FBD Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FBD Holdings Bundle

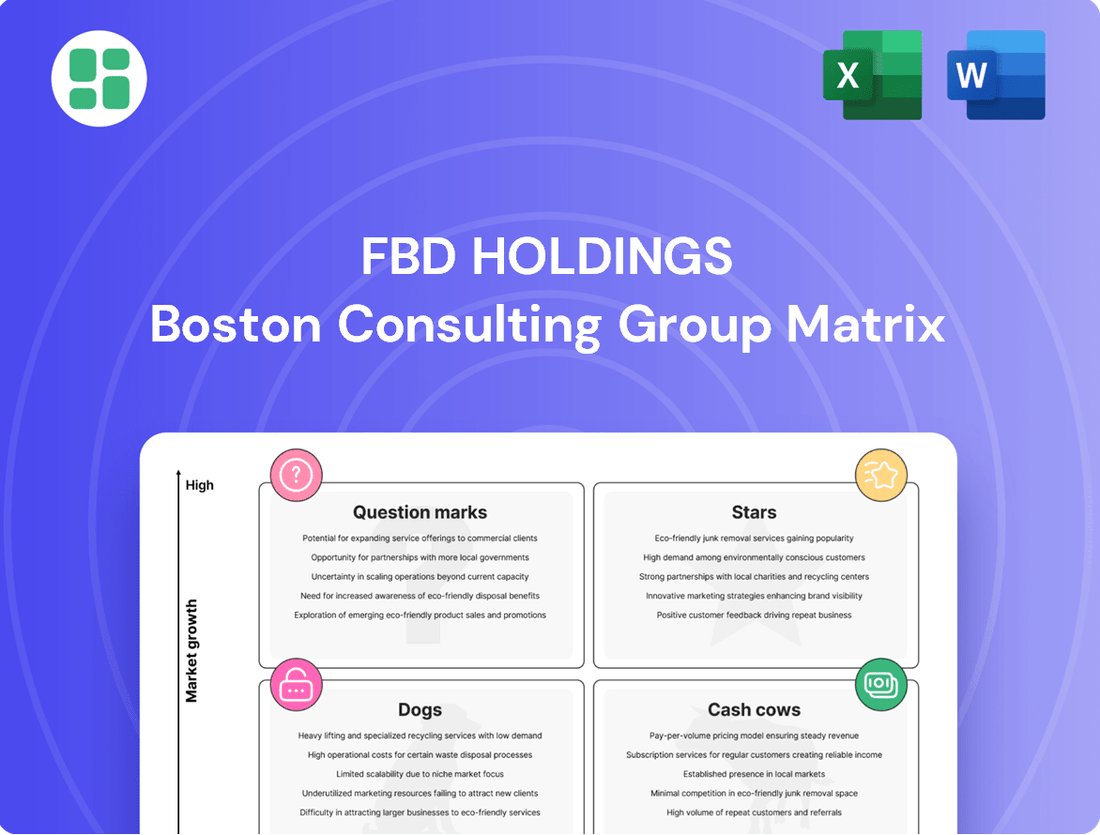

Unlock the strategic potential of FBD Holdings with a comprehensive look at its BCG Matrix. Understand which of their offerings are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or promising but unproven ventures (Question Marks).

This preview offers a glimpse into FBD Holdings' market positioning, but the full BCG Matrix report provides the detailed quadrant placements, data-driven analysis, and actionable recommendations you need to make informed investment and product development decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix today to gain a clear roadmap for optimizing FBD Holdings' portfolio and driving future growth.

Stars

FBD Holdings is strategically expanding its retail presence by leveraging digital distribution channels, notably through its direct-to-consumer platform, FBD Direct. This digital push is complemented by key partnerships with established players like An Post Insurance and Bank of Ireland, broadening FBD's reach and accessibility in the market.

The Irish insurance market's digital channels are experiencing robust growth, estimated at an 8% annual rate. This upward trend highlights the increasing importance of online platforms for customer acquisition and service delivery, indicating a fertile ground for FBD's digital initiatives.

The demand for cyber insurance in Ireland is expected to climb significantly, driven by stricter regulations and the escalating financial impact of data breaches. For FBD Holdings, successfully marketing specialized cyber insurance products to businesses positions them in a high-growth area where they can actively capture market share.

