Federated Hermes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federated Hermes Bundle

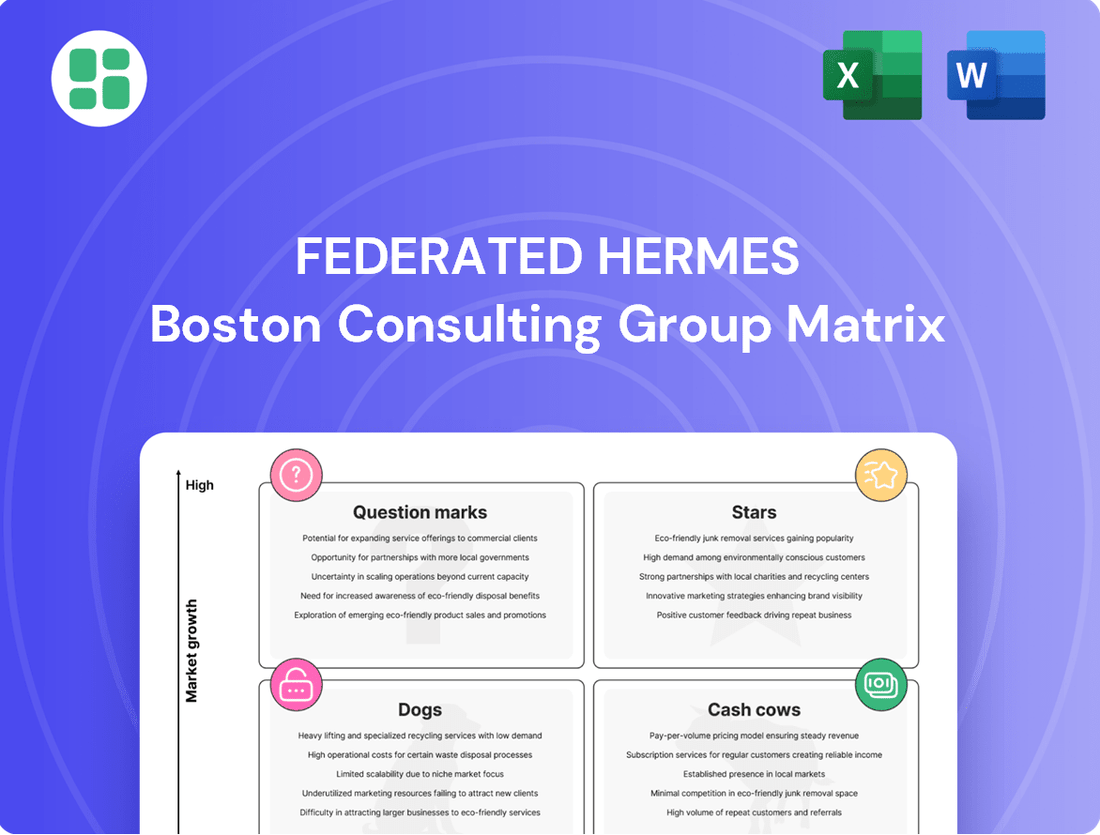

Curious about Federated Hermes' strategic positioning? This glimpse into their BCG Matrix highlights how their diverse portfolio is segmented into Stars, Cash Cows, Dogs, and Question Marks, offering a foundational understanding of their market dynamics.

To truly unlock actionable insights and make informed decisions about resource allocation and future investments, you need the complete picture. Purchase the full Federated Hermes BCG Matrix report for a detailed quadrant breakdown, expert analysis, and strategic recommendations tailored to optimize their business performance.

Stars

Federated Hermes' MDT Equity Strategies are demonstrating robust expansion, with net sales climbing to $3.8 billion in the second quarter of 2025, a notable increase from $3.3 billion in the preceding quarter. This growth trajectory has pushed total assets under management for these quantitative products to $23.2 billion.

