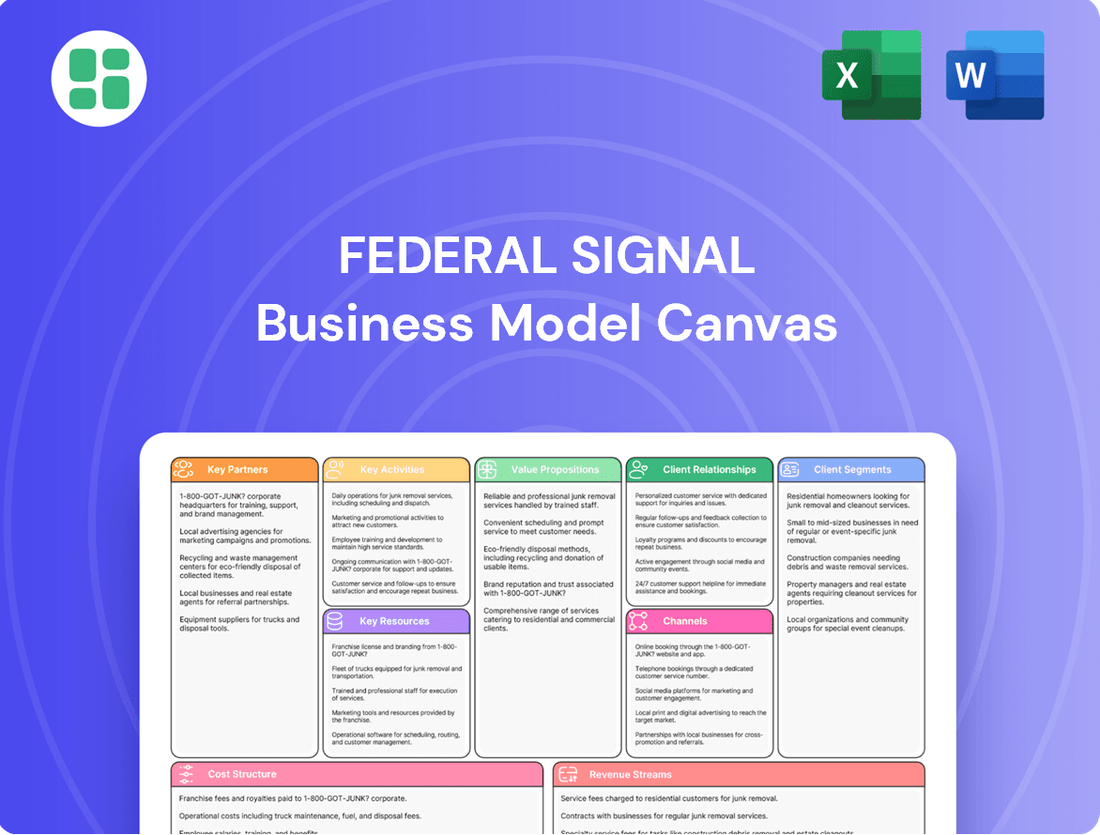

Federal Signal Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Federal Signal Bundle

Unlock the strategic core of Federal Signal's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals how they effectively serve their diverse customer segments and leverage key partnerships to deliver essential safety and signaling solutions. Gain a clear understanding of their value propositions and revenue streams.

Dive into the actionable insights of Federal Signal's complete Business Model Canvas. This professionally crafted document illuminates their key activities, resources, and cost structure, offering a powerful blueprint for understanding their competitive advantage. Ideal for strategists and analysts seeking to dissect a successful industrial model.

Want to truly understand how Federal Signal thrives? Our full Business Model Canvas provides an in-depth look at their customer relationships, channels, and competitive landscape. Download the complete, editable version to benchmark your own strategies and uncover growth opportunities.

Partnerships

Federal Signal's strategic suppliers are crucial for its operations, providing essential raw materials, components, and specialized parts for its emergency vehicle lighting, warning systems, and industrial signaling products. In 2024, the company continued to emphasize building robust relationships with these key partners to ensure a steady flow of high-quality inputs, directly impacting production timelines and the reliability of their offerings.

Federal Signal heavily relies on its extensive network of authorized dealers and distributors to reach a broad customer base, particularly for its specialized safety and signaling equipment. These partnerships are vital for extending market penetration into diverse geographical regions and customer segments, tapping into established local expertise and relationships.

In 2024, Federal Signal reported that its distributor network played a significant role in its revenue generation, with a substantial portion of sales channeled through these third-party partners. This strategy allows the company to effectively serve industries requiring on-site sales consultations and after-sales support, ensuring customer satisfaction and product adoption.

Federal Signal actively cultivates partnerships with technology developers and research institutions. These collaborations are crucial for integrating cutting-edge advancements, such as AI-driven analytics for their emergency vehicle warning systems and IoT capabilities for their environmental monitoring equipment. For instance, in 2024, the company continued to invest in R&D, with a significant portion of their budget allocated to exploring new sensor technologies and communication protocols.

Collaborating with specialized engineering firms allows Federal Signal to accelerate product innovation and enhance the performance of their diverse product portfolio, which includes signaling devices, emergency vehicle lighting, and gas detection systems. These strategic alliances ensure that Federal Signal remains at the forefront of technological integration, offering customers solutions that are not only reliable but also incorporate the latest in safety and communication technology.

Government Agencies and Regulatory Bodies

Federal Signal actively collaborates with government agencies and regulatory bodies to maintain compliance with crucial safety, environmental, and sector-specific regulations. This engagement is fundamental for operating within public safety and infrastructure markets.

