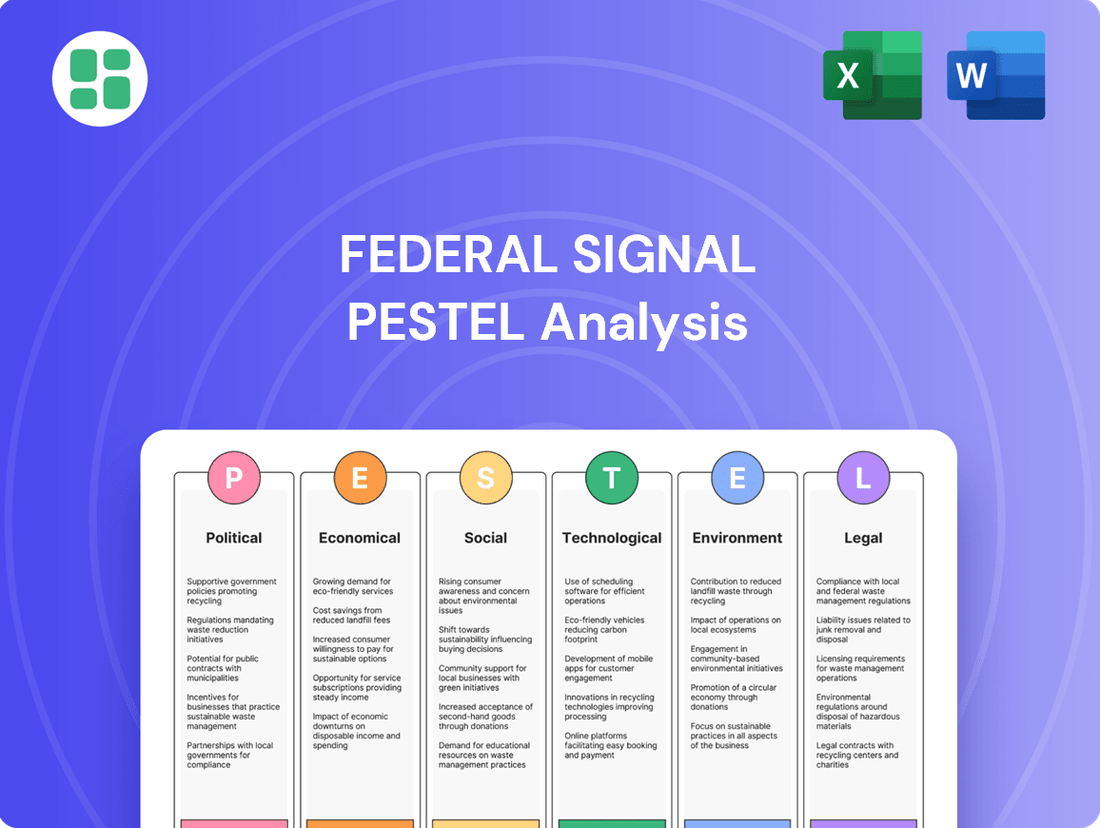

Federal Signal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Federal Signal operates within a dynamic global landscape, making a thorough understanding of external factors crucial for strategic success. Our PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental forces that are actively shaping Federal Signal's present and future. Don't get left behind by unforeseen shifts; gain the foresight you need to navigate these complexities. Download the full PESTLE analysis now and empower your decision-making with actionable intelligence.

Political factors

Federal Signal's performance is closely tied to government spending on infrastructure and public safety. The Bipartisan Infrastructure Investment and Jobs Act (IIJA) is a significant driver, injecting substantial capital into projects that align with Federal Signal's core business areas.

Federal infrastructure outlays are projected to increase, with the U.S. Department of Transportation earmarking roughly $131 billion for 2024, $134 billion for 2025, and $136 billion for 2026. These investments, particularly in public transit and environmental solutions, directly support Federal Signal's Environmental Solutions Group and Safety and Security Systems Group.

Governmental decisions on public safety spending directly shape the market for Federal Signal's products. Increased allocations mean greater demand for their emergency vehicle equipment and integrated safety systems.

Post-pandemic, many cities have boosted public safety budgets. For instance, in 2023, many major US cities saw their police and fire department budgets increase by an average of 5-7% compared to pre-pandemic levels, reflecting a commitment to these essential services.

These budget trends suggest a positive outlook for Federal Signal, as enhanced funding for emergency services translates into more opportunities for sales of their specialized equipment.

