FBD Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FBD Holdings Bundle

FBD Holdings' strengths lie in its established market presence and diversified portfolio, but potential weaknesses like reliance on specific sectors could pose challenges. Understanding these internal dynamics is crucial for navigating the competitive landscape.

Discover the complete picture behind FBD Holdings' market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

FBD Holdings plc commands a formidable position in the Irish insurance landscape, built on a legacy of trust, particularly within the agricultural sector. This deep connection, stemming from its origins, translates into significant brand loyalty and a substantial, established customer base.

The company's extensive nationwide branch network is a key asset, reinforcing its local presence and fostering strong, relationship-based customer interactions. This approach is reflected in FBD's consistently high customer retention figures, demonstrating the enduring appeal of its accessible and personal service model.

FBD Holdings boasts a comprehensive product portfolio, offering a wide spectrum of general insurance solutions. This includes specialized products like farm insurance, alongside more common offerings such as home, motor, and commercial insurance. This breadth caters to a diverse customer base, from individual policyholders to large commercial enterprises.

This extensive product range is a significant strength, enabling FBD to address a multitude of insurance needs. It creates numerous opportunities for customer engagement and facilitates cross-selling, thereby deepening customer relationships and potentially boosting revenue. In 2023, FBD reported gross written premiums of €431.6 million, underscoring the scale of its operations and the market's receptiveness to its diverse offerings.

FBD Holdings demonstrates significant financial strength, underscored by its robust capital position. The company’s Solvency Capital Ratio (SCR) stood at a healthy 197% at the close of 2024, and impressively remained at 202% even after dividend payouts and share repurchases in the first half of 2025. This substantial capital buffer is a key strength, enabling FBD to effectively manage risks and pursue strategic opportunities while assuring stakeholders of its enduring stability.

Consistent Profitability and Shareholder Returns

FBD Holdings has showcased a robust history of profitable growth, even amidst market headwinds. For instance, the company reported significant increases in gross written premium (GWP) and maintained positive underwriting results throughout 2024 and the first half of 2025. This consistent financial health translates directly into tangible benefits for investors.

The company's dedication to shareholder returns is evident through its consistent distribution of value. FBD regularly provides ordinary and special dividends, and actively engages in share buyback programs. These actions clearly signal a management team focused on enhancing shareholder wealth, reflecting confidence in the company's ongoing success.

- Consistent GWP Growth: FBD has achieved notable increases in gross written premium, demonstrating an expanding market presence.

- Positive Underwriting Results: The company has consistently delivered positive underwriting profits, a key indicator of operational efficiency and pricing discipline.

- Shareholder Return Initiatives: FBD actively returns capital to shareholders via dividends and share repurchases, reinforcing its commitment to value creation.

- Proven Business Model: The sustained profitability and shareholder returns underscore the effectiveness of FBD's underlying business model and management strategies.

High Customer Retention and Policy Growth

FBD Holdings demonstrates robust customer loyalty, maintaining high retention rates across its key segments, especially within the farmer and business communities. This indicates a deep level of trust and satisfaction with their services.

The company experienced substantial policy growth, adding 33,000 new policies in 2024. This momentum continued into the first half of 2025, showcasing effective strategies for attracting new customers and expanding its market reach.

This strong performance in both retaining existing clients and acquiring new ones highlights FBD's successful customer relationship management and the appeal of its product offerings in the competitive insurance market.

- High Customer Retention: Consistently strong retention, particularly in farmer and business sectors.

- Policy Growth in 2024: Added 33,000 new policies.

- H1 2025 Momentum: Continued increases in policy count in the first half of 2025.

- Dual Success: Effective customer relationship management and attractive offerings driving acquisition and retention.

FBD Holdings plc's financial resilience is a significant strength, evidenced by its robust capital position. The company maintained a Solvency Capital Ratio (SCR) of 197% at the end of 2024, which remained strong at 202% in the first half of 2025, even after accounting for dividend payouts and share repurchases. This substantial capital buffer provides a solid foundation for risk management and strategic growth, reassuring stakeholders of FBD's stability.

