Federated Hermes PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federated Hermes Bundle

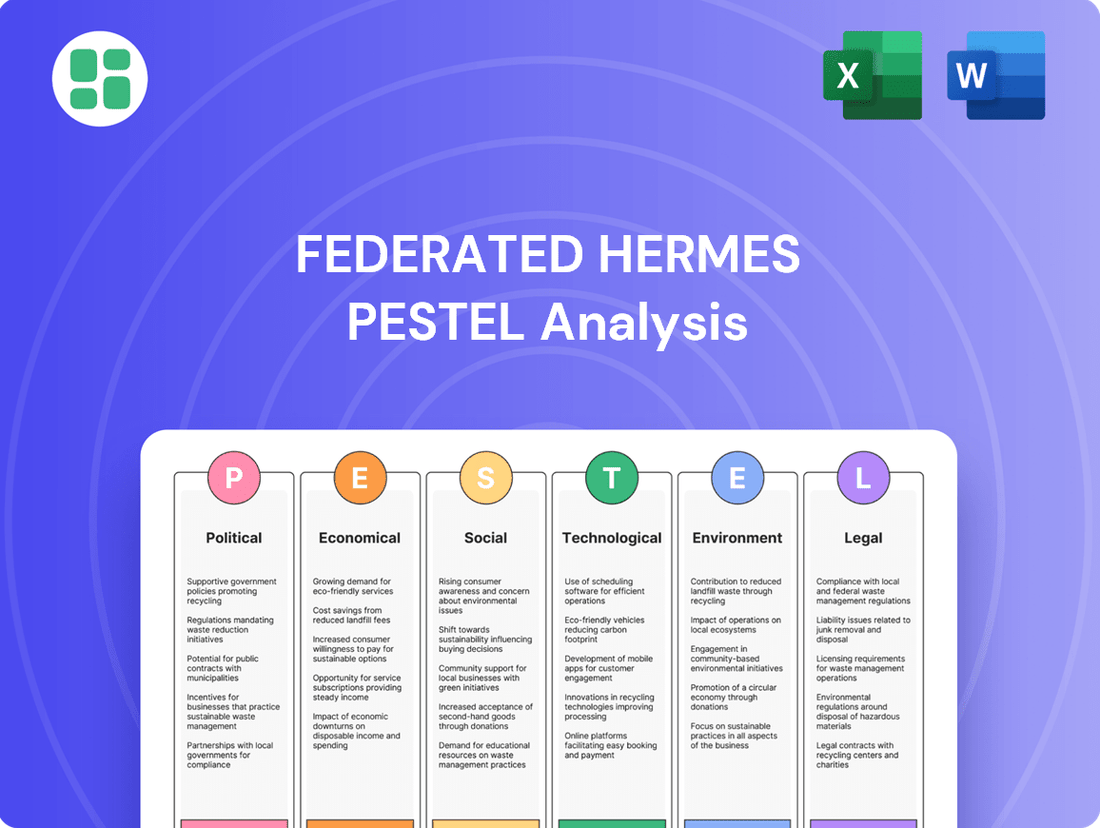

Navigate the complex external forces shaping Federated Hermes's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Equip yourself with actionable intelligence to refine your strategies and gain a competitive edge. Download the full report now for an in-depth understanding.

Political factors

The global political climate in 2024 is particularly turbulent, with ongoing conflicts in Europe and the Middle East creating substantial uncertainty for investors. Federated Hermes recognizes that these geopolitical tensions are a primary driver of market volatility, demanding flexible investment approaches.

A record number of national elections are scheduled across the globe in 2024, including major economies like the United States, India, and the European Union. This widespread electoral activity adds another layer of unpredictability, as policy shifts and potential leadership changes can significantly impact economic conditions and investment flows.

