Federal Signal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

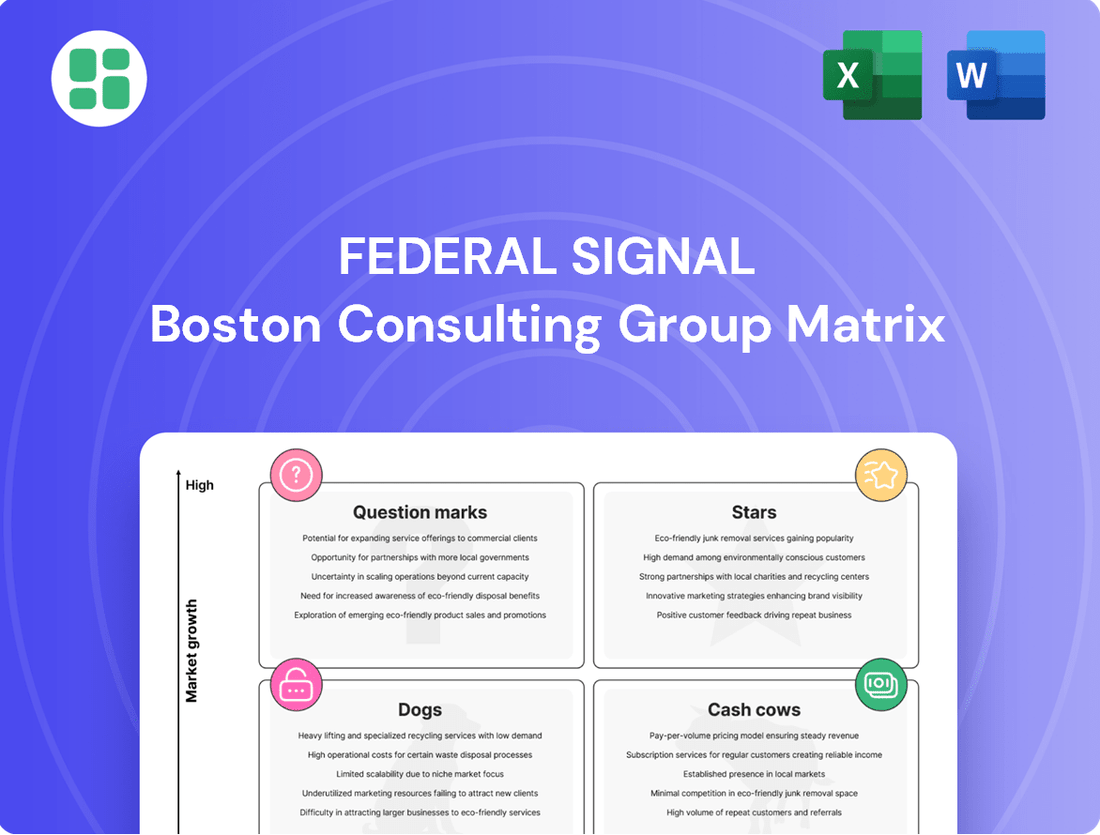

Unlock the strategic potential of Federal Signal's product portfolio with our comprehensive BCG Matrix. This powerful tool categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, offering a clear snapshot of their market performance and growth opportunities.

Don't settle for a glimpse; dive into the full Federal Signal BCG Matrix to gain actionable insights and a roadmap for optimizing your investments. Understand precisely where to allocate resources for maximum impact and competitive advantage.

Purchase the complete BCG Matrix today for a detailed analysis, including data-backed recommendations and a clear visualization of Federal Signal's market position. Equip yourself with the strategic clarity needed to make informed decisions and drive future success.

Stars

Federal Signal's Advanced Environmental Infrastructure Solutions, a key component of its BCG Matrix, is experiencing significant growth. Recent strategic acquisitions, like Hog Technologies, have fortified Federal Signal's standing in rapidly expanding markets such as road marking, line removal, and waterblasting equipment. This expansion is fueled by a global surge in infrastructure development and upgrades.