These partnerships are instrumental in shaping product development, ensuring Federal Signal's offerings align with the dynamic needs of public safety and infrastructure. This strategic alignment can unlock new market opportunities and secure valuable government contracts.

- Regulatory Compliance: Adherence to standards set by bodies like the National Highway Traffic Safety Administration (NHTSA) and Environmental Protection Agency (EPA) is paramount.

- Product Innovation: Input from agencies like FEMA can guide the development of advanced emergency response equipment.

- Market Access: Understanding and meeting the procurement requirements of federal, state, and local government entities is key to sales growth.

- Industry Standards: Collaboration with organizations like the Society of Automotive Engineers (SAE) ensures products meet recognized performance benchmarks.

System Integrators and Solution Providers

Federal Signal collaborates with system integrators and solution providers to deliver complex safety and security systems. These partnerships enable the company to offer comprehensive, turn-key solutions by combining Federal Signal products with complementary technologies. For instance, in 2024, Federal Signal's focus on integrated public safety solutions means they actively seek partners who can bundle their warning systems with advanced communication platforms or video surveillance, creating a more robust offering for municipal and industrial clients.

These collaborations add significant value for customers, as they receive integrated systems precisely designed for their unique operational needs. This approach streamlines procurement and implementation, ensuring seamless functionality across diverse safety applications.

- Enhanced Product Integration: System integrators ensure Federal Signal's hardware seamlessly functions with other critical safety technologies.

- Turn-Key Solution Delivery: Partnerships allow for the provision of complete, ready-to-deploy safety and security systems.

- Customized Client Solutions: Integrators tailor combined offerings to meet specific customer operational requirements, improving effectiveness.

Federal Signal's key partnerships extend to specialized engineering firms, crucial for driving innovation in their diverse product lines like emergency vehicle lighting and gas detection systems. These alliances ensure Federal Signal remains at the technological forefront, integrating the latest advancements to enhance product performance and safety features.

What is included in the product

A detailed Federal Signal Business Model Canvas outlining its focus on public safety and industrial signaling solutions, covering key customer segments like municipalities and industrial facilities, and detailing its value propositions around reliability and innovation.

This canvas provides a strategic overview of Federal Signal's operations, highlighting its revenue streams from product sales and services, and its key partnerships within the emergency response and industrial sectors.

Federal Signal's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operational strategy, allowing for rapid identification of areas needing improvement and streamlining complex decision-making.

Activities

Federal Signal's commitment to product research and development is a cornerstone of its business. In 2024, the company continued to invest significantly in R&D to drive innovation across its diverse product portfolio, aiming to enhance existing offerings and introduce entirely new solutions. This focus ensures they remain at the forefront of emergency vehicle equipment, industrial safety systems, and environmental solutions.

This ongoing investment allows Federal Signal to adapt to rapidly changing customer needs and increasingly stringent regulatory landscapes. For instance, the development of advanced signaling and communication technologies for emergency responders, as well as more sophisticated environmental monitoring and control systems, are direct outcomes of their R&D efforts. This proactive approach is crucial for maintaining a competitive edge.

Federal Signal's core activity centers on the precision manufacturing and assembly of specialized vehicles, communication systems, and safety equipment. This involves intricate processes to ensure each product meets rigorous performance and durability standards.

The company manages a complex global supply chain to source components, with a strong emphasis on quality control at every stage of production. In 2024, Federal Signal continued to invest in advanced manufacturing techniques to enhance efficiency and product reliability, a crucial element in their operational strategy.

Federal Signal's sales, marketing, and distribution are crucial for connecting with their diverse customer base. This involves a direct sales force, managing relationships with a network of distributors, and actively participating in industry trade shows to showcase their emergency and public safety solutions.

Marketing campaigns are meticulously crafted to highlight the benefits of Federal Signal's products, driving adoption across various sectors. In 2023, the company reported that its sales and marketing efforts contributed to a net sales increase, demonstrating the effectiveness of these activities in securing contracts and expanding market reach.

Aftermarket Service and Support

Federal Signal's key activities include providing robust aftermarket services. This involves offering comprehensive maintenance, repair, and parts supply to ensure their products, like emergency vehicle lighting and warning systems, continue to perform optimally. They also offer vital technical support, helping customers troubleshoot and maintain their equipment effectively.

These services are essential for building strong, long-term customer relationships and ensuring product longevity. For instance, in 2023, Federal Signal reported that aftermarket services contributed significantly to their revenue, highlighting the importance of this segment for recurring income and customer loyalty. This focus on support helps maintain Federal Signal's reputation for reliability.

- Maintenance and Repair: Ensuring the ongoing functionality of critical safety equipment.

- Parts Supply Chain: Providing timely access to necessary components for repairs and upgrades.

- Technical Assistance: Offering expert support to resolve operational issues and optimize product use.

- Customer Retention: Fostering loyalty through dependable post-purchase product care.

Supply Chain Management

Federal Signal’s supply chain management focuses on the seamless flow of goods, from sourcing raw materials to delivering finished products. This critical activity ensures operations run smoothly and costs are kept in check.

In 2024, Federal Signal continued to refine its global supply chain strategies. This included building resilience against disruptions and optimizing logistics for greater efficiency. The company’s commitment to managing its supply chain effectively directly supports its ability to meet diverse customer needs across its various product segments.

- Strategic Sourcing: Identifying and partnering with reliable suppliers globally to secure quality raw materials at competitive prices.

