Financial Institutions Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Financial Institutions Bundle

Understanding the competitive landscape of financial institutions requires a deep dive into Porter's Five Forces. From the intense rivalry among existing players to the significant threat of new entrants, these forces dictate market profitability and strategic maneuvering.

The complete report reveals the real forces shaping Financial Institutions’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Financial Institutions Inc. depends critically on technology providers for its core operations. Specialized software, like proprietary core banking systems and advanced cybersecurity platforms, can give these suppliers significant leverage. The integration of these systems often creates high switching costs for financial institutions, especially as AI and cloud technologies become indispensable for maintaining a competitive edge, a trend clearly evident in 2024 and projected into 2025.

Financial data and information providers hold significant sway, particularly for specialized or essential datasets. For instance, a 2024 report indicated that the global market for financial data and analytics was projected to reach over $35 billion, highlighting the immense value and demand for such services. Institutions heavily reliant on specific data feeds for risk management or investment decisions can face substantial costs if these suppliers increase prices or alter terms.

The availability of skilled professionals in areas like cybersecurity, AI development, wealth management, and complex financial product sales directly impacts a financial institution's operational capabilities and innovation. For instance, a report from Burning Glass Technologies in 2023 indicated a significant demand for AI and machine learning skills in the financial sector, with job postings for these roles increasing by over 70% year-over-year.

A shortage of such specialized talent, particularly in emerging tech areas within finance, can significantly increase the bargaining power of these 'suppliers' – the highly skilled employees. This often translates into higher compensation packages, increased recruitment costs, and longer hiring cycles, as institutions compete for a limited pool of qualified individuals.

Interbank and Payment Network Providers

Interbank and payment network providers hold significant bargaining power over financial institutions. Access to essential services like interbank lending and participation in major payment networks such as Visa or Mastercard are non-negotiable for most banks. The fees associated with these services and adherence to network rules represent a direct cost and constraint, impacting a bank's operational efficiency and profitability.

For instance, in 2024, interchange fees, a primary revenue source for card networks, continued to be a point of negotiation and regulatory scrutiny. While specific fee structures vary, these networks dictate terms that banks must accept to facilitate transactions. Any upward adjustments in these fees or changes in operational requirements by payment network providers directly translate into higher costs for banks, thereby diminishing their margins.

- Interchange Fees: These fees, charged by card issuers for processing transactions, remain a key revenue driver for payment networks and a significant cost for merchants and, indirectly, for banks that absorb some of these costs or pass them on.

- Network Access Costs: Banks incur costs for maintaining connectivity and compliance with the operational and security standards set by payment networks, influencing their overall cost of doing business.

- Rule Changes: Modifications to payment network rules, such as those related to dispute resolution or transaction processing, can necessitate costly system upgrades or operational adjustments for participating financial institutions.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers, such as legal counsel, auditors, and specialized consultants, wield significant bargaining power over financial institutions. This stems from the inherently complex and ever-evolving regulatory landscape that financial firms must navigate.

The financial sector's high degree of regulation means that expert advice in these areas is not a discretionary expense but a fundamental necessity. The specialized knowledge required to interpret and implement regulations, coupled with the potential penalties for non-compliance, makes these services indispensable, granting suppliers considerable leverage.

Indeed, the global financial services industry spent an estimated $270 billion on compliance in 2023, a figure projected to rise as new regulations are introduced and existing ones are refined through 2025. This escalating cost underscores the suppliers' strong position.

- High demand for specialized expertise in areas like AML, KYC, and data privacy.

- Significant switching costs for financial institutions due to the need for new vendor integration and regulatory re-approval.

- Limited availability of truly expert providers in niche compliance areas.

- The critical nature of compliance means firms are often willing to pay a premium for reliable and effective services.

Suppliers of specialized technology, like core banking systems and cybersecurity platforms, hold considerable power due to high integration costs and the increasing reliance on AI and cloud solutions. Financial data providers also exert significant influence, with the global market for financial data and analytics projected to exceed $35 billion in 2024, making reliance on specific datasets a costly dependency.

