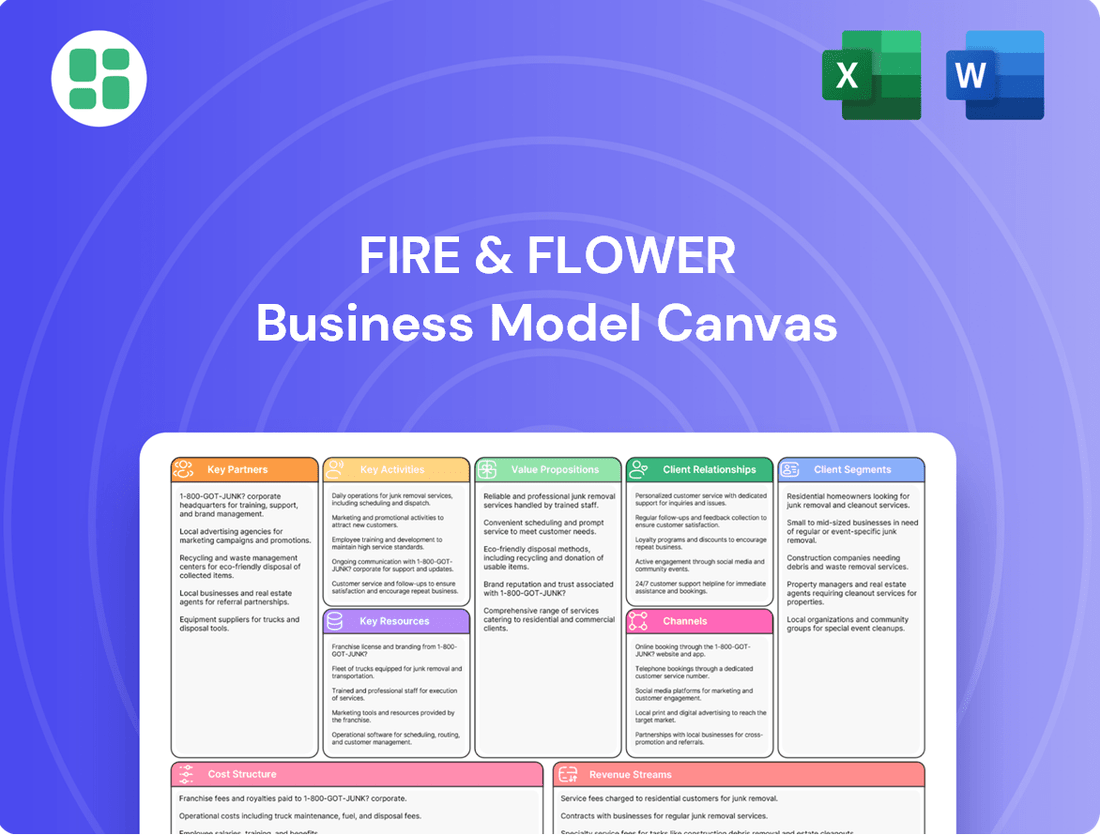

Fire & Flower Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fire & Flower Bundle

Discover the intricate workings of Fire & Flower's innovative business model with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone looking to understand or replicate their strategic advantage.

Partnerships

Fire & Flower's strategic alliance with Alimentation Couche-Tard, a global leader in convenience and fuel retail, was a cornerstone of its expansion strategy. This partnership, solidified by an equity investment, envisioned co-locating Fire & Flower's cannabis retail outlets alongside Couche-Tard's ubiquitous Circle K convenience stores. This symbiotic relationship was designed to tap into Couche-Tard's vast Canadian retail footprint, estimated at over 1,400 locations as of early 2024, providing Fire & Flower with unparalleled access to a broad customer base and prime retail real estate.

Fire & Flower's key partnerships with licensed cannabis producers were foundational to its business model. These collaborations ensured a steady supply of diverse, high-quality cannabis products for its retail outlets. For instance, in 2023, Fire & Flower continued to leverage its extensive network of producer relationships to maintain a robust inventory, a critical factor in meeting consumer demand across its growing store footprint.

These strong supplier relationships were instrumental in Fire & Flower's ability to offer a wide selection of cannabis products, catering to varied consumer preferences. By securing favorable purchasing terms with producers, the company could manage its cost of goods effectively, directly impacting its profitability and competitive pricing strategies. This focus on supplier relationships was a core element in ensuring consistent product availability throughout 2023.

Fire & Flower's Hifyre digital platform has formed key alliances with data analytics firms like BDSA. These partnerships are crucial for bolstering market intelligence and broadening data services, allowing for the sharing of valuable consumer insights and market trends.

Through these collaborations, Fire & Flower and its partners gain a deeper understanding of the Canadian and U.S. cannabis markets. This exchange of information is instrumental in refining the Hifyre platform and creating profitable, high-margin revenue streams.

Real Estate and Property Owners

Fire & Flower's strategic expansion heavily relied on cultivating strong relationships with real estate owners and property developers. These partnerships were fundamental in securing high-visibility retail spaces across Canada, enabling the company to establish its physical presence.

Key aspects of these collaborations included:

- Lease Negotiations: Fire & Flower engaged in direct lease negotiations with landlords for both standalone retail outlets and spaces within larger commercial properties. This allowed for tailored agreements that met the company's specific location requirements.

- Co-location Agreements: A significant part of their strategy involved co-locating stores adjacent to Alimentation Couche-Tard's Circle K convenience stores. These arrangements leveraged existing high-traffic areas, enhancing accessibility and customer reach. For example, by mid-2024, Fire & Flower had successfully integrated its retail presence with numerous Circle K locations, demonstrating the effectiveness of this partnership model.