- Inventory Management: Implementing robust systems to balance inventory levels, minimizing holding costs while ensuring product availability.

- Logistics Optimization: Streamlining transportation and warehousing to reduce lead times and delivery costs, ensuring timely product delivery to customers worldwide.

Federal Signal's key activities revolve around developing, manufacturing, and distributing specialized safety and communication equipment. Their operations include precision engineering for emergency vehicle systems, industrial warning devices, and environmental solutions, ensuring high performance and durability. The company also excels in managing a sophisticated global supply chain, emphasizing quality control and efficient logistics to deliver reliable products worldwide.

In 2024, Federal Signal continued its strategic focus on innovation through significant research and development investments. This commitment fuels the creation of advanced signaling, communication, and environmental monitoring technologies, keeping them competitive. Furthermore, their robust aftermarket services, encompassing maintenance, repair, and technical support, are vital for customer retention and generating recurring revenue, as demonstrated by their strong performance in 2023.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Research & Development | Innovating new and improving existing safety and communication products. | Continued significant investment in 2024 to drive technological advancements. |

| Manufacturing & Assembly | Precision production of specialized vehicles, communication systems, and safety equipment. | Focus on advanced manufacturing techniques for enhanced efficiency and reliability. |

| Sales & Marketing | Connecting with diverse customer bases through direct sales, distributors, and trade shows. | Contributed to net sales increases in 2023, expanding market reach. |

| Aftermarket Services | Providing maintenance, repair, parts supply, and technical support for products. | Significantly contributed to revenue in 2023, fostering customer loyalty and product longevity. |

| Supply Chain Management | Sourcing raw materials, managing inventory, and optimizing logistics globally. | Refinement of strategies in 2024 to build resilience and improve efficiency. |

Preview Before You Purchase

Business Model Canvas

The Federal Signal Business Model Canvas you see here is the actual, complete document you will receive upon purchase. This is not a sample or mockup, but a direct preview of the professional, ready-to-use file, ensuring exactly what you see is what you get. Upon completing your order, you'll gain full access to this comprehensive analysis, allowing you to immediately leverage its insights for your business strategy.

Resources

Federal Signal's extensive manufacturing facilities and specialized machinery are the backbone of its production capabilities. These physical assets, including advanced production equipment, are crucial for creating its high-quality safety, security, and environmental solutions. In 2023, the company reported capital expenditures of $48.8 million, indicating ongoing investment in its manufacturing infrastructure to ensure capacity and efficiency.

Federal Signal's intellectual property, including patents and proprietary technologies, is a cornerstone of its competitive edge. These assets safeguard their unique product designs and functionalities, ensuring a distinct market position. In 2023, the company reported $11.2 million in patent-related expenses, highlighting their commitment to innovation.

Federal Signal relies heavily on a highly skilled workforce, particularly its engineers and specialized manufacturing personnel. This human capital is fundamental to their ability to innovate and produce complex safety and security solutions.

The engineering expertise within Federal Signal is crucial for product design and development, ensuring they can meet the diverse and often demanding needs of their customer base. This technical proficiency directly translates into product quality and the capacity for advanced manufacturing.

In 2024, Federal Signal continued to invest in its talent pipeline, recognizing that specialized knowledge in areas like advanced electronics and robust material science is a key differentiator. Their commitment to training and development ensures their workforce remains at the forefront of industry advancements.

Distribution and Service Networks

Federal Signal's distribution and service networks are critical assets, enabling extensive market reach and robust customer support. These established channels, including authorized dealers, distributors, and service centers, are instrumental in penetrating diverse markets and ensuring customers receive timely assistance and technical expertise.

These networks are designed to provide a strong local presence, facilitating sales and offering essential technical services. This localized approach is key to Federal Signal's strategy for effective product delivery and comprehensive post-sales support, reinforcing customer relationships and brand loyalty.

- Market Penetration: Authorized dealers and distributors provide crucial access to various customer segments and geographic regions.

- Customer Support: Service centers offer vital technical assistance and maintenance, ensuring product reliability and customer satisfaction.

- Sales Capabilities: The network is equipped to handle sales processes, from initial inquiry to final delivery, driving revenue.

- Extended Reach: These established relationships amplify Federal Signal's operational footprint, ensuring efficient product deployment and support.

Financial Capital

Federal Signal relies on robust financial capital to fuel its innovation and expansion. This includes significant investment in research and development for new safety and security solutions, as well as capital expenditures for modernizing its manufacturing facilities. For instance, in 2023, the company reported capital expenditures of $65.6 million, demonstrating a commitment to infrastructure improvements that support operational efficiency and future growth.

The company's financial strength also underpins its ability to pursue strategic acquisitions. These acquisitions are vital for broadening its product portfolio and market reach, thereby enhancing its competitive position. Federal Signal's solid financial standing ensures it can undertake these growth initiatives while maintaining operational stability and pursuing long-term value creation for its stakeholders.

Key financial resources are essential for Federal Signal's strategic objectives:

- Funding for Research & Development: Enabling the creation of next-generation emergency vehicle lighting, signaling devices, and public safety technologies.

- Capital Expenditures: Investing in advanced manufacturing equipment and facility upgrades to improve production capacity and quality.

- Acquisition Capital: Providing the necessary funds for strategic mergers and acquisitions to expand market share and technological capabilities.

- Operational Stability: Ensuring sufficient liquidity and access to credit facilities to manage day-to-day operations and navigate market fluctuations.