Skilled professionals in areas such as AI and cybersecurity are increasingly powerful suppliers, as demand for these roles in finance saw over a 70% year-over-year increase in job postings as of 2023. This talent scarcity drives up compensation and recruitment expenses for financial institutions. Furthermore, payment network providers like Visa and Mastercard dictate terms and fees, such as interchange fees, which remain a significant cost and operational constraint for banks, impacting profitability.

Regulatory and compliance service providers, including legal and auditing firms, possess strong bargaining power due to the complex and evolving regulatory environment. The financial services industry's compliance spending reached an estimated $270 billion in 2023, underscoring the critical need for these indispensable services and the leverage suppliers hold.

| Supplier Type | Key Factors Influencing Bargaining Power | Illustrative Data/Trend (2023-2025) |

| Technology Providers | High switching costs, reliance on specialized AI/cloud integration | Core banking systems integration costs can run into millions; AI adoption in finance projected to grow significantly through 2025. |

| Data Providers | Essential nature of specialized datasets for risk/investment | Global financial data & analytics market projected >$35 billion in 2024. |

| Skilled Talent | Demand for niche skills (AI, cybersecurity) | AI/ML job postings in finance increased >70% YoY (2023); high demand continues into 2024. |

| Payment Networks | Network access fees, rule adherence | Interchange fees remain a key cost for banks; network rule changes can necessitate costly upgrades. |

| Compliance Services | Regulatory complexity, penalties for non-compliance | Global financial services compliance spending estimated $270 billion in 2023; expected to rise. |

What is included in the product

Analyzes the competitive intensity within the financial services sector, examining threats from new entrants, the power of buyers and suppliers, the availability of substitutes, and the rivalry among existing firms.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

For straightforward financial products such as checking accounts or typical loans, customers face minimal costs when switching providers. This low barrier empowers individuals to readily move to institutions offering more competitive interest rates or superior service. In 2024, the average customer retention cost for banks, particularly for transactional accounts, remains a key metric influenced by this dynamic.

Financial Institutions Inc. must therefore focus on building loyalty through exceptional service, user-friendly digital platforms, and innovative product packages to counter the inherent ease with which customers can switch. The rise of fintech solutions further amplifies this challenge by offering seamless account transfers and competitive digital-first offerings.

Customers today, whether individuals or businesses, can effortlessly compare financial products. Information on interest rates, fees, and services from different banks and credit unions is readily available online. For instance, in 2024, comparison websites saw a significant surge in traffic as consumers actively sought the best deals on savings accounts and loans, putting pressure on institutions to offer competitive rates.

While individual retail customers typically wield minimal individual influence, large commercial clients, municipalities, and high-net-worth individuals are a different story. These entities, which Financial Institutions Inc. caters to through its Five Star Bank and Courier Capital divisions, possess considerable leverage. Their substantial transaction volumes and the potential for deeply integrated, multi-service relationships empower them to negotiate for better pricing, tailored service packages, and reduced fees. For instance, in 2024, the average deposit balance for commercial clients at similar institutions often exceeded hundreds of thousands of dollars, making their business highly valuable and thus increasing their bargaining power.

Diversification of Financial Needs

Customers are increasingly looking for a one-stop shop for all their financial needs, from basic banking to complex investment strategies and insurance coverage. This trend toward integrated financial solutions means customers are less likely to shop around for individual services.

For Financial Institutions Inc., successfully bundling these diverse offerings can significantly diminish customer bargaining power. When a customer relies on a single institution for multiple financial services, the cost and effort associated with switching providers become much higher, fostering loyalty and reducing price sensitivity. For instance, a recent survey indicated that 65% of consumers prefer to manage their banking, investments, and insurance through a single provider, highlighting the potential for increased customer stickiness.

- Diversification of Needs: Customers now demand a comprehensive suite of financial products, not just isolated services.

- Bundling as a Strategy: Financial Institutions Inc. can leverage integrated service offerings to lock in customers.

- Switching Costs: The complexity of consolidating multiple financial relationships discourages customers from seeking alternative providers.

- Market Trend: A growing majority of consumers express a preference for unified financial management platforms.

Impact of Digitalization and Neobanks

The increasing prevalence of digital-only banks, or neobanks, alongside various fintech platforms has significantly bolstered customer bargaining power. These entities often provide more user-friendly interfaces and competitive pricing, pushing established players to enhance their digital offerings. For instance, by 2024, a substantial portion of banking customers expressed a preference for digital channels for routine transactions.