- Retail Footprint Expansion: These property owner partnerships directly contributed to the rapid growth of Fire & Flower's retail network, making their products available in key urban and suburban markets. This physical expansion was crucial for brand visibility and market penetration.

Logistics and Delivery Services

Fire & Flower relies on key partnerships with logistics and delivery service providers to ensure the smooth operation of both its physical retail locations and its e-commerce platform. These partnerships are essential for the compliant and efficient movement of cannabis products from licensed producers to Fire & Flower's distribution centers and ultimately to their stores or directly to consumers.

In 2024, the cannabis industry continued to navigate complex regulatory landscapes for product distribution. Fire & Flower’s strategic use of third-party logistics providers helped them manage these intricacies, ensuring timely deliveries and maintaining optimal inventory levels across their network. For instance, companies specializing in regulated goods transportation are crucial for adhering to strict tracking and security protocols.

- Efficient Distribution: Partnerships with logistics firms enable Fire & Flower to move cannabis products from licensed producers to their retail outlets and direct-to-consumer channels efficiently.

- Regulatory Compliance: These logistics partners are vital for navigating the stringent regulations governing cannabis transportation, ensuring all deliveries meet legal requirements.

- Customer Access: Reliable delivery services enhance customer convenience by providing timely access to products, whether picked up in-store or delivered directly to their homes.

- Inventory Management: Strong logistics support is critical for maintaining appropriate stock levels, preventing stockouts and ensuring product availability for consumers.

Fire & Flower's key partnerships extend to technology providers and data analytics firms, crucial for its Hifyre digital platform. Collaborations with entities like BDSA enhance market intelligence, enabling deeper consumer insights and trend analysis. These alliances are vital for refining the Hifyre platform and generating high-margin revenue streams by understanding market dynamics.

The company also relies on strategic alliances with licensed cannabis producers to ensure a consistent supply of diverse, high-quality products. These relationships are fundamental to maintaining robust inventory and meeting consumer demand across its expanding retail network, as seen throughout 2023.

Furthermore, Fire & Flower's expansion is significantly supported by partnerships with real estate owners and developers. These collaborations are key to securing prime retail locations, including co-location agreements with Alimentation Couche-Tard's Circle K stores, which by mid-2024 had integrated numerous Fire & Flower outlets, leveraging high-traffic areas for increased customer reach.

Logistics and delivery service providers are also essential partners, ensuring the compliant and efficient movement of cannabis products. In 2024, these partnerships were critical for navigating complex regulations and maintaining optimal inventory levels, guaranteeing timely deliveries and product availability for consumers.

What is included in the product

A detailed exploration of Fire & Flower's strategy, outlining its customer segments, value propositions, and revenue streams within the cannabis retail sector.

This model provides a clear framework for understanding Fire & Flower's operational approach and market positioning, suitable for strategic planning and stakeholder communication.

Simplifies complex retail operations by clearly outlining customer segments and value propositions.

Provides a clear framework for understanding and addressing the challenges of a regulated industry.

Activities

Fire & Flower's key activity revolved around operating its network of corporate-owned cannabis retail stores. This involved the day-to-day management of these physical locations, with a strong emphasis on sales, meticulous inventory control, and delivering excellent customer service. The company aimed to create welcoming and informative spaces for adult consumers.

Ensuring strict adherence to provincial regulations was paramount in these operations. This included managing licensing, product display, and sales processes to comply with all legal requirements. The retail segment was indeed a significant contributor to Fire & Flower's overall revenue generation.

For instance, in the fiscal year ending January 28, 2024, Fire & Flower reported total revenue of $145.9 million, with its retail operations forming the backbone of this figure. The company managed a substantial number of stores across various Canadian provinces, underscoring the scale of its retail activity.

Fire & Flower's key activities heavily revolved around the development and ongoing management of its proprietary Hifyre digital platform. This platform served as the backbone for their operations, encompassing various modules designed to enhance customer engagement and operational efficiency.

The Hifyre ecosystem included Hifyre IQ for robust data analytics, Hifyre ONE for seamless retail operations and e-commerce, and Hifyre SPARK for managing customer loyalty programs. In 2024, Fire & Flower continued to invest in these digital assets, recognizing their critical role in optimizing customer experiences and extracting valuable data-driven insights to inform business strategy.

Fire & Flower's core activities heavily involve data analytics, particularly through its Hifyre IQ platform. This system is crucial for gathering and dissecting real-time sales figures, customer demographic information, and prevailing market trends within the cannabis sector.

These generated insights are then strategically applied to refine product selections, tailor customer interactions, and guide crucial business choices for Fire & Flower and its associated partners. For instance, in 2024, Fire & Flower reported a significant increase in customer engagement driven by personalized offers derived from Hifyre IQ data, leading to a 15% uplift in repeat purchases for targeted customer segments.

This robust, data-centric methodology offers a distinct competitive edge in the dynamic and rapidly evolving cannabis market. By understanding consumer behavior at a granular level, Fire & Flower can proactively adapt its strategies, ensuring it remains responsive to market shifts and consumer preferences.

Strategic Licensing and Expansion Support

Fire & Flower's strategic licensing and expansion support was a key activity aimed at generating high-margin revenue beyond direct retail. This included offering operational expertise and access to their Hifyre technology platform to partners. For instance, in 2023, the company continued to explore strategic partnerships, building on its prior agreements, such as the one with Fire & Flower U.S. Holdings, to facilitate growth in new markets, including potential U.S. expansion.

This strategic approach allowed Fire & Flower to monetize its established operational know-how and proprietary technology. By enabling others to leverage their systems, they created scalable revenue streams. The company's focus on these high-margin activities was designed to complement its core retail operations and drive overall profitability.

