Federated Hermes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federated Hermes Bundle

Federated Hermes navigates a complex financial landscape, where the bargaining power of buyers and the intensity of rivalry significantly shape its competitive environment. Understanding these forces is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Federated Hermes’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Federated Hermes' reliance on specialized technology and data providers for its investment strategies and operational efficiency gives these suppliers considerable bargaining power. Services like advanced AI, sophisticated data analytics, and robust cybersecurity solutions are critical, and their specialized nature, coupled with high switching costs, means Federated Hermes has limited alternatives. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to grow significantly, highlighting the increasing demand and value of these specialized services.

The asset management sector, including giants like Federated Hermes, relies on a pool of highly specialized professionals. Think portfolio managers, sharp quantitative analysts, and diligent compliance officers. These individuals are the backbone of successful investment strategies.

The availability of such talent, especially in cutting-edge fields like artificial intelligence and intricate financial products, is often limited. This scarcity naturally translates into significant leverage for these skilled professionals. They can negotiate favorable compensation packages and working environments, as firms recognize their crucial role.

In 2023, the demand for AI specialists in finance saw a notable surge, with reported salary increases of up to 25% for experienced professionals in certain specialized roles. This highlights the intense competition for top talent and the resulting bargaining power they wield.

Federated Hermes, like its peers, actively focuses on retaining its key personnel. This proactive approach is essential in a market where losing a highly skilled individual can impact performance and client trust. The firm's investment in employee development and competitive remuneration reflects this strategic imperative.

Federated Hermes faces significant bargaining power from regulatory and legal service providers due to the ever-increasing complexity of financial regulations. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to implement new rules impacting asset managers, requiring specialized legal counsel to ensure compliance. This heightened demand for expertise in areas like ESG reporting and private fund regulations strengthens the negotiating position of these specialized law firms and compliance consultants.

Custody and Fund Administration Services

Federated Hermes relies on external providers for certain critical back-office functions like fund administration and custody. These services are essential for safeguarding client assets and meeting regulatory requirements, giving established and reputable suppliers a moderate degree of bargaining power.

The switching costs associated with changing custody and fund administration providers can be substantial, further bolstering the bargaining power of existing suppliers. This is particularly true for larger institutions with complex portfolios and stringent compliance needs.

- High Switching Costs: Migrating client assets and operational processes from one custodian to another can be complex and time-consuming, often involving significant IT integration and data reconciliation efforts.

- Regulatory Compliance Dependence: Suppliers specializing in regulatory reporting and compliance for fund administration can command higher prices due to the specialized knowledge and infrastructure required.

- Reputation and Trust: In the financial services industry, a provider's reputation for security and reliability is paramount, allowing trusted custodians to maintain pricing power.

Infrastructure and Office Space Providers

Essential infrastructure, such as office space and IT support, is critical for Federated Hermes' operations. In key financial centers like London or New York, commercial real estate providers can wield some bargaining power, especially for prime locations. For instance, average prime office rents in London’s City district hovered around £60-£70 per square foot in early 2024, indicating a significant cost component.

While these providers are necessary, their leverage is generally less pronounced compared to suppliers of specialized technology or highly skilled talent. The ongoing adoption of hybrid work models, which began gaining significant traction in 2020 and continued through 2024, may further dilute the bargaining power of traditional office space providers. Federated Hermes, like many firms, is re-evaluating its physical footprint, potentially reducing demand for extensive office leases.

- Office Space: Essential for physical operations, with costs varying significantly by financial hub. Prime London office rents were in the £60-£70 per sq ft range in early 2024.

- IT Support & Utilities: Necessary operational services, often with multiple providers available, limiting individual supplier leverage.

- Hybrid Work Impact: The shift towards flexible work arrangements in 2024 potentially reduces reliance on traditional office space, lessening supplier bargaining power.

- Supplier Comparison: The bargaining power of infrastructure providers is generally lower than that of specialized technology or talent suppliers.

Federated Hermes faces significant bargaining power from suppliers of specialized technology and data, as these are critical for its investment strategies and operations. The high switching costs and limited availability of alternatives for services like AI and advanced analytics empower these providers. For example, the global AI market was valued at approximately $150 billion in 2023, underscoring the demand and value of these specialized offerings.

