FBD Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FBD Holdings Bundle

FBD Holdings operates within a dynamic insurance landscape where buyer power can significantly influence pricing, while the threat of new entrants remains a constant consideration. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping FBD Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

FBD Holdings, a general insurer, depends on reinsurers to cover major risks, especially from events like extreme weather. Reinsurers are becoming more discerning about the risks they accept, particularly in casualty lines, where pricing is increasing due to social inflation and rising litigation expenses. This trend grants reinsurers more influence over contract terms and pricing, directly affecting FBD's expenses for transferring risk.

The Irish insurance sector's digital pivot, with FBD Holdings investing heavily in AI and automation, increases its dependence on technology and digital solution providers. This reliance, driven by the need for operational efficiency and better customer engagement, positions these specialized vendors favorably.

The growing demand for cutting-edge Insurtech solutions, coupled with a shortage of skilled digital talent in Ireland, significantly bolsters the bargaining power of technology suppliers. For instance, the global Insurtech market was projected to reach $10.5 billion in 2024, indicating strong demand for these specialized services.

FBD Holdings is experiencing significant inflationary pressures on its claims costs in 2024, with motor damage and property claims showing increased average costs and frequency. This upward trend in expenses directly reflects the growing influence of entities within the claims services and repair networks. These providers, from adjustment services to repair garages, can leverage their position to impact FBD's bottom line.

The bargaining power of these suppliers is evident in their ability to command higher prices for parts and labor, directly affecting FBD's underwriting profitability. For instance, the average cost of motor repairs, a key component of FBD's claims expenses, has seen a notable increase in 2024. This suggests that repair networks are effectively passing on their own rising costs, thereby exerting considerable leverage over FBD.

Legal and Actuarial Expertise

FBD Holdings faces significant bargaining power from its legal and actuarial service providers, driven by the intricate Irish insurance regulatory landscape and ongoing reform efforts. The necessity for specialized expertise to interpret evolving personal injury guidelines and ensure compliance with new regulations grants these professionals considerable leverage. This reliance on niche knowledge for accurate risk pricing and adherence to legal frameworks underscores their influential position.

The specialized nature of legal and actuarial services required by FBD Holdings means that fewer firms possess the necessary deep understanding of Irish insurance law and actuarial science. For instance, the implementation of the Judicial Council’s Personal Injury Guidelines in April 2021 significantly altered how injury claims are assessed, requiring actuaries to recalibrate pricing models and legal teams to adapt litigation strategies. This demand for highly specific, often scarce, expertise allows these service providers to command higher fees and influence contract terms.

- High Specialization: Legal and actuarial professionals possess niche knowledge critical for FBD's compliance and risk management.

- Regulatory Complexity: The intricate Irish insurance regulatory environment necessitates reliance on expert external advice.

- Essential Services: Accurate risk pricing and navigating legal reforms are fundamental to FBD's operations, increasing supplier leverage.

- Limited Alternatives: The scarcity of providers with the requisite specialized expertise limits FBD's ability to switch suppliers easily.

Skilled Workforce and Talent Acquisition

The Irish insurance sector, including companies like FBD, is experiencing a significant shortage of specialized talent. This deficit is particularly pronounced in areas critical for modern operations, such as digital technology, actuarial science, compliance, risk management, and underwriting.

As FBD pursues its growth objectives and digital transformation initiatives, the ability to attract and retain individuals with these sought-after skills is paramount. The scarcity of such a skilled workforce inherently strengthens the bargaining position of employees possessing these in-demand competencies.

This heightened employee leverage translates directly into increased demands for competitive compensation packages and enhanced benefits. Consequently, insurers face upward pressure on their operational expenses due to the need to offer more attractive remuneration to secure and retain vital talent.

- Skills Gap Impact: The Irish insurance industry faces a notable skills deficit in digital technology, actuarial science, compliance, risk, and underwriting.

- Talent Acquisition Challenge: Attracting and retaining scarce talent is crucial for FBD's growth and digital transformation efforts.