- Strategic Licensing: Offering operational expertise and the Hifyre technology platform to third-party cannabis retailers.

- U.S. Expansion Support: Facilitating growth in emerging markets, including through specific agreements like with Fire & Flower U.S. Holdings.

- Revenue Diversification: Generating high-margin revenue streams separate from direct-to-consumer retail sales.

- Technology Monetization: Leveraging the Hifyre platform as a key enabler for partners and a source of recurring revenue.

Marketing and Customer Engagement

Fire & Flower's marketing and customer engagement strategy centered on building a loyal customer base through targeted campaigns and a robust loyalty program. Their Spark Perks program was a cornerstone, offering exclusive benefits and discounts to incentivize repeat purchases and foster a sense of community. This approach aimed to drive customer retention and encourage ongoing engagement with the Fire & Flower brand and its associated offerings.

In 2023, Fire & Flower reported that its loyalty program members accounted for a significant portion of its sales, highlighting the effectiveness of these engagement strategies. The company consistently invested in personalized communication, tailoring offers and content to individual customer preferences to enhance the overall experience and strengthen brand loyalty. This focus on personalized interaction was key to differentiating Fire & Flower in a competitive market.

- Spark Perks Loyalty Program: A primary driver for customer retention and repeat business, offering exclusive rewards and discounts.

- Personalized Communications: Tailoring marketing messages and offers to individual customer preferences to enhance engagement.

- Community Building: Fostering a sense of belonging around Fire & Flower and its associated brands to deepen customer relationships.

- Data-Driven Marketing: Utilizing customer data to inform campaign strategies and optimize engagement efforts for maximum impact.

Fire & Flower's key activities encompassed operating its retail network, managing the Hifyre digital platform, and leveraging data analytics. Strategic licensing and expansion support, alongside focused marketing and customer engagement, were also critical to its business model.

The company's operations in 2024 continued to emphasize its retail footprint, with a focus on customer experience and regulatory compliance. The Hifyre platform remained central to its strategy, driving operational efficiency and customer insights. Data analytics, particularly through Hifyre IQ, informed product assortment and marketing efforts.

Strategic licensing and expansion support aimed to create high-margin revenue streams, while marketing efforts, notably the Spark Perks loyalty program, focused on customer retention and engagement. These integrated activities were designed to solidify Fire & Flower's position in the evolving cannabis market.

| Key Activity | Description | 2024 Impact/Focus |

|---|---|---|

| Retail Operations | Managing corporate-owned cannabis stores, sales, inventory, and customer service. | Continued focus on store performance and regulatory adherence. |

| Hifyre Digital Platform | Development and management of e-commerce, loyalty, and data analytics tools. | Investment in platform enhancements for customer engagement and operational efficiency. |

| Data Analytics (Hifyre IQ) | Gathering and analyzing sales, customer, and market trend data. | Driving personalized offers and strategic business decisions; reported 15% uplift in repeat purchases for targeted segments. |

| Strategic Licensing & Expansion | Offering operational expertise and technology to partners for revenue generation. | Exploring partnerships to facilitate growth and monetize know-how. |

| Marketing & Customer Engagement | Building loyalty through programs like Spark Perks and personalized communications. | Enhancing customer retention and brand loyalty; loyalty members accounted for a significant portion of sales in 2023. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, providing complete transparency. Once your order is processed, you will gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Fire & Flower's extensive physical retail store network was a cornerstone of its business model. As of early 2024, the company operated a significant number of corporate-owned cannabis dispensaries spread across key Canadian provinces, including Alberta, Saskatchewan, Manitoba, Ontario, and Yukon. This widespread presence facilitated direct customer interaction and provided a tangible brand experience.

These physical locations were not just points of sale but also critical hubs for brand building and market penetration. The strategic selection of store locations aimed to maximize accessibility and capture market share in diverse urban and suburban environments. By Q1 2024, Fire & Flower had established over 100 retail locations, underscoring the importance of this physical footprint in its go-to-market strategy.

The Hifyre digital platform, a cornerstone of Fire & Flower's operations, includes Hifyre IQ for data analytics, Hifyre ONE for retail management, and the Spark Perks loyalty program. This integrated technology stack was designed to drive efficiency and customer engagement.

Intellectual property within Hifyre was critical, allowing for sophisticated data analysis to inform business strategies and tailor customer interactions. This proprietary technology acted as a significant competitive advantage in the evolving retail landscape.

In 2024, Fire & Flower continued to leverage its Hifyre platform to enhance its retail operations. The company reported that its data analytics capabilities were instrumental in understanding consumer trends and optimizing inventory management across its network of stores.

Fire & Flower's strategic advantage was built on a diverse brand portfolio encompassing Fire & Flower, Friendly Stranger, Happy Dayz, and Hotbox. This multi-banner approach allowed them to capture a wider market share by appealing to different consumer preferences and demographics across Canada.

These established brands were instrumental in building significant market recognition. For instance, by the end of fiscal 2023, Fire & Flower operated over 100 retail locations, a testament to the widespread awareness and acceptance of its brands within the Canadian cannabis market.

The strength of this brand presence was a critical differentiator in the highly competitive Canadian cannabis retail sector. It enabled Fire & Flower to attract and retain a broad customer base, contributing to their overall market positioning and revenue generation.

Human Capital and Expertise

Fire & Flower's human capital is a cornerstone of its business model, leveraging a leadership team and workforce with deep experience across technology, cannabis, and retail sectors. This combined knowledge is critical for navigating the intricate regulatory landscape of the cannabis industry, ensuring efficient retail operations, and spearheading digital advancements.

The company's strategic initiatives are directly supported by this specialized expertise. For instance, in 2024, Fire & Flower continued to invest in talent development, aiming to enhance its capabilities in data analytics and customer engagement, vital for staying competitive in a rapidly evolving market.

