Fire & Flower Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

Fire & Flower navigates a complex retail landscape, facing moderate buyer power from price-sensitive consumers and significant threat from online substitutes. Supplier power is also a key consideration, as is the intense rivalry within the burgeoning cannabis market.

The complete report reveals the real forces shaping Fire & Flower’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Canadian cannabis market exhibits a notable concentration among Licensed Producers (LPs). For instance, as of early 2024, a handful of the largest LPs accounted for a substantial portion of provincial wholesale cannabis sales, particularly in high-demand segments like premium flower. This concentration means that retailers such as Fire & Flower may find their bargaining power diminished when dealing with these dominant suppliers, who can dictate terms more effectively.

Suppliers in the cannabis industry, including those serving Fire & Flower, face a labyrinth of regulations from Health Canada and provincial authorities. These rules, covering everything from cultivation to distribution, can be costly and time-consuming to navigate, effectively limiting the number of qualified suppliers. For instance, in 2024, the stringent licensing process for cannabis producers continued to be a significant barrier to entry, with only a select group meeting all requirements.

The complexity of these regulatory hurdles, coupled with intricate provincial distribution systems, often consolidates power among established Licensed Producers (LPs). These larger, more experienced LPs are better equipped to manage compliance and secure shelf space, thereby increasing their bargaining leverage. This situation means that suppliers who can consistently meet these demanding standards and ensure reliable product flow gain a significant advantage.

While cannabis flower itself can become a commodity, many Licensed Producers (LPs) actively differentiate their offerings. This often involves developing unique strains, investing in advanced processing for Cannabis 2.0 products such as edibles, vapes, and concentrates, and building strong brand recognition. Suppliers with well-known brands and innovative products often have more leverage, allowing them to negotiate higher prices with retailers who depend on these popular items to draw in consumers.

Switching Costs for Retailers

For cannabis retailers, the process of switching suppliers extends beyond a simple order change. It necessitates managing new inventory, updating extensive product catalogs, and potentially retooling marketing campaigns to align with new product offerings. This complexity, while not prohibitive, creates a moderate barrier.

Building strong, reliable relationships with Licensed Producers (LPs) that consistently deliver quality products and timely shipments can foster a degree of supplier loyalty. This 'stickiness' grants these established suppliers a moderate level of bargaining power, as retailers may hesitate to disrupt a dependable supply chain.

Furthermore, the stringent regulatory environment and the critical importance of quality assurance in the cannabis industry add inertia to supplier changes. Retailers must ensure new suppliers meet all compliance standards, a process that can be time-consuming and resource-intensive, further reinforcing the bargaining power of existing, compliant suppliers.

- Switching Costs: Retailers face costs related to inventory management, product listing updates, and marketing adjustments when changing suppliers.

- Relationship Building: Strong relationships with LPs offering consistent quality and delivery create a degree of supplier stickiness.

- Regulatory Hurdles: Compliance and quality assurance requirements add complexity and time to the supplier vetting process.

Potential for Forward Integration

The potential for Licensed Producers (LPs) to integrate forward into retail operations poses a significant threat to independent retailers like Fire & Flower. Some major LPs have actively pursued this strategy, either through acquisitions or by building their own retail outlets. This move directly reduces their dependence on existing retail partners, shifting the power dynamic.

While provincial regulations can sometimes create hurdles, the underlying strategic capability for LPs to enter retail remains. This capability acts as a constant pressure on retailers, influencing supplier negotiations. For instance, by controlling both production and distribution, LPs can potentially capture a larger share of the value chain.

The broader industry trend of LPs moving into retail, even while Fire & Flower operated as a retailer, likely impacted its supplier relationships. This trend means LPs have alternative avenues for selling their products, potentially diminishing their need to rely on or offer favorable terms to independent retailers.

Consider these points regarding forward integration:

- Vertical Integration by LPs: Many large LPs have been acquiring or developing their own retail locations, reducing their reliance on third-party retailers.

- Regulatory Limitations vs. Strategic Threat: While provincial rules may limit immediate forward integration in some jurisdictions, the underlying strategic intent and capability remain a threat to retailers.

- Shifting Bargaining Power: As LPs gain more control over the retail end of the market, their bargaining power with other suppliers and their own negotiation leverage with retailers increases.