The asset management industry, including Federated Hermes, is heavily reliant on highly skilled professionals such as portfolio managers and quantitative analysts. The scarcity of talent in specialized financial fields, especially in areas like AI, grants these individuals considerable leverage. This is evident in 2023 salary trends, where demand for AI specialists in finance saw increases of up to 25% for experienced professionals in certain roles.

Regulatory and legal service providers also exert considerable bargaining power due to the increasing complexity of financial regulations. The continued implementation of new rules by bodies like the SEC in 2024 necessitates specialized legal counsel, enhancing the negotiating position of law firms and compliance consultants. Furthermore, providers of essential back-office functions like fund administration and custody hold moderate leverage, amplified by substantial switching costs for institutions with complex portfolios.

| Supplier Category | Bargaining Power Level | Key Factors | Supporting Data/Examples |

|---|---|---|---|

| Specialized Technology & Data | High | Criticality of service, limited alternatives, high switching costs | Global AI market valued at ~$150B in 2023 |

| Highly Skilled Talent | High | Scarcity of expertise, critical role in performance | Up to 25% salary increase for AI specialists in finance (2023) |

| Regulatory & Legal Services | High | Increasing regulatory complexity, need for specialized expertise | Continued SEC rule implementation (2024) |

| Fund Administration & Custody | Moderate | Essential services, high switching costs, reputation | Complex migration processes for large institutions |

| Infrastructure (Office Space, IT) | Low to Moderate | Availability of alternatives, impact of hybrid work | Prime London office rents ~$60-£70/sq ft (early 2024) |