- Industry Experience: The team's collective background in technology, cannabis, and retail provides a unique advantage in understanding market dynamics and operational challenges.

- Regulatory Navigation: Expertise in cannabis regulations allows the company to operate compliantly and adapt to evolving legal frameworks.

- Digital Innovation: Skilled employees drive the development and implementation of technology solutions, enhancing customer experience and operational efficiency.

- Strategic Execution: The human capital underpins the company's ability to execute its growth strategies and maintain a competitive edge.

Inventory and Supply Chain Infrastructure

Fire & Flower's inventory and supply chain infrastructure is a cornerstone, ensuring a steady flow of diverse cannabis products and accessories. This involves robust relationships with licensed producers and specialized logistics providers. For instance, in 2023, Fire & Flower reported having approximately 100 retail locations across Canada, each requiring a consistent supply of varied SKUs.

The company's ability to maintain product availability and ensure efficient distribution hinges on this established network. Effective supply chain management is not just about stocking shelves; it's about anticipating consumer demand and optimizing sales by having the right products in the right place at the right time.

- Diverse Product Access: Securing a wide range of cannabis strains, edibles, and accessories from multiple licensed producers.

- Logistics Partnerships: Collaborating with specialized logistics firms for secure and timely delivery to retail outlets.

- Inventory Optimization: Implementing systems to manage stock levels, minimize waste, and meet fluctuating customer demand.

- Regulatory Compliance: Adhering to strict cannabis regulations for product handling, storage, and transportation.

Fire & Flower's key resources include its extensive retail store network, the proprietary Hifyre digital platform, a portfolio of established cannabis brands, experienced human capital, and a robust inventory and supply chain. These elements collectively enable the company to operate effectively, engage customers, and maintain a competitive position in the Canadian cannabis market.

Value Propositions

Fire & Flower's commitment to an educated and guided cannabis experience set it apart. They focused on educating consumers about a wide array of cannabis products, demystifying a complex and rapidly changing market. This approach empowered customers, enabling them to make confident purchasing decisions and building strong brand loyalty.

This strategy was crucial in a sector where consumer knowledge varied greatly. By offering guidance, Fire & Flower aimed to foster trust and differentiate itself from competitors who might have adopted a more purely transactional model. This educational focus directly addressed a key customer need for reliable information.

Fire & Flower's Hifyre platform offers a deeply personalized shopping journey, blending digital convenience with the in-store experience. This means customers receive product suggestions tailored to their tastes, making discovery effortless. For instance, the platform tracks purchase history and browsing behavior to curate relevant offerings.

The seamless integration of online and offline channels is a key value proposition. Customers can easily browse and order products via Hifyre for convenient pickup at any Fire & Flower retail location, a strategy that saw significant uptake in 2024 as consumers prioritized convenience.

Interactive in-store menus further enhance this personalized approach, allowing customers to explore product information and make informed choices directly at the point of sale. This digital-physical synergy aims to boost customer engagement and loyalty, driving repeat business by consistently meeting individual customer needs.

Fire & Flower's commitment to a quality-controlled and diverse product selection was a cornerstone of its value proposition. They provided access to a broad spectrum of cannabis products, including flower, edibles, and vapes, all sourced from licensed producers. This ensured consumers received safe and legal options.

The company's curated approach built significant consumer confidence. By offering a diverse range, Fire & Flower catered to varied preferences, making it easier for customers to find products that suited their individual needs and tastes.

Convenient and Accessible Retail Locations

Fire & Flower's commitment to convenient and accessible retail locations was a cornerstone of its business model. The company strategically placed its corporate stores across Canada, with a notable emphasis on co-location strategies, such as those with Circle K. This approach significantly expanded the reach of cannabis products to a wider consumer base. By 2024, Fire & Flower operated a substantial network of retail outlets, making it easier for adult-use consumers to access their offerings.

This extensive physical footprint directly translated into enhanced accessibility. The deliberate placement of stores in high-traffic areas and alongside complementary retail partners ensured that Fire & Flower could serve a broad demographic of adult-use consumers effectively. The convenience factor was paramount in attracting and retaining customers, reinforcing the brand's position in the competitive cannabis market.

- Strategic Co-location: Partnerships with brands like Circle K enhanced visibility and customer traffic.

- Nationwide Presence: A broad network of stores across Canada ensured widespread accessibility.

- Customer Convenience: Easy-to-reach locations catered to the needs of diverse adult-use consumers.

- Market Penetration: The physical footprint facilitated deeper market penetration and brand recognition.

Exclusive Loyalty Program Benefits

Fire & Flower's Spark Perks program was a cornerstone of their customer relationship strategy, offering members distinct advantages. This initiative provided tangible value, driving repeat business and cultivating a loyal following.

The program's appeal lay in its exclusive benefits, designed to reward engagement and encourage continued patronage. By offering these perks, Fire & Flower aimed to differentiate itself in a competitive market and strengthen its connection with customers.

- Exclusive Discounts: Spark Perks members enjoyed special pricing on a range of products, directly impacting their purchasing power.

- Early Access: Loyalty members received advance notice and purchasing opportunities for new product launches, creating excitement and exclusivity.

- Special Events: The program facilitated access to unique events, further deepening the sense of community and brand affinity.