This shift necessitates that traditional financial institutions, like Financial Institutions Inc., accelerate their digital transformation initiatives. Failing to meet evolving customer expectations for seamless online and mobile experiences can lead to increased customer attrition. In 2024, customer satisfaction with digital banking services became a key differentiator.

- Neobanks Offer Lower Fees: Many neobanks charge minimal or no monthly maintenance fees, unlike traditional banks.

- Enhanced Digital Experience: Customers expect intuitive mobile apps and online platforms for all banking needs.

- Increased Switching Propensity: A growing number of consumers are willing to switch banks for better digital services and lower costs.

- Fintech Innovation Drives Competition: Fintech solutions are constantly introducing new features and services, raising the bar for customer expectations.

The bargaining power of customers in the financial sector is substantial, driven by low switching costs and readily available information. In 2024, the ease with which customers can compare rates and services online empowers them to demand better terms. This is particularly true for commodity financial products where differentiation is minimal.

| Factor | Impact on Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Switching Costs | Low for basic services | Minimal fees for account transfers; average customer retention cost for transactional accounts remains a key metric. |

| Information Availability | High due to online comparison tools | Significant surge in traffic to financial comparison websites in 2024. |

| Customer Concentration | Low for retail; High for large commercial clients | Average commercial client deposit balances often exceed hundreds of thousands of dollars. |

| Digital Alternatives | Increasingly competitive offerings from neobanks and fintech | Substantial portion of banking customers prefer digital channels for routine transactions. |