What is included in the product

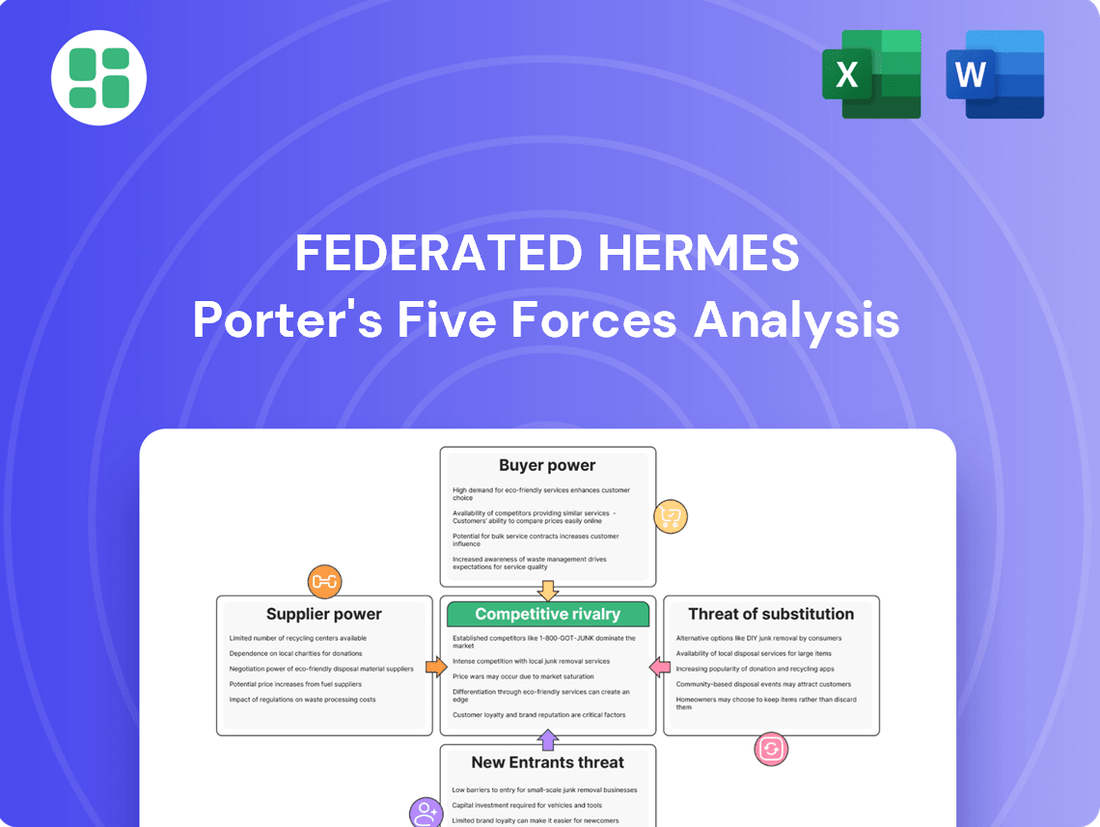

This analysis meticulously examines the five forces shaping Federated Hermes' competitive environment, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Federated Hermes serves a diverse client base, including significant institutional players like corporations, government bodies, and financial intermediaries. These large clients often manage vast amounts of capital, which translates into considerable bargaining power.

Their substantial assets under management allow these institutional clients to negotiate fees aggressively, demand highly customized investment strategies, and exert influence over the terms of service. For instance, in 2023, Federated Hermes reported that a significant portion of its assets were managed on behalf of institutional clients, highlighting the financial weight these entities carry.

The ability of these large investors to shift substantial capital flows can directly impact Federated Hermes' revenue streams and profitability. This leverage means the firm must continually demonstrate value and competitive pricing to retain these key relationships.

Customers today have an unprecedented number of investment choices. Beyond traditional active managers, they can easily access passive options like ETFs and index funds, utilize robo-advisors for automated management, or even invest directly in various assets. This accessibility significantly lowers the barrier to switching providers.

The ease with which investors can move their money means they have considerable leverage. If Federated Hermes or its competitors don't offer competitive fees, strong performance, or align with their investment beliefs, customers can readily shift their assets elsewhere. For instance, the global ETF market saw assets under management reach an estimated $10 trillion by the end of 2023, illustrating the scale of readily available passive alternatives.

Clients are becoming much more aware of how much they pay for investment management and are closely watching how their investments perform. This means that firms like Federated Hermes really need to show they are worth the fees they charge. For instance, in 2023, the average expense ratio for actively managed equity funds was around 0.67%, compared to just 0.06% for passive index funds, highlighting the gap clients are scrutinizing.

The growth of low-cost passive investment options, like index funds and ETFs, puts significant pressure on active managers. Federated Hermes, to keep clients, must demonstrate that their active management strategies deliver returns that consistently beat the market, or offer unique services that passive options can't match. This increased choice and transparency directly empowers customers.

Financial Intermediaries as Gatekeepers

Financial intermediaries, like wealth advisors and broker-dealers, play a crucial role as gatekeepers, directly influencing Federated Hermes' reach to individual investors. Their choices to recommend or distribute Federated Hermes' investment products are pivotal for the firm's market penetration. In 2024, the influence of these intermediaries remains substantial, with many individual investors relying heavily on their guidance for investment decisions.

These gatekeepers can leverage their position to exert bargaining power. They might demand more favorable terms, enhanced support services, or product innovations from Federated Hermes to continue distributing their offerings. For instance, a significant portion of assets under management for many asset managers flows through these intermediary channels, giving them considerable sway.

- Intermediary Influence: Financial advisors and broker-dealers act as crucial conduits between asset managers like Federated Hermes and individual investors.

- Distribution Power: Their willingness to promote and distribute Federated Hermes' products directly impacts the firm's ability to attract and retain clients.

- Negotiating Leverage: Intermediaries can negotiate for better fees, dedicated support, or customized product solutions, thereby increasing their bargaining power.

- Market Access: Access to a broad client base is often contingent on maintaining strong relationships with these key financial intermediaries.

Demand for Personalized and Digital Experiences

Modern clients, whether managing large institutional portfolios or personal savings, are increasingly vocal about their desire for tailored investment strategies. They expect digital platforms that are intuitive and provide real-time, transparent reporting on their assets. This shift significantly amplifies customer bargaining power.

Firms that lag in adopting FinTech and Artificial Intelligence risk alienating these digitally savvy clients. For instance, a recent survey indicated that 70% of investors under 40 consider a firm's digital capabilities a key factor in their decision-making process. Competitors leveraging AI for personalized advice and seamless user experiences are better positioned to capture and retain market share.