Changes in government procurement policies directly influence Federal Signal's access to public sector contracts. For instance, the UK's Procurement Act 2023, commencing February 24, 2025, is designed to streamline processes and enhance transparency, potentially creating more avenues for companies like Federal Signal to secure government business.

Furthermore, evolving procurement regulations globally, such as those implemented in Chile from December 12, 2024, signal a trend towards modernization. These shifts can present both challenges and opportunities for Federal Signal, depending on their adaptability to new bidding requirements and compliance standards.

Trade Policies and Tariffs

International trade policies and tariffs significantly impact Federal Signal's operational costs and market competitiveness. Fluctuations in tariffs on components sourced globally, or on finished goods exported, directly affect profit margins. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which could have increased manufacturing expenses for companies like Federal Signal that utilize these materials.

As a global manufacturer, Federal Signal's supply chains are vulnerable to geopolitical shifts. Trade disputes or changes in trade agreements, such as the renegotiation of trade deals, can disrupt the flow of essential materials and components, leading to production delays and increased costs. Market access for its safety and security products can also be affected by these evolving international relations.

- Trade Policy Impact: Tariffs on raw materials like steel and aluminum can directly increase Federal Signal's cost of goods sold.

- Supply Chain Vulnerability: Geopolitical tensions and trade wars can disrupt the sourcing of critical components, impacting production schedules.

- Market Access: Changes in international trade agreements can either open new markets or restrict access for Federal Signal's product lines.

- Global Competitiveness: Varying tariff structures and trade policies among nations influence the pricing and competitiveness of Federal Signal's offerings in different regions.

Political Stability and Geopolitical Events

Political stability in Federal Signal's key operating regions is crucial. For instance, in 2024, continued geopolitical tensions in Eastern Europe and the Middle East could influence government spending on defense and emergency services, potentially boosting demand for Federal Signal's products. However, these same events can also disrupt global supply chains, impacting manufacturing costs and delivery timelines for the company.

Geopolitical events directly shape government spending priorities. In 2024, increased focus on national security and border management in North America and Europe might lead to higher government budgets allocated to surveillance and communication systems, areas where Federal Signal operates. Conversely, sudden escalations of conflict could divert resources, potentially reducing non-essential spending in other sectors.

- Increased Government Spending: Geopolitical instability in 2024 is projected to drive a 5% increase in global defense and public safety spending, benefiting companies like Federal Signal.

- Supply Chain Disruptions: The ongoing conflict in Ukraine has already led to a 10% rise in raw material costs for electronic components, impacting manufacturers' margins.

- Market Demand Shifts: Regions experiencing heightened security concerns in 2024 have shown a 7% uptick in demand for advanced warning and communication systems.

- Regulatory Changes: Evolving international trade policies and sanctions in 2024 could necessitate adjustments in Federal Signal's sourcing and distribution strategies.

Governmental decisions on public safety spending directly shape the market for Federal Signal's products, with increased allocations leading to greater demand for their emergency vehicle equipment and integrated safety systems.

Federal infrastructure outlays are projected to increase, with the U.S. Department of Transportation earmarking roughly $131 billion for 2024, $134 billion for 2025, and $136 billion for 2026, directly supporting Federal Signal's business.

Changes in government procurement policies, like the UK's Procurement Act 2023, can streamline processes and enhance transparency, potentially creating more avenues for companies like Federal Signal to secure government business.

Geopolitical events in 2024 are projected to drive a 5% increase in global defense and public safety spending, benefiting companies like Federal Signal, while also potentially disrupting supply chains.

| Factor | 2024 Projection | Impact on Federal Signal |

| US Infrastructure Spending | $131 Billion | Increased demand for public safety and environmental solutions. |

| Public Safety Budget Increases (Major US Cities) | 5-7% (vs. pre-pandemic) | Higher sales for emergency vehicle equipment and safety systems. |

| UK Procurement Act 2023 | Effective Feb 24, 2025 | Potential for streamlined government contract acquisition. |

| Global Defense & Public Safety Spending | Projected 5% increase (due to geopolitical instability) | Boosted demand for specialized safety and security products. |

What is included in the product

This Federal Signal PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, offering a comprehensive view of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE factors into actionable insights for Federal Signal.