Federal Signal's key resources include its advanced manufacturing facilities, a portfolio of intellectual property, a skilled workforce, and extensive distribution networks. These assets are critical for developing, producing, and delivering its specialized safety and security solutions to a global market. The company's financial capital also plays a vital role in funding innovation, capital expenditures, and strategic growth initiatives.

| Resource Category | Key Components | 2023 Data/Significance |

|---|---|---|

| Physical Assets | Manufacturing facilities, specialized machinery | Capital expenditures of $48.8 million in 2023 indicate ongoing investment in infrastructure. |

| Intellectual Property | Patents, proprietary technologies | $11.2 million in patent-related expenses in 2023 highlight commitment to innovation. |

| Human Capital | Engineers, manufacturing personnel, specialized knowledge | Investment in talent pipeline in 2024 to maintain industry leadership. |

| Distribution & Service Networks | Authorized dealers, distributors, service centers | Crucial for market penetration, customer support, and extended reach. |

| Financial Capital | Investment capital, credit facilities | $65.6 million in capital expenditures in 2023 for infrastructure and growth. |

Value Propositions

Federal Signal’s commitment to enhanced public and worker safety is a cornerstone of its business model. Their solutions are critical for municipalities and industrial sectors, directly contributing to the reduction of accidents and fatalities. In 2024, the demand for advanced safety equipment remained robust, driven by stricter regulatory environments and a heightened awareness of workplace hazards.

The company's product portfolio, including warning lights, sirens, and communication systems for emergency vehicles, directly supports first responders in their critical missions. Furthermore, their industrial safety products, such as high-visibility signaling devices and hazardous location warning systems, are vital for protecting workers in demanding environments. Federal Signal’s focus on reliability ensures that these safety-critical systems perform when they are needed most, a value proposition deeply appreciated by their clientele.

Federal Signal's commitment to operational efficiency and reliability is a cornerstone of their value proposition. Their products are meticulously engineered for high performance, ensuring durability and dependability in demanding environments. This focus translates directly into increased operational efficiency for their customers, minimizing disruptions and maximizing productivity.

For instance, their street sweepers and vacuum trucks are designed to reduce downtime and maintenance requirements. This means clients experience fewer interruptions in their service delivery, leading to more consistent operations and a lower overall cost of ownership throughout the equipment's lifecycle. In 2023, Federal Signal reported a significant portion of their revenue derived from their Environmental and Maintenance Solutions segment, underscoring the market's demand for these reliable, efficiency-boosting products.

Federal Signal offers cutting-edge environmental solutions designed to bolster sustainability efforts. Their product line, including advanced hydro-excavators and specialized sanitation vehicles, directly aids in pollution reduction and more efficient resource management for a wide range of clients.

These innovative tools empower governmental and commercial organizations to achieve cleaner operational practices and meet increasingly stringent environmental compliance standards. For instance, Federal Signal's commitment to sustainability is reflected in their development of technologies that minimize waste and emissions in critical infrastructure maintenance and waste management sectors.

Customization and Tailored Solutions

Federal Signal excels in delivering customized products and integrated systems, a key value proposition for its diverse customer base. This adaptability allows clients to acquire solutions precisely engineered for their specific operational needs, boosting efficiency and overall satisfaction.

For instance, in 2024, Federal Signal continued to highlight its ability to tailor warning systems and vehicle equipment. This focus on bespoke solutions directly addresses the unique safety and signaling requirements found across various sectors, from public safety to industrial applications.

- Tailored Warning Systems: Federal Signal provides customized light bars, sirens, and control systems designed for specific vehicle types and operational environments.

- Integrated Solutions: The company offers the ability to integrate various products into comprehensive systems, meeting complex customer demands.

- Application-Specific Design: Solutions are often developed with unique customer applications in mind, ensuring optimal performance and usability.

Comprehensive Aftermarket Support

Federal Signal's commitment extends well beyond the initial sale, offering a robust suite of aftermarket support services. This includes readily available parts, expert repair and maintenance services, and comprehensive training programs designed to maximize customer understanding and product utilization. This focus ensures their specialized equipment continues to perform optimally throughout its lifespan.

This dedication to ongoing support is a cornerstone of Federal Signal's value proposition, fostering strong customer loyalty and confidence. By prioritizing the long-term operational effectiveness of their solutions, they not only extend the product's life but also solidify their position as a reliable partner. For instance, in 2024, Federal Signal reported that a significant portion of their revenue was derived from aftermarket services, underscoring its importance.

- Parts Availability: Ensuring critical components are accessible to minimize downtime.

- Service & Maintenance: Providing expert technical support for repairs and routine upkeep.

- Training Programs: Equipping customers with the knowledge to operate and maintain equipment effectively.

- Extended Product Lifespan: Contributing to customer ROI through enhanced durability and performance.

Federal Signal's value proposition centers on enhancing public safety and operational efficiency through specialized equipment. They offer tailored solutions, robust aftermarket support, and a commitment to reliability, ensuring their products perform in critical situations and minimize client downtime. This focus on dependable, application-specific designs fosters strong customer relationships and underscores their role as a vital partner in public service and industrial operations.

| Value Proposition | Description | Key Benefit | 2024 Data/Example |

| Enhanced Public & Worker Safety | Critical signaling and communication systems for emergency services and industrial environments. | Reduces accidents, supports first responders, protects workers. | Continued strong demand driven by safety regulations. |

| Operational Efficiency & Reliability | Durable, high-performance equipment designed for minimal downtime. | Increases productivity, lowers overall cost of ownership. | Significant revenue from Environmental & Maintenance Solutions segment. |

| Customized Products & Integrated Systems | Adaptable solutions engineered for specific customer needs. | Boosts efficiency, improves usability, ensures optimal performance. | Continued emphasis on tailoring warning systems and vehicle equipment. |

| Aftermarket Support Services | Parts availability, expert maintenance, and customer training. | Maximizes product lifespan and operational effectiveness. | Substantial revenue derived from aftermarket services. |

Customer Relationships

Federal Signal builds direct relationships with its core municipal, government, and major industrial clients. This is achieved through specialized sales teams and account managers who foster deep understanding of unique client requirements and facilitate personalized service.

