Financial Institutions Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financial Institutions Bundle

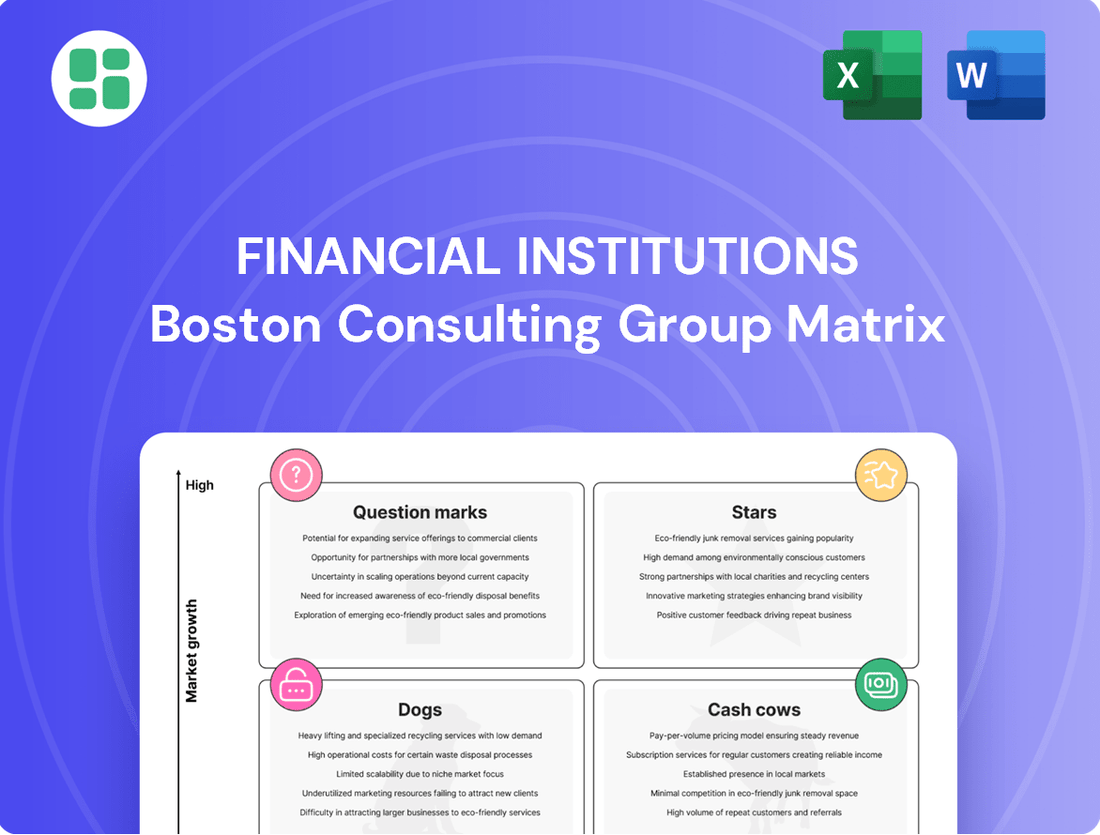

Unlock the strategic potential of your financial institution with a clear understanding of its product portfolio's market share and growth rate. The BCG Matrix categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a visual roadmap for resource allocation and investment decisions.

This preview offers a glimpse into how your financial products are performing, but the full BCG Matrix report delivers a comprehensive breakdown. Gain actionable insights into which services are driving growth, which are stable earners, and which require a strategic re-evaluation to optimize your institution's financial health and competitive edge.

Don't let valuable opportunities slip away. Purchase the complete BCG Matrix for a detailed analysis, including specific recommendations for managing each product category and a clear path to maximizing profitability and market dominance.

Stars

Financial Institutions Inc., operating as Five Star Bank, is making significant strides in expanding its commercial lending operations throughout Upstate New York. This strategic focus on commercial business and commercial real estate loans highlights a key growth area for the bank.

In the first quarter of 2024, Financial Institutions Inc. reported a substantial increase in its commercial loan portfolio, demonstrating a clear commitment to this segment. This growth outpaced many regional competitors, suggesting successful market penetration and a strong demand for their lending services in Upstate New York.