Federated Hermes faces heightened regulatory oversight concerning its Environmental, Social, and Governance (ESG) investment strategies. Regulations like the EU's Sustainable Finance Disclosure Regulation (SFDR) are already in effect, demanding significant transparency, and the proposed US SEC climate disclosure rules are poised to introduce further compliance burdens. This increased scrutiny necessitates that Federated Hermes meticulously adapts its reporting and product development to align with evolving global sustainability standards and investor expectations for clear, verifiable ESG integration.

Government fiscal and monetary policies, particularly interest rate decisions by central banks such as the Federal Reserve, are pivotal in shaping market dynamics and investment approaches. Federated Hermes' analyses for 2024 and 2025 consistently highlight how interest rate trajectories, inflation management, and recession avoidance strategies directly impact asset classes, with a notable focus on money markets and fixed income instruments.

Trade Policies and International Relations

Shifts in global trade policies and international relations significantly impact investment landscapes. For instance, ongoing adjustments in US-China trade dynamics, including potential tariff changes, can create volatility and reshape market opportunities. Federated Hermes actively monitors these developments to inform strategies in non-US developed and emerging markets.

Federated Hermes' analysis incorporates the potential for disruptions arising from evolving trade agreements and geopolitical tensions. These factors are crucial for assessing performance and identifying risks or advantages in international portfolios.

- Trade Policy Impact: Changes in tariffs and trade agreements can alter the cost of goods and services, affecting corporate profitability and consumer spending globally.

- Geopolitical Risk: Heightened tensions between major economic powers, such as the United States and China, can lead to market uncertainty and influence investment flows.

- Emerging Market Exposure: Federated Hermes' outlook for emerging markets is particularly sensitive to shifts in international relations, as these economies often rely heavily on global trade.

- Opportunity Identification: While risks exist, evolving trade policies can also present new avenues for growth and investment as supply chains reconfigure and new market access emerges.

Policy Support for 'Just Transition' and Climate Action

Governments worldwide are increasingly prioritizing a 'just transition' to a net-zero economy, a theme prominently featured at COP28. This policy shift aims to ensure that the move towards sustainability is equitable, addressing potential social and economic impacts on workers and communities. Federated Hermes actively engages with policymakers to champion regulations that support this transition, reflecting its dedication to climate action and sustainable investment strategies.

This policy environment presents both hurdles and avenues for growth. For instance, the EU's Green Deal, with its ambitious climate targets and associated funding mechanisms, offers significant opportunities for companies aligned with sustainable practices. Federated Hermes' proactive engagement with these evolving regulatory landscapes allows it to anticipate and adapt to policy changes, thereby strengthening its position in the sustainable finance market.

- Policy Support: Growing government backing for 'just transition' and net-zero initiatives, as evidenced by discussions at COP28.

- Federated Hermes' Role: Active engagement with regulators to advocate for policies enabling a sustainable economic shift.

- Opportunities: Potential for growth in sectors benefiting from green finance and supportive climate policies, such as those within the EU's Green Deal framework.

Global political instability remains a key concern, with ongoing conflicts in Eastern Europe and the Middle East impacting investor sentiment and market stability throughout 2024. The significant number of national elections scheduled globally in 2024, including in the US and India, introduces policy uncertainty and potential shifts in economic strategies. Federated Hermes is navigating these dynamics by focusing on flexible investment approaches that can adapt to evolving geopolitical and electoral landscapes.

What is included in the product

This Federated Hermes PESTLE Analysis examines how political, economic, social, technological, environmental, and legal forces shape the company's operational landscape, offering a comprehensive view of external influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic discussion.

Economic factors

The prevailing interest rate environment, with central banks like the Federal Reserve and European Central Bank maintaining elevated policy rates throughout much of 2024, has directly impacted Federated Hermes. Higher yields have driven significant growth in money market assets, a key area for the firm. For instance, Federated Hermes reported substantial inflows into its money market funds during the first half of 2024, benefiting from these attractive short-term rates.

Inflationary pressures, while showing signs of moderation in late 2024, continue to be a primary concern for investors and a focal point of Federated Hermes' analysis. The firm's outlooks consistently dissect central bank actions, such as potential rate cuts or pauses, and their ripple effects across fixed income and equity markets. This dynamic environment necessitates agile investment strategies to navigate the evolving economic landscape.