The strong demand for these investment vehicles highlights their position as leaders in an expanding market segment. The firm’s MDT strategies, such as MDT Mid Cap Growth and MDT All Cap Core, are not only attracting significant capital but also delivering competitive performance.

Further underscoring their success, seven out of the eight MDT mutual fund strategies have secured a spot in the top Morningstar quartile over the past three years, signaling consistent alpha generation and strong risk-adjusted returns for investors.

Federated Hermes is significantly bolstering its presence in alternative and private markets. This strategic expansion is highlighted by key acquisitions, including Hermes GPE in 2023 and Rivington Energy Management Limited in the second quarter of 2025. These moves underscore a commitment to diversifying and enhancing their offerings in these lucrative areas.

The firm's focus on strategies such as private equity, direct lending, and renewable energy infrastructure is particularly noteworthy. These asset classes typically command higher management fees and feature longer lock-up periods, which in turn generate more stable and predictable revenue streams for Federated Hermes. This approach aims to build a resilient income base.

By June 30, 2025, the assets under management (AUM) in Federated Hermes' alternative and private market segment had grown to an impressive $20.7 billion. This figure reflects consistent growth and a clear strategic direction, demonstrating the market's confidence in their expanding capabilities and investment approach in these specialized sectors.

Federated Hermes is actively exploring the future of finance through tokenized money market funds and digital asset infrastructure. Their collaboration with Bank of New York and Goldman Sachs on blockchain initiatives highlights a commitment to innovation in this rapidly evolving space. This positions them to capitalize on the significant growth potential within digital asset markets, aiming to enhance the utility of their existing money market offerings.

ESG-Focused Investment Products

Federated Hermes demonstrates a strong commitment to ESG-focused investment products, leveraging its extensive expertise in responsible investing. The firm’s EOS team, advising on $2.2 trillion in assets, underscores a deep-seated dedication to stewardship.

The company has actively expanded its sustainable offerings, including new global equity funds, and has strategically reclassified its product lineup. This move clearly labels Active ESG and Impact portfolios to meet escalating client demand for sustainable investment options.

- Long-standing Stewardship: Federated Hermes' EOS team advises on $2.2 trillion in assets, highlighting a significant commitment to responsible investing principles.

- Product Innovation: The firm has launched new sustainable global equity funds to cater to growing investor interest.

- Clear Labeling: Federated Hermes has reclassified its product range to explicitly identify Active ESG and Impact portfolios, enhancing transparency for clients.

- Market Alignment: This strategic focus on ESG aligns with a rapidly expanding market trend, positioning the firm for potential growth and increased market share in sustainable investments.

Exchange-Traded Funds (ETFs) and Collective Investment Trusts (CITs)

Federated Hermes is actively growing its Exchange-Traded Funds (ETFs) and Collective Investment Trusts (CITs) segment. These products have demonstrated robust performance, consistently ranking among the top performers in net sales during the second quarter of 2025. This success highlights their increasing appeal to investors seeking diversified and accessible investment solutions.

The company's strategic focus on these vehicles is evident in its product development pipeline. The introduction of new actively managed equity ETFs in the third quarter of 2024, alongside the launch of the Total Return Bond ETF in January 2024, signals a commitment to expanding its suite of offerings in these popular investment categories. This proactive approach aims to capture growing market demand.

- Strong Net Sales: ETFs and CITs were leaders in net sales in Q2 2025, indicating significant investor demand.

- Product Expansion: New actively managed equity ETFs launched in Q3 2024 and a Total Return Bond ETF in January 2024 show strategic growth.

- Market Traction: Continuous introduction of complementary offerings suggests these products are gaining substantial market share.

- Investor Appeal: The popularity and accessibility of ETFs and CITs are driving their strong performance for Federated Hermes.