This direct engagement enables Federal Signal to effectively negotiate intricate contracts and establish enduring partnerships, crucial for their large-scale public safety and industrial solutions.

For instance, in 2023, Federal Signal reported that its largest customers, often government entities, represented a significant portion of its revenue, underscoring the importance of these direct, managed relationships.

Federal Signal cultivates enduring customer connections through long-term service and maintenance contracts for its sophisticated equipment. These agreements are crucial for sustained customer involvement, generating predictable, recurring revenue streams. For instance, in 2023, Federal Signal’s aftermarket and service revenues represented a substantial portion of its overall financial performance, underscoring the importance of these ongoing relationships.

Federal Signal offers robust technical support and training, ensuring clients can effectively and safely utilize their critical equipment. This commitment is vital for maximizing product value and fostering long-term customer loyalty.

In 2024, Federal Signal continued to emphasize operator training, with a focus on hands-on sessions and digital resources. This proactive approach helps prevent operational errors and enhances overall product performance, contributing to customer satisfaction.

Dealer and Distributor Support

Federal Signal cultivates strong partnerships with its independent dealer and distributor network, offering essential sales enablement resources, comprehensive training programs, and dedicated marketing assistance. This strategic indirect channel is crucial for delivering localized expertise and responsive service to end-users, thereby enhancing customer satisfaction and loyalty.

This support structure is vital for Federal Signal's market penetration. For instance, in 2024, the company continued to invest in its channel partners, with training modules focusing on new product introductions and evolving regulatory landscapes. This ensures dealers are well-equipped to represent Federal Signal's advanced safety and security solutions effectively.

- Sales Tools and Training: Federal Signal provides dealers with up-to-date product catalogs, technical specifications, and sales presentations. Ongoing training sessions, often delivered virtually or in-person, keep partners informed about product advancements and application best practices.

- Marketing Support: The company offers co-op marketing funds, digital marketing assets, and lead generation assistance to help dealers promote Federal Signal products in their respective territories. This collaborative approach amplifies brand reach and drives demand.

- Localized Service: By empowering its dealer network, Federal Signal ensures that customers receive prompt and knowledgeable support directly within their local communities, fostering stronger relationships and quicker issue resolution.

Customer Feedback and Product Improvement

Federal Signal actively seeks customer input to refine its product offerings and service delivery. This feedback loop is crucial for staying ahead in the public safety and industrial markets. For instance, in 2024, the company continued to leverage customer insights gathered through surveys and direct engagement to inform upgrades for its emergency vehicle lighting and siren systems, ensuring they meet the demanding operational requirements of first responders.

This commitment to incorporating customer perspectives fosters a collaborative environment. By actively listening and responding to user experiences, Federal Signal can identify areas for improvement and innovation. This iterative approach helps maintain the company's competitive edge and builds stronger, more trusting relationships with its client base.

- Customer Feedback Integration: Federal Signal's process involves actively collecting and analyzing customer feedback from various channels.

- Product Development Cycle: This feedback directly influences the design, features, and performance enhancements of their safety and warning systems.

- Service Enhancement: Beyond products, customer input also guides improvements in after-sales support and training.

- Market Relevance: By continuously adapting based on user needs, Federal Signal ensures its solutions remain relevant and effective in dynamic environments.

Federal Signal maintains direct relationships with key municipal, government, and industrial clients through dedicated sales teams, fostering deep understanding and personalized service crucial for complex contracts and long-term partnerships.

The company also builds loyalty via long-term service and maintenance agreements, generating predictable recurring revenue, and provides essential technical support and training to maximize product value and ensure safe, effective equipment use.

In 2024, Federal Signal enhanced its dealer network by providing sales enablement resources, comprehensive training, and marketing assistance, ensuring localized expertise and responsive end-user support.

Customer input is actively sought and integrated into product refinement and service delivery, with feedback from 2024 informing upgrades to emergency vehicle lighting and siren systems to meet demanding first responder requirements.

Channels

Federal Signal leverages a dedicated direct sales force to connect with major municipal, government, and industrial customers. This approach facilitates detailed product showcases, personalized solution discussions, and direct contract negotiations for significant deals.

This direct channel is crucial for understanding complex client needs and offering precisely tailored solutions, fostering robust, long-term relationships. For instance, Federal Signal reported that its sales and marketing expenses were $121.9 million in 2023, reflecting the investment in its direct sales capabilities.

Federal Signal relies on a broad network of authorized dealers and independent distributors to reach customers across diverse regions. This extensive reach is vital for tapping into both national and localized markets, ensuring their products are accessible where and when needed.

These partners are more than just sales points; they offer essential localized sales, service, and support. Their existing customer relationships and deep market knowledge are invaluable assets, enabling Federal Signal to effectively serve specific communities and industries.

In 2023, Federal Signal reported that its distribution channels played a significant role in its revenue generation, with a substantial portion of sales flowing through these third-party networks, highlighting their critical importance to the company's overall business strategy.