The global economic landscape in 2024 and 2025 is characterized by a delicate balance between growth and potential slowdowns. While many economies are expected to see positive GDP expansion, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025 in its April 2024 World Economic Outlook, a slight uptick from earlier forecasts, indicating resilience but also persistent headwinds.

Federated Hermes' market outlooks for this period highlight a strategic focus on navigating this volatility. Their analysis anticipates a 'soft landing' for the US economy, suggesting a scenario where inflation is brought under control without triggering a significant downturn, a crucial factor for investor sentiment and asset valuations.

However, recession risks remain a significant concern globally, influenced by geopolitical tensions, persistent inflation in some regions, and the impact of tighter monetary policies. These factors directly influence investor confidence and can lead to downward pressure on asset prices, making risk management a paramount consideration for Federated Hermes.

Market liquidity, especially the robust growth seen in money market funds, directly fuels Federated Hermes' business model. These funds are a key component of their asset management operations.

Federated Hermes experienced a significant upswing, reporting record Assets Under Management (AUM) throughout 2024 and into Q2 2025. This surge was primarily driven by a substantial increase in money market assets, highlighting the company's proficiency in managing cash and providing effective cash management solutions.

Currency Fluctuations and Emerging Markets

Currency fluctuations significantly impact Federated Hermes' international investment strategies, particularly concerning emerging markets. For instance, a stronger US dollar can make emerging market debt less attractive to foreign investors, potentially increasing borrowing costs for these nations. Conversely, a weaker dollar can boost demand for emerging market assets.

Federated Hermes' 2025 outlook points to emerging market debt as a key opportunity. This optimism is fueled by improving credit profiles in several emerging economies and valuations that are considered attractive. However, these potential gains are balanced against ongoing geopolitical risks that can introduce volatility.

- Emerging Market Debt Growth: Projections indicate continued growth in emerging market debt issuance, with total outstanding debt expected to reach nearly $20 trillion by the end of 2025, up from approximately $17 trillion in 2023.

- Currency Volatility Impact: Currency fluctuations can directly affect returns for international investors. For example, a 10% depreciation of an emerging market currency against the USD can erode a significant portion of an investment's value.

- Credit Profile Improvements: Several emerging markets have seen credit rating upgrades in 2024, reflecting better fiscal management and economic stability, making their debt more appealing.

Competitive Landscape and Revenue Streams

The asset management industry is highly competitive, with Federated Hermes navigating a landscape populated by global giants and specialized boutiques. This competition directly influences fee structures and market share. In 2023, the global asset management industry saw significant inflows into passive strategies, but active managers like Federated Hermes continue to attract assets by demonstrating alpha generation, particularly in areas like fixed income.

Federated Hermes benefits from a diversified revenue model. Its income streams are spread across various asset classes, including money market funds, which provided a stable base in 2023 due to higher interest rates, and equity and fixed income strategies. This diversification helps cushion the impact of underperformance in any single segment.

Key revenue drivers for Federated Hermes include:

- Management fees: Earned on assets under management across all product types.

- Performance fees: Applicable to certain actively managed strategies, particularly in alternative and private markets.

- Distribution and servicing fees: Related to the administration and distribution of its funds.

- Net investment income: Primarily from its money market and fixed income offerings.

The economic environment for Federated Hermes in 2024-2025 is shaped by persistent inflation concerns and elevated interest rates, driving strong performance in money market funds. While global growth projections remain steady at 3.2% for both years according to the IMF, recession risks persist, necessitating agile investment strategies. Federated Hermes has capitalized on these trends, reporting record assets under management, particularly in cash management solutions.

| Metric | 2023 (Approx.) | H1 2024 (Approx.) | Outlook 2025 |

|---|---|---|---|

| Global GDP Growth | 3.0% | 3.2% | 3.2% |

| US Federal Funds Rate | 5.25%-5.50% | 5.25%-5.50% | Potentially lower, depending on inflation |

| Money Market Fund Assets | $5.5 Trillion | $6.0 Trillion | Continued strength, potentially exceeding $6.2 Trillion |

| Emerging Market Debt Outstanding | $18 Trillion | $19 Trillion | Approaching $20 Trillion |

What You See Is What You Get

Federated Hermes PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Federated Hermes PESTLE analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You can trust that the insights and structure you see are precisely what you'll get.