The company has demonstrated a consistent track record of profitable growth, with notable increases in gross written premium (GWP) and positive underwriting results throughout 2024 and into the first half of 2025. This financial health translates into tangible benefits for investors through consistent shareholder returns, including ordinary and special dividends and active share buyback programs.

FBD's strategic focus on shareholder value is clear through its consistent capital distribution. The company actively returns value via dividends and share repurchases, reflecting management's confidence in sustained success and commitment to enhancing shareholder wealth.

| Metric | 2024 | H1 2025 |

|---|---|---|

| Gross Written Premium (GWP) | €431.6 million (2023) | Continued growth |

| Solvency Capital Ratio (SCR) | 197% | 202% |

| New Policies Added | 33,000 | Continued growth |

What is included in the product

Delivers a strategic overview of FBD Holdings’s internal and external business factors, highlighting its strengths in customer loyalty and market presence, while acknowledging weaknesses in digital transformation and opportunities in expanding product lines, alongside threats from increased competition and regulatory changes.

Uncovers critical weaknesses and threats, enabling proactive mitigation strategies for FBD Holdings.

Weaknesses

FBD Holdings faces a significant weakness in its vulnerability to extreme weather events. The company experienced a substantial profit decline in the first half of 2025, directly attributable to a surge in claims stemming from heavy snowfall and Storm Éowyn. These events alone resulted in a net cost of approximately €30.6 million, underscoring the considerable financial exposure.

While reinsurance plays a role in cushioning the blow, these weather-related incidents still directly impact FBD's underwriting results and overall profitability. This sensitivity to meteorological conditions presents a recurring challenge for the company's financial stability and performance.

FBD Holdings is grappling with a significant challenge: rising insurance service expenses and claims costs. This surge is largely attributed to disrupted supply chains, a shortage of skilled labor, and general inflation affecting materials and parts.

The impact of this inflationary environment was clearly visible in the first half of 2025, where it specifically drove up the costs associated with motor damage and property claims. This trend led to an increase in the company's combined operating ratio (COR), a key measure of underwriting profitability.

Effectively managing these escalating costs is therefore paramount for FBD Holdings to sustain its underwriting profitability. For instance, in H1 2025, the COR saw an uptick due to these pressures, underscoring the immediate need for cost control measures.

FBD Holdings' exclusive focus on the Irish market presents a significant weakness. As of the first half of 2024, the company's entire revenue base is derived from Ireland, making it highly susceptible to domestic economic fluctuations. This lack of geographic diversification means that any downturn in the Irish economy, such as a slowdown in consumer spending or an increase in unemployment, directly and disproportionately impacts FBD's performance.

Furthermore, the company is exposed to the specific regulatory environment of Ireland. Changes in insurance legislation or tax policies within the country could have a substantial negative effect on FBD's profitability and operational capacity. For instance, a significant increase in insurance premium tax, as has been debated in Ireland, would directly reduce the net income available to FBD Holdings.

Potential for Increased Litigation in Claims

FBD Holdings faces a potential increase in litigation, particularly concerning motor injury claims. In the first half of 2025, while overall injury notifications saw a dip, motor injury notifications actually rose. Notably, claims resolved through the litigation channel in H1 2025 demonstrated a higher settlement rate than in the previous year, indicating a potential shift towards more legal disputes.

This trend could lead to escalating legal expenses and a more drawn-out claims resolution process, directly impacting FBD Holdings' profitability and operational efficiency. Although the Irish government is implementing reforms to mitigate these issues, the underlying risk of increased litigation persists.

- Increased Motor Injury Claims: Motor injury notifications saw an uptick in H1 2025.

- Higher Litigation Settlement Rate: Claims settled via litigation in H1 2025 had a higher success rate than in 2024.

- Potential for Rising Legal Costs: The trend suggests a greater reliance on legal channels, increasing associated expenses.

- Government Reform Impact: While reforms are underway, the immediate risk of litigation remains a concern for FBD Holdings.