The Environmental Solutions Group within Federal Signal demonstrated impressive momentum, reporting an 18% sales increase in the second quarter of 2025. This robust performance underscores the company's strong market leadership in these specialized, high-demand environmental infrastructure niches.

High-performance street sweepers and vacuum trucks, like the Elgin RegenX™ regenerative air sweeper, exemplify Federal Signal's commitment to innovative environmental solutions. These machines offer substantial fuel savings and lower emissions, appealing to a market increasingly focused on sustainability.

Federal Signal's advanced sweepers are gaining traction in the municipal and industrial cleaning equipment sector, a market experiencing robust growth. This increasing market share directly fuels the Environmental Solutions Group's expansion, driven by strong customer demand.

The company reported that its Environmental Solutions Group saw a significant increase in revenue in 2024, partly due to strong sales of these high-performance sweepers. Production capacity for these units has also been expanded to meet this rising demand.

Hydro-excavation equipment, like Federal Signal's TRUVAC brand, is experiencing robust demand driven by the critical need for safe digging and underground utility protection. This trend is further amplified by continuous infrastructure development and necessary replacement projects across the nation.

Federal Signal's position as a market leader in this essential sector is solidified by the ongoing growth in hydro-excavation. The company's Environmental Solutions Group, which includes TRUVAC, reported a substantial backlog as of the first quarter of 2024, offering strong forward visibility for these revenue streams.

Aftermarket Offerings for Environmental Solutions

Federal Signal is strategically growing its aftermarket services for environmental solutions, encompassing parts, maintenance, rentals, and used equipment. This focus capitalizes on their substantial installed customer base, aiming for a high-margin, recurring revenue stream within a market that consistently demands equipment upkeep and operational support.

The company's commitment to this segment is evident in its acquisition of Standard Equipment Company, which directly bolsters its aftermarket capabilities and growth trajectory. This expansion is crucial for maintaining and enhancing the performance of their environmental equipment in the field.

- Aftermarket Revenue Growth: Federal Signal's Environmental Solutions Group is a key area for aftermarket expansion, contributing to a growing segment of their business.

- High-Margin Opportunities: The aftermarket business, including parts and services, represents a significant source of high-margin revenue for the company.

- Strategic Acquisitions: The acquisition of Standard Equipment Company is a prime example of Federal Signal's strategy to enhance its aftermarket offerings and market reach.

- Market Demand: The increasing need for maintenance and operational support for environmental equipment fuels the growth of this aftermarket segment.

Specialized Municipal and Industrial Maintenance Equipment

Federal Signal's Specialized Municipal and Industrial Maintenance Equipment segment is a cornerstone of its business, catering to essential public works and industrial needs. This division benefits from a robust and expanding market, driven by ongoing infrastructure development and maintenance requirements.

The company's strategic acquisitions, such as that of Standard Equipment Company, have broadened its product offerings and market reach within this sector. These specialized equipment solutions are vital for efficient operations in both municipal services and industrial settings, ensuring Federal Signal maintains a competitive edge.

Sustained demand is a key characteristic of this market, bolstered by strong order intake and a healthy backlog. For instance, Federal Signal reported a significant increase in its municipal segment revenue in Q1 2024, reaching $145 million, up from $120 million in the same period of 2023, reflecting the strong market appetite for their specialized equipment.

- Market Position: Federal Signal holds a strong competitive standing in the municipal and industrial maintenance equipment sector.

- Demand Drivers: The segment benefits from consistent demand for critical infrastructure maintenance and public works solutions.

- Growth Factors: Recent acquisitions and strong order intake, including a reported 20% year-over-year revenue growth in the municipal segment for Q1 2024, fuel expansion.

- Product Portfolio: The diverse range of specialized equipment addresses essential operational needs for a growing customer base.

Federal Signal's Stars, primarily its Environmental Solutions Group, are characterized by high growth and market leadership. This segment, encompassing advanced sweepers and hydro-excavation equipment, benefits from significant global infrastructure investment and a strong demand for sustainable and efficient cleaning solutions. The company's strategic acquisitions and focus on expanding aftermarket services further solidify its dominant position in these lucrative niches.

