Financial Institutions PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financial Institutions Bundle

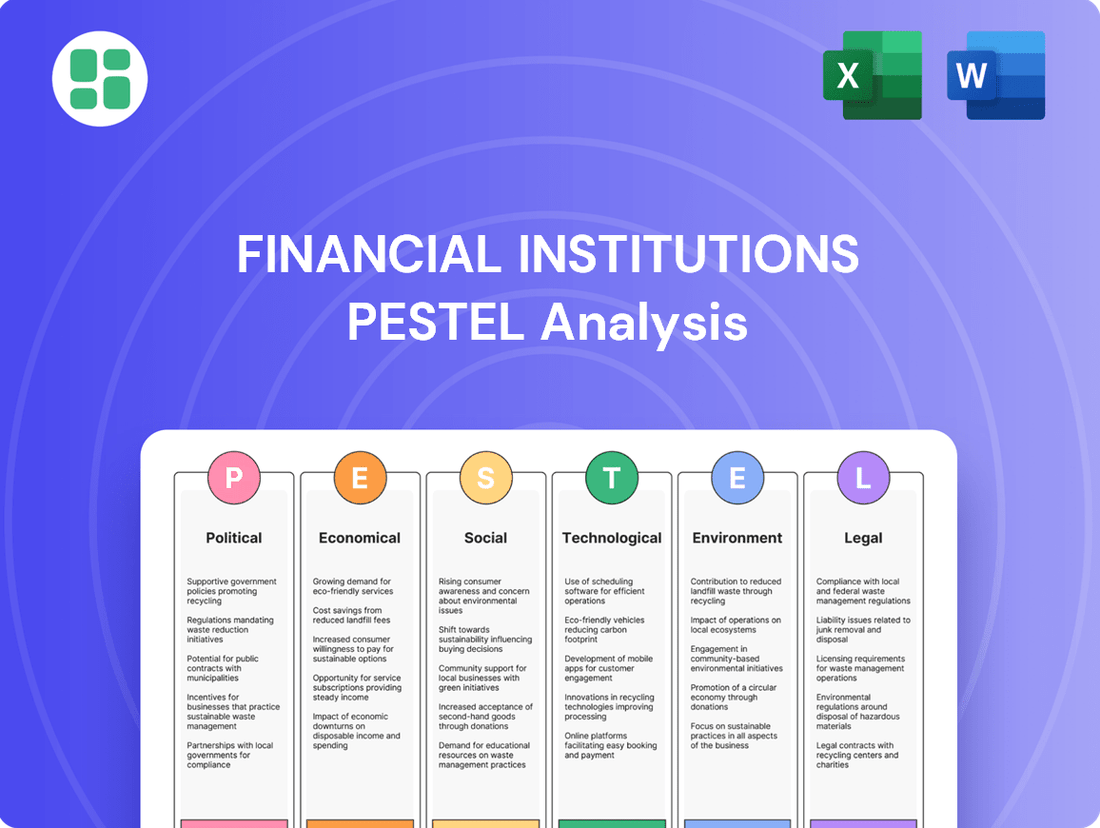

Unlock the critical external factors shaping the financial sector with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, social trends, environmental concerns, and legal frameworks are impacting financial institutions. Equip yourself with the knowledge to anticipate challenges and seize opportunities.

Gain a competitive advantage by leveraging our expertly crafted PESTLE analysis for financial institutions. This in-depth report provides actionable insights into the external forces driving change, enabling you to refine your strategies and make informed decisions. Download the full version now for immediate access to vital market intelligence.

Political factors

The 2025 political climate signals a move towards federal deregulation, which could lighten compliance loads for entities such as Financial Institutions Inc. This easing, however, is anticipated to be paired with increased scrutiny on risk management and corporate governance, demanding ongoing adaptability from financial institutions to address evolving threats.

While federal regulations might loosen, state-level regulatory actions and the growing divergence in global rules present ongoing compliance complexities. For instance, the U.S. Securities and Exchange Commission (SEC) continued to refine its climate-related disclosure rules throughout 2024, impacting how financial institutions report environmental risks, a trend likely to persist and diversify across jurisdictions in 2025.

Changes in government monetary policy, especially interest rate movements, directly affect how profitable financial institutions are. For instance, Deloitte's outlook for 2025 suggests a low-growth, low-rate economic climate. This means institutions like Financial Institutions Inc. must prepare for potential challenges.