The bargaining power of suppliers to Fire & Flower is influenced by the concentration of Licensed Producers (LPs) in Canada. As of early 2024, a few large LPs dominated wholesale cannabis sales, particularly for premium flower, giving them significant leverage. This means Fire & Flower may have limited options for sourcing, potentially facing less favorable terms from these dominant suppliers.

The complex regulatory landscape, including Health Canada's stringent licensing and provincial distribution rules, restricts the number of qualified suppliers. In 2024, the ongoing difficulty in obtaining licenses meant that established LPs, better equipped to handle compliance, held considerable power. This regulatory environment favors experienced producers, increasing their negotiating strength with retailers.

While cannabis can be viewed as a commodity, many LPs differentiate their products through unique strains, advanced processing, and brand building. Suppliers with strong brands and innovative products, such as those offering popular Cannabis 2.0 products, can command higher prices. This product differentiation allows these suppliers to exert more influence over retailers like Fire & Flower, who rely on these sought-after items.

Switching suppliers for Fire & Flower involves more than just changing orders; it requires managing new inventory, updating product catalogs, and potentially adjusting marketing strategies. These switching costs, though moderate, contribute to supplier stickiness. Furthermore, the critical need for quality assurance and regulatory compliance in the cannabis sector makes vetting new suppliers a time-consuming and resource-intensive process, further solidifying the power of established, compliant suppliers.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point (as of early 2024) |

|---|---|---|

| Supplier Concentration | High | A few large LPs accounted for a substantial share of provincial wholesale cannabis sales. |

| Regulatory Environment | High | Stringent licensing and compliance requirements limited the number of qualified suppliers. |

| Product Differentiation | Moderate to High | LPs investing in unique strains and Cannabis 2.0 products gained leverage. |

| Switching Costs for Retailers | Moderate | Costs associated with inventory, catalog updates, and marketing adjustments. |

| Supplier Relationships | Moderate | Strong relationships built on consistent quality and delivery created supplier stickiness. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fire & Flower's position in the evolving cannabis retail market.

Instantly understand strategic pressure with a powerful spider/radar chart, visualizing Fire & Flower's competitive landscape to pinpoint and address key pain points.

Customers Bargaining Power

Canadian cannabis consumers, including those who shop at Fire & Flower, are very mindful of prices. They often look for deals and cheaper options, which gives them a lot of influence. For instance, in 2024, the average price per gram of cannabis in Canada saw fluctuations, with value-tier products remaining a popular choice for a significant portion of the market, underscoring this price sensitivity.

The Canadian cannabis retail landscape is crowded, especially in provinces like Alberta and Ontario. This abundance of dispensaries means Fire & Flower faces stiff competition. In 2024, the number of licensed cannabis retail stores across Canada continued to grow, creating a highly competitive environment where consumers can easily switch between retailers based on price and product availability.

The bargaining power of customers in the cannabis retail sector, particularly for a company like Fire & Flower, is significantly influenced by low switching costs. For consumers, moving from one retailer to another typically involves minimal effort, often just a change in physical location or a few clicks online.

While Fire & Flower's Spark Perks loyalty program offers incentives to encourage repeat purchases, the sheer accessibility of numerous competitors means that customer allegiance can be easily swayed. Convenience and store location are also major drivers of consumer choice, further amplifying customer power.

Customers today have unprecedented access to information about cannabis products, including strains, effects, and pricing. Online platforms, review sites, and social media empower consumers to research extensively before making a purchase. This readily available data means customers are less dependent on any single retailer for product knowledge.

Fire & Flower's own Hifyre platform was designed to offer customers data-driven insights, but this initiative also highlights the trend of increasingly informed consumers. With more knowledge at their fingertips, customers can more easily compare offerings and identify the best value, thereby strengthening their negotiating position with retailers like Fire & Flower.

Continued Presence of the Illicit Market

The illicit cannabis market continues to be a significant factor influencing the bargaining power of customers, even with the expansion of legal channels. In Canada, this underground market offers products at considerably lower price points because it bypasses taxes and the costs associated with regulatory adherence. This persistent presence acts as a constant substitute, putting downward pressure on prices within the legal cannabis sector.

Customers can readily switch to illicit sources if they perceive legal market prices as too elevated. This dynamic compels legal retailers, such as Fire & Flower, to maintain competitive pricing strategies and focus on convenience to retain their customer base. For instance, while the legal market has captured substantial share, the existence of cheaper, untaxed alternatives directly impacts consumer price sensitivity.