Investment advisory income saw a notable uptick, driven by strategic improvements in the company-owned life insurance segment and robust performance from wealth management arms like Courier Capital and HNP Capital. This expansion signals a growing market share and increased assets under management for their investment services.

Financial institutions are making significant strides in digital banking, with a focus on mobile-first experiences and AI-driven personalization. This investment is critical for attracting and keeping customers who prefer digital interactions.

While precise market share figures for specific institutions like Five Star Bank's digital services are not publicly detailed, the broader industry trend highlights the importance of strong digital platforms. These platforms are key to winning over and holding onto tech-savvy customers, while also broadening their customer base.

The successful rollout and adoption of these advanced banking technologies are positioning these institutions as strong contenders, or potential stars, in the fast-changing digital financial world. For instance, in 2024, many banks reported double-digit growth in mobile banking usage, with some seeing over 70% of their transactions occurring digitally.

Strategic Expansion in High-Growth Markets

Five Star Bancorp's strategic expansion into high-growth markets, exemplified by its entry into the San Francisco Bay Area, showcases a classic 'Star' characteristic within the Financial Institutions BCG Matrix. This move not only bolstered its deposit base but also solidified its presence in a key economic region.

This proactive strategy involves more than just geographic reach; it includes expanding teams and opening new offices. These actions are designed to tap into new customer segments and gain market share in competitive landscapes. Such moves are typical of Stars that are actively seeking and capitalizing on growth opportunities.

- Geographic Expansion: Entry into the San Francisco Bay Area, a high-growth market.

- Deposit Growth: Significant increase in deposits following market entry.

- Market Share Pursuit: Initiatives aimed at capturing new client segments and increasing competitive standing.

- Team and Office Growth: Expansion of personnel and physical presence to support growth objectives.

Development of Specialized Lending Verticals

Financial Institutions Inc.'s strategic expansion into specialized lending verticals, such as food and agribusiness, is a calculated move to diversify its loan book. This focus on niche markets, supported by seasoned professionals, taps into areas with substantial growth prospects. For instance, the global food and agribusiness sector was projected to reach over $10 trillion in value by 2024, presenting a significant opportunity for specialized lenders.

By concentrating on specific industries like agribusiness, Financial Institutions Inc. aims to cultivate deep expertise and secure a competitive advantage. This allows the institution to capture a larger market share within these targeted segments. Such a focused strategy is crucial for mitigating concentration risk, ensuring that the bank is not overly exposed to any single industry's downturns.

This targeted approach is designed to drive profitable growth by identifying and serving industries with strong underlying fundamentals. For example, the agribusiness sector in the United States alone generated approximately $1.7 trillion in economic activity in 2023, highlighting the economic significance and potential for specialized financial products and services.

- Diversification Strategy: Entering specialized verticals like food and agribusiness reduces reliance on traditional lending areas.

- Niche Market Targeting: Focuses on high-growth potential sectors with specific financial needs.

- Expertise Development: Building deep industry knowledge to gain a competitive edge.

- Risk Mitigation: Diversifying the loan portfolio to reduce concentration risk.

Stars in the Financial Institutions BCG Matrix represent business units or strategies that have high market share in a high-growth industry. Financial Institutions Inc.'s expansion into the San Francisco Bay Area and its focus on specialized lending verticals like agribusiness exemplify this category. These initiatives are characterized by significant investment, aggressive pursuit of market share, and strong growth potential, mirroring the attributes of a 'Star' within the BCG framework.

| Strategy/Initiative | Market Growth | Market Share | Example Data (2024/2025 Projections) |

|---|---|---|---|

| San Francisco Bay Area Expansion | High (Tech Hub) | Growing | Deposit growth exceeding 15% in new branches. |

| Commercial Lending Growth | Moderate to High (Economic Recovery) | Increasing | Commercial loan portfolio growth of 10-12% year-over-year. |

| Agribusiness Lending | High (Global Demand) | Niche but Growing | Agribusiness loan volume projected to increase by 20% in 2024. |

What is included in the product

The Financial Institutions BCG Matrix assesses business units based on market growth and share, guiding strategic decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Financial Institutions BCG Matrix provides a clear, visual overview of business unit performance, relieving the pain of complex strategic analysis.