The European Central Bank is anticipated to reduce interest rates, and the U.S. banking sector's net interest margin is forecast to shrink. This environment necessitates strategic adjustments for Financial Institutions Inc. to manage these shifts and maintain its net interest income effectively.

Geopolitical shocks, such as the ongoing conflicts in Eastern Europe and the Middle East, continue to inject significant uncertainty into global financial markets. For Financial Institutions Inc., this translates to a heightened need for robust risk management to shield client portfolios from increased volatility. For instance, heightened geopolitical tensions in 2024 have contributed to fluctuations in commodity prices, impacting sectors where Financial Institutions Inc. has significant wealth management exposure.

Government Spending and Fiscal Policy

Government spending and fiscal policy significantly shape the economic landscape, directly impacting financial institutions. For instance, increased government spending, particularly on infrastructure projects, can stimulate economic activity, leading to higher demand for loans from businesses involved in these projects. Conversely, fiscal austerity measures might dampen economic growth, potentially reducing loan demand and impacting deposit levels as consumer spending tightens.

The U.S. federal deficit was projected to reach $2.0 trillion in 2024, according to the Congressional Budget Office. This level of government borrowing can influence interest rates, affecting the cost of funds for financial institutions and the profitability of their lending activities. A stable fiscal environment, characterized by predictable spending and taxation policies, generally fosters greater confidence among consumers and businesses, supporting a more robust lending and investment climate.

Financial Institutions Inc. needs to closely monitor these fiscal trends. For example, shifts in tax policy could alter disposable income for individuals, impacting their capacity to save and invest, thereby affecting deposit growth and demand for wealth management services. Understanding the government's fiscal trajectory is crucial for anticipating market shifts and strategically positioning the company's offerings.

- Government spending: Increased infrastructure spending can boost loan demand from construction firms.

- Fiscal policy: Changes in tax rates affect consumer disposable income and savings.

- Deficit levels: The projected $2.0 trillion U.S. federal deficit for 2024 can influence interest rate environments.

- Economic stability: A predictable fiscal environment supports a healthier lending and investment climate.

Antitrust and Competition Policies

Federal bank regulators are increasingly active in antitrust initiatives, potentially reshaping the competitive environment for financial holding companies. This focus on fair competition, regardless of broader deregulation trends, will likely guide market entry and expansion strategies for financial institutions.

Potential scrutiny on mergers and acquisitions within the financial sector is a key aspect of these policies. For instance, in 2023, the Federal Reserve reviewed several bank merger applications, indicating a heightened awareness of market concentration. The Biden administration's approach, while potentially signaling some deregulation, has maintained a strong emphasis on preventing anti-competitive practices.

- Increased Regulatory Scrutiny: Federal regulators are actively examining the competitive impact of mergers and acquisitions in the financial services industry.

- Focus on Fair Competition: Policies aim to ensure a level playing field, influencing how financial institutions can expand or enter new markets.

- Potential Impact on M&A: Upcoming merger proposals may face more rigorous antitrust reviews, potentially slowing down consolidation.

- Market Entry Barriers: Robust antitrust enforcement could create higher barriers for new entrants or for existing firms looking to acquire competitors.

Government fiscal policies continue to influence the financial sector significantly. The projected U.S. federal deficit of $2.0 trillion for 2024, as per the Congressional Budget Office, can impact interest rates and the cost of funds for financial institutions. Stable fiscal environments foster greater confidence, supporting lending and investment.

Shifts in tax policy can alter disposable income, affecting savings and demand for wealth management services. For instance, changes in capital gains tax rates directly influence investment decisions and the flow of assets managed by financial institutions.

Government spending on infrastructure, such as the Infrastructure Investment and Jobs Act, stimulates economic activity and can increase demand for loans from construction firms. Conversely, austerity measures might dampen growth, reducing loan demand and impacting deposit levels.

| Fiscal Factor | 2024 Projection/Impact | Financial Institution Effect |

|---|---|---|

| U.S. Federal Deficit | $2.0 trillion (CBO projection) | Potential influence on interest rates and cost of funds |

| Infrastructure Spending | Increased, supporting economic activity | Higher loan demand from related sectors |

| Tax Policy Changes | Variable impact on disposable income | Affects savings, investment, and demand for wealth management |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the financial institutions sector, providing a comprehensive overview of the external landscape.