Parametric insurance, especially for climate risks and natural disasters, is gaining traction in Ireland. If FBD Holdings were to be an early adopter or a major investor in these novel offerings, it could secure a dominant spot in this expanding market segment.

Specialised Commercial Insurance for Emerging Sectors

As the Irish economy diversifies, new sectors like renewable energy and specialized tech firms present distinct insurance needs. FBD Holdings, with its established presence and focus on business support, is well-positioned to cater to these emerging markets.

FBD's commitment to sustainability, exemplified by its investment in agricultural research and development, aligns with the growth trajectory of green industries. This strategic alignment suggests a potential expansion into insuring these high-potential commercial segments.

Consider the following for specialized commercial insurance:

- Renewable Energy: Covering risks associated with solar farms, wind turbines, and associated infrastructure.

- Niche Technology: Providing tailored policies for cybersecurity firms, AI developers, and advanced manufacturing.

- Biotechnology & Life Sciences: Addressing the unique liabilities and research risks in these rapidly advancing fields.

Enhanced Financial Services for Growth Segments

FBD Holdings' financial services segment, while secondary to its core insurance business, presents a compelling opportunity for growth, especially in Ireland's evolving demographic and wealth landscape. Areas like investment and pension brokerage align directly with increasing demand from aging populations and those accumulating wealth.

This segment is strategically positioned to capitalize on these trends. For instance, in 2024, Ireland's pension fund assets under management saw a notable increase, indicating a fertile ground for FBD's brokerage services. The company's focus on these growth areas could significantly bolster its market presence.

- Investment Brokerage Growth: FBD can leverage the increasing Irish household savings rate, which in early 2024 stood at a healthy level, to expand its investment brokerage offerings.

- Pension Planning Demand: With an aging population, the need for robust pension planning services is paramount, creating a direct avenue for FBD's financial services expansion.

- Wealth Accumulation Alignment: FBD's financial services can cater to individuals actively seeking to grow and manage their wealth, a trend amplified by positive economic indicators in Ireland throughout 2024.

- Market Presence Enhancement: By strategically investing in and promoting its financial services, FBD can solidify its position as a comprehensive financial solutions provider beyond traditional insurance.

Stars in the BCG matrix represent FBD Holdings' most promising ventures, characterized by high market growth and strong competitive positions. These are the areas where FBD is likely investing significant resources to maintain leadership and capitalize on future potential. The company's expansion into digital channels and specialized commercial insurance, such as cyber and parametric policies, align with this Star classification, reflecting their strong performance in rapidly expanding markets.

What is included in the product

This BCG Matrix overview for FBD Holdings identifies strategic growth opportunities and divestment candidates within its portfolio.

The FBD Holdings BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Farm Insurance within FBD Holdings represents a classic cash cow. Established by farmers for farmers, FBD boasts an exceptional market share, holding over 70% of the Irish non-life insurance market among its agricultural customer base. This dominant position is a testament to their deep understanding and commitment to this sector.

The segment consistently demonstrates robust new business growth, coupled with impressively high retention rates from its existing customers. This stability and consistent demand translate into a significant and reliable cash flow for FBD Holdings, underscoring its status as a core revenue driver.

Traditional Motor Insurance within FBD Holdings is a classic Cash Cow. Motor insurance represents a significant chunk of Ireland's non-life insurance sector, and FBD has a strong, enduring position here. Despite rising claim costs due to inflation, FBD has managed to maintain and even grow its premiums, signaling a robust market share in a stable, yet vital, industry. This segment reliably generates consistent cash flow for the company.

Traditional Home Insurance, within FBD Holdings' portfolio, operates as a classic Cash Cow. This sector benefits from a consistently stable demand, characteristic of a mature market where most households already possess coverage. FBD's established brand presence and extensive network across Ireland are key differentiators, likely securing a substantial market share.

This strong market position translates into dependable profit generation and robust cash flow for FBD. Despite the inflationary pressures leading to increased rebuild costs, which in turn affect premium pricing, the underlying demand and FBD's established customer base ensure continued financial stability. For instance, in 2023, the Irish home insurance market saw premiums rise, reflecting these cost pressures, yet the volume of policies remained resilient, underscoring the essential nature of the product.

