Federal Signal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Federal Signal operates in a landscape shaped by intense rivalry and the constant threat of substitutes, impacting their pricing power and market share. Understanding the nuances of supplier leverage and buyer bargaining is crucial for navigating this competitive environment effectively.

The complete report reveals the real forces shaping Federal Signal’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Federal Signal's reliance on specialized components for its advanced safety, security, and environmental solutions means it likely sources these from a concentrated group of suppliers. This concentration can give those suppliers significant leverage, potentially allowing them to dictate terms and pricing.

For instance, if a key supplier for Federal Signal's emergency lighting systems or siren technology controls a substantial portion of the market, they can command higher prices. This directly impacts Federal Signal's cost of goods sold, potentially squeezing profit margins if the company cannot pass these increased costs onto its customers.

High switching costs significantly bolster supplier power for Federal Signal. Consider the scenario where a company needs to transition from a supplier of highly specialized electronic components for its emergency vehicle warning systems. The expense of re-tooling manufacturing lines to accommodate new parts, coupled with the rigorous re-certification processes required for safety-critical equipment, can easily run into hundreds of thousands or even millions of dollars. This financial barrier makes it difficult for Federal Signal to simply switch to a competitor, thereby granting existing suppliers greater leverage in price negotiations and contract terms.

Federal Signal's reliance on suppliers for unique or proprietary components significantly impacts its bargaining power. When specific parts are essential for advanced technology or custom designs, suppliers offering these exclusive items gain considerable leverage. This is because alternative sources are often scarce or nonexistent, making Federal Signal more dependent on these specialized providers.

Supplier's Importance to Federal Signal

The bargaining power of suppliers for Federal Signal hinges on how crucial their business is to those suppliers. If Federal Signal constitutes a minor part of a supplier's total sales, that supplier might have more leverage, particularly for essential components. For instance, if a supplier of specialized electronic components for Federal Signal's emergency vehicle lighting systems serves many other industries, Federal Signal's order volume might not be significant enough to command preferential pricing or terms.

This dynamic is amplified when suppliers offer unique or highly specialized inputs that are difficult for Federal Signal to source elsewhere. In such cases, even a substantial customer like Federal Signal may find it challenging to negotiate favorable terms if the supplier has limited alternative markets for their specialized products. In 2024, companies across various manufacturing sectors reported that a significant portion of their cost of goods sold was tied to specialized components, underscoring the potential impact of supplier power.

- Supplier Dependence: Federal Signal's leverage with suppliers is inversely related to how much of a supplier's revenue Federal Signal represents.

- Input Criticality: The importance of a supplier's product to Federal Signal's operations and the availability of substitutes significantly influence supplier power.

- Market Concentration: If suppliers operate in concentrated markets with few competitors, their bargaining power increases.

- Component Specialization: Suppliers of unique or highly specialized components essential for Federal Signal's product lines often wield considerable influence.

Forward Integration Threat

If key suppliers for Federal Signal possess the necessary technical expertise and substantial financial backing, they could potentially explore forward integration. This means they might begin manufacturing some of Federal Signal's own products. While this is less common in highly specialized manufacturing sectors, it represents a significant escalation of supplier power.

Should suppliers move into direct manufacturing, Federal Signal would lose its role as a crucial intermediary. This would drastically alter the competitive landscape, giving suppliers greater control over pricing and market access. For instance, if a supplier of critical electronic components for Federal Signal's emergency vehicle warning systems decided to produce the entire system, it would directly compete with Federal Signal.

- Suppliers could leverage their manufacturing capabilities to produce Federal Signal's finished goods.

- This threat would diminish Federal Signal's value proposition by removing its manufacturing expertise.

- In 2023, Federal Signal reported revenues of $2.2 billion, highlighting the scale of operations that could be impacted by such integration.

Federal Signal's bargaining power with its suppliers is significantly influenced by the concentration of the supplier market and the uniqueness of the components it requires. When suppliers operate in markets with few alternatives and provide specialized inputs essential for Federal Signal's advanced safety and environmental solutions, their leverage increases substantially. This situation can lead to higher costs for Federal Signal, impacting its profitability if these costs cannot be passed on to customers.

The criticality of a supplier's product to Federal Signal's operations and the ease with which Federal Signal can switch suppliers are key determinants of supplier power. High switching costs, involving re-tooling and re-certification for specialized safety equipment, make it difficult for Federal Signal to change suppliers, thereby strengthening the hand of existing providers in negotiations.