- Employee Bargaining Power: A scarcity of skilled workers empowers employees with in-demand skills, leading to increased demands for compensation and benefits.

- Rising Operational Costs: The need to secure and retain specialized talent contributes to increased operational expenses for insurers.

The bargaining power of suppliers for FBD Holdings is multifaceted, stemming from reinsurers, technology providers, claims services, legal and actuarial experts, and skilled employees. Reinsurers hold significant sway due to increasing risk selectivity, particularly in casualty lines, impacting FBD's risk transfer costs. Technology suppliers are empowered by the growing demand for Insurtech solutions and a shortage of digital talent, with the global Insurtech market projected at $10.5 billion in 2024.

Claims service providers, including repair networks, exert influence through rising costs for parts and labor, a trend evident in 2024 motor repair expenses. Legal and actuarial firms leverage their specialized knowledge of Ireland's complex regulatory landscape and reforms, such as the 2021 Personal Injury Guidelines, to command higher fees. Furthermore, a significant skills shortage across critical areas like digital technology and actuarial science in Ireland strengthens employee bargaining power, driving up operational costs for insurers like FBD.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on FBD Holdings | Relevant Data/Trends (2024) |

|---|---|---|---|

| Reinsurers | Risk selectivity, pricing power in casualty lines | Increased cost of risk transfer | Rising reinsurance premiums in certain lines |

| Technology Providers | Demand for Insurtech, talent shortage | Higher costs for digital solutions | Global Insurtech market projected at $10.5 billion |

| Claims Services & Repair Networks | Inflationary pressures on parts and labor | Increased claims settlement costs | Notable increase in average motor repair costs |

| Legal & Actuarial Services | Specialized expertise, regulatory complexity | Higher fees for compliance and risk pricing | Impact of Judicial Council's Personal Injury Guidelines (April 2021) |

| Skilled Employees | Industry-wide skills shortage | Increased wage and benefit demands | Talent scarcity in digital, actuarial, compliance roles |