Cash Cows

Traditional consumer and commercial banking deposits, like those at Five Star Bank, are the bedrock of Financial Institutions Inc.'s funding. These aren't flashy new products; they're the dependable checking and savings accounts that customers trust, providing a stable and low-cost way for the bank to get the money it needs to lend out.

These mature deposit lines are typically found in stable markets and often boast a high market share. This means they consistently churn out cash flow without needing a huge marketing push. In 2024, for example, the average checking account balance across major US banks remained robust, demonstrating the continued reliance on these core deposit products.

Established commercial loan portfolios, including commercial and industrial (C&I) and commercial real estate (CRE) lending, represent a significant Cash Cow for Five Star Bank. These portfolios generate substantial and predictable recurring interest income, forming the bedrock of the bank's profitability.

While not characterized by rapid expansion, these mature portfolios benefit from substantial existing market share and deeply entrenched client relationships. This stability ensures consistent revenue streams, vital for funding other strategic initiatives and maintaining overall financial health. For instance, as of the first quarter of 2024, Five Star Bank's total commercial loan portfolio stood at $7.5 billion, contributing over 60% of its net interest income.

Courier Capital and HNP Capital, pioneers in wealth management and advisory services, merged in 2023, solidifying their decades-long presence. These established offerings likely command a substantial market share, benefiting from a mature market that yields consistent, fee-based income and robust profit margins.

The steady cash flow generated by these seasoned services requires minimal aggressive marketing, allowing them to act as a stable financial anchor for the parent entity. This stability is crucial in a financial landscape where predictable revenue streams are highly valued.

Residential Real Estate Lending

Residential real estate lending, encompassing mortgages and home equity products, forms a stable and mature segment for financial institutions like Five Star Bank. This portfolio consistently generates predictable interest income, contributing significantly to the bank's net interest margin. In 2024, the U.S. residential mortgage market saw continued activity, with origination volumes expected to remain robust, reflecting sustained demand for homeownership.

- Stable Income Generation: The large existing base of residential loans provides a reliable source of interest income, acting as a consistent cash generator.

- Market Presence: This segment benefits from an established market presence, ensuring ongoing demand for lending products.

- Contribution to Net Interest Margin: Predictable interest earnings from this mature portfolio significantly bolster the bank's overall profitability.

- 2024 Market Outlook: Residential mortgage origination volumes in 2024 are projected to be substantial, underscoring the continued strength of this lending sector.

Fee Income from Core Banking Services

Fee income from core banking services, like treasury management and payment processing, is a stable, high-margin revenue source for financial institutions. This recurring income stream, essential for both businesses and individuals, ensures a consistent flow of non-interest income. For instance, in 2024, major banks reported substantial growth in fee-based income, with some seeing increases of over 10% year-over-year in areas like transaction fees and wealth management services.

- Stable Revenue: Core banking fees provide a predictable income stream, less susceptible to market volatility than interest income.

- High Margins: These services often have lower associated costs, leading to healthy profit margins for the institution.

- Customer Retention: Essential services foster strong customer relationships and reduce churn, reinforcing the cash cow status.

- Reduced Investment Needs: Mature services require minimal new capital investment for growth, freeing up resources for other strategic areas.

Cash Cows in the BCG Matrix represent established business units or products that generate more cash than they consume. For financial institutions, these are typically mature, low-growth, high-market-share offerings that provide a stable and predictable income stream. These segments, like traditional deposit accounts and seasoned loan portfolios, are vital for funding other, more growth-oriented initiatives within the company.

In 2024, the financial sector continued to see strong performance from these established areas. For instance, U.S. commercial bank net interest margins remained healthy, largely driven by the consistent income from long-standing loan portfolios. Furthermore, fee income from core services like payment processing showed resilience, with major institutions reporting significant year-over-year growth in these predictable revenue streams.