Sociological factors

Clients increasingly seek investments that align with environmental, social, and governance (ESG) principles, driving substantial growth in sustainable finance. This trend is not just a niche interest; by the end of 2023, global sustainable investment assets reached an estimated $8.5 trillion, according to industry reports, demonstrating a significant market shift.

Federated Hermes, with its deep roots in responsible investing since 1983, is well-positioned to capitalize on this demand. The firm actively integrates ESG considerations into its investment analysis and offers specialized strategies, such as its Sustainable Global Equity fund, designed to meet this evolving client preference for impactful and responsible capital allocation.

Demographic shifts, like the growing aging population, significantly impact investment demand. As more people enter retirement, there's a greater need for income-generating assets and wealth preservation strategies. This trend is visible in the increasing assets managed by retirement-focused funds, which saw global assets under management grow by an estimated 7% in 2024, reaching over $55 trillion.

Federated Hermes recognizes these evolving investor behaviors and aims to support advisors in guiding clients through these transitions. A key focus is helping individuals move from conservative cash holdings to more diversified investment solutions that can offer better long-term growth potential. This aligns with the fact that in early 2025, cash holdings for retail investors in major markets remained elevated, with some estimates suggesting over $5 trillion parked in low-yield accounts.

As financial literacy grows, investors increasingly demand clear, understandable information about their investments. This trend is evident in the push for greater transparency in investment products and the processes used to manage them.

Federated Hermes responds to this by prioritizing clear reporting. For instance, their climate-related financial disclosures and annual reports are designed to offer comprehensive insights, ensuring their diverse client base can easily understand their investment performance and the underlying strategies.

Societal Attitudes Towards Finance and Wealth Management

Societal attitudes significantly influence how firms like Federated Hermes operate, particularly concerning trust in financial institutions and the public's growing emphasis on responsible wealth creation. As of late 2024, a significant portion of the investing public, particularly younger demographics, express a desire for their investments to align with their values, pushing for greater transparency and ethical practices. This societal shift directly impacts client acquisition and retention for wealth management firms.

Federated Hermes has strategically positioned itself by emphasizing responsible wealth creation and active stewardship, recognizing these as crucial differentiators. Their approach resonates with a growing segment of investors who are not only seeking financial returns but also positive societal impact. This commitment is reflected in their engagement with companies on environmental, social, and governance (ESG) issues, a practice increasingly valued by clients.

- Investor Demand for ESG: A 2024 survey indicated that over 60% of millennial investors consider ESG factors when making investment decisions.

- Trust in Financial Institutions: Public trust in financial institutions remains a critical factor, with recent polls showing a slight but steady increase in confidence for firms demonstrating strong ethical governance.

- Active Stewardship Growth: Federated Hermes' assets under management in strategies emphasizing active stewardship and ESG integration saw a 15% year-over-year increase leading into 2025.

- Reputational Impact: Positive societal perception of a firm’s commitment to responsible finance can lead to enhanced brand loyalty and a stronger competitive advantage.

Workforce Dynamics and Talent Retention

Federated Hermes recognizes that retaining top talent is crucial for growth, particularly as its business expands. A positive and supportive work culture is key to attracting and keeping skilled professionals in the competitive investment management sector.

The firm's commitment to fostering a collaborative environment where employees feel valued is a direct response to evolving workforce expectations. This focus on employee well-being and development is essential for long-term success.

- Employee Engagement: In 2023, Federated Hermes reported high levels of employee engagement, a critical metric for talent retention.