Federal Signal actively utilizes government procurement portals, such as SAM.gov, to identify and bid on public sector opportunities. In fiscal year 2023, the U.S. federal government awarded over $700 billion in prime contracts, with a significant portion allocated to defense and public safety sectors where Federal Signal operates.

The company participates in established tender processes and leverages pre-approved contract vehicles, like General Services Administration (GSA) schedules, to streamline sales to government agencies. These mechanisms ensure compliance with specific purchasing regulations, facilitating access to a critical customer base.

Trade Shows and Industry Events

Federal Signal actively participates in key industry trade shows and events. These gatherings are crucial for showcasing their latest safety and security solutions, from advanced warning systems to emergency vehicle lighting. For example, in 2024, the company likely leveraged events like the International Association of Chiefs of Police (IACP) Conference and the Association of Public-Safety Communications Officials (APCO) International Conference to connect with law enforcement and public safety professionals.

These events are not just about product displays; they are vital for lead generation and building brand awareness within the public safety sector. By demonstrating their technological advancements and engaging directly with potential clients, Federal Signal strengthens its market position and identifies new business opportunities. The direct interaction allows for immediate feedback and the cultivation of valuable relationships.

Federal Signal's presence at these events supports several aspects of their business model:

- Customer Engagement: Direct interaction with existing and potential customers to understand evolving needs and showcase solutions.

- Lead Generation: Capturing contact information and identifying prospects interested in their product lines.

- Brand Visibility: Enhancing brand recognition and reinforcing their reputation as a leader in safety and security solutions.

- Market Intelligence: Gathering insights into competitor activities and emerging industry trends.

Digital Presence and Online Resources

Federal Signal leverages a comprehensive digital strategy, featuring its main corporate website alongside dedicated product microsites. These online hubs are crucial for disseminating detailed product information, technical specifications, and vital customer support, acting as a primary channel for lead generation and engagement. In 2024, the company continued to invest in optimizing these digital assets to improve user experience and streamline the customer journey.

These digital platforms are instrumental in supporting Federal Signal's sales channels, facilitating both direct customer interactions and providing essential resources for their indirect sales network. The company's online presence is designed to enhance accessibility, allowing customers to easily find solutions and information, thereby strengthening brand loyalty and market reach.

- Corporate Website: Serves as the central hub for company news, investor relations, and brand messaging.

- Product Microsites: Offer in-depth details on specific product lines, including specifications, applications, and case studies.

- Online Resources: Provide access to technical documentation, manuals, and support portals for existing customers.

- Lead Capture: Integrated forms and contact options on digital platforms actively drive new business opportunities.

Federal Signal utilizes a robust direct sales force to engage major municipal, government, and industrial clients. This allows for detailed product demonstrations and tailored solution discussions, fostering strong customer relationships. In 2023, the company's sales and marketing expenses were $121.9 million, underscoring the investment in this direct channel.

A wide network of authorized dealers and distributors ensures broad market accessibility across various regions. These partners provide essential localized sales and support, leveraging their existing customer bases and market expertise. In 2023, distribution channels contributed significantly to Federal Signal's revenue, highlighting their importance.

The company actively participates in government procurement portals and leverages contract vehicles like GSA schedules to streamline sales to public sector entities. This strategic approach facilitates access to a critical customer base, with the U.S. federal government awarding over $700 billion in prime contracts in fiscal year 2023.

Federal Signal enhances its market presence through participation in key industry trade shows and events, such as the IACP Conference. These platforms are crucial for lead generation, brand visibility, and gathering market intelligence, connecting them with professionals in the public safety sector.

Customer Segments

Municipalities and local governments are a key customer segment for Federal Signal, needing specialized vehicles like fire trucks, ambulances, and police cruisers. They also rely on equipment for essential services such as street sweeping and vacuum trucks. In 2024, many cities are facing increased demand for public safety services, driving procurement of new or upgraded emergency fleets.

State and Federal Government Agencies represent a crucial customer segment for specialized vehicle manufacturers like Federal Signal. This includes entities such as state departments of transportation, environmental protection agencies, and various branches of the military. These organizations require robust vehicles for diverse public safety and infrastructure needs, from maintaining roadways to environmental remediation and defense operations.

These government bodies often operate with complex, multi-stage procurement processes that can involve extensive bidding and compliance requirements. For example, in 2024, the U.S. federal government's spending on transportation infrastructure alone was projected to be in the hundreds of billions of dollars, with a significant portion allocated to vehicle procurement and maintenance.

Industrial and manufacturing facilities, including chemical plants, refineries, and mining operations, represent a crucial customer segment for Federal Signal. These clients prioritize robust safety and security systems, essential warning devices, and specialized environmental cleanup equipment to ensure worker well-being and operational continuity. Their purchasing decisions are heavily influenced by the need for regulatory compliance and enhanced operational efficiency.

In 2024, the industrial sector continued to invest in advanced safety technologies. For instance, the global industrial safety market was projected to reach over $50 billion, indicating a strong demand for the types of solutions Federal Signal provides. These facilities are particularly interested in integrated systems that can alert personnel to hazards, manage emergency responses, and support environmental remediation efforts, directly aligning with Federal Signal's product offerings.

Commercial Businesses and Utilities

Commercial businesses, utility companies, and construction firms represent a significant customer segment for Federal Signal. These entities rely on environmental solutions, such as hydro-excavators, for critical infrastructure projects and ongoing maintenance. They also utilize safety systems to protect their workforce and operations. For instance, in 2024, the infrastructure spending in the US saw continued investment, driving demand for specialized equipment used in underground utility work.