- Client Expectations: Growing demand for personalized advice and digital interaction.

- FinTech Adoption: Firms utilizing FinTech and AI gain a competitive edge in client engagement.

- Data-Driven Insights: Clients expect transparent reporting and customized solutions.

- Market Impact: Failure to adapt leads to client attrition and loss of market position.

Customers possess significant bargaining power due to the sheer volume of assets they can move, especially institutional clients who manage vast sums. This financial weight allows them to negotiate fees and demand customized services, as evidenced by the substantial portion of Federated Hermes' assets managed for institutional investors in 2023.

The proliferation of low-cost passive investment options like ETFs, with global assets under management reaching an estimated $10 trillion by the end of 2023, empowers customers by providing readily available alternatives to active management. This increased choice puts pressure on firms like Federated Hermes to demonstrate superior performance or unique value propositions to justify their fees, especially when comparing active fund expense ratios (around 0.67% in 2023) to passive ones (around 0.06%).

Financial intermediaries, crucial for reaching individual investors, also wield considerable influence. Their decision to distribute Federated Hermes' products directly impacts market penetration, and they can leverage this position to negotiate favorable terms, enhanced support, or product innovations, reflecting the significant assets often channeled through these relationships.

Modern clients, increasingly digitally savvy, expect personalized investment strategies and intuitive digital platforms with transparent reporting. Firms that fail to adopt FinTech and AI risk alienating these clients, as a significant majority of younger investors consider digital capabilities a key decision-making factor in 2024.

Same Document Delivered

Federated Hermes Porter's Five Forces Analysis

This preview showcases the complete Federated Hermes Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the investment management industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate usability for your strategic planning needs.

Rivalry Among Competitors

The asset management landscape is incredibly fragmented, featuring a wide array of firms from massive global institutions to niche boutique operations. Federated Hermes, therefore, faces intense competition from a diverse group of companies offering comparable investment products across various asset classes like equities, bonds, and alternatives.

This vast number of competitors, each seeking to capture a piece of the market, significantly heightens the rivalry. For instance, in 2024, the global asset management industry managed an estimated $130 trillion in assets, with thousands of firms actively competing for investor capital, underscoring the intense pressure Federated Hermes navigates.

The burgeoning popularity of passive investment vehicles, particularly Exchange-Traded Funds (ETFs), significantly ratchets up competitive rivalry. By 2024, assets in U.S. ETFs alone surpassed $7.7 trillion, a testament to their appeal. This trend exerts considerable downward pressure on fees charged by active managers, compelling firms like Federated Hermes to showcase superior performance and distinct offerings to retain and attract assets.

Competitive rivalry within the asset management industry, including for firms like Federated Hermes, is significantly fueled by ongoing product innovation. This is particularly evident in fast-growing areas like alternative investments, private markets, and funds with a strong Environmental, Social, and Governance (ESG) focus. For instance, the global alternative assets market was projected to reach $22.1 trillion by the end of 2025, highlighting the intense competition to capture this growth.

Firms are actively differentiating themselves by developing highly specialized investment strategies. Federated Hermes, for example, has strategically concentrated on areas such as private equity and renewable energy infrastructure. This specialization allows them to attract distinct client segments seeking particular expertise and to stand out in an increasingly saturated market where many offer similar broad-based products.

Talent Wars and Technology Adoption

The competition for skilled professionals, especially those with expertise in areas like artificial intelligence and data analytics, is intensifying. For instance, in 2024, the demand for AI specialists continued to outstrip supply, leading to significant salary increases and a focus on retention strategies within financial services firms.

Firms are also locked in a fierce race to adopt and integrate new technologies. This investment is crucial for improving operational efficiency, enhancing client service delivery, and ultimately achieving a competitive advantage. In 2024, many asset managers reported increasing their IT spending by 10-15% to bolster their digital capabilities.

- Talent Acquisition: Competition for AI and data science talent remains a primary driver of increased recruitment costs.