The Environmental Solutions Group saw an 18% sales increase in Q2 2025, demonstrating robust market penetration. Federal Signal's TRUVAC hydro-excavation line, for example, reported a substantial backlog in Q1 2024, indicating strong future revenue visibility. The company's commitment to innovation, such as the Elgin RegenX sweeper with its fuel-saving technology, directly addresses market needs for eco-friendly equipment.

Federal Signal's aftermarket services, bolstered by the acquisition of Standard Equipment Company, are also a significant growth driver, offering high-margin, recurring revenue. This strategic focus on parts, maintenance, and rentals capitalizes on a large installed base, ensuring continued customer engagement and revenue streams.

The company's Specialized Municipal and Industrial Maintenance Equipment segment also exhibits strong Star characteristics. Q1 2024 municipal segment revenue reached $145 million, a notable increase from $120 million in Q1 2023, reflecting a 20% year-over-year growth. This segment's expansion is driven by consistent demand for essential infrastructure maintenance and public works solutions.

| Segment | Key Products | Growth Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Environmental Solutions Group | Road marking, line removal, waterblasting, street sweepers, vacuum trucks, hydro-excavation equipment | Infrastructure development, sustainability focus, safety regulations | 18% sales increase (Q2 2025), substantial backlog (Q1 2024) |

| Specialized Municipal and Industrial Maintenance Equipment | Specialized municipal and industrial maintenance equipment | Infrastructure maintenance, public works needs | $145M municipal revenue (Q1 2024), 20% YoY growth (Q1 2024) |

What is included in the product

The Federal Signal BCG Matrix offers a strategic framework to analyze its product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

A clear, single-page BCG Matrix visualizes your business units, easing strategic decision-making.

Cash Cows

Federal Signal's traditional emergency vehicle lighting and sirens are classic cash cows. They dominate a mature market, meaning sales are steady and predictable, not explosive. Think of them as the reliable workhorses of the company's product line.

These products, like lightbars and sirens, are non-negotiable for police, fire, and EMS vehicles, ensuring consistent demand. Federal Signal's strong brand recognition in this essential sector allows them to command high profit margins. For instance, in 2024, the demand for these safety-critical components remained robust, with fleet upgrades and replacements driving consistent revenue streams.

Federal Signal's established industrial signaling and public warning systems are classic cash cows. Their long-standing reputation for reliable alarms and communication devices has secured a dominant market share within the mature industrial safety sector. These essential products, often required for regulatory compliance and safety mandates, generate consistent, predictable cash flow with minimal need for extensive marketing spend.

The Safety and Security Systems Group, which houses these offerings, demonstrates robust financial health. For instance, in the first quarter of 2024, this segment reported an impressive EBITDA margin of 21.5%, underscoring the high profitability of these established product lines. This strong margin is a testament to the low ongoing investment required to maintain their market position and the inherent value customers place on their reliability.

Standard Replacement Parts and Services for Legacy Equipment are Federal Signal's cash cows. This segment leverages their extensive installed base of older, widely adopted equipment, generating substantial and predictable cash flow. These essential parts and services ensure the continued operation of durable goods, providing a stable, low-growth revenue stream.

The high margins in this area are driven by customer lock-in and the proprietary nature of many components. For instance, in 2023, Federal Signal reported that their aftermarket services and parts contributed significantly to their overall profitability, reflecting the enduring demand for maintenance and upgrades on their established product lines.

Core Street Sweeper and Sewer Cleaner Models

Federal Signal's core street sweeper and sewer cleaner models, such as the Vactor and Elgin product lines, represent significant cash cows for the company. These established and trusted machines command a considerable share of the market, particularly within municipal and contractor sectors. The consistent demand for essential infrastructure maintenance ensures a stable, mature market for these offerings.

These dependable workhorses generate robust cash flow for Federal Signal. For instance, in 2024, the municipal vehicle segment, which heavily features these core cleaning units, demonstrated resilience. While specific revenue figures for individual product lines within this segment are proprietary, the overall segment performance indicates sustained profitability from these established cash cows.