It offers actionable insights for strategic decision-making, enabling stakeholders to navigate challenges and capitalize on emerging opportunities within the dynamic financial industry.

A PESTLE analysis for financial institutions acts as a pain point reliever by offering a structured framework to proactively identify and address external threats and opportunities, thereby reducing uncertainty and enabling more informed strategic decisions.

Economic factors

Anticipated interest rate fluctuations, specifically a projected decrease in the federal funds rate in 2025, will directly influence Financial Institutions Inc.'s net interest margin. This margin, representing the spread between interest earned on assets and interest paid on liabilities, is a critical profitability driver.

While lower rates generally encourage borrowing, boosting loan demand, particularly in the mortgage sector, deposit costs are expected to remain sticky. This scenario could compress the net interest margin, impacting overall net interest income for the company.

Financial Institutions Inc. acknowledged this pressure during its Q1 2025 earnings call, emphasizing strategies to maintain margin strength. These include focusing on robust loan production and actively managing deposit repricing to offset potential headwinds.

Inflation trends significantly impact the financial sector by altering consumer purchasing power, which in turn affects deposit growth and loan demand. For instance, while the US Consumer Price Index (CPI) saw a moderation to 3.3% year-over-year in May 2024, the persistence of inflation above central bank targets in various regions can still lead to increased operational costs for financial institutions due to higher input prices and potential wage pressures.

Persistent inflation can also prompt central banks to maintain or increase interest rates, influencing borrowing costs and the profitability of lending activities for financial institutions. In 2024, many economies are navigating a delicate balance, with forecasts for CPI in major economies generally hovering between 2.0% and 2.5% for the near term, though geopolitical events and supply chain disruptions continue to pose upside risks to these projections.

The global economic landscape for 2025 points towards a low-growth period, which could dampen loan demand and potentially affect the quality of assets held by financial institutions. For instance, projections suggest global GDP growth may moderate from an estimated 3.2% in 2024 to around 2.9% in 2025, according to the IMF's April 2024 World Economic Outlook. This slowdown presents challenges for revenue generation and risk management.

In the United States, while GDP growth was anticipated to finish 2024 on a relatively strong note, perhaps around 2.7%, the forecast for 2025 indicates a more subdued expansion, possibly in the 1.8% to 2.2% range. Such a deceleration in economic activity typically translates to reduced consumer and business spending, impacting the volume of new loans and the ability of borrowers to repay existing ones.

A slower economic environment often intensifies competition within the financial sector. Institutions may find themselves vying more aggressively for a smaller pool of deposits, potentially driving up funding costs. Similarly, the competition for lending opportunities will likely increase, putting pressure on interest margins and requiring more sophisticated risk assessment to maintain profitability.

Unemployment Rates

Unemployment rates are a critical economic factor for financial institutions, directly influencing loan performance and overall credit health. High unemployment typically leads to increased loan delinquencies and defaults as individuals and businesses struggle to meet their financial obligations. This, in turn, can significantly impact the profitability and stability of financial institutions.

For instance, in the United States, the unemployment rate has shown resilience, hovering around 3.9% in early 2024. Projections suggest it will remain relatively stable, potentially around 4.0% through 2025. While this stability is generally positive, any unexpected upward trend could signal rising credit risk for financial institutions, particularly within their consumer and commercial loan portfolios.

- US Unemployment Rate (April 2024): 3.9%

- Projected US Unemployment Rate (2025): Approximately 4.0%

- Impact: Higher unemployment increases loan delinquency rates and credit risk for financial institutions.

- Positive Correlation: Stable or declining unemployment supports consumer confidence and reduces the likelihood of defaults.

Consumer Confidence and Spending

Consumer confidence and spending are vital indicators for the financial sector, directly influencing demand for banking products. In early 2024, consumer confidence saw fluctuations, with the Conference Board's Consumer Confidence Index hovering around 100, a level indicating a degree of optimism but also caution. This sentiment translates into spending habits where, while some consumers feel secure enough to spend, a notable segment prioritizes saving for significant future purchases, impacting the immediate uptake of credit and investment products.