- Technology Investment: Significant capital is being allocated to digital transformation initiatives by leading financial institutions.

- Client Experience: Technology adoption is directly linked to improving client interaction and service quality.

Regulatory Compliance Burden

The financial services industry faces a constantly evolving and expanding web of regulations. This complexity, driven by global events and a desire for market stability, places a significant burden on all firms, including established players like Federated Hermes.

For instance, in 2024, the Securities and Exchange Commission (SEC) continued to refine rules around digital assets and ESG disclosures, adding layers of compliance. Firms that can effectively navigate these changes, perhaps through dedicated compliance teams and robust technological solutions, can differentiate themselves. Conversely, those that falter risk substantial fines and reputational damage, directly impacting their competitive standing.

- Increased Compliance Costs: In 2023, the average cost of regulatory compliance for financial institutions globally was estimated to be in the tens of millions of dollars, a figure expected to rise with new mandates.

- Technological Investment: Firms are investing heavily in RegTech solutions to automate compliance processes, with the global RegTech market projected to reach over $30 billion by 2027.

- Competitive Advantage: Companies with proactive compliance strategies often experience fewer disruptions and can allocate more resources to innovation and client service compared to their less prepared counterparts.

Federated Hermes operates in a highly competitive asset management sector, facing pressure from a vast number of global and niche players. The sheer volume of firms vying for investor capital, estimated to be around $130 trillion globally in 2024, intensifies this rivalry. This crowded market necessitates differentiation through specialized offerings and superior performance to attract and retain assets amidst growing competition.

The rise of passive investments, particularly ETFs which held over $7.7 trillion in U.S. assets by 2024, forces active managers like Federated Hermes to justify their fees through outperformance. Furthermore, innovation in areas like alternative investments, projected to reach $22.1 trillion by 2025, and ESG-focused funds creates new competitive battlegrounds. Firms are also competing fiercely for top talent, especially in AI and data analytics, and are heavily investing in technology, with many asset managers increasing IT spending by 10-15% in 2024 to gain an edge.

| Competitive Factor | 2024 Data/Projection | Impact on Federated Hermes |

|---|---|---|

| Market Size & Fragmentation | $130 Trillion Global Assets Under Management | Intense pressure from numerous competitors |

| Passive Investment Growth | $7.7 Trillion U.S. ETF Assets | Downward pressure on active management fees |

| Alternative Assets Market | Projected $22.1 Trillion by 2025 | Opportunity and competition for specialized strategies |

| Technology Investment | 10-15% IT Spending Increase by Asset Managers | Need for significant investment to remain competitive |

SSubstitutes Threaten

The rise of direct investing and self-managed portfolios presents a significant threat of substitutes for traditional asset managers. Empowered by user-friendly online brokerage platforms and readily available financial data, individual investors can now easily bypass intermediaries. For instance, the growth in commission-free trading on platforms like Robinhood and Charles Schwab has lowered the barrier to entry for DIY investors, with millions actively managing their own portfolios.

The rise of robo-advisors and digital investment platforms presents a significant threat of substitution for traditional financial advisory services. These platforms offer automated, algorithm-based portfolio management at a fraction of the cost of human advisors. For instance, many robo-advisors charge annual management fees between 0.25% and 0.50%, compared to the 1% or more often charged by traditional advisors.

This accessibility and cost-effectiveness appeal strongly to a growing segment of investors, particularly millennials and Gen Z, who may have smaller initial investment amounts. By 2024, the assets under management for robo-advisors were projected to reach over $3 trillion globally, demonstrating their increasing market penetration and their capacity to siphon off clients from established financial institutions.

Clients might bypass Federated Hermes' commingled alternative and private market funds to gain direct exposure to specific asset classes like real estate or private equity. This trend is fueled by increasing investor appetite for direct participation in these less liquid, potentially higher-return markets.

Bank Deposits and Fixed Income Alternatives

For liquidity management, alternatives like high-yield savings accounts, certificates of deposit (CDs), and direct investments in short-term government securities can readily substitute for money market funds, particularly when interest rates are attractive. Federated Hermes, with its substantial money market asset base, must consider how these options impact demand for its offerings.