- Illicit Market's Price Advantage: Absence of taxes and regulatory compliance costs allows illicit sellers to offer lower prices, directly impacting customer willingness to pay for legal products.

- Persistent Substitute Threat: The ongoing availability of illicit cannabis provides consumers with a readily accessible alternative, especially when legal prices are perceived as high.

- Downward Price Pressure: This competitive threat from the illicit market forces legal retailers to be more price-conscious and offer value to attract and retain customers.

- Impact on Legal Retailers: Retailers must balance legal operational costs with the need to compete against the price advantage of the unregulated market, affecting profit margins.

Evolving Consumer Preferences and Product Versatility

Consumer preferences in the Canadian cannabis market are rapidly shifting, with a notable surge in demand for Cannabis 2.0 products. This includes a strong preference for pre-rolls, vapes, and edibles, moving away from traditional dried flower. For instance, in 2023, the edibles category alone saw significant growth, capturing a larger share of the market.

This diversification of product offerings means consumers have an ever-expanding array of choices. Retailers, including Fire & Flower, must actively adapt to these evolving demands. The collective purchasing power of consumers, driven by these changing trends, significantly influences product development and availability, thereby increasing their bargaining power.

- Shifting Product Demand: Consumers increasingly favor vapes, edibles, and pre-rolls over traditional dried flower.

- Increased Consumer Choice: Product diversification grants consumers more options, enhancing their ability to switch brands or retailers.

- Retailer Adaptation: Businesses must cater to new preferences, giving consumers leverage through their purchasing decisions.

- Market Responsiveness: Collective consumer trends dictate product innovation and availability, amplifying buyer power.

The bargaining power of customers is a significant force for Fire & Flower, primarily due to price sensitivity and the competitive retail environment. In 2024, Canadian cannabis consumers continued to prioritize value, making price a key factor in purchasing decisions. The widespread availability of numerous licensed dispensaries across provinces like Alberta and Ontario means consumers can easily compare prices and switch retailers, amplifying their influence.

| Factor | Impact on Fire & Flower | 2024 Relevance |

|---|---|---|

| Price Sensitivity | Customers actively seek deals, pressuring retailers on pricing. | High; value-tier products remained popular. |

| Low Switching Costs | Easy for customers to move between retailers. | Continual; minimal effort to change stores or online platforms. |

| Information Access | Informed consumers can easily compare products and prices. | High; online reviews and data platforms empower buyers. |

| Illicit Market Competition | Offers lower prices, creating a price ceiling for legal products. | Persistent; continues to exert downward price pressure. |