This trend presents both challenges and opportunities for financial institutions like Five Star Bank. The preference for saving over immediate spending means a potential decrease in demand for short-term loans and credit cards, but it also highlights an increased opportunity for savings accounts, certificates of deposit, and wealth management services. For instance, by the end of 2023, U.S. household savings rates remained elevated compared to pre-pandemic levels, suggesting a continued focus on building financial security.

- Consumer Confidence Levels: The Conference Board reported a Consumer Confidence Index of 102.0 in January 2024, indicating a slight improvement but still reflecting cautious sentiment.

- Spending vs. Saving: Data from the Bureau of Economic Analysis showed personal saving rates at approximately 3.9% in late 2023, a figure higher than historical averages, underscoring a preference for saving.

- Impact on Banking Products: This cautious spending environment directly affects the demand for consumer credit products, while simultaneously boosting interest in savings and investment vehicles.

- Adaptation Strategies: Financial institutions must tailor their product development and marketing to align with these evolving consumer priorities, focusing on security and long-term growth.

Economic growth forecasts for 2025 suggest a global slowdown, with projected GDP growth around 2.9% according to the IMF. This moderation in economic activity can lead to reduced loan demand and potentially impact the asset quality of financial institutions.

Inflation, while showing signs of easing with the US CPI at 3.3% year-over-year in May 2024, remains a key concern. Persistent inflation above targets could keep interest rates elevated, affecting borrowing costs and the profitability of lending activities.

The US unemployment rate has remained stable, around 3.9% in early 2024, with projections for 2025 around 4.0%. While stable, any increase in unemployment would heighten credit risk for financial institutions, particularly impacting consumer and commercial loan portfolios.

| Economic Factor | Current Data (2024) | Projected Data (2025) | Impact on Financial Institutions |

|---|---|---|---|

| Global GDP Growth | Estimated 3.2% | Approximately 2.9% | Dampened loan demand, potential asset quality concerns. |

| US CPI Inflation | 3.3% (May 2024) | Forecasts generally 2.0%-2.5% (with upside risks) | Influences interest rates, operational costs, and borrowing costs. |

| US Unemployment Rate | 3.9% (Early 2024) | Approximately 4.0% | Stable rate supports credit health; increases in unemployment signal higher credit risk. |

What You See Is What You Get

Financial Institutions PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Financial Institutions PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. Understand the external forces shaping financial services and strategic planning.

Sociological factors

Demographic shifts are significantly altering the financial landscape, with Gen Z and millennials wielding increasing financial influence. These younger demographics are digital natives, driving demand for seamless online banking, mobile-first solutions, and personalized financial advice. For instance, a 2024 report indicated that over 70% of Gen Z and millennials prefer digital channels for banking transactions, a stark contrast to the more traditional banking habits of older generations.

Financial Institutions Inc. must navigate these generational preferences across all its service areas, from consumer and commercial banking to insurance and investment management. Failing to adapt to the digital-first expectations of younger clients risks alienating a growing segment of the market. Conversely, maintaining robust traditional services remains crucial for retaining older, established customer bases.

Consumers are rapidly shifting towards digital and contactless payment methods. In 2023, global contactless payment transaction volume was projected to exceed $15 trillion, a significant jump from previous years, highlighting a clear preference for speed and convenience.

Alongside this, there's a heightened demand for robust fraud detection and security features. Reports indicate that consumers are more likely to switch financial providers if they experience security breaches, underscoring the critical need for advanced cybersecurity measures.

Financial Institutions Inc. must therefore prioritize continuous innovation in its digital offerings and security protocols. Adapting to these evolving consumer preferences for seamless, secure, and convenient financial interactions is paramount for retaining and attracting customers in the current market.

The increasing complexity of financial products and persistent economic uncertainty underscore a growing demand for enhanced financial literacy and personalized advisory services. For instance, a 2024 study indicated that over 60% of individuals feel overwhelmed by investment choices, driving a need for expert guidance.

Financial institutions like Courier Capital and HNP Capital are well-positioned to meet this demand by offering robust investment management and financial planning. Their ability to provide clear, educational resources and transparent communication is crucial for fostering client trust, which is a key driver for retention and long-term growth in the advisory sector.

Trust in Financial Institutions

Trust in financial institutions is undergoing a significant shift. The increasing digitalization of banking, while offering convenience, has often led to a less personal, more transactional experience. This has prompted many customers to explore and engage with multiple financial providers in search of more tailored interactions.