These substitutes offer comparable safety and liquidity, often with competitive yields. For instance, in early 2024, the average yield on a 1-year CD hovered around 4.5% to 5.0%, making them a compelling alternative to money market funds, which in the same period offered yields in a similar range but with potentially less predictable fixed returns.

- High-Yield Savings Accounts: Offer flexibility and competitive interest rates, directly competing for idle cash.

- Certificates of Deposit (CDs): Provide fixed returns for a set period, appealing to investors seeking predictable income.

- Short-Term Government Securities: Considered among the safest investments, they offer a benchmark for risk-free returns.

Real Estate and Tangible Assets

During times of economic instability or rising inflation, investors often seek refuge in tangible assets like real estate, commodities, and precious metals. These alternatives can draw significant capital away from traditional financial instruments and asset management firms.

For instance, in 2024, global real estate investment saw varied trends, with some markets experiencing robust activity as inflation hedges. The U.S. housing market, despite interest rate pressures, continued to attract investment, with median home prices showing resilience. Similarly, gold prices in 2024 often reacted positively to geopolitical tensions and inflation concerns, demonstrating its appeal as a store of value.

- Real Estate as a Substitute: In 2024, the appeal of real estate as an inflation hedge remained strong, particularly in markets with stable or appreciating property values.

- Commodities and Precious Metals: Gold and silver prices in 2024 were influenced by inflation expectations and central bank policies, attracting investors looking for tangible wealth preservation.

- Capital Diversion: The shift towards tangible assets in 2024 indicates a potential diversion of capital that might otherwise flow into financial products offered by asset management companies.

The increasing availability of direct investment options and self-directed trading platforms poses a significant threat of substitutes for traditional asset management services. Investors, empowered by accessible technology and abundant financial data, can now bypass intermediaries, managing their own portfolios with greater ease and lower costs. This shift is particularly evident with the continued growth of commission-free trading platforms.

Robo-advisors and digital investment solutions represent another potent substitute, offering automated, algorithm-driven portfolio management at a substantially lower fee structure than traditional human advisors. By 2024, global assets under management for robo-advisors were projected to exceed $3 trillion, underscoring their growing market share and appeal to a broad investor base.

Investors may opt to bypass Federated Hermes' commingled funds for direct access to alternative and private markets, driven by a desire for specific asset class exposure. Furthermore, for liquidity management, alternatives like high-yield savings accounts and short-term government securities offer comparable safety and yields, directly competing with money market funds. For instance, in early 2024, 1-year CD yields averaged around 4.5% to 5.0%, presenting a compelling alternative.

Entrants Threaten

The asset management industry presents considerable regulatory barriers, including stringent licensing, ongoing compliance obligations, and extensive reporting requirements. These can significantly deter potential new entrants who may lack the resources or expertise to navigate such complexities. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to emphasize robust compliance frameworks, making it harder for less established firms to gain a foothold.

Building a strong brand reputation and earning client trust is paramount in the investment management industry, a process that typically spans decades. Federated Hermes benefits significantly from its established brand recognition and the deep, long-standing relationships it has cultivated with its clients over many years.

New entrants face a substantial hurdle in quickly gaining the confidence and market acceptance necessary to attract significant assets, particularly from sophisticated institutional investors who prioritize stability and proven track records. This makes it difficult for newcomers to compete directly with established players like Federated Hermes.

Access to robust distribution channels is a significant barrier for new entrants in the asset management industry. Federated Hermes, for instance, leverages its established relationships with financial advisors and institutional consultants, providing a ready pathway to clients. In 2024, the reliance on these traditional channels remained strong, with a significant portion of assets under management still flowing through advisor networks.

For a new firm to compete, it must either invest heavily in building its own distribution capabilities or find innovative ways to reach clients, perhaps through digital platforms or strategic partnerships. The cost associated with gaining widespread client access, especially when competing against firms with decades of established networks, can be prohibitive, limiting the threat of new entrants.

Talent Acquisition and Retention

New entrants in the investment management space grapple with significant hurdles in attracting and retaining skilled professionals. Established firms often boast more attractive compensation packages and clearer paths for career advancement, making it tough for newcomers to compete for top talent. This intensified competition for skilled individuals, often termed the 'war for talent,' is a major barrier for startups aiming to build formidable teams.

