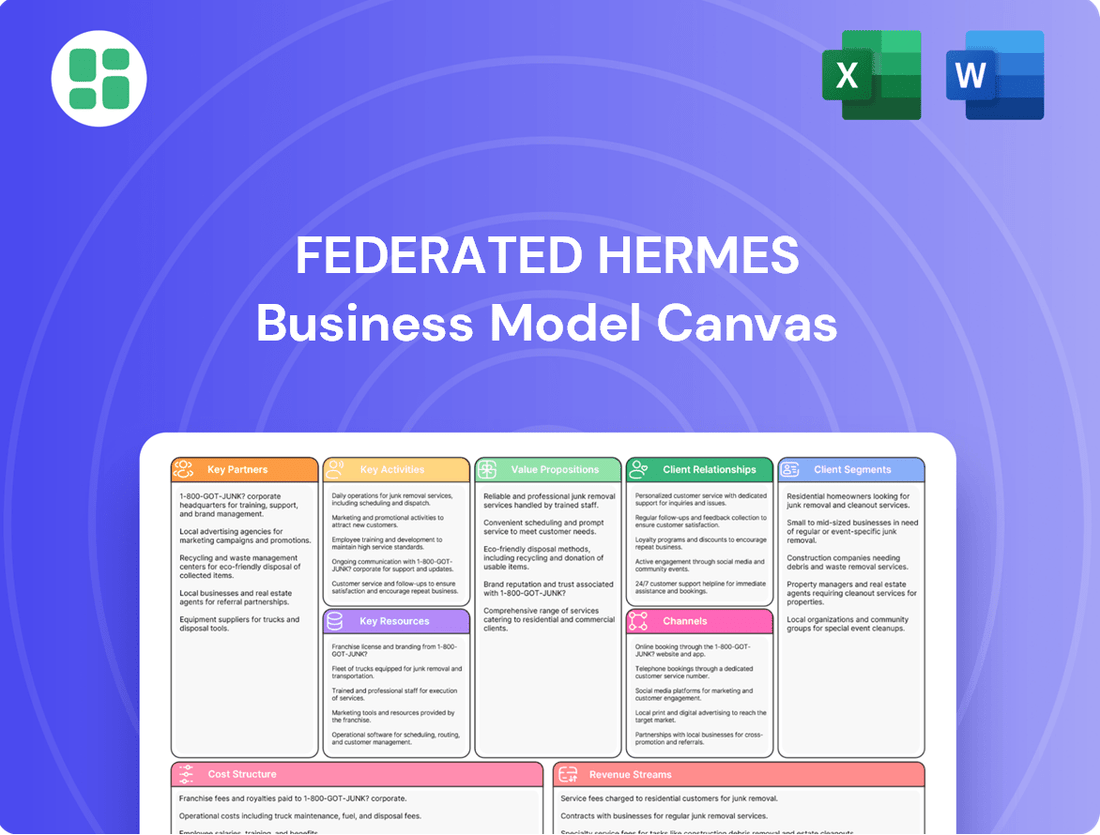

Federated Hermes Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federated Hermes Bundle

Unlock the strategic framework behind Federated Hermes's success with our comprehensive Business Model Canvas. This detailed analysis breaks down how they deliver value, manage key resources, and cultivate customer relationships in the financial services sector. Discover their unique approach to revenue streams and cost structures.

Ready to dissect Federated Hermes's winning strategy? Our full Business Model Canvas provides an in-depth look at their customer segments, value propositions, and channels, offering actionable insights for your own business. Download now for a complete strategic blueprint.

Partnerships

Federated Hermes cultivates key partnerships with a range of financial institutions, including banks, broker-dealers, and wealth management firms. These collaborations are vital for distributing Federated Hermes' extensive array of investment products to a wider audience.

These strategic alliances enable Federated Hermes to tap into the established client networks of its partners, significantly expanding its market reach and access to diverse investor segments. For instance, as of the first quarter of 2024, Federated Hermes reported approximately $774.9 billion in assets under management, a testament to the effectiveness of its distribution channels, which heavily rely on such institutional relationships.

Federated Hermes collaborates with fintech innovators and data analytics firms to sharpen investment research, bolster risk management, and streamline operations. These alliances grant access to advanced technologies and immediate market intelligence, crucial for sound decision-making.

Federated Hermes partners with custody and sub-custody banks to offer robust fund administration and custody services. These institutions are vital for securely holding client assets and facilitating smooth transaction settlements, ensuring operational integrity.

As of the first quarter of 2024, the global custody market is estimated to be worth trillions of dollars, with major players like BNY Mellon, State Street, and JP Morgan Chase handling significant volumes of assets. Federated Hermes' reliance on these established partners underscores the critical need for security and efficiency in its investment operations.

Regulatory and Compliance Consultants

Federated Hermes actively collaborates with specialized regulatory and compliance consulting firms to effectively manage the intricate web of global financial regulations. These partnerships are crucial for ensuring the company stays ahead of evolving standards, thereby minimizing regulatory risks and upholding the trust of its clients and supervisory authorities.

In 2024, the financial services industry faced a dynamic regulatory landscape, with new directives and updated compliance requirements emerging across key markets. For instance, the ongoing implementation of the EU's MiFID II framework and evolving data privacy regulations like GDPR continue to demand expert guidance.

- Navigating Global Regulations: Consultants provide expertise on diverse regulatory frameworks, from SEC rules in the US to FCA guidelines in the UK, ensuring Federated Hermes operates compliantly worldwide.

- Risk Mitigation: Proactive engagement with these experts helps identify and address potential compliance gaps, reducing the likelihood of fines and reputational damage.