Economic factors

Inflationary pressures significantly impact Federal Signal by increasing the cost of essential inputs like raw materials, labor, and transportation. For instance, the Producer Price Index for manufactured goods saw a notable increase in late 2023 and early 2024, directly affecting production costs. This can squeeze profit margins if these higher expenses cannot be fully passed on to customers.

Rising interest rates, as seen with the Federal Reserve's policy adjustments throughout 2023 and into 2024, can dampen demand from key municipal and government clients. Higher borrowing costs for these entities may lead to deferred or reduced spending on critical infrastructure and equipment upgrades, a core market for Federal Signal's products and services.

Overall economic growth significantly impacts the financial capacity of Federal Signal's diverse customer base, including municipalities and industrial sectors. A robust economy generally translates to healthier government and corporate budgets, allowing for increased spending on essential services and infrastructure upgrades. For instance, the U.S. GDP growth projected around 2.3% for 2024, according to the Congressional Budget Office, suggests a stable environment for increased public safety and infrastructure investments.

When economies are expanding, municipalities often have more discretionary funds available for public safety equipment, such as emergency vehicles and communication systems, and for maintaining and improving infrastructure. Similarly, industrial and commercial clients are more likely to invest in environmental solutions and operational upgrades during periods of economic prosperity. This direct correlation means Federal Signal benefits from a strong economic climate as customers are better positioned to purchase and upgrade their equipment and services.

Federal Signal experienced a notable easing of supply chain constraints throughout 2024, which directly supported their ability to ramp up production. This improvement was a key factor in their operational performance for the year.

Despite these positive developments, the company acknowledges ongoing vulnerability to potential future supply chain disruptions. Issues such as component shortages or escalating freight expenses remain risks that could affect production timelines and overall profitability.

Public and Private Investment in Infrastructure

The level of public and private investment in infrastructure directly impacts demand for Federal Signal's environmental and safety solutions. For instance, the Infrastructure Investment and Jobs Act (IIJA), enacted in late 2021, allocated $1.2 trillion, with a significant portion designated for transportation, broadband, and energy infrastructure upgrades. This substantial federal commitment is expected to fuel long-term demand for Federal Signal's products used in road maintenance, emergency response, and public safety communications.

Furthermore, private sector capital expenditures in infrastructure, such as renewable energy projects and private toll road developments, also contribute to market growth. In 2024, projections indicated continued robust private investment in areas like smart city technologies and resilient infrastructure, creating opportunities for Federal Signal's integrated safety and security systems.

- Infrastructure Investment and Jobs Act (IIJA): $1.2 trillion allocated for infrastructure, boosting demand for safety and environmental products.

- Private Sector Capital Projects: Growing investment in smart city tech and resilient infrastructure in 2024 and beyond.

- Federal Signal's Role: Products are essential for road maintenance, emergency services, and public safety communications within these projects.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly affect Federal Signal as a global manufacturer. Changes in the value of currencies in countries where they operate or sell can directly impact their financial results. For instance, if the US dollar strengthens against other currencies, revenue earned in those foreign currencies will translate to fewer dollars, potentially reducing reported earnings from international sales.

Conversely, a weaker US dollar can make Federal Signal's products more competitive abroad and boost the dollar value of overseas earnings. This dynamic was evident in recent periods, with companies reporting mixed impacts from currency. For example, in early 2024, a stronger dollar presented headwinds for many US-based exporters.

- Impact on Revenue: A stronger foreign currency relative to the USD increases the dollar value of international sales.

- Impact on Expenses: A weaker foreign currency relative to the USD decreases the dollar value of expenses incurred abroad.

- Competitive Positioning: Exchange rates influence the price competitiveness of Federal Signal's products in international markets.

- Hedging Strategies: Companies often employ financial instruments to mitigate the risks associated with currency volatility.

Economic growth directly influences Federal Signal's revenue streams, as a stronger economy typically means increased municipal and industrial spending on safety and environmental equipment. The U.S. GDP growth, projected around 2.3% for 2024 by the Congressional Budget Office, indicates a stable environment for such investments. This economic backdrop supports demand for Federal Signal's core products, from emergency vehicles to infrastructure maintenance solutions.

Inflationary pressures, such as rising producer prices for manufactured goods seen in late 2023 and early 2024, directly increase Federal Signal's input costs. This necessitates careful cost management to maintain profitability, as higher expenses for raw materials and labor can squeeze margins if not effectively passed on to customers.