The bargaining power of suppliers is also affected by how vital Federal Signal's business is to them. If Federal Signal represents a small portion of a supplier's sales, especially for essential components, the supplier may have more leverage. This is particularly true if the supplier serves multiple industries, reducing Federal Signal's ability to negotiate favorable terms based on its order volume alone.

In 2024, many manufacturers experienced increased costs due to the reliance on specialized components, a trend that directly affects companies like Federal Signal. The potential for suppliers to engage in forward integration, by manufacturing Federal Signal's finished products, presents an extreme escalation of supplier power, threatening to disrupt Federal Signal's market position.

| Factor | Impact on Federal Signal | 2024 Data/Context |

|---|---|---|

| Supplier Market Concentration | Increased supplier leverage if few competitors exist. | Many specialized component markets are oligopolistic. |

| Component Specialization & Uniqueness | Higher supplier power due to limited alternatives. | Federal Signal relies on proprietary tech for niche markets. |

| Switching Costs for Federal Signal | Lowers Federal Signal's ability to change suppliers. | Significant investment in re-tooling and re-certification for safety equipment. |

| Supplier Dependence on Federal Signal | Reduced supplier leverage if Federal Signal is a major customer. | Federal Signal's 2023 revenue was $2.2 billion, suggesting significant order volumes. |

What is included in the product

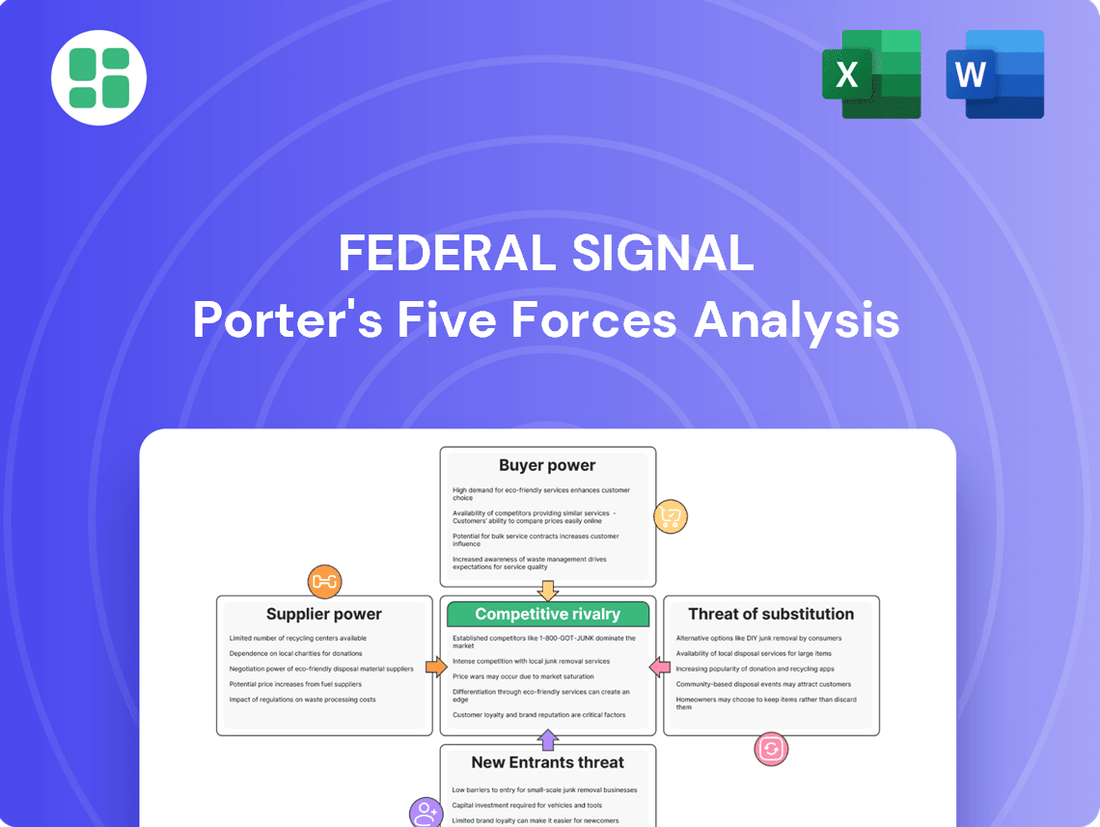

Federal Signal's Five Forces analysis reveals the intensity of competition, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly visualize competitive intensity with a dynamic, interactive Porter's Five Forces model, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Federal Signal's diverse customer base, encompassing municipal, governmental, industrial, and commercial sectors, is a significant factor in mitigating customer bargaining power. This broad reach means that no single customer segment or entity holds a disproportionate sway over pricing or terms. For instance, in 2023, sales to the municipal and governmental sector, a core area for Federal Signal, remained robust, contributing a substantial portion to their overall revenue, thereby diluting the impact of any individual customer's demands.