What is included in the product

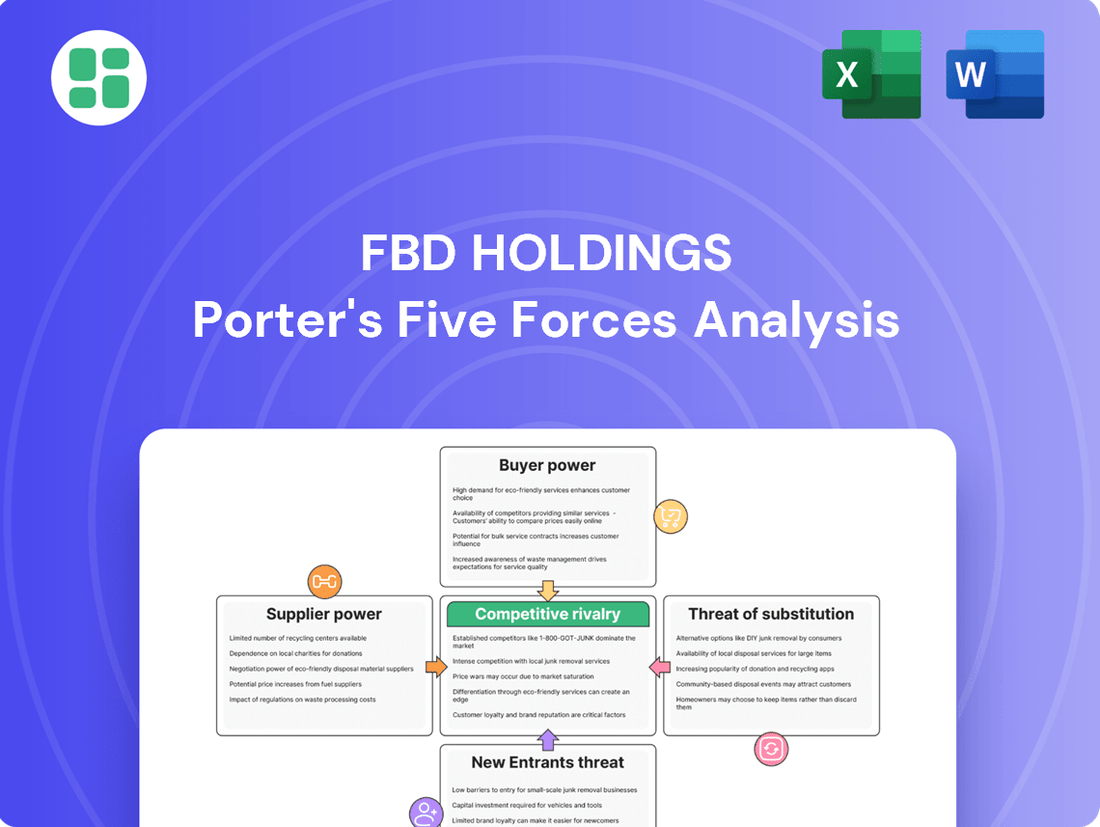

This analysis dissects the competitive forces impacting FBD Holdings, examining the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and strategize against competitive pressures with a dynamic, visual representation of FBD Holdings' Porter's Five Forces.

Customers Bargaining Power

Customers in the Irish general insurance market, especially for motor and home insurance, are very sensitive to price. They actively use online comparison tools to find the best deals.

This easy access to multiple quotes and policy comparisons allows consumers to easily find the most competitive prices. For instance, in 2023, the average premium for private car insurance in Ireland saw a notable increase, yet comparison sites remained a primary tool for consumers seeking value.

This transparency directly pressures insurers like FBD to keep their prices competitive to attract and retain customers, as switching is often straightforward and cost-driven.

For individuals looking for car or home insurance, the effort and expense involved in switching companies are quite minimal, particularly with today's easy online application systems. This ease of transition means customers can readily compare and move to other insurers if they find better deals or service.

While FBD Holdings has a strong track record of keeping its customers, this low switching cost significantly boosts the bargaining power of these individual policyholders. They can leverage the availability of alternatives to negotiate better terms or simply move their business elsewhere if dissatisfied.

Consequently, FBD must consistently focus on delivering superior value and fostering customer loyalty through excellent service and benefits, rather than relying solely on price to retain its personal lines business. For instance, in 2024, the average customer acquisition cost in the competitive Irish insurance market remained a key consideration for companies like FBD.

FBD Holdings caters to a broad customer spectrum, encompassing farmers, private individuals, and businesses. This segmentation means customer bargaining power isn't uniform; farmers, for instance, may show greater loyalty due to FBD's specialized agricultural products and established relationships.

Conversely, individual consumers and smaller enterprises often have a wider array of choices and simpler requirements, making them more sensitive to competitive pricing and promotions. This can amplify their collective bargaining influence.

FBD's strategic objective to expand across all these customer segments underscores the necessity of carefully managing the varied expectations and demands inherent in each group.

Increased Customer Expectations from Digitalization

Modern customers, accustomed to seamless digital experiences in other industries, now expect insurers like FBD Holdings to offer hyper-personalized, on-demand, and consistent engagement across all channels. This heightened expectation is a direct result of widespread digitalization.

Competitors leveraging advanced digital tools and AI-driven services are setting new benchmarks for customer experience. For instance, in 2024, the global AI in insurance market was valued at approximately $10.5 billion and is projected to grow significantly, indicating a strong industry trend towards digital enhancement.

If FBD Holdings fails to meet these evolving digital expectations, customers possess a greater ability to switch to providers offering a more streamlined and tailored digital journey. This shift directly amplifies the bargaining power of customers.

- Digitalization fuels customer expectations: Customers now demand personalized, on-demand, and omnichannel interactions from their insurers, mirroring experiences in other advanced digital sectors.

- Competitor advancements raise the bar: The availability of AI-driven services and advanced digital tools from rivals sets higher standards for customer experience, forcing all players to adapt.