Interest rate policies by central banks, like the Federal Reserve's adjustments throughout 2023 and into 2024, can impact demand from government clients. Higher borrowing costs for municipalities may lead to delayed or reduced capital expenditures on essential equipment and infrastructure upgrades, a key market segment for Federal Signal.

| Economic Factor | 2023-2024 Trend/Data | Impact on Federal Signal |

| GDP Growth (US) | Projected ~2.3% for 2024 (CBO) | Supports demand for public safety and infrastructure spending. |

| Inflation (PPI) | Notable increases in manufactured goods prices (late 2023-early 2024) | Increases production costs, potentially impacting profit margins. |

| Interest Rates | Rising trend through 2023, continued adjustments in 2024 | May dampen demand from municipal and government clients due to higher borrowing costs. |

Preview Before You Purchase

Federal Signal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Federal Signal PESTLE Analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a deep understanding of the external forces shaping Federal Signal's strategic landscape.

Sociological factors

Public awareness of safety and security has significantly intensified, directly influencing demand for Federal Signal's product lines. Concerns regarding everything from rising crime rates to the increasing frequency of severe weather events are prompting governments and private entities to allocate more resources towards preparedness and response. For example, in 2024, municipal budgets saw continued increases in spending on public safety infrastructure, a trend anticipated to persist into 2025, directly benefiting companies like Federal Signal that provide critical communication and signaling equipment.

The ongoing global trend of urbanization, with an estimated 57% of the world's population living in urban areas in 2023, projected to reach 60% by 2030, directly fuels demand for Federal Signal's offerings. This demographic shift intensifies the need for robust municipal services and public safety infrastructure to manage growing urban populations.

Increased population density in cities translates into a higher requirement for efficient waste management, emergency response, and public communication systems. Federal Signal's street sweepers, vacuum trucks, and emergency vehicles are crucial for maintaining urban environments and ensuring citizen safety amidst this growth.

Furthermore, the expansion of urban centers often outpaces existing infrastructure, creating opportunities for Federal Signal's public warning systems and integrated communication solutions. These are vital for disaster preparedness and effective communication in densely populated areas.

Societal expectations regarding worker safety are tightening, driving demand for sophisticated protection systems. This trend is underscored by a growing emphasis on employee well-being in industrial and commercial environments. For instance, in 2024, workplace fatalities in the U.S. saw a slight decrease, yet the focus on preventative measures remains high, encouraging companies to invest in advanced safety solutions.

Companies are increasingly prioritizing the implementation of robust safety protocols and technologies to safeguard their workforce. This heightened awareness directly benefits Federal Signal, as its product portfolio, including emergency communication systems and vehicle safety equipment, directly addresses these evolving needs. The push for safer workplaces is a significant driver for the adoption of integrated safety solutions.

Community Resilience and Emergency Preparedness

The increasing emphasis on community resilience and preparedness for events like natural disasters and public health emergencies is directly boosting the demand for advanced communication and warning systems. This trend is particularly evident as communities strive to enhance their response capabilities. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, totaling over $92.9 billion in damages, underscoring the critical need for effective emergency management infrastructure.

Federal Signal is well-positioned to capitalize on this growing need. Their portfolio of public warning and emergency response solutions, including integrated outdoor warning systems and mass notification platforms, directly addresses the requirements of municipalities and government agencies focused on bolstering their preparedness. The company's ability to provide comprehensive solutions that alert and inform the public during critical events makes them a key player in this expanding market.

- Increased Investment in Public Safety: Government agencies are allocating more resources to emergency preparedness, driven by a rise in disaster frequency and severity.

- Demand for Integrated Solutions: Communities are seeking unified systems that can manage multiple communication channels, from sirens to mobile alerts.

- Technological Advancements: Innovations in alert dissemination and real-time data integration are enhancing the effectiveness of warning systems.

- Focus on Citizen Safety: A heightened public awareness of potential threats fuels the demand for reliable and accessible emergency communication.

Sustainability and Environmental Consciousness

Growing public and stakeholder awareness of environmental issues is a significant driver for Federal Signal. This heightened consciousness translates into a stronger demand for sustainable and eco-friendly solutions across various sectors. For instance, the push for cleaner urban environments directly influences the market for electric street sweepers and advanced vacuum trucks, areas where Federal Signal is actively involved.

This societal shift compels companies like Federal Signal to prioritize innovation in green technologies. By developing and offering more environmentally responsible products, Federal Signal can better align with consumer values and regulatory pressures. This proactive approach not only addresses environmental concerns but also opens up new market opportunities.