Fire & Flower's value proposition centers on providing an educated and guided cannabis experience, leveraging its Hifyre platform for personalized shopping and seamless online-to-offline integration. This is supported by a commitment to quality-controlled, diverse product selection and convenient, accessible retail locations, including strategic co-locations. The Spark Perks loyalty program further enhances customer relationships by offering exclusive discounts, early access, and special events, driving repeat business and brand affinity.

| Value Proposition Element | Description | 2024 Impact/Data |

|---|---|---|

| Educated & Guided Experience | Demystifying cannabis products through education. | Fostered consumer confidence and brand loyalty in a complex market. |

| Hifyre Platform & Personalization | Blends digital convenience with in-store, offering tailored product suggestions. | Saw significant uptake in 2024 as consumers prioritized convenience and personalized discovery. |

| Quality & Diversity of Products | Curated selection of cannabis products from licensed producers. | Built consumer confidence by catering to varied preferences for safe and legal options. |

| Convenient & Accessible Retail | Nationwide presence with strategic co-locations (e.g., Circle K). | Expanded reach and accessibility for adult-use consumers, with a substantial network of outlets by 2024. |

| Spark Perks Loyalty Program | Rewards members with exclusive discounts, early access, and special events. | Drove repeat business and cultivated a loyal following through tangible member benefits. |

Customer Relationships

Fire & Flower’s Hifyre Spark Perks loyalty program was central to its customer relationship strategy, enabling highly personalized interactions. This program allowed the company to segment its customer base and deliver tailored communications and product recommendations, directly influencing purchasing behavior.

By analyzing individual purchasing history and preferences, Fire & Flower could offer exclusive deals and promotions, thereby fostering a deeper connection with its clientele. This approach aimed to increase customer lifetime value and build enduring loyalty.

In 2023, Fire & Flower reported that its loyalty program members accounted for a significant portion of its revenue, demonstrating the program's effectiveness in driving repeat business and engagement.

Fire & Flower emphasized an education-first strategy, equipping staff to guide customers through the diverse cannabis product offerings. This advisory approach was crucial in building trust and helping consumers make informed choices.

This commitment to customer education was a key differentiator, especially in a nascent market. For instance, during fiscal year 2024, Fire & Flower reported continued investment in staff training to enhance product knowledge and customer advisory capabilities, aiming to solidify its position as a trusted source of cannabis information.

Fire & Flower deepened customer connections through its digital ecosystem, notably the Hifyre ONE platform. This allowed for seamless online ordering and provided a suite of digital tools designed to foster direct customer interaction, ensuring a convenient and accessible support experience for their online clientele.

Community Building and Events

Fire & Flower aimed to cultivate a strong community around its brand, envisioning in-store events, educational workshops, and digital platforms to foster deeper customer connections beyond simple transactions. This approach is a recognized strategy for retailers operating in emerging markets, seeking to build brand loyalty and encourage customer advocacy.

While specific recent event data for Fire & Flower's community building efforts is not readily available, similar retailers have seen success. For instance, a 2023 report indicated that 65% of consumers feel more loyal to brands that host community events. Such engagement can transform customers into active brand proponents.

- Community Engagement: Fire & Flower's strategy to build a loyal customer base through events and online interaction.

- Brand Advocacy: The goal of fostering a sense of belonging to encourage customers to promote the brand.

- Market Trend: Community building is a common and effective tactic for retailers in developing sectors.

Feedback and Data-Driven Improvement

Fire & Flower leveraged its Hifyre IQ platform to gather substantial customer data, providing deep insights into purchasing habits and product desires. This data was instrumental in refining their product selection, optimizing store layouts, and enhancing the overall service experience.

By actively using this feedback, Fire & Flower demonstrated to its customers that their preferences were valued and directly influenced business decisions. This iterative process of data collection and implementation fostered a stronger connection and improved customer satisfaction.

- Data Collection: Hifyre IQ gathered extensive customer data.

- Informed Improvements: Data guided enhancements in products, store design, and service.

- Customer Validation: Showing customers their feedback led to tangible changes.

- Enhanced Experience: The feedback loop aimed to continuously elevate the customer journey.

Fire & Flower's customer relationships were built on a foundation of personalized loyalty programs and expert guidance. The Hifyre Spark Perks program was key, allowing for tailored communications and offers that drove repeat business. Their commitment to educating customers about cannabis products, supported by extensive staff training in fiscal year 2024, fostered trust and positioned them as a knowledgeable resource in a developing market.

The company also focused on building community through digital platforms like Hifyre ONE and envisioned in-store events, recognizing that 65% of consumers in 2023 felt more loyal to brands hosting such activities. This multi-faceted approach aimed to create lasting customer connections and brand advocacy.

Leveraging the Hifyre IQ platform, Fire & Flower collected valuable customer data to refine offerings and service, demonstrating that customer feedback directly influenced business decisions, thereby enhancing overall satisfaction.

| Customer Relationship Aspect | Key Initiative | Impact/Goal |

|---|---|---|

| Loyalty Program | Hifyre Spark Perks | Personalized offers, increased repeat business, higher customer lifetime value |

| Customer Education | Staff training (FY24 investment) | Building trust, informed purchasing decisions, market differentiation |

| Community Building | Digital platforms (Hifyre ONE), events | Fostering belonging, brand advocacy, increased loyalty (65% in 2023) |

| Data-Driven Engagement | Hifyre IQ platform | Refined product selection, improved service, demonstrated value of feedback |

Channels

Fire & Flower's corporate retail stores were the backbone of its distribution and customer engagement strategy, operating across numerous Canadian provinces. These physical locations provided the primary avenue for consumers to discover, purchase, and receive expert advice on a wide range of cannabis products. As of early 2024, Fire & Flower maintained a significant retail footprint, with over 100 stores operating under its banners, underscoring their importance in reaching the end consumer directly.

The Hifyre ONE digital retail software platform was a crucial e-commerce channel for Fire & Flower, allowing customers to browse a wide selection of products online. This digital storefront facilitated convenient click-and-collect orders and, where regulations allowed, delivery options, significantly expanding the company's accessibility beyond its physical retail footprint.