- Diversity & Inclusion Initiatives: The firm continues to invest in programs aimed at increasing diversity within its workforce, recognizing its importance for innovation and talent attraction.

- Training & Development: Federated Hermes allocated significant resources in 2024 to professional development programs, enhancing skills and career progression opportunities for its employees.

Societal attitudes are increasingly shaping investment preferences, with a growing demand for financial institutions to demonstrate ethical practices and a commitment to responsible wealth creation. This trend is amplified by younger demographics, who prioritize aligning their investments with personal values, driving a need for greater transparency and demonstrable positive impact.

Federated Hermes' strategic focus on active stewardship and responsible investing directly addresses these evolving societal expectations. By emphasizing ESG integration and engaging with companies on these critical issues, the firm resonates with a segment of investors seeking both financial returns and societal benefit, enhancing brand loyalty and competitive standing.

The demand for clear, understandable investment information is also a significant societal factor, pushing for greater transparency in financial products and management processes. Federated Hermes' commitment to comprehensive reporting and accessible insights meets this need, fostering trust and facilitating informed decision-making for its diverse client base.

| Societal Factor | Impact on Federated Hermes | Supporting Data (2023-2025 Estimates) |

|---|---|---|

| Demand for Responsible Investing | Increased client acquisition and retention for ESG-focused strategies. | 60% of millennial investors consider ESG factors (2024 survey). |

| Emphasis on Transparency | Need for clear reporting and accessible investment information. | Federated Hermes prioritizes comprehensive disclosures. |

| Trust in Financial Institutions | Importance of ethical governance and reputational management. | Slight increase in public trust for firms with strong ethical governance (late 2024 polls). |

| Talent Acquisition & Retention | Requirement for positive work culture and employee well-being. | High employee engagement reported (2023); investment in diversity & inclusion and training (2024). |

Technological factors

Artificial intelligence and machine learning are fundamentally reshaping the financial landscape, offering significant avenues for improving investment analysis, bolstering risk management frameworks, and streamlining operational processes. These technologies are no longer niche concepts but central to competitive strategy in the financial services industry.

Federated Hermes recognizes this transformative potential, making the exploration and integration of AI a paramount engagement priority for the firm. This strategic focus underscores a commitment to leveraging advanced technological capabilities to drive innovation and deliver enhanced value.

By Q1 2024, the global AI market was projected to reach over $200 billion, with financial services being a key driver of this growth. Federated Hermes' proactive stance positions them to capitalize on these advancements, potentially leading to more sophisticated data-driven insights and operational efficiencies in the coming years.

Federated Hermes recognizes that enhancing digital platforms is paramount for effective client engagement and distribution within the investment management sector. The firm is actively investing in its digital capabilities to better serve its advisor clients, a move that underscores the growing importance of technology in fostering stronger client relationships and delivering superior service.

This strategic focus on digital transformation is critical, especially as client expectations for seamless online interactions and accessible information continue to rise. By building out these services, Federated Hermes aims to streamline communication, provide valuable digital tools, and ultimately improve the overall client experience, a key differentiator in today's competitive landscape.

As financial services become more digitized, cybersecurity and data protection are critical concerns for Federated Hermes. The company must navigate evolving threats, a challenge echoed by the Financial Stability Oversight Council (FSOC) in its ongoing assessments of systemic risks within the financial sector.

In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the significant financial implications of security breaches for firms like Federated Hermes. This necessitates continuous investment in advanced security measures and proactive risk management to safeguard sensitive client data and maintain operational integrity.

Blockchain and Tokenization of Assets

Blockchain technology is revolutionizing asset management, with the tokenization of assets, including money market fund shares, gaining traction. Federated Hermes is actively exploring these advancements to boost the usability and transferability of its fund offerings. This move aligns with a broader industry trend towards digital assets, potentially streamlining operations and expanding investor access.

Federated Hermes' involvement in blockchain initiatives for money market funds highlights a strategic push into the digital asset space. This technology offers the promise of increased efficiency and new avenues for liquidity. For instance, by mid-2024, several pilot programs for tokenized securities were demonstrating faster settlement times compared to traditional methods, a key benefit blockchain can bring to funds.