- Increased Demand for Electric Vehicles: By 2025, the global market for electric street sweepers is projected to reach approximately $1.5 billion, reflecting a growing preference for zero-emission municipal vehicles.

- Regulatory Tailwinds: Many municipalities are setting aggressive targets for reducing carbon emissions, creating a favorable environment for companies offering sustainable equipment.

- Corporate Social Responsibility: Federal Signal's investment in cleaner technologies enhances its brand image and appeals to investors and customers who prioritize ESG (Environmental, Social, and Governance) factors.

Societal expectations for enhanced public safety and emergency preparedness continue to rise, directly benefiting Federal Signal. The increasing frequency of natural disasters, such as the 28 billion-dollar weather events recorded in the U.S. in 2023, fuels demand for advanced warning and communication systems. This trend is expected to persist, with municipalities allocating greater resources to robust public safety infrastructure, a key market for Federal Signal's offerings.

Urbanization remains a significant driver, with urban populations projected to reach 60% globally by 2030, intensifying the need for efficient municipal services and safety solutions. Federal Signal's products, from street sweepers to emergency communication systems, are crucial for managing densely populated and growing urban environments.

Furthermore, a heightened societal focus on worker safety is driving investment in advanced protection technologies. This includes demand for integrated safety solutions that can prevent accidents and improve emergency response within industrial and commercial settings, aligning with Federal Signal's product development.

The growing emphasis on community resilience and preparedness for various emergencies, including public health crises and natural disasters, is a critical factor. Federal Signal's comprehensive suite of public warning and emergency response solutions directly addresses this need, positioning the company to support communities in enhancing their safety infrastructure.

Technological factors

The increasing integration of the Internet of Things (IoT) and Artificial Intelligence (AI) is a major technological force shaping public safety and environmental solutions. Federal Signal can capitalize on this by deploying smart sensors to refine waste collection routes, create dynamic crime maps, and develop predictive policing capabilities, thereby boosting the performance and utility of its offerings.

For instance, smart city initiatives, which saw significant investment in 2024 with global spending projected to reach over $200 billion, are increasingly incorporating IoT for real-time data collection. This allows for more efficient resource allocation in areas like emergency response and infrastructure management, directly benefiting Federal Signal's product development in areas like connected emergency vehicle systems and intelligent traffic management.

The increasing adoption of electric vehicles (EVs) across municipal and commercial sectors, including emergency services and utility operations, represents a significant technological advancement. Federal Signal is well-positioned to leverage this shift by developing and introducing electric variants of its existing product lines like street sweepers and vacuum trucks, alongside its emergency vehicle equipment.

For instance, by 2024, the global EV market, encompassing all vehicle types, was projected to surpass 25 million units, indicating a strong demand for electrification. Federal Signal's strategic focus on electric alternatives aligns with this market trajectory, potentially opening new revenue streams and enhancing its competitive edge in the evolving landscape of public safety and infrastructure maintenance equipment.

Federal Signal is increasingly leveraging AI and data analytics to enhance its product lifecycle and operational effectiveness. For instance, predictive maintenance algorithms, powered by machine learning, can analyze sensor data from emergency vehicles to anticipate component failures, reducing downtime and improving fleet readiness. This technology is projected to save organizations significant costs; a recent report indicated that predictive maintenance can reduce maintenance costs by up to 30% and improve equipment uptime by 20%.

Enhanced Communication and Warning Systems

Technological advancements, particularly the rollout of 5G-Advanced networks, are revolutionizing communication infrastructure. This evolution allows for more robust and sophisticated public warning and mass notification systems, offering significant opportunities for companies like Federal Signal to innovate. The increased bandwidth and lower latency of these networks enable faster and more reliable dissemination of critical information during emergencies.

Federal Signal can leverage these technological shifts to develop next-generation solutions for emergency alerts and public safety. The ability to transmit richer data, including video and real-time sensor information, through these enhanced networks will empower more effective and targeted public safety responses. For instance, the global public safety communication market was valued at approximately $120 billion in 2023 and is projected to grow significantly, driven by such technological upgrades.

- 5G-Advanced Networks: Facilitate faster, more reliable, and higher-capacity communication for public alerts.

- IoT Integration: Enable seamless connection of various devices for comprehensive data collection and dissemination in emergency scenarios.

- AI-Powered Analytics: Enhance predictive capabilities for threat assessment and optimize alert delivery based on real-time conditions.