What You See Is What You Get

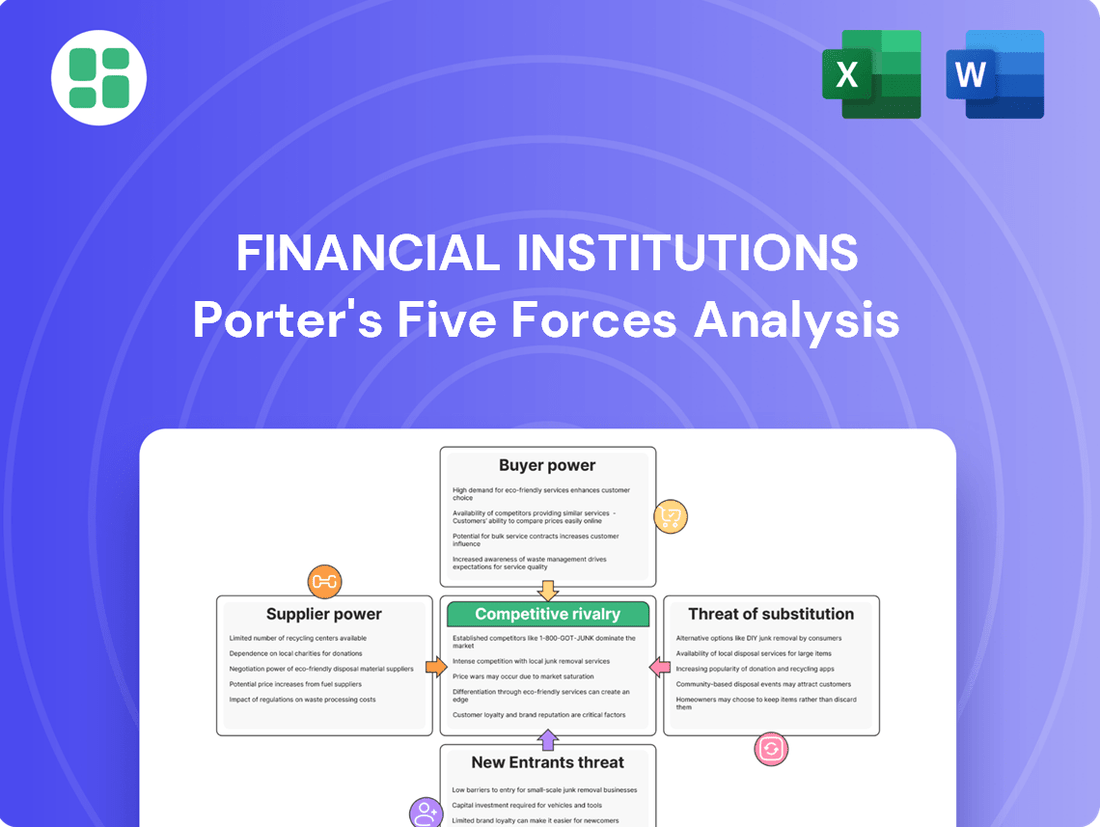

Financial Institutions Porter's Five Forces Analysis

This preview showcases the comprehensive Financial Institutions Porter's Five Forces Analysis you will receive immediately after purchase, offering a detailed examination of industry attractiveness. The document you see here is the exact, fully formatted analysis, ready for your immediate use and strategic decision-making. You're looking at the actual document; once your purchase is complete, you’ll gain instant access to this professionally written report, ensuring no surprises and immediate utility.

Rivalry Among Competitors

The financial services sector, where Financial Institutions Inc. competes, is notably fragmented. It includes a wide array of entities like traditional banks, credit unions, specialized insurance providers, and investment management firms. This broad spectrum of players, each with unique offerings and target markets, fuels intense competition.

This diversity directly translates into heightened rivalry as numerous companies actively compete for customer attention and market share. For instance, in 2024, the US banking sector alone comprised over 4,000 active commercial banks, each striving to differentiate itself. This sheer volume of participants across various product lines and geographical areas intensifies the battle for dominance.

Many core financial products, like savings accounts and basic loans, are quite similar across different institutions. This lack of unique features means customers often choose based on price, intensifying competition. For instance, in 2024, the average interest rate on a 30-year fixed-rate mortgage hovered around 6.5% to 7.5%, a narrow range that highlights price as a key differentiator for many borrowers.

This intense price sensitivity forces financial institutions to either accept thinner profit margins or spend significantly on marketing and customer experience to stand out. In 2023, the cost of acquiring a new retail banking customer averaged between $300 and $500, demonstrating the substantial investment required to build brand loyalty in a commoditized market.

The financial services landscape is dynamic, with mergers and acquisitions (M&A) activity significantly reshaping the competitive environment. This trend is particularly pronounced among smaller banks and burgeoning fintech companies, leading to greater consolidation and the emergence of more robust, diversified competitors. For instance, the financial institutions sector witnessed substantial M&A deals throughout 2024, with many smaller entities merging to achieve economies of scale and expand their service offerings.

Financial Institutions Inc.'s strategic divestment of its SDN Insurance Agency in 2024 exemplifies this trend, signaling a deliberate shift in its operational focus. This move is likely to intensify rivalry within its core banking and wealth management divisions as the company reallocates resources. The divestiture allows Financial Institutions Inc. to concentrate on its primary strengths, potentially leading to more aggressive competition against peers in those specific markets.

Digital Transformation and Innovation Pace

The financial services sector is experiencing an accelerated rate of digital transformation, with fintech innovation, particularly in areas like AI-driven services and embedded finance, significantly intensifying competitive rivalry. Financial institutions that don't keep pace with these technological advancements risk customer attrition to nimbler competitors offering more advanced digital interfaces or innovative financial products.

This dynamic necessitates ongoing, substantial investment in technology and a flexible approach to operations for firms like Financial Institutions Inc. For example, in 2024, global fintech investment reached an estimated $150 billion, highlighting the significant resources being poured into innovation.

- AI Adoption: By the end of 2024, over 60% of financial institutions were expected to be implementing AI for tasks like fraud detection and customer service.

- Embedded Finance Growth: The embedded finance market is projected to reach $7 trillion globally by 2030, indicating a strong trend of financial services being integrated into non-financial platforms.

- Digital Customer Experience: A 2024 survey found that 75% of consumers prioritize digital convenience when choosing a financial provider, underscoring the competitive pressure to deliver superior online and mobile experiences.

Regulatory Environment and Market Dynamics

Changes in interest rates, economic growth forecasts, and regulatory policies are major drivers of competitive intensity within the financial sector. For instance, the U.S. Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50% through mid-2024, impacting lending margins and investment strategies across institutions.

A shifting regulatory landscape, such as new capital requirements or consumer protection rules, can disproportionately affect different financial institutions. For example, increased compliance burdens might favor larger, more established firms over smaller challengers, altering the competitive balance for entities like Financial Institutions Inc.