- Risk of customer attrition: Failure by FBD Holdings to align with these evolving digital expectations could lead customers to seek out competitors offering superior digital engagement, thereby increasing customer power.

Regulatory Empowerment of Consumers

The Central Bank of Ireland's proactive stance on consumer protection significantly bolsters the bargaining power of customers in the insurance sector. Their ongoing reviews of the Consumer Protection Code, for instance, are designed to ensure greater fairness and transparency.

These regulatory actions directly translate into stronger consumer leverage. By mandating enhanced information disclosure and establishing clearer avenues for complaint resolution, the Central Bank empowers policyholders, making them less susceptible to unfavorable terms. For example, in 2023, the Central Bank reported a 15% increase in consumer complaints related to insurance products, prompting further scrutiny of insurer practices.

- Enhanced Information: Consumers receive clearer details about policy terms and conditions, enabling better comparison and informed choices.

- Improved Recourse: Regulatory frameworks provide accessible channels for consumers to address grievances, increasing accountability for insurers.

- Stricter Conduct: Insurers face rigorous conduct of business requirements, ensuring they act in the best interests of policyholders.

- Fairer Pricing: Increased transparency can lead to more competitive pricing as insurers are pressured to offer value.

Customers in the Irish insurance market, particularly for personal lines like motor and home insurance, exhibit significant bargaining power. This stems from their price sensitivity and the ease with which they can compare offerings, often utilizing online comparison tools. In 2023, the average private car insurance premium in Ireland saw an increase, yet comparison sites remained a primary channel for consumers seeking value, highlighting their leverage.

The low cost and minimal effort associated with switching insurance providers further amplify customer power. This ease of transition allows individuals to readily move to competitors offering better deals or service, compelling insurers like FBD to focus on delivering superior value and fostering loyalty beyond just price. The average customer acquisition cost in the competitive Irish insurance market remained a key consideration for companies like FBD in 2024.

Digitalization has also raised customer expectations, with demands for personalized, on-demand, and omnichannel engagement. Competitors leveraging advanced digital tools and AI, a market valued at approximately $10.5 billion globally in 2024, are setting new benchmarks. Failure to meet these evolving digital expectations can lead customers to switch, increasing their bargaining power.

Regulatory oversight from bodies like the Central Bank of Ireland also strengthens customer bargaining power. By mandating enhanced information disclosure and establishing clearer complaint resolution avenues, policyholders are better informed and less susceptible to unfavorable terms. For instance, a 15% increase in consumer complaints related to insurance products was reported by the Central Bank in 2023, indicating a trend of increased consumer vigilance and regulatory scrutiny.

Preview the Actual Deliverable

FBD Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive FBD Holdings Porter's Five Forces Analysis that you will receive instantly upon purchase. The document you see here is the exact, professionally formatted report, providing an in-depth examination of competitive forces within FBD Holdings' industry. You can be confident that no placeholders or sample content are present; this is the complete analysis ready for your immediate use.

Rivalry Among Competitors

The Irish general insurance market is decidedly mature, characterized by a crowded field of well-established domestic and international players. This maturity means that growth opportunities are often hard-won, forcing companies like FBD Holdings to fight for every percentage point of market share.

With over 180 international insurers and reinsurers actively operating from Ireland, the competitive intensity is palpable. FBD, as a leading general insurer, navigates this environment where strong brand recognition and deep-seated customer loyalty are significant barriers to entry and retention for rivals.

Competitive rivalry within the insurance sector is particularly fierce, fueled by ongoing pricing pressures and escalating claims costs. This trend was especially pronounced in motor and property insurance during 2024, where inflation significantly impacted expenses. While FBD Holdings managed to boost its gross written premium and revenue in 2024, the broader non-life insurance market faced a contraction in premium volumes.

Digital transformation is now a critical survival tactic in the Irish insurance sector, with competitors aggressively investing in artificial intelligence and automation. This surge in tech adoption means companies are battling not just on price or product, but on their innovative digital capabilities.