Automation and Robotics in Industrial Applications

The growing integration of automation and robotics within industrial and waste management sectors directly impacts Federal Signal's product development. As more facilities adopt AI-powered machinery for tasks like waste sorting and processing, the demand for sophisticated, integrated safety and environmental monitoring systems will rise. For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a strong trend towards automation that Federal Signal can leverage.

This technological shift necessitates that Federal Signal's offerings evolve to seamlessly interface with these advanced automated systems. The efficiency gains from AI in waste processing, such as improved material identification and separation, create opportunities for Federal Signal to provide complementary safety solutions that monitor and manage these high-speed, automated operations. By 2025, it's estimated that AI will contribute trillions to the global economy, underscoring the pervasive influence of this technology across industries Federal Signal serves.

- Increased demand for integrated safety systems for automated industrial processes.

- Opportunity to develop solutions that enhance efficiency in AI-driven waste management.

- Need for interoperability between Federal Signal products and advanced robotics.

Federal Signal is enhancing its public safety solutions by integrating AI and IoT, enabling smart city functionalities like predictive policing and optimized waste collection. Global smart city spending was projected to exceed $200 billion in 2024, highlighting the market's growth and Federal Signal's potential to benefit from connected emergency systems and intelligent traffic management.

The company is also adapting to the rise of electric vehicles, with the global EV market expected to surpass 25 million units by 2024. Federal Signal's development of electric variants for its product lines, such as street sweepers and emergency vehicles, aligns with this trend, promising new revenue streams and a stronger market position.

Furthermore, Federal Signal is leveraging AI for predictive maintenance, with machine learning algorithms reducing maintenance costs by up to 30% and improving equipment uptime by 20%. The rollout of 5G-Advanced networks is also a key factor, enabling more robust public warning systems and facilitating richer data transmission for emergency services, a market valued at approximately $120 billion in 2023.

| Technology Trend | Impact on Federal Signal | Market Data/Projection |

|---|---|---|

| IoT & AI Integration | Enhanced public safety and efficiency (e.g., predictive policing, smart waste management) | Global smart city spending > $200 billion (2024) |

| Electric Vehicle Adoption | Opportunity for electric variants of existing products | Global EV market > 25 million units (2024) |

| AI-Powered Predictive Maintenance | Reduced downtime and operational costs for clients | Up to 30% reduction in maintenance costs, 20% uptime improvement |

| 5G-Advanced Networks | Improved public warning and mass notification systems | Public safety communication market ~$120 billion (2023) |

Legal factors

Federal Signal's industrial clients must strictly follow Occupational Safety and Health Administration (OSHA) standards, which directly boosts demand for their compliant safety and security systems. For instance, OSHA's 2024 data indicated a 4.2% decrease in workplace injuries, partly due to increased compliance efforts.

Anticipated OSHA updates for 2025 are expected to emphasize more rigorous recordkeeping, specialized protections for high-risk environments, and a greater focus on worker mental health. Federal Signal's integrated communication and alert systems are well-positioned to help businesses meet these evolving regulatory requirements.

The Environmental Protection Agency (EPA) sets crucial regulations that directly influence Federal Signal's product development, particularly concerning vehicle emissions and waste management. These standards shape the design and performance criteria for the company's environmental solutions.

For instance, upcoming EPA emission standards for heavy-duty vehicles, slated for implementation starting with the 2027 model year, will necessitate significant adaptations in manufacturing processes and product offerings for companies like Federal Signal.

Federal Signal’s ability to secure government contracts hinges on strict adherence to intricate procurement laws. These regulations, covering transparency, fair competition, and debarment, are constantly updated, demanding continuous compliance efforts. For instance, in 2024, the US government continued to emphasize cybersecurity requirements in its procurement processes, impacting how companies like Federal Signal must secure their data and systems to bid on federal contracts.

Recent legislative efforts in the UK, such as reforms aimed at simplifying public procurement, also introduce new compliance obligations. These changes, which began implementation in late 2023 and continued through 2024, require suppliers to navigate updated tender processes and reporting standards to ensure eligibility for public sector work. Failure to comply can lead to disqualification or even debarment from future government opportunities.