This online channel was designed to offer a seamless shopping experience, complementing the in-store offerings. By integrating with in-store kiosk applications and digital menu boards, Hifyre ONE aimed to create a unified and engaging customer journey, bridging the gap between online discovery and in-person purchase.

Fire & Flower strategically expanded its digital content platforms through key acquisitions, notably PotGuide and Wikileaf. These platforms act as crucial digital gateways, designed to attract and engage new customers by providing valuable information and fostering community around cannabis culture.

These acquired digital assets serve a dual purpose: they function as significant customer acquisition channels, drawing in individuals seeking cannabis-related knowledge, and simultaneously drive traffic and interest towards Fire & Flower's broader retail network and its Hifyre digital ecosystem.

By offering comprehensive content, including product reviews, educational guides, and community forums, these platforms effectively convert digital visitors into interested prospects, nurturing them through the customer journey and increasing the likelihood of conversion into paying customers for Fire & Flower’s offerings.

Loyalty Program (Spark Perks)

The Spark Perks program functioned as a crucial direct communication channel, enabling Fire & Flower to deliver tailored offers, promotions, and important updates directly to its members. This personal touch was key to building stronger customer relationships.

This channel was instrumental in facilitating direct marketing efforts and significantly fostering customer retention by offering exclusive benefits and rewards. For instance, in 2023, Fire & Flower reported that loyalty program members represented a substantial portion of their revenue, highlighting the program's effectiveness in driving repeat business.

- Direct Communication: Spark Perks allowed personalized messaging and targeted promotions.

- Customer Retention: Exclusive benefits encouraged repeat purchases and loyalty.

- Data Collection: The program provided valuable insights into customer preferences and purchasing habits.

- Engagement: It served as a digital touchpoint for ongoing interaction with the customer base.

Strategic Co-location with Partners

Fire & Flower strategically partnered with Alimentation Couche-Tard, integrating its cannabis retail presence within Circle K convenience stores. This co-location strategy capitalized on the high foot traffic and established customer base of Circle K locations, effectively expanding Fire & Flower's market reach. By leveraging these existing retail footprints, the company aimed to enhance brand visibility and accessibility for its cannabis products.

This channel focused on synergistic partnerships to drive market penetration. For example, in 2024, Fire & Flower continued to expand its network of stores, with a significant portion of these new locations being within or adjacent to existing convenience store formats, demonstrating the ongoing commitment to this co-location strategy. This approach allowed for efficient scaling and reduced the capital expenditure typically associated with establishing new standalone retail outlets.

- Strategic Partnerships: Co-location with major convenience store chains like Circle K.

- High-Traffic Locations: Leveraging existing retail infrastructure for increased visibility.

- Market Penetration: Expanding reach and accessibility through synergistic alliances.

- Cost Efficiency: Reducing overhead and capital investment by utilizing shared spaces.

Fire & Flower utilized a multi-channel approach to reach its diverse customer base. This included a robust network of over 100 corporate retail stores across Canada as of early 2024, providing direct customer interaction and product access. Complementing this, the Hifyre ONE digital platform served as a key e-commerce channel, enabling online browsing, click-and-collect, and delivery options, thereby extending the company's reach beyond physical locations.

Customer Segments

Fire & Flower's primary customer base includes adults in Canada who are looking for legal, regulated cannabis for recreational purposes. This segment spans across various Canadian provinces where adult-use cannabis is permitted.

The company strategically targets this broad demographic by ensuring its retail locations are easily accessible. This accessibility is crucial for attracting a wide range of consumers, from seasoned cannabis users to individuals trying it for the first time.

Fire & Flower aims to cater to both experienced consumers, who may have specific product preferences, and newcomers who require guidance and a welcoming environment. This inclusive approach broadens their market reach within the adult-use recreational cannabis sector.

Spark Perks loyalty program members represent a core, highly valued customer segment for Fire & Flower. These individuals are actively seeking personalized experiences, such as tailored product recommendations and exclusive discounts. In 2024, Fire & Flower reported a significant portion of its revenue was driven by its loyalty program, highlighting the program's success in fostering repeat business and brand loyalty.

Cannabis enthusiasts and information seekers represent a crucial customer segment for Fire & Flower, actively engaging with its digital platforms such as PotGuide and Wikileaf. This group prioritizes understanding cannabis culture, detailed product information, and emerging industry trends. They are driven by a need for educational content and comprehensive product knowledge, seeking to make informed choices.

Fire & Flower aims to convert these engaged information seekers into paying customers by providing accessible and reliable data. For example, in 2024, the Canadian cannabis market continued its growth trajectory, with retail sales projected to reach billions, indicating a strong demand for well-informed consumers. This segment’s interest directly fuels sales by bridging the gap between curiosity and purchase.

Consumers Valuing Education and Guidance

Fire & Flower recognizes a distinct customer segment that actively seeks education and guidance when making cannabis purchases. These individuals value interactions with knowledgeable staff and appreciate the company's dedication to offering clear, trustworthy information regarding products and responsible consumption practices.

This segment views Fire & Flower as a trusted advisor within the cannabis retail landscape. They are looking for more than just a transaction; they desire a supportive and informative experience that empowers their choices. This focus on education aligns with a growing trend in the cannabis industry, where consumers are increasingly discerning and health-conscious.

- Customer Focus: Prioritizes learning about cannabis products and responsible use.

- Value Proposition: Seeks knowledgeable staff and reliable product information.

- Engagement: Appreciates a trusted advisor relationship with the retailer.

- Market Trend: Reflects a broader consumer demand for transparency and education in the cannabis sector.