Insurers are actively deploying AI across various functions, from streamlining underwriting and claims processing to enhancing fraud detection and customer service interactions. This focus on AI aims to boost operational efficiency and elevate the overall customer experience, creating a competitive edge.

The accelerated adoption of these advanced technologies significantly heightens competitive rivalry. Firms that lead in digital innovation and AI integration are better positioned to attract and retain customers, putting pressure on laggards to keep pace or risk falling behind in this rapidly evolving market.

Product Differentiation and Niche Markets

Competitors are increasingly differentiating themselves through highly tailored solutions, integrating insurance into other products, and offering personalized services, moving beyond standard insurance offerings. This intense focus on unique value propositions is reshaping the competitive landscape.

FBD Holdings benefits from its established presence in the farming community and its network of local offices, which offer a distinct advantage. However, to truly stand out in the wider market, continuous innovation in product development and service delivery is essential.

The pressure from rivals compels insurers to constantly innovate, introducing new products and services designed to meet the ever-changing demands of customers. For instance, in 2024, the general insurance sector saw a notable increase in demand for flexible, usage-based insurance options, reflecting this shift.

- Product Innovation: Insurers are developing specialized policies for emerging risks, such as cyber threats and climate-related events.

- Embedded Insurance: Integration of insurance at the point of sale for other goods and services is becoming a key differentiator.

- Personalization: Leveraging data analytics to offer customized pricing and coverage options tailored to individual customer needs.

- Customer Experience: Enhancing digital platforms and claims processes to provide seamless and efficient customer interactions.

Regulatory Reforms and Compliance Costs

Ongoing insurance reform initiatives in Ireland, such as the Personal Injuries Guidelines introduced in April 2021, are designed to foster market stability and curb escalating legal expenses. These reforms, while beneficial for reducing claims costs over time, necessitate significant investment in compliance and adaptation for all market participants.

The complexity and cost associated with adhering to new regulatory frameworks can create a competitive advantage for firms that effectively manage this burden. For instance, the Central Bank of Ireland’s focus on consumer protection and market conduct requires continuous investment in robust compliance systems and expertise. In 2024, the estimated cost for insurers to maintain regulatory compliance across the EU, including Ireland, continues to be a substantial operational expense, often running into millions of euros annually per large insurer.

- Impact of Personal Injuries Guidelines: These guidelines, implemented in April 2021, aim to standardize award levels for minor injuries, potentially reducing the frequency and cost of litigation.

- Adaptation Costs: Insurers face direct costs in updating systems, training staff, and potentially engaging legal counsel to ensure full adherence to evolving regulatory requirements.

- Competitive Differentiator: Companies with agile compliance frameworks and the financial capacity to invest in regulatory adaptation are better positioned to navigate the changing landscape.

- Industry-Wide Burden: The regulatory environment affects all insurers operating in Ireland, creating a baseline challenge that requires strategic resource allocation.

The competitive rivalry in the Irish general insurance market is intense, with FBD Holdings operating in a crowded space filled with both domestic and international players. This maturity means companies are constantly vying for market share, often through aggressive pricing strategies and escalating claims costs, which were particularly evident in motor and property insurance during 2024 due to inflation.

Digital transformation is now a key battleground, with insurers heavily investing in AI and automation to improve efficiency and customer experience. This technological race intensifies rivalry, as firms that lead in innovation gain a significant edge.

Competitors are increasingly differentiating themselves through personalized services and embedded insurance offerings, moving beyond traditional products. FBD's established presence, particularly in the farming sector, provides an advantage, but continuous innovation is crucial to remain competitive.