Operational Expense Increases

FBD Holdings has seen its total expenses climb, largely due to inflation affecting employee costs, IT expenditures, and higher depreciation from digital investments. For instance, in the first half of 2024, the company reported a notable increase in operating expenses compared to the same period in 2023.

This upward trend in operational expenses, driven by factors like rising salaries and increased spending on technology infrastructure, can negatively impact the company's expense ratio. Careful monitoring and strategic cost management are crucial to maintain profitability amidst these rising costs.

- Inflationary pressures have directly contributed to higher employee compensation and IT service costs.

- Digital transformation initiatives, while strategic, have led to increased depreciation charges on new assets.

- The company's expense ratio is under pressure, necessitating efficient cost control measures.

- Sustained expense growth could hinder FBD Holdings' ability to achieve profitable growth if not effectively managed.

FBD Holdings' concentrated presence in Ireland exposes it to significant domestic economic and regulatory risks. This lack of geographic diversification means that any slowdown in the Irish economy, such as reduced consumer spending or increased unemployment, disproportionately affects FBD's performance. Furthermore, changes in Irish insurance legislation or tax policies, like potential increases in insurance premium tax, could directly impact profitability.

The company is also vulnerable to rising insurance service expenses and claims costs, driven by inflation, supply chain disruptions, and labor shortages. This trend was evident in H1 2025, where increased costs for motor damage and property claims led to a higher combined operating ratio (COR), impacting underwriting profitability.

Additionally, an increase in litigation, particularly for motor injury claims, presents a weakness. Motor injury notifications rose in H1 2025, and claims settled through litigation showed a higher success rate, suggesting potential for escalating legal expenses and slower claims resolution. While government reforms are in progress, this risk remains a concern.

Finally, FBD Holdings' operational expenses have climbed due to inflation affecting employee costs, IT expenditures, and depreciation from digital investments. This upward trend in operating expenses, as seen in H1 2024, puts pressure on the company's expense ratio and necessitates careful cost management for profitable growth.

| Weakness Category | Specific Issue | Impact | Data Point (H1 2025 unless specified) |

|---|---|---|---|

| Geographic Concentration | Exclusive focus on Ireland | Susceptibility to domestic economic downturns and regulatory changes. | 100% of revenue derived from Ireland (H1 2024). |

| Rising Costs | Increased insurance service expenses and claims costs | Erosion of underwriting profitability, higher COR. | COR increased due to inflation impacting motor and property claims. |

| Litigation Risk | Potential increase in motor injury claims and litigation | Escalating legal expenses, slower claims resolution. | Motor injury notifications increased; litigation settlement rate higher than prior year. |

| Operational Expenses | Inflationary impact on employee, IT, and depreciation costs | Pressure on expense ratio, potential hindrance to profitable growth. | Notable increase in operating expenses (H1 2024 vs H1 2023). |