Stars in the BCG Matrix represent business units or products with high market share and high market growth. Federated Hermes' MDT Equity Strategies, with $23.2 billion in assets under management as of Q2 2025 and seven out of eight strategies in the top Morningstar quartile, clearly fit this description. Their strong net sales of $3.8 billion in Q2 2025 further validate their position as market leaders experiencing significant growth.

| Federated Hermes Business Segment | Market Position | Growth Potential | Key Metrics (as of Q2 2025) |

|---|---|---|---|

| MDT Equity Strategies | High Market Share | High Market Growth | $23.2 billion AUM, $3.8 billion net sales (Q2 2025), 7/8 strategies in top Morningstar quartile |

What is included in the product

The Federated Hermes BCG Matrix provides a strategic overview of a company's business units based on market growth and share.

It guides investment decisions by classifying units as Stars, Cash Cows, Question Marks, or Dogs.

The Federated Hermes BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positioning and alleviating the pain of complex strategic analysis.

Cash Cows

Money Market Funds are Federated Hermes' dominant Cash Cow, boasting a record $634.4 billion in Assets Under Management (AUM) as of June 30, 2025, representing a substantial 75% of their total AUM. This segment is a cornerstone of their revenue, contributing 53% in the second quarter of 2025, highlighting its consistent profitability and significant market share.

Despite the inherent sensitivity of money market funds to interest rate shifts, their appeal for capital preservation and a proven long-term compound annual growth rate solidify their position. This consistent demand, coupled with Federated Hermes' strong market presence, ensures they remain a reliable, low-growth, high-cash-generating asset within the BCG Matrix.

Federated Hermes' core fixed-income assets stood at $98.7 billion as of June 30, 2025, a significant component of their overall long-term holdings. These strategies, like their Total Return Bond Fund, are considered cash cows due to their consistent fee generation, even with lower growth potential.

Despite experiencing some net outflows in the second quarter of 2025, influenced by market turbulence, the enduring client relationships and Federated Hermes' established position in this mature market segment underpin their reliable revenue streams.

The U.S. financial intermediary distribution channel is Federated Hermes' largest and most significant revenue generator, representing a substantial 67% of their total Assets Under Management (AUM). As of the latest available data, this channel accounts for an impressive $565 billion.

This mature distribution network offers a stable and broad client base, ensuring consistent revenue streams with minimal need for extensive new client acquisition costs. Federated Hermes' strategic emphasis on expanding its Registered Investment Advisor (RIA) segment within this channel further solidifies its dominant position and future growth prospects.

Traditional Fund Administration and Custody Services

Traditional fund administration and custody services represent a core, mature offering for Federated Hermes. These services, while not experiencing rapid expansion, are essential for asset management operations and typically command significant market share for established players.

These services are characterized by stable, recurring fee income, reflecting their consistent demand within the investment management ecosystem. Although specific 2024 revenue breakdowns aren't publicly itemized, it's understood that such foundational services contribute reliably to an asset manager's overall financial health.

- Mature Market Position: Typically, these services are in a mature phase with established market share.

- Stable Fee Income: They generate predictable, consistent fee-based revenue.

- Operational Investment: Requires ongoing investment in infrastructure and compliance.

- Low Growth, High Stability: Characterized by low growth prospects but high operational stability.

Established Large-Cap Equity Funds

Federated Hermes' established large-cap equity funds represent a stable core within their product offerings. These funds, while not exhibiting the hyper-growth of newer strategies, benefit from substantial assets under management (AUM) accumulated over years from loyal, long-term investors. As of late 2024, many such large-cap equity funds continue to command significant market share in a mature, well-understood segment of the investment landscape.

These mature funds are crucial for Federated Hermes' financial health, acting as reliable generators of consistent management fees. Their stability contributes significantly to the firm's overall revenue stream, providing a dependable income source. For instance, a large-cap equity fund with $10 billion in AUM and a 0.75% management fee would generate $75 million annually in fees alone, illustrating the substantial contribution of these established products.

- Stable AUM: Funds benefit from long-term investor commitment, maintaining substantial asset bases.

- High Market Share: They hold a significant position in the established large-cap equity market.