For many of Federal Signal's highly specialized offerings, like integrated safety and security systems or substantial environmental vehicles, customers encounter significant hurdles when considering a switch. These barriers are often rooted in the substantial investments already made in training personnel, ensuring compatibility with existing infrastructure, and the inherent long service life of the durable equipment itself.

These factors collectively diminish a customer's flexibility to readily transition to a competitor's products. For instance, a municipality investing millions in Federal Signal's specialized fleet management and emergency response systems would incur considerable costs for retraining operators, reconfiguring communication networks, and potentially writing off the remaining value of their current, albeit functional, equipment. This makes switching a less attractive proposition, thereby strengthening Federal Signal's position against customer pressure.

The critical nature of Federal Signal's products for public safety, worker safety, and essential infrastructure means customers are less likely to switch or demand steep price cuts. For instance, in 2023, Federal Signal reported that its Safety and Security segment, which includes many of these critical products, saw robust demand, underscoring their indispensable role in customer operations.

Fragmented Customer Demand

Federal Signal's customer base, while including significant governmental contracts, is largely fragmented. This means demand is spread across many different municipalities, industrial sites, and commercial businesses, rather than being concentrated with a few large buyers.

This widespread customer distribution significantly dilutes the bargaining power of any single customer. Because no individual client typically represents a substantial percentage of Federal Signal's overall revenue, their ability to negotiate favorable terms or prices is inherently limited.

For instance, in 2023, Federal Signal reported total revenue of $2.3 billion. This vast revenue base, derived from a diverse array of clients, underscores the lack of dominance by any one customer segment.

- Fragmented Demand: Federal Signal serves a wide range of customers, including numerous municipalities, industrial facilities, and commercial enterprises.

- Limited Individual Leverage: No single customer typically accounts for a significant portion of the company's total sales, reducing individual bargaining power.

- Revenue Diversification: The company's $2.3 billion in 2023 revenue highlights the broad customer base that prevents any one entity from dictating terms.

Budgetary Constraints of Public Sector Clients

Federal Signal's reliance on public sector clients means these customers often face significant budgetary limitations. This directly translates into heightened price sensitivity and a preference for competitive bidding processes, especially for substantial government contracts.

These budgetary constraints empower public sector clients, as they can leverage their purchasing power to negotiate more favorable terms. For instance, in 2023, government spending on public safety equipment, a key market for Federal Signal, saw continued pressure due to evolving fiscal priorities and inflation, impacting procurement decisions.

- Price Scrutiny: Public sector procurement often involves rigorous price comparisons and justification, forcing suppliers to offer their most competitive pricing.

- Competitive Bidding: Large government contracts typically require open bidding, allowing multiple suppliers to compete, which further drives down prices.

- Budgetary Limits: Agencies operate within allocated funds, making them highly sensitive to cost overruns and encouraging negotiation to stay within budget.

- Procurement Processes: Formal, often lengthy, government procurement procedures can add complexity and provide opportunities for clients to exert influence on contract terms.

Federal Signal's diverse customer base, spread across municipal, governmental, industrial, and commercial sectors, significantly dilutes the bargaining power of any single customer. With total revenues reaching $2.3 billion in 2023, the company's broad client distribution means no individual entity typically accounts for a substantial portion of sales, limiting their leverage in negotiations.

The specialized nature and high switching costs associated with Federal Signal's products, such as integrated safety systems and specialized vehicles, further reduce customer bargaining power. The substantial investments in training, infrastructure compatibility, and the long service life of the equipment make it economically impractical for customers to readily switch to competitors.

While public sector clients often face budgetary constraints and engage in competitive bidding, Federal Signal's critical product offerings for public safety and essential infrastructure reduce extreme price sensitivity. The indispensable nature of their equipment means customers are less likely to push for drastic price reductions, even within procurement processes.

| Customer Segment | 2023 Revenue Contribution (Illustrative) | Impact on Bargaining Power |

|---|---|---|

| Municipal & Governmental | ~50-60% (Estimated) | Moderate to High (due to bidding processes and budget constraints) |

| Industrial & Commercial | ~40-50% (Estimated) | Low to Moderate (due to specialization and switching costs) |

What You See Is What You Get

Federal Signal Porter's Five Forces Analysis

This preview shows the exact Federal Signal Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This professionally formatted document is ready for your immediate use, providing actionable intelligence without any surprises.