Preview Before You Purchase

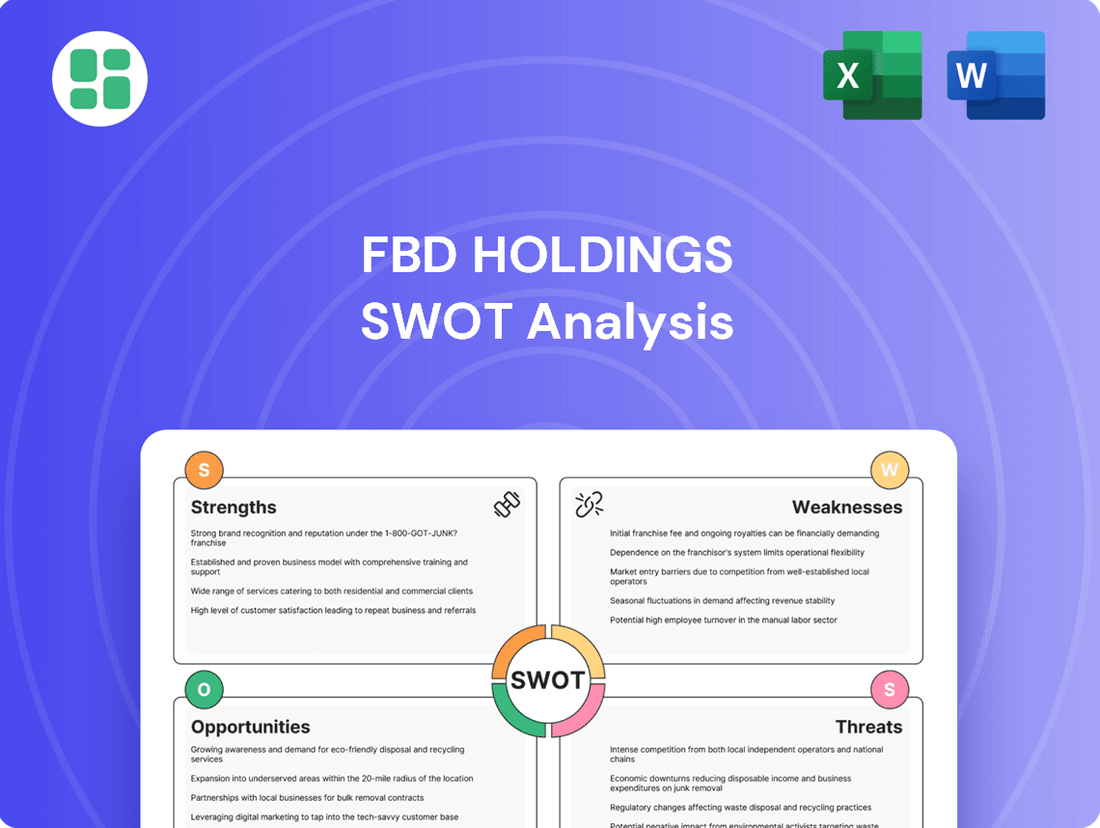

FBD Holdings SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for FBD Holdings. The complete version, offering a comprehensive breakdown of its Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use for FBD Holdings. Gain a clear understanding of its strategic position with this detailed analysis.

Opportunities

FBD Holdings can seize the opportunity to deepen its digital transformation and data capabilities. This will allow for a richer customer experience, more efficient operations, and overall improved performance. For instance, by 2025, the global insurance industry is projected to invest heavily in AI, with estimates suggesting significant cost savings through automation in areas like claims processing and fraud detection. This trend highlights a clear path for FBD to reduce overhead and boost service quality.

Specifically, embracing AI for claims handling and fraud detection presents a substantial opportunity. By automating these processes, FBD can expect to see a reduction in processing times and a decrease in operational expenses. Industry reports from 2024 indicate that insurers implementing AI for claims saw an average reduction in processing costs by up to 20%, alongside a marked improvement in accuracy.

Ultimately, a commitment to becoming a digitally forward and data-rich entity is crucial for FBD's long-term success. This strategic focus will unlock new avenues for value creation, benefiting both its customers and its stakeholders in the evolving financial landscape.

FBD Holdings has demonstrated robust new business growth, evidenced by an increase in policy counts across its farmer, business, and retail segments. This momentum highlights a significant opportunity to broaden its customer reach and intensify product penetration within its current client base.

By developing customized solutions and leveraging its high customer retention rates, FBD can further capitalize on market receptiveness. The company’s continued expansion in gross written premium, reaching an estimated €1.2 billion in 2024, underscores the strong demand for its insurance products.

The Irish insurance landscape is evolving, with embedded insurance and open finance gaining traction. FBD Holdings can leverage these trends by forming strategic partnerships, potentially integrating its offerings into retail purchases or financial services. This could unlock new customer bases and distribution channels, moving beyond conventional sales methods.

Benefit from Insurance Reform Initiatives

FBD Holdings is well-positioned to capitalize on the Irish Government's proactive insurance reform agenda. Initiatives like the Second Action Plan for Insurance Reform (2025-2029) are specifically designed to foster a more stable and cost-effective insurance sector. These reforms target reductions in legal expenses and improvements in how claims are handled, directly benefiting insurers like FBD.