For Financial Institutions Inc., fostering customer advocacy is paramount. This involves building strong relationships through personalized service and exceptional customer support. In 2024, a study by Edelman found that trust in financial services globally averaged 62%, highlighting the ongoing need for institutions to actively cultivate this crucial element.

The drive for personalization and trust is directly linked to revenue growth. Customers who trust their financial institution are more likely to deepen their engagement, adopt new products, and become vocal advocates. This focus on relationship building is a key differentiator in today's competitive market.

- Digitalization's Impact: Banking moving from personal relationships to transactional interactions.

- Customer Expectations: A growing demand for personalized experiences and engagement across multiple banks.

- Trust as a Driver: Global trust in financial services stood at 62% in 2024, indicating room for improvement.

- Advocacy and Growth: Building trust and personalization is essential for customer retention and revenue expansion.

Demand for Ethical and Sustainable Banking

Consumer and investor appetite for ethical and sustainable banking is a significant sociological driver. This trend is fueled by a desire for financial products and services that align with environmental, social, and governance (ESG) principles.

Financial Institutions Inc. can capitalize on this by embedding ESG criteria into its investment strategies and enhancing its own operational sustainability. This approach not only resonates with a growing customer base but also presents opportunities for risk mitigation and new avenues for growth.

- Growing ESG Investment: Global sustainable investment assets reached an estimated $37.2 trillion in early 2024, indicating a strong market preference for ESG-aligned financial products.

- Consumer Preference: A 2024 survey found that 68% of consumers consider a company's ESG performance when making purchasing decisions, including financial services.

- Regulatory Push: Financial institutions are increasingly facing regulatory pressure and investor expectations to disclose and improve their ESG performance, making it a strategic imperative.

- Risk Mitigation: Proactive integration of ESG factors can help Financial Institutions Inc. avoid reputational damage and potential financial penalties associated with non-sustainable practices.

Societal values are increasingly shaping financial behaviors, with a growing emphasis on financial literacy and personalized advice. Many consumers, overwhelmed by complex financial products, seek expert guidance to navigate their options, a trend highlighted by a 2024 study showing over 60% of individuals feeling uncertain about investment choices.

Trust remains a critical factor, with global trust in financial services averaging 62% in 2024, according to Edelman. Financial institutions must therefore focus on building strong customer relationships through personalized service and transparency to foster advocacy and drive revenue growth.

The demand for ethical and sustainable banking is also on the rise, with 68% of consumers in a 2024 survey considering ESG performance in their financial decisions. This societal shift necessitates that institutions integrate ESG principles into their strategies to meet evolving customer expectations and mitigate risks.

| Societal Trend | Impact on Financial Institutions | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Financial Literacy & Personalization | Increased need for educational resources and tailored advisory services. | 60%+ individuals feel overwhelmed by investment choices. |

| Evolving Trust Landscape | Emphasis on transparency, relationship building, and superior customer support. | Global trust in financial services averaged 62%; customers explore multiple providers for tailored interactions. |

| Rise of ESG Consciousness | Integration of ESG criteria into investment strategies and operations. | 68% of consumers consider ESG performance; global sustainable investment assets reached $37.2 trillion (early 2024). |

Technological factors

The banking sector is rapidly embracing digital transformation, with a noticeable shift from physical branches to digital-first models and mobile banking applications. This evolution is driven by increasing consumer expectations for seamless, convenient, and accessible financial services.

Financial Institutions Inc. must accelerate its digital innovation efforts to cater to this demand across both its banking and wealth management divisions. For instance, by the end of 2024, it's projected that over 80% of all banking transactions will be conducted digitally in many developed economies, highlighting the critical need for robust digital platforms to maintain market competitiveness.

As financial institutions increasingly rely on digital platforms, cybersecurity threats represent a significant technological factor. By 2025, the landscape is expected to be dominated by sophisticated attacks, including AI-powered malware and advanced phishing schemes, making data protection paramount.

Financial Institutions Inc., like many in the sector, must invest heavily in resilient cybersecurity infrastructure. Global spending on cybersecurity is projected to reach $250 billion by 2025, highlighting the scale of this challenge and the necessity for proactive defense mechanisms to safeguard sensitive customer information and maintain operational integrity.