Preview Before You Purchase

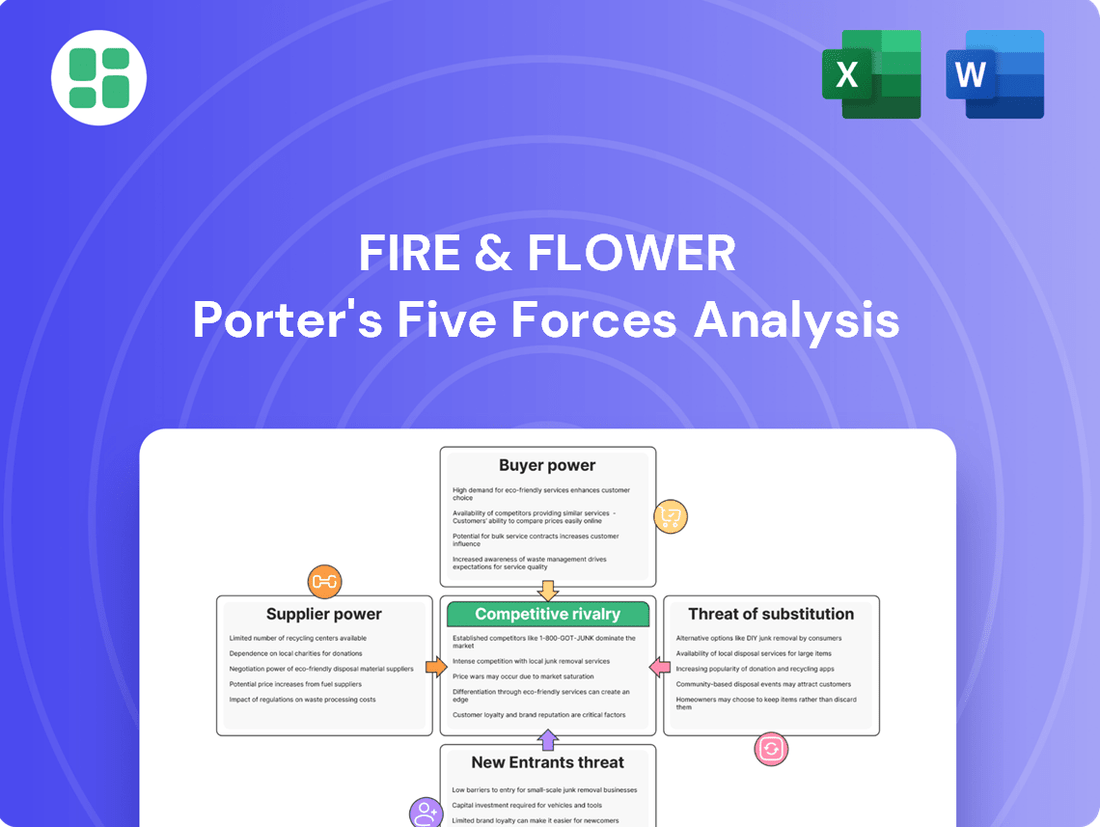

Fire & Flower Porter's Five Forces Analysis

This preview showcases the comprehensive Fire & Flower Porter's Five Forces Analysis, detailing the competitive landscape of the cannabis retail industry. You're viewing the exact document you'll receive immediately after purchase, offering an in-depth examination of buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry. This professionally formatted analysis is ready for your immediate use, providing valuable strategic insights into Fire & Flower's market position.

Rivalry Among Competitors

The Canadian cannabis retail landscape, especially in provinces like Alberta, is crowded with a significant number of licensed stores. This high density of retailers creates intense competition, forcing businesses like Fire & Flower to constantly differentiate themselves to capture market share.

Market saturation means many players are competing for the same customers. In 2024, provinces like Alberta continued to see a substantial number of cannabis retailers operating, leading to a fragmented market where survival often hinges on efficient operations and strong brand loyalty.

Fire & Flower, as a prominent multi-location operator, directly competes with a vast array of smaller, independent dispensaries as well as other larger retail chains. This competitive rivalry necessitates strategic pricing, effective marketing, and superior customer experiences to stand out.

The Canadian cannabis retail market, after its initial boom, is experiencing a slowdown in growth. This means companies like Fire & Flower are increasingly competing for existing customers rather than benefiting from an expanding market. For instance, while sales volumes might rise, overall revenue growth has flattened or even dipped in certain periods, indicating a tougher competitive landscape.

This deceleration directly fuels price compression. As demand growth cools, retailers often resort to discounting to attract and retain customers. This pressure on pricing significantly impacts profit margins for all players, including Fire & Flower, making it harder to achieve profitability and invest in future growth initiatives.

The cannabis market, particularly for dried flower, often resembles a commodity market. This makes it tough for retailers like Fire & Flower to stand out based on product uniqueness alone, potentially sparking price wars. For instance, in 2023, the average retail price per gram of dried cannabis in Canada saw fluctuations, highlighting the competitive pricing landscape.

Fire & Flower's strategy, through its Hifyre platform, focused on differentiating via data-driven customer engagement and loyalty. However, the fundamental challenge remains that many core cannabis products offered by various retailers are quite similar, making it difficult to escape the perception of sameness.

High Exit Barriers

High exit barriers in the cannabis retail sector, despite market saturation and profitability struggles, mean that companies often find it hard to leave. Significant investments in store construction, securing licenses, and stocking inventory represent sunk costs. These specialized assets are not easily transferable, trapping businesses in a competitive landscape as they strive to survive.

This difficulty in exiting prolongs intense competition. For instance, the Canadian cannabis market, which experienced rapid growth, has seen many retailers struggle with profitability. In 2023, many operators reported declining revenues and faced significant debt burdens, making a clean exit challenging.

- Sunk Costs: Retailers have invested heavily in store build-outs and licensing, creating substantial barriers to leaving the market.

- Specialized Assets: The unique nature of cannabis retail assets limits their resale value and transferability.

- Prolonged Competition: Difficulty exiting means struggling businesses remain, intensifying competition for healthier players.

- Market Maturation: Recent consolidation, such as Fire & Flower's own strategic moves, suggests market maturation, often involving the acquisition of distressed assets.