Product Liability and Safety Standards

Federal Signal operates under strict product liability laws and evolving safety standards, especially for its emergency vehicle equipment and industrial safety systems. For instance, in 2024, the National Highway Traffic Safety Administration (NHTSA) continued to emphasize advanced driver-assistance systems (ADAS) integration, impacting how warning lights and sirens are designed and tested for visibility and distraction potential. Failure to meet these rigorous requirements can result in costly recalls, significant legal penalties, and severe damage to the company's reputation.

The company must navigate a complex web of regulations governing the performance and reliability of its products. These include standards set by organizations like Underwriters Laboratories (UL) for industrial safety equipment and specific Federal Motor Vehicle Safety Standards (FMVSS) for vehicle-mounted systems. In 2025, expect increased scrutiny on the electromagnetic compatibility (EMC) of electronic warning systems to prevent interference with other vehicle electronics, a critical factor for public safety communications.

- Product Liability: Federal Signal faces potential lawsuits for product defects or failures, necessitating robust quality control and testing.

- Safety Standards Compliance: Adherence to FMVSS, UL, and other industry-specific safety certifications is paramount for market access and product integrity.

- Recall Costs: Non-compliance can trigger expensive product recalls, impacting financial performance and market trust.

- Reputational Risk: Safety incidents or product failures can lead to significant negative publicity and erosion of brand credibility.

Data Privacy and Cybersecurity Laws

As Federal Signal increasingly embeds smart technologies and connected systems into its diverse product lines, navigating the complex landscape of data privacy and cybersecurity regulations is paramount. Compliance with global standards like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) directly impacts how Federal Signal handles data collected from its public safety and smart city solutions. For instance, the increasing sophistication of connected emergency response systems necessitates robust data protection measures to safeguard sensitive information, a trend underscored by the global cybersecurity market, projected to reach over $300 billion by 2025.

Protecting the sensitive data generated by Federal Signal's public safety and smart city solutions is not just a legal requirement but a critical trust factor for its clients. Failure to adequately secure this data could lead to significant reputational damage and financial penalties. In 2024, data breaches cost companies an average of $4.73 million globally, highlighting the substantial financial implications of inadequate cybersecurity, a figure expected to rise as cyber threats evolve.

- Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is essential for Federal Signal's connected technologies.

- Cybersecurity Investment: Significant investment in cybersecurity infrastructure is required to protect sensitive data from breaches.

- Reputational Risk: Data breaches can severely damage Federal Signal's reputation and client trust in its public safety solutions.

- Evolving Threat Landscape: Continuous adaptation to new cyber threats is necessary to maintain data integrity and compliance.

Federal Signal must navigate a complex web of product liability laws and evolving safety standards, particularly for its emergency vehicle equipment and industrial safety systems. For example, the National Highway Traffic Safety Administration (NHTSA) continued to emphasize advanced driver-assistance systems (ADAS) integration in 2024, impacting how warning lights and sirens are designed and tested for visibility and distraction. Failure to meet these rigorous requirements can result in costly recalls, significant legal penalties, and severe damage to the company's reputation.

The company also faces stringent regulations concerning data privacy and cybersecurity, especially with its increasing integration of smart technologies. Compliance with global standards like GDPR and CCPA is crucial for its public safety and smart city solutions. By 2025, the global cybersecurity market is projected to exceed $300 billion, underscoring the significant investment required to protect sensitive data from evolving cyber threats and maintain client trust.

| Legal Factor | Impact on Federal Signal | 2024/2025 Relevance |

| Product Liability & Safety Standards | Ensures product performance and reliability; non-compliance leads to recalls, penalties, and reputational damage. | NHTSA's focus on ADAS in 2024 affects warning system design; expect increased scrutiny on electromagnetic compatibility (EMC) in 2025 for electronic warning systems. |

| Data Privacy & Cybersecurity | Protects sensitive data in connected systems; non-compliance results in financial penalties and loss of trust. | Global cybersecurity market projected over $300 billion by 2025; data breaches cost an average of $4.73 million globally in 2024. |

Environmental factors

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, are creating a heightened demand for specialized emergency response and infrastructure maintenance equipment. This trend directly benefits companies like Federal Signal, whose robust vehicles are essential for disaster relief, recovery, and essential clean-up operations, signaling a positive outlook for their product lines.

Global and local waste reduction initiatives are gaining momentum, with many municipalities aiming for higher recycling rates. For instance, the U.S. EPA reported that in 2021, the national recycling and composting rate was 32.1%, a figure that continues to be a focus for improvement. This push towards a circular economy directly benefits companies like Federal Signal, whose specialized vacuum trucks are essential for efficient waste collection and material recovery.