The purchasing decisions within this segment are heavily influenced by practical considerations. Key drivers include the cost-effectiveness of the solutions, their proven reliability in demanding conditions, and how well they meet the specific technical requirements of individual projects. Federal Signal's ability to offer durable, efficient, and adaptable equipment is paramount to capturing this market share.

- Infrastructure Development: Businesses and utilities utilize hydro-excavators for non-destructive digging, crucial for safely accessing underground utilities during expansion or repair projects.

- Operational Safety: Construction firms and utilities invest in emergency vehicle lighting and warning systems to enhance site safety and compliance with regulations.

- Fleet Modernization: Many companies are upgrading their fleets with more fuel-efficient and technologically advanced equipment to reduce operating costs and improve project timelines.

- Maintenance and Repair: Regular maintenance of public and private infrastructure, from water lines to power grids, necessitates specialized equipment like those offered by Federal Signal.

Emergency Services and First Responders

Federal Signal deeply serves emergency services, a critical customer segment encompassing fire departments, police forces, and emergency medical services. These organizations depend on Federal Signal for essential equipment like sirens, warning lights, and communication systems, vital for their life-saving operations.

The purchasing criteria for this segment are non-negotiable: unwavering reliability and cutting-edge features are paramount. For instance, the rapid deployment of effective warning signals can be the difference in preventing accidents or ensuring public safety during critical events. In 2024, the global market for emergency vehicle equipment was valued at approximately $15 billion, with North America representing a significant portion, underscoring the substantial demand from these sectors.

- Dedicated Focus: Serves fire, police, and EMS with specialized safety and communication equipment.

- Key Purchasing Drivers: Prioritizes product reliability, advanced functionality, and swift deployment in emergencies.

- Market Significance: This segment represents a substantial and consistent revenue stream for Federal Signal, driven by essential public safety needs.

Federal Signal also caters to a broad spectrum of commercial entities, including private security firms, airports, and industrial complexes. These customers require robust signaling and communication solutions for site security, operational efficiency, and emergency preparedness. Their needs often involve integrated systems for managing large areas and ensuring rapid response to incidents.

In 2024, the demand for advanced security and surveillance technologies continued to grow across commercial sectors. For instance, the global market for physical security equipment, which includes warning systems and communication devices, was projected to exceed $100 billion. This indicates a strong market for Federal Signal's offerings in enhancing safety and security for private enterprises.

Key purchasing considerations for commercial clients include the durability of equipment, ease of integration with existing systems, and the overall return on investment. Federal Signal's ability to provide reliable, scalable solutions that enhance operational safety and security makes it a valuable partner for these businesses.

Cost Structure

Federal Signal's manufacturing and production costs represent a substantial part of its expense structure. These costs encompass direct materials like steel and electronic components, as well as indirect expenses such as assembly labor and factory overhead. In 2023, the company reported cost of sales of $1.16 billion, highlighting the significant investment in production.

Managing these manufacturing expenses is key to maintaining profitability. For instance, fluctuations in raw material prices can directly impact the cost of goods sold. Federal Signal's focus on operational efficiency aims to mitigate these impacts and ensure competitive pricing for its diverse product lines.

Federal Signal dedicates substantial resources to Research and Development, a significant cost driver. These investments fund highly skilled engineering and scientific talent, crucial for developing cutting-edge solutions in emergency vehicle lighting, warning systems, and public safety technology.

In 2023, Federal Signal reported R&D expenses of $55.1 million. This expenditure is vital for creating innovative products, ensuring differentiation in competitive niche markets, and maintaining a technological advantage, directly impacting their ability to offer advanced and reliable safety equipment.

Federal Signal's sales, marketing, and distribution expenses are significant, covering sales team compensation, advertising efforts, and trade show presence. These are crucial for reaching new customers and expanding market share.

In 2024, Federal Signal reported selling, general, and administrative expenses of $329.1 million, a substantial portion of which is dedicated to these customer-facing activities. Managing their broad network of dealers and distributors also adds to these operational costs.

Aftermarket Service and Support Costs

Federal Signal’s aftermarket service and support costs are a crucial component of their business model, encompassing expenses for ongoing customer assistance, essential maintenance, managing parts inventory, and fulfilling warranty obligations. These activities, while revenue-generating, incur substantial costs.

The company's investment in skilled technicians, efficient logistics networks for parts delivery, and robust inventory management systems directly impacts this cost structure. For instance, in 2024, Federal Signal reported that its cost of sales, which includes many of these service-related expenses, was a significant portion of its overall expenditures.

- Personnel Costs: Salaries and benefits for service technicians, customer support staff, and inventory managers.

- Logistics and Distribution: Expenses related to shipping parts, managing repair facilities, and transportation.

- Inventory Management: Costs associated with holding and tracking spare parts to ensure availability for repairs and maintenance.

- Warranty Expenses: Provisions set aside to cover the costs of repairs or replacements under warranty agreements.

General, Administrative, and Corporate Overhead

General, Administrative, and Corporate Overhead for Federal Signal encompasses essential functions like executive leadership, accounting, human resources, and IT support. These costs are crucial for the smooth operation of the entire organization, even though they aren't directly linked to manufacturing a specific product or making a sale. For instance, in 2023, Federal Signal reported selling, general, and administrative expenses of $323.3 million, reflecting the investment in these vital support systems.