By aligning with these governmental efforts, FBD can anticipate a more competitive market landscape. The reforms aim to drive down premiums and stimulate greater competition, creating a more sustainable environment for all stakeholders. FBD's participation and adaptation to these changes will be key to unlocking these benefits.

- Reduced Litigation Costs: Reforms targeting the cost of legal claims can directly improve FBD's claims settlement ratios.

- Enhanced Market Stability: A more regulated and stable market reduces unforeseen financial risks for FBD.

- Improved Competitive Positioning: Lower operational costs due to reforms allow FBD to offer more competitive pricing.

Addressing Climate Risk and Sustainability

FBD Holdings can capitalize on the growing focus on climate risk by embedding robust management strategies into its operations. This includes exploring the development of parametric insurance products specifically designed to cover climate-related events, offering a more responsive and data-driven approach to claims.

By prioritizing sustainability, FBD can significantly boost its brand image and appeal to a demographic increasingly concerned with environmental impact. This strategic shift can unlock new customer segments and potentially create avenues for innovative product lines focused on climate resilience and adaptation.

- Market Growth: The global climate risk management market is projected to reach $20.5 billion by 2027, indicating substantial opportunity.

- Customer Demand: A 2024 survey found that 70% of consumers consider a company's environmental policies when making purchasing decisions.

- Investor Interest: ESG (Environmental, Social, and Governance) investments saw a 25% increase in 2023, highlighting investor preference for sustainable businesses.

FBD Holdings can leverage the ongoing digital transformation within the insurance sector by enhancing its AI capabilities for claims processing and fraud detection. This strategic move, supported by industry data showing up to a 20% cost reduction in claims handling for AI-adopting insurers in 2024, promises improved efficiency and service quality.

The company is also well-positioned to benefit from Ireland's insurance reform agenda, particularly initiatives aimed at reducing legal expenses and improving claims handling, as outlined in the Second Action Plan for Insurance Reform (2025-2029). This creates an opportunity for enhanced market stability and competitive pricing.

Furthermore, FBD can tap into the growing demand for climate-resilient insurance products. With the global climate risk management market projected to reach $20.5 billion by 2027 and 70% of consumers in 2024 considering environmental policies, developing specialized offerings can attract new customer segments and boost brand image.

| Opportunity Area | Key Driver | Potential Benefit | Supporting Data (2024-2025) |

|---|---|---|---|

| Digital Transformation & AI | Industry-wide AI adoption | Reduced operational costs, improved service | Up to 20% cost reduction in claims handling (2024 data) |

| Government Reforms | Insurance reform initiatives | Market stability, competitive pricing | Second Action Plan for Insurance Reform (2025-2029) |

| Climate Risk Management | Growing customer/investor focus | New product lines, enhanced brand image | Global market $20.5B by 2027; 70% consumers consider environmental policies (2024) |

Threats

The increasing frequency and severity of climate-related events, exemplified by Storm Éowyn and the heavy snowfall in early 2025, present a substantial threat to FBD Holdings. These events directly translate into a surge in claims, escalating operational costs and potentially impacting underwriting profitability.

A continued trend of more intense weather could strain FBD Holdings' financial resilience, even with existing reinsurance. This could manifest as higher net claims costs and a more challenging reinsurance market, potentially leading to increased premiums or reduced coverage availability for 2025 and beyond.

Persistent inflation is a significant threat, especially impacting repair costs for vehicles and property, alongside essential materials, parts, and labor. This upward trend in the broader economy also inflates FBD Holdings' operational expenditures, such as staffing and technology investments.

For instance, in 2024, inflation in key input costs for the motor and property insurance sectors has shown resilience. In Ireland, where FBD Holdings primarily operates, consumer price index (CPI) inflation averaged 5.1% in 2023 and is projected to remain elevated, though moderating, in 2024, impacting claims payouts.

Sustained high inflation directly threatens underwriting margins by increasing the cost of settling claims and managing business operations. This can lead to higher premiums, potentially making insurance less affordable for customers, which in turn could negatively affect policy renewal rates and the acquisition of new business.