- Established Market Dominance: Vactor and Elgin lines are widely recognized and adopted, holding substantial market share.

- Steady Demand: The ongoing need for infrastructure cleaning and maintenance provides a reliable, mature market.

- Consistent Cash Generation: These models are key contributors to Federal Signal's strong cash flow.

- Resilient Segment Performance: The municipal vehicle segment, encompassing these core products, showed stability in 2024.

Standard Duty Work Truck Signaling Devices

Standard duty work truck signaling devices, encompassing basic lightbars, beacons, and backup alarms, represent a mature market segment for Federal Signal. This category caters to a consistent demand for both replacement parts and new installations.

These products benefit from high market penetration, indicating widespread adoption across the industry. This maturity translates into stable sales volumes, contributing significantly to the profitability of the Safety and Security Systems Group.

- Market Maturity: The signaling devices for standard duty work trucks are established products with a long history in the market.

- Consistent Demand: A steady replacement cycle and ongoing new truck production ensure a predictable sales stream.

- Profitability Driver: These devices generate reliable sales volumes with minimal need for substantial growth investment, bolstering overall group profitability.

- High Penetration: Their widespread use across the work truck fleet signifies a mature market where most potential customers already utilize these safety features.

Federal Signal's traditional emergency vehicle lighting and sirens are classic cash cows, dominating a mature market with steady, predictable sales. These non-negotiable safety components for police, fire, and EMS vehicles ensure consistent demand, allowing Federal Signal to command high profit margins due to strong brand recognition and essential application.

The company's established industrial signaling and public warning systems also function as cash cows, holding dominant market share in the mature industrial safety sector. These essential, often regulatory-mandated products generate consistent, predictable cash flow with minimal marketing investment, as evidenced by the Safety and Security Systems Group's robust EBITDA margin of 21.5% in Q1 2024.

Standard replacement parts and services for legacy equipment are key cash cows, leveraging an extensive installed base for substantial, predictable cash flow. High margins are driven by customer lock-in and proprietary components, contributing significantly to profitability as reported in 2023.

Core street sweeper and sewer cleaner models, like Vactor and Elgin, are significant cash cows within the municipal and contractor sectors, benefiting from consistent demand for infrastructure maintenance in a stable, mature market. The municipal vehicle segment, including these core cleaning units, demonstrated resilience and sustained profitability in 2024.

| Product Category | BCG Matrix Classification | Market Characteristics | Key Financial Indicator (2024/2023 Data) | Strategic Implication |

| Emergency Vehicle Lighting & Sirens | Cash Cow | Mature, High Demand, Strong Brand Recognition | Robust Fleet Upgrades & Replacements Driving Consistent Revenue | Maintain Market Share, Optimize Profitability |

| Industrial Signaling & Public Warning Systems | Cash Cow | Mature, Regulatory Compliance Driven, Dominant Share | 21.5% EBITDA Margin (Q1 2024) in Safety & Security Systems Group | Harvest Cash Flow, Minimal Investment |

| Legacy Equipment Parts & Services | Cash Cow | Mature, High Customer Lock-in, Proprietary Components | Significant Profitability Contribution (2023) | Leverage Installed Base, Maximize Service Revenue |

| Street Sweepers & Sewer Cleaners (Vactor, Elgin) | Cash Cow | Mature, Essential Infrastructure Maintenance, Stable Demand | Resilient Municipal Vehicle Segment Performance | Continue Generating Stable Cash Flow |

Delivered as Shown

Federal Signal BCG Matrix

The Federal Signal BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This ensures you get exactly what you see, with no hidden surprises or altered content, ready for your strategic decision-making.

Dogs

Certain legacy signaling devices within Federal Signal's Safety and Security Systems Group might be considered obsolete or undifferentiated. These products often struggle with a low market share within a shrinking market segment, facing significant price pressure from generic competitors. For instance, in 2024, Federal Signal's revenue from such older product lines may have shown minimal growth, potentially less than 1% annually, and their contribution to the company's overall profitability could be negligible.