Established Business Insurance Portfolio

FBD Holdings' established business insurance portfolio, primarily serving small and mid-sized enterprises in Ireland, functions as a classic Cash Cow within the BCG Matrix. The company boasts exceptional retention rates within this segment, indicating strong customer loyalty and a stable market position.

This robust portfolio generates a consistent stream of premium income, acting as a reliable engine for FBD's overall profitability. In 2023, FBD reported gross written premiums of €423.6 million, with a significant portion attributed to its business insurance lines, reflecting the maturity and stability of these offerings.

- Consistent Premium Income: The established business insurance portfolio provides a predictable and substantial revenue stream for FBD Holdings.

- High Retention Rates: Strong customer loyalty in this segment ensures a stable client base, minimizing churn and maximizing long-term value.

- Profitability Driver: This mature business line significantly contributes to FBD's overall financial health and profitability.

- Market Stability: Operating in a well-established market segment allows for predictable performance and resource allocation.

Existing Customer Base and Retention

FBD Holdings benefits significantly from its existing customer base, particularly in the business sector where retention rates consistently surpass 90%. This high loyalty means less capital is spent on acquiring new clients, allowing FBD to leverage a stable and predictable revenue flow. This established customer loyalty is a hallmark of a cash cow, providing a solid foundation for the company.

- High Business Sector Retention: Over 90% of FBD's business clients remain loyal, indicating strong customer satisfaction and product/service fit.

- Reduced Acquisition Costs: The focus on retention minimizes the need for expensive marketing and sales efforts to attract new customers.

- Stable Recurring Revenue: The consistent renewal of policies and services from this established base generates a predictable and reliable income stream.

- Mature Market Strength: Operating in mature markets with a loyal customer base solidifies FBD's position as a cash cow, generating consistent profits with minimal reinvestment needs.

FBD Holdings' established business insurance portfolio acts as a prime example of a Cash Cow within the BCG Matrix. This segment consistently delivers strong, predictable premium income, underpinned by exceptional customer retention rates exceeding 90% in the business sector. This loyalty translates into reduced client acquisition costs and a stable, recurring revenue stream, significantly contributing to FBD's overall profitability and financial health.

| Segment | BCG Category | Key Characteristics | 2023 Financial Insight |

|---|---|---|---|

| Farm Insurance | Cash Cow | Dominant market share (>70% of agri-customers), high retention, stable demand. | Core revenue driver, consistent cash flow. |

| Traditional Motor Insurance | Cash Cow | Strong, enduring market position, premium growth despite rising costs. | Reliable cash flow generation in a vital sector. |

| Traditional Home Insurance | Cash Cow | Mature market, stable demand, strong brand presence, high customer base. | Dependable profit generation, robust cash flow despite cost pressures. |

| Business Insurance | Cash Cow | Exceptional retention (>90%), stable market position, consistent premium income. | Significant portion of €423.6M gross written premiums, strong profitability driver. |

What You’re Viewing Is Included

FBD Holdings BCG Matrix

The FBD Holdings BCG Matrix preview you're examining is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, will be delivered in its entirety, ready for immediate integration into your strategic planning and decision-making processes. You are viewing the final, fully editable version, ensuring no surprises and complete usability for your business needs.

Dogs

FBD Holdings' legacy commercial schemes, particularly older policies that haven't kept pace with evolving business risks or competitive market pricing, represent potential 'Dogs' in the BCG matrix. These might include niche commercial policies with a shrinking customer base or those burdened by high administrative overheads.

For instance, if FBD has a low market share in a particular legacy commercial insurance segment, say, older industrial property insurance without updated cyber risk coverage, and this segment shows minimal growth prospects, it would fit the 'Dog' profile. In 2024, such a scheme might have seen its premium income stagnate or even decline by 2-3% year-on-year, while its associated claims costs continue to rise due to outdated risk assessments.

FBD Holdings' reliance on its extensive branch network, while historically a strength, presents a potential challenge if segments are heavily dependent on outdated, non-digital direct sales channels. These traditional methods may struggle to keep pace with evolving consumer preferences, particularly as the market continues its rapid shift online.

For instance, in 2023, a significant portion of the financial services industry reported that customers increasingly prefer digital interactions for account opening and service requests. Companies that haven't effectively integrated digital solutions into their direct sales efforts risk lower customer acquisition rates and reduced engagement compared to digitally savvy competitors. This disconnect can lead to underperformance in segments where digital adoption is high.