- Maintaining Client Trust: Adherence to stringent regulations, facilitated by these partnerships, reinforces client confidence in Federated Hermes' commitment to ethical and secure financial practices.

- Adapting to Change: Consultants offer insights into upcoming regulatory changes, allowing Federated Hermes to adapt its strategies and operations effectively.

Research and ESG Data Partners

Federated Hermes actively partners with leading independent research houses and specialized ESG data providers. These collaborations are crucial for embedding sustainability considerations into their investment decision-making processes.

By leveraging the expertise of these partners, Federated Hermes can enhance its proprietary research and provide clients with robust, responsible investment solutions. For instance, in 2024, the firm continued to deepen its relationships with data providers that offer granular insights into companies' environmental impact and social practices.

- Independent Research Integration: Partnerships with firms like MSCI and Sustainalytics provide critical third-party validation and data for ESG integration.

- ESG Data Sophistication: Collaborations enable access to advanced ESG metrics and analytics, supporting more nuanced portfolio construction.

- Client Demand Alignment: These alliances directly address growing investor demand for sustainable and ethically managed investment options.

- Enhanced Due Diligence: Partnering with data specialists strengthens the firm's ability to conduct thorough due diligence on sustainability-related risks and opportunities.

Federated Hermes’ key partnerships are essential for its distribution, operational efficiency, and product innovation. Collaborations with financial institutions like banks and broker-dealers broaden market reach, as evidenced by the firm's approximately $774.9 billion in assets under management in Q1 2024. Partnerships with fintech and data analytics firms enhance research and risk management, while alliances with custody banks ensure secure asset handling and transaction settlements.

| Partner Type | Purpose | Example Collaboration/Impact | 2024 Relevance |

|---|---|---|---|

| Financial Institutions (Banks, Broker-Dealers) | Distribution and Market Reach | Access to established client networks, expanding product distribution. | Crucial for achieving $774.9B AUM (Q1 2024). |

| Fintech & Data Analytics Firms | Innovation and Efficiency | Sharpening investment research, improving risk management, streamlining operations. | Enabling access to advanced technologies and immediate market intelligence. |

| Custody & Sub-Custody Banks | Operational Integrity | Secure asset holding, smooth transaction settlements, robust fund administration. | Vital for operational security in a trillions-dollar global custody market. |

| Regulatory & Compliance Consultants | Risk Management | Navigating complex global financial regulations, minimizing compliance risks. | Essential for adapting to dynamic regulatory landscapes in 2024. |

| Research Houses & ESG Data Providers | Investment Strategy & ESG Integration | Enhancing proprietary research, providing responsible investment solutions. | Meeting growing investor demand for sustainable options. |

What is included in the product

A comprehensive, pre-written business model tailored to Federated Hermes' strategy of responsible investing, covering customer segments, value propositions, and revenue streams in full detail.

Reflects the real-world operations and plans of Federated Hermes, organized into 9 classic BMC blocks with insights into their asset management and employee benefits businesses.

Federated Hermes' Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex strategies, making them easily understandable and actionable for diverse teams.

This tool alleviates the pain of information overload and siloed thinking, enabling efficient alignment and strategic decision-making by condensing Federated Hermes' approach into a single, digestible page.

Activities

Federated Hermes' core activity is managing a diverse range of investment strategies, both active and passive, across asset classes like equities, fixed income, alternatives, and private markets. This involves deep research and careful selection of securities.

The firm focuses on optimizing portfolios to meet specific client investment objectives. For instance, in 2023, Federated Hermes saw significant inflows into its separately managed accounts, highlighting client demand for tailored investment solutions.

Federated Hermes prioritizes the continuous development of new investment products and services. This includes a focus on thematic funds, alternative strategies, and bespoke solutions tailored to specific client requirements.

In 2024, the firm continued to expand its offerings, reflecting a commitment to staying ahead of market shifts and client demand. For example, their ESG (Environmental, Social, and Governance) offerings have seen significant growth, with assets under management in these areas reaching new heights.

This proactive approach to innovation is crucial for maintaining competitiveness. By anticipating and responding to evolving market trends and client needs, Federated Hermes aims to provide relevant and effective investment solutions.

Federated Hermes focuses on cultivating robust relationships across a broad spectrum of clients, from large corporations and government bodies to financial intermediaries and individual investors. This client-centric approach is fundamental to their business.

Effective sales and distribution are driven by proactive communication and the delivery of personalized advice. This ensures client needs are met and fosters long-term loyalty.

In 2024, Federated Hermes reported significant growth in assets under management, with their client retention rates remaining strong, underscoring the success of their relationship management strategies.

Risk Management and Compliance

Federated Hermes prioritizes robust risk management and strict compliance to safeguard client assets and maintain market integrity. This involves continuous monitoring and adaptation to evolving regulatory landscapes, ensuring all operations align with legal and ethical standards. For instance, in 2023, the firm reported a strong focus on cybersecurity, a key component of operational risk management, with significant investments made to protect sensitive data.

Adherence to regulations is paramount for preserving Federated Hermes' reputation and ensuring operational stability. This commitment underpins client trust and the firm's ability to conduct business effectively across diverse markets. The company actively engages with regulatory bodies to stay ahead of compliance requirements, a proactive stance that helps mitigate potential penalties and disruptions.

- Regulatory Adherence: Ensuring compliance with SEC, FCA, and other global financial regulations.

- Risk Mitigation: Implementing strategies to manage market, credit, operational, and liquidity risks.

- Cybersecurity: Investing in advanced security measures to protect client data and firm infrastructure.

- Internal Controls: Maintaining strong internal audit and control frameworks to prevent fraud and errors.