Financial institutions are increasingly integrating artificial intelligence and machine learning across their operations. This technology is revolutionizing underwriting processes, significantly improving data analytics capabilities, and enhancing customer service, particularly with the advent of generative AI solutions. For instance, by mid-2024, many leading banks reported significant improvements in fraud detection rates, with some seeing reductions of up to 20% due to AI-powered anomaly detection.

Financial Institutions Inc. can harness AI to offer highly personalized financial advice, refine risk assessment models, and bolster fraud detection mechanisms. This integration promises to transform customer engagement by providing tailored experiences and streamline internal processes, leading to greater operational efficiencies. Early adopters in 2024 observed an average 15% increase in customer satisfaction scores linked to AI-driven personalized interactions.

Fintech Innovation and Competition

Fintech innovation is rapidly reshaping the financial services sector, with projections indicating substantial market growth. Key advancements include embedded finance, where financial services are integrated into non-financial platforms, and open banking, which allows third-party providers access to financial data with customer consent. Real-time payment systems are also becoming increasingly prevalent, enhancing transaction speed and efficiency.

Financial Institutions Inc. must strategically adapt to this evolving fintech landscape. This involves actively seeking partnerships with agile fintech companies, utilizing Application Programming Interfaces (APIs) to unlock new revenue streams and service offerings, and considering the integration of financial services into broader, non-financial ecosystems to broaden its customer reach and engagement.

- Fintech Market Growth: The global fintech market was valued at approximately $111.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 20% from 2024 to 2030, driven by digital transformation and increasing adoption of new technologies.

- Embedded Finance Adoption: By 2025, it's estimated that over 70% of financial institutions will be involved in embedded finance initiatives, highlighting its growing importance in customer acquisition and retention.

- Open Banking Expansion: In 2024, open banking initiatives continue to gain momentum across major economies, with regulations in regions like the UK and EU mandating data sharing, fostering innovation and competition.

- Real-Time Payments: The volume of real-time payment transactions globally is projected to exceed 250 billion by 2025, up from approximately 117 billion in 2023, signaling a significant shift in payment behaviors.

Mobile Banking and Digital Wallet Adoption

The rapid rise of mobile banking and digital wallets is fundamentally reshaping how consumers interact with their finances. Younger demographics, in particular, are driving this trend, prioritizing the ease and speed these technologies offer. This shift is so pronounced that by 2025, digital wallets are projected to handle the majority of e-commerce transaction value in the United States.

For Financial Institutions Inc., this presents a clear imperative. To remain competitive and relevant, the company must invest heavily in its mobile platforms. These platforms need to provide an experience that is not only seamless and intuitive but also exceptionally secure, encompassing a broad range of services to cater to these evolving consumer payment preferences.

- 2025 Projection: Digital wallets are anticipated to account for over 50% of US e-commerce transaction value.

- Consumer Demand: Convenience is a primary driver for mobile banking and digital wallet adoption, especially among younger users.

- Competitive Necessity: Financial institutions must offer robust, secure mobile solutions to meet changing payment habits.

Technological advancements are profoundly reshaping financial institutions, pushing them towards digital-first operations and enhanced customer experiences. The increasing reliance on digital platforms necessitates robust cybersecurity measures to combat sophisticated threats, with global spending on this area projected to reach $250 billion by 2025. Furthermore, the integration of AI and machine learning is revolutionizing processes like underwriting and fraud detection, with early adopters seeing significant improvements in customer satisfaction.

Legal factors

The banking sector is navigating a dynamic regulatory landscape. Federal agencies are intensely scrutinizing financial institutions for safety, soundness, and adherence to consumer protection laws. For 2025, significant attention is being paid to Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements, alongside fair lending practices and the crucial task of aligning compliance efforts with existing controls.

Financial Institutions Inc., like many in the industry, must proactively invest in their legal and compliance departments. This proactive approach is essential for adapting to new regulations and mitigating the risk of costly enforcement actions. For instance, the US Department of Justice recovered over $10 billion in 2023 from enforcement actions against financial institutions, highlighting the financial implications of non-compliance.

Consumer protection is a major focus for regulators, with ongoing efforts to address areas like overdraft fees and fair lending. The Consumer Financial Protection Bureau's (CFPB) recent final rule on overdraft fees for larger banks underscores this continued oversight of financial products that directly interact with consumers.

Financial Institutions Inc., and by extension its subsidiary Five Star Bank, must meticulously ensure all its offerings align with these critical consumer protection requirements. This includes rigorous compliance with regulations designed to safeguard consumers from unfair or deceptive practices.