Niche, unprofitable niche products within FBD Holdings' portfolio might represent specialized insurance offerings with very limited market appeal. These could be products designed for extremely specific risks or customer segments that are no longer growing or are facing intense competition.

Such offerings often struggle to achieve economies of scale, leading to disproportionately high administrative costs relative to the revenue generated. For instance, a specialized cyber insurance policy for a very small, outdated industry might have high underwriting and claims management expenses that outweigh its premium income.

In 2024, it's plausible that FBD Holdings could have identified certain legacy insurance lines, perhaps related to declining industries or highly specialized equipment, that are now operating at a loss. These products might be kept for customer retention or as part of a broader service offering, but their direct financial contribution is negligible or negative, potentially costing the company more than they bring in.

Segments with High Claims Frequency and Uncontrolled Inflation

FBD Holdings' insurance segments facing both high claims frequency and significant inflation in repair or settlement costs, without adequate premium increases, represent a substantial risk. These areas can become cash traps, draining resources without generating sufficient returns. For instance, if automotive repair costs, a key driver of claims inflation, continue to outpace premium adjustments, this segment could see profitability erode rapidly.

Consider the implications for FBD's property insurance. Rising material costs for repairs and increased frequency of weather-related events, as seen in the heightened storm activity reported in Europe during late 2023 and early 2024, can severely impact profitability if premiums do not keep pace. In 2023, global insured losses from natural catastrophes were estimated to be around $100 billion, a significant figure that highlights the inflationary pressures on claims payouts.

- Automotive Repair Costs: Inflation in parts and labor for vehicle repairs can outstrip premium adjustments, leading to underwriting losses.

- Property Claims Inflation: Increased frequency and severity of weather events, coupled with rising construction material costs, strain profitability in property insurance lines.

- Unhedged Inflationary Exposure: Segments where FBD lacks sufficient pricing power to offset escalating claims costs are particularly vulnerable to becoming cash traps.

Products with Low Differentiation in Highly Saturated Micro-Markets

Products with low differentiation in highly saturated micro-markets, like those FBD Holdings might encounter in general insurance, represent a significant challenge. When many competitors offer very similar products, it becomes difficult to stand out and attract customers. This is particularly true in niche segments where the market is already crowded.

In such scenarios, FBD could face stagnant growth and diminished profitability. For instance, if a micro-market within auto insurance sees numerous providers offering comparable coverage at similar price points, FBD's ability to capture new customers or retain existing ones without aggressive price undercutting becomes limited. This can lead to a situation where the company is essentially in a price war, eroding margins.

Consider the UK general insurance market in 2023, which saw intense competition, particularly in popular segments like home and motor insurance. Reports indicated that customer acquisition costs remained high due to the need for significant marketing spend to cut through the noise of undifferentiated offerings. This environment directly impacts companies with less distinct products.

- Market Saturation: Highly competitive micro-markets with numerous similar offerings.

- Low Differentiation: Products lack unique features or benefits compared to rivals.

- Growth Challenges: Difficulty in acquiring new customers and retaining existing ones.

- Profitability Concerns: Potential for price wars and reduced profit margins.

Dogs within FBD Holdings' portfolio are insurance lines with low market share in slow-growing or declining sectors. These segments often require significant resources for minimal return, draining capital that could be invested in more promising areas. For example, legacy personal accident policies with limited uptake and high administrative costs would fit this category. In 2024, FBD might find that these products contribute less than 1% of overall premium income while consuming disproportionate management attention.

These segments are characterized by a lack of competitive advantage and often face intense price pressure. Their continued operation can hinder overall portfolio performance and dilute profitability. A prime example could be a niche travel insurance product for a specific, shrinking demographic that has seen minimal innovation and is now offered by numerous competitors with more modern digital platforms. By 2023, many insurers reported that such legacy products were being phased out or actively managed down due to their inability to compete effectively.

Question Marks

FBD Holdings' strategic shift towards a digitally enabled business model includes significant capital investment in exploring new digital-only insurance products. These offerings, while potentially tapping into high-growth market segments, are likely to represent a low market share initially as they strive for broader customer acceptance and market penetration.

The company's commitment to digital innovation suggests these products are designed to meet evolving consumer demands for convenience and accessibility in insurance. For instance, the global insurtech market was valued at approximately $11.1 billion in 2023 and is projected to grow significantly, indicating a fertile ground for such digital-first products.