- Blockchain's Role: Facilitates secure, transparent, and efficient record-keeping and transfer of tokenized assets.

- Federated Hermes' Engagement: Actively participating in projects to enhance money market fund share utility and transferability.

- Industry Trend: Growing adoption of digital assets and tokenization across the financial services sector.

- Potential Benefits: Improved liquidity, reduced transaction costs, and expanded investor access to fund shares.

Data Analytics for Investment Insights

Federated Hermes leverages sophisticated data analytics to unearth unique investment opportunities and customize their approaches. This commitment to proprietary analysis is crucial in today's competitive landscape.

The firm integrates Environmental, Social, and Governance (ESG) data, alongside other critical information, into its proprietary assessment frameworks. This data-driven methodology directly informs their investment teams, shaping both analysis and the construction of portfolios.

For example, in 2024, Federated Hermes reported that its ESG integration strategies contributed to enhanced risk management and alpha generation across various asset classes. The firm’s data science teams continuously refine algorithms to process vast datasets, aiming to identify trends and correlations that might elude traditional methods.

- Proprietary Data Tools: Federated Hermes utilizes internally developed analytical platforms to process and interpret investment data.

- ESG Data Integration: ESG metrics are a core component of their analytical process, influencing investment decisions.

- Informed Portfolio Construction: Advanced analytics directly support the strategic allocation of assets within portfolios.

- Continuous Refinement: The firm consistently updates its analytical models to adapt to evolving market dynamics and data availability.

Artificial intelligence and machine learning are transforming financial services, enhancing investment analysis and risk management. Federated Hermes is actively integrating these technologies, recognizing their importance for competitive advantage. By Q1 2024, the global AI market was projected to exceed $200 billion, with finance as a significant growth driver.

The firm is also prioritizing digital platform enhancements for better client engagement and distribution. This focus on digital transformation is crucial as client expectations for seamless online experiences grow. Federated Hermes aims to improve client relationships and service delivery through these digital investments.

Cybersecurity remains a critical concern, with the global cost of cybercrime projected to reach $10.5 trillion annually in 2024. Federated Hermes must invest in robust security measures to protect sensitive data and maintain operational integrity amidst evolving threats.

Blockchain technology is revolutionizing asset management through tokenization, and Federated Hermes is exploring its potential for money market funds to improve usability and transferability. Pilot programs by mid-2024 showed faster settlement times for tokenized securities, highlighting blockchain's efficiency benefits.

Federated Hermes leverages sophisticated data analytics, including ESG data, to refine investment strategies and manage risk. Their data science teams continuously improve algorithms to identify market trends, with ESG integration contributing to enhanced risk management and alpha generation in 2024.

| Technology Area | Federated Hermes' Engagement | Industry Trend/Data Point |

| AI & Machine Learning | Integration for analysis and risk management | Global AI market projected >$200B (Q1 2024) |

| Digital Platforms | Enhancement for client engagement | Rising client expectations for online interaction |

| Cybersecurity | Critical concern, investment in security | Global cybercrime cost projected $10.5T annually (2024) |

| Blockchain | Exploring tokenization for funds | Pilot programs showing faster settlement times (mid-2024) |

| Data Analytics (incl. ESG) | Proprietary analysis, ESG integration | ESG integration cited for risk management/alpha (2024) |

Legal factors

Federated Hermes navigates a complex web of financial services regulations, including the Companies Act 2014 and European UCITS Regulations, which dictate operational standards and investor protections. The company's commitment to compliance is a recurring theme in its annual reports, underscoring its dedication to maintaining trust and stability within its global operations.

Federated Hermes faces a growing landscape of ESG disclosure regulations worldwide. Key among these are the EU's Sustainable Finance Disclosure Regulation (SFDR), the Task Force on Climate-related Financial Disclosures (TCFD), and the Task Force on Nature-related Financial Disclosures (TNFD). These regulations mandate comprehensive reporting on sustainability matters, impacting how Federated Hermes operates and communicates its environmental, social, and governance performance.