Aggressive Expansion and Consolidation by Chains

The Canadian cannabis retail sector, including Fire & Flower's operating landscape, saw significant consolidation and aggressive expansion by major chains. These large players pursued growth through new store openings and strategic acquisitions, aiming to capture market share and achieve economies of scale. For instance, by the end of 2023, the number of licensed cannabis retail stores in Canada surpassed 3,000, with a notable portion being part of larger, consolidated groups.

This drive for scale allows these larger chains to leverage greater marketing budgets, optimize supply chains, and offer more competitive pricing, putting pressure on smaller, independent operators. The trend of consolidation is a key factor in the intense rivalry, as it leads to a more concentrated market where a few dominant players dictate competitive dynamics.

- Aggressive Store Openings: Major cannabis retailers, including Fire & Flower during its active phase, significantly expanded their physical footprints across Canada.

- Acquisition Strategies: Consolidation was a key theme, with larger chains acquiring smaller independent retailers to gain market share and operational efficiencies.

- Economies of Scale: The pursuit of scale by these larger entities enables them to benefit from reduced per-unit costs in areas like procurement, marketing, and distribution.

- Intensified Rivalry: This expansion and consolidation directly fuels competitive rivalry, as larger players use their scale advantages to outmaneuver smaller competitors.

The competitive rivalry within the Canadian cannabis retail sector is fierce, driven by a high number of licensed stores, particularly in provinces like Alberta. This saturation means companies like Fire & Flower face constant pressure to differentiate through pricing, marketing, and customer experience. The market's maturation, marked by consolidation and aggressive expansion by larger chains, further intensifies this rivalry, as scale advantages allow dominant players to dictate market dynamics.

| Metric | 2023 (Approximate) | 2024 (Projected/Early Data) |

|---|---|---|

| Number of Licensed Retail Stores (Canada) | 3,000+ | Continued growth, potentially exceeding 3,200 |

| Average Retail Price per Gram (Dried Flower) | Fluctuated, indicating price sensitivity | Likely continued pressure due to competition |

| Market Share Concentration (Top 5 Retailers) | Increasing | Expected to rise further with ongoing consolidation |

SSubstitutes Threaten

The illicit market remains a significant substitute for legal cannabis retail in Canada, often undercutting legal prices by avoiding taxes and regulatory compliance costs. For instance, in 2023, the illicit market was estimated to still hold a substantial share of cannabis sales, despite the growth of legal channels. This price advantage directly impacts legal retailers like Fire & Flower, especially for consumers prioritizing affordability.

Canadian law allows adults to grow up to four cannabis plants at home, creating a direct substitute for retail purchases. This home cultivation option, while not for everyone due to effort or space, offers an alternative supply for consumers.

The increasing number of personal cultivation licenses issued in Canada suggests a growing consumer interest in this do-it-yourself approach to cannabis sourcing. This trend could potentially impact the demand for products from licensed retailers.

For consumers looking for recreational or leisure activities, established legal substances like alcohol and tobacco represent significant indirect substitutes for cannabis. These alternatives compete directly for discretionary spending and leisure time, impacting the overall market share available to cannabis products. In 2023, the global alcohol market was valued at over $1.5 trillion, demonstrating the sheer scale of consumer expenditure on these long-standing recreational options.

Emergence of Non-Cannabis Wellness Products

The expanding wellness sector presents a significant threat of substitutes for Fire & Flower. A growing array of non-cannabis products now cater to consumers seeking relaxation, pain management, and general well-being, often without the regulatory hurdles or psychoactive components associated with cannabis. For instance, the global CBD market, a direct substitute, was valued at approximately $5.2 billion in 2023 and is projected to reach $15.8 billion by 2029, demonstrating its substantial reach and consumer acceptance.

These alternatives, including herbal supplements, aromatherapy, and various over-the-counter pain relief options, offer comparable perceived benefits. As consumer awareness and acceptance of these non-cannabis wellness solutions increase, they may increasingly divert demand from traditional cannabis products. This trend is particularly pronounced in markets with evolving or restrictive cannabis regulations.

- Growing Wellness Market: The global wellness market is a vast and diverse industry, with consumers actively seeking products that enhance their physical and mental health.

- CBD as a Direct Substitute: Cannabidiol (CBD) products, which are legal and widely accessible in many regions, offer many of the perceived benefits of cannabis without the intoxication, posing a direct competitive threat.