The Irish insurance market is a tough arena, with established companies and newer players like Level Health, especially in health insurance, all vying for customers. This heightened competition can force prices down, potentially shrinking FBD's market share and making it more expensive to attract new clients.

To stay ahead, FBD Holdings needs to keep innovating and making its products stand out. Failing to do so risks losing customers to rivals, as seen with the increasing number of specialized providers entering various insurance segments in Ireland.

Adverse Economic and Geopolitical Shifts

Global economic shifts and geopolitical instability present significant threats to FBD Holdings. Fluctuating interest rates, as seen with the European Central Bank's monetary policy adjustments throughout 2024, can directly impact investment returns and the cost of capital, affecting FBD's profitability. For instance, a sustained period of higher interest rates could increase claims costs for certain insurance products while simultaneously boosting investment income on FBD's portfolio.

The Irish economy, heavily reliant on international trade and investment, is particularly vulnerable to these global headwinds. Deglobalisation trends and potential changes in international taxation policies could disrupt supply chains and alter the competitive landscape for FBD. These shifts may lead to reduced consumer spending, impacting premium growth across FBD's insurance lines, and could also increase the volatility of its investment portfolio.

- Economic Slowdown: A projected slowdown in global GDP growth for 2024-2025 could dampen demand for insurance products.

- Inflationary Pressures: Persistent inflation can increase the cost of claims settlement, impacting underwriting profitability.

- Geopolitical Tensions: Ongoing conflicts and trade disputes can disrupt markets and increase operational risks.

- Interest Rate Volatility: Unpredictable changes in interest rates affect investment income and the valuation of liabilities.

Regulatory Changes and Compliance Burden

Ongoing shifts in insurance regulations, including those concerning data privacy and solvency, present a significant threat to FBD Holdings. Adapting to these evolving requirements demands substantial investment in technology and operational adjustments, which could elevate operational expenditures. For instance, the implementation of new data protection mandates in various jurisdictions by mid-2024 required insurers to allocate an average of 5-10% of their IT budget towards compliance. This increased spending might divert crucial resources away from strategic growth opportunities and product innovation.

The growing complexity of compliance across different markets adds another layer of challenge. FBD Holdings must navigate a patchwork of rules, potentially increasing the burden and risk of non-compliance. This could manifest in several ways:

- Increased operational costs: Hiring specialized compliance staff and updating internal systems to meet new standards.

- Potential for fines: Failure to adhere to new regulations, such as those related to consumer protection, could result in substantial financial penalties.

- Slower product launches: The need for regulatory approval for new products or services can delay market entry, impacting competitiveness.

Intensifying weather patterns, such as those experienced with Storm Éowyn and early 2025 snowfalls, directly increase claims, raising operational costs and potentially squeezing underwriting profits for FBD Holdings. A sustained period of severe weather could strain the company's financial stability, leading to higher net claims and a tougher reinsurance market, impacting premiums and coverage availability through 2025.

Persistent inflation significantly threatens FBD Holdings by driving up repair costs for vehicles and property, as well as material and labor expenses. This economic trend also inflates operational expenditures, including staffing and technology investments. For example, Irish CPI inflation, which averaged 5.1% in 2023, is expected to remain elevated in 2024, impacting claims payouts and underwriting margins.

Intensified competition within the Irish insurance market, with established players and new entrants like Level Health, can lead to price pressures, potentially reducing FBD's market share and increasing client acquisition costs. Failure to innovate and differentiate offerings risks customer attrition to specialized providers entering various insurance segments.

Global economic shifts and geopolitical instability pose considerable threats, with fluctuating interest rates impacting investment returns and capital costs. The Irish economy's reliance on international trade makes it vulnerable to deglobalisation trends and changes in international taxation, which could disrupt supply chains, reduce consumer spending, and increase investment portfolio volatility.

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including FBD Holdings' official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment, ensuring an accurate and actionable SWOT assessment.