The firm actively publishes reports detailing its progress in adopting these frameworks. For instance, Federated Hermes' sustainability reports often highlight adherence to TCFD recommendations, providing insights into climate-related risks and opportunities within its investment strategies. This commitment to transparency demonstrates a proactive approach to meeting evolving regulatory demands in sustainable finance.

Federated Hermes, like all financial institutions, operates under stringent anti-money laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are designed to prevent financial crimes and require rigorous customer due diligence. For instance, in 2024, regulators globally continued to emphasize the importance of robust KYC procedures, with fines for non-compliance reaching significant figures, underscoring the critical nature of these obligations.

The company's commitment to legal and ethical conduct is explicitly stated in its code of business conduct and ethics. This includes a directive to adhere to all applicable laws and regulations, which naturally encompasses maintaining comprehensive AML and KYC programs. This proactive approach ensures that Federated Hermes not only meets but often exceeds the minimum legal requirements, safeguarding its reputation and operational integrity.

Data Privacy Laws (e.g., GDPR, CCPA)

Global data privacy laws, like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly shape how Federated Hermes manages and safeguards its client and operational data. These regulations necessitate robust data protection measures and transparent data handling practices.

Federated Hermes must maintain strict confidentiality of client information, only disclosing it when explicitly authorized or legally required. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Fines: $2,500 per unintentional violation and $7,500 per intentional violation.

- Data Breach Notification: Timely reporting is crucial under various privacy statutes.

- Cross-border Data Transfers: Navigating international data transfer rules is a key legal challenge.

Corporate Governance and Shareholder Protection

Federated Hermes places significant emphasis on strong corporate governance and robust shareholder protection, which are cornerstones of its business. The company's annual reports and code of business conduct clearly articulate its dedication to ethical operations, responsible investment strategies, and stringent oversight of potential conflicts of interest and related-party transactions.

These principles are not just theoretical; they are embedded in the firm's operational framework. For instance, as of their latest disclosures, Federated Hermes actively engages in practices designed to safeguard investor interests, ensuring transparency and accountability in all its dealings. This commitment is crucial for maintaining trust and ensuring long-term sustainability in the financial services sector.

- Corporate Governance Framework: Federated Hermes operates under a governance structure designed to ensure accountability and ethical conduct, with oversight committees actively monitoring business practices.

- Shareholder Rights: The firm adheres to regulations and best practices that protect shareholder rights, including clear disclosure policies and mechanisms for addressing shareholder concerns.

- Conflict of Interest Management: Robust policies are in place to identify, manage, and mitigate conflicts of interest, ensuring that client and shareholder interests are prioritized.

- Transparency in Reporting: Federated Hermes is committed to transparent financial reporting, providing stakeholders with comprehensive information about the company's performance and governance.

Federated Hermes must navigate evolving global regulations, particularly those concerning sustainable finance and data privacy. For instance, the EU's Sustainable Finance Disclosure Regulation (SFDR) continues to shape reporting requirements, while data protection laws like GDPR, with penalties up to 4% of global annual turnover, demand stringent data handling. The company's adherence to these legal frameworks is critical for maintaining trust and operational integrity in the 2024-2025 period.

Environmental factors

Federated Hermes views environmental, social, and governance (ESG) factors as fundamental to generating long-term wealth, actively integrating them into their investment analysis. This approach involves proprietary assessments to pinpoint significant ESG risks and opportunities within their managed portfolios.

For instance, by 2024, an increasing number of investors are demanding greater transparency on climate-related financial disclosures, a trend Federated Hermes is well-positioned to address through its established ESG integration framework. This focus on sustainability is not just ethical but also financially prudent, as companies with strong ESG performance often demonstrate greater resilience and innovation.