- Consistent Revenue: Management fees from these funds provide a reliable and predictable income.

- Financial Stability: They act as a foundational element supporting the firm's overall financial performance.

Federated Hermes' Money Market Funds are a prime example of a cash cow, holding $634.4 billion in AUM as of June 30, 2025, which is 75% of their total. These funds consistently contribute to revenue, making up 53% in Q2 2025. Their appeal lies in capital preservation and a proven growth rate, ensuring consistent, low-growth, high-cash generation for the company.

The firm's core fixed-income assets, totaling $98.7 billion by June 30, 2025, also function as cash cows. Despite recent market-induced outflows, these mature strategies generate reliable fee income due to established client relationships and a strong market presence.

Federated Hermes' established large-cap equity funds, with substantial AUM from long-term investors, are key revenue generators. A $10 billion fund with a 0.75% fee generates $75 million annually, highlighting their importance for consistent management fee income and overall financial stability.

| Asset Class | AUM (as of June 30, 2025) | Revenue Contribution (Q2 2025) | Growth Potential | Cash Generation |

|---|---|---|---|---|

| Money Market Funds | $634.4 billion (75% of total) | 53% | Low | High |

| Core Fixed Income | $98.7 billion | Consistent Fee Generation | Low | High |

| Large-Cap Equity Funds | Substantial, Long-Term Investor Base | Consistent Management Fees | Low | High |

Full Transparency, Always

Federated Hermes BCG Matrix

The Federated Hermes BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Underperforming niche funds, often referred to as 'dogs' in a strategic framework like the BCG matrix, are those that struggle with both market share and market growth. These funds typically experience consistent net outflows, signaling investor dissatisfaction or a lack of appeal in their specific investment segment. For instance, a niche sector fund focused on a rapidly declining industry, like physical media manufacturing, would likely fall into this category if it holds a small market share.

These funds drain valuable resources, including management time and capital, without delivering commensurate returns or fostering growth. In 2024, the asset management industry continues to see consolidation and a focus on core, high-performing strategies, making the continued existence of such underperforming niche funds a strategic drain. While specific fund names are not publicly categorized as 'dogs,' the reality is that a portion of any asset manager's portfolio will fit this description, requiring careful re-evaluation.

Certain legacy fixed-income strategies are facing persistent net outflows, with Q2 2025 alone seeing $2.4 billion depart from these segments. This trend suggests these strategies are not resonating with current investor demands or adapting to evolving market dynamics.

When fixed-income funds struggle to attract new capital and experience significant redemptions, particularly in older, less adaptable strategies, it points to a low market share coupled with stagnant or declining growth. These are classic indicators of a 'dog' in a BCG matrix framework.

These underperforming assets can become cash traps, tying up capital without generating substantial returns or contributing meaningfully to overall revenue. Their decline impacts the broader portfolio's efficiency and growth potential.

Multi-asset strategies currently represent a modest 6% of Federated Hermes' long-term assets, translating to just 1% of the firm's total revenue. This indicates a relatively small contribution to the overall financial picture.

Older, less diversified, or inflexible multi-asset products may struggle to attract new investments or could face significant redemptions. If these products hold a low market share and operate within a slow-growth segment for the firm, they become prime candidates for divestiture or substantial strategic overhaul, especially if their performance remains consistently subpar.

Geographically Concentrated or Less Strategic International Offerings

Federated Hermes' global presence shows a strong reliance on North America, which accounted for $786.7 billion in Assets Under Management (AUM) as of the latest available data. In contrast, Europe's AUM stood at $53.3 billion, and the Asia Pacific region represented a much smaller $3.5 billion. This significant disparity highlights potential areas that might be classified as dogs within their international portfolio.

Specifically, certain international offerings in regions with limited growth potential or where Federated Hermes has a very small market share could be categorized as dogs. These segments may operate at a breakeven point or even consume valuable resources without generating substantial growth. For example, operations in emerging markets with regulatory hurdles or intense competition might fall into this category.