Rivalry Among Competitors

Federal Signal operates in the safety, security, and environmental solutions market, a sector that, while substantial, is characterized by numerous specialized segments. Within these niches, Federal Signal often commands a leading market share, frequently holding the number one or two spot. For instance, in the emergency vehicle lighting and warning systems market, the company is a dominant player.

While the overall market may appear fragmented with many participants, the direct competitive intensity can be less pronounced in specific product categories where Federal Signal has established a strong leadership position. This specialization allows the company to leverage its expertise and brand recognition, mitigating some of the pressures from a broader, more generalized competitive landscape.

Federal Signal actively differentiates its offerings by highlighting 'equipment of unmatched quality' and pioneering innovative solutions, such as its advancements in electrification. This strategic emphasis on superior quality, cutting-edge technology, and a commitment to sustainability helps to steer clear of direct price wars with competitors. For instance, their investment in electric vehicle technology positions them ahead of many legacy players.

Federal Signal operates in an industry characterized by high fixed costs due to the significant capital required for manufacturing heavy equipment and complex safety systems. This includes substantial investments in advanced facilities, ongoing research and development, and the cultivation of specialized labor. For instance, the development and production of sophisticated emergency vehicle lighting and siren systems demand considerable upfront expenditure.

These substantial fixed costs, coupled with considerable exit barriers, create a challenging environment for competitors. Exit barriers arise from the specialized nature of the assets and the difficulty in redeploying them if a company decides to leave the market. Consequently, companies are often incentivized to continue competing vigorously, even during periods of economic slowdown, in an effort to recoup their initial investments and avoid substantial losses associated with exiting the industry.

Strategic Acquisitions and Consolidation

Federal Signal's proactive acquisition strategy significantly shapes competitive rivalry. By integrating companies that broaden its product offerings, customer base, and service capabilities, Federal Signal escalates the competitive pressure on smaller, independent businesses. This consolidation trend, driven by M&A, leads to fewer, larger players dominating market segments.

This M&A activity not only intensifies rivalry but also fosters market consolidation, creating a more concentrated industry structure. Federal Signal's stated goal of muting cyclicality through diversification via acquisitions means it's actively working to strengthen its position against competitors by offering a more comprehensive suite of solutions.

- Federal Signal's acquisition of Pye-Barker Fire & Safety in 2023 for $335 million exemplifies this strategy, adding significant fire and life safety solutions.

- The company has historically used acquisitions to gain scale and expand into adjacent markets, a tactic that inherently raises the bar for competitors.

- This consolidation can lead to greater pricing power for larger entities and potentially squeeze margins for smaller rivals unable to achieve similar economies of scale.

Competitor Landscape and Market Share

Federal Signal operates in a competitive landscape with significant players such as Oshkosh Corp, Dover Corp, Alamo Group Inc., Schneider Electric, and Honeywell. These companies, while varying in size, actively compete across Federal Signal's diverse product segments.

Despite the presence of larger entities, Federal Signal has carved out robust market positions within its specialized niches. This suggests that while rivalry is present, it is manageable, with product performance and long-standing customer relationships playing a critical role in maintaining competitive advantage.

- Key Competitors: Oshkosh Corp, Dover Corp, Alamo Group Inc., Schneider Electric, Honeywell.

- Market Positioning: Federal Signal holds strong positions in specialized niches.

- Competitive Dynamics: Rivalry is characterized by a focus on product performance and established relationships.

Competitive rivalry for Federal Signal is present, with established players like Oshkosh Corp and Dover Corp vying for market share. However, Federal Signal's strategy of focusing on specialized niches where it holds leading positions, such as emergency vehicle lighting, mitigates direct, head-on competition. The company's emphasis on quality and innovation, exemplified by its investment in electric vehicle technology, further differentiates it from competitors and helps avoid pure price-based battles.

| Competitor | Approximate Revenue (2023, USD Billions) | Key Market Overlap |

|---|---|---|

| Oshkosh Corp | 4.5 | Emergency Vehicles, Municipal Equipment |

| Dover Corp | 8.4 | Industrial Automation, Specialty Products |

| Alamo Group Inc. | 1.3 | Municipal and Agricultural Equipment |

| Schneider Electric | 35.9 | Energy Management, Automation Solutions |

| Honeywell | 36.7 | Building Technologies, Safety & Productivity Solutions |

SSubstitutes Threaten

While Federal Signal is a key player in public safety equipment, the threat of substitutes exists, particularly in communication and incident management. Advancements in cellular networks, private LTE, and satellite communication offer alternative ways to transmit data and manage incidents, potentially reducing reliance on some traditional Federal Signal products. For instance, the global public safety communication market was valued at approximately $11.5 billion in 2023 and is projected to grow, indicating a competitive landscape where new technologies can emerge as substitutes.