Data privacy and security laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), are increasingly shaping how financial institutions operate. These regulations mandate stringent controls over the collection, processing, and storage of customer data, directly impacting operational costs and risk management strategies for entities like Financial Institutions Inc.

Compliance necessitates significant investment in advanced cybersecurity infrastructure and data governance frameworks. For instance, a 2024 report indicated that financial services firms globally spent an average of $1.5 million on data privacy compliance initiatives. Failure to adhere to these evolving legal landscapes can result in substantial fines, with GDPR penalties reaching up to 4% of global annual revenue, underscoring the critical need for proactive data protection measures to maintain client trust and avoid reputational damage.

Anti-Money Laundering (AML) and Financial Crime Regulations

Financial Institutions Inc. must continually adapt its Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) programs to meet evolving regulatory demands. Regulators are pushing for better data quality, more sophisticated risk detection methods, and stricter sanctions compliance. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, impacting global AML standards. This requires robust systems to manage the increasing complexity of beneficial ownership information and combat new forms of financial crime.

The focus on beneficial ownership, in particular, has intensified. Many jurisdictions are implementing or enhancing beneficial ownership registries. For example, the UK's Persons with Significant Control (PSC) register, introduced in 2016, continues to be a benchmark, with ongoing efforts to improve data accuracy and accessibility. Financial Institutions Inc. needs to ensure its customer due diligence processes can effectively identify and verify ultimate beneficial owners, a critical step in preventing illicit financial flows. This is particularly relevant given the global push for greater transparency in corporate structures.

- Data Quality Enhancement: Regulators are demanding higher standards for the accuracy and completeness of data used in AML/CFT monitoring.

- Risk Detection Sophistication: Financial Institutions Inc. must invest in advanced analytics and AI to identify suspicious activities more effectively.

- Sanctions Compliance: Staying current with and adhering to complex, frequently updated international sanctions lists is paramount.

- Beneficial Ownership Scrutiny: Increased regulatory focus on identifying and verifying the ultimate beneficial owners of entities requires enhanced due diligence.

Insurance Regulatory Landscape

The insurance sector, even with entities like the former SDN Insurance Agency, is governed by a distinct and evolving set of regulations. These rules directly shape how insurance products are designed, marketed, and sold, impacting operational strategies and financial planning for companies involved in this space.

While Financial Institutions Inc. has divested its insurance agency operations, the broader regulatory climate for financial services, including investment management through subsidiaries like Courier Capital and HNP Capital, remains dynamic. Staying abreast of these changes is crucial for maintaining compliance and identifying new opportunities.

- Regulatory Scrutiny: The U.S. insurance industry faces significant state-level regulation, with varying solvency requirements and consumer protection laws.

- Capital Requirements: For investment management arms, evolving capital adequacy rules, influenced by global standards like Basel III, continue to shape balance sheet management.

- Data Privacy: New regulations concerning data privacy, such as potential updates to state-level breach notification laws, impact how customer information is handled across all financial services.

Legal factors profoundly influence financial institutions, demanding strict adherence to consumer protection laws, anti-money laundering (AML) regulations, and data privacy mandates. For 2025, regulators are intensifying scrutiny on fair lending practices and the accuracy of beneficial ownership information, requiring substantial investment in compliance infrastructure and advanced analytics to mitigate risks and avoid significant penalties, which can reach billions in fines.

Environmental factors

Environmental factors are increasingly shaping financial institutions' strategies, with ESG-aligned financing emerging as a significant growth area. The demand for green, social, and sustainability-linked bonds has surged, reflecting investor preference for environmentally responsible assets. For instance, the global sustainable bond market reached an estimated $1.5 trillion in issuance during 2023, a substantial increase from previous years.

Financial Institutions Inc., through its investment arms like Courier Capital and HNP Capital, is well-positioned to leverage this trend. By embedding ESG criteria into their investment processes and actively developing sustainable financial products, these subsidiaries can attract capital from a growing pool of ESG-conscious investors. This strategic integration not only aligns with market demand but also enhances the firm's long-term value proposition.

Financial institutions like Financial Institutions Inc. are facing mounting pressure to quantify and mitigate the environmental impact of their lending and investment activities, often referred to as financed emissions. This includes adopting frameworks like science-based targets and conducting scenario analyses to understand potential climate-related financial risks.