- North America Dominance: $786.7 billion AUM.

- Europe Contribution: $53.3 billion AUM.

- Asia Pacific Presence: $3.5 billion AUM.

- Dog Identification: Concentrated or low-market-share international offerings with limited growth prospects.

Funds with High Expenses and Low Scalability

Funds within Federated Hermes' offerings that exhibit high expenses and poor scalability are categorized as dogs in the BCG matrix. These strategies, often burdened by significant operational or distribution costs relative to their asset base and growth prospects, struggle to achieve efficient scaling. For instance, a niche actively managed fund with substantial research overhead and limited investor appeal might fall into this category, consuming valuable management attention without generating commensurate returns or market traction.

These underperforming products represent a drain on capital and resources. They tie up management bandwidth and investment capital without contributing meaningfully to the firm's overall growth or profitability. As of early 2024, some actively managed, lower-AUM strategies in the industry, particularly those with complex trading or high active share, can incur expense ratios exceeding 1.50%, significantly impacting net returns for investors and limiting the fund's ability to attract new assets efficiently.

The implications for Federated Hermes are clear:

- Resource Drain: High-cost, low-scalability funds divert management attention and capital from more promising growth areas.

- Profitability Erosion: These strategies can negatively impact overall profitability due to their cost structure and limited revenue generation.

- Strategic Re-evaluation: Such dogs necessitate a strategic review, potentially leading to consolidation, restructuring, or divestment to optimize the firm's product lineup.

Dogs in the Federated Hermes BCG matrix represent funds with low market share and low market growth, often leading to consistent net outflows and draining resources. These underperforming niche funds, such as legacy fixed-income strategies experiencing significant redemptions, are prime examples. For instance, Q2 2025 saw $2.4 billion depart from certain fixed-income segments, indicating a lack of investor appeal and market adaptation.

These strategies, like some older multi-asset products contributing only 6% to long-term assets, can become cash traps, tying up capital without meaningful returns. The firm's geographic AUM distribution, with North America at $786.7 billion versus Asia Pacific at $3.5 billion, highlights potential international segments that may fit the dog profile due to limited growth or market share.

Funds with high expenses and poor scalability, such as niche actively managed strategies with expense ratios exceeding 1.50% in early 2024, also fall into the dog category. These products divert management attention and capital, negatively impacting overall profitability and necessitating strategic review or divestment to optimize the product lineup.

| Category | Market Share | Market Growth | Federated Hermes Example | 2024/2025 Data Point |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy Fixed Income, Certain International Offerings | $2.4 billion net outflows from fixed-income segments in Q2 2025 |

| Dogs | Low | Low | Older, Inflexible Multi-Asset Products | Multi-asset strategies represent 6% of long-term assets |

| Dogs | Low | Low | High-Expense, Low-Scalability Niche Funds | Expense ratios >1.50% for some active funds in early 2024 |

Question Marks

Federated Hermes' new thematic ETFs and specialized sector funds represent their strategic move into niche, potentially high-growth areas. These offerings, like the burgeoning AI or clean energy ETFs, are designed to capture investor interest in specific trends. For instance, the global thematic ETF market saw significant inflows in 2024, with assets under management reaching new highs as investors sought targeted exposure.

Initially, these specialized funds will likely exhibit low market share, a characteristic of the question mark category in the BCG matrix. They require substantial marketing efforts and capital to build investor awareness and assets under management. For example, a newly launched ESG-focused ETF might need extensive outreach to financial advisors and retail investors to gain traction, mirroring the early stages of other successful specialized funds that eventually transitioned to Stars.

Federated Hermes views emerging market debt favorably for 2025, expecting outperformance from a blend of frontier and core emerging market issuers. This constructive stance acknowledges the broader market's growth potential.

Within this expanding landscape, newer or less established strategies in emerging market debt might currently represent a smaller portion of Federated Hermes' overall portfolio. These niche areas would necessitate substantial capital allocation to capitalize on their future growth trajectories.