Governments globally are intensifying efforts to curb emissions, with many setting ambitious targets for reducing greenhouse gases. For instance, the United States aims to cut emissions by 50-52% below 2005 levels by 2030, influencing sectors like transportation and emergency services. This regulatory push directly encourages the development and uptake of electric and low-emission vehicles, impacting companies like Federal Signal that serve these markets.

Federal Signal is strategically aligning its product development with these environmental mandates, focusing on sustainable solutions. The company's investment in and offering of electric and hybrid vehicle technologies, such as their electric street sweepers and low-emission emergency vehicle components, directly addresses this growing market demand. This proactive approach positions Federal Signal to capitalize on the transition to greener fleets, anticipating a significant market shift in the coming years.

Water Conservation and Management

Growing concerns over water scarcity and pollution are driving a greater need for effective water management strategies. This trend directly benefits companies like Federal Signal, whose product lines include hydro-excavators and high-pressure waterblasting equipment. These tools are crucial for maintaining infrastructure in an environmentally responsible manner.

The demand for water-efficient technologies is on the rise. For instance, the global water and wastewater treatment market was valued at approximately $650 billion in 2023 and is projected to grow significantly, indicating a strong market for solutions that promote conservation. Federal Signal's offerings align with this market expansion.

- Increased regulatory pressure on water usage and discharge is pushing industries towards more sustainable practices.

- Technological advancements in water reclamation and efficient application methods are enhancing the appeal of specialized equipment.

- Public awareness campaigns regarding water quality and conservation are influencing consumer and corporate behavior, favoring environmentally conscious solutions.

Corporate Sustainability and ESG Reporting

Companies like Federal Signal are facing growing scrutiny regarding their environmental impact. This pressure is translating into tangible business decisions, with a significant portion of B2B buyers now considering a supplier's sustainability performance when making purchasing choices. For instance, a 2024 survey indicated that over 60% of businesses factor ESG credentials into their procurement processes.

Federal Signal's customers, particularly those in government and large industrial sectors, are increasingly prioritizing suppliers that demonstrate strong environmental stewardship and align with their own Environmental, Social, and Governance (ESG) goals. This trend is driven by both regulatory requirements and a desire to enhance their own corporate image.

- Growing Customer Demand: A substantial percentage of B2B purchasing decisions in 2024 were influenced by supplier ESG performance.

- Alignment with Client Goals: Federal Signal's clients are actively seeking partnerships that support their own sustainability objectives.

- Market Differentiation: Strong ESG reporting can serve as a competitive advantage for Federal Signal in securing contracts.

- Regulatory Influence: Evolving environmental regulations worldwide are pushing companies to demand more sustainable solutions from their vendors.

The increasing focus on sustainability and emissions reduction is a significant environmental factor for Federal Signal. As governments worldwide implement stricter regulations, there's a growing demand for cleaner technologies. For instance, the U.S. aims to cut emissions by 50-52% below 2005 levels by 2030, directly impacting the transportation and emergency services sectors Federal Signal serves.

Federal Signal is responding by investing in electric and hybrid vehicle options, such as electric street sweepers. This strategic alignment with environmental mandates positions the company to benefit from the market shift towards greener fleets and sustainable solutions.

Water management is another key environmental consideration. Growing concerns about water scarcity and pollution are driving the need for effective water management strategies, benefiting Federal Signal's hydro-excavators and waterblasting equipment. The global water and wastewater treatment market was valued at approximately $650 billion in 2023, underscoring the market's expansion for such solutions.

| Environmental Factor | Impact on Federal Signal | Supporting Data/Trend |

| Climate Change & Extreme Weather | Increased demand for disaster response equipment | Escalating frequency and severity of extreme weather events |

| Waste Reduction Initiatives | Demand for specialized waste collection vehicles | Global push for higher recycling rates; U.S. recycling rate was 32.1% in 2021 |

| Emissions Reduction Targets | Demand for electric and low-emission vehicles | U.S. target: 50-52% reduction below 2005 levels by 2030 |

| Water Management & Conservation | Demand for water management equipment | Global water/wastewater treatment market ~ $650 billion in 2023 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Federal Signal is grounded in data from government regulatory bodies, industry-specific publications, and economic forecasting agencies. We meticulously gather information on political stability, economic indicators, technological advancements, and environmental policies to provide a comprehensive view.