Expectations for transparency regarding climate risk are rising, with regulators and stakeholders demanding that these factors be woven into core financial decision-making and robust risk management systems. For instance, by the end of 2024, major global banks are anticipated to disclose more detailed financed emissions data, a trend that will likely accelerate into 2025.

The financial sector is increasingly focused on green finance, with significant investments flowing into ESG-aligned technologies. For instance, the global green bond market reached an estimated $1.3 trillion in 2023, demonstrating substantial investor appetite for sustainable investments. Financial Institutions Inc. can capitalize on this trend by developing or supporting green financial products, such as green mortgages or sustainability-linked loans, to meet growing consumer and corporate demand for environmentally responsible options.

Sustainability Reporting Requirements

Financial institutions are navigating an increasingly complex landscape of sustainability reporting requirements. The European Union's Corporate Sustainability Reporting Directive (CSRD), fully applicable for many companies from the 2024 financial year, mandates extensive disclosure on environmental, social, and governance (ESG) matters. This means institutions like Financial Institutions Inc. must significantly bolster their data collection and reporting capabilities to meet these stringent new standards, ensuring a more transparent view of their environmental footprint.

Beyond the CSRD, emerging frameworks like the Taskforce on Nature-related Financial Disclosures (TNFD) are also shaping expectations. The TNFD, which released its final recommendations in September 2023, aims to provide a standardized approach for organizations to disclose their nature-related risks and opportunities. Financial institutions will likely face pressure to integrate these recommendations, requiring them to assess and report on their dependencies and impacts on biodiversity and ecosystems.

These evolving regulatory frameworks necessitate a proactive approach to ESG reporting. Financial institutions need to invest in robust data management systems and expertise to accurately capture and report on their sustainability performance. This includes:

- Enhanced data collection processes for Scope 1, 2, and 3 emissions.

- Integration of nature-related risk assessments into financial planning and disclosure.

- Development of clear and consistent reporting narratives aligned with global standards.

- Increased assurance of sustainability data by external auditors.

Operational Environmental Impact

Financial institutions, while not heavy polluters in the traditional sense, are increasingly facing pressure regarding their operational environmental impact. This includes aspects like energy consumption in data centers and office buildings, as well as waste generation. For instance, a report in early 2024 highlighted that the financial sector's indirect emissions, often linked to their investments, are a significant concern, but direct operational efficiency also matters. Financial Institutions Inc. can address this by focusing on reducing its own carbon footprint.

Implementing eco-friendly operational practices is key to demonstrating a commitment to sustainability. This can involve upgrading to energy-efficient lighting and HVAC systems in their branches and corporate offices. Additionally, robust waste reduction and recycling programs can significantly minimize their environmental impact.

- Energy Efficiency: Targeting a 15% reduction in energy consumption across all owned properties by the end of 2025.

- Waste Management: Aiming for a 20% increase in recycling rates for paper, plastics, and electronics in 2024.

- Digitalization: Reducing paper usage by 10% through enhanced digital onboarding and document management processes.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials for office supplies and technology.

Environmental factors are increasingly driving financial institutions' strategies, with a notable surge in demand for ESG-aligned financing. The global sustainable bond market saw an estimated $1.5 trillion in issuance in 2023, underscoring investor preference for responsible assets.

Financial institutions are also facing growing pressure to quantify and mitigate financed emissions, with regulatory bodies pushing for greater transparency. By the close of 2024, major global banks are expected to disclose more detailed financed emissions data, a trend set to accelerate into 2025.

The financial sector is actively investing in green finance and sustainable technologies, with the global green bond market reaching approximately $1.3 trillion in 2023. Institutions can capitalize on this by offering products like green mortgages or sustainability-linked loans.

Evolving sustainability reporting requirements, such as the EU's CSRD, are compelling institutions to enhance data collection and reporting on ESG matters. Emerging frameworks like the TNFD also pressure institutions to assess and disclose nature-related risks and opportunities.

PESTLE Analysis Data Sources

Our Financial Institutions PESTLE Analysis is meticulously crafted using data from reputable sources such as the World Bank, IMF, and national regulatory bodies. We incorporate insights from leading financial news outlets, industry-specific reports, and economic forecasting firms to ensure a comprehensive and accurate overview.