- Consumer Preferences Shift: As the wellness landscape diversifies, consumers may opt for alternatives that are perceived as less stigmatized, more convenient, or better aligned with their lifestyle choices.

- Accessibility and Regulation: Non-cannabis wellness products often face fewer regulatory barriers and enjoy broader distribution channels, making them more accessible to a wider consumer base than regulated cannabis products.

Traditional Pharmaceutical or Medical Alternatives

For individuals seeking treatment, traditional pharmaceuticals and conventional medical interventions represent significant substitutes for cannabis-based therapies. While medical cannabis offers an alternative, its adoption is influenced by the efficacy and accessibility of established treatments.

In Canada, for instance, the medical cannabis market has experienced a notable shift, with a decline in registered users. Data from Health Canada indicated a decrease in the number of registered medical cannabis patients through 2023 and into early 2024, suggesting that some patients may be opting for other medical solutions or transitioning to the recreational market.

The ongoing scientific and regulatory debate surrounding cannabis's role in mainstream medicine continues to shape the competitive landscape. This uncertainty impacts how readily physicians and patients consider cannabis as a primary or supplementary treatment compared to well-established pharmaceutical options.

- Substitute Threat: Traditional pharmaceuticals and conventional medical treatments offer established efficacy and regulatory frameworks, posing a significant competitive threat to medical cannabis.

- Market Dynamics: A decline in registered medical cannabis users in Canada, observed through 2023-2024, indicates a potential preference for alternative medical solutions or recreational pathways.

- Patient Choice: The availability and perceived effectiveness of existing medical options directly influence patient decisions regarding cannabis-based therapies.

- Evolving Landscape: The continued discussion on cannabis's medical legitimacy impacts its positioning against long-standing pharmaceutical alternatives.

The threat of substitutes for Fire & Flower is multifaceted, encompassing illicit markets, home cultivation, established recreational substances, and the burgeoning wellness industry. Consumers prioritizing price may turn to the illicit market, which bypasses taxes and regulations. Additionally, the legal allowance for personal cannabis cultivation in Canada offers a direct, albeit less convenient, substitute for retail purchases.

The vast global alcohol market, valued at over $1.5 trillion in 2023, highlights how deeply entrenched legal recreational alternatives are. Furthermore, the expanding wellness sector, with its $5.2 billion CBD market in 2023, presents a growing array of non-cannabis products offering similar perceived benefits like relaxation and pain relief, often with fewer regulatory hurdles.

| Substitute Category | Examples | Market Size/Trend (2023/2024 Data) | Impact on Fire & Flower |

| Illicit Market | Unregulated cannabis sales | Estimated substantial share of Canadian cannabis sales | Price competition, reduced legal market share |

| Home Cultivation | Personal cannabis growing | Increasing number of personal cultivation licenses in Canada | Reduced demand for retail products |

| Established Recreational Substances | Alcohol, Tobacco | Global alcohol market valued at over $1.5 trillion | Competition for discretionary spending and leisure time |

| Wellness Alternatives | CBD products, herbal supplements, aromatherapy | Global CBD market valued at approx. $5.2 billion; projected to reach $15.8 billion by 2029 | Diversion of consumers seeking relaxation and well-being |

| Medical Alternatives | Traditional pharmaceuticals | Decline in registered medical cannabis patients in Canada (2023-early 2024) | Potential shift to other medical solutions |

Entrants Threaten

Stringent licensing and regulatory hurdles significantly deter new entrants in the Canadian cannabis retail market. Navigating complex federal and provincial requirements demands substantial capital for facility compliance and security, alongside a lengthy application process. For instance, in 2024, provinces continued to refine their licensing frameworks, with some, like Ontario, seeing ongoing adjustments to store caps and licensing timelines, which inherently slow down new market participants.

Establishing a cannabis retail business, like Fire & Flower, demands significant upfront investment. This includes acquiring prime real estate, constructing compliant retail spaces, and implementing advanced inventory and sales systems, such as their Hifyre platform. For instance, in 2023, the average cost to open a cannabis dispensary in Canada could range from $200,000 to over $1 million, depending on location and scale.

Furthermore, ongoing operational expenditures present a substantial barrier. These costs encompass not only rent and staffing but also significant excise taxes and provincial licensing fees, which can add considerably to the financial strain. In 2023, for example, federal excise tax on cannabis products could be as high as $1 per gram or 10% of the value, whichever is greater, making it tough for new players to match the pricing and operational efficiency of established entities.