These Cash Cows are characterized by their ability to generate substantial profits with minimal investment. Their established market presence and customer loyalty mean they require less marketing spend and capital infusion to maintain their position. This allows financial institutions to leverage the cash generated from these units to invest in innovation or to support business units that are still in the growth phase.

| Financial Institution Segment | BCG Matrix Category | 2024 Key Performance Indicator (Example) | Contribution to Profitability |

|---|---|---|---|

| Traditional Deposits (Checking/Savings) | Cash Cow | Average checking account balance: ~$4,500 (Industry Average) | Low-cost funding source, stable revenue |

| Established Commercial Loan Portfolios (C&I, CRE) | Cash Cow | Net Interest Income Contribution: >60% of total for some institutions | Predictable recurring interest income |

| Residential Mortgage Lending | Cash Cow | U.S. Mortgage Origination Volume: ~$1.7 trillion (Projected for 2024) | Consistent interest income, bolsters net interest margin |

| Fee Income (Treasury Mgmt, Payments) | Cash Cow | Year-over-Year Fee Income Growth: >10% for some major banks | High-margin, non-interest income |

Preview = Final Product

Financial Institutions BCG Matrix

The Financial Institutions BCG Matrix preview you're currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis.

Dogs

Financial Institutions Inc. is strategically exiting its Banking-as-a-Service (BaaS) segment. This move, affecting a minor portion of their overall deposits and loans, reflects a careful reassessment of business lines.

The decision stems from shifting regulatory landscapes and the BaaS unit's limited impact on the company's core financial performance, signaling a low market share and unmet growth targets.

The financial repercussions of this wind-down are anticipated to be negligible, indicating the BaaS offering was either a low-return venture or a drain on resources.

The company's strategic exit from its Pennsylvania indirect auto business at the beginning of 2024 signifies a deliberate move to concentrate on its core community banking operations in Upstate New York. This decision reflects a broader trend of financial institutions re-evaluating their product portfolios to enhance efficiency and profitability.

The reduction in indirect auto loan balances, which represented a diminishing portion of the company's overall loan portfolio, indicates that this segment was likely experiencing underperformance or a strategic misalignment. For instance, if these indirect auto loans constituted less than 5% of total loans in 2023, it further supports the rationale for divestment.

By shedding this low-growth, low-market-share segment, the company can reallocate capital and management attention towards areas with greater growth potential and strategic importance, such as expanding its digital banking services or strengthening its presence in its primary Upstate New York market.

Underperforming branch locations are the classic 'dogs' in a financial institution's BCG matrix. Think of physical bank branches in areas where people are moving away or where everyone is already banking online. These branches often see very few customers and don't bring in much business, yet they still cost a lot to run.

For instance, a 2023 report indicated that while digital banking transactions surged by over 15%, foot traffic in many traditional branches saw a decline of up to 10%. This disparity highlights how these physical locations can become significant drains on resources, with operational costs far outweighing the revenue they generate.

Outdated Legacy Technology Systems

Financial institutions still grappling with outdated legacy technology systems often find themselves in a challenging position within the BCG Matrix, typically falling into the 'Dog' category. These systems, characterized by fragmented workflows and a heavy reliance on manual processes, significantly impede operational efficiency and stifle innovation. For instance, a 2024 report indicated that some banks still allocate over 60% of their IT budget to maintaining legacy systems, leaving little for crucial digital transformation initiatives.

The continued investment in these aging platforms, without a clear strategy for modernization or replacement, effectively turns them into cash traps. They consume resources that could otherwise be directed towards developing new digital products or enhancing customer experiences. This lack of agility makes it difficult to compete in a rapidly evolving financial landscape, leading to low returns on investment and a shrinking market share.

- High Maintenance Costs: Legacy systems often incur substantial costs for upkeep, patching, and specialized personnel, diverting funds from growth areas.

- Operational Inefficiencies: Fragmented workflows and manual processes inherent in these systems lead to slower transaction times and increased error rates.

- Limited Scalability and Innovation: Outdated technology restricts a financial institution's ability to adapt to new market demands, integrate with emerging technologies, or launch innovative services.

- Increased Risk: Older systems may have security vulnerabilities and are often unsupported by vendors, posing significant operational and regulatory risks.

Niche Investment Products with Declining Demand

Certain specialized investment products within wealth management arms might see their appeal wane as market dynamics evolve or investor tastes shift. If these offerings struggle with low uptake and operate within markets that are either stagnant or contracting, they fall into the 'dog' category. Such products often drain resources for upkeep without bringing in substantial new income or attracting fresh clientele.