Federal Signal’s portfolio includes niche, low-volume industrial products that don’t fit neatly into its high-growth strategy. These items, often serving specific legacy customer needs, may lack significant market relevance and growth potential.

While these products might continue to be offered, they can consume resources without contributing substantially to overall growth. For instance, if a particular specialized product line saw only a 1% revenue increase in 2023 compared to a company-wide average of 8%, it would likely be classified here.

Federal Signal's BCG Matrix includes product lines that have been formally discontinued and now see very little demand for parts or servicing. These are products that, despite efforts to grow the aftermarket, are so old or were unsuccessful that they generate negligible revenue.

For instance, if a specific siren model from the early 2000s was discontinued and only a handful of units remain in the field, the revenue generated from its spare parts or repair services would be minimal, potentially making it a candidate for complete divestiture.

Non-Strategic, Regional-Specific Offerings from Minor Acquisitions

Federal Signal's portfolio may include product lines that are considered dogs, often stemming from smaller, regional acquisitions. These offerings typically possess low market share and operate in slow-growth sectors, failing to contribute significantly to overall revenue or strategic objectives.

These non-strategic, regional-specific offerings are characterized by limited geographic reach and cater to niche demands that are not easily scalable. Their lack of broad market penetration and minimal synergy with core Federal Signal businesses often relegate them to dog status within the BCG matrix.

- Low Market Share: These acquired product lines often hold less than 10% market share in their respective categories.

- Limited Growth Potential: The markets they serve are typically experiencing annual growth rates below 3%.

- Geographic Constraints: Operations are often confined to specific regions, limiting scalability and broader market access.

- Lack of Synergy: These offerings may not align with Federal Signal's primary strategic focus, leading to underinvestment and stagnation.

Basic, Commoditized Communication Systems

Basic, commoditized communication systems within Federal Signal's portfolio likely fall into the Dogs category of the BCG Matrix. These offerings, characterized by a lack of advanced features and limited integration capabilities, struggle to gain significant traction in a crowded and highly competitive market. Their low market share is a direct consequence of this intense competition and their inherent lack of differentiation.

Such products are unlikely to be drivers of Federal Signal's future strategic growth. They offer minimal competitive advantage and are therefore not expected to contribute substantially to the company's overall expansion. The returns generated from these commoditized systems are typically low, reflecting their mature stage and the difficulty in commanding premium pricing.

- Low Market Share: These systems compete in saturated markets where established players and new entrants offer similar, undifferentiated products.

- Limited Growth Potential: Without unique features or technological innovation, these offerings struggle to attract new customers or expand their existing market footprint.

- Low Profitability: Price competition is fierce in commoditized markets, squeezing profit margins and making these products less attractive financially.

- Strategic Disadvantage: Resources allocated to maintaining or marginally improving these products could be better utilized in areas with higher growth and return potential.

Federal Signal's "Dogs" represent product lines with low market share in mature or declining industries. These often include older, commoditized signaling devices or niche industrial products acquired through smaller regional deals. In 2024, these segments likely contributed minimally to overall revenue, perhaps less than 2%, with growth rates struggling to surpass 1% annually.

These offerings face intense price competition and lack significant differentiation, making them poor candidates for future strategic investment. Their limited geographic reach and low synergy with core Federal Signal businesses further solidify their position as dogs within the BCG matrix, often consuming resources without substantial returns.

For example, a specific legacy siren model discontinued in the early 2000s, with only a handful of units in the field, would generate negligible revenue from spare parts, classifying it as a dog. Similarly, basic, undifferentiated communication systems in saturated markets struggle with low profitability due to fierce price wars.

| Product Category | Market Share (Estimated 2024) | Annual Growth Rate (Estimated 2024) | Profitability Contribution | Strategic Fit |

|---|---|---|---|---|

| Legacy Signaling Devices | < 5% | < 1% | Negligible | Low |

| Niche Industrial Products (Acquired) | 5-10% | 1-3% | Low | Low |

| Commoditized Communication Systems | < 10% | < 2% | Low | Low |

Question Marks

Federal Signal is strategically investing in electrification for its specialty vehicle lines, including street sweepers, to align with stricter environmental standards and growing customer demand for greener solutions. This focus positions them within a high-growth market segment.