FBD Holdings' strategic positioning within the BCG matrix is being shaped by emerging trends like embedded insurance. The Irish insurance market is increasingly adopting these models, seamlessly integrating policies into other customer transactions. FBD's recent collaborations, including those with An Post Insurance and Bank of Ireland, represent potential early moves into this burgeoning distribution channel, though their precise market share impact is still developing as of 2024.

FBD Holdings, despite its established nationwide presence in Ireland, is strategically considering expansion into specific geographic micro-markets where its brand recognition and market share are currently less pronounced. This approach targets areas exhibiting high growth potential, indicating an opportunity for FBD to build a stronger local foothold and capture new customer segments.

For instance, in 2024, while FBD maintained a strong presence in major urban centers, certain rural counties in Ireland, such as Leitrim or Westmeath, might represent these untapped micro-markets. These regions could offer a less saturated competitive landscape, allowing FBD to invest in localized marketing and community engagement to foster brand loyalty and increase penetration.

Innovative IoT-driven Insurance Offerings

The insurance sector is increasingly adopting IoT to offer personalized and proactive policies. For FBD Holdings, investing in telematics for auto insurance or smart home devices for property coverage represents a strategic move into high-growth areas where their market share is currently minimal.

- Telematics adoption in motor insurance is projected to grow significantly, with global revenues expected to reach $75 billion by 2025, up from $25 billion in 2020.

- Smart home device integration in property insurance can reduce claims by up to 20% through early detection of issues like water leaks or fires.

- FBD's focus on these areas positions them as potential Stars in the BCG Matrix, requiring substantial investment to capture market share.

Specialized Financial Planning Services for Younger Demographics

FBD Holdings could be exploring specialized financial planning services for younger demographics in Ireland, a market with increasing household wealth. This strategic move acknowledges Ireland's aging population while targeting a segment poised for future growth. The company would need to carefully consider how to capture market share against established financial institutions already serving this younger demographic.

This initiative aligns with a potential BCG Matrix placement as a question mark, representing a high-growth but potentially low-market-share business. For instance, in 2024, the average net wealth for Irish households under 35, while lower than older cohorts, is projected to see significant increases as this group enters prime earning years. FBD's success would hinge on offering innovative, accessible, and digitally-native financial solutions that resonate with younger consumers.

- Targeting a Growing Market: Ireland's younger population is increasingly accumulating wealth, presenting a significant opportunity for specialized financial planning.

- Competitive Landscape: FBD would face competition from existing banks, credit unions, and independent financial advisors already active in this segment.

- Service Innovation: Success will likely depend on offering tailored digital platforms, accessible advice, and products that address the unique financial goals of younger individuals, such as first-time home ownership and early-stage investment strategies.

- Market Share Acquisition: Building brand awareness and trust among younger demographics will be crucial for FBD to gain traction and establish a strong market position.

FBD Holdings is exploring new ventures, such as specialized financial planning for younger Irish demographics, which represent a high-growth potential market. However, these initiatives likely begin with a low market share, characteristic of Question Marks in the BCG matrix. Success hinges on innovative, digitally-focused strategies to capture this emerging wealth segment.

In 2024, while Ireland's younger population's net wealth is growing, it remains lower than older cohorts, necessitating FBD to offer compelling, accessible financial solutions. The company must navigate a competitive landscape, building trust and brand recognition to gain traction in this segment.

These new ventures require substantial investment to foster growth and market penetration, a hallmark of Question Mark business units. FBD's strategic allocation of resources toward these areas will determine their future success and potential transition to Stars or Dogs.

| BCG Category | Market Growth | Market Share | FBD Holdings Example | Strategic Implication |

|---|---|---|---|---|

| Question Mark | High | Low | Specialized financial planning for younger demographics | Requires significant investment to gain market share; potential for future growth. |

| Star | High | High | Telematics in motor insurance (projected 2025 global revenue $75bn) | Leader in a growing market; requires investment to maintain growth and dominance. |

| Cash Cow | Low | High | Established home insurance products in core markets | Generates consistent cash flow with minimal investment; funds other ventures. |

| Dog | Low | Low | Legacy IT systems for policy management | Low market share in a slow-growing market; consider divestment or turnaround. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.