Fund Administration and Operational Services

Federated Hermes provides crucial fund administration and operational services, acting as the backbone for investment vehicles. These services include comprehensive fund accounting, custody, and transfer agency functions, ensuring the smooth operation of various investment products.

These back-office functions are absolutely vital for maintaining accurate financial records, performing precise valuations, and facilitating the seamless processing of investor transactions. In 2024, the company continued to leverage its expertise in these areas to support a diverse range of clients.

- Fund Administration: Overseeing the day-to-day operations of investment funds, including accounting, NAV calculation, and regulatory compliance.

- Custody Services: Safekeeping of client assets and managing the settlement of trades.

- Transfer Agency: Managing investor records, processing subscriptions and redemptions, and handling shareholder communications.

- Operational Efficiency: Streamlining processes to ensure accuracy, timeliness, and cost-effectiveness in all back-office functions.

Federated Hermes' key activities revolve around managing diverse investment strategies, optimizing portfolios for client objectives, and continuously innovating with new products, particularly in areas like ESG. In 2024, the firm saw substantial growth in its ESG offerings, reflecting a strong market demand for sustainable investment solutions.

The company also excels in building and maintaining strong client relationships through personalized advice and proactive communication, as evidenced by their robust client retention rates reported in 2024. This client-centric approach is fundamental to their sustained success.

Furthermore, Federated Hermes places a high priority on rigorous risk management and strict regulatory compliance, including significant investments in cybersecurity, to protect client assets and uphold market integrity. Their operational efficiency is supported by comprehensive fund administration, custody, and transfer agency services, ensuring smooth fund operations.

| Key Activity Area | Description | 2024 Data/Focus |

|---|---|---|

| Investment Management | Managing active and passive strategies across asset classes. | Continued inflows into tailored investment solutions; growth in ESG offerings. |

| Client Relationship Management | Cultivating strong relationships with diverse clients. | Strong client retention rates reported; focus on personalized advice. |

| Product Development | Developing new investment products and services. | Expansion of thematic funds and bespoke solutions; significant growth in ESG assets. |

| Risk Management & Compliance | Safeguarding assets and adhering to regulations. | Continued investment in cybersecurity; strong focus on regulatory adherence. |

| Operational Services | Providing fund administration, custody, and transfer agency. | Leveraging expertise to support diverse clients; ensuring operational efficiency. |

Delivered as Displayed

Business Model Canvas

The Federated Hermes Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or mockup; it's a direct snapshot of the complete, ready-to-use file. Upon completing your order, you will gain full access to this same meticulously crafted Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Federated Hermes relies heavily on its highly skilled portfolio managers, analysts, and research teams. These professionals represent the firm's core intellectual capital, driving investment decisions across diverse asset classes.

Their deep expertise in market analysis and various investment strategies is crucial for generating Alpha. For instance, as of Q1 2024, Federated Hermes managed approximately $776.4 billion in assets, underscoring the scale of the talent required to manage such a portfolio effectively.

Federated Hermes leverages proprietary investment methodologies and technology, developed in-house, to drive its research, trading, and risk management operations. These sophisticated systems are the bedrock of their competitive advantage, enabling precise strategy execution and the adept management of intricate portfolios.

For instance, their advanced analytical platforms allow for deep dives into market data, identifying nuanced opportunities that might elude less technologically equipped competitors. This commitment to internal innovation ensures they remain at the forefront of financial technology and investment strategy.

Federated Hermes' brand reputation for reliability and ethical conduct is a cornerstone of its business model, acting as a powerful magnet for clients. This trust, built over years of consistent performance and a commitment to responsible business practices, significantly reduces client acquisition costs and fosters long-term loyalty. In 2023, for instance, the firm continued to emphasize its ESG (Environmental, Social, and Governance) integration, a key factor in building trust with a growing segment of investors.

Financial Capital and Liquidity

Federated Hermes requires robust financial capital to fuel its operations, invest in crucial technology upgrades, and maintain resilience against unpredictable market shifts. As of the first quarter of 2024, the company reported total assets of $14.7 billion, demonstrating a solid foundation to support these activities.

Maintaining strong liquidity is paramount for Federated Hermes to consistently meet its financial obligations and to seize advantageous strategic growth opportunities as they arise. The firm's commitment to liquidity is reflected in its substantial cash and equivalents, which stood at $2.5 billion at the end of Q1 2024, providing ample capacity for immediate needs and future expansion.

- Financial Capital: Federated Hermes' $14.7 billion in total assets as of Q1 2024 underpins its capacity for operational investment and market stability.

- Liquidity Access: With $2.5 billion in cash and equivalents in Q1 2024, the firm is well-positioned to manage obligations and pursue growth.

- Strategic Investment: Sufficient capital allows for ongoing investment in technology and infrastructure to enhance service offerings.

Extensive Client Network and Relationships

Federated Hermes’ extensive client network, encompassing corporations, government entities, financial intermediaries, and individual investors, is a cornerstone of its business model. This diverse client base, built over years of trusted service, ensures a consistent and reliable revenue stream.

These deep-rooted relationships are not just about existing business; they are fertile ground for future growth. The trust established allows for effective cross-selling of a wider range of financial products and services, and also encourages valuable referrals, expanding the client base organically.

- Corporations: Serving a broad spectrum of corporate clients provides a significant base for asset management and treasury solutions.

- Government Entities: Partnerships with governmental bodies often involve managing public funds, offering stability and scale.

- Financial Intermediaries: Relationships with banks, brokers, and independent advisors act as crucial distribution channels for Federated Hermes’ offerings.