Fire & Flower, like other established cannabis retailers, benefits significantly from strong brand recognition and deep customer loyalty, particularly through its Spark Perks program. This existing customer base presents a substantial barrier for newcomers. For instance, as of early 2024, Fire & Flower reported a substantial portion of its revenue coming from repeat customers, a testament to their loyalty initiatives.

New entrants must overcome the challenge of attracting consumers in a saturated market where brand preference and existing loyalty programs are already deeply entrenched. Building the necessary trust and a solid customer foundation demands considerable marketing expenditure and a prolonged period of operation, making it a high hurdle for aspiring competitors.

Economies of Scale and Supply Chain Relationships

Existing players in the cannabis retail sector, like Fire & Flower, often leverage significant economies of scale. This advantage allows them to negotiate better pricing on inventory, optimize distribution networks, and spread marketing costs across a larger operational base. For instance, by purchasing in bulk, established retailers can achieve lower per-unit costs, a benefit that is hard for new entrants to match immediately.

Furthermore, long-standing relationships with Licensed Producers and distributors are crucial barriers. These established supply chain connections ensure consistent product availability and can lead to preferential terms. New entrants face the challenge of building these networks from scratch, often at a disadvantage regarding both access and cost of goods.

In 2024, the Canadian cannabis market continued to see consolidation, with larger retail chains acquiring smaller operators. This trend highlights the ongoing importance of scale. For example, companies with extensive store footprints can command better shelf space and promotional opportunities from Licensed Producers, reinforcing the cost and access advantages they hold over nascent competitors.

The threat of new entrants is therefore moderated by these entrenched advantages:

- Economies of Scale: Established retailers benefit from lower per-unit costs in purchasing, logistics, and marketing.

- Supply Chain Relationships: Existing players have secured reliable and often preferential terms with Licensed Producers and distributors.

- Cost Disadvantage: New entrants face higher initial costs to establish comparable supply chain and operational efficiencies.

Market Saturation and Consolidation

The Canadian cannabis retail landscape, particularly in provinces like Ontario and Alberta, is characterized by significant saturation. This oversupply of retail locations has driven down prices and squeezed profit margins for many operators. For instance, by late 2023, Ontario alone had over 1,500 licensed cannabis stores, a number that continues to grow, intensifying competition.

This intense competition naturally leads to market consolidation. We've already seen several smaller players being acquired by larger entities or ceasing operations due to unsustainable financial performance. This trend suggests that the barriers to entry are rising, as newcomers face established brands with greater market share and capital resources.

Consequently, the threat of new entrants is somewhat mitigated by the current market conditions. New businesses entering this space must possess highly differentiated business models or target underserved niche markets to gain traction. Simply opening another standard retail outlet is unlikely to be successful against the entrenched competition and the ongoing consolidation.

- Market Saturation: Over 1,500 licensed cannabis stores in Ontario by late 2023.

- Intensified Competition: Reduced profit margins due to oversupply.

- Consolidation Trend: Smaller operators are being acquired or exiting the market.

- Barriers to Entry: Rising due to established players and market maturity.

The threat of new entrants into the Canadian cannabis retail market, impacting companies like Fire & Flower, is significantly lowered by substantial capital requirements for licensing and compliant store build-outs. For example, in 2024, provinces continued to implement rigorous licensing processes, demanding significant investment in security and infrastructure, which deters smaller players. Established brands also benefit from strong customer loyalty and economies of scale, making it difficult for newcomers to compete on price and product selection.

| Barrier Type | Description | 2023/2024 Impact |

| Capital Requirements | Licensing, compliance, and store setup costs | Average dispensary opening costs $200k-$1M+; ongoing excise taxes and fees |

| Brand Loyalty & Marketing | Customer retention through programs like Spark Perks | Repeat customers forming a substantial revenue portion for established players |

| Economies of Scale | Bulk purchasing, optimized logistics, and shared marketing costs | Lower per-unit costs for established retailers |

| Supply Chain Relationships | Established connections with Licensed Producers | Consistent product availability and preferential terms for incumbents |

Porter's Five Forces Analysis Data Sources

Our Fire & Flower Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including the company's annual reports, investor presentations, and regulatory filings. We also incorporate insights from industry-specific market research reports and reputable financial news outlets to provide a comprehensive view of the competitive landscape.