for these locations to gain traction or even maintain their current sales figures. For instance, while the overall Canadian cannabis market showed some resilience, specific provincial performance varied, with some provinces like Alberta demonstrating stronger growth compared to others.

- Declining Provincial Sales: Ontario and British Columbia reported significant year-over-year decreases in cannabis sales throughout 2024.

- Low Market Share Locations: Stores in these specific declining markets with already low market share are prime candidates for the Dog category.

- Profitability Challenges: Adverse market conditions and intense local competition in these regions severely hinder the ability of these stores to achieve profitability.

- Market Share Erosion: Stores in these areas are likely to experience further erosion of their already small market share due to unfavorable economic and competitive landscapes.

High Debt Burden and Negative Cash Flow

Fire & Flower's financial health, marked by a substantial debt burden and persistent negative cash flow from operations, placed its overall business model in a precarious position, akin to the 'Dogs' category in the BCG Matrix. This financial strain meant the company was burning through cash rather than generating it, a situation that severely hampered its ability to invest in growth or even sustain its current operations.

The company's struggles were evident in its financial reports leading up to its restructuring. For instance, in the third quarter of 2023, Fire & Flower reported a net loss of $20.8 million, with negative operating cash flow. This financial reality underscored the challenges of its business model, which was consuming resources without generating sufficient returns.

- High Debt: Fire & Flower carried a significant amount of debt, making it difficult to service and reinvest in the business.

- Negative Operating Cash Flow: The core operations of the company were not generating enough cash to cover expenses, leading to a cash deficit.

- Restructuring Impact: These financial pressures ultimately led to a significant restructuring, including a significant debt-for-equity swap in late 2023, highlighting the severity of its 'Dog' status.

Fire & Flower's wholesale and logistics operations, facing declining revenues and negative EBITDA in 2022 and early 2023, represent a classic 'Dog' in the BCG matrix. These segments are characterized by low market share and low growth potential, consuming capital without generating sufficient returns. If efficiency improvements or market share gains are not realized, these operations risk continued underperformance.

Stores in declining provincial markets like Ontario and British Columbia, which saw notable sales decreases in 2024, also fall into the 'Dog' category. These locations, especially those with already minimal market share, struggle due to adverse market conditions and intense local competition, making profitability a distant prospect.

The company's overall financial structure, burdened by significant debt and negative operating cash flow as seen in Q3 2023 with a $20.8 million net loss, pushed its business model towards a 'Dog' classification. This precarious financial state, leading to a debt-for-equity swap in late 2023, underscored the need for drastic measures to address the cash-burning nature of its operations.

| Business Segment | Market Share | Market Growth | Profitability | BCG Classification |

| Wholesale & Logistics | Low | Low | Negative (e.g., FY2022 Adj. EBITDA negative) | Dog |

| Retail (Ontario/BC) | Low (in declining markets) | Declining (e.g., 2024 year-over-year sales decreases) | Low / Negative | Dog |

| Overall Business Model | N/A | N/A | Negative Cash Flow (e.g., Q3 2023 negative operating cash flow) | Dog |

Question Marks

Fire & Flower's strategic expansion into highly competitive retail zones, such as major urban centers in Ontario and Alberta, places these new locations squarely in the Question Mark category of the BCG Matrix. These markets, while offering substantial overall demand for cannabis products, are characterized by a high concentration of existing retailers, making market penetration challenging.

The company's investment in these new stores, including significant outlays for marketing and prime real estate, reflects the high cost of gaining traction in such saturated environments. For instance, by the end of Q1 2024, Fire & Flower continued to navigate these competitive landscapes, with the success of these newer, smaller market share locations dependent on their ability to capture a meaningful portion of the high-potential, yet intensely contested, consumer base.

Expanding Hifyre into untested verticals within cannabis or broader retail tech presents significant challenges for Fire & Flower. These ventures demand considerable investment and development, with success hinging on swift market acceptance and strong differentiation against new rivals.

In 2024, the retail technology landscape is highly competitive. For instance, companies like Shopify have seen substantial growth in their e-commerce solutions, indicating the need for truly innovative offerings to gain traction. Hifyre’s expansion would need to demonstrate a clear value proposition to capture market share in areas where Fire & Flower’s existing presence is minimal.