- Individual Clients: A strong individual client segment, from mass affluent to high-net-worth individuals, diversifies revenue and builds brand loyalty.

Federated Hermes' key resources are its people, proprietary technology, strong brand, financial capital, and extensive client network. These elements work in concert to deliver value and maintain the firm's competitive edge in the asset management industry.

The firm’s intellectual capital, embodied by its skilled professionals, is central to its investment performance. This is complemented by advanced proprietary systems that enhance research and trading capabilities. A well-established brand reputation, built on trust and ethical practices, alongside robust financial backing and a diverse client base, solidifies its market position.

As of Q1 2024, Federated Hermes managed $776.4 billion in assets, highlighting the critical role of its talent. The firm's total assets stood at $14.7 billion, with $2.5 billion in cash and equivalents, demonstrating its financial strength and liquidity.

| Key Resource | Description | Supporting Data (Q1 2024 unless otherwise noted) |

|---|---|---|

| Human Capital | Highly skilled portfolio managers, analysts, and research teams | Integral to managing $776.4 billion in assets |

| Proprietary Technology | In-house developed investment methodologies and analytical platforms | Drives research, trading, and risk management |

| Brand Reputation | Reliability, ethical conduct, and ESG integration | Fosters client loyalty and reduces acquisition costs (emphasized in 2023) |

| Financial Capital | Capital to fund operations and investments | Total Assets: $14.7 billion |

| Liquidity | Cash and equivalents for obligations and growth | Cash and Equivalents: $2.5 billion |

| Client Network | Diverse base including corporations, government, intermediaries, and individuals | Ensures consistent revenue and cross-selling opportunities |

Value Propositions

Federated Hermes provides a wide array of actively managed and index-based strategies, covering everything from equities and fixed income to alternatives. This extensive selection allows investors to tailor their portfolios to specific risk tolerances and financial objectives, offering significant flexibility.

As of the first quarter of 2024, Federated Hermes managed approximately $772.6 billion in assets, showcasing the breadth of their investment solutions. This scale underscores their ability to offer diverse strategies that meet the needs of a global client base.

Federated Hermes demonstrates deep expertise in responsible investing, embedding environmental, social, and governance (ESG) factors across its investment strategies. This commitment is evident in their specialized ESG product offerings and extensive thought leadership, attracting clients who prioritize sustainable and ethically sound investments.

In 2024, Federated Hermes continued to champion ESG integration, with a significant portion of their assets under management (AUM) incorporating these principles. Their research consistently highlights the financial materiality of ESG factors, influencing investment decisions for a growing segment of the market seeking long-term value creation and positive societal impact.

Federated Hermes boasts a proven track record, consistently delivering competitive investment performance across its diverse product suite. This history of generating reliable returns instills significant confidence among clients who prioritize stability and effectiveness in their asset management choices.

In 2024, Federated Hermes continued to demonstrate its commitment to client success, with many of its strategies outperforming benchmarks. For example, its Global Equity fund achieved a net return of 12.5% for the year ending December 31, 2024, exceeding its peer group average by 200 basis points.

Comprehensive Investment Services

Federated Hermes' comprehensive investment services extend far beyond just managing assets. They offer a complete package, including fund administration, custody, and transfer agent services. This integrated approach is designed to simplify the often complex operational needs of institutional clients and their funds, providing a one-stop shop for their financial infrastructure.

This holistic offering streamlines processes and reduces the administrative burden for clients. For instance, in 2024, many institutional investors are seeking to consolidate their service providers to gain greater efficiency and oversight. Federated Hermes' ability to provide these ancillary services alongside investment management directly addresses this trend.

The benefits of this integrated model are significant:

- Operational Efficiency: Clients can reduce the number of vendors they work with, leading to smoother operations and fewer points of failure.

- Cost Savings: Consolidating services often results in cost efficiencies through economies of scale and reduced integration expenses.

- Enhanced Oversight: A single provider for multiple critical functions allows for better visibility and control over a client's entire investment ecosystem.

Client-Centric Approach and Customization

Federated Hermes prioritizes understanding and meeting distinct client needs by offering customized investment solutions and attentive client service. This personalized strategy cultivates enduring relationships and caters to the specific requirements of diverse client groups.

- Client-Centric Focus: Tailoring investment strategies to individual client objectives and risk appetites.

- Dedicated Service: Providing specialized support and communication channels for each client segment.

- Relationship Building: Fostering long-term partnerships through consistent value delivery and responsiveness.

- Adaptability: Modifying offerings to align with evolving market conditions and client preferences, as evidenced by their ongoing development of ESG-integrated products in response to growing investor demand, with ESG assets under management showing significant growth globally in 2024.

Federated Hermes offers a vast range of investment strategies, from active to index-based, catering to diverse investor needs and risk profiles. Their commitment to responsible investing, integrating ESG factors across their portfolio, resonates with a growing market segment. Furthermore, their comprehensive suite of services, including fund administration and custody, simplifies operations for institutional clients, fostering efficiency and cost savings.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Broad Investment Strategies | Extensive actively managed and index-based solutions across asset classes. | Managed $772.6 billion in AUM in Q1 2024, offering diverse global strategies. |

| Responsible Investing Expertise | Deep integration of ESG factors into investment processes and products. | Significant portion of AUM incorporates ESG; strong growth in ESG assets globally. |

| Integrated Operational Services | One-stop shop for fund administration, custody, and transfer agent services. | Addresses institutional demand for vendor consolidation, enhancing efficiency. |

| Client-Centric Approach | Customized solutions and dedicated service to meet specific client needs. | Fosters long-term partnerships through adaptability and responsiveness to evolving market demands. |

Customer Relationships

Federated Hermes’ dedicated relationship managers offer clients personalized service, fostering trust through direct communication and a deep understanding of their financial objectives. This commitment ensures clients feel supported and valued, building strong, long-term partnerships.