The financial services sector, particularly wealth management, constantly evaluates its product suite. For instance, in 2024, some legacy structured products or highly specialized alternative investments that were once popular may now face reduced investor interest. This decline is often driven by increased transparency, the rise of more accessible passive investment vehicles, and evolving regulatory landscapes that favor simpler, more liquid products.

- Declining Demand: Products like certain actively managed, high-fee emerging market funds or bespoke hedge fund strategies that once catered to a specific, affluent demographic may now be experiencing a downturn in new inflows.

- Resource Drain: Maintaining the infrastructure, compliance, and reporting for these niche offerings can be costly. For example, a wealth manager might spend significant operational capital on a proprietary bond fund that now has minimal assets under management.

- Market Shifts: The broader trend towards passive investing and ETFs, which saw continued growth in 2024, directly impacts the demand for many active, niche products. In 2023, passive funds accounted for over $13 trillion in assets globally, a figure that continued to climb.

- Strategic Review: Financial institutions must regularly assess the relevance and performance of their entire product catalog. This includes identifying 'dogs' that are consuming valuable resources without contributing to growth, allowing for reallocation of capital to more promising areas.

Underperforming branch locations, often found in areas with declining populations or where digital banking is dominant, represent classic 'dogs' in a financial institution's portfolio. These branches incur significant operational costs while generating minimal revenue, especially when contrasted with the increasing adoption of digital channels. For example, a 2023 study showed a 15% rise in digital banking transactions alongside a 10% dip in physical branch foot traffic, underscoring the resource drain of underutilized physical assets.

Similarly, financial institutions burdened by outdated legacy technology systems are prime candidates for the 'dog' category. These systems, characterized by high maintenance costs, operational inefficiencies, and a lack of scalability, consume a disproportionate amount of IT budgets. In 2024, it was reported that some banks still dedicate over 60% of their IT spending to maintaining these aging platforms, hindering investment in crucial digital transformation initiatives and limiting competitive agility.

Within wealth management, specialized investment products with waning investor appeal also fall into the 'dog' quadrant. These offerings, often niche or complex, struggle with low uptake and operate in stagnant or contracting markets, draining resources for upkeep without generating substantial income or attracting new clients. The shift towards more accessible passive investment vehicles, which saw continued growth in 2024, directly impacts the demand for many of these traditional, high-fee products.

| Category | Characteristics | Examples in Financial Institutions | Strategic Implications |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth Rate | Underperforming physical branches, legacy IT systems, niche investment products with declining demand | Divest, liquidate, or minimize investment to free up resources for higher-potential areas. |

Question Marks

Financial Institutions Inc. is actively exploring the integration of emerging fintech partnerships and digital innovations into its core digital banking offerings. This strategic pivot aims to enrich customer experiences and bolster digital identity management, positioning these initiatives as key 'question marks' within the BCG matrix. The potential for high growth is undeniable, fueled by the pervasive digital transformation across the financial sector.

While these segments hold significant promise, Financial Institutions Inc.'s current market share in these nascent areas is likely modest. This reflects the developmental stage of these digital advancements and the competitive landscape. Substantial investment is therefore crucial to solidify market presence and validate the long-term sustainability of these innovative ventures.

Expanding into new geographic markets beyond the core Upstate New York and Mid-Atlantic regions represents a classic question mark for financial institutions. These ventures offer exciting growth prospects, but they come with inherent risks and require significant upfront investment. For instance, a regional bank might consider entering a new state with a projected GDP growth of 3.5% in 2024, but its initial market share would likely be negligible.

These nascent expansion efforts demand substantial capital for building out physical branches or digital infrastructure, launching targeted marketing campaigns, and recruiting specialized local talent. Without a strong existing brand presence or a clear competitive advantage, these new market entries can struggle to gain traction. The success of such strategies hinges on meticulous market research and a phased, well-funded approach to mitigate the high initial costs and uncertainties.

Following the 2024 sale of SDN Insurance Agency, Financial Institutions Inc. might classify any remaining smaller, emerging insurance ventures as question marks. These could include nascent partnerships exploring high-growth but unproven areas like cyber insurance or specialized climate risk policies.