However, for the core physical equipment Federal Signal offers, such as sirens, warning lights, and robust communication systems designed for harsh environments, direct and practical substitutes are scarce. These specialized products are engineered for reliability and specific operational needs that many alternative technologies cannot fully replicate. The durability and specialized functionality of Federal Signal's hardware often present a barrier to substitution in critical public safety scenarios.

For specific environmental or industrial cleaning needs, customers might opt for generic or multi-purpose equipment instead of Federal Signal's specialized vehicles. These less specialized, often cheaper, alternatives can represent a threat, especially for clients with tighter budgets or less complex operational requirements.

Smaller municipalities or certain industrial clients may choose to handle tasks like street sweeping or sewer cleaning using their own in-house maintenance crews and less sophisticated equipment. This approach, while often less efficient and potentially less thorough, offers a lower-cost alternative to acquiring Federal Signal's specialized, advanced machinery.

Rental Market for Specialty Equipment

The rental market for specialty equipment, such as street sweepers and vacuum trucks, presents a significant threat of substitution for Federal Signal. Customers can opt to rent this equipment instead of purchasing it outright, which offers greater flexibility and avoids substantial capital outlay. This can directly impact Federal Signal's new equipment sales.

For instance, in 2024, the global construction equipment rental market was valued at over $110 billion, indicating a robust alternative to ownership. This trend highlights how readily available rental options can curb demand for new capital equipment purchases.

- Rental Availability: The widespread availability of rental units for specialized vehicles like street sweepers and vacuum trucks provides a direct substitute for purchasing new equipment.

- Cost-Effectiveness: Renting reduces upfront capital expenditure and can be more cost-effective for short-term or intermittent needs, thereby impacting Federal Signal's sales volume.

- Market Dynamics: A strong rental market can influence purchasing decisions, particularly for municipalities or contractors with budget constraints or fluctuating project demands.

- Competitive Landscape: While Federal Signal also offers rental services, the presence of third-party rental companies intensifies this competitive pressure.

Shifting Regulatory or Policy Focus

Changes in regulatory landscapes, particularly concerning environmental standards and public safety, pose a significant threat of substitutes for Federal Signal's product lines. For instance, stricter emissions regulations could favor alternative technologies over traditional combustion-engine-based warning systems.

A notable example is the potential shift in public safety policies that might prioritize non-equipment-based solutions. Consider the growing emphasis on preventative maintenance strategies across various industries, which could diminish the demand for reactive maintenance equipment Federal Signal offers, such as certain types of industrial cleaning or inspection tools.

The evolving regulatory environment in 2024 and projected into 2025 highlights this threat. For example, a hypothetical increase in mandates for quieter, less disruptive emergency vehicle sirens could drive demand for alternative auditory or visual signaling technologies that are not currently core to Federal Signal's offerings.

- Regulatory Shifts: Evolving environmental and public safety policies can create demand for alternative solutions.

- Policy Impact: A move towards preventative strategies may reduce the need for reactive equipment.

- Market Adaptation: New regulations could spur the development and adoption of entirely new, non-equipment-based solutions.

- Competitive Landscape: Such shifts can introduce new competitors offering novel, regulation-compliant alternatives.

For Federal Signal's core public safety equipment like sirens and warning lights, direct substitutes are minimal due to specialized design and reliability needs. However, advancements in communication technology, such as private LTE and satellite systems, offer alternative methods for incident management and data transmission, potentially reducing reliance on some of Federal Signal's communication products. The global public safety communication market was valued at around $11.5 billion in 2023, indicating a dynamic space where new technologies can emerge as substitutes.

The rental market for specialized vehicles, like street sweepers and vacuum trucks, presents a significant threat. Customers can rent this equipment instead of purchasing, offering flexibility and avoiding large capital outlays. The global construction equipment rental market exceeded $110 billion in 2024, underscoring the strength of this alternative to ownership and impacting new equipment sales.