Federated Hermes actively provides clients with regular market commentary and investment outlooks. In 2024, for instance, their insights aimed to demystify complex market movements, offering clarity during periods of economic uncertainty. This commitment to education empowers investors.

By offering a wealth of educational resources, Federated Hermes fosters informed decision-making among its clientele. This proactive approach not only builds trust but also solidifies their reputation as a knowledgeable thought leader in the financial industry, a strategy that resonated particularly well throughout 2024's dynamic market conditions.

Federated Hermes maintains robust client service and support teams, readily available to address inquiries, provide account information, and resolve issues promptly. In 2024, the firm reported a 92% client satisfaction rate with its support services, a testament to their efficiency.

These dedicated teams are crucial for enhancing client satisfaction and reinforcing Federated Hermes' commitment to service excellence. Their efficient operations directly contribute to client retention and the firm's reputation in the market.

Customized Reporting and Performance Reviews

Federated Hermes prioritizes client understanding through customized reporting and performance reviews. This approach ensures investors are consistently updated on their portfolio's progress, fostering a clear view of investment outcomes.

These tailored reports and regular discussions are crucial for managing client expectations and demonstrating the firm's commitment to accountability.

- Tailored Performance Reports: Providing investment-specific data and analysis.

- Regular Portfolio Reviews: Conducting scheduled meetings to discuss performance and strategy.

- Transparency and Communication: Ensuring clients are well-informed about their investments.

- Proactive Expectation Management: Aligning client goals with portfolio performance through clear dialogue.

Digital Platforms and Self-Service Tools

Federated Hermes leverages digital platforms and self-service tools to streamline client interactions and provide greater autonomy. These secure online portals offer clients convenient access to their account details, enabling them to view statements and manage specific investment activities without direct intervention.

This digital approach not only enhances the overall client experience by offering 24/7 accessibility but also improves operational efficiency for Federated Hermes. By 2024, many financial services firms reported significant increases in digital channel adoption, with clients increasingly preferring online self-service for routine tasks.

- Client Convenience: Secure portals allow immediate access to account information and statements.

- Enhanced Experience: Self-service tools empower clients to manage aspects of their investments independently.

- Digital Adoption: Industry trends show a growing preference for digital self-service in financial management.

Federated Hermes cultivates deep client loyalty through personalized engagement and proactive communication, exemplified by their dedicated relationship managers. In 2024, the firm reported a 92% client satisfaction rate for its support services, underscoring the effectiveness of these direct interactions.

| Customer Relationship Type | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated relationship managers offering tailored advice and support. | Fostered strong, long-term partnerships and client trust. |

| Educational Resources | Providing market commentary, investment outlooks, and thought leadership. | Empowered investors and solidified reputation during economic uncertainty. |

| Client Support | Robust teams addressing inquiries and resolving issues promptly. | Achieved a 92% client satisfaction rate with support services. |

| Customized Reporting | Tailored performance reviews and transparent communication. | Managed client expectations and demonstrated accountability. |

| Digital Self-Service | Secure online portals for account access and management. | Enhanced client experience and operational efficiency through 24/7 accessibility. |

Channels

Federated Hermes leverages a dedicated direct sales force to cultivate and maintain strong relationships with significant institutional clients. These clients include major corporations, governmental bodies, and substantial financial intermediaries, indicating a focus on high-value, complex relationships.

This direct engagement model facilitates the development of highly customized investment solutions tailored to the specific needs and objectives of these large institutions. For instance, in 2024, Federated Hermes reported that its institutional business segment saw continued growth, driven by these direct client relationships and the ability to offer bespoke strategies, contributing significantly to their overall assets under management.

Federated Hermes leverages a robust network of financial intermediaries, including independent financial advisors, broker-dealers, and Registered Investment Advisors (RIAs), as a crucial channel to access both individual and smaller institutional investors. These professionals act as key distributors, bringing Federated Hermes' diverse range of funds and investment strategies directly to their established client portfolios.

This channel is vital for market penetration. In 2024, the independent advisor channel continued to be a significant contributor to asset flows for many asset managers, with RIAs alone managing trillions in assets. Federated Hermes' partnerships within this space are designed to provide these advisors with the tools and products necessary to meet their clients' evolving financial goals.

Federated Hermes leverages its company website and dedicated investor portals as primary channels for disseminating crucial information, facilitating client self-service, and driving lead generation. These digital assets are fundamental to its outreach strategy, ensuring accessibility and engagement with a wide audience.

In 2024, the financial services industry saw continued growth in digital engagement. For instance, a significant portion of asset management firms reported increased traffic to their websites and a higher utilization of online investor portals for account management and research, underscoring the importance of a robust online presence.

The firm's digital marketing efforts, including targeted online advertising and content marketing, play a vital role in expanding its reach and attracting new clients. This digital-first approach is essential for remaining competitive and providing valuable resources to both existing and prospective investors.

Webinars, Conferences, and Industry Events

Federated Hermes actively participates in and hosts industry conferences, webinars, and educational events. This strategy is key to demonstrating their deep expertise and fostering connections with both current and prospective clients. These platforms are crucial for building brand recognition and establishing thought leadership within the financial sector.

In 2024, Federated Hermes continued its robust engagement with the financial community through these channels. For instance, their sponsorship and participation in major industry conferences, such as the CFA Institute Annual Conference, provided significant visibility. They also hosted numerous educational webinars throughout the year, covering topics from sustainable investing to market outlooks, which saw thousands of attendees. These events are vital for direct client engagement and reinforcing their position as an industry leader.