The challenge is amplified by the fact that experienced investment professionals are in high demand across the financial sector. For instance, in 2024, the demand for financial analysts and portfolio managers remained robust, with many seeking roles in firms offering greater stability and proven track records. This dynamic means that new entrants must offer compelling incentives beyond just salary to lure and keep the best people.

- High Demand for Expertise: Specialized skills in areas like ESG investing, quantitative analysis, and alternative assets are particularly sought after.

- Compensation Disparity: Established firms can often offer higher base salaries, bonuses, and equity options, creating a significant gap for new entrants to bridge.

- Career Progression: New entrants may lack the structured career development programs and mentorship opportunities that attract experienced professionals to larger, more established organizations.

- Brand Reputation: A strong employer brand and reputation, built over years, significantly influences talent attraction, a factor new firms struggle to establish quickly.

Technological Investment and Economies of Scale

The threat of new entrants in the asset management sector, particularly for firms like Federated Hermes, is significantly influenced by the capital required for technological advancement and the pursuit of economies of scale. New players must invest heavily in cutting-edge technologies such as artificial intelligence and sophisticated data analytics to remain competitive. For instance, in 2024, the global AI in financial services market was projected to reach hundreds of billions of dollars, highlighting the substantial investment needed.

Established firms benefit from significant cost efficiencies derived from their scale, making it difficult for newcomers to match their pricing and operational leverage. Federated Hermes, with its extensive infrastructure and client base, can spread the costs of technology and compliance over a larger asset base. This creates a barrier, as new entrants need to achieve a critical mass quickly to offset their high initial technology outlays and compete effectively on cost.

- Technological Investment: New entrants face substantial upfront costs for AI, machine learning, and advanced data analytics platforms, crucial for fund management and client servicing in 2024.

- Economies of Scale: Established firms like Federated Hermes leverage their large asset under management (AUM) to reduce per-unit costs in operations, compliance, and technology, posing a significant challenge to new entrants aiming for profitability.

- Competitive Cost Structure: The cost efficiencies achieved by large asset managers mean that new entrants must either secure significant funding to absorb initial losses or find niche markets where scale is less critical.

The threat of new entrants for Federated Hermes is relatively low due to substantial barriers. High capital requirements for technology and economies of scale make it difficult for newcomers to compete on cost and operational efficiency. For example, in 2024, the need for advanced AI and data analytics platforms demanded significant upfront investment, a hurdle many startups struggle to overcome.

Regulatory hurdles, including licensing and compliance, also act as a significant deterrent. Federated Hermes benefits from its established brand and client trust, built over years, which new entrants find challenging and time-consuming to replicate. Access to distribution channels and the intense competition for skilled talent further solidify the position of established players.

| Barrier Type | Description | Impact on New Entrants | Federated Hermes Advantage |

|---|---|---|---|

| Regulatory Compliance | Stringent licensing, ongoing compliance, and reporting requirements. | High cost and complexity, especially in 2024 with increased SEC scrutiny. | Established infrastructure and expertise to manage compliance efficiently. |

| Brand Reputation & Trust | Building client confidence takes years, particularly with institutional investors. | Difficult to attract assets without a proven track record. | Decades of established relationships and a recognized brand name. |

| Distribution Channels | Access to financial advisors and institutional consultants. | Requires significant investment in building networks or finding alternative channels. | Leverages existing, strong relationships for client acquisition. |

| Talent Acquisition | Competition for skilled professionals in areas like ESG and quantitative analysis. | New entrants struggle to match compensation and career progression of established firms. | Can offer more attractive packages and career paths, securing top talent. |

| Capital & Scale | Investment in technology (AI, data analytics) and achieving economies of scale. | High upfront costs; difficult to match cost efficiencies of larger firms. | Benefits from economies of scale, spreading technology and operational costs over a larger AUM. |

Porter's Five Forces Analysis Data Sources

Our Federated Hermes Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and financial statements. We also incorporate insights from reputable industry analysis firms and market intelligence platforms.