The sector saw a rise in demand for flexible, usage-based insurance options in 2024, highlighting the need for insurers to adapt their product development and service delivery.

| Key Competitive Factors | 2024 Observations | Impact on FBD Holdings |

| Pricing Pressure | Significant due to inflation and claims costs | Requires efficient cost management and pricing strategies |

| Digital Innovation (AI/Automation) | Aggressive investment by competitors | Necessitates ongoing investment in technology to maintain parity |

| Product Differentiation | Focus on personalization and embedded insurance | Opportunity for FBD to leverage data for tailored offerings |

| Customer Experience | Enhancement of digital platforms and claims processes | Drives need for seamless and efficient customer interactions |

SSubstitutes Threaten

For substantial businesses, self-insurance or setting up captive insurance firms presents a direct substitute to buying commercial policies from companies like FBD. This approach enables them to manage their own risks, potentially cutting premium expenses and gaining greater command over their risk funding. The viability of self-insurance is directly tied to a client's scale and their established risk management practices. For instance, in 2023, the global captive insurance market was valued at approximately $75 billion, indicating a significant alternative for risk financing.

Sophisticated corporate clients are increasingly exploring Alternative Risk Transfer (ART) mechanisms, like catastrophe bonds and industry loss warranties, to manage severe risks. These financial instruments directly link risk to capital markets, bypassing traditional insurance. For example, the catastrophe bond market saw significant issuance in 2023, with total issuance reaching approximately $15 billion, demonstrating a growing appetite for such solutions.

The increasing focus on proactive risk management and loss prevention, powered by technologies like IoT and telematics, can diminish the demand for traditional insurance. For instance, advancements in predictive analytics allow businesses to anticipate and mitigate potential losses, potentially reducing their reliance on extensive coverage.

This shift means that companies and individuals investing in robust risk mitigation strategies may opt for less comprehensive insurance policies. They might prioritize coverage for catastrophic events over broader protection, effectively substituting prevention efforts for full insurance policies.

Government or Industry-Specific Schemes

Government or industry-specific schemes can act as substitutes for traditional insurance products by offering alternative forms of protection. For instance, in agriculture, government-subsidized crop insurance programs can reduce the need for private sector coverage, especially for widespread risks. In 2024, many nations continued to bolster their agricultural support programs, with countries like the United States allocating billions to disaster assistance and crop insurance subsidies, directly impacting the market for private agricultural insurers.

These schemes often provide a safety net for specific events or sectors, thereby diminishing the reliance on commercial insurers. For FBD Holdings, this is particularly relevant in sectors like agriculture, where niche government programs or industry mutual funds could emerge as a substitute threat. For example, the European Union's Common Agricultural Policy (CAP) includes measures that can indirectly subsidize risk management for farmers, potentially limiting the demand for certain private insurance offerings.

- Government-backed compensation schemes offer a safety net for specific risks, potentially reducing reliance on commercial insurers.

- Industry-specific mutual funds can pool resources to cover common risks within a sector, presenting an alternative to private insurance.

- Agricultural support programs, such as subsidies for crop insurance or disaster relief, are significant substitutes in that sector. For example, the US Federal Crop Insurance Program saw participation from over 1.2 million policyholders in 2023, demonstrating the scale of government involvement.

- Niche programs tailored to particular industries or risks can fragment the market and divert potential customers from private insurers like FBD.

Embedded Insurance and Non-Traditional Providers

The increasing prevalence of embedded insurance presents a significant threat to traditional insurers like FBD Holdings. This model integrates insurance seamlessly into product or service purchases, such as vehicle financing or travel bookings. For instance, by 2024, the global embedded insurance market is projected to reach over $3 trillion in premiums, demonstrating its rapid growth and customer acceptance.

This shift makes standalone policies from FBD appear less convenient and potentially more expensive. Non-traditional providers, including large technology firms and specialized digital platforms, are well-positioned to capitalize on this trend. They can offer these integrated solutions, acting as indirect substitutes that bypass traditional distribution channels.

- Embedded insurance growth: The global market is expected to exceed $3 trillion in premiums by 2024, indicating a substantial shift in customer acquisition for insurance products.

- Customer convenience: Bundling insurance with core purchases simplifies the process for consumers, making separate policy acquisition seem cumbersome.