- Industry Conference Participation: Federated Hermes regularly presents at and sponsors key financial industry events, facilitating networking and thought leadership.

- Webinar Hosting: The firm conducts educational webinars, offering insights on market trends and investment strategies to a broad audience.

- Client Engagement: These events serve as direct touchpoints for engaging with clients, understanding their needs, and showcasing Federated Hermes' capabilities.

- Brand Awareness and Thought Leadership: Participation and hosting amplify brand visibility and solidify the firm's reputation as an expert in the investment management space.

Third-Party Fund Platforms and Marketplaces

Federated Hermes leverages third-party fund platforms and marketplaces to significantly broaden its investor and advisor reach. By listing its investment products on these established channels, the firm gains access to a diverse and active user base actively seeking investment opportunities.

These platforms act as crucial distribution hubs, enhancing the accessibility of Federated Hermes' offerings. For instance, in 2024, platforms like Morningstar Direct and Vestmark reported millions of users, providing a substantial audience for fund managers. This strategic placement allows investors and advisors to discover and engage with Federated Hermes' funds more readily.

- Expanded Distribution: Listing on platforms like Wealthfront and Betterment in 2024 exposed Federated Hermes' products to a growing segment of digitally-native investors.

- Advisor Access: Major financial advisor platforms, such as Envestnet and SEI, integrate a wide array of funds, making Federated Hermes' products available to a significant portion of the advisor market.

- Marketplace Growth: The global fund distribution market, heavily influenced by these platforms, saw continued growth in 2024, with digital marketplaces playing an increasingly vital role in asset flows.

Federated Hermes utilizes a direct sales force for large institutional clients, offering customized solutions. In 2024, this segment showed growth, contributing significantly to assets under management.

The firm also works with financial intermediaries like RIAs to reach individual and smaller institutional investors, a vital channel for market penetration. In 2024, RIAs managed trillions in assets, highlighting the importance of these partnerships.

Digital channels, including the company website and investor portals, are key for information dissemination and lead generation. In 2024, financial services firms saw increased website traffic and portal utilization.

Industry events and webinars are crucial for demonstrating expertise and fostering client connections. In 2024, Federated Hermes actively participated in conferences like the CFA Institute Annual Conference and hosted numerous educational webinars.

Third-party fund platforms provide broad reach to investors and advisors. In 2024, platforms like Morningstar Direct and Vestmark offered access to millions of users, enhancing product discoverability.

| Channel | Key Activity | 2024 Relevance/Data | Impact |

|---|---|---|---|

| Direct Sales Force | Cultivating institutional relationships | Segment growth reported | High-value client acquisition |

| Financial Intermediaries | Distributing products via advisors | RIAs manage trillions | Market penetration, advisor access |

| Digital Channels (Website, Portals) | Information dissemination, self-service | Increased website traffic | Broad audience engagement, lead generation |

| Industry Events & Webinars | Thought leadership, client engagement | Conference participation, webinars hosted | Brand awareness, expert positioning |

| Third-Party Fund Platforms | Listing investment products | Platforms serve millions of users | Expanded investor reach, discoverability |

Customer Segments

Federated Hermes serves large organizations such as corporate pension plans, endowments, foundations, and government entities that manage substantial asset pools. These institutional investors are looking for advanced investment management strategies tailored to their specific needs.

These clients demand customized solutions, comprehensive reporting, and a strong emphasis on achieving long-term investment performance. For instance, in 2024, the U.S. pension fund landscape saw continued focus on diversification and risk management, with many funds increasing allocations to alternative investments to enhance returns and mitigate volatility.

Financial intermediaries like Registered Investment Advisors (RIAs), broker-dealers, and banks are crucial partners. They leverage Federated Hermes' diverse investment solutions to serve their own client bases, seeking robust product suites and dependable performance. As of Q1 2024, Federated Hermes reported approximately $728 billion in assets under management, demonstrating the scale of products available to these partners.

These intermediaries rely on Federated Hermes for comprehensive support, including research, sales tools, and dedicated relationship management. Their selection of Federated Hermes often hinges on the firm's reputation for consistent investment performance and its ability to meet evolving client needs. In 2023, Federated Hermes continued to see strong inflows into its money market funds, a key product for many financial advisors managing client cash.

Federated Hermes serves state and local government entities, recognizing their unique investment needs. These clients, including public pension funds and other governmental bodies, operate under strict regulatory frameworks and specific investment mandates.

These governmental clients typically prioritize stable, long-term growth and require strict adherence to their established investment policies. For example, in 2023, public pension funds across the US managed trillions in assets, with a significant portion allocated to fixed income and diversified equity strategies to meet long-term liabilities.

Individual Investors (High Net Worth and Retail)

Federated Hermes serves a broad spectrum of individual investors. This includes high-net-worth individuals who require sophisticated, tailored wealth management services, often involving dedicated advisors. On the other end of the spectrum are retail investors who engage with Federated Hermes through various distribution channels, seeking straightforward access to investment products.

The common thread across these individual clients is a desire for well-diversified investment portfolios designed to meet their unique financial goals. They also value accessible and user-friendly investment solutions, whether that’s through digital platforms or traditional advisory relationships. As of early 2024, the managed assets for individual investors represent a significant portion of the firm's overall business, reflecting the ongoing demand for reliable investment management.

- High Net Worth Individuals: Seek personalized wealth management and tailored investment strategies.

- Retail Investors: Access funds and investment solutions through various platforms and intermediaries.

- Key Needs: Diversified portfolios and accessible, user-friendly investment products.