Effective management of these overheads directly impacts Federal Signal's bottom line. By optimizing these costs, the company can improve its overall profitability and financial health. This category also includes expenses related to legal counsel, compliance, and maintaining the corporate infrastructure necessary for strategic decision-making and business development.

- Corporate Management: Salaries and benefits for executives and senior leadership.

- Administrative Staff: Compensation for personnel in HR, finance, legal, and IT.

- IT Infrastructure: Costs associated with technology systems, software, and cybersecurity.

- General Operating Expenses: Includes things like office rent, utilities, and insurance not tied to production.

Federal Signal's cost structure is heavily influenced by its manufacturing and production expenses, which include raw materials and labor. Research and development is another significant investment, fueling innovation in safety technology. Sales, marketing, and administrative costs are also substantial, supporting their broad distribution network and customer outreach.

The company also incurs costs for aftermarket services and support, ensuring customer satisfaction and product longevity. These operational costs, alongside general administrative overhead, are critical for maintaining efficiency and profitability across its diverse product lines. In 2024, Federal Signal reported selling, general, and administrative expenses of $329.1 million, underscoring the investment in these key areas.

| Cost Category | 2023 Actual ($M) | 2024 Projection ($M) | Key Components |

|---|---|---|---|

| Cost of Sales | 1,160.0 | 1,210.0 | Direct materials, direct labor, manufacturing overhead |

| R&D Expenses | 55.1 | 58.0 | Engineering talent, product development, testing |

| SG&A Expenses | 323.3 | 329.1 | Sales commissions, marketing, executive salaries, IT |

Revenue Streams

Federal Signal's core revenue originates from selling its manufactured products, a significant driver of its financial performance. This includes a diverse range of essential equipment such as emergency vehicles, crucial for public safety, and industrial safety systems designed to protect workers in hazardous environments. The company also generates substantial income from sales of specialized vehicles like street sweepers, vacuum trucks, and hydro-excavators, vital for municipal and industrial operations.

In 2024, product sales are expected to continue as the dominant revenue stream, fueled by ongoing demand for new vehicle acquisitions and fleet modernization across various sectors. This segment's strength is directly tied to capital expenditure cycles in government and industrial markets.

Federal Signal generates revenue by selling replacement parts, components, and accessories for its specialized vehicles and systems. This aftermarket parts sales stream is crucial, offering a steady income as customers need these items for ongoing maintenance, repairs, and to extend the operational life of their equipment.

In 2023, Federal Signal reported that aftermarket and service revenue, which includes parts sales, represented a significant portion of their overall business. For instance, the company's consolidated net sales for the fiscal year 2023 were $1.4 billion, with their Safety and Security segment, where many aftermarket parts are sold, contributing substantially.

Federal Signal generates recurring revenue through service and maintenance contracts, offering customers ongoing support and upkeep for their installed equipment. These agreements ensure predictable income streams and foster deeper customer loyalty by providing essential preventative maintenance and repair services.

Customization and Upgrades

Federal Signal generates additional revenue by offering customization services and upgrades for its existing equipment. This ensures that products can be tailored to meet unique customer needs or adapt to evolving technological standards.

These services allow clients to enhance the functionality and lifespan of their Federal Signal assets, fostering continued sales and customer loyalty. For instance, in 2023, Federal Signal reported that its aftermarket and service segment, which includes upgrades and customization, contributed significantly to its overall revenue, reflecting the value customers place on extending the utility of their investments.

- Customization Services: Tailoring equipment to specific operational requirements.

- Upgrade Packages: Enhancing existing units with new technology or features.

- Extended Asset Life: Providing solutions that prolong the useful life of purchased equipment.

- Ongoing Revenue Stream: Creating repeat business through value-added services.

Training and Consulting Services

Federal Signal leverages its expertise by offering specialized training programs focused on the effective operation and maintenance of its sophisticated equipment. These programs are designed to maximize customer investment and ensure safety compliance.

Beyond training, Federal Signal provides valuable consulting services. These services often center on developing comprehensive safety and environmental solutions tailored to specific client needs, further solidifying customer relationships and creating an additional revenue stream.

For instance, in 2023, Federal Signal's commitment to customer success through these services contributed to their overall revenue growth, demonstrating the financial viability of this segment. This approach not only enhances customer adoption and proficiency but also generates incremental income.

- Specialized Training: Focused on operational efficiency and equipment longevity.

- Consulting Services: Offering expertise in safety and environmental solutions.

- Incremental Revenue: Generating additional income beyond core product sales.

- Customer Value: Enhancing customer success and equipment utilization.

Federal Signal's revenue streams are diversified, moving beyond initial product sales to include ongoing support and value-added services. This multi-faceted approach ensures a more stable and predictable financial performance.

Aftermarket parts and service contracts are critical, providing recurring income as customers maintain and repair their specialized equipment. These segments are vital for extending the life of Federal Signal's products and fostering customer loyalty.

In 2023, Federal Signal reported consolidated net sales of $1.4 billion, with aftermarket and service revenue, including parts sales and maintenance contracts, forming a substantial component of this total.

Customization, upgrades, and specialized training further enhance revenue by tailoring equipment to specific needs and ensuring optimal customer use, contributing to incremental income and long-term customer relationships.

Business Model Canvas Data Sources

The Federal Signal Business Model Canvas is constructed using a blend of internal financial reports, customer feedback mechanisms, and market intelligence gathered from industry analysis. These diverse data sources ensure a comprehensive and accurate representation of the company's strategic framework.