- New market entrants: Big tech and fintech companies can leverage existing customer bases and data to offer competitive embedded insurance products, posing a direct challenge to established players like FBD.

- Disintermediation: These new models can reduce the reliance on traditional insurance intermediaries and direct sales forces, potentially eroding FBD's market share.

The threat of substitutes for FBD Holdings is significant, encompassing both direct and indirect alternatives. Self-insurance and captive insurance firms provide substantial businesses with direct control over risk management, potentially reducing costs. For example, the global captive insurance market's valuation of approximately $75 billion in 2023 highlights this alternative's scale.

Alternative Risk Transfer (ART) mechanisms, such as catastrophe bonds, also serve as substitutes, directly linking risk to capital markets. The $15 billion issuance in the catastrophe bond market in 2023 underscores the growing adoption of these financial instruments.

Furthermore, advancements in risk mitigation technologies and government-backed schemes, particularly in sectors like agriculture where US Federal Crop Insurance saw over 1.2 million policyholders in 2023, present considerable substitution threats by reducing reliance on traditional insurance.

| Substitute Type | Description | Market Indicator (2023/2024 Data) | Impact on FBD |

|---|---|---|---|

| Self-Insurance/Captives | Direct risk management by businesses. | Global captive insurance market valued at ~$75 billion (2023). | Reduces demand for commercial policies. |

| Alternative Risk Transfer (ART) | Catastrophe bonds, industry loss warranties. | Catastrophe bond issuance reached ~$15 billion (2023). | Bypasses traditional insurance for severe risks. |

| Risk Mitigation Tech | IoT, telematics, predictive analytics. | Growing adoption across industries. | Decreases need for extensive coverage. |

| Government/Industry Schemes | Crop insurance subsidies, mutual funds. | US Federal Crop Insurance: >1.2 million policyholders (2023). | Fragment market, reduce reliance on private insurers. |

Entrants Threaten

The Irish insurance market presents significant barriers to entry due to stringent regulations. The Central Bank of Ireland enforces strict capital requirements under Solvency II, a framework designed to ensure insurers can meet their obligations. For instance, Solvency II requires insurers to hold capital commensurate with their risk profile, often translating into hundreds of millions of euros in required capital, making it a substantial hurdle for new entrants.

Beyond capital, new companies must navigate complex licensing and ongoing compliance procedures. These administrative burdens demand considerable legal and financial expertise, further increasing the cost and time associated with market entry. In 2024, the complexity of these requirements continues to deter potential new players, safeguarding established entities like FBD Holdings.

Established insurers like FBD Holdings benefit from decades of strong brand recognition, especially within the Irish farming sector. This deep-rooted trust is a significant hurdle for newcomers. For instance, FBD's commitment to the agricultural community has fostered loyalty that new entrants would struggle to replicate quickly.

FBD's extensive distribution network, comprising 34 local offices across Ireland, provides unparalleled customer access. New competitors would need to invest heavily in marketing and establishing a physical presence to even approach FBD's reach. This widespread network acts as a substantial barrier, making it difficult for new entrants to gain traction and build a comparable customer base.

Incumbent insurers like FBD Holdings enjoy substantial economies of scale, which translate into lower per-unit costs for underwriting, claims handling, and overall operations. This efficiency allows them to price their products more competitively than newer, smaller players. For instance, in 2024, the Irish insurance market saw continued consolidation, with larger firms leveraging their scale to absorb fixed costs more effectively.

Moreover, established insurers possess a critical data advantage. Years of accumulated data on customer behavior, risk profiles, and claims history enable more precise actuarial modeling and accurate pricing. New entrants, lacking this extensive historical dataset, face a significant hurdle in matching the risk assessment capabilities and therefore the pricing strategies of incumbents like FBD Holdings.

Access to Reinsurance and Underwriting Expertise

Newcomers often struggle to access the same favorable reinsurance terms as established insurers. In 2024, the global reinsurance market, while possessing ample capacity, saw new entrants facing higher costs and more restrictive terms due to their lack of a proven track record and established relationships with reinsurers. This can significantly impact a new insurer's ability to compete on price and coverage.