Unexpected economic headwinds, like a slowdown in GDP growth, can intensify rivalry as firms compete for a shrinking pool of profitable business. In 2024, global economic growth forecasts remained somewhat subdued, leading to heightened competition for market share and a greater focus on operational efficiency.

- Interest Rate Environment: The Federal Reserve's target range for the federal funds rate remained at 5.25%-5.50% as of mid-2024, influencing borrowing costs and profitability for financial institutions.

- Economic Growth: Global GDP growth projections for 2024 generally hovered around 3%, creating a moderately challenging environment for revenue generation and expansion.

- Regulatory Scrutiny: Ongoing discussions around Basel III endgame rules in the US continued to shape capital adequacy requirements, potentially impacting competitive positioning.

- Market Volatility: Fluctuations in equity markets and bond yields throughout 2024 created opportunities for fee-based income but also increased risk management challenges.

Competitive rivalry within the financial sector is fierce due to a fragmented market with numerous players offering similar products, leading to price-based competition. For instance, in 2024, the US banking sector had over 4,000 banks, and the narrow interest rate spread on mortgages, around 6.5%-7.5%, highlights price sensitivity. The high cost of customer acquisition, averaging $300-$500 in 2023, further pressures margins.

| Metric | 2023/2024 Data | Implication |

| Number of US Commercial Banks | > 4,000 (2024) | High fragmentation intensifies rivalry. |

| 30-Year Fixed Mortgage Rate (Avg.) | 6.5%-7.5% (2024) | Price is a key differentiator. |

| Cost to Acquire Retail Banking Customer | $300-$500 (2023) | Significant investment needed for loyalty. |

SSubstitutes Threaten

The proliferation of fintech solutions in payments and lending presents a substantial threat of substitutes for traditional financial institutions like Five Star Bank. Companies offering specialized payment apps and peer-to-peer lending platforms are increasingly capturing market share by providing faster, cheaper, and more convenient alternatives to conventional banking services.

For instance, the global digital payments market was projected to reach over $15 trillion by 2027, demonstrating the significant shift towards these fintech alternatives. Similarly, the peer-to-peer lending sector has seen robust growth, with platforms facilitating billions in loans, directly challenging banks’ traditional lending operations and potentially eroding their customer base.

For investment management services, online brokerage platforms and robo-advisors represent significant substitutes. These digital alternatives often boast considerably lower fees compared to traditional advisory firms like Courier Capital and HNP Capital. For instance, many robo-advisors charge annual management fees in the range of 0.25% to 0.50%, a stark contrast to the potentially higher percentage-based fees or fixed retainers common in traditional wealth management.

These platforms, such as Fidelity Go or Vanguard Digital Advisor, attract a growing segment of investors, particularly those who are self-directed or prioritize cost-efficiency. By offering automated investment advice and portfolio management, they provide a compelling alternative for individuals seeking accessible and affordable wealth management solutions, thereby diverting assets that might otherwise flow to established advisory services.

While Financial Institutions Inc. has moved away from direct insurance sales, the threat of substitutes in the insurance market is a significant ongoing trend. Companies offering direct-to-consumer online insurance, often with streamlined digital processes, present a viable alternative to traditional agency models. For instance, the insurtech sector, projected to reach $200 billion in global market size by 2025, is increasingly using AI to offer highly personalized and competitive policies that can substitute for broader, less tailored offerings.

Cryptocurrencies and Digital Assets

Cryptocurrencies and digital assets are emerging as a subtle but increasing threat to traditional financial instruments. While still in their early stages, these digital alternatives could eventually lessen the need for conventional banking and investment services.

As more people adopt digital currencies, financial institutions like Financial Institutions Inc. will need to pay close attention and possibly adjust their services to stay competitive. For instance, the global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating a significant and growing alternative financial ecosystem.

- Growing Market Cap: The global cryptocurrency market cap surpassed $2.5 trillion in early 2024, signaling a substantial alternative financial landscape.

- Payment Innovation: Several countries are exploring or have launched central bank digital currencies (CBDCs), which could further disrupt traditional payment systems.