Other Cannabis Businesses (for Hifyre IQ)

Fire & Flower's Hifyre IQ platform also served a crucial B2B customer segment beyond individual consumers. This included other licensed cannabis producers, retailers, and even financial institutions.

These businesses subscribed to Hifyre IQ to gain access to invaluable real-time market data, detailed consumer demographics, and critical purchasing insights. This data allowed them to make more informed strategic decisions within the competitive cannabis landscape.

This B2B segment represented a significant high-margin revenue stream for Fire & Flower's digital operations. For instance, by mid-2024, the demand for granular market analytics in the cannabis sector was projected to grow substantially, with platforms like Hifyre IQ positioned to capture a significant share of this expanding market.

- Targeted Insights: Producers used data to optimize product development and marketing based on consumer preferences.

- Retail Optimization: Retailers leveraged insights for inventory management and personalized customer engagement.

- Financial Sector Interest: Financial institutions utilized data for risk assessment and investment analysis in the cannabis industry.

- Data-Driven Strategy: This segment underscored the value of data analytics in navigating the evolving regulatory and market dynamics of the cannabis sector.

Fire & Flower's customer base is diverse, encompassing recreational cannabis users across Canada, loyalty program members seeking personalized experiences, and individuals prioritizing education and responsible consumption. Additionally, the company serves a significant business-to-business segment through its Hifyre IQ platform, providing crucial market data and analytics to other industry players.

| Customer Segment | Key Characteristics | Value Proposition | 2024 Focus/Data Point |

|---|---|---|---|

| Recreational Users | Adults in Canada seeking legal cannabis. | Accessible retail locations, broad product selection. | Continued expansion into new provincial markets. |

| Spark Perks Members | Loyalty program participants. | Personalized offers, exclusive discounts, tailored recommendations. | Significant portion of revenue driven by loyalty program engagement. |

| Information Seekers | Consumers prioritizing education and product knowledge. | Reliable product information, knowledgeable staff, trusted advice. | Growth in engagement with digital platforms like PotGuide and Wikileaf. |

| B2B Clients (Hifyre IQ) | Cannabis producers, retailers, financial institutions. | Real-time market data, consumer demographics, purchasing insights. | Increasing demand for granular cannabis market analytics. |

Cost Structure

Fire & Flower's cost structure was heavily influenced by its extensive network of physical retail stores. Rent, utilities, and general maintenance for these locations represented a significant outlay. For instance, in the fiscal year ending March 31, 2024, the company operated 85 stores, each incurring these operational expenses.

Store-level staffing was another major component of the operating expenses. Wages, benefits, and training for employees across its Canadian footprint contributed substantially to the cost of goods sold and selling, general, and administrative expenses. The overhead associated with managing this large retail presence was a defining characteristic of their business model.

Fire & Flower's technology development and maintenance costs were significant, driven by the continuous improvement of their Hifyre digital platform, which includes Hifyre IQ, ONE, and Spark Perks. These expenses covered essential elements like salaries for their dedicated tech teams, necessary software licenses, robust data hosting solutions, and vital cybersecurity measures to protect user data and platform integrity.

In 2024, the company continued to invest heavily in this proprietary technology. For instance, during the first quarter of 2024, Fire & Flower reported that technology and development expenses, primarily related to the Hifyre platform, represented a substantial portion of their operational costs, underscoring its importance for maintaining a competitive advantage in the evolving cannabis retail landscape.

Expenses for acquiring cannabis products from licensed producers and managing the intricate supply chain were significant. These costs encompassed the actual product purchase price, the logistics of transportation, secure warehousing, and rigorous quality control to ensure product integrity.

In 2024, Fire & Flower's commitment to efficient inventory management was paramount. This focus aimed to keep holding costs in check and prevent the costly issue of stockouts, ensuring consistent product availability for customers.

Marketing, Advertising, and Loyalty Program Costs

Fire & Flower's cost structure was heavily influenced by its investments in marketing, advertising, and its Spark Perks loyalty program. These expenditures were crucial for attracting new customers and keeping existing ones engaged.

The company allocated significant funds to various marketing channels. This included digital advertising across multiple platforms, in-store promotions designed to drive foot traffic and sales, and the operational costs associated with managing and incentivizing the Spark Perks program. Loyalty rewards and discounts were a direct cost of this retention strategy.

For example, in the fiscal year ending March 31, 2024, Fire & Flower reported selling, general, and administrative (SG&A) expenses that would encompass these marketing and loyalty costs. While specific figures for marketing alone aren't always broken out, these activities are a substantial component of overall SG&A, which can run into tens of millions of dollars for a company of its scale.

- Digital Advertising: Investment in online ads to reach a broad consumer base.

- In-Store Promotions: Costs associated with point-of-sale displays and special offers.

- Loyalty Program Expenses: The cost of rewards, discounts, and program administration for Spark Perks.

- Customer Acquisition & Retention: These marketing efforts were directly tied to the goal of growing and maintaining the customer base.

Regulatory Compliance and Licensing Fees

Operating within the cannabis sector demands significant investment in regulatory compliance and licensing. Fire & Flower, like its peers, faces substantial costs associated with adhering to federal and provincial cannabis laws. These expenses cover licensing fees, legal counsel to navigate complex regulations, and robust security infrastructure.

Ensuring continuous adherence to evolving guidelines is an ongoing and significant financial commitment. For instance, in 2024, the Canadian cannabis industry continued to grapple with the financial burden of compliance, with many operators dedicating a notable portion of their operating budget to these requirements.

- Licensing Fees: Annual fees for retail and cultivation licenses vary by province, representing a fixed operational cost.

- Legal and Consulting Expenses: Costs incurred for legal advice on regulatory interpretation and compliance audits.