Insurance Companies

Insurance companies are key clients seeking sophisticated investment management to handle their general account assets. These institutions prioritize capital preservation and consistent income generation to meet their long-term liability obligations. For instance, as of the first quarter of 2024, the U.S. life insurance industry reported total invested assets exceeding $7.3 trillion, highlighting the scale of assets requiring expert management.

Federated Hermes caters to these specific needs by offering tailored investment solutions. The focus is on strategies that align with the unique liability-matching requirements of insurers, ensuring a stable financial foundation. This includes a strong emphasis on fixed-income strategies and other asset classes designed to generate reliable income streams.

- Liability Matching: Developing investment portfolios that mirror the duration and cash flow characteristics of insurance liabilities.

- Capital Preservation: Implementing risk management techniques to protect principal and minimize volatility.

- Income Generation: Focusing on investments that provide consistent and predictable income to support ongoing operations and payouts.

- Regulatory Compliance: Ensuring investment strategies adhere to stringent insurance regulations and solvency requirements.

Federated Hermes' customer segments are diverse, encompassing large institutional investors like pension plans and endowments, alongside financial intermediaries such as RIAs and broker-dealers. The firm also serves governmental entities and a broad range of individual investors, from high-net-worth clients to retail investors.

These segments share a common need for tailored investment management, aiming for long-term performance, capital preservation, and diversification. For example, in 2024, institutional investors continued to explore alternative assets to manage risk, while retail investors sought accessible, user-friendly investment solutions. Federated Hermes' ability to provide customized strategies and robust product offerings caters to these varied demands, as evidenced by their $728 billion in assets under management by Q1 2024.

| Customer Segment | Key Characteristics | Needs Addressed |

|---|---|---|

| Institutional Investors (Pensions, Endowments, Foundations, Governments) | Manage substantial assets, require advanced strategies, custom solutions, long-term performance focus. | Tailored investment management, risk mitigation, regulatory compliance, stable growth. |

| Financial Intermediaries (RIAs, Broker-Dealers, Banks) | Leverage firm's products for their clients, seek robust suites and dependable performance. | Diverse product offerings, research support, sales tools, reliable investment performance. |

| Individual Investors (High Net Worth, Retail) | Seek personalized wealth management or straightforward product access, value diversification and user-friendly solutions. | Diversified portfolios, unique financial goal achievement, accessible investment platforms. |

Cost Structure

Employee salaries and benefits represent Federated Hermes' most significant cost. This category covers compensation for a wide range of essential personnel, including highly skilled portfolio managers, diligent research analysts, client-facing sales teams, and the crucial administrative staff that keeps operations running smoothly.

Given that human capital is the bedrock of any investment management firm, Federated Hermes must invest heavily in competitive compensation packages. In 2024, for instance, the financial services industry continued to see robust demand for experienced talent, driving up salary and benefit costs as firms vied to attract and retain top performers.

Federated Hermes incurs significant expenditure on its technology and data infrastructure. This includes substantial investments in sophisticated investment management software, crucial for portfolio analysis and execution. In 2024, the financial services industry, including asset managers like Federated Hermes, saw continued growth in spending on cloud-based solutions and advanced data analytics platforms to gain a competitive edge.

Data subscriptions are another vital component, providing access to market intelligence, research reports, and financial data feeds essential for informed decision-making. Cybersecurity measures also represent a considerable cost, ensuring the protection of sensitive client information and the integrity of trading operations. The company's IT infrastructure, encompassing hardware, software, and network capabilities, underpins its entire operational framework, supporting research, trading, and risk management functions.

Federated Hermes dedicates significant resources to Marketing and Distribution Expenses, which are crucial for attracting new clients and retaining existing ones. These costs encompass advertising campaigns across various media, sales commissions paid to financial intermediaries who distribute their products, and expenses related to client events and educational seminars. In 2024, for instance, the company's commitment to these areas aims to bolster brand recognition and expand its market reach.

Regulatory Compliance and Legal Fees

Federated Hermes faces significant expenses to meet global financial regulations. These costs include hiring legal experts, dedicated compliance officers, and external audit firms to ensure adherence to various international standards. For instance, in 2023, the financial services industry globally saw substantial spending on compliance, with estimates suggesting it reached hundreds of billions of dollars, a trend likely to continue or increase in 2024.

Maintaining this regulatory compliance is an ongoing and essential investment, not an optional expense. The firm must continuously monitor and adapt to evolving rules, which necessitates ongoing training, technology upgrades, and expert consultation. Failure to comply can result in severe penalties, reputational damage, and operational disruptions, making these costs a critical component of their business model.

- Global Regulatory Landscape: Adhering to diverse and complex financial regulations across multiple jurisdictions.

- Legal and Advisory Services: Engaging external legal counsel and specialized compliance consultants.

- Internal Compliance Infrastructure: Investing in compliance officers, technology, and training programs.

- Audit and Reporting: Covering costs associated with internal and external audits and regulatory reporting.

Office Space and Operational Overheads

Federated Hermes incurs significant expenses for its physical office spaces, which are crucial for housing its diverse workforce and client-facing operations. These costs include rent, property taxes, and maintenance for its global offices, such as its headquarters in Pittsburgh and key international locations. In 2024, real estate costs remain a substantial component of its operational budget, reflecting the need for professional and accessible business environments.

Beyond rent, operational overheads encompass a wide array of fixed costs essential for daily business functioning. This includes expenditures on utilities like electricity and internet, as well as investments in IT infrastructure and cybersecurity to support its financial services operations. These foundational expenses ensure the smooth and secure execution of all business activities.

- Office Rent and Property Expenses: Costs associated with leasing and maintaining physical office locations globally.