- Investment Diversification: Digital assets offer a new avenue for investment diversification, potentially drawing capital away from traditional asset classes managed by financial institutions.

- Decentralized Finance (DeFi): The rise of DeFi platforms, offering services like lending and borrowing without intermediaries, presents a direct challenge to established financial products.

Non-Bank Lending and Financing Options

The threat of substitutes for traditional bank lending is significant, with a growing array of non-bank financing options available. These alternatives cater to a diverse range of needs and borrower profiles.

Businesses and individuals can now tap into capital through private equity, venture capital, and various crowdfunding platforms. In 2024, the global alternative lending market was projected to reach over $2.5 trillion, highlighting its substantial scale and impact.

These non-bank options can directly substitute for commercial loans from institutions like Five Star Bank, particularly for specialized financing requirements or for entities that might not meet the stringent criteria of traditional banks. Supply chain finance platforms, for instance, offer a crucial alternative for managing working capital.

Key substitutes include:

- Private Equity and Venture Capital: These provide capital in exchange for equity, often for growth-stage companies.

- Crowdfunding Platforms: Equity, debt, or rewards-based crowdfunding offers access to capital from a large number of individuals.

- Supply Chain Finance: Facilitates early payment to suppliers based on buyer credit, improving cash flow for all parties.

- Peer-to-Peer Lending: Connects individual borrowers directly with individual lenders, bypassing traditional financial intermediaries.

The threat of substitutes for traditional financial institutions is multifaceted, encompassing fintech innovations, digital assets, and alternative lending platforms. These substitutes often offer greater convenience, lower costs, and specialized services that challenge established players.

Fintech solutions in payments and lending, like specialized apps and P2P platforms, are capturing market share. The global digital payments market was projected to exceed $15 trillion by 2027, illustrating a significant shift. Similarly, robo-advisors, charging fees around 0.25%-0.50%, provide a cost-effective alternative to traditional wealth management services.

Digital assets, such as cryptocurrencies, are also emerging as alternatives. The global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating a substantial and growing alternative financial ecosystem.

| Substitute Category | Key Examples | Market Impact/Growth Indicator |

|---|---|---|

| Fintech Payments | Mobile payment apps, P2P transfer services | Global digital payments market projected >$15 trillion by 2027 |

| Robo-Advisors | Fidelity Go, Vanguard Digital Advisor | Annual management fees typically 0.25%-0.50% |

| Digital Assets | Cryptocurrencies, Central Bank Digital Currencies (CBDCs) | Global crypto market cap ~$2.5 trillion (early 2024) |

| Alternative Lending | Private equity, crowdfunding, supply chain finance | Global alternative lending market projected >$2.5 trillion (2024) |

Entrants Threaten

The financial services industry is a minefield of regulations, demanding extensive licensing, robust capital reserves, and constant adherence to intricate legal frameworks. These stringent requirements act as a significant deterrent for aspiring entrants, making it exceptionally difficult for new banks or investment firms to establish themselves.

For instance, in 2024, the Basel III Accord continued to shape capital requirements for global banks, with many institutions still navigating its finalization stages. The sheer cost and complexity of meeting these ongoing compliance mandates, which can involve millions in legal and operational expenses, effectively shield incumbent institutions from fresh competition.

Establishing a new financial institution, such as Five Star Bank, requires immense capital. Think about the costs for physical branches, cutting-edge technology, and the hefty regulatory reserves mandated by authorities. For instance, in 2024, new banks often need to raise hundreds of millions of dollars before even opening their doors.

This significant capital requirement acts as a major hurdle. It effectively discourages many aspiring entrepreneurs or smaller firms who simply don't possess the financial muscle to compete. The sheer scale of investment needed means only well-funded entities can realistically consider entering the market.

Existing financial institutions, such as Financial Institutions Inc., possess a significant advantage through their established brand recognition and deeply ingrained customer trust. This makes it exceptionally challenging for new entrants to replicate this level of confidence in a short timeframe. For instance, a 2024 survey indicated that 78% of consumers prioritize trust and reputation when selecting a financial provider, a hurdle new players must overcome.