Building a strong underwriting team is another substantial hurdle. Acquiring deep expertise across various insurance lines, such as farm, home, motor, and commercial, requires significant investment in talent acquisition and training. This process is both time-consuming and costly, making it difficult for new entrants to match the specialized knowledge of incumbents.

- Reinsurance Access: New entrants face challenges securing favorable terms, potentially increasing their cost of capital compared to established players with long-standing reinsurer relationships.

- Underwriting Expertise: Developing a skilled underwriting team across diverse insurance segments is a significant barrier, requiring substantial time and financial resources.

- Market Entry Costs: The combined costs of securing reinsurance and building underwriting talent represent a considerable financial barrier to entry in the insurance sector.

Insurtech Disruption and Niche Entry

The threat of new entrants for FBD Holdings is amplified by the Insurtech revolution. These digital-first companies, utilizing AI and data analytics, can enter specific market niches with lower overhead and more agile operations, potentially challenging established players.

Insurtechs are not just about partnerships; some are building the capital and seeking regulatory approvals to become direct competitors. For instance, in 2024, global Insurtech funding reached over $10 billion, with a significant portion directed towards companies aiming to disrupt traditional insurance models through technology and customer-centric offerings.

These new entrants can bypass some traditional barriers by focusing on specialized products or underserved customer segments. For example, a new Insurtech might offer highly personalized travel insurance leveraging real-time data, a segment where incumbents may have been slower to innovate.

- Insurtech Funding Surge: Global Insurtech funding exceeded $10 billion in 2024, indicating significant capital available for new market entrants.

- Niche Market Disruption: Insurtechs often target specific, profitable niches, offering tailored digital solutions that incumbents may overlook.

- Technological Advantage: AI and advanced analytics allow Insurtechs to underwrite more accurately and manage claims more efficiently, creating a competitive edge.

- Regulatory Navigation: While challenging, Insurtechs are actively seeking necessary licenses to operate independently, posing a direct competitive threat.

The threat of new entrants in the Irish insurance market, while generally low for traditional players, is being reshaped by Insurtech innovation. High capital requirements and stringent regulatory approvals, such as those under Solvency II, continue to be significant deterrents for new, capital-intensive insurance companies. Established firms like FBD Holdings also benefit from strong brand loyalty and extensive distribution networks, making it difficult for newcomers to gain immediate traction.

However, Insurtechs, backed by substantial funding—global Insurtech funding surpassed $10 billion in 2024—are entering niche markets with agile, technology-driven models. These digital-first companies can bypass some traditional barriers by focusing on specialized products and leveraging AI for underwriting and claims processing, thereby posing a distinct, albeit different, competitive challenge.

| Barrier Type | Description | Impact on New Entrants |

| Regulatory Capital | Solvency II requirements necessitate significant capital reserves. | High financial hurdle for new insurers. |

| Licensing & Compliance | Complex administrative and legal processes. | Increases cost and time to market entry. |

| Brand Loyalty & Trust | Established reputation, particularly in sectors like agriculture. | Difficult for new entrants to replicate quickly. |

| Distribution Network | Extensive physical presence and customer access. | Requires substantial investment to match. |

| Economies of Scale | Lower per-unit costs for established players. | Enables more competitive pricing for incumbents. |

| Data Advantage | Accumulated historical data for risk assessment. | New entrants lack the precision of incumbents' pricing. |

| Reinsurance Access | Established relationships with reinsurers. | New entrants face higher costs and restrictive terms. |

| Underwriting Expertise | Deep, specialized knowledge across various insurance lines. | Costly and time-consuming to build. |

| Insurtech Funding (2024) | Over $10 billion globally. | Enables agile, niche market entry and disruption. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FBD Holdings is built upon a robust foundation of data, including company annual reports, industry-specific market research from firms like IBISWorld, and publicly available regulatory filings. This blend of internal and external information allows for a comprehensive understanding of the competitive landscape.