Fire & Flower's strategic licensing support for cannabis retail operations in unproven markets represents a classic 'Question Mark' in the BCG Matrix. These ventures, while holding the allure of high growth potential due to nascent market demand, are inherently risky. For instance, in early 2024, many new international markets were grappling with evolving regulations, creating significant uncertainty for potential licensees.

The company's ability to navigate these complex and often unpredictable regulatory landscapes is paramount. Securing a strong market position in these emerging territories, where brand recognition and customer loyalty are yet to be established, requires substantial investment and a keen understanding of local consumer preferences and competitive dynamics. This is a high-stakes game with the potential for significant rewards if successful, but also the possibility of substantial losses.

International Market Entry Initiatives

Fire & Flower's international market entry, especially into the United States and European markets as their regulatory landscapes shift, presented a classic high-growth potential, low-market-share situation. These ambitious undertakings demanded significant initial capital for legal compliance, establishing operations, and building brand awareness in unfamiliar territories. The inherent uncertainty surrounding success in these new ventures firmly placed them in the category of Stars within the BCG Matrix.

For instance, Fire & Flower's expansion into the US, particularly after the Farm Bill's impact on hemp-derived cannabinoids, represented a significant opportunity. However, navigating varying state-level regulations and establishing a foothold against existing players required substantial investment. In 2024, the company continued to explore these avenues, acknowledging the high risk and high reward associated with such strategic moves.

- High Growth Potential: The evolving legal frameworks in the US and Europe offered substantial untapped market opportunities for cannabis retail and related services.

- Low Market Share: As a new entrant, Fire & Flower had minimal existing market share in these international territories, necessitating significant effort to gain traction.

- Substantial Investment Required: Entering these markets involved considerable upfront costs for legal, operational setup, supply chain development, and marketing campaigns.

- Uncertain Outcome: The success of these international ventures was not guaranteed, depending heavily on regulatory changes, competitive responses, and consumer adoption rates.

Investment in New Product Categories Beyond Retail

Investing in new product categories beyond retail, such as cultivation or processing, would position Fire & Flower as a potential 'Question Mark' in the BCG Matrix. These segments offer substantial growth potential, with the Canadian cannabis market projected to reach CAD $6.4 billion by 2026, according to Deloitte. However, Fire & Flower would enter these markets with a low market share, necessitating significant capital investment and specialized expertise to gain traction against established players.

The evolving Canadian cannabis landscape presents both opportunities and challenges for diversification. For instance, edibles and beverages saw a 15% increase in sales in early 2024, indicating a shift in consumer preferences that could be leveraged. Yet, the capital expenditure for cultivation facilities alone can range from $5 million to $10 million, and processing requires adherence to stringent regulatory standards, adding complexity and cost.

- Diversification into cultivation or processing would place Fire & Flower in high-growth, but highly competitive, market segments.

- The Canadian cannabis market's projected growth to CAD $6.4 billion by 2026 highlights the potential upside.

- Significant capital outlay and specialized expertise are critical requirements for success in these new ventures.

- Shifting consumer preferences, such as the rise in edibles and beverages, present strategic opportunities but also inherent risks.

Question Marks represent business units with low market share in high-growth industries, demanding significant investment to capture potential. Fire & Flower's expansion into new, competitive urban retail zones and nascent international markets exemplifies this. These ventures require substantial capital for market penetration and brand building, with uncertain outcomes.

The company's strategic moves into new product categories like cultivation or processing also fall into this category. These areas offer significant growth potential, as seen in the Canadian cannabis market's projected growth, but necessitate considerable investment and specialized expertise to compete effectively.

For instance, Fire & Flower's investment in new stores in Ontario and Alberta by Q1 2024 aimed to capture market share in high-demand areas, but faced intense competition. Similarly, expanding its Hifyre technology into new verticals requires innovation to stand out against established players like Shopify.

The success of these Question Mark initiatives hinges on Fire & Flower's ability to secure a strong market position quickly and adapt to evolving consumer preferences and regulatory landscapes, particularly in areas like edibles and beverages.

| Business Unit | Market Growth | Market Share | Investment Need | Potential |

|---|---|---|---|---|

| New Urban Retail Stores (Ontario, Alberta) | High | Low | High | High |

| Hifyre Expansion into New Verticals | High | Low | High | High |

| International Market Entry (US, Europe) | High | Low | Very High | Very High |

| Diversification into Cultivation/Processing | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.