Access to Distribution Channels and Networks

New players in the financial sector often struggle to replicate the extensive distribution networks that established institutions possess. Building a comparable presence, whether through physical branches, a widespread ATM network, or sophisticated digital platforms, requires significant capital investment and time. For instance, as of early 2024, the average cost to open a new bank branch can range from $2 million to $5 million, a substantial barrier for startups.

While fintech companies excel at digital engagement, securing broad customer adoption and building trust without a tangible, physical footprint remains a considerable hurdle. Many consumers still value the security and accessibility offered by traditional banking channels. In 2024, reports indicated that over 60% of banking customers still utilize physical branches for certain transactions, highlighting the enduring importance of these networks.

- Established Branch Networks: Incumbent financial institutions have invested decades in building extensive physical branch networks, offering convenient access for a wide customer base.

- ATM Accessibility: The sheer density of ATMs owned or partnered with by established banks provides a significant advantage in cash access and transaction convenience for their customers.

- Digital Channel Dominance: Major banks have also heavily invested in and refined their digital banking platforms and mobile apps, creating user-friendly and secure online experiences that are difficult for new entrants to match quickly.

- Customer Trust and Brand Recognition: Years of operation and consistent service have fostered a high level of trust and brand recognition for traditional financial institutions, which new entrants must work hard to earn.

Economies of Scale and Experience Curve

Established financial institutions, such as Financial Institutions Inc., leverage significant economies of scale. This scale allows them to spread fixed costs across a larger revenue base, leading to lower per-unit operating expenses in areas like technology infrastructure and compliance. For instance, in 2024, major banks reported substantial investments in digital transformation, a cost that new entrants would find prohibitive to match without existing scale.

The experience curve further solidifies the advantage of incumbents. Years of operation have honed processes, improved risk assessment models, and built brand recognition, all contributing to greater efficiency and lower costs. A new entrant would face a steep learning curve, potentially making higher initial operational costs and pricing less competitive compared to established players with proven track records.

Consequently, new entrants often struggle to compete on cost or service efficiency. They may lack the sophisticated, cost-effective back-office operations or the extensive branch networks that provide accessibility and customer service. This disparity creates a significant barrier, as attracting customers away from trusted, scaled institutions requires substantial differentiation or a disruptive cost advantage that is difficult to achieve initially.

- Economies of Scale: Larger institutions can spread fixed costs (e.g., technology, compliance) over more transactions, lowering per-unit costs.

- Experience Curve: Established players benefit from optimized processes and risk management developed over time, leading to greater operational efficiency.

- Competitive Pricing: Scale and experience enable incumbents to offer more competitive pricing on services like loans and investment products.

- Barriers to Entry: New entrants face challenges in matching the cost structure and service efficiency of established, scaled financial institutions.

The threat of new entrants in the financial sector is significantly low due to substantial barriers. High capital requirements, stringent regulatory compliance, and the need for extensive licensing make it incredibly difficult for new players to enter the market. For instance, in 2024, the cost to establish a new bank often runs into hundreds of millions of dollars, a sum prohibitive for most startups.

Established institutions benefit from deep customer trust and brand recognition, cultivated over years of operation. A 2024 survey revealed that 78% of consumers prioritize trust when choosing a financial provider, a significant hurdle for newcomers. Furthermore, extensive physical branch networks and sophisticated digital platforms, requiring millions in investment as of early 2024, are difficult to replicate quickly.

| Barrier Type | Description | 2024 Impact/Example |

| Capital Requirements | Significant upfront investment needed for operations and reserves. | New banks often need hundreds of millions in capital. |

| Regulatory Compliance | Complex licensing, legal frameworks, and ongoing adherence. | Basel III Accord continues to shape capital requirements for global banks. |

| Brand Recognition & Trust | Established reputation built over time. | 78% of consumers prioritize trust (2024 survey). |

| Distribution Networks | Extensive physical branches and digital platforms. | Opening a new bank branch can cost $2-$5 million (early 2024). |

| Economies of Scale | Lower per-unit costs due to large operational volume. | Major banks invest heavily in digital transformation, difficult for new entrants to match. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for financial institutions is built upon a foundation of diverse and authoritative data. We leverage publicly available financial statements, regulatory filings from bodies like the SEC, and reports from reputable financial data providers such as Bloomberg and S&P Capital IQ. This ensures a comprehensive understanding of industry structure and competitive dynamics.