The Q2 2025 acquisition of Rivington Energy Management Limited bolsters Federated Hermes' private markets capabilities, particularly in the burgeoning renewable energy infrastructure sector. This strategic move positions Federated Hermes to capitalize on the global shift towards sustainable energy sources, a market projected to see substantial growth in the coming years.

While specific new product launches and venture details post-acquisition are still emerging, the renewable energy infrastructure segment itself is a high-growth area. Federated Hermes' involvement here, though likely representing a nascent market share, signifies a high-potential growth trajectory within its expanded private markets platform.

Blockchain-Based Investment Products (Beyond Money Market Tokenization)

Federated Hermes is actively exploring the digital asset space beyond simple money market tokenization, looking into opportunities like tokenized share classes and fully digitized assets. This strategic move positions them to capitalize on the evolving landscape of blockchain-based investments.

While tokenized money market funds are seeing progress, other direct blockchain-based investment products and fully digitized assets are still in their early stages. These nascent products currently hold a low market share but possess substantial growth potential as the digital asset ecosystem matures.

Developing these advanced blockchain-based investment products requires significant investment and a clear strategic focus to achieve viability. For instance, the global tokenization market is projected to reach $5.5 trillion by 2030, highlighting the immense future opportunity for innovative digital asset offerings.

- Tokenized Share Classes: Offering fractional ownership of traditional equity through blockchain technology.

- Fully Digitized Assets: Creating entirely new investment vehicles native to the blockchain.

- Market Growth Potential: Anticipated significant expansion in the digital asset investment sector.

- Strategic Investment: Commitment to research, development, and infrastructure for these new products.

New Geographic Market Entries (e.g., specific Asia Pacific expansions)

Federated Hermes is actively exploring new geographic markets, with a particular focus on Asia Pacific. While North America currently represents the largest portion of their assets under management (AUM), the firm recognizes the significant growth potential in emerging markets.

The strategy involves targeted expansions into specific, rapidly growing, but currently underdeveloped regions within Asia Pacific. These new ventures are anticipated to begin with a low market share but possess high growth potential, aligning with the characteristics of a question mark in the BCG matrix.

- Federated Hermes' global AUM breakdown shows North America as the dominant region.

- The firm's strategic objective is to expand the reach of its cash management solutions worldwide.

- New entries into underdeveloped Asia Pacific markets are classified as question marks due to low initial market share and high growth prospects.

- Substantial initial investment is a prerequisite for establishing presence and achieving market penetration in these new territories.

Federated Hermes' new thematic ETFs, emerging market debt strategies, renewable energy infrastructure investments, and digital asset ventures all currently exhibit characteristics of question marks. These initiatives are in their early stages, meaning they likely have a low market share but are positioned in high-growth potential areas.

Significant investment in marketing, research, and development is crucial for these nascent products and strategies to gain traction and build market share. For example, the global tokenization market is projected to reach $5.5 trillion by 2030, presenting a substantial opportunity for Federated Hermes' digital asset offerings.

The firm's expansion into underdeveloped Asia Pacific markets also fits the question mark profile, requiring substantial capital to establish a presence and achieve growth. These ventures, while starting small, are targeted at regions with high anticipated expansion.

Federated Hermes' strategic focus on these areas indicates a deliberate effort to cultivate future growth engines, acknowledging the inherent risks and investment requirements associated with question mark categories.

| Initiative | Current Market Share | Growth Potential | Investment Required |

|---|---|---|---|

| Thematic ETFs | Low | High | High |

| Emerging Market Debt (Niche) | Low | High | High |

| Renewable Energy Infra. | Nascent | Very High | High |

| Digital Assets | Low | Very High | Very High |

| Asia Pacific Expansion | Low | High | High |

BCG Matrix Data Sources

Our Federated Hermes BCG Matrix leverages comprehensive data, including company financial disclosures, market research reports, and industry growth forecasts, to provide strategic insights.