While the electric and hybrid specialty vehicle market is expanding rapidly, Federal Signal's current market share in this emerging area might be modest. Capturing a significant presence will necessitate substantial capital allocation and dedicated development efforts.

Federal Signal's advanced integrated public safety and security platforms, incorporating IoT, AI, and 5G, represent a Stars segment. These solutions offer real-time data and improved coordination, a rapidly expanding market. Federal Signal's investment in these technologies in 2024 positions them for substantial future growth, though significant R&D and market penetration are still underway.

Federal Signal's acquisition of Hog Technologies positions its specialized street sweeping and debris removal equipment for global expansion. The strategy focuses on entering new international markets where Federal Signal's existing distribution networks can be leveraged, aiming to build brand awareness and market share for these newly acquired product lines. This initiative targets regions with high growth potential, acknowledging the need for strategic investment to overcome initial low penetration.

Specialized Robotics or Automation for Infrastructure Maintenance

Specialized robotics and automation for infrastructure maintenance could be a promising area for Federal Signal, fitting into the Question Marks quadrant of the BCG matrix. This segment likely represents a nascent market with substantial future growth prospects, though Federal Signal's current market share might be minimal as they explore or develop these advanced capabilities.

The global market for infrastructure inspection and maintenance robots was estimated to be around $2.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 15% through 2030. This indicates a significant opportunity for companies investing in this niche.

- Emerging Market: Robotics for infrastructure maintenance is a rapidly developing field with high growth potential.

- Low Market Share: Federal Signal may be in the early stages of adoption or development, resulting in a low current market share.

- High Growth Potential: The sector is expected to expand significantly, offering substantial long-term returns.

- Investment Focus: Companies like Federal Signal may need to invest heavily in research and development or acquisitions to capture this market.

Digital Services and Data Analytics for Fleet Optimization

Federal Signal is actively expanding its digital services and data analytics offerings to enhance fleet optimization for its customers. These platforms focus on improving equipment performance, enabling predictive maintenance, and boosting overall operational efficiency.

This segment represents a significant growth opportunity within the industrial and municipal sectors. Federal Signal is strategically positioning itself to capture market share in this burgeoning area, likely starting from a relatively modest base.

- Market Growth: The global fleet management market was valued at approximately $26.7 billion in 2023 and is projected to reach over $55 billion by 2030, indicating substantial room for Federal Signal's digital services.

- Key Offerings: Federal Signal's digital solutions aim to provide real-time insights into vehicle health, usage patterns, and maintenance needs, thereby reducing downtime and operational costs for municipalities and industrial clients.

- Competitive Landscape: While a growing field, Federal Signal competes with established telematics providers and other equipment manufacturers developing similar data-driven solutions.

- Strategic Focus: The company's investment in these services aligns with industry trends towards greater connectivity and data utilization for enhanced asset management.

Robotics and automation for infrastructure maintenance represent a nascent but rapidly growing market for Federal Signal. While the company may currently hold a small market share in this area, the sector's projected growth rate of over 15% annually through 2030, with a market size of approximately $2.5 billion in 2023, signifies substantial future potential. Federal Signal's strategic exploration of this segment positions it to capture future opportunities, though significant investment in research and development or strategic acquisitions will be crucial for market penetration.

| BCG Quadrant | Federal Signal Segment | Market Characteristics | Federal Signal Position | Strategic Outlook |

|---|---|---|---|---|

| Question Marks | Robotics & Automation for Infrastructure Maintenance | Nascent market, high growth potential (15%+ CAGR projected) | Low current market share, early exploration/development phase | Requires significant R&D investment or strategic acquisitions to build market share and capitalize on growth. |

BCG Matrix Data Sources

Our Federal Signal BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.