Climate change presents a significant systemic risk across financial markets, a reality Federated Hermes acknowledges by aligning with global objectives to cap warming at 1.5°C. This commitment is underscored by their comprehensive Climate Action Plan, which outlines specific targets for reducing emissions within their investment portfolios.

Federated Hermes' Climate Action Plan includes ambitious goals for reducing financed emissions, aiming for a 25% reduction by 2030 compared to a 2019 baseline. Furthermore, the firm actively engages with companies in which it invests, encouraging them to adopt robust decarbonization strategies and set their own science-based targets.

Federated Hermes is an early adopter of the Taskforce on Nature-related Financial Disclosures (TNFD), integrating nature-related reporting into its climate disclosures. This proactive approach aligns with growing investor demand for transparency on environmental risks and opportunities. For instance, as of early 2024, over 300 organizations globally had expressed commitment to TNFD recommendations.

Biodiversity investing is a core focus, with Federated Hermes actively engaging companies on quantifying positive impact, particularly concerning deforestation. This commitment is crucial given that the global economy loses an estimated $125 billion to $140 billion annually due to land degradation, according to UN data from 2023.

Sustainable Investment Product Development

Federated Hermes is actively developing and offering sustainable investment products, demonstrating a commitment to environmental factors. For instance, their Sustainable Global Equity Strategy targets companies at the forefront of decarbonization and those improving sustainability through their offerings, reflecting growing investor interest in eco-conscious options.

This strategic focus is crucial as client demand for environmentally sound investments continues to surge. By 2024, assets in sustainable funds globally were projected to reach significant figures, with ESG (Environmental, Social, and Governance) investing becoming a mainstream consideration for many asset managers and their clients.

- Client Demand: Growing preference for investments aligning with environmental values.

- Product Development: Focus on strategies like decarbonization and sustainability enhancement.

- Market Trend: ESG investing is a significant and expanding segment of the financial market.

Operational Environmental Impact and Advocacy

Federated Hermes is actively working to minimize its own operational environmental footprint, going beyond just portfolio-level impact. This commitment is demonstrated through initiatives aimed at reducing their direct emissions.

Their EOS stewardship team plays a crucial role in advocating for systemic change. This involves engaging with regulators and policymakers to champion policies that support a net-zero transition.

- Operational Emissions Reduction: Federated Hermes is implementing strategies to lower its direct greenhouse gas emissions from its own operations.

- Policy Advocacy for Net-Zero: Through its EOS stewardship team, the firm actively engages with governments to influence policies promoting a net-zero economy.

- Promoting Best Practices: The company advocates for the adoption of environmental best practices across the financial industry.

Federated Hermes recognizes the profound impact of environmental factors on investment performance, integrating them through robust ESG analysis. By 2024, investor demand for climate-related disclosures has surged, a trend Federated Hermes addresses with its comprehensive climate action plan, targeting a 25% reduction in financed emissions by 2030 from a 2019 baseline.

The firm is also a proponent of nature-related financial disclosures, aligning with the TNFD framework as over 300 organizations globally committed to its recommendations by early 2024. This focus extends to biodiversity, addressing the significant economic losses from land degradation, estimated at $125 billion to $140 billion annually as of 2023.

Federated Hermes actively develops sustainable investment products, catering to the growing client preference for environmentally conscious options, a market segment experiencing substantial growth. The company also prioritizes reducing its own operational footprint and advocates for net-zero policies through its stewardship team.

| Environmental Factor | Federated Hermes Action/Focus | Relevant Data/Target |

| Climate Change | Climate Action Plan, Financed Emissions Reduction | 25% reduction by 2030 (vs. 2019 baseline) |

| Nature & Biodiversity | TNFD Adoption, Deforestation Engagement | Over 300 global TNFD commitments (early 2024); $125-$140bn annual loss from land degradation (UN, 2023) |

| Sustainable Investing | Product Development, Client Demand | Growing market segment |

| Operational Footprint | Direct Emissions Reduction | Internal initiatives |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable financial institutions, international organizations, and leading market research firms. We integrate insights from government policy documents, economic forecasts, and technological innovation reports.