Changes in regulations, particularly for environmental standards and public safety, can favor alternative technologies. For instance, stricter emissions rules could push demand towards solutions other than traditional combustion-engine warning systems. The evolving regulatory landscape in 2024 and 2025 may also see a preference for preventative strategies, potentially reducing demand for reactive maintenance equipment.

Entrants Threaten

Entering the specialized manufacturing sector for heavy-duty environmental vehicles and advanced safety systems, like those Federal Signal operates in, demands a significant upfront capital outlay. This includes substantial investments in research and development to innovate complex technologies, establishing state-of-the-art manufacturing plants, and building robust distribution and service networks. For example, developing a new line of advanced emergency response vehicles can easily cost tens of millions of dollars before the first unit is even sold.

The threat of new entrants for Federal Signal, particularly in its public safety and environmental solutions segments, is significantly mitigated by substantial regulatory hurdles and the need for rigorous certifications. Companies looking to enter these markets must navigate a complex web of federal, state, and local regulations, which can be incredibly time-consuming and expensive to understand and comply with. For instance, products designed for emergency response or environmental monitoring often require specific approvals from agencies like the FCC, EPA, or NHTSA, adding substantial barriers to entry.

Federal Signal, a company with a legacy dating back to 1901, has cultivated a robust brand reputation and deep-seated customer relationships. This long-standing presence has allowed them to build trust and a perception of quality and reliability among their core clientele in municipal, governmental, and industrial sectors.

Newcomers face a significant hurdle in replicating this established goodwill. Building the necessary trust and enduring relationships to challenge Federal Signal's market position would likely require substantial time and investment, making the threat of new entrants relatively low in this regard.

Proprietary Technology and Patents

Federal Signal's commitment to innovation, including its focus on electrification and advanced systems, is a significant deterrent to new entrants. The company holds proprietary technologies and patents, alongside specialized manufacturing know-how. This creates a substantial hurdle, as new competitors would need considerable research and development investment to match Federal Signal's product performance and feature set.

For instance, Federal Signal's investments in new product development, which often lead to patentable technologies, directly impact the threat of new entrants. In 2023, the company reported significant capital expenditures aimed at enhancing its product portfolio and manufacturing capabilities, further solidifying its technological advantage.

- Proprietary technology and patents act as a strong barrier to entry.

- Significant R&D investment is required for new entrants to replicate Federal Signal's product performance.

- Electrification initiatives represent a forward-looking area where Federal Signal is building a technological lead.

- Specialized manufacturing expertise is difficult and costly for newcomers to acquire.

Extensive Aftermarket and Service Network

The extensive aftermarket and service network Federal Signal has cultivated presents a significant barrier to new entrants. This network, encompassing readily available parts, specialized service, and efficient repair capabilities, is vital for ensuring the extended operational life and reliability of their critical infrastructure equipment. For instance, in 2023, Federal Signal reported that its aftermarket and service revenue contributed a substantial portion to its overall financial performance, underscoring the value and demand for these offerings.

Establishing a comparable service infrastructure requires considerable investment in logistics, trained personnel, and geographic reach, making it a daunting challenge for newcomers. This deep-rooted support system not only fosters customer loyalty but also creates a substantial competitive moat, as new players would struggle to match the speed and comprehensiveness of Federal Signal's existing support capabilities.

- Significant Capital Investment: New entrants need substantial upfront capital to build a comparable network of service centers, spare parts inventory, and trained technicians.

- Geographic Reach: Federal Signal's established presence across various regions allows for quicker response times and localized support, a difficult feat for a new competitor to replicate.

- Customer Trust and Loyalty: Existing customers rely on Federal Signal's proven track record and dependable service, making it challenging for new entrants to gain market share.

- Operational Expertise: Years of experience in managing complex service operations translate into efficiencies and a deeper understanding of customer needs that new entrants lack.

The threat of new entrants for Federal Signal is generally low due to high capital requirements and established brand loyalty. Significant investments in R&D, manufacturing, and distribution networks are necessary, creating a substantial barrier. For instance, developing new environmental vehicles can cost tens of millions. Furthermore, Federal Signal's long history, dating back to 1901, has fostered deep customer relationships and a strong reputation for quality and reliability, making it difficult for newcomers to gain trust.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Federal Signal is built upon a foundation of publicly available financial data from SEC filings, industry-specific market research reports from firms like IBISWorld, and news from trade publications to capture competitive dynamics.