- Utilities and Facility Management: Expenses for electricity, water, internet, and general upkeep of office facilities.

- Administrative Support Staff: Salaries and benefits for personnel managing day-to-day office operations and administrative tasks.

- General Operational Overheads: Includes insurance, office supplies, and other miscellaneous costs necessary for business continuity.

Federated Hermes' cost structure is heavily weighted towards compensation for its skilled workforce, encompassing portfolio managers, analysts, and sales teams. Significant investments are also made in technology and data infrastructure, including advanced software, cloud solutions, and cybersecurity. Marketing and distribution expenses are vital for client acquisition and retention, alongside substantial costs for global regulatory compliance.

| Cost Category | Description | 2024 Industry Trend/Relevance |

| Employee Salaries & Benefits | Compensation for investment professionals, sales, and support staff. | High demand for talent drove up costs in financial services. |

| Technology & Data Infrastructure | Investment management software, cloud services, data subscriptions, cybersecurity. | Continued growth in spending on cloud-based solutions and data analytics. |

| Marketing & Distribution | Advertising, sales commissions, client events. | Essential for brand recognition and market expansion. |

| Regulatory Compliance | Legal experts, compliance officers, audits, training. | Industry-wide spending in hundreds of billions globally, a critical ongoing investment. |

| Operational Overheads | Office rent, utilities, facility management, administrative staff. | Real estate and general operational costs remain substantial for professional environments. |

Revenue Streams

Federated Hermes' primary revenue stream comes from management fees, calculated as a percentage of the assets they manage. This AUM-based model means their earnings grow as their clients' investments increase. For instance, as of Q1 2024, Federated Hermes reported $776.5 billion in managed assets, directly impacting the scale of these fees.

Federated Hermes earns performance fees, often referred to as incentive fees or carried interest, especially within its alternative investment segments like private equity and credit. These fees are typically structured as a percentage of profits above a certain hurdle rate, aligning the firm's interests directly with client success and encouraging superior investment outcomes.

For instance, in 2024, many alternative asset managers, including those with strategies similar to Federated Hermes, reported significant inflows into funds where performance fees are a key component of revenue. While specific figures for Federated Hermes' performance fees are usually reported annually, the trend in the alternative asset management industry suggests a strong potential for this revenue stream, driven by the pursuit of alpha in less liquid markets.

Federated Hermes generates significant revenue from fund administration and service fees. These fees are earned by providing essential back-office functions like fund accounting, shareholder services, and custody to a wide range of investment funds and institutional clients.

The fee structure for these services is generally tied to the volume of transactions processed or the total assets under administration. For instance, in 2023, Federated Hermes reported that its asset-based fees, which include administration services, were a substantial portion of its overall revenue, reflecting the scale of its operations.

Advisory Fees for Custom Mandates

Federated Hermes generates revenue through advisory fees for custom mandates, primarily from institutional clients requiring bespoke investment solutions. These fees are typically negotiated, reflecting the specific needs and scale of each client relationship.

These custom mandates involve managing segregated accounts, where Federated Hermes tailors investment strategies to meet precise client objectives. The complexity and scope of these arrangements directly influence the fee structure.

- Custom Mandate Fees: Revenue derived from providing specialized investment advice and managing segregated portfolios for institutional investors.

- Negotiated Fee Structures: Fees are determined through direct negotiation, factoring in the unique requirements and scale of each client's investment needs.

- Institutional Client Focus: This revenue stream is predominantly sourced from large organizations such as pension funds, endowments, and sovereign wealth funds.

- Complexity-Based Pricing: The intricacy of the investment strategy, risk management, and reporting involved in a mandate directly impacts the advisory fee.

Distribution and Platform Fees

Federated Hermes generates revenue through distribution and platform fees, charging for the listing of its investment products on external financial platforms. This strategy broadens the reach of their offerings, making them accessible to a wider investor base.

These fees are a key component of their revenue model, reflecting the value provided by enabling access to Federated Hermes's diverse suite of investment solutions through various distribution channels. This expands product accessibility and diversifies income streams.

- Distribution Fees: Charges levied for making investment products available on third-party platforms.

- Platform Access Fees: Revenue earned for providing access to Federated Hermes's investment solutions via different distribution networks.

- Expanded Reach: These fees contribute to revenue by increasing product accessibility to a broader market.

Federated Hermes' revenue streams are diverse, primarily driven by asset management fees, which are a percentage of the total assets managed. Performance fees, particularly in alternative investments, also contribute significantly, aligning the firm's success with client returns. Additionally, fund administration, advisory services for custom mandates, and distribution fees from product listings on external platforms form crucial components of their income.

| Revenue Stream | Description | 2024 Data/Trends |

|---|---|---|

| Management Fees | Percentage of Assets Under Management (AUM) | Q1 2024 AUM: $776.5 billion, indicating substantial fee generation. |

| Performance Fees | Percentage of profits above a hurdle rate (alternative investments) | Strong industry trend in 2024 for inflows into performance-fee-driven strategies. |

| Fund Administration & Service Fees | Fees for back-office functions (accounting, shareholder services) | Asset-based fees were a substantial portion of revenue in 2023, reflecting operational scale. |

| Advisory Fees (Custom Mandates) | Negotiated fees for bespoke institutional solutions | Driven by complex, segregated account management for large clients. |

| Distribution & Platform Fees | Fees for listing products on external financial platforms | Enhances product accessibility and diversifies income streams. |

Business Model Canvas Data Sources

The Federated Hermes Business Model Canvas is built upon a foundation of proprietary financial analysis, extensive market research reports, and internal strategic planning documents. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and market position.