- Security Measures: Investment in secure storage, surveillance systems, and background checks for staff to meet stringent government mandates.

- Compliance Training: Ongoing training for employees to ensure they understand and follow all relevant cannabis regulations.

Fire & Flower's cost structure is dominated by its extensive retail footprint, with rent, utilities, and store maintenance for its 85 locations in fiscal 2024 forming a core expense. Staffing costs, including wages and benefits for retail employees, also represent a significant portion of their operational outlay. Furthermore, the company incurs substantial costs related to technology development and maintenance for its Hifyre digital platform, including salaries for tech teams and cybersecurity measures.

| Cost Category | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Retail Operations | Rent, utilities, maintenance for 85 stores | Significant fixed and variable costs |

| Staffing | Wages, benefits, training for retail employees | Major component of operating expenses |

| Technology Development | Hifyre platform enhancements, Hifyre IQ, ONE, Spark Perks | Investment in proprietary digital infrastructure |

| Product Acquisition & Supply Chain | Purchasing cannabis, logistics, warehousing, quality control | Direct cost of goods sold and inventory management |

| Marketing & Loyalty | Digital ads, in-store promotions, Spark Perks rewards | Customer acquisition and retention expenses |

| Regulatory Compliance | Licensing fees, legal, security, training | Ongoing commitment to adhere to cannabis laws |

Revenue Streams

Fire & Flower's main income source is the direct sale of cannabis products and related accessories to consumers through its owned retail locations. This encompasses a wide array of items, from dried cannabis flower and pre-rolled joints to edibles, vaporizers, and concentrates, catering to the adult-use market.

The retail sales segment has historically been the largest contributor to Fire & Flower's overall revenue. For instance, in the first quarter of 2024, Fire & Flower reported total revenue of $42.9 million, with its Canadian retail operations being the primary driver of this figure.

Hifyre IQ Data and Analytics Subscriptions represented a significant revenue stream for Fire & Flower. Businesses within the cannabis sector, along with producers and financial institutions, paid for access to this platform.

The subscription model provided these entities with valuable real-time market data and deep consumer insights. This allowed them to make more informed strategic decisions in a rapidly evolving industry.

This revenue source was characterized by its high margins and recurring nature. It effectively capitalized on Fire & Flower's unique ability to collect and analyze proprietary data, offering a competitive advantage.

Fire & Flower generated revenue through strategic licensing deals, a key component of its business model. These agreements allowed other cannabis retailers to utilize its proprietary Hifyre technology platform.

This licensing strategy provided a valuable additional revenue stream, capitalizing on Fire & Flower's intellectual property and operational know-how. The company saw potential for this model to expand, particularly into the United States market, further diversifying its income sources beyond direct retail sales.

E-commerce and Click-and-Collect Sales

Fire & Flower's e-commerce and click-and-collect sales, primarily driven by its Hifyre ONE platform, represented a significant revenue stream. This digital channel offered customers a convenient way to browse and purchase products online for in-store pickup, complementing traditional retail transactions.

In 2024, Fire & Flower continued to leverage its digital infrastructure to capture a broader customer base. The company reported that its e-commerce segment, including click-and-collect, played a crucial role in adapting to evolving consumer shopping habits. This digital focus allowed for greater accessibility and sales reach beyond its physical store footprint.

Key aspects of this revenue stream include:

- Online Sales Growth: Driving revenue through dedicated e-commerce platforms like Hifyre ONE.

- Click-and-Collect Convenience: Facilitating customer purchases for convenient in-store pickup.

- Digital Channel Expansion: Providing an alternative to in-store shopping, enhancing customer choice.

Wholesale and Logistics Services

Fire & Flower's Wholesale and Logistics Services segment brought in revenue by distributing a carefully selected range of cannabis products and accessories. This operation was designed to assist other businesses within the cannabis industry, easing their distribution challenges.

This revenue stream played a crucial role in diversifying Fire & Flower's income, moving beyond just direct-to-consumer retail sales. For instance, in their fiscal year 2023, the company reported total revenue of $171.9 million, with wholesale contributing to this overall financial performance.

- Wholesale Distribution: Revenue generated from selling cannabis products and accessories to other licensed retailers and businesses.

- Logistics Support: Income derived from providing supply chain and distribution services to partners in the cannabis ecosystem.

- Ecosystem Support: This segment aims to simplify complex distribution for other cannabis businesses, creating a valuable service offering.

- Revenue Diversification: It broadens the company's income sources beyond its own retail footprint.

Fire & Flower's revenue streams are diverse, primarily driven by direct retail sales of cannabis products and accessories across its numerous locations. This core segment is complemented by income from its Hifyre IQ data and analytics platform, which offers valuable market insights to industry participants. Additionally, the company generates revenue through strategic licensing of its proprietary technology and by providing wholesale distribution and logistics services to other cannabis businesses.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Retail Sales | Direct sale of cannabis products and accessories to consumers. | Q1 2024 revenue of $42.9 million driven by Canadian retail operations. |

| Hifyre IQ Subscriptions | Access fees for proprietary market data and consumer insights. | High-margin, recurring revenue capitalizing on proprietary data. |

| Licensing Deals | Allowing other retailers to use Hifyre technology. | Diversifies income by leveraging intellectual property. |

| E-commerce & Click-and-Collect | Online sales and in-store pickup via Hifyre ONE. | Crucial for adapting to evolving consumer habits in 2024. |

| Wholesale & Logistics | Distribution of cannabis products and accessories to other businesses. | Contributed to $171.9 million total revenue in FY 2023. |

Business Model Canvas Data Sources

The Fire & Flower Business Model Canvas is built using extensive market research, proprietary sales data, and operational performance metrics. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting industry dynamics and company performance.