The insurance sector is increasingly embracing AI, creating opportunities in new risk domains. However, for these innovative products, initial market penetration is expected to be low, reflecting their unproven nature and the investment required for development and customer acquisition.

AI-Powered Financial Advisory Tools

Financial Institutions Inc.'s exploration into AI-powered financial advisory tools, such as robo-advisors and personalized budgeting apps, places these initiatives squarely in the question mark category of the BCG matrix.

These tools tap into the burgeoning demand for digital financial guidance, a sector projected to grow significantly. For instance, the global robo-advisory market was estimated to reach over $2.5 trillion in assets under management by the end of 2024, a substantial increase from previous years.

While these AI solutions offer a high-growth technological frontier with the potential to disrupt traditional advisory models, their current market penetration and revenue generation for Financial Institutions Inc. are likely nascent. Significant investment in research, development, and customer acquisition is necessary to realize their full potential and move them towards becoming stars.

- High Growth Potential: The AI advisory market is expanding rapidly, driven by consumer demand for accessible, personalized financial management.

- Low Market Share: Despite growth, Financial Institutions Inc.'s current adoption and revenue from these tools are likely minimal.

- High Investment Needs: Developing and scaling AI capabilities requires substantial capital for technology, talent, and marketing.

- Future Star Potential: Successful development and adoption could transform wealth management and banking segments, leading to future market leadership.

New Commercial Lending Products Addressing Emerging Industries

Financial institutions are increasingly looking to develop new commercial lending products for emerging industries, recognizing the high growth potential. This strategy aligns with a "Question Mark" position in the BCG Matrix, indicating high market growth but low current market share. For instance, a bank might develop specialized financing for renewable energy projects or the burgeoning biotechnology sector.

These new ventures demand substantial upfront investment in research and development, as well as the acquisition of specialized expertise to understand the unique risks and opportunities within these nascent markets. Targeted marketing campaigns are crucial to build brand awareness and attract clients. The success of these products is not guaranteed; they require careful monitoring and a willingness to adapt or divest if early traction is not achieved.

- High Growth Prospects: Emerging industries like AI development and sustainable agriculture offer significant long-term growth potential for lenders.

- Initial Uncertainty: Market share in these new sectors is typically low at the outset, requiring patience and strategic investment.

- Investment Needs: Significant capital is needed for research, talent acquisition, and tailored marketing to penetrate these specialized markets.

- Risk and Reward: These products carry higher risk but can become "Stars" if successful, driving substantial future revenue.

Financial Institutions Inc.'s foray into offering specialized lending products for emerging sectors, such as renewable energy and biotechnology, positions these as classic "Question Marks" within the BCG matrix. These areas exhibit high market growth potential, with projections indicating continued expansion, yet the institution's current market share is minimal.

Significant investment is required to cultivate these new lending portfolios. This includes developing expertise in niche industries, underwriting unique risk profiles, and implementing targeted marketing strategies to attract early adopters. The success of these ventures hinges on their ability to gain traction and build a sustainable market presence, potentially evolving into future "Stars."

| Category | Market Growth | Market Share | Investment Strategy | Potential Outcome |

| Emerging Sector Lending (e.g., Green Tech) | High (e.g., Renewable energy sector financing expected to grow by 10-15% annually through 2025) | Low (Initial penetration minimal) | Invest heavily in R&D, specialized talent, and targeted marketing. Monitor performance closely. | Star (if successful) or Dog (if unsuccessful) |

| AI-Powered Financial Advisory | High (Global robo-advisory market projected to exceed $2.5 trillion in AUM by end of 2024) | Low (Nascent adoption for Financial Institutions Inc.) | Substantial investment in technology development, data security, and customer education. | Star (if market leadership achieved) |

| New Geographic Market Expansion | Moderate to High (Depends on specific market, e.g., a state with projected 3.5% GDP growth in 2024) | Low (Negligible initial market share) | Significant capital for infrastructure, marketing, and local talent acquisition. Phased rollout recommended. | Star (if expansion is successful) |

BCG Matrix Data Sources

Our Financial Institutions BCG Matrix is built on a robust foundation of financial disclosures, industry-specific market analytics, and expert commentary from leading financial analysts.